Professional Documents

Culture Documents

Batch 1 - Lecture 1 - Partnership Formation - Part 3

Uploaded by

VILLANUEVA Monica Therese0 ratings0% found this document useful (0 votes)

11 views4 pagesThis document contains information about the capital balances and adjustments for three partnerships - Roces Records, Sales Records, and Basco.

For Roces Records, the unadjusted capital balance was $161,600 but after increasing accounts receivable and merchandise inventory and decreasing fixtures, the adjusted capital balance is $224,000.

For Sales Records, the unadjusted capital balance was $195,200 but after decreasing fixtures and increasing goodwill, the adjusted capital balance is also $224,000.

For Basco, the unadjusted capital balance was $35,200 but after decreasing accounts receivable and fixtures, the adjusted capital balance is $31,500. Basco's capital ratio is 40% of the

Original Description:

Part 3/3 - 1st Year 2nd Semester FAR 2

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information about the capital balances and adjustments for three partnerships - Roces Records, Sales Records, and Basco.

For Roces Records, the unadjusted capital balance was $161,600 but after increasing accounts receivable and merchandise inventory and decreasing fixtures, the adjusted capital balance is $224,000.

For Sales Records, the unadjusted capital balance was $195,200 but after decreasing fixtures and increasing goodwill, the adjusted capital balance is also $224,000.

For Basco, the unadjusted capital balance was $35,200 but after decreasing accounts receivable and fixtures, the adjusted capital balance is $31,500. Basco's capital ratio is 40% of the

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesBatch 1 - Lecture 1 - Partnership Formation - Part 3

Uploaded by

VILLANUEVA Monica ThereseThis document contains information about the capital balances and adjustments for three partnerships - Roces Records, Sales Records, and Basco.

For Roces Records, the unadjusted capital balance was $161,600 but after increasing accounts receivable and merchandise inventory and decreasing fixtures, the adjusted capital balance is $224,000.

For Sales Records, the unadjusted capital balance was $195,200 but after decreasing fixtures and increasing goodwill, the adjusted capital balance is also $224,000.

For Basco, the unadjusted capital balance was $35,200 but after decreasing accounts receivable and fixtures, the adjusted capital balance is $31,500. Basco's capital ratio is 40% of the

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

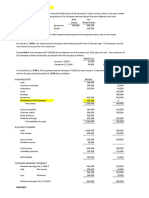

Case B - Problem 1-4

POV of Roces' Records Carrying Amount Agreed Value Changes

Accounts Receivable 57,600.00 56,000.00 -1,600.00

Fixtures 64,000.00 80,000.00 16,000.00

Merchandise Inventory 124,800.00 132,800.00 8,000.00

Goodwill - 40,000.00 40,000.00

Unadjusted Capital Balance of Roces 161,600.00

1. Decrease in Accounts Receivable -1,600.00

2. Increase in Fixtures 16,000.00

3. Increase in Merchandise Inventory 8,000.00

4. Increase in Goodwill 40,000.00

Adjusted Capital Balance of Roces 224,000.00

POV of Sales' Records Carrying Amount Agreed Value Changes

Fixtures 8,000.00 4,800.00 -3,200.00

Goodwill - 32,000.00 32,000.00

Unadjusted Capital Balance of Sales 195,200.00

1. Increase in Fixtures -3,200.00

2. Increase in Goodwill 32,000.00

Adjusted Capital Balance of Sales 224,000.00

Partnership Balances for the following accounts:

Cash 19,200.00

Accounts Receivable 115,200.00

Merchandise Inventory 324,800.00

Delivery Equipment 46,400.00

Fixtures 84,800.00

Prepaid Insurance 8,000.00

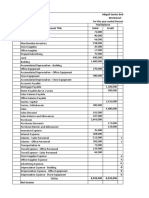

Cases B - Problem 1-3

POV of Basco' Records Carrying Amount Agreed Value Changes

Accounts Receivable 14,400.00 11,200.00 -3,200.00

Furniture and Fixtures 4,000.00 3,500.00 -500

Unadjusted Capital Balance of Basco 35,200.00

1. Decrease in Accounts Receivable -3,200.00

2. Decrease in Furniture and Fixtures -500

Adjusted Capital Balance of Basco 31,500.00

RATIO ACTUAL ADJUSTMENT AGREED

Basco 40.00% 31,500.00 31,500.00 40.00%

Torre 60.00% 47,250.00 47,250.00 60.00%

78,750.00 78,750.00 TOTAL

40% OF THE TOTAL CAPITAL OF THE PARTNERSHIP = BASCO'S CAPITAL

40% OF TCP = P31,500 TCP = P31,500 / 40%

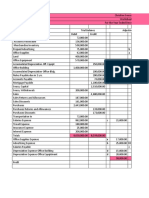

1. Magfocus sa partner na kumpleto ang data - may ratio / percent at capital

2. Kapag nagfocus sa partner na may kumpletong data, ang gagawin ay ididivide ang capital sa ratio

at ang makukuha ay ang TOTAL CAPITAL NG PARTNERSHIP.

