Professional Documents

Culture Documents

03activity1 Accounting For Business Combination

Uploaded by

Natalie SerranoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03activity1 Accounting For Business Combination

Uploaded by

Natalie SerranoCopyright:

Available Formats

Accounting for Business Combination

03 Activity 1

PROBLEM SOLVING

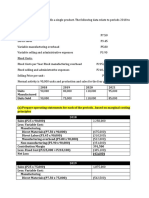

1.

a. Determine the amount of goodwill or gain on bargain purchases that should be

recognized at the acquisition date.

P3,250,000

Contingent Consideration (300,000 x 156,000

52%)

Total Consideration 3,406,000

Less: Fair Value of Assets 1,076,000

Goodwill 2,330,000

Answer: P2,330,000

b. Give the adjusting entry to be made by Yanna Corporation if it estimated as of

July 1, 202Y that there is a 63% probability of achieving the target income.

Loss on Increase in Contingent Consideration P 33,000

Contingent Consideration Payable

P 33,000

2.

a. Determine the amount of goodwill or gain on bargain purchase that should be

recognized if the non-controlling interest is measured on a proportionate basis.

Fair Value of Consideration - 70% P2,520,000

Fair Value of Previously Acquired Shares (2,520,000 / 648,000

0.70 x 0.18)

Non-controlling Interest (3,350,000 x 0.12) 402,000

Total Consideration 3,570,000

Less: Fair Value of Net Assets 3,350,000

Goodwill 220,000

Answer: P220,000

b. Determine the amount of goodwill or gain on bargain purchase that should be

recognized if the non-controlling interest is measured on a fair value basis.

Fair Value of Consideration - 70% P2,520,000

Fair Value of Previously Acquired Shares (2,520,000 / 648,000

0.70 x 0.18)

Non-controlling Interest (3,168,000/0.88 x 0.12) 432,000

Total Consideration 3,600,000

Less: Fair Value of Net Assets 3,350,000

Goodwill 250,000

Answer: P250,000

This study source was downloaded by 100000825019950 from CourseHero.com on 10-06-2022 20:49:41 GMT -05:00

https://www.coursehero.com/file/91627881/03Activity1-Accounting-for-Business-Combinationdocx/

Powered by TCPDF (www.tcpdf.org)

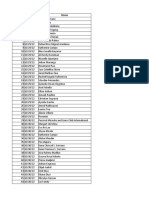

You might also like

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- ASYN Rodriguez PN. EssayDocument1 pageASYN Rodriguez PN. EssayNatalie SerranoNo ratings yet

- Donations ListDocument5 pagesDonations ListNatalie SerranoNo ratings yet

- BUS 227 MA Long Questions Answers Chapter 11Document13 pagesBUS 227 MA Long Questions Answers Chapter 11Natalie SerranoNo ratings yet

- Ynbsc Hand GuideDocument259 pagesYnbsc Hand GuideNatalie SerranoNo ratings yet

- YNBSC CL-10 Marcher's Report As of 20 Dec 21Document3 pagesYNBSC CL-10 Marcher's Report As of 20 Dec 21Natalie SerranoNo ratings yet

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- AAO JPIA Days Consent Waiver FormDocument2 pagesAAO JPIA Days Consent Waiver FormNatalie SerranoNo ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Notes Serrano - Overview of The Auditing ProfessionDocument5 pagesNotes Serrano - Overview of The Auditing ProfessionNatalie SerranoNo ratings yet

- D. VAT Registration and Compliance Requirements FinalDocument34 pagesD. VAT Registration and Compliance Requirements FinalNatalie SerranoNo ratings yet

- ACCLAW-4 SyllabusDocument9 pagesACCLAW-4 SyllabusNatalie SerranoNo ratings yet

- G4 Research DraftDocument36 pagesG4 Research DraftNatalie SerranoNo ratings yet

- Escribano Nadezhda A.1Document3 pagesEscribano Nadezhda A.1Natalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tugas Bahasa Inggris 16Document6 pagesTugas Bahasa Inggris 16Inayah Khairi SyahfitriNo ratings yet

- Children Education AllowanceDocument1 pageChildren Education AllowanceDesikanNo ratings yet

- Mobilizaton-Indian Organizations PDFDocument146 pagesMobilizaton-Indian Organizations PDFvikram singhNo ratings yet

- 2019 ECO State Rank Essay Plan BOP Lucas LinDocument2 pages2019 ECO State Rank Essay Plan BOP Lucas LinAbishek KarnanNo ratings yet

