Professional Documents

Culture Documents

V12 AFAR-08 (Business Combinations)

V12 AFAR-08 (Business Combinations)

Uploaded by

Richard VictoriaCopyright:

Available Formats

You might also like

- ReSA CPA Review Batch 45 Pre-Recorded Lecture VideosDocument2 pagesReSA CPA Review Batch 45 Pre-Recorded Lecture VideosMarielle GonzalvoNo ratings yet

- Mary The Queen College of Pampanga Inc.: Agency Accounting Focus NotesDocument16 pagesMary The Queen College of Pampanga Inc.: Agency Accounting Focus NotesAllain GuanlaoNo ratings yet

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- NPO-Multiple Choice Questions PART VIDocument3 pagesNPO-Multiple Choice Questions PART VILorraineMartinNo ratings yet

- Fischer10j Ch21 TBDocument2 pagesFischer10j Ch21 TBLouiza Kyla AridaNo ratings yet

- Module 1 - Introduction To Assurance Services PDFDocument10 pagesModule 1 - Introduction To Assurance Services PDFglobeth berbanoNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- RFBT Final Preboard QuestionairesDocument18 pagesRFBT Final Preboard QuestionairesMABI ESPENIDONo ratings yet

- Focus Notes Philippine Framework For Assurance EngagementsDocument6 pagesFocus Notes Philippine Framework For Assurance EngagementsThomas_Godric100% (1)

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Practical Accounting 2: 2011 National Cpa Mock Board ExaminationDocument6 pagesPractical Accounting 2: 2011 National Cpa Mock Board ExaminationMary Queen Ramos-UmoquitNo ratings yet

- ICare First Preboard Examination-MSDocument14 pagesICare First Preboard Examination-MSLeo M. SalibioNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Chapter 13 Audit of Long LiDocument37 pagesChapter 13 Audit of Long LiKaren Balibalos100% (1)

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- CRC Auditing Oct 2022 (1st PB)Document18 pagesCRC Auditing Oct 2022 (1st PB)Rodmae VersonNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Accounting 7an Business CombinationDocument8 pagesAccounting 7an Business CombinationLabLab ChattoNo ratings yet

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Auditing Problems Test Banks - SHE Part 1Document5 pagesAuditing Problems Test Banks - SHE Part 1Alliah Mae ArbastoNo ratings yet

- Ass 2 in AuditingDocument5 pagesAss 2 in Auditingarnel gallarteNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Ast TX 801 Items of Gross Income (Batch 22)Document5 pagesAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoNo ratings yet

- Advance Financadvance Financial Accounting and Reportingweek 1 AfarDocument22 pagesAdvance Financadvance Financial Accounting and Reportingweek 1 AfarCale HenituseNo ratings yet

- 1st Assignment - FinalDocument13 pages1st Assignment - FinalJeane Mae BooNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- CH 021Document2 pagesCH 021Joana TrinidadNo ratings yet

- Forex&Derivative HODocument7 pagesForex&Derivative HOMarielle SidayonNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- Lecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021Document9 pagesLecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021ruel c armillaNo ratings yet

- Toa Cpa ReviewDocument10 pagesToa Cpa ReviewKim ZamoraNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Unit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Document11 pagesUnit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Marynelle Labrador Sevilla100% (1)

- Auditing Theory - Internal Control ConsiderationDocument11 pagesAuditing Theory - Internal Control ConsiderationNeil BacaniNo ratings yet

- Audit Documentation Test BankDocument1 pageAudit Documentation Test BankJadeNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- Govac Chap 6Document5 pagesGovac Chap 6Yami HeatherNo ratings yet

- Business Combi TsetDocument28 pagesBusiness Combi Tsetsamuel debebeNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- CPAR B94 TAX Final PB Exam - QuestionsDocument14 pagesCPAR B94 TAX Final PB Exam - QuestionsSilver LilyNo ratings yet

- 3 Partnership LiquidationDocument11 pages3 Partnership LiquidationLach Mae . FloresNo ratings yet

- Business CombinationDocument9 pagesBusiness CombinationRoldan Arca PagaposNo ratings yet

- Unit Ii: Audit of IntangiblesDocument13 pagesUnit Ii: Audit of IntangiblesMarj ManlagnitNo ratings yet

- Pink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseDocument26 pagesPink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseGene Albert LopezNo ratings yet

- Corporation Liquidation Notes PDFDocument4 pagesCorporation Liquidation Notes PDFTk KimNo ratings yet

- FAR-4102b (Lecture Notes - Discontinued Operations & NCA Held For Sale)Document2 pagesFAR-4102b (Lecture Notes - Discontinued Operations & NCA Held For Sale)Eira ShaneNo ratings yet

- Corporation LiquidationDocument2 pagesCorporation LiquidationPatrishaNo ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Ap-600Q: Investing Cycle: Audit of Investment: - T R S ADocument13 pagesAp-600Q: Investing Cycle: Audit of Investment: - T R S AChristine Jane AbangNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

- V14 and V15 AFAR-12 (Foreign Currency Transactions & Translation)Document21 pagesV14 and V15 AFAR-12 (Foreign Currency Transactions & Translation)Richard VictoriaNo ratings yet

- V16 and V17 TAX-2001 (Preferential Taxation 1)Document5 pagesV16 and V17 TAX-2001 (Preferential Taxation 1)Richard VictoriaNo ratings yet