3. Para makuha ang capital ng naiwang partner, ibawas ang total sa capital ng partner na may kumpletong data.

Application Example:

RATIO CAPITAL

Partner A 30.00% 105,000.00

Partner B 70.00% 245,000.00 Partner with complete data

350,000.00

Application Example - For Bonus Method

ACTUAL ADJUSTMENT AGREED

Partner A 105,000.00 35,000.00 140,000.00 40%

Partner B 245,000.00 -35,000.00 210,000.00 60%

350,000.00 350,000.00

The total actual capital = total agreed capital

Adjusting Entry:

B, Capital 35,000.00

A, Capital 35,000.00

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 1Z0-960 Exam QuestionsDocument7 pages1Z0-960 Exam QuestionsBill Hopes100% (1)

- Badvac1x - Mod 3 TemplatesDocument44 pagesBadvac1x - Mod 3 TemplatesRezhel Vyrneth TurgoNo ratings yet

- ACCTG 029 MOD 3 Conso Subsequent TemplateDocument40 pagesACCTG 029 MOD 3 Conso Subsequent TemplateBetty Santiago67% (3)

- CA No. 2 - Business FinanceDocument43 pagesCA No. 2 - Business FinanceArthurLeonard MalijanNo ratings yet

- Partnership Formation: Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Formation: Name: Date: Professor: Section: Score: QuizWenjun100% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- Osceola County Real Property Records Forensic ExaminationDocument759 pagesOsceola County Real Property Records Forensic ExaminationStephen Dibert100% (2)

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- Afar Partnership LiquidationDocument42 pagesAfar Partnership LiquidationKrizia Mae Uzielle PeneroNo ratings yet

- PDF-Afar CompressDocument128 pagesPDF-Afar CompressCharisse VisteNo ratings yet

- HDFC Car LoanDocument28 pagesHDFC Car Loanchetannagar88100% (1)

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Castro, Geene - Activity 1 - Bsma 3205Document6 pagesCastro, Geene - Activity 1 - Bsma 3205Geene CastroNo ratings yet

- Akuntansi Keuangan Lanjutan 1Document14 pagesAkuntansi Keuangan Lanjutan 1darwas darwasNo ratings yet

- A 1. FormationDocument3 pagesA 1. Formationmartinfaith958No ratings yet

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Past Paper Answers - 2017 (B) : Business Name:-NM Company LTDDocument42 pagesPast Paper Answers - 2017 (B) : Business Name:-NM Company LTDName of RoshanNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Cost Flow ModelDocument3 pagesCost Flow ModelMae AstovezaNo ratings yet

- AE 120 Group Activity AnswersDocument5 pagesAE 120 Group Activity AnswersRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Badvac1x - Mod 3 TemplatesDocument42 pagesBadvac1x - Mod 3 TemplatesKyla de SilvaNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Worksheet - Service - Gracia Bigasan CoDocument4 pagesWorksheet - Service - Gracia Bigasan CoJasmine ActaNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument8 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- Alomia - Ae 112 Midterm Sa1 SolutionDocument9 pagesAlomia - Ae 112 Midterm Sa1 SolutionRica Ann RoxasNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Solution AssignmentDocument6 pagesSolution AssignmentRaven SiaNo ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Consolidated Fiancial StatementsDocument15 pagesConsolidated Fiancial StatementsChristie SabidorNo ratings yet

- Partnership Formation Problem IVDocument8 pagesPartnership Formation Problem IVAnnie MalinaoNo ratings yet

- Chapter 1 - Teacher's Manual - Afar Part 1-1Document10 pagesChapter 1 - Teacher's Manual - Afar Part 1-1Mayeth BotinNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- MZM Grocery Store Worksheet For The Year Ended December 31, 2021 Trial Balance Account Titles Debit CreditDocument11 pagesMZM Grocery Store Worksheet For The Year Ended December 31, 2021 Trial Balance Account Titles Debit CreditNichole Joy XielSera Tan100% (1)

