Professional Documents

Culture Documents

Problem 38

Uploaded by

YukidoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 38

Uploaded by

YukidoCopyright:

Available Formats

Problem 38

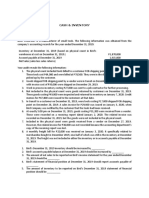

Dana Company accounted for noncurrent assets using the cost model.

On October 1, 2019, the entity classified a noncurrent asset as for sale.

At that date, the carrying amount was P3,200,000, the fair value was estimated at P2,200,00 and

the cost of disposal at P200,000.

On December 31, 2019, the asset was sold for net proceeds of P1,850,000.

What amount be recognized as an impairment loss for 2019?

Problem 39

Arlene Company accounted for noncurrent using the cost model.

On October 30,2019. The entity classified a noncurrent asset as held for sale.

At that date, the carrying amount was P1,500,000, the fair value was estimated

at P1,100,000 and the cost of disposal at P150,000.

On December 31, 2019, the asset was sold for net proceeds of P800,000.

1. What amount should be reported as impairment loss for 2019?

2. What amount should be recognized as loss on disposal for 2019?

Problem 40

On September 30, 2019, when the carrying amount of the net assets of a business segment was

P70,000,000, Young company signed a legally binding contract to sell the business segment.

The sale is expected to be completed by January 31, 2020 at a sale price of P60,000,000.

In addition, prior to January 31, 2020, the sale contract obliged Young Company to terminate the

employment of certain employees of the business segment incurring an expected termination cost

of P5,000,000 to be paid on June 30, 2020.

The segment revenue and expenses for 2019 were P40,000,000 and P45,000,000 respectively.

The income tax rate is 30%.

What amount should be reported as loss from discontinued operation for 2019?

You might also like

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Problem 79Document2 pagesProblem 79YukidoNo ratings yet

- Inventories and Cost FlowDocument5 pagesInventories and Cost Flowalford sery CammayoNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- 1911 Investments Investment in Associate and Bond InvestmentDocument13 pages1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- Quiz#2 Problem Solving InventoryDocument3 pagesQuiz#2 Problem Solving InventoryMyles Ninon LazoNo ratings yet

- Stock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!From EverandStock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!No ratings yet

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- 4 - Audit of InvestmentsDocument11 pages4 - Audit of InvestmentsSharmaine Clemencio0No ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- Audit of InvestmentsDocument9 pagesAudit of InvestmentsMark Lawrence YusiNo ratings yet

- EXAM About INTANGIBLE ASSETS 4Document3 pagesEXAM About INTANGIBLE ASSETS 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- The Secrets To Making Money From Commercial Property: Property Investor, #2From EverandThe Secrets To Making Money From Commercial Property: Property Investor, #2Rating: 5 out of 5 stars5/5 (1)

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Chapter 6 Noncurrent Asset Held For SaleDocument6 pagesChapter 6 Noncurrent Asset Held For SaleCarrie DangNo ratings yet

- Quiz Inventories and InvestmentsDocument13 pagesQuiz Inventories and InvestmentsRinconada Benori ReynalynNo ratings yet

- Problems - Non-Current Assets Held For SaleDocument1 pageProblems - Non-Current Assets Held For SaleChristine Alysza AnquilanNo ratings yet

- Investments Problem 1Document9 pagesInvestments Problem 1Rex AdarmeNo ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- Assessment 3 2024 Financial AssetDocument9 pagesAssessment 3 2024 Financial Assetmarinel pioquidNo ratings yet

- Problem 2 (Intercompany Sales)Document1 pageProblem 2 (Intercompany Sales)Tk KimNo ratings yet

- Badvac1x Mod 4 Interco Invty ReviewDocument4 pagesBadvac1x Mod 4 Interco Invty ReviewRezhel Vyrneth TurgoNo ratings yet

- Reviewer - Exam 5 To 6Document30 pagesReviewer - Exam 5 To 6ZalaR0cksNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- Investment in Associate-Mytha Isabel D. SalesDocument9 pagesInvestment in Associate-Mytha Isabel D. SalesMytha Isabel SalesNo ratings yet

