Professional Documents

Culture Documents

Monthly Return Data

Uploaded by

Subrata Chanda Uthpal0 ratings0% found this document useful (0 votes)

7 views3 pagesThe document contains stock return data for 5 companies (CTBK, GRAE, DLIN, BXSY, SQPH) over a 5 year period from 2016 to 2021. It also includes calculations for portfolio returns, variance, standard deviation, and Sharp Ratios under different portfolio weight scenarios. The highest Sharp Ratio of 0.393819 was achieved with a portfolio weighted 100% to DLIN, which had an annualized return of 21% and standard deviation of 12%.

Original Description:

Original Title

monthly-return-data

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains stock return data for 5 companies (CTBK, GRAE, DLIN, BXSY, SQPH) over a 5 year period from 2016 to 2021. It also includes calculations for portfolio returns, variance, standard deviation, and Sharp Ratios under different portfolio weight scenarios. The highest Sharp Ratio of 0.393819 was achieved with a portfolio weighted 100% to DLIN, which had an annualized return of 21% and standard deviation of 12%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesMonthly Return Data

Uploaded by

Subrata Chanda UthpalThe document contains stock return data for 5 companies (CTBK, GRAE, DLIN, BXSY, SQPH) over a 5 year period from 2016 to 2021. It also includes calculations for portfolio returns, variance, standard deviation, and Sharp Ratios under different portfolio weight scenarios. The highest Sharp Ratio of 0.393819 was achieved with a portfolio weighted 100% to DLIN, which had an annualized return of 21% and standard deviation of 12%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