- Risk Management Your Pocket Guide To Enterprise Risk IntelligenceDocument19 pagesRisk Management Your Pocket Guide To Enterprise Risk IntelligenceRichard VictoriaNo ratings yet

- Far 2019Document11 pagesFar 2019Richard VictoriaNo ratings yet

- Afar 2019Document10 pagesAfar 2019Richard VictoriaNo ratings yet

V12 AFAR-08 (Business Combinations)

V12 AFAR-08 (Business Combinations)

Uploaded by

Richard VictoriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

V12 AFAR-08 (Business Combinations)

V12 AFAR-08 (Business Combinations)

Uploaded by

Richard VictoriaCopyright:

Available Formats

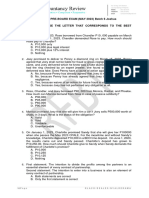

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 43 May 2022 CPA Licensure Examination Week No. 8

ADVANCED FINANCIAL ACCOUNTING & REPORTING A. DAYAG C. CAIGA M. NGINA

AFAR-08: BUSINESS COMBINATIONS

BUSINESS COMBINATION- Creating a Single Economic Entity

The term business combination refers in general to any set of conditions in which two or more organizations

are joined together through common ownership.

PFRS 3 Revised

Business combination is a transaction or event in which an acquirer obtains control of one or more

businesses. A business is defined as an integrated set of activities and assets that is capable of being

conducted and managed for the purpose of providing a return directly to investors or other owners,

members or participants.

Scope of PFRS 3 Revised

Formation of all type of joint arrangements (joint venture and joint operations)* x

Acquisition of an asset (a group of assets) that is not a business x

Entities under common control x

Combinations involving mutual entities √

By contract alone (dual listing, stapling) √

x = not within the scope

√ = within the scope

*the scope exception only applies to the financial statements of the joint venture or joint

operation itself and not the accounting for the interest in a joint arrangement in the

financial statements of a party to the joint arrangement.

Classification of BUSINESS COMBINATIONS

Business Combinations may be classified into three schemes:

1. Based on the structure of the combination.

2. Based on the method used to accomplish the combination.

3. Based on the accounting method used.

Structure of the Combination (Business Point of View)

Combinations are classified into four types:

1. Horizontal Integration – this type of combination is one that involves companies within the same

industry that have been previously competitors. A horizontal integration would occur if Shell

Company and Petron Company, both integrated oil companies, were to combine.

2. Vertical Integration – this type of combination take place between two companies involved in the

same industry but at different levels. It normally involves a combination of a company and its

suppliers or customers. For example – a tire manufacturer and a tire distributor; Bally Shoe Company

(a manufacturer of shoes and Rustans Department Store)

3. Conglomerate Combination – is one involving companies in unrelated industries having little, if any,

production or market similarities for the purpose of entering into new markets or industries - such as

a tire manufacturer and an insurance company.

3

4. Circular Combination - entails some diversification, but does not have a drastic change in operation

as a conglomerate. For example – San Miguel Corporation accomplished when they diversify their

activities by putting up Magnolia Products.

Method of Combination (Legal Point of View)

Business combinations are also classified by method of combination into three types – statutory mergers,

statutory consolidations, and stock acquisition.

A Statutory Merger results when one company acquires all the net assets (assets and liabilities) of one or

more other companies through an exchange of stock, payment of cash or other property, or the issue of

debt instruments (or a combination of these methods). The acquiring company survives (remains in

existence), whereas the acquired company (or companies) ceases to exist as a separate legal entity,

although it may be continued as a separate division of the acquiring company.

Page 1 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

Thus, if A Company acquires B Company in a statutory merger, the combination is often expressed as:

A Company + B Company = A Company

Or, if B Company acquires A Company:

A Company + B Company = B Company

The Board of Directors of the companies involved, normally negotiate the terms of a plan of merger, which

must be approved by the stockholders of each company involved.

A Statutory Consolidation results when a new corporation is formed to acquire the net assets (assets and

liabilities) two or more other corporations. The acquired company, then cease to exist as separate legal

entities. For example, if C Company is formed to consolidate A Company and B Company, then the

combination is generally expressed as follows:

A Company + B Company = C Company

Stockholders of the acquired companies (A and B) become stockholders in the new entity (C). The

acquired companies may be operated as separate divisions of the new corporation, just as they may

under a statutory merger. Statutory consolidation requires the same type of stockholders approval as in

statutory mergers.

The use of the term consolidation should not be confused with the accounting usage of the same word.

In accounting, consolidation refers to the mechanical process of bringing together the financial records of

two or more organizations to form a single set of statements. Statutory consolidation is a legal term used to

denote a specific type of business combination in which two or more existing companies are united under

the ownership of a newly created company.

A Stock Acquisition occurs when one corporation pays cash or issues stock or debt for all part of the voting

stock of another company, and the acquired companies remained intact as a separate legal entity. If the

acquiring company acquires more than 50% of the voting stock of the acquired company, for example, if

A Company acquires 75% of the voting stock of B Company, a parent-subsidiary relationship results.

Consolidated financial statements (explained in later topics) are prepared and the business combination

is often expressed as:

Financial Statements of A Co. + Financial Statements of B. Co.

=

Consolidated Financial Statements of A Co. and B Co.

