Professional Documents

Culture Documents

MOD5 Business Combination For Sending (AutoRecovered)

MOD5 Business Combination For Sending (AutoRecovered)

Uploaded by

Natalie SerranoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MOD5 Business Combination For Sending (AutoRecovered)

MOD5 Business Combination For Sending (AutoRecovered)

Uploaded by

Natalie SerranoCopyright:

Available Formats

1

ADVANCED ACCOUNTING

Module 5: Accounting for Business Combinations

Module 5.0: Introduction

Accounting for Business Combinations is perhaps the most advanced topic in Advanced Accounting.

Advanced… but not the most difficult. At the end of this module, you will realize that this topic is, at

its core, procedural and methodical in nature.

In law, business combinations are classified either as a merger (A + B = A or B) or a consolidation (A

+ B = C). In accounting, business combinations are classified in a similar way. The focal point,

however, is the accounting treatment of the transaction/s rather than its legal structure.

a. Acquisition of net assets (Accounting merger) – there is an actual purchase of ALL

(100%) the assets and liabilities of the acquiree. To put it in another way, all the assets and

liabilities of the acquiree are closed in its separate books and transferred to the books of the

acquirer. After the acquisition, the acquiree is dissolved and only the acquirer continues in

existence.

b. Acquisition of stock (Accounting consolidation) – control is obtained USUALLY by

purchasing all or majority of the voting shares of another company. The acquiree (or more

appropriately referred to as the subsidiary) and the acquirer (i.e. parent) continue their

separate existence. However, at the end of the accounting period, they are consolidated into

one company. Normally, I would have romanticized this, but I’ll leave that up to you.

The difference between the two primarily lies in the journal entries made in the books of the

acquirer (or parent), the acquiree (or subsidiary), and the consolidated books. Journalizing the

transactions involved in business combinations will be embedded in our classroom discussions, but

to give you an overview of the entries made, the following illustration is provided:

Acquisition of Net assets: Assume that A Corp. acquired all the assets and assumed all the liabilities

of B Corp. for P1,000,000 cash. The fair values, which is also equal to their book values, of B Corp.’s

assets and liabilities at the date of acquisition is P1,500,000 and P700,000, respectively. The

combination is properly accounted for as an acquisition of net assets. The ff. entries are made at the

acquisition date:

Books of A Corp. (Acquirer) Books of B Corp. (Acquiree) Consolidated books

Assets of B Corp P1.5 M Liabilities P0.7 M The consolidated books is simply the

Goodwill 0.2 M Equity 0.8 M books of A Corp.

Cash (consideration) P1 M Assets P1.5 M

Liabilities of B Corp. 0.7 (to close the books of B Corp.)

Acquisition of Stock: Assume that C Corp. obtained control of D Corp. by acquiring 100% of the

voting shares of the latter for P1,000,000 cash. The fair values, which is also equal to their books

values, of D Corp.’s assets and liabilities at the date of acquisition is P1,500,000 and P700,000,

respectively. The combination is properly accounted for as an acquisition of stock. The ff. entries are

made:

Books of C Corp. (Parent) Books of D Corp. (Subsidiary) Consolidated books

Investment in D Corp. P1 M No journal entry is made. The cash Equity – D Corp. P0.8 M

Cash (consideration) P1 M consideration is a personal Goodwill 0.2 M

transaction to the shareholders of D Investment in D Corp. P1

Corp. M

Notice that the goodwill recognized for both types of acquisitions is the same, but the journal

entries to recognize the business combination at the date of acquisition are different.

According to IFRS 3, the ACQUISITION METHOD is the only acceptable method in accounting for

business combinations. The acquisition method involves the following steps:

1. Identify the acquirer.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

2

2. Determine the acquisition date – the acquisition date is the date control is obtained.

3. Recognize and measure the identifiable assets acquired, liabilities assumed, and any non-

controlling interest in the acquiree.

4. Recognize and measure goodwill or bargain purchase gain.

Module 5.1: Business Combination – Date of Acquisition

Focus notes:

The MAIN CONCERN of accounting problems for business combinations at the date of

acquisition is the computation of GOODWILL or BARGAIN PURCHASE GAIN (i.e. negative

goodwill).

The basic formula to compute goodwill (bargain purchase gain) is:

Cost of investment (COI) xxx

Fair value of the identifiable net assets of the acquiree/subsidiary (FVNA) _xxx_

Goodwill/(Bargain Purchase Gain) xxx

Question: Where is goodwill/bargain purchase gain recorded?

It depends on the type of acquisition. If it is an acquisition of net assets, goodwill is

recorded in the BOOKS OF THE ACQUIRER. If it is an acquisition of stock, goodwill is

recorded in the CONSOLIDATED BOOKS. In no case shall goodwill or gain arising from the

combination be recorded in the books of the acquiree/subsidiary or the parent.

Cost of investment (COI) – the COI is essentially the consideration given by the acquirer (or

parent) to the acquiree (or subsidiary) to effect the business combination. The COI is the sum of

the following items, all of which are valued at FAIR VALUE:

1. Cash consideration given to acquire the acquiree or subsidiary

2. Nonmonetary assets given as consideration

3. Equity instruments issued as consideration

4. Liabilities assumed

5. Contingent consideration payable (CCP) – the CCP is a consideration payable when the

subsidiary satisfies a certain condition (e.g. a profit target or a sales quota).

6. Share-based payments

7. Non-controlling interest (NCI) – arises in acquisition of stock and less than 100% of the

voting shares are acquired by the parent.

8. Previously-held interest (PHI) – arises in step acquisitions. Accounting for step

acquisitions is discussed in the succeeding pages.

Acquisition-related costs – these costs are NOT PART of the COI. They are expensed

immediately. However, if they relate to the issuance of equity securities, they are treated as a

DEDUCTION to the extent of the APIC arising from the issuance of such securities. Any EXCESS

to the amount of the APIC arising from the issuance is EXPENSED. Examples of share issuance

costs are SEC registration fees and printing costs.

Illustration: Assume that A Corp. acquired B. Corp. by issuing 10,000 shares with a par of P2 and

fair value of P5 per share. The following acquisition-related costs were incurred and paid: legal

fees P10,000, SEC registration fees P20,000, printing of stock certificates P20,000. The legal fees

are expensed immediately. The SEC registration fees and printing of stock certificates should be

deducted or offset against the APIC. But since the APIC arising from the issuance is just P30,000

(10,000 shares x [P5 – P2]), P10,000 of the cost of issuing shares is expensed. All these are

summarized in the journal entry below:

Acquisition-related expenses (P10,000 finders fee + P10,000 excess) P20,000

Additional paid-in capital (APIC) 30,000

Cash P50,000

When debt securities (such as bonds) are issued as consideration, any issuance costs are treated

as a deduction to the carrying amount of the security. A new effective rate is computed to

amortize the liability. However, accounting problems on business combinations rarely involve

debt securities as a consideration. Rarely… but not never.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

3

Fair value of the identifiable net assets of the acquiree/subsidiary (FVNA) – the FVNA is

simply the difference of the identifiable assets and the identifiable liabilities of the

subsidiary/acquiree at fair value.

