Professional Documents

Culture Documents

ACCA MA and FMA Updates For 2020-21 Sittiings 160620

Uploaded by

John WehkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA MA and FMA Updates For 2020-21 Sittiings 160620

Uploaded by

John WehkCopyright:

Available Formats

ACCA – Management Accounting MA

Updates for the material for 2020–21 sittings

Amendments required to Study Text (ISBN 978-1-78740-587-5)

Study Amendment

Text

Page

224 Chapter 8 Missing text from Illustration 2

Please see Appendix 1 below.

443 Chapter 15 Actual quantity used × standard price should equal $6,600

Illustration 4

Amendments required to Exam Kit (ISBN 978-1-78740-612-4)

Exam Amendment

Kit

Page

96 Question 326 Please remove 'effective' from the question stem

213 Answer 325 Answers to Q325

235 Answer 456 Correct answer should be:

$186,000/3.433 = $54,180

Amendments required to Pocket Notes (ISBN 978-1-78740-639-1)

None reported

Integrated Workbook

IW Amendment

Page

Updated: 16 June 2020

ACCA – Management Accounting MA

Updates for the material for 2020–21 sittings

Appendix 1

The fixed production overhead figure has been calculated on the basis

of a budgeted normal output of 36,000 units per annum. The fixed

production overhead actually incurred in March was $15,000.

Selling, distribution and administration expenses are:

Fixed $10,000 per month

Variable 15% of the sales value

The selling price per unit is $50 and the number of units produced and

sold were:

Production 2,000

Sales 1,500

Prepare the absorption costing and marginal costing statements of

profit or loss for March.

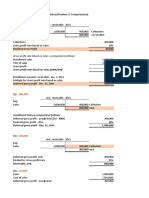

Absorption costing statement of profit or loss – March

$ $

Sales 75,000

Less Cost of sales: (full production cost)

Opening inventory –

Variable cost of production (2,000 × $15) 30,000

Fixed production overhead absorbed (2,000 × $5) 10,000

Less Closing inventory (W1) (500 × $20) (10,000)

(30,000)

(Under)/over-absorption (W2) (5,000)

–––––

Gross profit 40,000

Less Non-production costs (W3) (21,250)

–––––

Profit/loss 18,750

–––––

Workings

(W1) Closing inventory = opening inventory + production – sales units

= 0 + 2,000 – 1,500 = 500 units

(W2)

$

Overheads absorbed (2,000 × $5) 10,000

Overheads incurred 15,000

Under-absorption on overheads 5,000

Updated: 16 June 2020

ACCA – Management Accounting MA

Updates for the material for 2020–21 sittings

(W3)

Fixed = 10,000

Variable = 15% × $75,000 = $11,250

Total = $(10,000 + 11,250) = $21,250

Marginal costing statement of profit or loss – March

$ $

Sales 75,000

Less Cost of sales: (marginal production costs)

Opening inventory –

Variable cost of production (2,000 × $15) 30,000

Less Closing inventory (500 × $15) (7,500)

––––– (22,500)

–––––

52,500

Less Other variable costs (15% × $75,000) (11,250)

–––––

Contribution 41,250

Less Total fixed costs (actually incurred) (25,000)

$(15,000 + 10,000)

–––––

Profit/loss 16,250

–––––

Found another error? Please let us know on mykaplanreporting@kaplan.com – do provide as much

information as possible including the name/page of the book and/or question number. Thanks.

Updated: 16 June 2020

You might also like

- Furnace Gks9090Document40 pagesFurnace Gks9090Rich BentoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- F2 Past Paper - Ans12-2006Document8 pagesF2 Past Paper - Ans12-2006ArsalanACCANo ratings yet

- Mysql Bt0075Document319 pagesMysql Bt0075Abdul Majeed MohamedNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Financial Control - 2 - Variances - Additional Exercises With SolutionDocument9 pagesFinancial Control - 2 - Variances - Additional Exercises With SolutionQuang Nhựt100% (1)

- Prescriptive AnalyticsDocument7 pagesPrescriptive AnalyticsAlfredo Romero GNo ratings yet