The stock may be acquired through market purchases or through direct purchase from, or exchange with,

individual stockholders of the subsidiary company. Sometimes stock is acquired through a tender offer,

which is an open offer to purchase up to a stated number of shares of a given corporation at a stipulated

price per share. The offering price is generally set somewhat above the current market price of the shares

in order to provide an additional incentive to prospective sellers. The investee or subsidiary company

continues its legal existence and the investor or parent company records its acquisition in its records as a

long-term investment.

Although business combination is a broad term encompassing all forms of combination and the terms

merger and consolidation and stock acquisition have technical, legal definitions, the three terms are often

used interchangeably in practice. Thus, one cannot always rely on the accuracy of the term used to

identify the type of combination, but, must look to the facts of the situation to determine its accounting

treatment.

Method of Accounting for Business Combinations

The acquisition method is used for all business combinations. The pooling of interests method is prohibited.

Acquirer must be identified. Under PFRS No. 3, an acquirer must be identified for all business combinations.

Identification of an Acquirer

Control. The acquirer is the combining entity that obtains control of the other combining entities or

businesses. PFRS No. 3 provides considerable guidance for identifying the acquirer.

Other indicators of which party was the acquirer in any given business combinations are as follows (these

are suggestive only, not conclusive):

1. The fair value of one entity is significantly greater than that of the other combining enterprises; in

such a case, the larger entity would be deemed the acquirer.

2. The combination is effected by an exchange of voting stock for cash; the entity paying the cash

would be deemed to be the acquirer.

3. Management of one enterprise is able to dominate selection of management of the combined

entity; the dominant entity would be deemed to be the acquirer.

Page 2 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

Recognizing and Measuring Goodwill and Gain from a Bargain Purchase

As a result of the PFRS 3 Revised, the way in which goodwill or a gain on a bargain purchase is calculated

has changed, being the difference between:

I. The sum of:

the fair value of the consideration transferred

the recognized amount of any non-controlling interest in the acquire

for a business combination achieved in stages, the fair value of any previously held equity

interest in the acquiree; and

II. The acquisition-date recognized fair value amount of the identifiable assets acquired and liabilities

assumed.

Goodwill arises when I exceed II, under:

➢ Option 1: “Full” Goodwill Method – there is a non-controlling interest share in the goodwill.

➢ Option 2: “Partial/Proportionate Basis” Goodwill Method – there is no non-controlling interest

share in the goodwill.

Bargain purchase arises when II exceeds I. When a bargain purchase (as previously defined) occurs,

a gain on acquisition is recognized in the profit or loss. While this is consistent with the

pronouncement of PFRS 3 (old) under Option 2, the amount recognized may differ, due to the other

changes in the PFRS 3 Revised (new) which may also allow Option 1. It is under Option (1) where

there is an inconsistency of recognition of gain, wherein any excess that remains is recognized as a

gain, which is attributable only to the acquirer (or parent company).

Before concluding that bargain purchase (or discount on acquisition) has arisen, however, PFRS No.

3 requires that the acquirer shall:

1. reassess the identification and measurement of the acquiree's identifiable assets, liabilities,

and contingent liabilities and the measurement of the cost of the combination; and

2. recognize immediately in profit or loss any excess remaining after that reassessment.

Consideration transferred

For the purposes of applying the acquisition method, the fair value of the consideration transferred in

exchange for the acquirer’s interest in the acquiree is calculated as the sum of:

a. the acquisition-date fair values of the assets transferred by the acquirer, liabilities assumed or

incurred by the acquirer, and equity interests issued by the acquirer. Examples include cash, other

assets, contingent consideration, a business or a subsidiary of the acquirer, common or preferred

equity instruments, options, warrants, and member interests of mutual entities; and

b. the acquisition-date fair value of any non-controlling equity investment in the acquiree that the

acquirer owned immediately before the acquisition date.

The consideration transferred may include assets or liabilities of the acquirer that have carrying amounts

that differ from their fair values at the acquisition date (for example, non-monetary assets or a business of

the acquirer). In that case, the acquirer shall remeasure those transferred assets or liabilities to their fair

values as of the acquisition date and recognize any gains or losses in profit or loss. However, if those assets

or liabilities are transferred to the acquiree and, therefore, remain within the combined entity after the

business combination, the acquirer shall eliminate any gains or losses on those transferred assets or liabilities

in the consolidated financial statements.

The acquisition-date fair value of the consideration transferred, including the fair value of each major class

of consideration, such as:

1. Cash or other monetary assets. The fair value is the amount of cash or cash equivalent dispersed.

The amount is usually readily available.

2. For deferred payment, the fair value to the acquirer is the amount the entity would have to borrow

to settle their debt immediately. Hence, the discount rate used is the entity’s incremental borrowing

rate.

3. Non-monetary assets. These consist of assets such as property, plant and equipment, investments,

licenses and patents. If active second-hand market price exists, fair values can be obtained by

reference to those markets. Where active markets do not exist, other means of valuation, including

the use of expert valuers, may be used.

4. Equity Instruments. If an acquirer issues its own shares as consideration, it will need to determine the

fair value of those shares at the date of exchange.

Page 3 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

5. Debt instruments/Liabilities undertaken. The fair values of liabilities undertaken are best measured

by the present value of future cash outflows. As noted in PFRS 3, future losses or other costs expected

to be incurred as a result of the business combination are not liabilities of the acquirer and are

therefore not included in the calculation of the fair value of consideration paid. These must be

treated as post-combination expenses.