FVNA = Identifiable assets @ FV – Identifiable Liabilities @ FV

The label “identifiable” is very important. IDENTIFIABLE does not necessarily mean that it is

RECORDED (and vice versa) in the books of the subsidiary/acquiree. Some assets and

liabilities may not be recorded in the books of the acquiree/subsidiary but are identifiable at the

point of acquisition. The fair value of these assets and liabilities should be included in the

computation of the FVNA. Examples are unrecorded intangibles in the books of the

acquiree/subsidiary but have existing fair values per appraisal. Similarly, some recorded assets

and liabilities are not identifiable and should be excluded in the computation of the FVNA. An

example would be receivables that are fully uncollectible. GOODWILL in the BOOKS OF THE

ACQUIREE/SUBSIDIARY is NOT IDENTIFIABLE and should be EXCLUDED from the

computation of the FVNA.

Another tricky rule in computing the FVNA is in the treatment of CONTINGENT ASSETS and

LIABILITIES. Normally, contingent assets are neither disclosed nor recognized, while contingent

liabilities are disclosed when their existence is possible and recognized as provisions when they

are probable. In business combinations, contingent assets are considered identifiable

when their level of existence is probable, while contingent liabilities are considered

identifiable when they are either possible or probable. In other words, the level of

recognition of the subsidiary’s contingent assets and liabilities at the date of acquisition is “one

step higher” than the usual accounting. The table below summarizes this rule:

Accounting for Business

Normal Accounting

Combinations

NEVER RECOGNIZED or Recognized when they are

Contingent assets

DISCLOSED PROBABLE

Recognized when they are Recognized when they are

Contingent liabilities

PROBABLE POSSIBLE or PROBABLE

For a more comprehensive discussion on the theory behind the recognition of assets and

liabilities at the point of acquisition, refer to your Module in ACCTG 610 on Business

combinations (IFRS 3). #CumulativeLearning #TinatamadLangTalagaAkoMagEncode

Valuation of NCI – NCI is valued using the following HIERARCHY:

1. Explicit fair value (1st level) – the given fair value of the NCI in the problem.

2. Assumed fair value (2nd level) – if the fair value is not explicitly given, it is is obtained by

grossing up the consideration given by the parent to the subsidiary and multiplying the

ownership percentage of the NCI. To illustrate, assume that A Corp. acquired 80% of B Corp.

for P800,000 cash. The assumed FV of the NCI is P200,000 (P800,000 ÷ 80% x 20%).

Control premium – when control premium is part of the purchase price, it should be

deducted from the price before grossing up the consideration to obtain the assumed FV of

the NCI. Illustration: Assume that A Corp. acquired 70% of B Corp. for P710,000 cash. The

purchase price includes control premium of P10,000. The assumed FV of the NCI is

P300,000 ([P710,000 – 10,000] ÷ 70% x 30%).

3. Proportionate share in the subsidiary’s FVNA (3 rd level) – obtained by multiplying the

ownership percentage of the NCI by the FVNA. Illustration: Assume that the fair value of

the net assets of B Corp, the subsidiary, is P1,200,000. If the parent owns 70% of the voting

stock of the subsidiary, then the proportionate share of the NCI in the subsidiary’s FVNA is

P360,000 (P1,200,000 x 30%).

NCI valuation rule - the value of the NCI at the date of acquisition CANNOT GO BELOW its

value when computed using the proportionate share in the subsidiary’s FVNA. The reason

behind this rule is to avoid the recognition of NEGATIVE GOODWILL (i.e. bargain purchase gain)

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

4

that is attributed to the NCI. Illustration: if the assumed fair value is P300,000, but the NCI’s fair

value using the proportionate method is P360,000, the P360,000 will be used to compute COI

even if the proportionate method is the third level of the valuation hierarchy. This valuation rule

should always be remembered when solving since it is one of the many tricks that your examiner

(including me) can use to mislead your computation of the NCI and the resulting goodwill or

bargain purchase gain.

The following table can be used to facilitate your solution and to double-check whether the

valuation rule is violated or not:

TOTAL PARENT (%) NCI (%)

COI XXX3 XXX2 XXX1

FVNA _(XXX)_ _(XXX)_ _(XXX)_

Goodwill (BP gain) XXX XXX XXX4

1

the acquisition-date value of NCI using the valuation hierarchy.

2

the consideration given by the parent to obtain control over the subsidiary (e.g. cash,

shares, nonmonetary assets, liabilities assumed, CCP, etc.)

3

the total of (1) and (2).

4

this should never be negative, otherwise the valuation rule is violated.

Measurement period – when the fair values of the acquiree or subsidiary’s net assets are

provisional (i.e. tentative), a measurement period of ONE (1) YEAR from the DATE OF

ACQUISITION is given to allow any changes in the fair values recognized to compute goodwill or

bargain purchase gain. Changes in the fair value after the measurement period are disregarded

and no longer accounted for as adjustments to the goodwill or bargain purchase gain initially

recognized.

Step acquisition (Business combination achieved in stages) – this happens when the

acquirer initially has no control over the subsidiary but subsequently obtains control by

purchasing additional interest. In accounting, our primary concern in step acquisitions is the

valuation of the previously-held interest (PHI) to be included in the COI to compute goodwill or

bargain purchase gain. The fair value of the PHI is computed by grossing up the consideration

given by the parent to acquire the additional interest and multiplying the percentage of the PHI

in relation to the total voting shares of the subsidiary.

Illustration: Assume that A Corp. initially owns 20% of B Corp. This investment is accounted for

using the equity method and has a book value of P150,000 at the end of the year. At that time, A

Corp. acquired an additional 60% of B’s voting shares for P600,000, bringing its total ownership

to 80%. The fair value of the previously-held interest of 20% at the date of acquisition is

P200,000 (600,000 ÷ 60% x 20%). A remeasurement gain of P50,000 is recognized in the books

of A Corp.

Practice problems (Business Combination – Date of Acquisition):

Problem 1: The following Statements of Financial Position were prepared for POTATO Corp. and

SALAD Corp. on January 1, 2015, just before they entered into a business combination.

Potato Corp. Salad Corp.

Cash P84,000 P2,000

Accounts receivable 30,000 8,000

Inventory 80,000 20,000

PPE (net) 120,000 30,000

Goodwill ___-___ 20,000

Total assets P314,000 P80,000

Accounts payable P50,000 P28,000

Bonds payable 80,000 12,000

Common stock 84,000 20,000

Additional paid-in capital 20,000 4,000

Retained earnings 80,000 16,000

Total liabilities and equity P314,000 P80,000

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

5

On that date, the fair market value of POTATO’s property, plant and equipment amounts to

P150,000, while its bonds payable has a fair value of P65,000. The fair market value of SALAD’s

inventories and PPE were P31,200 and P49,600, respectively, while its bonds payable has a fair

value of P16,800. The fair market value of all other assets and liabilities of POTATO and SALAD

(except for goodwill) were equal to their book values.

