Professional Documents

Culture Documents

STE Micro Project (1) SAKSHI

STE Micro Project (1) SAKSHI

Uploaded by

RP Graphics0 ratings0% found this document useful (0 votes)

29 views26 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views26 pagesSTE Micro Project (1) SAKSHI

STE Micro Project (1) SAKSHI

Uploaded by

RP GraphicsCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

Micro-Project Proposal Micro Project for

information about

“Payment method of G- PAY”

1.0 Aims of the Micro-Project

1. The careful selection of the Payment method to be developed.

‘To get deep knowledge about Payment method of phone-pay .

‘The undertaking of payment methods between costumer and bank.

Monitoring & Evaluation activities to monitor progress and confirm results

2.0 Course Outcomes Addressed

a) Apply various software testing methods,

b) Prepare test plan for an application

©) Test software for performance measures using automated testing tools.

3.0 Proposed Methodology

Collect the information of all the * Payment method of phone-pay with its Working & Code, The Payment

‘method of phone-pay also include the methodology and various info. detail

I searched the micro project topics related to subject. Then selected micro project title. After selection of topic

searched and collected information related to selected topic, Then completed proposal of micto project. PhonePe is

1 mobile payment platform using which you can transfer money using UPI, recharge phone numbers, pay utility

bills, ete. There is no need to recharge the wallet, because the money will be direetly debited from your bank

account at the lick of a button in a safe and secure manner.

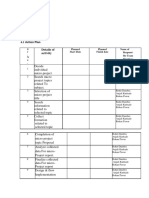

4.0 Action Plan

Sr.No] Planned Planned [Name of Responsibl

. Start Date hdate [Team Members

1 _| Decide individual miro project Jbangar Sarthak Santosh

2 _| Search miero project topes related To |Bangar Sarthak Santosh

subject.

3 _| Sclection of micro project title Jbangar Sarthak Santosh

4 | Search information related to selected JBangar Sarthak Santosh

topic

Collect information related to selected topic JBangar Sarthak Santosh

6 _ [Completion of miero project topie Proposal JBangar Sarthak Santosh

7 [Analyze collected data For micro Project JBangar Sarthak Santosh

report.

|Bangar Sarthak Santosh

8. _ | Finalize collected data For micro-Project seh Pealalearaais

report

9 | Finalize Design & flow of Implementation JBangar Sarthak Santosh

10 | Flow of Implementation Jbangar Sarthak Santosh

11 | Implementation of report. JBangar Sarthak Santosh

12 [Report preparation JBangar Sarthak Santosh

13 _ [Finalization of report Jbangar Sarthak Santosh

14 |Submission of report JBangar Sarthak Santosh

Resources Required

Name of Resource

sr. | /Materi Qty. | Remarks

No.

Processor 3.00 GHZ,RAM 4

Computer System erea een 1 Used

Operating System Windows 7 T Used

Textedior Microsoft Word Hi Used

Browser ‘Mozilla Firefox, Google Chrome : Used

Printer HP Laser Tet T Used

Other resource Internet Connection : Used

‘Names of Team Members with Roll Nos.

1, Bangar Sarthak Santosh

(To be Approved by the con

Roll No,

7

A

PROJECT REPORT

ON

“Payment method of G - Pay”

SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR

THE AWARD OF

DIPLOMA IN

COMPUTER ENGINEERING

ie

SUBMITTED TO

MAHARASHTRA STATE BOARD OF TECHNICAL EDUCATION,

MUMBAI

SUBMITTED BY

Name of Student Enrollment Number

Bangar Sarthak Santosh 2009920106

GUIDED BY

(Ms.Thorat S.K.)

SAMARTH POLYTECHNIC, BELHE

This is to certify that the project report entitled “Payment method of

phone G - Pay” Was successfully completed by Student of Fifth semester

Diploma in computer engineering.

Bangar Sarthak Santosh

in partial fulfillment of the requirements for the award of the Diploma in

Computer engineering and submitted to the Department of Computer of

Samarth Polytechnic, Belhe work carried out during a period for the academic

year 2022- 23 as per curriculum .

Ms. Thorat S.K. Prof.Navale S.K Prof. Kapile A.S.

(Subject Teacher) (H.0.D) (Principal)

ACKNOWLEDGMENT

This project is done as a Fifth semester project, as a part course titled “Payment method of phone-pay”

We are really thankful to our course the Principal Prof. Kapile A. S. and the HOD

Prof. Navale S.K Samarth Polytechnic, Belhe for his invaluable guidance and assistance, without which

the accomplishment of the task would have never been possible.