6. Contingent consideration. The acquirer shall recognize the acquisition-date fair value of contingent

consideration. PFRS 3 Revised has formally defined contingent consideration as additional

consideration by the acquirer to the former owners (or return of consideration from the former

owners).

Changes that are the result of the acquirer obtaining additional information about facts and

circumstances that existed at the acquisition date, and that occur within the measurement period

(which may be a maximum of one year from the acquisition date), are recognized as adjustments

against the original accounting for the acquisition (and so may impact goodwill). Changes resulting

from events after the acquisition date are not measurement period adjustments. Such changes are

therefore accounted for separately from the business combination.

Costs and Expenses of Business Combination

The PFRS 3 Revised states that acquisition-related costs are costs incurred by the acquirer to effect a

business combination, including reimbursements to the acquiree for bearing some of the acquisition costs,

except costs of issuing debt instruments are accounted for under PFRS 9, and costs of issuing equity

instruments are accounted for under PAS 32, shall be accounted for as expenses in the periods in which

they are incurred. They are summarize as follows:

Acquisition-related costs Examples Treatment

1. Directly attributable costs professional fees paid to Expenses

accountants, legal advisers, valuers,

and other consultants (finders and

brokerage fees) to effect the

combination.

2. Indirect acquisition costs general and administrative costs, Expenses

including the costs of maintaining an

internal acquisitions department

(management salaries, depreciation,

rent, and costs incurred to duplicate

facilities) and other costs of which

cannot be directly attributed to the

particular acquisition

3. Costs of issuing securities transaction costs such as stamp Debit to APIC/Share

(issue and register stocks)* duties, professional adviser’s fees, Premium Account

underwriting costs and brokerage

fees may be incurred

*Similarly, the cost of arranging (registering) and issuing debt securities or financial liabilities are an

integral part of the liability issue transaction (Bond Issue Costs).

Allocating the cost of the business combination

Par. 36 of PFRS 3 includes the following statements:

“The acquirer shall measure and recognize as of the acquisition date the assets acquired and

liabilities assumed as part of the business combination. The identifiable assets acquired and

liabilities assumed shall be measured at fair value and recognized separately from goodwill.”

Recognition of Acquired Assets and Liabilities

The allocation of acquired assets and liabilities measurement which is at fair value occurs at acquisition

date. The allocation requires the recognition of:

1. Identifiable Tangible Assets. An asset other than an intangible asset is recognized if it is probable

(probability test) that any associated future economic benefits will flow to the acquirer, and its

fair value can be measured reliably (reliability test).

2. Identifiable Intangible Assets. PFRS 3 Revised requires the acquirer to recognize identifiable

assets acquired regardless of the degree of probability of an inflow of economic benefits. This

change emphasizes the expectation that all intangible assets that satisfy the definition criteria

in PAS 38, if acquired as part of a business combination, must be recognized.

Page 4 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

An intangible asset is identifiable if it:

➢ can be separated; or

➢ meets the contractual-legal criterion e.g. license to operate a nuclear power plant is an

intangible asset, even though the acquirer cannot sell or transfer the license separately

from the acquired power plant.

The acquirer shall recognize, separately from goodwill, the acquisition-date fair value of intangible

assets acquired in a business combination that meet the definition of an intangible asset in PAS 38.

Examples that would meet the definition of Intangible Assets:

a. Marketing-related intangible assets:

- trademarks, trade names, service marks, collective marks and certification marks

- internet domain names

- trade dress – unique color, share or package design

- newspaper mastheads

- non-competition assets

b. Customer-related intangible assets:

- customer lists

- order or production backlog

- customer contracts and the related customer relationships

- non-contractual customer relationships

c. Artistic-related intangible assets:

- plays, operas and ballets

- books, magazines, newspapers and other literary works

- musical works such as compositions, song lyrics, and advertising jingles

- pictures and photographs

- video and audiovisual material, including films, music videos, and television programs

d. Contract-based intangible assets

- licensing, royalty, and standstill agreements

- advertising, construction, management, service or supply contracts

- lease agreements

- construction permits

- franchise agreements

- operating and broadcasting rights

- use rights such as drilling, water, timber-getting and route authorities

- servicing contracts such as mortgage servicing contracts

- employment contracts priced below their market value

e. Technology-based intangible contracts

- patented technology

- computer software and mask works

- unpatented technology

- databases

- trade secrets such as secret formulas, processes or recipes

3. Liabilities. A liability other than a contingent liability is recognized if it is probable that an outflow

of resources will be required to settle the obligation, and its fair value can be measured reliably.

4. Contingent Liabilities. PFRS No. 3 Revised requires recognition of a contingent liability (of the

acquiree) assumed in a business combination will be recognize at their fair values if it is a present

obligation that arises from past events and its fair value can be measured reliably, regardless of

the probability of a cash flow arising.

******

Every great success was at the beginning impossible.

Opportunities are usually disguised as hard work, so most people don’t recognize them.

A goal is nothing more than a dream with a time limit.