On January 2, 2015, POTATO Corp acquired the net assets of SALAD Corp by issuing 2,500 shares of

its P12 par value common stock (current fair value P14.40 per share). Cash amounting to P12,800

was also given by POTATO to SALAD. A contingent consideration amounting to P1,000 will be given

by POTATO in the event that the acquisition will result to a 10% increase in SALAD’s revenue. The

contingent consideration is probable and determinable, and it has been ascertained that the fair

value of this liability is P800. Additional cash payments made by POTATO Corp in completing the

acquisition were the following: legal fees for contract of business combination, P3,200; Accounting

and legal fees for SEC registration, P4,400; Printing costs of stock certificates, P2,400; Finder’s fee,

P2,800; Indirect cost, P2,000.

Compute for the following amounts at the date of acquisition:

a. Goodwill or bargain purchase gain c. Consolidated liabilities

b. Consolidated assets d. Consolidated equity

Problem 2: ABC Company acquired all of JKL Corporation's assets and liabilities on October 1,

2015. JKL reported assets with a book value of P998,400 and liabilities of P569,600.

ABC noted that JKL included the amount of P64,000 pertaining to the cost of obsolete

merchandise in its recorded assets. The merchandise are no longer saleable.

ABC also determined that an old delivery van previously used by JKL had a fair value of

P192,000 but is fully depreciated in its books.

Except for machinery and equipment, ABC determined the fair value of all other assets and

liabilities reported by JKL approximated their recorded values.

In recording the transfer of assets and liabilities in its books, ABC recorded gain on

acquisition of P148,800. ABC paid P327,200 to acquire JKL's assets and liabilities.

(1) If the book value of JKL's machinery and equipment was P345,600, what was their fair value?

(2) Using the same information above, but with the following changes in assumption: ABC

recorded goodwill of P402,000 and ABC paid P1,037,000 to acquire JKL's assets and liabilities.

If the book value of JKL's machinery and equipment was P516,500, what was their fair value?

A. P264,800; P438,300 C. P264,800; P594,700

B. P426,400; P438,300 D. P426,400; P594,700

Problem 3: On September 18, 2015, DG Co. acquired all the AX Inc.'s P2,150,000 identifiable assets

and P530,000 liabilities. Book values of the AX's assets and liabilities equal to their fair values

except for the overvalued furniture and fixtures. As a consideration, DG issued its own shares of

stock with a market value of PI,715,000 and cash amounting to P375,000. Contingent consideration

that was probable and reasonably estimated on the date of acquisition amount to P148,000. The

merger resulted into P647,000 goodwill. DG Co. had P4,890,000 total assets and P2,731,000 total

liabilities prior to the combination and no additional cash payments were made. Expenses were

incurred for acquisition-related cost amounting to P28,000.

(1) After the merger, how much is the combined total assets in the books of the acquirer?

(2) After the merger, how much is the increase in liabilities in the books of the acquirer?

A. P7,283,000; P706,000 C. P7,658,000; P706,000

B. P7,128,000; P678,000 D. P7,255,000; P678,000

Problem 4: On August 1, 2015, the Polo Company acquired the net assets of Sport Company for a

consideration transferred of P17,450,000 cash. In addition to the cash consideration, an extra

P1,015,000 cash shall be transferred nine months after the acquisition date if a specified profit

target was met. At the acquisition date there was only a low probability of the profit target being

met, so the fair value of the additional consideration liability was determined to be P468,000.

At the acquisition date, the carrying amount of Sport's net assets was P11,925,000 and a

temporary appraisal of fair value amounting to P12,385,000 was given.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

6

On December 31, 2015, an new provisional fair value of P16,815,000 was attributed to the

net assets. Also, at year end the estimated amount of the contingent consideration payable

is determined to decrease by P72,000 from the original estimate.

On March 31, 2016 the estimated amount of the contingent consideration payable is

determined to be probable at P284,000

On July 1, 2016 the temporary appraisal decreased by P940,000 from the latest valuation.

The provisional fair value was finalized on August 31, 2016 with an amount that is higher

by P1,070,000 from the temporary appraisal as of July 1, 2016.

As a subsequent event, the profit target was met and the P1,015,000 cash was transferred.

What amount of goodwill is presented in the separate statement of financial position of the acquirer

company as of December 31, 2016?

A. P1,859,000 B. P2,625,000 C. P789,000 D. P1,555,000

Problem 5: On January 1, 2015, the Statement of Financial Position of Body and Shop Company

prior to the combination are:

Body Co. Shop Co.

Cash P675,000 P22,500

Inventories 450,000 45,000

Property and equipment (net) 1,125,000 157,500

Total Assets P2,250,000 P225,000

Current liabilities P135,000 P22,500

Ordinary shares, P100 par 225,000 22,500

Share premium 675,000 45,000

Retained earnings 1,215,000 135,000

Total Liabilities and Stockholder’s Equity P2,250,000 P225,000

The fair value of Shop Company’s equipment is P229,500.

Assume the following independent cases:

1. Assume that Body Company acquired all of the outstanding stock of Shop Company

resulting to a goodwill of P99,000. Contingent consideration is P54,000. How much is the

price paid to Shop Company's stock?

A. P373,500 B. P472,500 C. P319,500 D. P427,500

2. Assuming Body Company acquired 70% of the outstanding common stock of Shop Company

for P157,500. Non-controlling interest is measured at fair value of P91,500. How much is

the goodwill or bargain purchase gain?

A. P(25,500) B. P25,500 C. P34,650 D. P(34,650)

3. Assuming Body Company acquired 80% of the outstanding common stock of Shop Company

for P205,200. Non-controlling interest is measured at its proportionate share in Shop

Company's identifiable net assets. How much is the consolidated stockholder's equity on the

date of acquisition?

A. P2,115,000 B. P2,129,400 C. P2,169,900 D. P2,184,300

4. Assuming Body Company acquired 90% of the outstanding common stock of Shop Company

for P364,500. Non-controlling interest is measured at fair value. How much is the total

consolidated assets on the date of acquisition?

A. P2,313,000 B. P2,677,500 C. P2,605,500 D. P2,241,000

Problem 6: Acquirer Company acquires 25% of Acquired Company’s common stock for P190,000

cash and carries the investment using the cost method. After three months, Parent purchases

another 60% of Subsidiary’s common stock for P540,000. On this date, Acquired Company reports

identifiable net assets with carrying value of P720,000 and fair value of P920,000. The liabilities of

the acquired company has a book value and fair value of P280,000. The fair value of the 15% non-

controlling interest is P125,000.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

7

How much is the goodwill or bargain purchase gain?

A. P(17,000) B. P250,000 C. P(30,000) D. P263,000

Problem 7: Blue Co. merged into Soda Corp. on June 30, 2015. In exchange for the net assets at fair

market value of Blue Co. amounting to P2,785,800 , Soda issued 68,000 common shares at P36 par

value, then going at a market price of P41 per share. Relevant data on stockholders' equity

immediately before the combination show;

Soda Blue

Common stock P8,790,000 P2,030,000

APIC 3,834,000 782,000

Retained earnings/(deficit) (1,516,000) 495,000

Out of pocket costs of the combination were as follows:

Legal fees for the contract of business combination P174,700

Audit fee for SEC registration of stock issue 198,400

Printing costs of stock certificates 144,900

Broker's fee 135,000

Accountant's fee for pre-acquisition audit 161,000

Other direct cost of acquisition 90,400

General and allocated expenses 115,300

Listing fees in issuing new-shares 172,000

What is the amount to be expensed at the date of acquisition?

