Professional Documents

Culture Documents

Chapter 7 Chapter Review Questions

Uploaded by

Như NguyễnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7 Chapter Review Questions

Uploaded by

Như NguyễnCopyright:

Available Formats

CHAPTER 7: REPORTING AND

ANALYZING INVENTORY

Q7-1. When company A purchases inventory from company B, the buyer and seller

must agree on which firm is responsible for the transportation costs. The

terminology “freight on board shipping point” or FOB is used to indicate the

buyer assumes responsibility for the transportation cost once notice of delivery

to the shipper is received. In addition, the buyer assumes responsibility for any

delay or damage during transit.

When goods are shipped FOB, the seller normally can recognize revenue

unless the seller has not fulfilled all requirements of the purchase agreement.

An example is when an equipment installation and/or up-and-running properly

is part of that agreement.

Q7-2. If stable purchase prices prevail, the dollar amount of inventories (beginning or

ending) tends to be approximately the same under different inventory costing

methods and the choice of method does not materially affect net income. To see

this, remember that FIFO profits include holding gains on inventories. If the

inflation rate is low (or inventories turn quickly), there will be less holding

(inflationary) profit in inventory.

Q7-3. FIFO holding gains occur when the costs of earlier inventory acquisitions are

matched against current selling prices. Holding gains on inventories increase with

an increase in the inflation rate and a decrease in the inventory turnover rate.

Conversely, if the inflation rate is low or inventories turn quickly, there will be less

holding (inflationary) profit in inventory.

Q7-4. (a) Last-in, first-out, (b) Last-in, first-out, (c) First-in, first-out, (d) First-in, first-out,

(e) Last-in, first-out.

Q7-5. A significant tax benefit results from using LIFO when costs are consistently

rising. LIFO results in lower pretax income and, therefore, lower taxes payable,

than other inventory costing methods.

Q7-6. Kaiser Aluminum Corporation is using the lower of cost or market (LCM) rule.

When the replacement cost for inventory falls below its (FIFO or LIFO)

historical cost, the inventory must be written down to the lower replacement

costs (market value).

Q7-7. The various inventory costing methods would produce the same results (inventory

values and cost of goods sold) if prices were stable. The inventory costing

methods produce differing results when prices are changing.

Q7-8. Inventory “shrink” refers to the loss of inventory due to theft, spoilage, damage,

etc. Shrink costs are part of cost of goods sold but do not represent goods that

were actually sold.

©Cambridge Business Publishers, 2017

Solutions Manual, Chapter 7 7-1

CHAPTER 7: REPORTING AND

ANALYZING INVENTORY

Q7-9. The “LIFO reserve” is the difference between the cost of inventory determined

using the last-in, first-out (LIFO) method and the cost determined using another

method (either FIFO or average cost). Companies that report inventory cost

using the LIFO method must also report the LIFO reserve. This allows the

financial statement reader to convert from LIFO to another method for comparison

purposes.

The LIFO reserve represents the difference between the historical, LIFO cost of

inventory and its current cost. This disparity between the book value and the

current value represents a gain from holding the inventory that has not yet been

recognized in income or in equity ̶ an unrealized holding gain.

Q7-10. Because LIFO assigns the last units purchased during the year to cost of goods

sold (COGS), changing prices can make it difficult to forecast earnings.

Companies have discretion as to when and how much inventory they purchase

during an accounting period. LIFO is always applied on a periodic, annual basis,

so a purchase made during the final days of the year will end up in COGS and

affect current earnings. However, if that purchase is delayed until the first week of

the next year, it could be several years before those units are transferred to

COGS. Unlike other inventory methods, LIFO requires that the quantity and price

of inventory purchases be predicted to make accurate earnings forecasts.

Q7-11A. LIFO liquidation is involuntary when it is caused by events that are beyond

management’s control. Examples of such events include labor strikes, natural

disasters, or wars which could interrupt the delivery of inventory by suppliers or

shut down production facilities.

Q7-12A. In periods of rising prices, LIFO liquidation results in older, lower-cost goods being

expensed as cost of goods sold, yielding higher profits. This may be the result of

a management decision to reduce inventory levels for efficiency purposes.

However, it may also be an earnings management tactic. Management may be

trying to avoid violating bond covenants, or it may be trying to manipulate

management compensation. In any case, this practice is costly, in that the

additional profits lead to higher income taxes.

