Professional Documents

Culture Documents

Problem 1: Course of Operation To Be Sold Beyond 12 Months Amounting To P700,000

Uploaded by

YukidoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 1: Course of Operation To Be Sold Beyond 12 Months Amounting To P700,000

Uploaded by

YukidoCopyright:

Available Formats

Problem 1

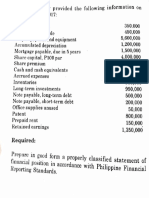

Darwin Company provided the following information at year-end:

Cash 1,500,000

Accounts receivable 1,200,000

Inventory, including inventory expected in the ordinary

Course of operation to be sold beyond 12 months

Amounting to P700,000 1,000,000

Financial asset held for trading 300,000

Equity investment at fair value through other

Comprehensive income 800,000

Equipment held for sale 2,000,000

Deferred tax asset 150,000

What amount should be reported as total current assets at year-

end? 1,500,000

1,200,000

ANSWER: 1,000,000

Cash 300,000

Accounts Receivable 0

Inventory

Financial asset held for trading

TOTAL CURRENT ASSETS

Problem 2

Petite company reported the following current assets at year-end:

Cash 5,000,000

Account receivable 2,000,000

Inventory, including goods received on

consignment P200,000 800,000

Bond investment at fair value through other

Comprehensive income 1,000,000

Prepaid expenses, including a deposit of P50,000 made

On inventory to be delivered in 18 months 150,000

Total current assets 8,950,000

Cash in general checking account 3,500,000

Cash fund to retire 5-year bonds payable 1,000,000

Cash held to pay value added taxes 500,000

Total cash 5,000,000

What total amount of current assets should be 4,000,000 reported at year-end?

2,000,000

ANSWER: 600,000

Cash 300,000

Accounts Receivable 100,000

Inventory

0

Financial asset held for trading

Prepaid Expense

TOTAL CURRENT ASSETS

You might also like

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- PPEDocument30 pagesPPEJohn Kenneth AlicawayNo ratings yet

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Financial StatementsDocument6 pagesFinancial StatementsLuiNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Document33 pagesPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNo ratings yet

- Chapter 1Document20 pagesChapter 1Coursehero PremiumNo ratings yet

- Problem 1-1 (IFRS) : Operations To Be Sold Beyond 12 Months Amounting ToDocument1 pageProblem 1-1 (IFRS) : Operations To Be Sold Beyond 12 Months Amounting ToSIAN DAVIDNo ratings yet

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- Problem 1Document1 pageProblem 1Abe Mayores CañasNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document7 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Corina Mamaradlo CaragayNo ratings yet

- Cbea FAR 01 Lecture 02Document16 pagesCbea FAR 01 Lecture 02Osirisheen Aizle CubacubNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- Problem 1-2 (AICPA Adapted) : SolutionDocument2 pagesProblem 1-2 (AICPA Adapted) : SolutionSIAN DAVIDNo ratings yet

- Exerc5se 2313Document5 pagesExerc5se 2313Chris tine Mae MendozaNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionJane GavinoNo ratings yet

- Problem 2 - 3Document1 pageProblem 2 - 3Abe Mayores CañasNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Mockbiard Questions - Practical 1Document10 pagesMockbiard Questions - Practical 1Regina Clarete0% (1)

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Financial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionDocument29 pagesFinancial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionBernadette PalermoNo ratings yet

- Las#3 - (Ia3) STATEMENT OF CASH FLOWS PDFDocument6 pagesLas#3 - (Ia3) STATEMENT OF CASH FLOWS PDFStella MarieNo ratings yet

- Valix Book Chapt 1 5 Probs PDFDocument34 pagesValix Book Chapt 1 5 Probs PDFRengeline LucasNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- FAR Test BankDocument24 pagesFAR Test BankMaryjel17No ratings yet

- Petite Company Reported The Following Current Assets On December 31Document1 pagePetite Company Reported The Following Current Assets On December 31Katrina Dela CruzNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- ACCTG 16 FAR W2 Problems PDFDocument5 pagesACCTG 16 FAR W2 Problems PDFLabLab ChattoNo ratings yet

