Professional Documents

Culture Documents

Audit Problems 3 - Special Topics Assets

Uploaded by

Locke KnoxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Problems 3 - Special Topics Assets

Uploaded by

Locke KnoxCopyright:

Available Formats

BALIUAG UNIVERSITY

APC 5: Auditing & Assurance: Specialized Industries

Module 1: Special Topics – Assets LVC

I. Accounting for Government Grants and Disclosure of Government Assistance (PAS 20)

1. Ali-Muong Inc. acquired a transferable 9-year taxi license by way of government grant on January 1, Year 1, when the

fair value of the license was P180,000. The license was given free of charge on the basis of Ali-Muong performance

and there are no future performance condition attached to the grant. How should the grant be accounted in Year 1?

A. Recognized P180,000 in the profit and loss

B. Recognized P20,000 as grant income in the profit or loss.

C. Recognized P180,000 gain from grants in other comprehensive income.

D. Recognized P20,000 as deferred grant income.

2. Refer to preceding problem. Assume that Ali-Muong is required to operate at least 10 taxis in the deprived

neighborhood of the city during the 9-year period. Failure to do so will result in the revocation of the license. How

should the grant be accounted in Year 1?

A. Recognized P180,000 in the profit and loss

B. Recognized P20,000 as grant income in the profit or loss.

C. Recognized P180,000 gain from grants in other comprehensive income.

D. Recognized P20,000 as deferred grant income.

3. Culany Company received a government grant of P1,800,000 on May 1, Year 1 in return for the reforestation of Mt.

Arayat until April 30, Year 4. The project would be implemented every year. A grant relating to income is reported

separately by Culany as 'other income'. How much would be the grant income to be recognized in the profit and loss

for year ended December 31, Year 1?

A. 450,000 B. 300,000 C. 600,000 D. 400,000

II. Borrowing Costs (PAS 23)

4. Cole Co. began constructing a building for its own use in January year 4. During year 4, Cole incurred interest of

P50,000 on specific construction debt, and P20,000 on other borrowings. Interest computed on the weighted-average

amount of accumulated expenditures for the building during year 4 was P40,000. What amount of interest cost

should Cole capitalize?

A. 20,000 B. 40,000 C. 50,000 D. 70,000

5. On April 1, Year 1, Bootleg Inc. obtained a one-year loan of P4 million specifically to finance the construction of its

new building. Borrowing costs for year 1 amounted to P300,000. Part of the proceeds of the loan was invested to earn

P40,000 interest The building as completed on December 31, Year 1. What would be the amount of borrowing cost

eligible for capitalization?

A. 260,000 B. 300,000 C. 340,000 D. none

6. On October 1, Year 1, Ali-Fu-Nga Corp. obtained a two-year, 12% loan of P6 million specifically to finance the

construction of its new building. The building was completed on November 30, Year 2. Pertinent details about the

construction and the loan are as follows:

Construction Costs Investment Income earned

Period

(excluding borrowing costs) from Loan Proceeds

Oct 1 to Dec 31, Year 1 P 2,000,000 P 10,000

Jan 1 to Nov 30, Year 2 5,000,000 40,000

What would be the total cost of the new building as of December 31, Year 2?

A. 7,720,000 B. 7,670,000 C. 7,790,000 D. 7,840,000

7. Refer to preceding problem. What would be the interest expense of Ali-Fu-Nga for Year 1 and Year 2, respectively?

A. 0 and 60,000 C. 540,000 and 60,000

B. 180,000 and 660,000 D. 720,000 and 0

III. Agriculture (PAS 41)

8. On December 31, Year 1, Kalabasa Inc. has harvested coffee beans costing P3,000,000 and with fair value less cost to

sell of P3,500,000 at the point harvest.

Because of long aging and maturation process after harvest, the harvested coffee beans were still on hand on

December 31, Year 2. On such date, the fair value less cost to sell is P3,900,000 and the net realizable value is

P3,200,000.

What is the measurement of the coffee beans inventory on December 31, Year 2?

A. 3,000,000 B. 3,500,000 C. 3,200,000 D. 3,900,000

9. The following information pertains to the biological asset and agricultural produced of Kamatis Company. The fair

value less cost to sell of the company’s vineyard was P25 million on June 30, Year 1. As of June 30, Year 2 Kamatis

Company determines the following:

Fair value of the grapes harvested at March 31, Year 2 P 5,000,000

Estimated point-of-sale costs of the grapes 100,000

Estimated point-of-sale costs of the vines 200,000

Fair value of the vines as of March 31, Year 2, prior to harvest 31,000,000

Module 12 Page 1 of 2

Module 12: Special Topics – Assets LVC

Kamatis Company determines that there is no change in fair value of the vines between March 31, Year 2 and June 30,

Year 2. What total amount of gain should Kamatis Company report in its June 30, Year 2 statement of comprehensive

income as a result the change in the fair value of the biological asset and agricultural produce?