We also thank Ms. Thorat S.K.for giving this opportunity to explore into the real world

and realize the interrelation without which a Project can never progress. In our present

project we have chosen the topic- “Payment method of G-pay”

Weare also thankful to parents, friend and all staff of Computer engineering department, for providing us

relevant information and necessary clarifications, and great support.

Bangar Sarthak Santosh

INDEX

Sr.No. Name of Chapter Page No.

Chapter 1 Synopsis 1

1.1 Project Title

1.2 Project Option

1.3 Internal Guide

1.4 Problem Statement

Chapter 2 ‘Abstract 2

Chapier3 Introduction 3

Chapter ‘Actual Resources Used 6

Chapters Test Plan 7

Chapter 6 “Advantages and disadvantages ®

Chapter? Uiility uses of PhonePe 13

Chapter 8 Digital Wallets in India 16

Chapter 9 Strategies to become profitable 17

Chapter 10 Conclusion 18

Payment method of G-pay

CHAPTER 1

SYNOPSIS

1.1 Project Title

Payment method of G - pay

1.2 Project Option

None

1.3 Internal Guide

Ms.

‘Thorat S.K

1.4 Problem Statement

Payment method of phone g - pay.

Samarth Polytechnic, Belhe Page |

Payment method of G-pay

CHAPTER 2

ABSTRACT

Google Pay is a digital wallet and payment platform from Google. It enables users to pay for

transactions with Android devices in-store and on supported of phonepe over Paytm and

promoting the usage of Indian Developed application over foreign technologies and the reason

which are responsible for the ignorance of using phonepe. The sampling is random. The data for

this research paper is a primary source of information which iscollected during the months of

Nov-Dec 2019 and is analysed using various statistical tools such as probability analysis, simple

percentage analysis, averages. On the basis of the finding suitable suggestions will be given. The

paper also gives information about why Indian digital banking application should be preferred

over transoceanic technologies. Keywords: - Digital payments, Phonepe, Paytm, Indian payment

service The Mobile Payments OR digital payment applications are occupying a wider

competition in the area of electronic modes of payment, with phonepe and Paytm being the recent

addition.One of the important services provided by NPCI (NATIONAL PAYMRNT

CARPORATION OF INDIA) is to upgrade the UPI market share of digital payment companies.

Through Phonepe UPI app, you can send and receive money instantly using a VPA (or Virtual

Payment Address). This means you can also transfer money between any two bank accounts, You

can also pay directly from your bank account to both online and offline merchants. The best part:

You don’t need to enter credit or debit card details, a onetime password, your bank’s IFSC code

or any other details. Phonepe cash back is also limited to your Phonepe wallet only. It does not

get transferred to your bank account. Phonepe works on the Unified Payment Interface (UPI)

system and all you need is to feed in your bank account details and create a UPI ID

Samarth Polytechnic, Belhe Page 2

Payment method of G-pay

CHAPTER 3

[TRODUCTION

Firstly, we find the various topics related to Payment method of phone- pay. Then we

had finalized micro project title as “Payment method of phone- pe”. We search the

information about Payment method of phone-pe. Then we collect all the information related

to the types and limits and the steps at the level of phone-pe. Then we will lean about

Preparation of Action Plan, Implementation of the Planned Monitoring & Evaluation

activities to monitor progress and confirm results. Then we will analyze and finalized data

for the micro project report.

Phone pe is an Indian e-commerce payment system and digital wallet, It was founded

by Sameer Nigam, Rahul Chari and Burzin Engineer in 2015, headquartered at Bangalore.

Phone pe is the first payment app in India that is built on Unified payments interface. The

company was acquired by Flip kart in 2016 and it was rebranded as Phone Pe wallet. Within

3 months of launch, the app was downloaded by over 10 million users. In 2018, Phone Pe

also became the fastest Indian payment app to get a 50 million badge on the Google play

store. Phone Pe is an UPI-based App launched by e-commerce giant Flip kart, to provide a

cashless and a seamless payment experience. The Phone Pe app is based on the Unified

Payment Interface (UPI) platform. UPI payment system allows money transfer between any

‘two bank accounts by using a smartphone. UPI allows a customer to pay directly from a

bank account to different merchants, both online and offline. In UPA system to send money,

‘we don't need to give credit card details, IFSC code, net banking passwords ete.