- 7294 - Cash BasisDocument2 pages7294 - Cash BasisJulia MirhanNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleRommel Angelo AgacitaNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- 2020 Valix Answer Key Acounting 3 - CompressDocument19 pages2020 Valix Answer Key Acounting 3 - Compressrandomfinds864No ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDocument3 pagesAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDocument23 pagesFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNo ratings yet

- Decided To Open A Branch in ManilaDocument2 pagesDecided To Open A Branch in Manilaasdfghjkl zxcvbnmNo ratings yet

- Paco Company: A. Accounting For Corporate LiquidationDocument3 pagesPaco Company: A. Accounting For Corporate LiquidationTine Griego100% (1)

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- Cannon Ball Review With Exercises PART 1Document11 pagesCannon Ball Review With Exercises PART 1Genelyn Langote100% (1)

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Problem 50Document1 pageProblem 50YukidoNo ratings yet

- Problem 4: AnswerDocument2 pagesProblem 4: AnswerYukidoNo ratings yet

- Problem 36Document1 pageProblem 36YukidoNo ratings yet

- Problem 46Document2 pagesProblem 46YukidoNo ratings yet

- Problem 38Document1 pageProblem 38YukidoNo ratings yet

- Problem 77Document1 pageProblem 77YukidoNo ratings yet

- Problem 79Document2 pagesProblem 79YukidoNo ratings yet

- Quiz 8Document1 pageQuiz 8YukidoNo ratings yet

- Problem 76Document1 pageProblem 76YukidoNo ratings yet

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- Quiz 7Document1 pageQuiz 7YukidoNo ratings yet

- Problem 57Document1 pageProblem 57YukidoNo ratings yet

- Quiz 6Document1 pageQuiz 6YukidoNo ratings yet

- Final ExamDocument3 pagesFinal ExamVincent Roy RiveraNo ratings yet

- Final Exam Acctng 12Document2 pagesFinal Exam Acctng 12YukidoNo ratings yet

- Problem 53Document1 pageProblem 53YukidoNo ratings yet

- Vincent Roy Rivera Bsa - 4 Assignment 8Document1 pageVincent Roy Rivera Bsa - 4 Assignment 8Vincent Roy RiveraNo ratings yet

- Problem 54Document1 pageProblem 54YukidoNo ratings yet

- Assignment 9Document1 pageAssignment 9Vincent Roy RiveraNo ratings yet

- Assignment 21Document4 pagesAssignment 21YukidoNo ratings yet

- Assignment 7Document1 pageAssignment 7Vincent Roy RiveraNo ratings yet

- Course 1 - Evaluating Financial PerformanceDocument4 pagesCourse 1 - Evaluating Financial PerformanceYukidoNo ratings yet

- Course 1 - Evaluating Financial PerformanceDocument4 pagesCourse 1 - Evaluating Financial PerformanceYukidoNo ratings yet

- Problem 53Document1 pageProblem 53YukidoNo ratings yet

- Problem 54Document1 pageProblem 54YukidoNo ratings yet

- Assignment 21Document4 pagesAssignment 21YukidoNo ratings yet

- Pengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)Document16 pagesPengaruh Kualitas Produk Kartuhalo Terhadap Kepuasan Pengguna (Studi Pada Grapari Telkomsel MTC Bandung)IrawanNo ratings yet

- Lampurginni (MGT 337)Document3 pagesLampurginni (MGT 337)Nasrullah Khan AbidNo ratings yet

- Theorizing Digital Innovation Ecosystems - A Multilevel EcologicalDocument17 pagesTheorizing Digital Innovation Ecosystems - A Multilevel EcologicalHelge SalgNo ratings yet

- Bản Dịch MarDocument5 pagesBản Dịch MarHùng ThanhNo ratings yet

- Mathematics For Economics and Business 8th Edition Jacques Solutions ManualDocument36 pagesMathematics For Economics and Business 8th Edition Jacques Solutions Manualduckingsiddow9rmb1100% (21)

