Professional Documents

Culture Documents

Answer To Q2

Uploaded by

Teresa Man0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

20220918_Answer to Q2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesAnswer To Q2

Uploaded by

Teresa ManCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Question

Benny, Sammy and Jenny

Partnership appropriation account for the year ended 31 January 2022

01.02.2021 01.09.2021

to to

31.08.2021 31.01.2022

£ £

Pro%it for the year (W1) 58 625 41 875

Less

Salary: Sammy (W2) 14 350 10 250

Interest on capital (W3) (W4)

Benny 1 575 1 310

Sammy 2 940 1 490

Jenny 125

--------- ---------

ProBit available for distribution 39 760 28 700

Share of ProBits (W5)

Benny 19 880 10 045

Sammy 19 880 11 480

Jenny 7 175

Workings:

W1

Pro$it for the year as at 31.08.2021 = £100 500 x 7/12 = £58 625

Pro$it for the year as at 31.31.2022 = £100 500 x 5/12 = £41 875

W2

Salary – Sammy as at 31.08.2021 = £24 600 x 7/12 = £14 350

Salary – Sammy as at 31.01.2022 = £24 600 x 5/12 = £10 250

W3

Interest on capital: Benny, Sammy

Benny £45 000 x 6% x 7/12 = £1 575

Sammy £84 000 x 6% x 7/12 = £2 040

W4

Interest on capital: Benny, Sammy, Jenny

Benny £45 000 + £25 500 + (£27 000 - £18 900) = £78 600

£78 600 x 4% X 5/12 = £ 733

Sammy £84 000 + (£27 000 - £21 600) = £89 400

£89 400 x 4% x 5/12 = £1 490

Jenny (£21 000 - £13 500) x 4% x 5/12 = £125

W5

Share of proJits: Benny and Sammy

Benny £39 760 x 50% = £19 880

Sammy £39 760 x 50% = £19 880

Share of proJits: Benny, Sammy and Jenny

Benny £28 700 x 35% = £10 045

Sammy £28 700 x 40% = £11 480

Jenny £28 700 x 20% = £7 175

(a) (i) Goodwill is in intangible asset that represent the reputation built up by

the business., equalling to the difference between the sale price of the

business and the net value of the assets less liabilities.

(ii) Examples of goodwill include location, quality products,

skilled/experienced staff, brand, reputation, loyal customers

(iii) Reasons include: it is dif1icult to value or to estimate of cost; the value of

goodwill can 1luctuate; it also goes against prudence concept as assets

may be overstated until it is realised.

(iv) Pro$it/loss for the year: no effect (goodwill is asset)

Bank overdraft: no effect

(c) Regarding Jenny’s proposal to combine the capital and current account in this

partnership, it is preferred to reject such as idea due to the following reasons:

• if capital injections and share of pro$its are kept separate, it enables more accurate

calculation for the appropriation account.

• Capital account is preferred to be kept $ixed – for easier calculation of interest on

capital

• If current account is kept $luctuating, it is easier for the partners to know what

their annual earnings were for the $inancial year

• Some partners may wish to show the excess/surplus for their share of pro$it which

has not been withdrawn.

• Also, with a $ixed capital account and $luctuated current account, it is easier to tell

that Jenny has withdrawn more than she is entitled to, and it is a fact that can be

hidden from other partners if both accounts are combined. It is illustrated below:

Drawings Share of proJits*

£ £

Benny 26 000 32 810

Sammy 35 000 60 390

Jenny 10 000 7 300

As shown above, it is quicker to $ind the information for the $inancial statement

which should include the amount invested in the partnership by each partner if

the capital and current accounts are separated.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Info On House Joint Resolution 192Document4 pagesInfo On House Joint Resolution 192Freeman Lawyer75% (4)

- Planse de Colorat SF NicolaeDocument5 pagesPlanse de Colorat SF NicolaeNatalia Corlean100% (3)

- MEE Frequency Chart July 2019Document54 pagesMEE Frequency Chart July 2019Nader100% (5)

- Sap Fi Bootcamp Training Day3Document163 pagesSap Fi Bootcamp Training Day3vi100% (1)

- Week 2 - In-Sessional PracticeDocument2 pagesWeek 2 - In-Sessional PracticeTeresa ManNo ratings yet

- Week 02 - Ratios - SDocument6 pagesWeek 02 - Ratios - STeresa ManNo ratings yet

- Week 1 - Control AccountsDocument11 pagesWeek 1 - Control AccountsTeresa ManNo ratings yet

- Week 1 - Control Accounts (In Sessional)Document4 pagesWeek 1 - Control Accounts (In Sessional)Teresa ManNo ratings yet

- Week 1 - DepreciationDocument8 pagesWeek 1 - DepreciationTeresa ManNo ratings yet

- Profit For The Year (W1) 58 625 41 875Document5 pagesProfit For The Year (W1) 58 625 41 875Teresa ManNo ratings yet

- Fact Sheet - Financial Statements For Sole TradersDocument5 pagesFact Sheet - Financial Statements For Sole TradersTeresa ManNo ratings yet

- Week 1 - AssignmentDocument27 pagesWeek 1 - AssignmentTeresa ManNo ratings yet

- Week 1 - Correction of ErrorsDocument16 pagesWeek 1 - Correction of ErrorsTeresa ManNo ratings yet

- Week 02 - Valuation of Stock - SDocument4 pagesWeek 02 - Valuation of Stock - STeresa ManNo ratings yet