Payment method of G-pay

Samarth Polytechnic, Belhe

While digital payments are safe and convenient, itis important to be aware of different types

of fraud and how fraudsters are constantly finding ways to dupe users oftheir hard-earned money.

Here are the latest types of frauds and what you need to do to transact safely’

ORequest Money Scam: Seamstress use fake links set up through fake websites with

appealing texts such as “Get scratch card” or “Win lottery”. Clicking on the link would

debit money from your account and credit it to the fraudster’s account. Therefore, never

click on unknown links without proper verification,

OCash back Fraud: Fraudsters contact users posing as representatives from a payment

app and tell them that they are eligible for a cash back. Fraudsters then send payment

requests to the user and ask them to click on ‘Pay’ and enter the UPI PIN. Always

remember you do not have to click on ‘Pay’ or enter your UPI PIN to receive money on

any other UPI app. You should always decline such requests,

Oamily/Friend Impersonation: One of the latest fraud MOs is to impersonate

probable victim's friend or family member by seting up a fake social media account. Once they've eretted

the account, they DM the vietim requesting money for an emergency. You should, thus, always verify who

you are communicating with especially when money is involved,

ODebit/Credit Card or Top-Up Fraud: In such scenarios, fraudsters call you claiming

to be representatives of your bank, the RBI, an e-commerce site, or even a lottery scheme,

They may ask you to share your 16 digit card number and CVV, and you receive an SMS

with an OTP. The fraudster calls you back and asks for this OTP for verification purpose

Samarth Polytechnic, Belhe Page 4

Payment method of phone-pay

fraud in the name of Part-time/WFH jobs: Since a considerable number of people

are looking for part-time jobs these days, fraudsters ask to download apps or click on links

of fake websites that dupe people of their money. Of late, people have been victimized by

creating fake job offers for international migrants or requesting advance payment for fake

VISA.

OAdvance Payment Scam: Fraudsters, in some cases, put up fake listings for items or

properties on sale or create fake shopping websites in order to ask for the payment in

advance. They collect the money and don’t deliver the promised item.

(Investment Seam: Certain gambling apps or platforms that promise to deliver double

the money invested, initially provide returns to establish a fake sense of trust and once the

users invest large amounts of money, they shut the operations down and flee with the

money.

ORraud by Remote Access or Vishing: Senior citizens are found to be the common

targets in this type of fraudulent activity. Here, a fraudster calls up and asks the individual

to download a remote access app and provide access. This way, the fraudster will be able

to control the device and scam the person of his/her money.

Samarth Polytechnic, Belhe Page 5

CHAPTER 4

Actual Resources Used

Name of

Sr. | Resource Specifications Qty. [Remarks

No. | (Material

Processor: Intel i7 3.00 GHz, used

RAM: 12GB

i Computer SSD: 1TB 1

‘System Windows 10 64-bit Operating System

used

2 Browser Google Chrome 1

used

3 Text Editor Microsoft Word 2019 1

used

4 Printer HP LaserJet 1

Samarth Polytechnic, Belhe Page 6

CHAPTER 5 Test Plan

1) Introduction

The Test Plan is designed to prescribe the scope, approach, resources, and schedule of

all testing activities of the project Travel Booking Site. The plan identifies the items to be

tested, the features to be tested, the types of testing to be performed, and the personnel

responsible for testing.

The purpose of this document is to create an application test plan for Travel Booking

. The presented study to test plan evaluates to testing this application. The purpose of

testing this program is to check the correct operation of its functionality and ease of use.

2)Featured to be tested:

l. Data Gathering

2. Identifying test requirement.

3. Collecting the test cases on Application

4. Gathering the information of testing types

3)Featured not to be tested:

Cannot Test at Administrator.

4)Approach:

OBy accessing the source code- Black Box, Beta Testing, Performance testing, Security testing

Oy degree of automation ~manual

On the test object: Functional

‘Non-Functional According to the Requirement: Positive nigative

5) Environmental needs:

In windows 10 we will occur Following Travel Booking Site,

6)Schedule:

‘The Deadline for compilation of all works and delivery of the project is 24.12.2021

—_—_————

Samarth Polytechnic, Belhe Page 7

CHAPTER 6

Skill Developed/ Learning outcome of this Micro-Project

OLeadership

OCommunication

skill Planning skill

OTime Management

ORisk Management

ONegotiation skill

OTeam work

Advantages:

+ Convenient way to pay. Paying for goods and services has never been more convenient

than with using a mobile payment system. ...

