Professional Documents

Culture Documents

Custom - CHAPTER 2 ANSWER

Uploaded by

Bhanu DangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Custom - CHAPTER 2 ANSWER

Uploaded by

Bhanu DangCopyright:

Available Formats

CUSTOME DUTY CS PROFESSIONAL – JUNE / DEC – 22 TEST PAPER

TEST 2 - CUSTOMS TARRIFE ACT 1975

Note: - Each Question Carries 5 Marks

Que. 1

Briefly explain the provisions of rule 2(a) of Rules of interpretation of the First Schedule to the

Customs Tariff Act, 1975 on classification of incomplete / unfinished articles.

Ans.

The provisions of rule 2(a) of Rules of Interpretation of the First Schedule to the Customs Tariff Act,

1975 on classification of incomplete / unfinished articles are as under:

If any particular heading refers to a finished/complete article, the incomplete/unfinished form of that

article shall also be classified under the same heading provided the incomplete/unfinished goods have

the essential characteristics of the finished goods.

Reference to an article will also include the article complete or finished [or failing to be classified as

complete or finished] presented un-assembled or dis-assembled.

Que. 2

When shall the safeguard measures under section 8B of the Customs Tariff Act, 1975 be not

applied? Discuss briefly.

Ans.

The safeguard measures under section 8B of the Customs Tariff Act, 1975 is not applied on the import

of the following types of articles :

(i) Articles originating from a developing country, so long as the share of imports of that article from

that country does not exceed 3% of the total imports of that article into India;

(ii) Articles originating from more than one developing countries, so long as the aggregate of imports

from developing countries each with less than 3% import share taken together does not exceed 9%

of the total imports of that article into India;

Articles imported by a 100% EOU or units in a Special Economic Zone unless the duty is specifically

made applicable in such notification or to such undertaking or unit.

Que. 3

Differentiate between protective duty and safeguard dutymeasures

Ans.

1) Protective Duty- Protective duties are intended to give protection to indigenous industries. If resort

to protective duties is not made there could be a glut of cheap imported articles in the market

making the indigenous goods unattractive.

Section 7 of the Customs Tariff Act provides as follows:

(a) The protective duty shall be effective only upto and inclusive of the date if ony, specified in the

First Schedule.

(b) The Central Government may reduce or increase the duty by notification in the Official Gazette.

CMA VIPUL SHAH www.vipulshah.org 75591 73787 2.1

CUSTOME DUTY CS PROFESSIONAL – JUNE / DEC – 22 TEST PAPER

(c) if there is any increase in the duty as specified above, then the Central Government is required

to place such notification in the Parliament for its approval. If the Parliament recommends any

change in the notification, then the notification shall have effect subject to such changes.

2) Safeguard measures- If the Central Government, after conducting such enquiry as it deems fit, is

satisfied that any article is imported into India in such increased quantities and under such

conditions so as to cause or threatening to cause serious injury to domestic industry, then, it may,

by notification in the Official Gazette, apply such a safeguard measures on that article, as it deems

appropriate.

In this case government can levy the SAFEGUARD MEASURES under section 8B of customs act,

1962, to reduce the increased quantity of import of GOODS

Que. 4

Determine the customs duty payable under the Customs Tariff Act, 1975 including the safeguard

duty of 25% under section 8B of the said Act with the following information made available by

the importer: (CA Final Jul 21 Exam)

Assessable value of fibre granules imported from three developing countries during ₹

July 2020 25,00,000

Share of imports of fibre granules from three developing countries taken together 10%

against total imports of fibre granules to India

Rate of basic customs duty 10%

Rate of integrated tax 12%

Rate of social welfare surcharge 10%

Ans.

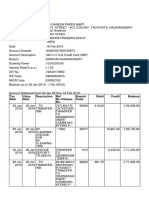

Computation of customs duty payable including the safeguard duty payable thereon

Particular ₹

Assessable value of fibre granules imported 25,00,000

Add: Basic custom duty @ 10% (₹25,00,000 x 10%) 2,50,000

Safeguard duty @ 25% on ₹ 25,00,000 6,25,000

[Safeguard duty is imposible in the given case since share of imports of fibre granules

from the three developing countries taken together exceeds 9% of the total import of

fibre granules into India.]