©Cambridge Business Publishers, 2017

7-2 Financial Accounting, 5th Edition

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Fa4e SM Ch07Document25 pagesFa4e SM Ch07michaelkwok1No ratings yet

- IFA1ESMHDocument52 pagesIFA1ESMHAditya Rvp ShahNo ratings yet

- Cfa Prepare Part 2Document55 pagesCfa Prepare Part 2Роберт МкртчянNo ratings yet

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Document32 pagesChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNo ratings yet

- 221 Chapter 6Document25 pages221 Chapter 6Shane HundleyNo ratings yet

- Dmp3e Ch07 Solutions 01.28.10 FinalDocument26 pagesDmp3e Ch07 Solutions 01.28.10 Finalmichaelkwok1No ratings yet

- CH 07 SMDocument34 pagesCH 07 SMChris Tian FlorendoNo ratings yet

- Fundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions ManualDocument38 pagesFundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions Manualjeanbarnettxv9v100% (18)

- Solutions - Chapter 7Document18 pagesSolutions - Chapter 7Dre ThathipNo ratings yet

- 08 Inventory Cost MeasurementDocument34 pages08 Inventory Cost MeasurementLeonilaEnriquezNo ratings yet

- Reporting and Interpreting Cost of Goods Sold and Inventory: Answers To QuestionsDocument61 pagesReporting and Interpreting Cost of Goods Sold and Inventory: Answers To Questionschanyoung4951No ratings yet

- CH 09Document32 pagesCH 09errahahahaNo ratings yet

- Open BookDocument3 pagesOpen Bookbablubadmash78No ratings yet

- Intermediate Accounting Chapter 9 SolutionsDocument40 pagesIntermediate Accounting Chapter 9 SolutionsNatazia Ibañez80% (5)

- Spiceland SM 7ech09 PDFDocument72 pagesSpiceland SM 7ech09 PDFmas aziz100% (2)

- Managerial Accounting 2Nd Edition Hilton Solutions Manual Full Chapter PDFDocument67 pagesManagerial Accounting 2Nd Edition Hilton Solutions Manual Full Chapter PDFjezebeldouglasz3n100% (11)

- Advantages and Disadvantages of FIFO The FIFO Method Has Four Major Advantages: (1) ItDocument3 pagesAdvantages and Disadvantages of FIFO The FIFO Method Has Four Major Advantages: (1) ItveronikaNo ratings yet

- Inventory Valuation MethodsDocument1 pageInventory Valuation MethodsAwang NoviariNo ratings yet

- Any Legal Costs of Filing A Successful Patent Are Viewed As Being An Intangible Asset and Are CapitalizedDocument2 pagesAny Legal Costs of Filing A Successful Patent Are Viewed As Being An Intangible Asset and Are CapitalizedMaadyNo ratings yet

- Corporate Financial Reporting: (Post-Mid Assignment 1)Document3 pagesCorporate Financial Reporting: (Post-Mid Assignment 1)tehniatNo ratings yet

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisDocument41 pagesAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsieNo ratings yet

- Inventories Time Stamped & Los StampedDocument30 pagesInventories Time Stamped & Los StampedRajnish RajNo ratings yet

- Valuation of Inventories: A Cost-Basis ApproachDocument36 pagesValuation of Inventories: A Cost-Basis ApproachjulsNo ratings yet

- Effects of Choosing Different Inventory MethodsDocument4 pagesEffects of Choosing Different Inventory MethodsgregNo ratings yet

- Comparison 7.5 ĐiểmDocument23 pagesComparison 7.5 Điểmtuân okNo ratings yet

- Libby 4ce Solutions Manual - Ch08Document66 pagesLibby 4ce Solutions Manual - Ch087595522No ratings yet

- 8 (A) - Master BudgetDocument4 pages8 (A) - Master Budgetshan_1299No ratings yet

- Acca AfmDocument41 pagesAcca AfmGowri Shankari100% (1)

- Kap 1 6th Workbook Te CH 7Document96 pagesKap 1 6th Workbook Te CH 7Gurpreet KaurNo ratings yet

- Final Revesion 2016 Essay Q & A CMA Part 1 by ArabwebsoftDocument48 pagesFinal Revesion 2016 Essay Q & A CMA Part 1 by ArabwebsoftAslam SiddiqNo ratings yet

- Transcript For Lecture Video 1Document5 pagesTranscript For Lecture Video 1StaygoldNo ratings yet

- Cost & Management AccountingDocument9 pagesCost & Management AccountingshubhmNo ratings yet

- Financial Accounting 8Th Edition Libby Solutions Manual Full Chapter PDFDocument77 pagesFinancial Accounting 8Th Edition Libby Solutions Manual Full Chapter PDFDawnZimmermanxwcq100% (11)

- Inventories (Peserta)Document21 pagesInventories (Peserta)bush0275No ratings yet

- SM Chapter 13Document52 pagesSM Chapter 13ginish120% (1)

- 2100 Solutions - CH6Document77 pages2100 Solutions - CH6Md Delowar Hossain MithuNo ratings yet

- What Steps Might The Companies Take To Avoid Such A Serious Disruption Caused by Just-in-Time in Future?Document3 pagesWhat Steps Might The Companies Take To Avoid Such A Serious Disruption Caused by Just-in-Time in Future?shrutNo ratings yet

- Chapter 5 Chapter Review QuestionsDocument3 pagesChapter 5 Chapter Review QuestionsTAE'S POTATONo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument30 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont Collegethanhtra023No ratings yet

- Costing and Profit PlanningDocument27 pagesCosting and Profit PlanningSIDDHANT CHUGHNo ratings yet

- FSA-Tutorial 4 Analyzing Investing Activities Part 1Document9 pagesFSA-Tutorial 4 Analyzing Investing Activities Part 11 KohNo ratings yet