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Statement of LiquidationDocument13 pagesStatement of LiquidationnerieroseNo ratings yet

- Activities On Module 1 - Partnership AccountingDocument4 pagesActivities On Module 1 - Partnership AccountingANDI TE'A MARI SIMBALANo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- ClassProblemsChapter5 SolutionDocument6 pagesClassProblemsChapter5 SolutionA373728272No ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Safari - 12 Aug 2019 at 1:00 PM PDFDocument1 pageSafari - 12 Aug 2019 at 1:00 PM PDFPauline BiancaNo ratings yet

- Afar 107 - Business Combination Part 2Document4 pagesAfar 107 - Business Combination Part 2Maria LopezNo ratings yet

- SOPL, SOFP Dynamic Peony EnterpriseDocument3 pagesSOPL, SOFP Dynamic Peony EnterpriseIsmahNo ratings yet

- AssignmentDocument3 pagesAssignmentalmira garciaNo ratings yet

- P Company Acquires 80Document5 pagesP Company Acquires 80hus wodgyNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationJessica C. Dela CruzNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Instructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Document5 pagesInstructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Success LibraryNo ratings yet

- International Accounting Standard CommitteeDocument2 pagesInternational Accounting Standard Committeeshamrat ronyNo ratings yet

- Horizontal and Vertical Analysis of Wallmart 10kDocument9 pagesHorizontal and Vertical Analysis of Wallmart 10kKelly Milagros Orozco Rosales100% (1)

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Analysis of The Risk and Return Relationship of Equity Based Mutual Fund in IndiaDocument7 pagesAnalysis of The Risk and Return Relationship of Equity Based Mutual Fund in Indiagau2gauNo ratings yet

- MBBsavings - 158118 107625 - 2016 12 31Document7 pagesMBBsavings - 158118 107625 - 2016 12 31Zahar ZekNo ratings yet

- Course Outline Fundamentals of Financial AccountingDocument7 pagesCourse Outline Fundamentals of Financial AccountingHammad AliNo ratings yet

- Concept Map - Cooperatives & Construction CompaniesDocument2 pagesConcept Map - Cooperatives & Construction CompaniesSherilyn BunagNo ratings yet

- TutorialDocument9 pagesTutorialNaailah نائلة MaudarunNo ratings yet

- Indvi Assignment 2 Investment and Port MGTDocument3 pagesIndvi Assignment 2 Investment and Port MGTaddisie temesgen100% (1)

- SPX 3m SkewDocument2 pagesSPX 3m SkewahmadnaminiNo ratings yet

- June 2022 BoltDocument77 pagesJune 2022 BoltRambabu PalepoguNo ratings yet

- The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinDocument51 pagesThe Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/Irwinazee inmixNo ratings yet

- Amarakosha Knowledge StructureDocument5 pagesAmarakosha Knowledge Structureaarpee78No ratings yet

- Fac22a2 SuppDocument11 pagesFac22a2 Suppsacey20.hbNo ratings yet

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Document3 pagesAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNo ratings yet

- CP 1 Consolidated Foods DataDocument5 pagesCP 1 Consolidated Foods DataASHUTOSH BISWALNo ratings yet

- Testimonial 9 (11.5.16)Document69 pagesTestimonial 9 (11.5.16)LeninNo ratings yet

- Module 3 Principles of Accounting 2Document25 pagesModule 3 Principles of Accounting 2Phoebe Jane AbrahamNo ratings yet

- Ordinary Old - Accounting Paper 2 NSSCODocument20 pagesOrdinary Old - Accounting Paper 2 NSSCOTangeniNo ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- Sanction Letter INST5187568192559754 914871556872853Document10 pagesSanction Letter INST5187568192559754 914871556872853ManiNo ratings yet

- Accounts Worksheet 2Document1 pageAccounts Worksheet 2Sidharth RamalingamNo ratings yet

- Liquidity RatiosDocument2 pagesLiquidity Ratiosabrar mahir SahilNo ratings yet

- Money Market WordDocument18 pagesMoney Market Wordshrikant_b1No ratings yet

- Role of Regional Rural Banks in The Economic Development of Rural Areas in India: A StudyDocument11 pagesRole of Regional Rural Banks in The Economic Development of Rural Areas in India: A StudyNAGAVENINo ratings yet