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anumNo ratings yet

- 1 2 2006 Jun ADocument8 pages1 2 2006 Jun AcyoteditorNo ratings yet

- Leverages: Solutions To Assignment ProblemsDocument7 pagesLeverages: Solutions To Assignment ProblemsPalash BairagiNo ratings yet

- 4$20 Triangles$20 ProofsDocument23 pages4$20 Triangles$20 ProofsBaskaran SeetharamanNo ratings yet

- VP Engineering CTO in San Francisco Bay CA Resume Ahmed EzzatDocument3 pagesVP Engineering CTO in San Francisco Bay CA Resume Ahmed EzzatAhmedEzzat2No ratings yet

- Answer Key To Test #3 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- BS 583-5 PDFDocument56 pagesBS 583-5 PDFwi100% (1)

- Ilustrated Kinesio TapingDocument117 pagesIlustrated Kinesio TapingNewtonBaldan94% (32)

- Chapter 10Document6 pagesChapter 10Love FreddyNo ratings yet

- Functional Description of LSC System 11.00 CDocument8 pagesFunctional Description of LSC System 11.00 CStasNo ratings yet

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Denton Company Income Statement Periode 1 - July, 2020Document4 pagesDenton Company Income Statement Periode 1 - July, 2020Farrell FerenceNo ratings yet

- Sol ch13Document6 pagesSol ch13Kailash KumarNo ratings yet

- Chapter 5 - AfaDocument6 pagesChapter 5 - AfaNguyễn Phương ThảoNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingValérie CamangueNo ratings yet

- Exercise Topic 5-AnswerDocument3 pagesExercise Topic 5-AnswerPatricia TangNo ratings yet

- A. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Document10 pagesA. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Love FreddyNo ratings yet

- CH 2 Cost-Volume-Profit RelationshipsDocument24 pagesCH 2 Cost-Volume-Profit RelationshipsMona ElzaherNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Chapter 5 Tutorial ExerciseDocument5 pagesChapter 5 Tutorial ExerciseFarheen AkramNo ratings yet

- Topic 5: Short Term Decision Making Answer To Exercise 1: BKAM3023 Management Accounting IIDocument3 pagesTopic 5: Short Term Decision Making Answer To Exercise 1: BKAM3023 Management Accounting IIdini sofiaNo ratings yet

- 07 Marginal Costing and Pricing DecisionsDocument21 pages07 Marginal Costing and Pricing DecisionsAyushNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Fin. Anal RafaelDocument6 pagesFin. Anal RafaelMarjonNo ratings yet

- 6 LeveragesDocument9 pages6 LeveragesAishu SathyaNo ratings yet

- Unrealized Gain On Sale of Equipment: Cost ModelDocument25 pagesUnrealized Gain On Sale of Equipment: Cost ModelLove FreddyNo ratings yet

- Problem 6 (Determination of Earnings and Earnings Per Share)Document8 pagesProblem 6 (Determination of Earnings and Earnings Per Share)TABOCTABOC JOHN PHILIP M.No ratings yet

- Accounting PoliciesDocument10 pagesAccounting PoliciesHohohoNo ratings yet

- Exercise 5-1: Total Per UnitDocument18 pagesExercise 5-1: Total Per UnitSaransh Chauhan 23No ratings yet

- Tutorial 10 Contribution Analysis For Decision-Making 2: Make or Buy?Document4 pagesTutorial 10 Contribution Analysis For Decision-Making 2: Make or Buy?Steven CHONGNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Seminar in Management AccountingDocument6 pagesSeminar in Management AccountinglolaNo ratings yet

- A208 Traditional Vs Contribution Income StatementDocument4 pagesA208 Traditional Vs Contribution Income StatementKyla Joy T. SanchezNo ratings yet

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020No ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Activity Chapter 5Document3 pagesActivity Chapter 5Randelle James FiestaNo ratings yet

- Investment in AssociateDocument26 pagesInvestment in AssociateEUNICE LAYNE AGCONo ratings yet

- Direct Costing 4Document3 pagesDirect Costing 4Hasan AhmmedNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2021Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2021Maham IlyasNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Exercise of VariableDocument10 pagesExercise of VariableAqoon Kaab ChannelNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Shah ReenNo ratings yet