A. P676,400 B. P851,700 C. P765,400 D. P940,700

Problem 8: On July 1, 2015, Giordano, Inc. acquired most of the outstanding common stock of

Esprit Company for cash. The incomplete working paper elimination entries on that date for the

consolidated statement of financial position of Giordano, Inc. and its subsidiary are shown below:

(1) Stockholders’ equity – Esprit 2,437,500

Investment in Esprit 1,584,375

Non-controlling interest 853,125

(2) Inventories 62,500

Equipment 312,500

Patent 61,250

Goodwill ?

Investment in Esprit 468,750

Non-controlling interest ?

Included in the purchase price is a control premium of P68,750.

The amount of goodwill to be reported in the consolidated statement of financial position on July 1,

2015 (1) assuming non-controlling interest is measured at fair value, (2) assuming non-controlling

interest is measured at the proportionate or relevant share, and (3) assuming non-controlling

interest is measured at fair value. The fair value of the non controlling interest is P1,150,000.

A. P179,135; P185,188; P260,625

B. P284,904; P253,938; P398,125

C. P247,885; P185,188; P329,375

D. P185,188; P284,904; P260,625

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

8

Module 5.2: Business Combination (Stock Acquisition) – Subsequent to

Date of Acquisition

Focus notes:

MAIN CONCERN: Computation of the consolidated net income and breaking it down into the

share of the parent and the share of the NCI.

Notice that this topic is exclusively for business combinations through stock acquisition. This is

because in ACQUISITION OF NET ASSETS, consolidation does not recur after the date of

acquisition. The moment the assets and liabilities of the acquiree are acquired and transferred

to the books of the acquirer, the acquiree ceases to operate. The acquirer and acquiree will

and will always be ONE COMPANY with ONE SET OF BOOKS at ANY GIVEN POINT IN TIME.

However, for STOCK ACQUISITIONS, it’s a different story. Although the parent already controls

the subsidiary, the two continue to operate separately. They are considered to be distinct

accounting entities with separate sets of financial statements. At the end of the accounting

period, the two books are then consolidated for external reporting purposes. In other words,

consolidation is done every accounting period.

How is consolidation done? By instinct, one might think that the process of consolidation is

simply adding the balances in the books of the parent and the subsidiary. Well, it’s a little bit

more complicated than that. Similar to accounting for home office and branches, there are

certain amounts that we need to eliminate/recognize to conform to financial reporting

standards.

The process (or the ‘how’ aspect) of consolidation becomes easier and more digestible when its

‘why’ aspect is understood. Why do we need to consolidate? The following KEY CONCEPTS are

CRUCIAL for you to understand the reason behind the computations for consolidation:

1. In the separate books, the income/loss of the parent and the subsidiary are closed to their

respective retained earnings account. In the consolidated books, the income/loss of the

parent and the subsidiary should be allocated to the parent (as the owner of the

subsidiary) and the NCI (as the minority shareholders of the subsidiary).

2. In the separate books, NCI, as an equity account, is not recognized. NCI only arises upon

consolidation.

3. Goodwill is not recorded in the separate books. Goodwill only arises when the consolidated

books are prepared. Consequently, any goodwill impairment loss will only be

recognized upon consolidation.

4. Since the “Investment in Subsidiary” account in the separate books of the parent is usually

carried using the cost method, dividends given by the subsidiary to the parent are recorded

by the parent as “Dividends Income” in its separate books. Upon consolidation, it would be

improper for such dividends to be classified as income in the consolidated income

statement since it constitutes a mere intercompany transfer of cash.

5. The assets and liabilities of the subsidiary at the date of acquisition are still recorded at

book value in its separate books. These assets and liabilities are only adjusted to their

fair values when consolidation is made to comply with IFRS 3 requirements.

6. Depreciable assets of the subsidiary at the DATE OF ACQUISITION are being depreciated

at their book value in the separate books. In the consolidated books, these assets are

revalued to fair value. This means that there is either unrecognized depreciation (if FV >

BV) or excess depreciation (if BV > FV) to be recognized or eliminated in the consolidated

books, as the case may be.

7. The inventory of the subsidiary at the DATE OF ACQUISITION will become cost of goods

sold at book value at the point of sale in the separate books (following a FIFO assumption).

In the consolidated books, the cost of goods sold should be the fair value of the inventory

sold. This means that there is either unrecognized COGS (if FV > BV) or excess COGS (if

BV > FV) to be recognized or to be eliminated in the consolidated books, as the case may be.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

9

So, why do we need to consolidate? It is for us to recognize certain accounts (such as goodwill and

NCI) that are absent in the separate books and eliminate amounts (such as intercompany

income) that should not be present in the consolidated financial statements. Ultimately, the goal

is to present the parent and all its subsidiaries as a SINGLE COMPANY based on financial

reporting standards.

In computing consolidated net income, the logic is to get the sum of the parent’s and the

subsidiary’s net incomes (losses) and eliminate or recognize any item of income or expense to

comply with generally accepted accounting principles “as if” the parent and the subsidiary are

one company ever since control is obtained by the parent. To facilitate this process, the following

table is useful:

Parent’s share in the NCI in the net

Consolidated Net income of the Explanation

Income (CNI-P) subsidiary (NCINIS)

Net income (loss) of The NCI has no share

the parent in its XXX - in the parent’s net

separate books (NI-P) income (loss).

The NI-S is allocated

Net income (loss) of

to the parent and the

the subsidiary in its XXX XXX

NCI using their

separate books (NI-S)

ownership ratios.

To eliminate dividend

Dividends received by income recognized by

the parent from the (XXX) - the parent in its books

subsidiary (DIV-S) that came from its

own subsidiary.

To allocate any excess

or insufficient

Amortization of fair depreciation or

value-book value amortization of

XXX/(XXX) XXX/(XXX)

differences depreciable assets to

(FV-BV AMORT) the parent and the

NCI using their

ownership ratios.

To allocate any

impairment loss to the

Goodwill impairment

(XXX) (XXX) parent and the NCI

loss (IMP LOSS)

using their

GOODWILL ratios.*

TOTAL XXXX XXXX CNI-P + NCINIS = CNI

*The GOODWILL RATIO pertains to the ratio of goodwill attributed to parent equity and goodwill

attributed to NCI using the three-column goodwill table at the date of acquisition.

1. PARTIAL GOODWILL – there is partial goodwill when only the parent has a share in the

goodwill that is presented in the consolidated balance sheet. This arises when the NCI is

valued at its proportionate share in the fair value of the subsidiary’s net assets (FVNA).

When there is partial goodwill, any goodwill impairment loss is fully allocated to CNI-

P.