+ Secure way to pay. Mobile payment apps allow you to use your cell phone to make in-store

purchases. ..

+ Faster way to pay. .

+ More places to pay. .

+ Always able to pay.

Disadvantages:

+ Security RisksO

+ Inconvenience For Some Customer0

+ Too Many Alternatives To Choose FromO

Samarth Polytechnic, Belhe Page 8

Output of microproject :

[rest | Test Precondi | Steps Expected [Actual [Stat us

case | Case —_| tion Result [Result

ID Objecti ve!

[rc-o1 | Check | Intemnetis 1. Cheek the network Internet internet [Pass

That available ‘onnecti_feonneeti on

internet mn must be jis

connect available available

ion is

availabl e

or not

[TC-02 | Check | Applicati 1. Openchrome/ google —applicat —fapplicat [Pass

whether | on should 2. Search for phone pay app jion should jon is

applicat | be location website be (Opening

ion available pening —_successf

on chrome Successfully

/google lly

Samarth Polytechnic, Belhe Page 9

[re-03 | Check | applicati 1. Open the application |Android Pass

the on must {Android

operati | should ispresent

ng Junch lepresent

system

of

applica

tion

[TC-04 | Enter | applicati 1 Open the application | Error Error Pass

invalid | on 2. Click,keys mouse|should is

phone | should rollover |be \displa

numbe | launch display

t y

[rc-0s | Chee | Different 1 ‘open Phone [Phone [Pass

k ways are the numbe number

login available applicati Ir iscorrect

page for on

il customer 2. click

savailabl | to on registration

cor not Logi

n

in the

applicat

ion

[rc-06 | Verify | Phone — | L.open the application Phone |Phone [Pass

the number | 2.Click on number number

phone | details | Registration. should _|isvalid

numbe | are be

rdetails | available Werified

are

availab

le or

not

[rc-07 | Check | Occupati | 1.open the application (Occupat |Occupat [Pass

other on ion type _jion type

‘occupa typ) ‘should _jiscorrect

tion eis bbecorrect

type | available

‘tc_8 | To For 1. Open the application [Salaried [Salaried [Pass

select | Enterin type type

occupat | g should i

ion type | occupat Ibecorrect

ion type lcorreet

Irc_9 | To For open the application [Select [Sei ass

select | entering Ithe

other | other fself

occupat [Employ employe

ion type edtype fd

lor typ

joccupati is

lontype correct

(rc_10| Enter | applicati | 1. open the application IPin code [Pin code Pass

pin on 2. Click on Registration. _ should be jis correct,

code | launch {correct

number

rc_11 | Enter | applicati | 1. open the application lvalid = [Full Pass

valid | on 2. Click on Registration, _ full name is

full launch name ‘orrect

name Ishould be

{correct

(rC_12| Enter | applicati | 1. Open the application Email — | Email ID Pass

email- | on 2. Click on view score {ID

ID off launch Ishould be fis

candida correct correct

te

Samarth Polytechnic, Belhe Page 1

rc_i3| Enter | For 1. open the [Date [Date Pass.

date | Login | application2. °

applicati_ | 19/11/2002 f birth

of birth | on page should be pirth

of is -orrect

- available is correct

ec

(TC_14| Click | applicati | 1. Open the application thoose \valid Pass

other | on 2. Click on view score. valid ther

optio | launch ther option is

n ption _feorrect

[rc_1s | Enter | applicati | 1.open the application IPan card [Pan card [Pass

pan card | on 2.Click on view score Inumber [number is

number | launch ‘should be [correct

of {correct

candied

(rc_16 | Click | Login Open the application fapplicati [Pass

view | page lon lon

score i i

ls is

lopened —_ opened

isuecessf

lully

(tC_17 | Check | Login | 1 Click on view score (Option is [Option is [Pass

whethe | page lavailable opened

rOTP is lsuccessf

receive lully

db

y

your

mo.no

or not

Samarth Polytechnic, Belhe Page 11

CHAPTER7

Utility uses of PhonePe

“Customers can use PhonePe app to pay your postpaid and utility bills. You can use Phonepe

app for the following:”

1. Recharging prepaid mobile number

2. Recharge data card and DTH

3. Send or request money from friends entering their number, name or VPA

4, Split bills between people

5. Check the bank account balance

6. Scan QR codes to pay

Key Drivers

The exponential growth of the digital payment sector is driven by multiple factors including

1. Convenience to pay

2. The ever-growing smartphone paynetration

3.