Social welfare surcharge @ 10% of ₹ 2,50,000 25,000

Total 34,00,000

Integrated tax (₹ 34,00,000 x 12%) 4,08,000

[value for calculation of integrated tax shall also include safeguard duty amount]

Total customs duty payable 13,08,000

₹ (2,50,000 + 6,25,000 + 25,000 + 4,08,000)

Que. 5

CMA VIPUL SHAH www.vipulshah.org 75591 73787 2.2

CUSTOME DUTY CS PROFESSIONAL – JUNE / DEC – 22 TEST PAPER

PCB Limited has imported printed circuit boards for sale in India from Country X, which are liable

for anti-dumping duty. You are provided with the following details.

(i) Country X does not sell these goods in its domestic market. However, it exports the same

printed circuit boards at USD 200 per piece to another third country.

(ii) The printed circuit board is sold in domestic industry @ USD 175 per piece.

(iii) PCB Limited has imported the printed circuit boards at USD 100 per piece.

(iv) Landed value of the printed circuit boards is USD 125 per piece. Compute the anti-dumping

duty payable by PCB Limited for 1,000 pieces of printed circuit boards it has imported during

the year assuming conversion rate @75 per USD. [CA final Nov 2020 Exam New] duty is:

Ans.

The quantum of anti-dumping duty is:

(i) margin of dumping or

(ii) injury margin, whichever is lower. Margin of dumping is the difference between export price and

normal value of the imported article and injury margin is the difference between the fair selling

price [non-injurious price (NIP)] due to the domestic industry and the landed value of the dumped

imports.

In the given case, anti-dumping duty per piece is:

(i) Margin of dumping is USD 100 [USD 200 - USD 100] or

(ii) Injury margin is USD 50 [USD 175 - USD 125]

whichever is lower i.e. USD 50

Anti-dumping duty for 1,000 pieces (in rupees) = USD 50 x 1,000 pieces x * 75 = 37,50,000

Que. 6

What will be the dates of commencement of the definitive anti-dumping duty in the following

cases under section 9A of the Customs Tariff Act, 1975 and the rules made thereunder?

(i) Where no provisional duty is imposed;

(ii) Where provisional duty is imposed;

(iii) Where anti-dumping duty is imposed retrospectively from a date prior to the date of

imposition of provisional duty. (Exam Question, Nov 2006)

Ans.

The Central Government has power to levy anti-dumping duty on dumped articles in accordance with

the provisions of section 9A of the Customs Tariff Act, 1975 and the rules framed thereunder.

(i) In a case where no provisional duty is imposed, the date of commencement of anti-dumping duty will

be the date of publication of notification, imposing anti dumping duty under section 9A(1), in the

Official Gazette.

(ii) In a case where provisional duty is imposed under section 9A(2), the date of commencement of anti-

dumping duty will be the date of publication of notification, imposing provisional duty under section

9A (2), in the Official Gazette.

(iii) In a case where anti-dumping duty is imposed retrospectively under section 9A(3) from a date prior

to the date of imposition of provisional duty, the date of commencement of anti-dumping duty will

CMA VIPUL SHAH www.vipulshah.org 75591 73787 2.3

CUSTOME DUTY CS PROFESSIONAL – JUNE / DEC – 22 TEST PAPER

be such prior date as may be notified in the notification imposing anti-dumping duty retrospectively,

but not beyond days from the date of such notification of provisional duty.

Que. 7

Determine the customs duty payable under the Customs Tariff Act, 1975 including the safeguard

duty of 30% under section 8B of the said Act with the following details available on hand: (May

16) [ICAI Material]

Import of Sodium Nitrite from a developing country from 26th February, 2014 to ₹ 30,00,000

25th February, 2015 (both days inclusive)

Share of imports of Sodium Nitrite from the developing country against total imports 4%

of Sodium Nitrite to India

Basic custom duty 10%

Additional customs duty under section 3(7) of the Customs Tariff Act, 1975. 12%

Additional customs duty under section 3(9) of the Customs Tariff Act, 1975 Nil

SWS@ 10%

Ans.