A. 800,000 B. 1,000,000 C. 4,900,000 D. 5,700,000

10. Kalabaw Company is in business of deer farming. A herd of 100 deer is held throughout Year 1. The only change

during the year is the increase in their physical attributes due to ageing from two to three years. The relevant data are

as follows:

Fair value of a 2-year old deer at 1 January Year 1 P 3,000

Fair value of a 2-year old deer at 31 December Year 1 3,300

Fair value of a 3-year old deer at December 31 Year 1 4,800

How much is the increase in the fair value of the biological asset due to price change?

A. 30,000 B. 150,000 C. 180,000 D. 480,000

11. Refer to preceding problem. How much is the increase in the fair value of the biological asset due to physical change?

A. 30,000 B. 150,000 C. 180,000 D. 480,000

IV. Other Investments

12. In year 1, Chain, Inc. purchased a P1,000,000 life insurance policy on its president, of which Chain is the beneficiary.

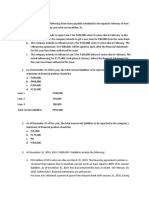

Information regarding the policy for the year ended December 31, year 4, follows: Cash surrender value, 1/1/Y4 P

87,000 Cash surrender value, 12/31/Y4 108,000 Annual advance premium paid 1/1/Y4 40,000 During year 4,

dividends of P6,000 were applied to increase the cash surrender value of the policy. What amount should Chain

report as life insurance expense for year 4?

A. 40,000 B. 25,000 C. 19,000 D. 13,000

13. On March 15, year 1, Ashe Corp. adopted a plan to accumulate P1,000,000 by September 1, year 5. Ashe plans to

make four equal annual deposits to a fund that will earn interest at 10% compounded annually. Ashe made the first

deposit on September 1, year 1. Future value and future amount factors are as follows:

Future value of P1 at 10% for 4 periods 1.46

Future amount of ordinary annuity of P1 at 10% for four periods 4.64

Future amount of annuity in advance of P1 at 10% for four periods 5.11

Ashe should make four annual deposits (rounded) of

A. 250,000 B. 215,500 C. 195,700 D. 146,000

14. The following information relates to noncurrent investments that Fall Corp. placed in trust as required by the

underwriter of its bonds: Bond sinking fund balance, 12/31/Y1 P450,000; Year 1 additional investment P90,000;

Dividends on investments P15,000; Interest revenue P30,000; Administration costs P5,000; and Carrying amount of

bonds payable P1,025,000 What amount should Fall report in its December 31, year 2 balance sheet related to its

noncurrent investment for bond sinking fund requirements?

A. 585,000 B. 580,000 C. 575,000 D. 540,000

“Never be lazy, but work hard and serve the Lord enthusiastically.” Romans 12:11

“Live as if you were to die tomorrow. Learn as if you were to live forever.” Mahatma Gandhi

Module 12 Page 2 of 2

You might also like

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Legend - Docx 1Document101 pagesLegend - Docx 1Juberlina CerbitoNo ratings yet

- Intermediate Accounting 1 Problems and SolutionDocument26 pagesIntermediate Accounting 1 Problems and SolutionRAFALLO, ABMYR ROSE R.No ratings yet

- 1912 Derivatives Investment Property and Other InvestmentDocument5 pages1912 Derivatives Investment Property and Other InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- CPA Review: Investment Property and Cash Surrender ValueDocument3 pagesCPA Review: Investment Property and Cash Surrender ValueAljur SalamedaNo ratings yet

- p1 Midterm 2012Document8 pagesp1 Midterm 2012marygraceomacNo ratings yet

- Accountancy exam reviewDocument4 pagesAccountancy exam reviewJERROLD EIRVIN PAYOPAYNo ratings yet

- UNIT 2 Discussion ProblemsDocument6 pagesUNIT 2 Discussion ProblemsCal PedreroNo ratings yet

- Paulita Company financial reporting questionsDocument7 pagesPaulita Company financial reporting questionsArvin John Masuela100% (1)

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- Acctg 100C 08Document2 pagesAcctg 100C 08Maddie ManganoNo ratings yet

- Use The Following Information To Answer Items 3 and 4Document15 pagesUse The Following Information To Answer Items 3 and 4charlies parrenoNo ratings yet