2. TOTAL/FULL GOODWILL – there is total goodwill when both the parent and the NCI have

shares in the goodwill amount. This arises when then the NCI is valued at assumed fair

value (i.e. grossed-up amount) or explicit fair value, and the amount is greater than the

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

10

NCI’s share in the FVNA of the subsidiary. When there is total goodwill, any goodwill

impairment loss is allocated to CNI-P and NCINIS using the goodwill ratios.

Take note that the sum of the parent’s share in the CNI and the NCI’s share is equal to the TOTAL

CONSOLIDATED NET INCOME. Notice also that intercompany sales transactions are not yet

incorporated in the CNI table above. A more comprehensive CNI table is presented in Module 5.4:

Business Combination – Intercompany Sales Transactions.

Practice problems (Business Combination – Subsequent Date):

Problem 1: On January 1, 2015, Perry Corporation purchased 80% of Sub Company's common

stock for P3,240,000. P150,000 of the excess is attributable to goodwill and the balance to an

undervalued depreciable asset with a remaining useful life of ten years. Non-controlling interest is

measured at its fair value on date of the acquisition. On the date of acquisition, stockholders' equity

of the two companies are as follows:

Perry Corporation Sub Company

Common stock P5,250,000 P 1,200,000

Retained earnings 7,800,000 2,100,000

On December 31, 2015, Sub Company reported net income of P525,000 and paid dividends of

P225,000. Perry reported net income of P1,605,000 and paid dividends of P690,000. Goodwill had

been impaired and should be reported at P30,000 on December 31, 2015.

Questions:

a. What is the non-controlling interest in net income of Sub Company (NCINIS)? P69,000

b. What is the consolidated net income attributable to parent shareholders (CNI-P)?

P1,701,000

c. What is the consolidated net income (CNI) to be presented in the consolidated income

statement at year-end? P1,770,000

d. What is the consolidated retained earnings (CRE) to be presented in the consolidated

statement of financial position at year-end? P8,811,000

e. What is the non-controlling interest in the net assets of the subsidiary (NCINAS) to be

presented in the consolidated statement of financial position at year-end? P834,000

Problem 2: Periwinkle Corporation acquired 80% of the outstanding common stock of Strawberry

Company on June 1, 2015 for P2,345,000. At the date of acquisition, the fair value of the non-

controlling interest was P470,000.

Strawberry Company's stockholder's equity components at December 31, 2015 are as

follows: Common stock 100 par, P1,000,000, APIC P450,000, Retained Earnings P890,000.

All the assets of Strawberry were fairly valued except for inventories, which are overstated

by P44,000, and equipment, which was understated by P60,000. The equipment has a

remaining useful life of 4 years. The straight-line method for depreciation is used.

Stockholder's equity of Periwinkle on June 1, 2015 is composed of Common stock

P3,000,000, APIC P700,000, Retained Earnings P2,100,000.

Goodwill, if any, should be written down by 56,900 at year-end.

Net income for the first year of parent and subsidiary are P300,000 and P170,000,

respectively.

The parent and the subsidiary declared and paid dividends amounting to P80,000 and

P60,000, respectively.

During the year, there was no issuance of new ordinary shares for both companies.

What is the balance of the non-controlling interest in net assets of subsidiary on December 31,

2015?

A. P580,670 B. P508,970 C. P496,970 D. P487,670

What is the consolidated shareholder’s equity on December 31, 2015?

A. P6,081,380 B. P6,569,050 C. P6,569,050 D. P6,578,350

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

11

Problem 3: P Company purchased 75% of the capital stock of S Company on December 31, 2010 at

P126,000 more than the book value of its net assets. The excess was allocated to equipment in the

amount of P56,250 and to goodwill for the balance. The equipment has an estimated useful life of

10 years and goodwill was not impaired. For four years, S Company reported cumulative earnings

of P567,000 and paid P163,800 in dividends. On January 1, 2015, non-controlling interest in net

asset of S Company amounts to P236,250. Assuming NCI is measured at estimated fair value, what

is the price paid by P Company on the date of acquisition?

A. P423,225 B. P420,525 C. P504,000 D. P532,350

Module 5.3: Business Combination – Intercompany Sales Transactions

Focus notes:

MAIN CONCERN: Eliminating the effects of intercompany transactions on consolidated net

income.

What are intercompany sales transactions? These are sales transactions between a parent and its

subsidiary. An intercompany sales transaction can either be:

1. Downstream – the parent sells an asset to the subsidiary

o (i.e. PARENT = SELLING AFFILIATE; SUBSIDIARY = BUYING AFFILIATE)

2. Upstream – the subsidiary sells an asset to the parent

o (i.e. SUBSIDIARY = SELLING AFFILIATE; PARENT = BUYING AFFILIATE)

Why do I need to know if it is a downstream or upstream transaction? Identifying whether an

intercompany sales transaction is downstream or upstream is crucial in the allocation of the

intercompany income or loss to the CNI-P and the NCINIS.

Type of transaction Treatment

Any intercompany income/loss is allocated

DOWNSTREAM

entirely to the CNI-P.

Any intercompany income/loss is allocated

between the CNI-P and the NCINIS using

UPSTREAM

the ownership percentages of the parent and

the NCI.

What is the effect of intercompany sales transactions on consolidation, specifically on consolidated

net income? The effect of an intercompany sales transaction will depend on the type of asset

sold.

A. INTERCOMPANY SALE OF INVENTORY

Intercompany sales of inventory give rise to intercompany gross profit. In the separate books of the

selling affiliate, this gross profit may be valid for internal purposes. However, in the consolidated

books (or for external reporting), such gross profit is considered unrealized unless it is sold to an

unrelated party. The following consolidating items are incorporated in our CNI table:

1. Unrealized profit in ending inventory (UPEI) – gross profit that is considered unrealized

in the ending inventory of the buying affiliate since the inventory from intercompany sales

is still unsold to unrelated parties. There are multiple ways of computing UPEI, but the most

common is:

Ending/Unsold inventory from intercompany sales x GP ratio of selling affiliate

Accounting treatment: UPEI is a DEDUCTION in the CNI table since it represents fictitious or

overstatement of gross profit that should be eliminated in consolidation.

2. Realized profit in beginning inventory (RPBI) – due to a FIFO cost flow assumption, the

RPBI of this year is simply equal to any UPEI last year.

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

12

Accounting treatment: RPBI is an ADDITION in the CNI table since it represents incremental

gross profit had the inventory been sold by its original owner to unrelated parties.

Illustration: Parent Corp. acquired 80% of Subsidiary Inc. at book value. No goodwill or bargain

purchase gain was recognized. During 2015, Parent Corp. sold goods costing P80,000 to Subsidiary

Inc. for P100,000 (i.e. downstream sale), 40% of which remained unsold to unrelated parties at the

end of the year. Also, on the same year, an upstream sale of inventory for P120,000 occurred with a

gross profit rate on sales of 25%, all of which was unsold at the end of 2015. At the end of 2015, the

parent and the subsidiary reported separate net incomes of P300,000 and P100,000, respectively.

No dividends were declared by both companies.

Question 1: What is the UPEI for 2015?