- Blindness Theme Wheel: Blindness and Its Themes, and Also About The WaysDocument1 pageBlindness Theme Wheel: Blindness and Its Themes, and Also About The WaysTeresa ManNo ratings yet

- Blank Theme Wheel With ThemesDocument1 pageBlank Theme Wheel With ThemesTeresa ManNo ratings yet

- Week 2 - Assignment (20200905)Document6 pagesWeek 2 - Assignment (20200905)Teresa ManNo ratings yet

- Blank Theme Wheel With Blank ThemesDocument1 pageBlank Theme Wheel With Blank ThemesTeresa ManNo ratings yet

- Completed Theme WheelDocument1 pageCompleted Theme WheelTeresa ManNo ratings yet

- Symbol Analysis Sample AnswersDocument7 pagesSymbol Analysis Sample AnswersTeresa ManNo ratings yet

- CH11 CartaDocument13 pagesCH11 CartaTeresa ManNo ratings yet

- CH08 CartaDocument12 pagesCH08 CartaTeresa ManNo ratings yet

- Character Analysis OrganizersDocument3 pagesCharacter Analysis OrganizersTeresa ManNo ratings yet

- CH05 LettersDocument14 pagesCH05 LettersTeresa ManNo ratings yet

- Blindness LitChartDocument71 pagesBlindness LitChartTeresa ManNo ratings yet

- Directorate of Local Fund Audit, Odisha,: No .Idlfa, Date.... .:. .Document3 pagesDirectorate of Local Fund Audit, Odisha,: No .Idlfa, Date.... .:. .Gouri Sankar MahapatraNo ratings yet

- Digest Cases Finals SpeccomDocument21 pagesDigest Cases Finals SpeccomJorg ィ ۦۦNo ratings yet

- 5 Question Insider TradingDocument9 pages5 Question Insider TradingGauravNo ratings yet

- InvoiceSimple PDF TemplateDocument1 pageInvoiceSimple PDF TemplateSd AmanNo ratings yet

- Econ 310 SyllabusDocument3 pagesEcon 310 SyllabusParin ShahNo ratings yet

- The UDHR and The Indian Constitution A ComparisonDocument5 pagesThe UDHR and The Indian Constitution A ComparisonSaiby KhanNo ratings yet

- Contract-Agreement Rosehall ISMS NotarizedDocument8 pagesContract-Agreement Rosehall ISMS NotarizedCastor, Cyril Nova T.No ratings yet

- NMMNNW - Nu - , U - Un '"'''' PT S U : Commission OnDocument14 pagesNMMNNW - Nu - , U - Un '"'''' PT S U : Commission OnCeslhee AngelesNo ratings yet

- The Three (3) Components of Agrarian Reforms Are The Following: The LAPDocument2 pagesThe Three (3) Components of Agrarian Reforms Are The Following: The LAPJANNo ratings yet

- Duties of Counsel NotesDocument7 pagesDuties of Counsel Notesabdul rahimNo ratings yet

- Fire Safety Measures in Shopping MallsDocument4 pagesFire Safety Measures in Shopping MallsElla Lee Galve100% (1)

- A-Health Advance-I Premium RatesDocument2 pagesA-Health Advance-I Premium RatesExsan OthmanNo ratings yet

- Danza in E Minor by Jorge MorelDocument8 pagesDanza in E Minor by Jorge MorelMagda NogueraNo ratings yet

- Spa Ifo YbpDocument3 pagesSpa Ifo YbpOfelia L QuizonNo ratings yet

- Maxworth Orchards India Limited Anr V T Mohan Ors 2022 Livelaw Mad 110 412733Document38 pagesMaxworth Orchards India Limited Anr V T Mohan Ors 2022 Livelaw Mad 110 412733Kannaiah TedlaNo ratings yet

- Asian Agriculture v. Republic of Sri LankaDocument57 pagesAsian Agriculture v. Republic of Sri LankaDana MardelliNo ratings yet

- Important Instructions To ExamineesDocument8 pagesImportant Instructions To ExamineesAakashBhattNo ratings yet

- Makes I.T. Happen!Document15 pagesMakes I.T. Happen!Dannie Beltran BocNo ratings yet

- Nisce vs. Equitable PCI Bank, Inc.Document30 pagesNisce vs. Equitable PCI Bank, Inc.Lj Anne PacpacoNo ratings yet

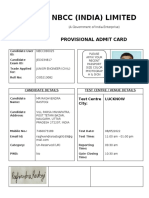

- NBCC (India) Limited: Provisional Admit CardDocument4 pagesNBCC (India) Limited: Provisional Admit CardRaghvendra RastogiNo ratings yet

- Redundancy 2Document7 pagesRedundancy 2reginaamondi133No ratings yet

- US v. Ah Sing, 36 Phil 978 (1917)Document6 pagesUS v. Ah Sing, 36 Phil 978 (1917)breylee guzmanNo ratings yet

- Mi NotesDocument69 pagesMi NotesShilpa VKNo ratings yet

- Vajiram & Ravi Subject: General Studies Token No: GS 36Document1 pageVajiram & Ravi Subject: General Studies Token No: GS 36Rahul YadavNo ratings yet

- Research Essay For Plain English in LegaDocument28 pagesResearch Essay For Plain English in Legaابو ريمNo ratings yet

- Great White Shark Enterprises, Inc. vs. Daniel Caralde (GR No. 192294, 21 November 2012)Document3 pagesGreat White Shark Enterprises, Inc. vs. Daniel Caralde (GR No. 192294, 21 November 2012)Archibald Jose Tiago ManansalaNo ratings yet