- Accounting ProblemsDocument7 pagesAccounting ProblemsMarisolNo ratings yet

- Final Exam Fin 2Document3 pagesFinal Exam Fin 2ma. veronica guisihanNo ratings yet

- Financial Accounting and Reporting Review Questions - Week 2Document15 pagesFinancial Accounting and Reporting Review Questions - Week 2Fery AnnNo ratings yet

- SME'sDocument7 pagesSME'sJiezelEstebeNo ratings yet

- INTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFDocument2 pagesINTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFUnnamed homosapienNo ratings yet

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Document34 pages#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- MCQ practice test on accounting conceptsDocument12 pagesMCQ practice test on accounting conceptsGuinevereNo ratings yet

- Fin AcctgDocument9 pagesFin AcctgCarl Angelo0% (1)

- 1911 Investments Investment in Associate and Bond InvestmentDocument13 pages1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- FAR 1 Reviewer AnswerDocument27 pagesFAR 1 Reviewer AnswerZace Hayo100% (1)

- FAR 1 Reviewer AnswerDocument27 pagesFAR 1 Reviewer AnswerMary Joy CabilNo ratings yet

- ACP Task 3 (20230328164424)Document2 pagesACP Task 3 (20230328164424)Roque LestieNo ratings yet

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- 1stpreboard Oct 2013-2014Document19 pages1stpreboard Oct 2013-2014Michael BongalontaNo ratings yet

- Pas 40-41 & Pfrs 1 QuizDocument3 pagesPas 40-41 & Pfrs 1 QuizWendy Cagape0% (1)

- PPL Cup AverageDocument7 pagesPPL Cup AverageRukia KuchikiNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Financial Quali - ADocument9 pagesFinancial Quali - ACarl AngeloNo ratings yet

- Government Grant and Borrowing CostDocument2 pagesGovernment Grant and Borrowing CostMaximusNo ratings yet

- Second PreboardDocument6 pagesSecond PreboardBella AyabNo ratings yet

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocument11 pages5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNo ratings yet

- FINAL For Students Premium and Warranry Liability and LiabilitiesDocument8 pagesFINAL For Students Premium and Warranry Liability and LiabilitiesHardly Dare GonzalesNo ratings yet

- AFAR PracDocument13 pagesAFAR PracTeofel John Alvizo PantaleonNo ratings yet

- USJR FAR Quizbowl BlankDocument8 pagesUSJR FAR Quizbowl BlankSarah BalisacanNo ratings yet

- ICPA - FAR Multiple ChoiceDocument25 pagesICPA - FAR Multiple ChoiceCheska LeeNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- FarDocument64 pagesFarBrevin PerezNo ratings yet

- Midterm Exam 1Document14 pagesMidterm Exam 1Erisa MeloraNo ratings yet

- Quiz Audit of LiabilitiesDocument3 pagesQuiz Audit of LiabilitiesCattleyaNo ratings yet

- 2011 NATIONAL CPA MOCK BOARD EXAMINATIONDocument7 pages2011 NATIONAL CPA MOCK BOARD EXAMINATIONkonyatanNo ratings yet

- IA2Document12 pagesIA2John FloresNo ratings yet

- ADVANCED FINANCIAL ACCOUNTING AND REPORTING MULTIPLE CHOICEDocument6 pagesADVANCED FINANCIAL ACCOUNTING AND REPORTING MULTIPLE CHOICEYeji BabeNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- 2022 Accele4 M5 AssignmentDocument6 pages2022 Accele4 M5 AssignmentPYM MataasnakahoyNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- Abc 6Document4 pagesAbc 6Kath LeynesNo ratings yet

- Quiz AppliedDocument12 pagesQuiz AppliedLharissa Ballesteros100% (1)

- Finals Answer KeyDocument11 pagesFinals Answer Keymarx marolinaNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- Investment Property and Other InvestmentsDocument4 pagesInvestment Property and Other InvestmentsMiguel MartinezNo ratings yet

- Quiz 1Document2 pagesQuiz 1mkrisnaharq99No ratings yet

- Exotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsFrom EverandExotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsNo ratings yet

- Module 3 - Special Topics - AssetsDocument7 pagesModule 3 - Special Topics - AssetsLocke KnoxNo ratings yet

- Module 3 Additional NotesDocument1 pageModule 3 Additional NotesLocke KnoxNo ratings yet

- Module 3 - Special Topics - Assets (2) - MergedDocument10 pagesModule 3 - Special Topics - Assets (2) - MergedLocke KnoxNo ratings yet