Solution: For the downstream sale, the UPEI is P8,000, computed using any of the two

alternatives:

Alternative 1: Gross profit from intercompany sale x % unsold

P100,000 – P80,000 = P20,000 x 40% = P8,000

Alternative 2: Sales price x unsold inventory x GP ratio on sales

P100,000 x 40% x 20% = P8,000

Since it is a downstream sale, the P8,000 is allocated entirely to CNI-P in the CNI table as a

deduction.

For the upstream sale, the UPEI is P30,000. Computed as follows: P120,000 x 25% x 100% unsold.

Since it is an upstream sale, the P30,000 is allocated to CNI-P and NCINIS using the ownership

percentages. Total UPEI for the year is P38,000.

Question 2: What is the RPBI for 2016?

Solution: The RPBI for next year is simply equal to the UPEI of last year. The rule of allocation for

upstream and downstream transactions still applies. Consequently, RPBI for 2015 is zero since the

problem does not mention of any intercompany sale of inventory during 2014.

Question 3: What is the CNI-P, NCINIS and CNI for 2015?

Solution:

CNI-P (80%) NCINIS (20%)

NI-P P300,000 -

NI-S 80,000 20,000

UPEI (Downstream) (8,000) -

UPEI (Upstream) (24,000) (6,000)

RPBI - -

TOTAL P348,000 P14,000

Consolidated Net Income (CNI) = P348,000 + P14,000 = P362,000

B. INTERCOMPANY SALE OF DEPRECIABLE ASSETS

When a depreciable asset is sold by the parent to the subsidiary (and vice versa), the book value of

the asset is derecognized in the books of the seller, while the buyer records the asset purchased at

its selling price. This results to two things: (1) an unrealized gain (loss) on sale in the consolidated

books, since the sale is not to an unrelated party, and (2) a change in the periodic depreciation

recognized on such asset since the buying affiliate records the asset at its new purchase price. The

following consolidating items are incorporated in our CNI table:

1. Unrealized gain/loss on sale (UG/UL) – equal to the gain or loss on sale arising from the

intercompany sale (i.e. Selling price less book value). In our CNI table, the UG/UL is only

recognized at the year of the intercompany sale (i.e. the first year). Any UG/UL

recognized on the year of the intercompany sale is no longer recognized in subsequent

periods since it no longer affects net income in those periods.

Accounting treatment: Unrealized gains (UG) are a DEDUCTION in the CNI table since

they represent fictitious gains that should be eliminated in consolidation. On the contrary,

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

13

unrealized losses (UL) are an ADDITION in the CNI table since they represent fictitious

losses.

2. Realized gain/loss (RG/RL) – equal to the change in the periodic depreciation due to the

intercompany sale. There are multiple ways of computing RG/RL, but the most common is:

Unrealized gain (loss) / Remaining life of the depreciable asset from the point of sale

The periodic realization of the unrealized gain or loss is (surprisingly or not) equal to the

change in the periodic depreciation of the depreciable asset (try figuring this out through

journalizing the transactions). HOWEVER, if the asset is sold to unrelated parties before

it is fully depreciated, any remaining unrealized gain or loss that arose from its

intercompany sale is immediately recognized.

Accounting treatment: Realized gains (RG) is an ADDITION in the CNI table since it

represents excess depreciation expense that should be eliminated. On the other hand,

realized losses (RL) is a DEDUCTION in the CNI table since it represents insufficient

depreciation that should be recognized in the consolidated books.

Illustration: P Co. owns 70% of S Inc. The acquisition was at book value. No goodwill or bargain

purchase gain was recorded. On January 1, 2015, P Co. sold machinery to S Inc. for a gain of

P100,000. The machinery has a remaining useful life of 5 years on that date. Also, on July 1, 2016, S

Inc. sold a delivery truck to P Co. for P200,000. The truck had a book value of P250,000 and has a

remaining life of 10 years from the date of sale. No other intercompany transactions occurred for

2015 and 2016. Net income of P Co. and S Inc. for 2015 is P500,000 and P200,000, respectively; for

2016, P400,000 and P150,000, respectively. No dividends were declared by both companies for

2015 and 2016.

Question 1: What is the CNI-P, NCINIS and CNI for 2015 and 2016?

FOR 2015:

CNI-P (70%) NCINIS (30%) Explanation/Computation

NI-P P500,000 - Net income of parent

NI-S 140,000 P60,000 P200,000 is allocated using 70:30 ratio.

UG (100,000) - The unrealized gain of P100,000 is only

deducted in the CNI-P column since it is

downstream.

RG 20,000 - 100,000 / 5 years, this pertains to

EXCESS DEPRECIATION arising from

the intercompany downstream sale

that should be eliminated in the

consolidated books every period until

the asset is fully-depreciated or until

the asset is sold to unrelated parties.

UL - - N/A

RL - - N/A

TOTAL P560,000 60,000 CNI (2015) = P620,000

FOR 2016:

CNI-P (70%) NCINIS (30%) Explanation/Computation

NI-P P400,000 - Net income of parent

NI-S 105,000 P45,000 P150,000 is allocated using 70:30 ratio.

UG - - The UG last year will no longer be

eliminated in the consolidated books

this year since it no longer affects the

net income of both companies this year.

RG 20,000 - 100,000 / 5 years, same explanation

as above

UL 35,000 15,000 The unrealized loss of P50,000 is

allocated to CNI-P and NCINIS since it is

upstream.

RL (1,750) (750) 50,000 / 10 years x 6/12 = P2,500,

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

14

this pertains to INSUFFICIENT

DEPRECIATION arising from the

intercompany upstream sale that

should be recognized in the

consolidated books.

TOTAL P558,250 P59,250 CNI (2016) = P617,500

Question 2: If the machinery was sold on January 1, 2017 to unrelated parties, what is the amount of

realized gain for 2017 attributed to the sale of this asset to be included in the CNI table?

Unrealized gain during intercompany sale P100,000

Cumulative realized gains (P20,000 + P20,000) (40,000)

Realized gain – 2017 P60,000

INTERCOMPANY SALE OF NON-DEPRECIABLE ASSET

The effect is similar to an intercompany sale of depreciable asset, except that depreciation is not

affected. The effect is an unrealized gain or loss on sale, as the case may be. The amount will always

be unrealized since no periodic realization occurs, unless the non-depreciable asset is sold to

unrelated parties.

COMPREHENSIVE CNI TABLE:

Consolidating items CNI-P NCINIS Things to remember:

NI – P XXX - Fully to CNI-P

NI – S XXX XXX Allocated using ownership percentages

Dividends paid by S x % ownership of

Div Income from S (XXX) - parent; Note: If NI-P is from own or separate

operations, no need to deduct this amount.

XXX/

FV-BV Amortization XXX/(XXX) Allocated using ownership percentages

(XXX)

Allocated using GOODWILL ratios if total

GW Imp. Loss (XXX) (XXX) goodwill. If partial goodwill, allocated only

to CNI-P

UPEI

(XXX)

(End inv. x GP%)

RPBI If DOWNSTREAM, entire amount is

XXX

(Beg. inv. x GP%) to CNI-P only.

UG If UPSTREAM, amount is allocated to

(XXX)

(SP > BV) CNI-P and NCINIS using

RG ownership percentages.