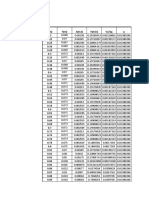

CTBK GRAE DLIN BXSY SQPH Perod: 1/1/2016-1/12/2021

-0.025641 0.014068 -0.027652 0 0.010859 source: investing.com

-0.025 -0.028452 -0.064 0 -0.033759

-0.014085 -0.057075 0.204649 -0.086957 -0.094963 CTBK: City Bank

0.007092 0.048538 0.269065 0.210526 0.068844 GRAE: Grameenphone

0.04059 -0.044028 0.006517 0.134328 0.020721 DLIN: Delta Life Insuarance

0.026515 0.085575 -0.10499 0.914286 0.030162 BXSY: Beximco Synthetics

-0.04 0.008952 0.480806 0.029412 0.011737 SQPH: Sqaure Pharma

0.200873 0.021534 0.499281 0.0625 0.005666

-0.064542 0.031963 0.049849 -0.085714 0.077314

0.028139 -0.028968 -0.044733 -0.054054 -0.091497

-0.152669 -0.090347 -0.071046 0.027778 -0.063609

0.18967 0.071449 0.093842 0 0.052847

0.033246 0.087747 -0.056708 -0.052632 0.193583

-0.032176 -0.03215 0.002774 -0.05 -0.026727

-0.019917 -0.000909 -0.056283 -0.111111 -0.027485

0.176758 0.036432 0.147147 0 -0.068064

0.327285 0.231721 -0.067227 -0.237288 0.209421

-0.02956 0.082496 0.231034 -0.016667 0.049242

0.03046 -0.066823 0 -0.047619 -0.090159

-0.118286 0.071608 0 0 0.046783

0.074279 0 0 -0.030769 0.049973

-0.028043 -0.129738 -0.189944 -0.155844 -0.108041

-0.078615 0.064391 -0.02981 0.054795 -0.024211

-0.095025 -0.097971 -0.059873 0.177419 0.043161

-0.057665 -0.101823 -0.087209 0.016393 -0.087862

0.018138 0.002205 0.005848 -0.075758 -0.051993

-0.102015 -0.099035 -0.061471 -0.131579 -0.004235

-0.068663 0.129487 -0.053998 -0.037975 -0.062709

-0.050417 -0.061372 0.024468 -0.081395 0.003985

-0.003776 -0.088566 -0.06 -0.085106 -0.050712

0.022394 0.027035 0.02145 -0.096154 0.037303

0.119758 -0.010036 0.058378 -0.037037 -0.019626

-0.045004 -0.123412 -0.121557 -0.181818 -0.026225

-0.075925 0.039898 -0.040984 0.222222 -0.025195

-0.116318 -0.011803 -0.018767 0.213483 0.039853

0.082877 0.084127 0.019126 0.022989 0.0358

-0.032155 0.012683 0.024254 0.115385 -0.035262

-0.018724 -0.045024 -0.080617 -0.082353 0.055158

-0.009615 0.025378 0.134241 -0.022989 -0.020146

-0.095652 -0.041904 0.057613 -0.054348 -0.016945

0.187316 -0.009226 -0.005118 -0.041667 0.036613

-0.110236 0.003343 -0.023 0.28 -0.086994

-0.005871 -0.06244 -0.005964 0 0.038594

-0.011287 -0.116695 -0.046445 -0.0625 -0.080458

-0.09354 0.01645 -0.018605 -0.012346 -0.010005

0.03416 -0.034886 0.067527 -0.047059 -0.010552

-0.098883 -0.047174 0.000994 #DIV/0! -0.038941

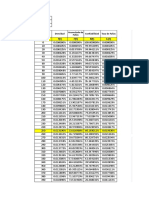

-0.201262 0.06712 -0.065056 0.080183

-0.023789 -0.001273 -0.070812 0

0.133093 0.075519 0.088346 0.090905

0.052432 0.055382 -0.022957 -0.028126

0.038674 0.065965 0.067647 0.069561

0.047685 0.026614 0.032389 0.011699

0.122872 0.101916 -0.00202 -0.025169

0.130115 0.047764 0.047619 0.028734

0.031013 -0.026363 -0.096558 -0.006013

-0.176907 0.016561 -0.081651 0.02088

0.178384 0.074757 0.039234 0.036138

-0.012094 0.024536 -0.000912 0.031973

0.231489 #DIV/0! 0.090457 0.043318

0.087963 #DIV/0! #DIV/0!

0.073025

-0.045066

0.060896

-0.00401

-0.037627

0.048028

0.054933

0.033627

-0.074962

0.008745

#DIV/0!

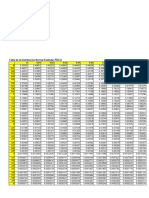

CTBK GRAE DLIN BXSY SQPH Monthly Return

CTBK 0.009467 0.004717 0.014412 0.029133 0.003781 1%

GRAE 0.004717 0.004797 0.004861 0.004877 0.004933 1%

DLIN 0.014412 0.004861 0.014756 0.014402 0.013495 2%

BXSY 0.029133 0.004877 0.014402 0.030929 0.013495 1%

SQPH 0.003781 0.004933 0.013495 0.013495 0.003774 0%

Portfolio Weights

CTBK 0% 0% 0% 2% 0%

GRAE 0% 48% 48% 98% 0%

DLIN 100% 52% 52% 0% 100%

BXSY 0% 0% 0% 0% 0%

SQPH 0% 0% 0% 0% 0%

100% 100% 100% 100% 100%

Monthly Annualized

Return 2% 21% 14% 14% 6% 21%

variance 0.014756

Std Dev 12% 42% 30% 30% 24% 12%

Risk free rate 4% 4% 4% 4% 4%

Sharp Ratio 0.393819 0.31845 0.3184 0.087269 0.393819

You might also like

- Monthly Return DataDocument3 pagesMonthly Return DataSubrata Chanda UthpalNo ratings yet

- Quality Assign 2Document8 pagesQuality Assign 2Vy ThoaiNo ratings yet

- Trabajo de SismosDocument2,630 pagesTrabajo de SismosArturo SuarezNo ratings yet

- Dokumen PDF 2Document51 pagesDokumen PDF 2HAFNI KHAIRANI SIREGARNo ratings yet

- Monte Carlo Simulation of CER Model and Asset ReturnsDocument52 pagesMonte Carlo Simulation of CER Model and Asset ReturnsZhou YunxiuNo ratings yet

- Ti A (m/s2) Pi Cpi Dpi+1 Bůi Ůi Aui UiDocument27 pagesTi A (m/s2) Pi Cpi Dpi+1 Bůi Ůi Aui UiJhonatan Narvaez RodriguezNo ratings yet