- Inventories - Lower of Cost and NRVDocument12 pagesInventories - Lower of Cost and NRVmarkNo ratings yet

- ACC101 Ch. 13Document60 pagesACC101 Ch. 13hira_naz86No ratings yet

- Adjusted NAV Method of Company ValuationDocument5 pagesAdjusted NAV Method of Company ValuationOladeleIfeoluwaOlayodeNo ratings yet

- CH 8Document19 pagesCH 8Isra' I. SweilehNo ratings yet

- InventoriesDocument10 pagesInventoriesJames BarzoNo ratings yet

- Long Lived Assets L1Document37 pagesLong Lived Assets L1heisenbergNo ratings yet

- Variable CostingDocument47 pagesVariable Costing21-51749No ratings yet

- Financial Statement AnalysisDocument33 pagesFinancial Statement AnalysisAlessandra ZannellaNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- SM Chapter 13Document52 pagesSM Chapter 13Fedro Susantana0% (1)

- Spiceland 9e CH 09 SM Solutions ManualDocument83 pagesSpiceland 9e CH 09 SM Solutions ManualStephen Andrei VillanuevaNo ratings yet

- Spiceland 9e CH 09 SM Solutions ManualDocument83 pagesSpiceland 9e CH 09 SM Solutions ManualStephen Andrei VillanuevaNo ratings yet

- Marginal Costing Vs Absorption CostingDocument3 pagesMarginal Costing Vs Absorption CostingAntrickscoolNo ratings yet

- Chapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document133 pagesChapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- CVP Analysis & Decision MakingDocument67 pagesCVP Analysis & Decision MakingcmukherjeeNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAreeb Baqai100% (1)

- ReceiptDocument3 pagesReceiptAhsan KhanNo ratings yet

- ATC List 2017 Updated 5517Document47 pagesATC List 2017 Updated 5517Varinder AnandNo ratings yet

- Mary Kay Inventory - NSD Diana SumpterDocument6 pagesMary Kay Inventory - NSD Diana SumpterMaryKayVictims0% (1)

- ProfitMart DEMATDocument24 pagesProfitMart DEMATProfit CircleNo ratings yet

- MCQ - LiabilitiesDocument4 pagesMCQ - LiabilitiesEshaNo ratings yet

- Management Hierarchy: Askari Bank LimitedDocument14 pagesManagement Hierarchy: Askari Bank LimitedEeshaa MalikNo ratings yet

- CAPE 2003 AccountingDocument13 pagesCAPE 2003 AccountingStephen WhiteKnight BuchananNo ratings yet

- PT Zalia Cash Receipts JournalDocument8 pagesPT Zalia Cash Receipts Journalsovia deviNo ratings yet

- EMBA ResumeBookDocument221 pagesEMBA ResumeBooknikunjhandaNo ratings yet

- 04 QuestionsDocument7 pages04 QuestionsfaizthemeNo ratings yet

- Projected Income Statement For 12 MonthsDocument5 pagesProjected Income Statement For 12 Monthsblueviolet21No ratings yet

- AFM Assignment 3Document6 pagesAFM Assignment 3Zuhair NasirNo ratings yet

- p.21 Case 1-1 Ribbons An' Bows, IncDocument3 pagesp.21 Case 1-1 Ribbons An' Bows, Incrajo_onglao50% (2)

- General Journal Date Account Titles / ExplanationDocument22 pagesGeneral Journal Date Account Titles / ExplanationPauline Bianca70% (10)

- Pag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountDocument11 pagesPag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountChristian D. OrbeNo ratings yet

- Summer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Document35 pagesSummer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Sanskar YadavNo ratings yet

- The Philip Fisher Screen That Fishes Quality StocksDocument3 pagesThe Philip Fisher Screen That Fishes Quality StocksMartinNo ratings yet

- Break Even Point, Forecasting, and DecisionDocument23 pagesBreak Even Point, Forecasting, and DecisionidnodNo ratings yet

- Auditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHDocument27 pagesAuditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHWinnie ToribioNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- Acctg Equity Practice QuizDocument16 pagesAcctg Equity Practice QuizJyNo ratings yet

- Ala in Finacct 3Document4 pagesAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Document36 pagesSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadNo ratings yet

- Startups - Financial PrudenceDocument12 pagesStartups - Financial PrudenceNeelajit ChandraNo ratings yet

- ADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsDocument6 pagesADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsFahad33% (3)

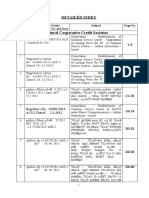

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoDocument10 pagesDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookNo ratings yet

- Property Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693Document8 pagesProperty Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693fido1983No ratings yet

- Infra Finance Role Campus JDDocument3 pagesInfra Finance Role Campus JDJohn DoeNo ratings yet

- Personal Financial Planning and Manage EntDocument19 pagesPersonal Financial Planning and Manage EntJoseNo ratings yet

- Capital Budgeting MasDocument6 pagesCapital Budgeting MasHainiel ReforzadoNo ratings yet