I

Tree Corporation is a company involved in manufacturing cars. On January 1, 2019, the board of directors of the

said company has decided to acquire the net assets of Knee Corporation and Dudd Corporation, suppliers of

materials they use in production. The merger is expected to result in producing higher quality cars with lower total

cost. The following information was gathered from the books of the entities on January 1, 2019:

Page 5 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

Tree Knee Dudd

Current Assets................................................................. P 1,375,000 P 390,000 P 260,000

Noncurrent Assets.......................................................... 3,125,000 2,550,000 1,700,000

Liabilities.......................................................................... 325,000 210,000 140,000

Ordinary Share Capital, P100 par................................ 2,748,500 1,780,200 1,186,800

Share Premium – Ordinary Share.................................. 176,500 169,800 113,200

Accumulated Profits (Losses)......................................... 1,250,000 780,000 520,000

Tree will issue 22,500 of its ordinary shares in exchange for the net assets of Knee and 11,200 of its ordinary shares

in exchange for the net assets of Dudd. The fair value of Tree’s shares is P150. In addition, the following fair values

were available:

Knee Dudd

Current Assets........................................................ P 450,000 P 230,000

Noncurrent Assets................................................. 2,150,000 1,975,000

The following out of pocket costs of the combination were as follows:

Legal fees for the contract of business combination........................ P 8,000

Audit fee for SEC registration of share issue........................................ 9,000

Printing costs of share certificates........................................................ 5,000

Broker’s fee ............................................................................................ 4,000

Accountant’s fee for pre-acquisition audit........................................ 10,000

Other direct cost of acquisition............................................................ 7,000

Internal secretarial, general and allocated expenses...................... 9,000

Documentary stamp tax on the new shares...................................... 2,000

Required:

1. Record the acquisition of the net assets of Knee and Dudd and related transactions on the books of

Tree.

2. Determine the following amounts that will appear in the balance sheet of Tree on January 1, 2019:

a. Goodwill arising from acquisition of Knee

b. Gain on acquisition of Dudd (to be added to accumulated P&L)

c. Current assets

d. Noncurrent assets

e. Total assets

f. Total liabilities

g. Ordinary share capital

h. Share premium

i. Accumulated profits (losses)/retained earnings

j. Shareholders’equity

3. (Cash Contingency) Determine the amount of goodwill arising from business combination of assuming

that Tree agreed to pay an additional P500,000 on January 1, 2021 to Knee Company, if the average

income of Knee Company during the 2-year period of 2019 - 2020 exceeds P5,000,000 per year. The

expected value is P200,000 calculated based on the 40% probability of achieving the target average

income. The amount of goodwill arising from acquisition amounted to:

4. Assuming the same facts as in (3) above. Before the contingency period is over, the probability present

value of the earnings contingency declines to P180,000, determine the amount of goodwill if the

changes in:

a. the value is within the measurement period (due to facts and circumstances existing as of the

date of acquisition).

b. the value is due to events occurring subsequent to acquisition.

5. (Stock Contingency with Market Value Given). In addition to the stock issue, Tree Company also agreed

to issue additional shares of common stock to the former stockholders of Knee Company if the average

post-combination earnings over the next two years equaled or exceeded P5,000,000 per year. The

additional 2,000 shares expected to be issued are valued at P320,000.

On January 1, 2021, the earnings for 2019 and 2020 amounted to P5,000,000 and P5,350,000,

respectively.

Required:

a. Determine the amount of goodwill on January 1, 2019

b. The entry on January 1, 2021.

Page 6 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

6. (Stock Contingency). In addition to the stock issue, Tree Company also agreed to issue additional 2,000

shares of common stock to the former stockholders of Knee Company two years later if the fair value of

acquirer (Tree’s common stock) fell below P150 per share.

On January 1, 2021, the contingent event happens and the common stock of Tree had a fair value

below P150.

Required:

a. Determine the amount of goodwill on January 1, 2019

b. The entry on January 1, 2021.

c. The entry on January 1, 2021, if the fair value of stock increase to P155:

7. (Stock Contingency). In addition to the stock issue, Tree Company also agreed to issue additional shares

of common stock to the former stockholders of Knee Company on January 1, 2021, to compensate for

any fall in the market value of Tree common stock below P150 per share. The settlement would be to

cure the deficiency by issuing added shares based on their fair value on January 1, 2021.

On January 1, 2021, the contingent event happens and the stock had a fair value of P135.

Required:

a. Determine the amount of goodwill on January 1, 2019

b. The entry on January 1, 2021.

II – with Answer

Pam Company is acquiring the net assets of Jam Company for an agreed-upon price of P900,000 on July

1, 20x4. The value was tentatively assigned as follows:

Current assets…………………………………………………………..................... P 100,000

Land…………………………………………………………………………………… 50,000

Equipment………………………………………………………………………......... 200,000 (5-year life)

Building…………………………………………………………………………........... 500,000 (20-year life)

Current liabilities…………………………………………….................................... ( 150,000)

Goodwill…………………………………………………………………………........ 200,000

Values were subject to change during the measurement period. Depreciation is taken to the nearest

month. The measurement period expired on July 1, 20x5, at which time the fair values of the equipment

and building as of the acquisition data was revised to P180,000 and P550,000, respectively.

At the end of 20x5, what adjustments are needed for the financial statements for the period ending

December 31, 20x4 and 20x5?

Answers:

The 20x4 financial statements would be revised as they are included in the 20x4 – 20x5 comparative

statements. The 20x4 statements would be based on the new values. The adjustments would be:

(a) The equipment and building will be restated at P180,000 and P550,000 on the comparative 20x4 and

20x5 balance sheets.

