Professional Documents

Culture Documents

Activity Chapter 5

Uploaded by

Randelle James Fiesta0 ratings0% found this document useful (0 votes)

33 views3 pages1. The total unrealized gross profit from intercompany sales of inventory was $2,800. This consisted of $800 in unrealized profit from upstream sales and $2,000 from downstream sales.

2. The non-controlling interest (NCI) in net assets as of December 31, 20x1 was $21,070. This was calculated as 20% of the subsidiary XYZ's net assets at fair value of $105,350.

3. The consolidated retained earnings were $130,280. This consisted of the parent ABC's retained earnings of $120,000 plus net consolidation adjustments including the parent's share in changes to the subsidiary's net assets.

Original Description:

Original Title

ACTIVITY CHAPTER 5

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The total unrealized gross profit from intercompany sales of inventory was $2,800. This consisted of $800 in unrealized profit from upstream sales and $2,000 from downstream sales.

2. The non-controlling interest (NCI) in net assets as of December 31, 20x1 was $21,070. This was calculated as 20% of the subsidiary XYZ's net assets at fair value of $105,350.

3. The consolidated retained earnings were $130,280. This consisted of the parent ABC's retained earnings of $120,000 plus net consolidation adjustments including the parent's share in changes to the subsidiary's net assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views3 pagesActivity Chapter 5

Uploaded by

Randelle James Fiesta1. The total unrealized gross profit from intercompany sales of inventory was $2,800. This consisted of $800 in unrealized profit from upstream sales and $2,000 from downstream sales.

2. The non-controlling interest (NCI) in net assets as of December 31, 20x1 was $21,070. This was calculated as 20% of the subsidiary XYZ's net assets at fair value of $105,350.

3. The consolidated retained earnings were $130,280. This consisted of the parent ABC's retained earnings of $120,000 plus net consolidation adjustments including the parent's share in changes to the subsidiary's net assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

ACTIVITY CHAPTER 5

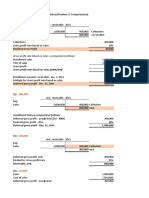

1. How much is the total unrealized gross profit from the intercompany sales

of inventory?

Ans. 800

Solution:

Downstream Upstream Total

Sale price of intercompany sale 20,000 12,000

Cost of intercompany sale (12,000) (9,600)

Profit from intercompany sale 8,000 2,400

Multiply by: Unsold portion as of yr.-end 1/4 4/12

Unrealized gross profit 2,000 800 2,800

2. How much is the NCI in net assets as of December 31, 20x1?

Ans. 21,070

Solution:

Step 2: Analysis of net assets

XYZ, Inc. Acquisition Consolidation Net

date date change

Share capital 50,000 50,000

Retained earnings 24,000 50,150

Other components of equity - -

Totals at carrying amounts 74,000 100,150

Fair value adjustments at acquisition 16,000 16,000

date

Subsequent depreciation of FVA NIL (10,000)*

Unrealized profits (Upstream only) NIL (800)**

Subsidiary's net assets at fair 90,000 105,350 15,350

value

Step 3: Goodwill computation

The problem states that goodwill on acquisition date was ₱3,000. This is also the amount at year-end

because there is no impairment of goodwill during the year.

Step 4: Non-controlling interest in net assets

XYZ's net assets at fair value – Dec. 31, 20x1 (Step 2) 105,350

Multiply by: NCI percentage 20%

Total 21,070

Add: Goodwill to NCI net of accumulated impairment losses - *

Non-controlling interest in net assets – Dec. 31, 20x1 21,070

3. How much is the consolidated retained earnings?

Ans. 130,280

Solution

Step 5: Consolidated retained earnings

ABC's retained earnings – Dec. 31, 20x1 120,000

Consolidation adjustments:

ABC's share in the net change in XYZ's net assets (a) 12,280

Unrealized profits (Downstream only) - (Step 1) (2,000)

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to Parent -

Net consolidation adjustments 10,280

Consolidated retained earnings – Dec. 31, 20x1 130,280

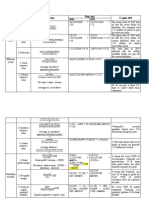

4. How much is the consolidated profit or loss?

Ans. 83,350

Solution:

Step 6: Consolidated profit or loss

Parent Subsidiary Consolidated

Profits before adjustments 70,000 26,150 96,150

Consolidation adjustments:

Unrealized profits - (Step 1) (2,000) (800) (2,800)

Dividend income from ( - ) N/A ( - )

subsidiary Gain or loss on

extinguishment

of bonds ( - ) ( - ) ( - )

Net consolidation adjustments (2,000) (800) (2,800)

Profits before FVA 68,000 25,350 93,350

Depreciation of FVA (b) (8,000) (2,000) (10,000)

Impairment loss on goodwill ( - ) ( - ) ( - )

Consolidated profit 60,000 23,350 83,350

5. How much is the consolidated profit or loss attributable to

Ans. Owners parent 80,280, NCI 3,070

Solution:

Step 7: Profit or loss attributable to owners of parent and NCI

Owners Consolidated

of parent NCI

ABC's profit before FVA 68,000 N/A 68,000

(Step 6)

Share in XYZ’s profit 20,280 5,070 25,350

(c)

before FVA

Depreciation of FVA (2,000

(Step 6) (8,000) ) (10,000)

Share in impairment ( - ) ( - ( - )

loss on goodwill )

Totals 80,280 3,070 83,350

You might also like

- Trivago ProspectusDocument269 pagesTrivago ProspectusMichaelNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Consolidation of Financial Statement - Miscellaneous TopicsDocument42 pagesConsolidation of Financial Statement - Miscellaneous TopicsJen KerlyNo ratings yet

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Valuation - Models - DamodaranDocument47 pagesValuation - Models - DamodaranJuan Manuel VeronNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)Document3 pagesConsolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)mhar lon100% (2)

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Sol. Man. - Chapter 5 - Statement of Changes in EquityDocument2 pagesSol. Man. - Chapter 5 - Statement of Changes in Equitynatalie clyde matesNo ratings yet

- Chapter 16Document35 pagesChapter 16Kad SaadNo ratings yet

- Jawaban Quiz 2Document2 pagesJawaban Quiz 2Muhammad IrvanNo ratings yet

- Chapter 4 - Consolidated Financial Statements (Part 1)Document32 pagesChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNo ratings yet

- Ud12 08 09Document157 pagesUd12 08 09Raj AnandNo ratings yet

- Final Review Jawaban IntermediateDocument33 pagesFinal Review Jawaban Intermediatelukes12No ratings yet

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- UD BUANA Trial BalanceDocument1 pageUD BUANA Trial Balancerasaz deviNo ratings yet

- 1 Statement of Financial PositionDocument46 pages1 Statement of Financial Positionapi-267023512100% (1)

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- Case Study - Maverick DeloitteDocument9 pagesCase Study - Maverick DeloitteSnehal Gandhe0% (1)

- Chapter 6 - Consolidated Financial Statements (Part 3)Document11 pagesChapter 6 - Consolidated Financial Statements (Part 3)Kim GarciaNo ratings yet

- Chapters 5-6 Classroom Discussion Answer KeyDocument12 pagesChapters 5-6 Classroom Discussion Answer KeyJeeramel TorresNo ratings yet

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document14 pages2076 - Varias, Aizel Ann B - Module 3Aizel Ann VariasNo ratings yet

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDocument8 pagesProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 3Document16 pages2076 - Varias, Aizel Ann B - Module 3AIZEL ANN VARIASNo ratings yet

- BusinessCombi (Chapter 5)Document18 pagesBusinessCombi (Chapter 5)richmond naragNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- BusinessCombi (Chapter 6)Document5 pagesBusinessCombi (Chapter 6)richmond naragNo ratings yet

- Module 5Document11 pagesModule 5Jacqueline OrtegaNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Quiz 2 ABC SolutionsDocument3 pagesQuiz 2 ABC SolutionsAndrew wigginNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Chapter 4 & 5 AbcDocument16 pagesChapter 4 & 5 AbcAlthea Lyn ReyesNo ratings yet

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Chapter 4Document36 pagesChapter 4MARRIETTE JOY ABADNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Overall TemplateDocument5 pagesOverall TemplateUsman GhaniNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Solutions:: I. In-Transit ItemDocument6 pagesSolutions:: I. In-Transit ItemMary EdsylleNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Financial Reporting 2 Final Exam 2020Document3 pagesFinancial Reporting 2 Final Exam 2020kateNo ratings yet