- Statistics Report on CU Variable Distribution and PropertiesDocument2 pagesStatistics Report on CU Variable Distribution and PropertiesNando YarangaNo ratings yet

- Carta PsicrometricaDocument14 pagesCarta PsicrometricaNemesi De L'amourNo ratings yet

- Energia EspDocument8 pagesEnergia EspJOAN JUNIORS ATENCIO VELASQUEZNo ratings yet

- TesDocument105 pagesTesardan nagraNo ratings yet

- Time (S) Linear Acclinear Acclinear Accabsolute Acceleration (M/S 2)Document5 pagesTime (S) Linear Acclinear Acclinear Accabsolute Acceleration (M/S 2)Harvey ZhengNo ratings yet

- STUDY ABOUT 641-212 AIRFOIL PROPERTIES - Fillipe OliveiraDocument15 pagesSTUDY ABOUT 641-212 AIRFOIL PROPERTIES - Fillipe OliveiraFillipe OliveiraNo ratings yet

- GarchDocument53 pagesGarchDipak KumarNo ratings yet

- Hong Kong Assured Lives Mortality Table HKA01 Age LastDocument6 pagesHong Kong Assured Lives Mortality Table HKA01 Age LastJames ChuNo ratings yet

- REGRESSIONDocument2 pagesREGRESSIONUtkarsh VikramNo ratings yet

- Observations:: Flow Through A Fluidised BedDocument5 pagesObservations:: Flow Through A Fluidised BedMayank KumrawatNo ratings yet

- Ejemplo FDocument739 pagesEjemplo FRosita OrtechoNo ratings yet

- TABEL DISTRIBUSI MOMENDocument3 pagesTABEL DISTRIBUSI MOMENdickiNo ratings yet

- Real Roots Numerical MethodsDocument7 pagesReal Roots Numerical MethodsAyhen Claire Espina BathanNo ratings yet

- Trabalho de Casa 1 (Carla)Document9 pagesTrabalho de Casa 1 (Carla)Maria LauraNo ratings yet

- Ects1 Buzea Stefania GeorgianaDocument82 pagesEcts1 Buzea Stefania GeorgianaPirtac Vladut-MihaiNo ratings yet

- Portfolio Sharpe RatioDocument7 pagesPortfolio Sharpe RatioPooja SivayoganNo ratings yet

- PDM 82 Aligned My36nDocument10 pagesPDM 82 Aligned My36nArbaz100% (1)

- The mean values and principal components of componentsDocument10 pagesThe mean values and principal components of componentsDevhyNo ratings yet

- Cibil Data1Document15 pagesCibil Data1harinihar05No ratings yet

- C3Dtools 438bcDocument83 pagesC3Dtools 438bcVraviniteNo ratings yet

- S1046 ProfileDocument4 pagesS1046 ProfilevrajendraupadhyayNo ratings yet

- 18.13 Al NO de Pastaza, Alto Amazonas - Loreto - C131Document7,168 pages18.13 Al NO de Pastaza, Alto Amazonas - Loreto - C131Manuel LiñanNo ratings yet

- Oscillating system coefficients and responseDocument2,624 pagesOscillating system coefficients and responseManuel LiñanNo ratings yet

- 0809 Sem 1Document22 pages0809 Sem 1Kent Choo100% (1)

- Calculo de Peraltes AashtoDocument6 pagesCalculo de Peraltes AashtoManuel Bernuy CoralNo ratings yet

- distribucionesDocument1 pagedistribucioneskiara noemiNo ratings yet

- Ancash earthquake acceleration dataDocument5,941 pagesAncash earthquake acceleration dataLuis Fernando Vergaray AstupiñaNo ratings yet

- Group Point Coordinates DataDocument2 pagesGroup Point Coordinates DataPiyush KumawatNo ratings yet

- KPN 유전능력 자료 (201712평가결과)Document348 pagesKPN 유전능력 자료 (201712평가결과)_the_bridge_No ratings yet