(b) Originally, depreciation on the equipment was P40,000 (P200,000/5) per year. It will be recalculated

as P36,000 (P180,000/5) per year. The adjustment for 20x4 is for a half year 20x4 depreciation expense

and accumulated depreciation will be restated at P18,000 instead of P20,000 for the half year.

Depreciation expense for 20x5 will be P36,000.

(c) Originally, depreciation on the building was P25,000 (P500,000/20) per year. It will be recalculated as

P27,500 (P550,000/20) per year. The adjustment for 20x4 is for a half year 20x4 depreciation expense

and accumulated depreciation will be restated at P13,750 instead of P12,500 for the half year.

Depreciation expense for 20x5 will be P27,500.

(d) Goodwill is reduced P30,000 on the comparative 20x4 and 20x5 balance sheets.

III

TT Corporation acquired assets and assumed liabilities of SS Corporation’s on December 31, 20x4. Balance

sheet data for the two companies immediately following the acquisition follow:

Item TT Corporation SS Corporation

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 49,000 P 30,000

Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . 110,000 45,000

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130,000 70,000

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000 25,000

Buildings and Equipment . . . . . . . . . . . . . . . . . . . . . . 500,000 400,000

Page 7 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

Less: Accumulated Depreciation . . . . . . . . . . . . . . (223,000) (165,000)

Investment in SS Corporation Stock . . . . . . . . . . . . __198,000 _________

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . P 844,000 P 405,000

Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,500 28,000

Taxes Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95,000 37,000

Bonds Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . 280,000 200,000

Common Stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150,000 50,000

Retained Earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . _257,500 ___90,000

Total Liabilities and Stockholders' Equity . . . . . . . . . . P 844,000 P 405,000

At the date of the business combination, the book values of SS’s net assets and liabilities approximated fair

value except for inventory, which had a fair value of P85,000, and land, which had a fair value of

P45,000.Indicate the appropriate total that should appear in the balance sheet prepared immediately

after the business combination.

1. What amount of inventory will be reported?

a. P70,000. c. P200,000

b. P130,000. d. P215,000

2. What amount of goodwill will be reported?

a. P-0- c. P43,000

b. P23,000 d. P58,000

3. What amount of total assets will be reported?

a. P84,400 c. P1,109,000

b. P1,051,000 d. P1,249,000

4. What amount of total liabilities will be reported?

a. P265,000 c. P701,500

b. P436,500 d. P1,249,000

5. What amount of retained earnings will be reported?

a. P547,500 c. P347,500

b. P397,500 d. P257,500

6. What amount of total stockholders’ equity will be reported?

a. P407,500 c. P844,000

b. P547,500 d. P1,249,000

IV

Geri acquired the net assets of Mark Corp. on July 1, 20x5. In exchange for net assets at fair market value

of Mark Co. amounting to P835,740, Geri issued 81,600 shares at a market price of P12 per share (P9 par

value). Out of pocket costs of the combination were as follows:

Legal fees for the contract of business combination................................. P 10,000

Audit fee for SEC registration of share issue ................................................ 13,000

Costs of shares of stock certificates ............................................................. 7,000

Broker’s fee ..................................................................................................... 8,000

Other direct cost of acquisition ................................................................... 22,000

General and allocated expenses ............................................................... 25,000

Geri will pay an additional cash consideration of P546,000 in the event that Mark’s net income will be equal

or greater than P1,140,000 for the period ended December 31, 20x5. At acquisition, there is a high

probability of reaching the target net income and the fair value of the additional consideration was

determined to be P234,000. Actual net income for the period ended December 31, 20x5 amounted to

P1,500,000. The additional consideration was paid.

1. What is the amount of goodwill to be recognized in the statement of financial position as of December

31, 20x5?

a. P -0- c. P377,460

b. P257,040 d. P425,640

2. What amount chargeable to operations (loss/expense) to be recognized for the year ended December

31, 20x5?

a. P -0- c. P377,000

b. P337,000 d. P397,000

V

The balance sheet of Salt Company, along with market values of its assets and liabilities, is as follows:

Salt Company

Book value: dr (cr) Market value: dr (cr)

Current assets P 2,000,000 P 1,500,000

Plant & equipment (net) 30,000,000 35,000,000

Patents 100,000 2,000,000

Completed technology 0 10,000,000

Page 8 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

Broader customer base 0 16,000,000

Technically skilled workforce 3,000,000

Potentially profitable future contracts 2,000,000

Licensing agreements 0 4,000,000

Potential contracts with new customers 1,500,000

Potential advertising jingles 1,000,000

Future cost savings 1,800,000

Goodwill 200,000 700,000

Liabilities (28,000,000) (30,000,000)

Common stock, P10 par (1,000,000)

Additional paid-in capital (5,000,000)

Retained earnings 1,700,000

1. Pail Company pays P100,000,000 in cash for Salt Company’s assets and liabilities. Pail records goodwill

of:

a. P50,800,000 c. P72,500,000

b. P66,800,000 d. P77,500,000

2. Now assume Pail Company pays P10,000,000 in cash to acquire the assets and liabilities of Salt

Company. Pail records a bargain purchase gain on acquisition of:

a. Zero c. P17,500,000

b. P12,500,000 d. P28,500,000

3. Pail paid P100,000,000 in cash for Salt. Three months later, Salt’s patents are determined to have been

worthless as of the date of acquisition. The entry to record this information includes

a. a debit to loss of P2,000,000.

b. a debit to patents of P2,000,000.

c. A debit to goodwill of P2,000,000.

d. A debit to retained earnings of P2,000,000.