- Answers To Assignement 1 Period 3Document16 pagesAnswers To Assignement 1 Period 3trishaNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Step 1: Analysis of The Subsidiary's Net AssetsDocument10 pagesStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- FRS 8 Ig (2016)Document4 pagesFRS 8 Ig (2016)David LeeNo ratings yet

- SHE (Part 2) - OvilloDocument13 pagesSHE (Part 2) - OvilloMaria AngelicaNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Consolidation Q76Document4 pagesConsolidation Q76johny SahaNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- Midterm Assignment 5Document2 pagesMidterm Assignment 5Randelle James FiestaNo ratings yet

- Activity Chapter 5-Profe04: What Is Audit Sampling?Document1 pageActivity Chapter 5-Profe04: What Is Audit Sampling?Randelle James FiestaNo ratings yet

- Post Test Chapter 1Document4 pagesPost Test Chapter 1Randelle James FiestaNo ratings yet

- Post Quiz 1Document3 pagesPost Quiz 1Randelle James FiestaNo ratings yet

- Activity-Chapter 7: Ans. None of These SolutionDocument1 pageActivity-Chapter 7: Ans. None of These SolutionRandelle James FiestaNo ratings yet

- BOOK REVIEW "Rich Dad Poor Dad" by Robert KiyosakiDocument3 pagesBOOK REVIEW "Rich Dad Poor Dad" by Robert KiyosakiDEV S PANCHARIYA 03FL22BBL005No ratings yet

- Karnataka Silk Marketing Board LTD 2005Document9 pagesKarnataka Silk Marketing Board LTD 2005Tom PrinceNo ratings yet

- Introduction To Presentation of Final AccountsDocument36 pagesIntroduction To Presentation of Final AccountsSoumya GhoshNo ratings yet

- Sample Exam - Section A (MCQS)Document6 pagesSample Exam - Section A (MCQS)TUNG DUONG HANo ratings yet

- HBA Interest CalculationDocument3 pagesHBA Interest CalculationfayazstarNo ratings yet

- Bcom I Fa 103 MCQSDocument11 pagesBcom I Fa 103 MCQSTushar GuptaNo ratings yet

- Question 5Document4 pagesQuestion 5Siti Latifatul ZannahNo ratings yet

- Stock Market Main Project PDFDocument57 pagesStock Market Main Project PDFshridhar gadeNo ratings yet

- Pre and Post of Accounting 2Document14 pagesPre and Post of Accounting 2Nancy AtentarNo ratings yet

- Bài tập chương 3 Financil ratiosDocument14 pagesBài tập chương 3 Financil ratiosThu LoanNo ratings yet

- USA v. Michael Cohen - Criminal Information 8-21-2018Document22 pagesUSA v. Michael Cohen - Criminal Information 8-21-2018Legal InsurrectionNo ratings yet

- Semester Wise Syllabus of B.A. Semester-III Paper-II Public FinanceDocument10 pagesSemester Wise Syllabus of B.A. Semester-III Paper-II Public FinanceVishal A KumarNo ratings yet

- MGT211 Shortnotes 1 To 45 LecDocument12 pagesMGT211 Shortnotes 1 To 45 LecEngr Imtiaz Hussain GilaniNo ratings yet

- Comparison Partnership and LLPDocument9 pagesComparison Partnership and LLPSiti Nazatul MurnirahNo ratings yet

- Corporate Finance - Exercises Session 1Document18 pagesCorporate Finance - Exercises Session 1LouisRemNo ratings yet

- Profile On The Production of JeansDocument27 pagesProfile On The Production of JeansDinesh VermaNo ratings yet

- Northwell Q2 2019 Financial StatementsDocument15 pagesNorthwell Q2 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Summary of Sales Report: Dranix Distributor IncDocument6 pagesSummary of Sales Report: Dranix Distributor Incshipmonk7No ratings yet

- Chapter 1Document31 pagesChapter 1VirencarpediemNo ratings yet

- Electrolux Report Final TotalDocument128 pagesElectrolux Report Final TotalAnonymous H0SJWZE8No ratings yet

- My ReportDocument36 pagesMy ReportMohib Ullah YousafzaiNo ratings yet