Professional Documents

Culture Documents

Core Acctg 10

Core Acctg 10

Uploaded by

Baby Babe0 ratings0% found this document useful (0 votes)

11 views1 pageHope it helps

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHope it helps

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageCore Acctg 10

Core Acctg 10

Uploaded by

Baby BabeHope it helps

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

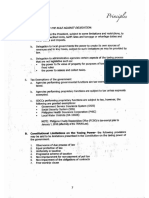

Princyples

Theory and Basis of Taxation

1. Necessity Theory The power of taxation proceeds upon the theory that the existence

of government is a necessity. It Is a power predicated upon necessity (Phil Guarantee

Co, Inc, v. Commissioner (13 SCRA 775)]. The government cannot continue to

perform of serving and protecting Its people without means to pay its expenses. For

this reason, the state has the right to compel all its citizens and property within its

limits to contribute.

2. Lifeblood Doctrine - Taxes are the lifeblood of the government without which it can

neither exist nor endure. Upon taxation depends the State’s ability to serve the people

for whose benefits taxes are collected.

MANIFESTATION OF THE LIFEBLOOD DOCTRINE/THEORY:

+ No Estoppel against the Government

Collection of taxes cannot be enjoined (stopped) by injunction

Taxes could not be the subject of compensation or set-off

AA valid tax may result in the destruction of the taxpayer's property

Right to select objects (subjects) of taxation» :!

3. The Benefits Protection Theory - The basis of taxation is the reciprocal. duties of

“protection and support” between the State and its inhabitants. The State collects

taxes from the subjects of taxation in order that it may be able to perform the

functions of government. The citizens, on the other hand, pay taxes in order that they

may be secured in the enjoyment of the benefits of organized society. This theory

spawned the Doctrine of Symbiotic Relationship which means, taxes are what we pay

for a civilized society.

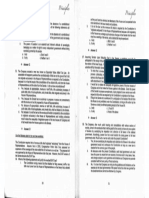

DISTINCTIONS AMONG THE THREE (3) INHERENT POWERS OF THE STATE

ceri E Emenee

NATURE Power to enforce contributions Power to make and implement Power to take private property for

to raise gov't funds. laws forthe general welfare. - public use with ust compensation,

AUTHORITY Govemment only Goverment only

PURPOSE ——_Forthe support ofthe Promotion of general welfare The taking of private property for

government through regulation ~ public use.

PERSONS Community or a class of Community or a class of On an individual as the owner of

AFFECTED —_ individuals. individuals, personal property.

‘Applies to all persons, property Applies to all persons, property Only particular property is

and excises that may be and excises that may be subject comprehended.

subject thereto thereto.

TYPE OF Property is wholesome and is Property is noxious or intended Property is wholesome and is

PROPERTY devoted lo pubic use or for a noxious purpose and es devoted to public use or purpose

Purpose. ‘such taken and destroyed.

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Activity On Financial ForecastingDocument2 pagesActivity On Financial ForecastingBaby BabeNo ratings yet

- ANswer CostDocument1 pageANswer CostBaby BabeNo ratings yet

- Answer ShitDocument1 pageAnswer ShitBaby BabeNo ratings yet

- Answer ShitDocument1 pageAnswer ShitBaby BabeNo ratings yet

- Answer ShitDocument1 pageAnswer ShitBaby BabeNo ratings yet

- CST Acctg NeededDocument1 pageCST Acctg NeededBaby BabeNo ratings yet

- ANswer CostDocument1 pageANswer CostBaby BabeNo ratings yet

- CST Acctg NeededDocument1 pageCST Acctg NeededBaby BabeNo ratings yet

- Answer ShitDocument1 pageAnswer ShitBaby BabeNo ratings yet

- Sample Prob.Document1 pageSample Prob.Baby BabeNo ratings yet

- Stat NDDocument1 pageStat NDBaby BabeNo ratings yet

- Sample Prob.Document1 pageSample Prob.Baby BabeNo ratings yet

- Core Acctg - 11111116Document1 pageCore Acctg - 11111116Baby BabeNo ratings yet

- CST Acctg NeededDocument1 pageCST Acctg NeededBaby BabeNo ratings yet

- Stat NDDocument1 pageStat NDBaby BabeNo ratings yet

- Sample Prob.Document1 pageSample Prob.Baby BabeNo ratings yet

- Core Acctg - 1111111118Document1 pageCore Acctg - 1111111118Baby BabeNo ratings yet

- Sample Prob.Document1 pageSample Prob.Baby BabeNo ratings yet

- Core Acctg 111Document1 pageCore Acctg 111Baby BabeNo ratings yet

- Sample Prob.Document1 pageSample Prob.Baby BabeNo ratings yet

- Core Acctg - 111111117Document1 pageCore Acctg - 111111117Baby BabeNo ratings yet

- Core Acctg - 1Document1 pageCore Acctg - 1Baby BabeNo ratings yet

- DPDS - TEMPLATE - 302228 - Final Quarter 2 (April-June)Document11 pagesDPDS - TEMPLATE - 302228 - Final Quarter 2 (April-June)Baby BabeNo ratings yet

- CHapter 1-3Document23 pagesCHapter 1-3Baby BabeNo ratings yet

- Core Acctg - 11111111119Document1 pageCore Acctg - 11111111119Baby BabeNo ratings yet

- A Oblicon 212 - 111Document1 pageA Oblicon 212 - 111Baby BabeNo ratings yet

- Presentation, Analysis, and Interpretations of DataDocument6 pagesPresentation, Analysis, and Interpretations of DataBaby BabeNo ratings yet

- A Oblicon 212 - 111111111120Document1 pageA Oblicon 212 - 111111111120Baby BabeNo ratings yet

- NEEd EntrepDocument14 pagesNEEd EntrepBaby BabeNo ratings yet

- Others (Specify in Remarks) Others (Specify in Remarks) LGU-BarangayDocument11 pagesOthers (Specify in Remarks) Others (Specify in Remarks) LGU-BarangayBaby BabeNo ratings yet