(UG/Rem. Life) x XXX *UG and UL are only recognized once

fraction of time on the year of the intercompany sale

UL of the asset.

XXX

(SP < BV)

RL

(UL/Rem. Life) x (XXX)

fraction of time

TOTAL XXXX XXXX CNI-P + NCINIS = CNI

---------------------------------------------------------------------------------------------------------------------------

TOO… MUCH… INFORMATION... SIR, HOW DO YOU EXPECT ME TO REMEMBER ALL OF THESE?!

---------------------------------------------------------------------------------------------------------------------------------

Well, the only way that you can only absorb all these is if you understand the concept behind.

Luckily, the inclusion of the UPEI, RPBI, UG, UL, RG, and RL in the CNI table follows a single

underlying concept: Obtaining consolidated net income (CNI) assuming that NO

INTERCOMPANY TRANSACTIONS occurred.

As what I’ve mentioned at the beginning of this module, accounting for business combinations are

fundamentally procedural. However, due to the bulk of the procedures, it is almost impossible to

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

15

retain everything in one sitting. That’s when conceptual learning comes in. Again, the “how” will

only make sense if you understand the “why”. Just remember:

The PARENT and the SUBSIDIARY are ONE and THE SAME COMPANY, and that

the HEART of CONSOLIDATION is the PREVENTION of FRAUDULENT FINANCIAL

REPORTING.

Practice problems:

Problem 1: GV Company purchased 70% ownership of DL Company on January 1, 2013 at

underlying book value. While each company has its own sales forces and independent product

lines, there are substantial intercompany sales of inventory each period. The following

intercompany sales occurred during 2014 and 2015:

Selling Cost of Buying Sales Unsold at Year Sold to

Year affiliate goods sold affiliate Price year-end Outsiders

2014 GV Co. P448,000 DL Co. P640,000 P140,000 2015

2015 DL Co. P312,000 GV Co. P480,000 P77,000 2016

2015 GV Co. P350,000 DL Co. P437,500 P63,000 2016

The following data summarized the results of their financial operations for the year ended,

December 31, 2015:

GV Company DL Company

Sales P3,850,000 P1,680,000

Gross Profit 1,904,000 504,000

Operating Expenses 770,000 280,000

Ending Inventories 336,000 280,000

Dividend Received from affiliate 126,000 -

Dividend Received from non-affiliate - 70,000

For the year ended 2015, compute:

1. Consolidated sales and Consolidated cost of goods sold

A. P4,612,500; P2,457,550 C. P4,612,500; P2,202,050

B. P4,612,500; P2,206,950 D. P5,530,000; P2,202,050

2. Consolidated net income attributable to parent’s shareholders equity and non-controlling

interest in net income

A. P1,301,335; P59,115 C. P1,476,335; P80,115

B. P1,476,335; P59,115 D. P1,350,335; P80,115

Problem 2: A Co. acquired 60% of the outstanding ordinary shares of B Co. on January 1, 2014. A

Co. acquired it at book value which is the same as its fair value at the date of acquisition. Income

statements of A Co. and B Co. for 2015 were as follows:

A B

Net Sales P875,000 P350,000

Cost of Sales 525,000 210,000

Gross Profit P350,000 P140,000

Operating expenses 105,000 52,500

Operating income P245,000 P87,500

Dividend income 56,000 ____-____

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

16

Net income P301,000 P87,500

There was an upstream sales of P112,000 in 2014 and P168,000 in 2015.

The buying affiliate reported inventory on December 31, 2014 amounting to P70,000 of

which 20% comes from the selling affiliate and inventory on December 31, 2015 amounting

to P84,000 of which 30% comes from the selling affiliate.

A Co. uses 30% mark up on cost and B Co. uses 25% mark up on cost for their selling prices.

A Co. and B Co. declared and paid dividends in 2015 amounting to P84,000 and P70,000

respectively.

On January 1, 2015, B Co. has ordinary shares of P320,000; share premium of P120,000 and

retained earnings of P160,000.

How much is the non-controlling interest in the net assets of the subsidiary (NCINAS) at the end of

2015?

A. P296,156 B. P244,984 C. P246,104 D. P245,024

Problem 3: On January 1, 2015, RDJ Company purchased 80% of the stocks of MCD Corporation at

book value. The stockholders’ equity of MCD Corporation on this date showed: Common stock -

PI,140,000 and Retained earnings - P980,000.

On April 30, 2015, RDJ Company acquired a used machinery for P168,000 from MCD Corp.

that was being carried in the latter's books at P210,000. The asset still has a remaining

useful life of 5 years.

On the other hand, on August 31, 2015, MCD Corp. purchased an equipment that was

already 20% depreciated from RDJ Co. for P690,000. The original cost of this equipment

was P750,000 and had a remaining life of 8 years.

Net income of RDJ Co. and MCD Corp. for 2015 amounted to P720,000 and P310,000.

Dividends paid totaled to P230,000 and P105,000 for RDJ Co. and MCD Corp, respectively.

Net income attributable to parent's shareholders equity and non-controlling interest net income:

A. P826,870; P69,280 C. P834,150; P62,000

B. P826,870; P62,000 D. P834,150; P59,280

Non-controlling interest in net assets and carrying value of the Property and equipment:

A. P472,280; P810,000 C. P465,000; P757,000

B. P465,000; P810,000 D. P472,280; P757,000

Problem 4: On January 1, 2015, P Corporation purchased 80% of S Company's outstanding stock

for P3,100,000. At that date, all of S Company's assets and liabilities had market values

approximately equal to their book values and no goodwill was included in the purchase price.

The following information was available for 2015: Income from own operations of P

Corporation, P750,000 ; Operating loss of S Company, P100,000

Dividends paid in 2015 by P Corporation, P375,000; by S Company to P Corporation,

P60,000.

On July 1, 2015, there was a downstream sale of equipment at a gain of P125,000. The

equipment is expected to have a remaining useful life of 10 years from the date of sale.

Also, on January 2, 2015, there was an upstream sale of furniture at a loss of P37,500. The

furniture is expected to have a useful life of five years from the date of sale.

Non-controlling interest is measured at fair market value.

How much is the consolidated net income attributable to parent shareholders' equity?

A. P486,250 B. P575,250 C. P561,250 D. P515,250

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

17

Comprehensive problem:

On January 1, 2014, Parent Corporation acquired 70% of the common stock of Subsidiary

Corporation by issuing 150,000 shares (P2 par value, P10 market value) and paying cash of

P2,000,000. The shareholders’ equity balances of the two companies at the acquisition date are

given below:

Parent Corporation Subsidiary Corporation

Common stock P2,000,000 P1,500,000

Additional paid-in capital 4,000,000 2,750,000

Retained earnings 890,000 180,000

Upon appraisal, the following has been determined:

a. Non-controlling interest is valued at P1,400,000.

b. The subsidiary’s land is overvalued by P200,000

c. One of the subsidiary’s machinery has a book value and fair value of P300,000 and

P400,000, respectively. The machinery has a remaining useful life of 4 years.

d. The inventory of the subsidiary is undervalued by P30,000.