4. Pail paid P10,000,000 in cash for Salt. Three months later, it is determined that Seattle’s acquisition-date

liabilities omitted a pending lawsuit valued at P2,000,000. The entry to record this information includes

a. a debit to bargain purchase gain on acquisition of P2,000,000.

b. a debit to liabilities of P2,000,000.

c. A debit to goodwill of P2,000,000.

d. A debit to retained earnings of P2,000,000.

VI

Kelly Corporation acquires Lawson Co. in a statutory merger. Below is the balance sheet of Lawson at

the date of acquisition.

Book value Market value

Dr(cr) Dr(cr)

Current assets P 1,000,000 P 4,000,000

Plant & equipment 50,000,000 70,000,000

Identifiable intangibles 20,000,000 30,000,000

Goodwill 4,000,000 7,000,000

Current liabilities (2,000,000) (2,000,000)

Long-term liabilities (52,000,000) (52,000,000)

Capital stock (3,000,000)

Retained earnings (18,000,000)

1. Kelly issues stock with a market value of P58,000,000 for Lawson. How much goodwill does Kelly record?

a. P 1,000,000 c. P 8,000,000

b. P 7,000,000 d. P10,000,000

2. Assume that three months after the acquisition, additional identifiable intangibles, belonging to Lawson

at the date of acquisition, are discovered. These intangibles have a market value of P500,000. The

entry to reflect this new information includes

a. a credit to goodwill of P500,000. c. a gain of P500,000.

b. a credit to intangible assets of P500,000. d. a loss of P500,000.

3. Assume that a year after the acquisition, it is determined that because of a downturn in the economy

and resulting reduction in sales, the acquired plant and equipment is only worth P60,000,000. The entry

to reflect this new information includes

a. a debit to goodwill of P10,000,000.

b. a debit to plant and equipment of P10,000,000.

c. a gain of P10,000,000.

d. a loss of P10,000,000.

Page 9 of 10 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AFAR-08

Week 8: BUSINESS COMBINATIONS

VII

During its inception, Devon Company purchased land for P100,000 and a building for P180,000. After

exactly 3 years, it transferred these assets and cash of P50,000 to a newly created subsidiary, Regan

Company, in exchange for 15,000 shares of Regan's P10 par value stock. Devon uses straight-line

depreciation. Useful life for the building is 30 years, with zero residual value.

1. At the time of the transfer, Regan Company should record:

a. Building at P180,000 and no accumulated depreciation

b. Building at P162,000 and no accumulated depreciation.

c. Building at P200,000 and accumulated depreciation of P24,000.

d. Building at P180,000 and accumulated depreciation of P18,000.

2. Regan Company will report

a. additional paid-in capital of P0

b. additional paid-in capital of P150,000

c. additional paid-in capital of P162,000

d. additional paid-in capital of P180,000

VIII

Envigo Corporation acquired all the assets and liabilities of CFC Corporation by issuing shares of its common stock On

January 1, 2019. Partial balance sheet data for the companies prior to the business combination and immediately

following the combination is provided:

Envigo CFC

Book Value Book Value Combination

Cash P 65,000 P 25,000 P 90,000

Accounts receivable 72,000 20,000 94,000

Inventory 33,000 45,000 88,000

Buildings and equipment (net) 400,000 150,000 650,000

Goodwill ________ ________ _______?

Total Assets P 570,000 P 240,000 P ?

Accounts payable P 50,000 P 25,000 P 75,000

Bonds payable 250,000 100,000 350,000

Common stock, P2 par 100,000 25,000 160,000

Additional paid-in capital 65,000 20,000 245,000

Retained earnings 105,000 70,000 _______?

Total Liabilities and Equities P 570,000 P 240,000 P ?

1. What number of shares did Envigo issue for this acquisition?

a. P80,000 c. P30,000

b. P50,000 d. P17,500

2. At what price was Envigo stock trading when stock was issued for this acquisition?

a. P2.00 c. P6.00

b. P5.63 d. P8.00

3. What was the fair value of the net assets held by CFC at the date of combination?

a. P115,000 c. P270,000

b. P227,000 d. P497,000

4. What amount of goodwill will be reported by the combined entity immediately following the

combination?

a. P 13,000 c. P173,000

b. P125,000 d. P413,000

5. What balance in retained earnings will the combined entity report immediately following the

combination?

a. P35,000 c. P105,000

b. P70,000 d. P175,000

GOD’s LOVE is like a river that keeps on flowing.