- Application For Registration Private Education Institution Part Time 2019Document10 pagesApplication For Registration Private Education Institution Part Time 2019Btwins123No ratings yet

- Deepna ITC Project ReportDocument124 pagesDeepna ITC Project ReportAnKit SacHanNo ratings yet

- Module 4 Lesson 5 Transitional Word QuizDocument2 pagesModule 4 Lesson 5 Transitional Word QuizEm-Em Alonsagay DollosaNo ratings yet

- Account Statement From 1 Jul 2021 To 15 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Jul 2021 To 15 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVicky GunaNo ratings yet

- Regulations and Financial StabilityDocument7 pagesRegulations and Financial StabilityRelaxation MusicNo ratings yet

- Name: Tamzid Ahmed Anik ID:1911031 Code: HRM 370 Submitted To: Dr. SHIBLY KHAN Date: 5 July, 2022Document8 pagesName: Tamzid Ahmed Anik ID:1911031 Code: HRM 370 Submitted To: Dr. SHIBLY KHAN Date: 5 July, 2022Tamzid Ahmed AnikNo ratings yet

- Analytical ReportDocument34 pagesAnalytical ReportAbdul SamadNo ratings yet

- Vebsar: Specific Gravity PorousDocument2 pagesVebsar: Specific Gravity Porousrahul srivastavaNo ratings yet

- Lit266 Bli Heal Abut Options FinalDocument2 pagesLit266 Bli Heal Abut Options FinalJean-Christophe PopeNo ratings yet

- Delgado VS Alonso 44 Phil 739Document4 pagesDelgado VS Alonso 44 Phil 739kreistil weeNo ratings yet

- 1st BPP ObservationDocument20 pages1st BPP ObservationMaRiLoU AlApAgNo ratings yet

- Circular Fashion Report - Year Zero - November 2020 PagesDocument42 pagesCircular Fashion Report - Year Zero - November 2020 PagesJaney BurtonNo ratings yet

- KPMG Global Economic Outlook h1 2023 ReportDocument50 pagesKPMG Global Economic Outlook h1 2023 Reportz_k_j_v100% (1)

- Chapter 5 Marginal CostingDocument36 pagesChapter 5 Marginal CostingSuku Thomas SamuelNo ratings yet

- Open Banking: Global State of PlayDocument16 pagesOpen Banking: Global State of PlayaldykurniawanNo ratings yet

- Ambuja CementDocument25 pagesAmbuja CementHarshkinder SainiNo ratings yet

- Jawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanDocument12 pagesJawaban Diisi Dengan Angka 1 Untuk Jawaban Benar, 0 Untuk Jawaban Salah Cell Yang Berwarna Kuning Tidak Perlu Diisi No Jenis Isi JawabanY AjaNo ratings yet

- SECOMET PresentationDocument12 pagesSECOMET PresentationABDELKADER BENABDALLAHNo ratings yet

- Priciples of Commerce Short Long Questions I YearDocument4 pagesPriciples of Commerce Short Long Questions I YearMuhammad MuneebNo ratings yet

- FACTS: Francisco de Guzman Was Hired by San MiguelDocument1 pageFACTS: Francisco de Guzman Was Hired by San MiguelGabriel LiteralNo ratings yet

- Resume CyrineDocument2 pagesResume CyrineCyrine DridiNo ratings yet

- 12th Economics Minimum Study Materials English Medium PDF DownloadDocument12 pages12th Economics Minimum Study Materials English Medium PDF DownloadSenthil KathirNo ratings yet

- Thesis Topics in Logistics and Supply Chain ManagementDocument5 pagesThesis Topics in Logistics and Supply Chain Managementbsnj6chr100% (1)

- Revealed Preference TheoryDocument5 pagesRevealed Preference TheoryRitu SundraniNo ratings yet

- Unit 4 Leadership and ManagementDocument9 pagesUnit 4 Leadership and ManagementMuhammad UzairNo ratings yet