Computation of customs duty payable thereon

Particular ₹

Assessable value of sodium nitrite imported" 30,00,000

Add: Basic custom duty @ 10% ( 30,00,000 x 10%) 3,00,000

SWS @ 10% 30,000

Safeguard duty @ 30% on 30,00,000 [Safeguard duty is imposable in the given case 9,00,000

since share of imports of sodium nitrite from the developing country is more than 3%

of the total imports of sodium nitrite into India (Proviso to section 8B (1) of the Customs

Tariff Act, 1975)]

Total 42,30,000

Additional duty leviable under section 3(S) of Customs Tariff Act (42,30,000 × 12%) 5,07,600

Total customs duty payable (3,00,000+ 30,000+ 9,00,000 +5,07,600) 17,37,600

Note:-If any article is imported into India in such increased quantities, and under such conditions so

as to cause or threatening to cause serious injury to domestic industry, then CG may, by notification in

Official Gazette, apply such a safeguard measures on that article, as it deems appropriate. The

safeguard measures shall include - imposition of Safeguard duty, ii) Application of Tariff rate quota,

iii) other appropriate measures

Que. 8

CMA VIPUL SHAH www.vipulshah.org 75591 73787 2.4

CUSTOME DUTY CS PROFESSIONAL – JUNE / DEC – 22 TEST PAPER

Determine the total duties (duty, tax and cess) payable under Customs Act if Mr. Rao imported

rubber from Malaysia at landed price of 25 lakh. It has been notified by the Central Government

that share of imports of rubber from the developing country against total imports to India exceeds

5%. Safeguard duty notified on this product is 30%, rate of integrated tax u/s 3(7) is 12% and

rate of basic customs duty is 10%. (CA Final May 19 New) [ICAI Material]

Ans.

S.No. Particular ₹

1 Landed price 25,00,000

2 Add: Basic customs duty @ 10% 2,50,000

3 Add: Safeguard duty @ 30% on 25,00,000 7,50,000

4 Add: Social welfare surcharge (SWS) @ 10% on 2,50,000 [While calculating 25,000

SWS, safeguard duty is excluded]

5 Add: Integrated tax 4,23,000

12% of 35,25,000 ( 25,00,000+ 2,50,000+ 7,50,000+25,000) [Integrated tax

is levied on the sum total of the assessable value of the imported goods,

customs duties and applicable SWS]

6 Total customs duties and tax payable 14,48,000

[2,50,000+ 7,50,000+ 25,000+ 4,23,000]

Note:-If any article is imported into India in such increased quantities, and under such conditions so

as to cause or threatening to cause serious injury to domestic industry, then CG may, by notification in

Official Gazette, apply such a safeguard measures on that article, as it deems appropriate. The

safeguard measures shall include - imposition of- i) Safeguard duty, ii) Application of Tariff rate quota,

iii) other appropriate measures.

CMA VIPUL SHAH www.vipulshah.org 75591 73787 2.5

You might also like

- Unit 2 Types of Customs DutyDocument3 pagesUnit 2 Types of Customs DutyAnant KhandelwalNo ratings yet

- ITX AssignmentDocument4 pagesITX AssignmentDaniel_Solomon_9624No ratings yet

- Compendium of Law&Regulations For-MailDocument281 pagesCompendium of Law&Regulations For-MailAmbuj SakiNo ratings yet

- Classification & Types of Customs DutiesDocument31 pagesClassification & Types of Customs Dutieskg704939No ratings yet

- Customs TMP 1Document28 pagesCustoms TMP 1ankit1007No ratings yet

- 21833vol3cstms cp11Document6 pages21833vol3cstms cp11timirkantaNo ratings yet

- Types of Duty PDFDocument27 pagesTypes of Duty PDFfirastiNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- Customs DutyDocument8 pagesCustoms DutyBhavana GadagNo ratings yet

- Chapter 03Document39 pagesChapter 03Ram SskNo ratings yet

- Types of Custom DutyDocument3 pagesTypes of Custom DutyKarina ManafNo ratings yet

- Various Schemes Like EOUDocument14 pagesVarious Schemes Like EOUranger_passionNo ratings yet

- Types of Custom DutiesDocument25 pagesTypes of Custom DutiesAkshay KumarNo ratings yet

- Customs Duty & GSTDocument23 pagesCustoms Duty & GSTkakki1088No ratings yet

- 05 Composition SchemeDocument52 pages05 Composition SchemeKANCHIVIVEKGUPTANo ratings yet

- Exemption From Customs DutyDocument4 pagesExemption From Customs DutyRavikumar PaNo ratings yet