Page 10 of 10 0915-2303213/0908-6567516 www.resacpareview.com

You might also like

- ReSA CPA Review Batch 45 Pre-Recorded Lecture VideosDocument2 pagesReSA CPA Review Batch 45 Pre-Recorded Lecture VideosMarielle GonzalvoNo ratings yet

- Mary The Queen College of Pampanga Inc.: Agency Accounting Focus NotesDocument16 pagesMary The Queen College of Pampanga Inc.: Agency Accounting Focus NotesAllain GuanlaoNo ratings yet

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- NPO-Multiple Choice Questions PART VIDocument3 pagesNPO-Multiple Choice Questions PART VILorraineMartinNo ratings yet

- Fischer10j Ch21 TBDocument2 pagesFischer10j Ch21 TBLouiza Kyla AridaNo ratings yet

- Module 1 - Introduction To Assurance Services PDFDocument10 pagesModule 1 - Introduction To Assurance Services PDFglobeth berbanoNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- RFBT Final Preboard QuestionairesDocument18 pagesRFBT Final Preboard QuestionairesMABI ESPENIDONo ratings yet

- Focus Notes Philippine Framework For Assurance EngagementsDocument6 pagesFocus Notes Philippine Framework For Assurance EngagementsThomas_Godric100% (1)

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Practical Accounting 2: 2011 National Cpa Mock Board ExaminationDocument6 pagesPractical Accounting 2: 2011 National Cpa Mock Board ExaminationMary Queen Ramos-UmoquitNo ratings yet

- ICare First Preboard Examination-MSDocument14 pagesICare First Preboard Examination-MSLeo M. SalibioNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Chapter 13 Audit of Long LiDocument37 pagesChapter 13 Audit of Long LiKaren Balibalos100% (1)

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- CRC Auditing Oct 2022 (1st PB)Document18 pagesCRC Auditing Oct 2022 (1st PB)Rodmae VersonNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Accounting 7an Business CombinationDocument8 pagesAccounting 7an Business CombinationLabLab ChattoNo ratings yet

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)

- Auditing Problems Test Banks - SHE Part 1Document5 pagesAuditing Problems Test Banks - SHE Part 1Alliah Mae ArbastoNo ratings yet

- Ass 2 in AuditingDocument5 pagesAss 2 in Auditingarnel gallarteNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Ast TX 801 Items of Gross Income (Batch 22)Document5 pagesAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoNo ratings yet

- Advance Financadvance Financial Accounting and Reportingweek 1 AfarDocument22 pagesAdvance Financadvance Financial Accounting and Reportingweek 1 AfarCale HenituseNo ratings yet

- 1st Assignment - FinalDocument13 pages1st Assignment - FinalJeane Mae BooNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- CH 021Document2 pagesCH 021Joana TrinidadNo ratings yet

- Forex&Derivative HODocument7 pagesForex&Derivative HOMarielle SidayonNo ratings yet

- PCPAr Special Materials 1 1stPB PDFDocument54 pagesPCPAr Special Materials 1 1stPB PDFJessie jorgeNo ratings yet

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- Lecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021Document9 pagesLecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021ruel c armillaNo ratings yet

- Toa Cpa ReviewDocument10 pagesToa Cpa ReviewKim ZamoraNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Unit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Document11 pagesUnit 6 AUDIT OF INTANGIBLE ASSETS Lecture Notes 2020Marynelle Labrador Sevilla100% (1)

- Auditing Theory - Internal Control ConsiderationDocument11 pagesAuditing Theory - Internal Control ConsiderationNeil BacaniNo ratings yet

- Audit Documentation Test BankDocument1 pageAudit Documentation Test BankJadeNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- Govac Chap 6Document5 pagesGovac Chap 6Yami HeatherNo ratings yet

- Business Combi TsetDocument28 pagesBusiness Combi Tsetsamuel debebeNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- CPAR B94 TAX Final PB Exam - QuestionsDocument14 pagesCPAR B94 TAX Final PB Exam - QuestionsSilver LilyNo ratings yet

- 3 Partnership LiquidationDocument11 pages3 Partnership LiquidationLach Mae . FloresNo ratings yet

- Business CombinationDocument9 pagesBusiness CombinationRoldan Arca PagaposNo ratings yet

- Unit Ii: Audit of IntangiblesDocument13 pagesUnit Ii: Audit of IntangiblesMarj ManlagnitNo ratings yet

- Pink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseDocument26 pagesPink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseGene Albert LopezNo ratings yet

- Corporation Liquidation Notes PDFDocument4 pagesCorporation Liquidation Notes PDFTk KimNo ratings yet

- FAR-4102b (Lecture Notes - Discontinued Operations & NCA Held For Sale)Document2 pagesFAR-4102b (Lecture Notes - Discontinued Operations & NCA Held For Sale)Eira ShaneNo ratings yet

- Corporation LiquidationDocument2 pagesCorporation LiquidationPatrishaNo ratings yet

- PDF Advanced Accounting Solman CompressDocument91 pagesPDF Advanced Accounting Solman CompressLeah Mae NolascoNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Ap-600Q: Investing Cycle: Audit of Investment: - T R S ADocument13 pagesAp-600Q: Investing Cycle: Audit of Investment: - T R S AChristine Jane AbangNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

- V14 and V15 AFAR-12 (Foreign Currency Transactions & Translation)Document21 pagesV14 and V15 AFAR-12 (Foreign Currency Transactions & Translation)Richard VictoriaNo ratings yet

- V16 and V17 TAX-2001 (Preferential Taxation 1)Document5 pagesV16 and V17 TAX-2001 (Preferential Taxation 1)Richard VictoriaNo ratings yet

- Risk Management Your Pocket Guide To Enterprise Risk IntelligenceDocument19 pagesRisk Management Your Pocket Guide To Enterprise Risk IntelligenceRichard VictoriaNo ratings yet

- Far 2019Document11 pagesFar 2019Richard VictoriaNo ratings yet

- Afar 2019Document10 pagesAfar 2019Richard VictoriaNo ratings yet