- Market Cap To GDP RatioDocument8 pagesMarket Cap To GDP RatiokalpeshNo ratings yet

- Declaration Format Loss of SV TVDocument1 pageDeclaration Format Loss of SV TVArivaazhi PeriyaswamyNo ratings yet

- IMT LisaBenton NikithaDocument6 pagesIMT LisaBenton NikithaNikitha NayakNo ratings yet

- Accreditation and Certification Agreement FormDocument2 pagesAccreditation and Certification Agreement FormMichael AngNo ratings yet

- TA Universal Analysis ManualDocument346 pagesTA Universal Analysis ManualSayantan ChakrabortyNo ratings yet

- Spousal Support PDFDocument107 pagesSpousal Support PDFemxn100% (1)

- Technical Cleanless Articles - Bought-In Parts (External Use)Document19 pagesTechnical Cleanless Articles - Bought-In Parts (External Use)Gonzalo de LuisNo ratings yet

- Pipeline Oil & Gas DesignDocument5 pagesPipeline Oil & Gas DesignReynante MojicaNo ratings yet

- Energy Crises in Pakistan 29-10-23Document5 pagesEnergy Crises in Pakistan 29-10-23tahseen khanNo ratings yet

- 3 & 4 The Demand CurveDocument4 pages3 & 4 The Demand CurveAdeeba iqbalNo ratings yet

- BIA Email Brochure - Data Science & Business Analytics - 2023Document4 pagesBIA Email Brochure - Data Science & Business Analytics - 2023Yojit ChavhanNo ratings yet

- Accountingnincomenstatements 445f7ca6d561b83 PDFDocument2 pagesAccountingnincomenstatements 445f7ca6d561b83 PDFANDREA MELISSA PRADA LAGUADONo ratings yet

- 7 3 Evaluate The Extent To Which The Organisational Structure of The Design Division Contributes To TheDocument6 pages7 3 Evaluate The Extent To Which The Organisational Structure of The Design Division Contributes To TheFariya HossainNo ratings yet

- Unit 11 - Dealings in CopyrightDocument34 pagesUnit 11 - Dealings in CopyrightFrancis ChikombolaNo ratings yet

- United States Bankruptcy Court District of Delaware 824 Market Street, 3rd Floor Wilmington, DE 19801Document6 pagesUnited States Bankruptcy Court District of Delaware 824 Market Street, 3rd Floor Wilmington, DE 19801Chapter 11 DocketsNo ratings yet

- Merican Ational Tandard: ANSI/ASSE Z117.1-2009 Safety Requirements For Confined SpacesDocument71 pagesMerican Ational Tandard: ANSI/ASSE Z117.1-2009 Safety Requirements For Confined SpacesDarwin MoroccoNo ratings yet

- Forecasting For Financial Planning: "If You Are Going To Forecast, Forecast Often."Document26 pagesForecasting For Financial Planning: "If You Are Going To Forecast, Forecast Often."Trần Huyền MyNo ratings yet

- Revision of Au Small Finance Bank Credit Card Usage Terms Condition - 1st - March - 2024Document2 pagesRevision of Au Small Finance Bank Credit Card Usage Terms Condition - 1st - March - 2024ARUN SNo ratings yet

- alashankri-Bangalore-3ST Road, Phase.: WXIN2106250004345 4th 7th Banashankn User Type: End UserDocument2 pagesalashankri-Bangalore-3ST Road, Phase.: WXIN2106250004345 4th 7th Banashankn User Type: End UserKaushal RaghuNo ratings yet

- IT Act NotesDocument43 pagesIT Act NotesSrr Srr100% (2)

- Bank Reconciliation Solution - Uhuru Sacco LTD V1Document9 pagesBank Reconciliation Solution - Uhuru Sacco LTD V1Daniel Dayan SabilaNo ratings yet

- Bitcoin To PaypalDocument10 pagesBitcoin To PaypalRobiulNo ratings yet

- Foundations of Information Systems in BusinessDocument28 pagesFoundations of Information Systems in BusinessRaheel PunjwaniNo ratings yet

- Abuja Alternate Festival ProposalDocument10 pagesAbuja Alternate Festival ProposalFemi AmorinNo ratings yet

- TQM-Vision - MissionDocument5 pagesTQM-Vision - MissionSASIKUMARNo ratings yet

- Clarify and Standardize Heineken Brand Image WorldwideDocument9 pagesClarify and Standardize Heineken Brand Image WorldwideclovicNo ratings yet