- Module 4 - Special Topics - LiabilitiesDocument13 pagesModule 4 - Special Topics - LiabilitiesLocke KnoxNo ratings yet

- MODULE 2 PFRS 5 Asset Held For Sale and Discontinued OperationDocument10 pagesMODULE 2 PFRS 5 Asset Held For Sale and Discontinued OperationLocke KnoxNo ratings yet

- 1 s2.0 S2352340920315791 MainDocument6 pages1 s2.0 S2352340920315791 MainLocke KnoxNo ratings yet

- Derivative Loan - Gold Loan Strategy To Counter RiskDocument2 pagesDerivative Loan - Gold Loan Strategy To Counter RiskRaghu.GNo ratings yet

- Importer Wins Insurance Claim for Spilled Lactose CrystalsDocument1 pageImporter Wins Insurance Claim for Spilled Lactose CrystalsSopongco ColeenNo ratings yet

- International Student Insurance Coverage Certification Form 0 0Document1 pageInternational Student Insurance Coverage Certification Form 0 0Chew BachaNo ratings yet

- Accounting Cycle of A Service BusinessDocument8 pagesAccounting Cycle of A Service BusinessNiziU MaraNo ratings yet

- Financial Risk Management Instruments for Renewable Energy Projects in Developing CountriesDocument118 pagesFinancial Risk Management Instruments for Renewable Energy Projects in Developing CountriessyoussefNo ratings yet

- Direct Nickel Test Plant Program 2013 in ReviewDocument40 pagesDirect Nickel Test Plant Program 2013 in ReviewklshfyusbdfkNo ratings yet

- Comparison Study Between Sunfeast and Britannia Biscuits: Scope of The StudyDocument36 pagesComparison Study Between Sunfeast and Britannia Biscuits: Scope of The StudygoudarameshvNo ratings yet

- Unit 1 IMC Study TextDocument336 pagesUnit 1 IMC Study TextChirag Sinai100% (4)

- Whole life insurance explainedDocument15 pagesWhole life insurance explainedEmir AdemovicNo ratings yet

- Getting Started: Public Finance Manual SolutionsDocument92 pagesGetting Started: Public Finance Manual SolutionsChan ZacharyNo ratings yet

- Enjoy growth while protecting your investmentsDocument18 pagesEnjoy growth while protecting your investmentsPrakash SainiNo ratings yet

- A Review of Literature On Life Insurance in IndiaDocument13 pagesA Review of Literature On Life Insurance in Indiavenkat7tallyNo ratings yet

- SSS Vs MoonwalkDocument2 pagesSSS Vs MoonwalkJessa LoNo ratings yet

- PolicyDocument17 pagesPolicyowen100% (1)

- Banking Financial Institutions.Document18 pagesBanking Financial Institutions.Jhonrey BragaisNo ratings yet

- China Social InsuranceDocument6 pagesChina Social InsuranceHenrik WallmarkNo ratings yet

- Pro Health Billing Setup GuideDocument22 pagesPro Health Billing Setup Guideapi-248512169100% (1)

- Digitally Signed Motor Insurance CertificateDocument3 pagesDigitally Signed Motor Insurance CertificateAnshul SaravgiNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Stock Market Workshop PDFDocument3 pagesStock Market Workshop PDFLokesh Basappa50% (2)

- Brochure Young Star Insurance PolicyDocument15 pagesBrochure Young Star Insurance PolicyAbhishek ANo ratings yet

- FM 03 Financial IntermediationDocument8 pagesFM 03 Financial IntermediationIvy ObligadoNo ratings yet

- Tax Declaration Guide 2022-23Document15 pagesTax Declaration Guide 2022-23shasvinaNo ratings yet

- BDA 2021 End of Year Report FinalDocument20 pagesBDA 2021 End of Year Report FinalBernewsAdminNo ratings yet

- The Payment of Gratuity Act 1972Document13 pagesThe Payment of Gratuity Act 1972Dev Thakkar100% (2)

- Phil. Home Assurance Corp vs. CADocument1 pagePhil. Home Assurance Corp vs. CACaroline A. LegaspinoNo ratings yet

- NICA Class-Action LawsuitDocument18 pagesNICA Class-Action LawsuitCasey FrankNo ratings yet

- 2014-15 PFS WorkbookDocument24 pages2014-15 PFS Workbookmakarina1No ratings yet

- Rejda rmiGE ppt03 PDFDocument33 pagesRejda rmiGE ppt03 PDFHala MfarrijNo ratings yet

- CP Word - Mitali-2 (1)Document91 pagesCP Word - Mitali-2 (1)Dixitaba DodiyaNo ratings yet