- Chart TitleDocument126 pagesChart TitleIagar OanaNo ratings yet

- Regression Coefficients and Interaction ParametersDocument303 pagesRegression Coefficients and Interaction ParametersWaqar BhattiNo ratings yet

- Mining Earnings to NiceHash and External WalletsDocument4 pagesMining Earnings to NiceHash and External WalletsAhlul Nasa Cah MusamyNo ratings yet

- Mttf η β: Tiempo vs. DensidadDocument10 pagesMttf η β: Tiempo vs. DensidadLuis AsenciosNo ratings yet

- R Spectra BmeriahDocument15 pagesR Spectra BmeriahDavid SaranaNo ratings yet

- Graph of Sin X FunctionDocument42 pagesGraph of Sin X FunctionMAROSYANA AYU FEBRIANINo ratings yet

- Ortmann FX L V-152 Airfoil Data and ChartDocument8 pagesOrtmann FX L V-152 Airfoil Data and ChartvrajendraupadhyayNo ratings yet

- MachnoDocument15 pagesMachnovishwasbNo ratings yet

- Book 2Document15 pagesBook 2vishwasbNo ratings yet

- Period T (S) Elastic Accelerations Elastic Displacement Design Accelerations Design Displacement S (G) S (M) S (M/S) S (M)Document10 pagesPeriod T (S) Elastic Accelerations Elastic Displacement Design Accelerations Design Displacement S (G) S (M) S (M/S) S (M)Flat EarthNo ratings yet

- 3 MDocument18 pages3 MMorabet FaridNo ratings yet

- C23A Seismic Station Acceleration DataDocument562 pagesC23A Seismic Station Acceleration DataArmando CasasNo ratings yet

- Mw7.6 Estación4612 N E VDocument712 pagesMw7.6 Estación4612 N E Vosvaldo contrerasNo ratings yet

- Normality Test Using Liliefors TestDocument4 pagesNormality Test Using Liliefors TestkhairussfNo ratings yet

- FP y Biseccion PlanDocument7 pagesFP y Biseccion PlanJosept AlbitesNo ratings yet

- 240Document18 pages240pejuang muda ISLAMNo ratings yet

- Integral SimpsonDocument467 pagesIntegral SimpsonAngie Patricia Oviedo SaucedoNo ratings yet

- Florensia Kristaveren 102316028 / CE1 Tugas Nanomaterial (Gambar 11)Document8 pagesFlorensia Kristaveren 102316028 / CE1 Tugas Nanomaterial (Gambar 11)Florensia KristaverenNo ratings yet

- PROB 2 WilsonDocument4 pagesPROB 2 WilsonJose AlbertoNo ratings yet

- Standard Normal Distribution TableDocument1 pageStandard Normal Distribution TableCharley StillionNo ratings yet

- Final Requirement Numerical Methods 7. 50 XDocument5 pagesFinal Requirement Numerical Methods 7. 50 XAyhen Claire Espina BathanNo ratings yet

- Table: Base Reactions Outputcase Casetype Steptype Stepnum Steplabel Globalfx Globalfy GlobalfzDocument5 pagesTable: Base Reactions Outputcase Casetype Steptype Stepnum Steplabel Globalfx Globalfy GlobalfzdianNo ratings yet

- Askaria f1051151052 Modul UjiDocument27 pagesAskaria f1051151052 Modul UjiAskaria FahrezaNo ratings yet

- Class 03 - Black-Litterman - For Distribution-5Document13 pagesClass 03 - Black-Litterman - For Distribution-5Norine MelodizeNo ratings yet

- Stock Price Change Over TimeDocument17 pagesStock Price Change Over TimeSubrata Chanda UthpalNo ratings yet

- IntroductionDocument32 pagesIntroductionSubrata Chanda UthpalNo ratings yet

- Risk, Return and Portfolio TheoryDocument47 pagesRisk, Return and Portfolio TheorySubrata Chanda UthpalNo ratings yet

- 360q 6,400 2,900 + 35q 2,600 + 2q 970 1,680 500 + 3q: Less: ExpensesDocument1 page360q 6,400 2,900 + 35q 2,600 + 2q 970 1,680 500 + 3q: Less: ExpensesSubrata Chanda UthpalNo ratings yet