ise of non-banking payment institutions (payments bank, digital wallets, ete.),

4 Progressive regulatory policies

5.Increasing consumer readiness to the digital payment platform

The convenience to pay along with the availability of lucrative offers, are two key factors that

have been driving the growth of digital payments in India. This coupled with the increasing

smartphone paynetration is proving to be a boon for digital payments sector. India, currently, has

third largest internet user base in the world with 300 million users. 50 per cent of these users are

connected to internet through mobile only. These 150 million mobile only internets users are

playing a key role in the growth story of digital payments, The advent of next-generation

payment systems like payment banks, digital wallets and Bharat QR, is fueling digital payments

furthermore. It is projected that digital payments in India will supersede cash by 2022, according

to the IDC Financial Insights report titled The Future of Payments in India: More Spectacular

Growth Ahead. Another key driver of digital payments is positive policy framework changes

and government initiatives like launch of new payments systems like - UPI, Aadhar linked

electronic payments and improvement of the digital infrastructure.

According to Consumer Payments Insights survey, India is one of the top markets to adopt

mobile wallets. Mobile wallet transactions in India have inereased with a CAGR of 120% in the

last 5 years and is expected to grow to 32 billion transactions by 2021. One of the biggest reasons

for increase in digital wallet usage in India is demonetisation. The digital wallet platforms saw

a major boost in traffic after the demonetisation of major denominations

Samarth Polytechnic, Belhe Page 14

PhonePe BusinessModel

Components of a Business Model

‘The main components ofa business model are Capabilities, Customer Value Proposition, Market

Segments, Reventic Model & Growth Model. Below isthe basic analysis of components of

= PhonePe = Business: Retail + Commissions * Sustainability

facilitates online outlets, online received from strategy: Focus

transactions shopping the transactions ‘on Speed and

which are secure platforms done and convenience

and fast in * Individuals services * Aim: To create

compared to provided, hence copan pitfarae

traditional dependent on eee

methods number of dighal footprint

transactions

made

‘Customer Value Market Segments Revenue Model Growth Model

Proposition

Analysis of Business Model using TEECE Framework

Complementary capabilities and Imitability are two main factors to be considered for making money

from invention or discovery.

TEECE Model takes these factors into consideration and predicts the profitability aspect from

innovations.

PhonePe:

Complementary assets: Tightly held and important

Imitability: High

The services offered by PhonePe like mobile recharge, paying bills of telephone, electricity and gas

are highly imitabe. In fact, Paytm too offers similar services.

Samarth pollytecnical college belhe

CHAPTER 8

1 Wallets in India:

Digital wallets are virtual wallets that store user’s payment information. With the increase in

internet penetration and smartphone usage in India, digital wallets ecosystem has seen major

changes in the last 5 years. Features of digital wallets like security from theft compared to

jonal currency and the ability to make transactions throughout the day, attracted a lot of

consumers to use digital wallets. A lot of fin-tech companies emerged, changing the digital

landscape of financial transactions in India, forcing other major players in the banking sector

to invest in digital wallets. * Mobile wallet providers can be broadly classified into two types

viz., banking entities and nonbanking entities. Banking entities include major banks like ICICI,

Axis etc., whereas nonbanking entities include platforms like PayTm, PhonePe etc., “ Digital

wallet market in fragmented and highly competitive with companies coming up with new and.

innovative offers to attract more customers. The timeline of major events in digital wallet

ecosystem in India is as follows:” PhonePe: A Report COPYRIGHT © 2020 CENTRE FOR

DIGITAL ECONOMY, IIM RAIPUR ALL RIGHTS RESERVED 3 Source: cbinsights.com

According to Consumer Payments Insights survey, India is one 0

About the Report

The digital payments sector in India is facing tectonic shifts. Entities with divergent business

models, subject to diverse regulations, are competing for a pie in the market share. This report

takes a stock of the existing business models in the digital payments sectors and reviews the

applicable regulatory framework to such business models. The objective is to ascertain if level

playing field exists for the market players in the sector to compete efficiently. The report takes

a step further and analyses reasons for lack of level playing field in the sector, highlights

adverse impacts of such situation on consumer welfare. The report concludes with providing

specific recommendations to level the playing field for leveraging the potent

payments in the sector

Samarth Polytechnic, Belhe Page 16

Payment method of phone-pay

CHAPTER 9

Strategies to become profitable

‘The current revenue

sneration model of PhonePe is based on Commissions. The digital payment

system is expanding exponentially with more number of people preferring digital payment systems over

traditional methods. Also, there is high customer loyalty in this ecosystem. Hence the focus of the

Digital wallets is currently on gaining market share through which they can collect the consumer data,

to analyze the buying behavior and patterns of their customers.