- CONSOLIDATION FOR SMEsDocument1 pageCONSOLIDATION FOR SMEsvictoriaNo ratings yet

- ACCTG 029 - MOD 4 INTERCO INVTY (Review Prob)Document4 pagesACCTG 029 - MOD 4 INTERCO INVTY (Review Prob)Alliah Nicole RamosNo ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- Activity 7 - Equity InvestmentsDocument1 pageActivity 7 - Equity InvestmentsMa. Alexandra Teddy BuenNo ratings yet

- Quiz No. 2 - ReceivablesDocument1 pageQuiz No. 2 - ReceivablesJi BaltazarNo ratings yet

- Assessment 3 2024 Financial AssetDocument9 pagesAssessment 3 2024 Financial AssetAlthea mary kate MorenoNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- FAR MOCK Edited PDFDocument21 pagesFAR MOCK Edited PDFKorinth BalaoNo ratings yet

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- Exercises Investment and Inventory PDFDocument6 pagesExercises Investment and Inventory PDFLuke Myrrone Mangahas0% (1)

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- 3rd Year BusCom Intercompany TransactionsDocument2 pages3rd Year BusCom Intercompany TransactionsJoshua UmaliNo ratings yet

- Afar First TakeDocument14 pagesAfar First TakePau CaisipNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Noncurrent Asset Held For Sale Multiple Choice: A. B. C. DDocument5 pagesNoncurrent Asset Held For Sale Multiple Choice: A. B. C. Dlinkin soyNo ratings yet

- Q2FT InventoriesDocument2 pagesQ2FT Inventoriesfrancis dungcaNo ratings yet

- Answers T10 Tutorial Question 10 - CHP 11Document14 pagesAnswers T10 Tutorial Question 10 - CHP 11Shiv AchariNo ratings yet

- Finals Q1 - Investment in Equity PDFDocument4 pagesFinals Q1 - Investment in Equity PDFCzerielle QueensNo ratings yet

- Quiz # 4 Cash & InventoryDocument1 pageQuiz # 4 Cash & InventoryChristine CarmonaNo ratings yet

- FAR - Inventory Estimation - No AnsDocument2 pagesFAR - Inventory Estimation - No AnsJacob Raphael100% (1)

- Use The Following Information To Answer Items 3 and 4Document15 pagesUse The Following Information To Answer Items 3 and 4charlies parrenoNo ratings yet

- Fun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - OnlineDocument1 pageFun Depot Is A Retail Store That Sells Toys Games: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Questions PrelimsDocument14 pagesQuestions PrelimsNicole Allyson AguantaNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- I. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsDocument4 pagesI. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsRoxell CaibogNo ratings yet

- Inventories ExercisesDocument11 pagesInventories ExercisesVincrsp BogukNo ratings yet

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- Conso Drill PDFDocument1 pageConso Drill PDFTk KimNo ratings yet

- Problem 4Document3 pagesProblem 4novyNo ratings yet

- 2nd Sem 2021 Acctg 5a NCADocument7 pages2nd Sem 2021 Acctg 5a NCARUNEL J. PACOTNo ratings yet

- Exotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsFrom EverandExotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Problem 50Document1 pageProblem 50YukidoNo ratings yet

- Problem 1: Course of Operation To Be Sold Beyond 12 Months Amounting To P700,000Document2 pagesProblem 1: Course of Operation To Be Sold Beyond 12 Months Amounting To P700,000YukidoNo ratings yet

- Problem 4: AnswerDocument2 pagesProblem 4: AnswerYukidoNo ratings yet

- Problem 57Document1 pageProblem 57YukidoNo ratings yet

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- Problem 77Document1 pageProblem 77YukidoNo ratings yet

- Quiz 7Document1 pageQuiz 7YukidoNo ratings yet

- Course 1 - Evaluating Financial PerformanceDocument4 pagesCourse 1 - Evaluating Financial PerformanceYukidoNo ratings yet

- Assignment 21Document4 pagesAssignment 21YukidoNo ratings yet