For the year 2014 and 2015, the parent and the subsidiary reported the following figures in their

separate books:

Parent Corporation Subsidiary Corporation

YEAR 2014

Sales P1,500,000 P650,000

Cost of goods sold (1,125,000) (520,000)

Operating expenses (169,000) (32,400)

Other income (other losses) _91,500_ ___-____

Net income (Net loss) 297,500 97,600

Dividends declared and paid 40,000 45,000

YEAR 2015

Sales P1,275,000 P480,000

Cost of goods sold (892,500) (360,000)

Operating expenses (60,500) (189,700)

Other income (other losses) _39,000_ _(20,000)_

Net income (Net loss) 361,000 (89,700)

Dividends declared and paid 45,000 20,000

During 2014, the subsidiary sold inventory to the parent for P150,000. The parent was able to sell

70% of the inventory to outsiders before the end of 2014. There was also a downstream sale of

inventory costing P45,000, half of which remained in the ending inventory of the buying affiliate.

The gross profit rates (on sales) of the parent and subsidiary averaged 25% and 20%, respectively.

On October 1, 2015, a delivery truck with a remaining life of 5 years on that date was sold by the

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

18

parent to the subsidiary for P100,000, resulting to a gain of P60,000. Goodwill, if any, is impaired

by P50,000.

On February 23, 2015, there was an downstream sale of land costing P300,000. The sale resulted to

a gain of P25,000. On March 31, 2015, the subsidiary sold to its parent machinery with a book value

of P80,000 for P20,000 loss. The machinery has a remaining life of 4 years on that date. Towards

the end of the year, an upstream sale of inventory occurred for P100,000. The sale resulted to a

P30,000 increase in gross profit in the books of the selling affiliate. Only 10% of the inventory was

sold to outsiders. An assessment of intangibles indicated that goodwill is impaired to P450,000 at

the end of 2015.

Required: Prepare the consolidated income statement of Parent Corporation and Subsidiary

Corporation.

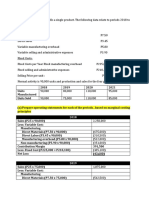

Appendix (Other Formulas):

Assets of the acquirer (parent) at BOOK VALUE XXX

Assets of the acquiree (subsidiary) at FAIR VALUE XXX

Cash consideration/Purchase price (XXX)

Non-monetary assets given as consideration at FAIR VALUE (XXX)

Payment for acquisition-related costs (XXX)

Goodwill arising from acquisition XXX_

Total consolidated assets – DATE OF ACQUISITION XXXX

Liabilities of the acquirer (parent) at BOOK VALUE XXX

Liabilities of the acquiree (subsidiary) at FAIR VALUE XXX

Acquisition-related costs INCURRED BUT NOT YET PAID XXX

Liabilities assumed as consideration at FAIR VALUE/PRESENT VALUE XXX

Contingent consideration payable (CCP) XXX_

Total consolidated liabilities - DATE OF ACQUISITION XXXX

Cost of goods sold – Parent XXX

Cost of goods sold – Subsidiary XXX

Intercompany sales (XXX)

FV-BV amortization of inventory XXX/(XXX)

UPEI (current year) XXX

RPBI (current year, which is the UPEI last year) (XXX)

Consolidated COGS for the year XXXX

Sales – Parent XXX

Sales – Subsidiary XXX

Intercompany sales (XXX)

Consolidated Sales for the year XXXX

Operating expenses – Parent XXX

Operating expenses – Subsidiary XXX

FV-BV amortization of depreciable assets XXX/(XXX)

Realized gain on intercompany sale of plant assets (XXX)

Realized losses on intercompany sale of plant assets XXX

Consolidated Operating Expenses for the year XXXX

Retained earnings, parent (at date of acquisition) XXX

Cumulative consolidated net income (loss) – parent (CNI-P) XXX

Cumulative dividends declared by the parent (XXX)

Consolidated retained earnings (CRE), end XXXX

Or

Consolidated retained earnings, beginning XXX

Consolidated net income (loss) – parent (CNI-P) XXX

Dividends declared by the parent (XXX)

Consolidated retained earnings (CRE), end XXXX

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

19

NCI (at date of acquisition) XXX

Cumulative NCI in the net income (loss) of the subsidiary (NCINIS) XXX

Cumulative dividends paid to NCI (XXX)

NCI in the net assets of the subsidiary (NCINAS), end XXXX

Or

NCINAS, beginning XXX

NCINIS XXX

Dividends paid to NCI (XXX)

NCI in the net assets of the subsidiary (NCINAS), end XXXX

Shareholders’ equity – PARENT XXX

Bargain purchase gain (date of acquisition) XXX

Consolidated retained earnings (CRE) XXX

Non-controlling interest in the net assets of the subsidiary (NCINAS) XXX

Consolidated shareholders’ equity, end XXXX

ADVACC (Acctg 630) – MODULE 5: ACCOUNTING FOR BUSINESS COMBINATIONS

Ateneo de Zamboanga University – School of Management and Accountancy

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- D. VAT Registration and Compliance Requirements FinalDocument34 pagesD. VAT Registration and Compliance Requirements FinalNatalie SerranoNo ratings yet

- BA-ReportFormat-apr 1-16_serranoDocument1 pageBA-ReportFormat-apr 1-16_serranoNatalie SerranoNo ratings yet

- Opportunity RecognitionDocument22 pagesOpportunity RecognitionNatalie SerranoNo ratings yet

- BA-ReportFormat-1 - SERRANO, MA. NATALIE DOMINICDocument2 pagesBA-ReportFormat-1 - SERRANO, MA. NATALIE DOMINICNatalie SerranoNo ratings yet

- Updates in FSDocument3 pagesUpdates in FSNatalie SerranoNo ratings yet

- BUS 227 MA Long Questions Answers Chapter 11Document13 pagesBUS 227 MA Long Questions Answers Chapter 11Natalie SerranoNo ratings yet

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- Ynbsc Hand GuideDocument259 pagesYnbsc Hand GuideNatalie SerranoNo ratings yet

- ASYN Rodriguez PN. EssayDocument1 pageASYN Rodriguez PN. EssayNatalie SerranoNo ratings yet

- Donations ListDocument5 pagesDonations ListNatalie SerranoNo ratings yet

- YNBSC CL-10 Marcher's Report As of 20 Dec 21Document3 pagesYNBSC CL-10 Marcher's Report As of 20 Dec 21Natalie SerranoNo ratings yet

- Ynbsc CL 10 Peer RatingDocument3 pagesYnbsc CL 10 Peer RatingNatalie SerranoNo ratings yet

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- AAO JPIA Days Consent Waiver FormDocument2 pagesAAO JPIA Days Consent Waiver FormNatalie SerranoNo ratings yet

- G4 Research DraftDocument36 pagesG4 Research DraftNatalie SerranoNo ratings yet

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- ACCLAW-4 SyllabusDocument9 pagesACCLAW-4 SyllabusNatalie SerranoNo ratings yet

- Escribano Nadezhda A.1Document3 pagesEscribano Nadezhda A.1Natalie SerranoNo ratings yet