PhonePe can adopt the following strategies to generate profi

Business services ~ Phonepe can partner with businesses to provide them a platform for hassle

less transactions. PhonePe should develop an ecosystem for business services where they can

eam commissions from the transactions performed. PhonePe should target SME'S for

partnership and bring them aboard. PhonePe can also ereate a premium segment where they ean

also include additional services like paying on credit to premium customers and charge premium

for registration and additional interest forthe credit provided.

Applications of Micro-Project

OTo confirm that the phone pay application is error or bug free.

OThis project is used to find out the defect,

OTo provide guideline on another application.

Samarth Polytechnic, Belhe Page 17

CHAPTER 10

Conclusion

PhonePe is a payment app that encompasses different aspects as well. One ean book flight tickets

through online travel apps without installing the other app or moving out of PhonePe App. This

increases

the convenience of individuals. It is an all-in-one app. However, just like other payment apps, it also

‘comes with a maximum limit on the quantum of transactions that is possible through the app in 24 hours.

As you may not able to carry large transaction:

a single day, it is important to note the maximum

amount that can be transferred through the PhonePe app.

ANNEXURE II

Evaluation Sheet for Micro Project,

Academie Year -- 2022-23

Course := STE

Name of Faculty :- Thorat $.K

Course Code :- 22518

Title of Project := Payment method of g- pay

Cos addressed by the Micro Project :- I.Jdentify Systemldentificatin & designtesteases for

purpose order

‘management

2Prepare test plan form identified mobile

Application

3.Design test case for Google pay

method.

4.

Semester = V

Major Learning Outcomes achieved by students by doing the project

Comments ‘suggestions about team work/leadership/inter-personal communication (if any)

Marks out of 6 | Marks out of4

for for

eae sformance | performance

a Student Name per P ae

in group in oral/ of 10

activity | presentation

(scols) | (scols)

17 [Bangar Sarthak Santosh

Ms.Thorat SK

(Name & Signature of Faculty)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- E-KYC Pending File (Parner)Document1,656 pagesE-KYC Pending File (Parner)RP GraphicsNo ratings yet

- PrachiDocument8 pagesPrachiRP GraphicsNo ratings yet

- MicroDocument28 pagesMicroRP GraphicsNo ratings yet

- Sangram BhaiDocument36 pagesSangram BhaiRP GraphicsNo ratings yet

- Mic Micro OosDocument31 pagesMic Micro OosRP GraphicsNo ratings yet

- MIC MicroproDocument40 pagesMIC MicroproRP GraphicsNo ratings yet

- Day 1Document20 pagesDay 1RP GraphicsNo ratings yet

- Gad MPDocument26 pagesGad MPRP GraphicsNo ratings yet

- Anjali Project - RemovedDocument3 pagesAnjali Project - RemovedRP GraphicsNo ratings yet

- Practical No - 01Document4 pagesPractical No - 01RP GraphicsNo ratings yet

- RohanDocument10 pagesRohanRP GraphicsNo ratings yet

- Rohan Final ProjectDocument31 pagesRohan Final ProjectRP GraphicsNo ratings yet

- Ste PracticalprachiDocument5 pagesSte PracticalprachiRP GraphicsNo ratings yet

- Practical 7 SteDocument1 pagePractical 7 SteRP GraphicsNo ratings yet

- DCC Micro RohanDocument23 pagesDCC Micro RohanRP GraphicsNo ratings yet

- MicroDocument43 pagesMicroRP GraphicsNo ratings yet

- Practical 9 SteDocument1 pagePractical 9 SteRP GraphicsNo ratings yet

- Management MicroprojectDocument35 pagesManagement MicroprojectRP GraphicsNo ratings yet

- STE - Final KDocument23 pagesSTE - Final KRP GraphicsNo ratings yet

- Vijaya Itr Report FinalDocument31 pagesVijaya Itr Report FinalRP GraphicsNo ratings yet

- Citut Diaq Ram: Built Test Fun Thon of 9 Lhe-OeDocument4 pagesCitut Diaq Ram: Built Test Fun Thon of 9 Lhe-OeRP GraphicsNo ratings yet

- Management MicroprojectDocument27 pagesManagement MicroprojectRP GraphicsNo ratings yet