- Measures of Multivariate Skewness and KurtosisDocument12 pagesMeasures of Multivariate Skewness and KurtosisbrenyokaNo ratings yet

- Scatter Plots and Line of Best Fit Line of BestDocument2 pagesScatter Plots and Line of Best Fit Line of Bestapi-16254560No ratings yet

- Sta2005s EdDocument165 pagesSta2005s EdManelisi LuthuliNo ratings yet

- UE20CS312 Unit2 SlidesDocument206 pagesUE20CS312 Unit2 Slidesabhay spamNo ratings yet

- Pinky B. Carig, Ed. DDocument6 pagesPinky B. Carig, Ed. DMhelet Dequito PachecoNo ratings yet

- Econometrics 2Document84 pagesEconometrics 2josephnyamai1998No ratings yet

- 03 Statistics in Analytical ChemistryDocument92 pages03 Statistics in Analytical ChemistrySimran singhNo ratings yet

- Materi Teknik Data PanelDocument30 pagesMateri Teknik Data PanelAyu Sondang Hasian TobingNo ratings yet

- Kamau - 2013 Determinants of Audit Expectation Gap - Evidence From Limited Companies in KenyaDocument12 pagesKamau - 2013 Determinants of Audit Expectation Gap - Evidence From Limited Companies in KenyathoritruongNo ratings yet

- Advantages and Disadvantages of Sampling TechniquesDocument2 pagesAdvantages and Disadvantages of Sampling TechniquesEr Shivsagar B. Pasi0% (1)

- Point and Interval Estimation: Presented By: Shubham Mehta 0019Document43 pagesPoint and Interval Estimation: Presented By: Shubham Mehta 0019Gabriel BelmonteNo ratings yet

- FDA Module 1 Reading MaterialDocument23 pagesFDA Module 1 Reading MaterialJayasurya IpsNo ratings yet

- SPSS Practical 5 - Categorical DataDocument3 pagesSPSS Practical 5 - Categorical DataSuhar TomiNo ratings yet

- CQF ML Lab Estimating Default Probability With Logistic RegressionDocument7 pagesCQF ML Lab Estimating Default Probability With Logistic RegressionAndy willNo ratings yet

- STPM 2019-3-ActualDocument1 pageSTPM 2019-3-ActualRozita Awang HitamNo ratings yet

- Ex Ml-BasicsDocument1 pageEx Ml-BasicsaaamouNo ratings yet

- Pencegahan Perdarahan Postpartum.Document8 pagesPencegahan Perdarahan Postpartum.tri erdiansyahNo ratings yet

- All As 525 v2Document10 pagesAll As 525 v2Al-amin AlexNo ratings yet

- MANOVA and Sample ReportDocument24 pagesMANOVA and Sample ReportIdhanivNo ratings yet

- Statistic Practice QuestionDocument28 pagesStatistic Practice QuestionSaqib AliNo ratings yet

- QMM 1Document18 pagesQMM 1Ravi ReddyNo ratings yet

- Ch. 10 Inference About Means and Proportions With Two PopulationsDocument2 pagesCh. 10 Inference About Means and Proportions With Two Populationsgulzira3amirovnaNo ratings yet

- MAT2001 - Statistics For Engineers: Embedded LabDocument6 pagesMAT2001 - Statistics For Engineers: Embedded LabFarith AhamedNo ratings yet

- Logit ModelDocument50 pagesLogit ModelNISHANTNo ratings yet

- A Two-Parameter Ratio-ProductDocument19 pagesA Two-Parameter Ratio-ProductHospital BasisNo ratings yet

- Quick GRETL GuideDocument5 pagesQuick GRETL GuideFernanda Carolina FerreiraNo ratings yet

- Stat1012 Cheatsheet Double-SidedDocument2 pagesStat1012 Cheatsheet Double-SidedNicholas So100% (1)

- Discriminant Analysis SPSSDocument7 pagesDiscriminant Analysis SPSSNeelima Varma NadimpalliNo ratings yet

- Innovasion Vol 5 Issue 2-6-13Document8 pagesInnovasion Vol 5 Issue 2-6-13Princess MarielleNo ratings yet