- Lecture 5Document39 pagesLecture 5Shixi ZhuNo ratings yet

- Solution CH.6Document14 pagesSolution CH.6Thanawat PHURISIRUNGROJNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Chapter 7 & 8Document29 pagesChapter 7 & 8Mary Ann F. MendezNo ratings yet

- 1415J M - Sesi 07 08 - Akuntansi Manajemen - CVP TDMDocument59 pages1415J M - Sesi 07 08 - Akuntansi Manajemen - CVP TDMAnonymous yMOMM9bs100% (1)

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- CVP - GitttDocument15 pagesCVP - GitttFarid RezaNo ratings yet

- Latihan Soal Week 8Document6 pagesLatihan Soal Week 8Natasya Prashta WidyadhariNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Sale Mix and Break Even Analysis With Multiple Products (Lecture 9 Supp Notes)Document3 pagesSale Mix and Break Even Analysis With Multiple Products (Lecture 9 Supp Notes)renakwokNo ratings yet

- This Proc Edur e Woul D Be Not Be Appli Cable Wher e TheDocument38 pagesThis Proc Edur e Woul D Be Not Be Appli Cable Wher e TheLove FreddyNo ratings yet

- Anderol 6320: H1 High Performance Food Grade Gear LubricantDocument1 pageAnderol 6320: H1 High Performance Food Grade Gear Lubricanteka prayataNo ratings yet

- Carbonization of Pitch and Resin PDFDocument8 pagesCarbonization of Pitch and Resin PDFWagnerdeLagesNo ratings yet

- Structural Audit of Indusind Mass and Media Building SR - No Date Activity Assignment-1Document4 pagesStructural Audit of Indusind Mass and Media Building SR - No Date Activity Assignment-1PiyushNo ratings yet

- QBXLH 6565a VTMDocument4 pagesQBXLH 6565a VTMSebastianNo ratings yet

- Gem GK340 IDocument4 pagesGem GK340 IAnonymous Syjpyt4MoNo ratings yet

- Cyclical Lever DriveDocument24 pagesCyclical Lever DriveJesus Daniel QuispeNo ratings yet

- Design of AC MachinesDocument24 pagesDesign of AC Machinessameerpatel1577050% (2)

- Space Time (ST) and Space Velocity (SV)Document2 pagesSpace Time (ST) and Space Velocity (SV)Marco A. Castillo LudeñaNo ratings yet

- Steering Controlled Adaptive HeadlampsDocument7 pagesSteering Controlled Adaptive HeadlampsIJRASETPublicationsNo ratings yet

- GS PDFDocument41 pagesGS PDFdivakarsNo ratings yet

- Maximization of Natural Gas Liquids Production FroDocument9 pagesMaximization of Natural Gas Liquids Production Froerwin_carryNo ratings yet

- ProductSheet-MCD7500 2023Document1 pageProductSheet-MCD7500 2023alexggggNo ratings yet

- Lab 3Document8 pagesLab 3Mian BlalNo ratings yet

- BUS 426 Week 9 DBDocument3 pagesBUS 426 Week 9 DBMishrin MishkatNo ratings yet

- Pioneer Mini VRFDocument13 pagesPioneer Mini VRFCarlos LehmanNo ratings yet

- Curso HTMLDocument1,310 pagesCurso HTMLsaltamontes69No ratings yet

- Concrete Anchor PDFDocument8 pagesConcrete Anchor PDFStraus WaseemNo ratings yet

- Melds ApparatusDocument4 pagesMelds ApparatusMalik ZohaibNo ratings yet

- Assessment of Irrigation Water QualityDocument10 pagesAssessment of Irrigation Water Qualitymusa ballah koromaNo ratings yet

- NACA Conference On Aircraft Loads 1957Document614 pagesNACA Conference On Aircraft Loads 1957Mark Evan SalutinNo ratings yet

- Quick Response Technique For Travel Demand Estimation in SmallDocument26 pagesQuick Response Technique For Travel Demand Estimation in SmallMonalisa GadpalliwarNo ratings yet

- L. Stability Analysis and Design of Structures: Murari GambhirDocument12 pagesL. Stability Analysis and Design of Structures: Murari GambhirsamuelNo ratings yet