- Icai CustomsDocument130 pagesIcai CustomsP LAVANYANo ratings yet

- Customs ActDocument7 pagesCustoms ActVarun VarierNo ratings yet

- Levy of Exemptions From Customs Duty: HapterDocument8 pagesLevy of Exemptions From Customs Duty: HaptertimirkantaNo ratings yet

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375No ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument13 pagesIntermediate Examination: Suggested Answers To Questionsnarendra225No ratings yet

- Unit 1-2-3-4-5 Custom DutyDocument27 pagesUnit 1-2-3-4-5 Custom DutyVishesh SharmaNo ratings yet

- Duty DrawbackDocument4 pagesDuty DrawbackShaji KuttyNo ratings yet

- Paper 11 - Indirect Taxation - Syl2012Document43 pagesPaper 11 - Indirect Taxation - Syl2012sumit4up6rNo ratings yet

- 10 Duty DrawbackDocument11 pages10 Duty DrawbacksrinivasNo ratings yet

- Customs ActDocument24 pagesCustoms ActSoujanya NagarajaNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- The Customs Tariff Act, 1975: EctionsDocument1,116 pagesThe Customs Tariff Act, 1975: EctionsAndrea RobinsonNo ratings yet

- Special Additional Duty SchemeDocument28 pagesSpecial Additional Duty SchemeDakshata SawantNo ratings yet

- Customs DutyDocument8 pagesCustoms DutyRanvids100% (1)

- Suggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate Examinationseenu pNo ratings yet

- Basics of Customs DutyDocument7 pagesBasics of Customs DutyJasmin BidNo ratings yet

- Duty DrawbackDocument9 pagesDuty DrawbackshubhamNo ratings yet

- Customs Act, 1962Document40 pagesCustoms Act, 1962Mainak ChandraNo ratings yet

- Bcom CC 512 Semester V GST & Custom LawDocument6 pagesBcom CC 512 Semester V GST & Custom LawSwetaNo ratings yet

- HighLights ST FEDocument34 pagesHighLights ST FEShakir MuhammadNo ratings yet

- Guidance Note On Accounting Treatment For MODVATDocument13 pagesGuidance Note On Accounting Treatment For MODVATapi-38285050% (1)

- Indirect Tax AmendmentsDocument46 pagesIndirect Tax AmendmentsCeciro LodhamNo ratings yet

- Approved Toll Manufacturer SchemeDocument16 pagesApproved Toll Manufacturer SchemetenglumlowNo ratings yet

- Exemption From Custom DutyDocument13 pagesExemption From Custom DutyAbhinav PrasadNo ratings yet

- Indirect Tax AssignmentDocument6 pagesIndirect Tax AssignmentkarishanmuNo ratings yet

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- Short Title, Extent and Commencement.Document13 pagesShort Title, Extent and Commencement.SagarNo ratings yet

- JT Customs Law Exam Importance .Document26 pagesJT Customs Law Exam Importance .ParitoshNo ratings yet

- Misc Sections For Exams March 2022Document11 pagesMisc Sections For Exams March 2022Daniyal AhmedNo ratings yet

- Suggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate ExaminationDocument14 pagesSuggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate Examinationseenu pNo ratings yet

- Drawback Section 75.Document4 pagesDrawback Section 75.PRATHAMESH MUNGEKARNo ratings yet

- Levy & Collection CGST (11-2)Document11 pagesLevy & Collection CGST (11-2)kapuNo ratings yet

- Imposition of Supplementary DutyDocument7 pagesImposition of Supplementary DutyHarippa23No ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- 8 Value of Supply - TYBCOM FinalDocument13 pages8 Value of Supply - TYBCOM FinalNew AccountNo ratings yet

- Refunds: S. No. Particulars (')Document9 pagesRefunds: S. No. Particulars (')Rohit KasbeNo ratings yet

- Adobe Scan 21-Feb-2024Document8 pagesAdobe Scan 21-Feb-2024rahatkokate7No ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- 2018 Tariff NotesDocument23 pages2018 Tariff NotesYash SawantNo ratings yet

- Unit-5 Indirect TaxDocument26 pagesUnit-5 Indirect TaxNithya RajNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Minor Project ReportDocument24 pagesMinor Project ReportBhanu DangNo ratings yet

- Forwarding - Letter - Petrol - Pump - Policy - Dated 04.09.2020Document16 pagesForwarding - Letter - Petrol - Pump - Policy - Dated 04.09.2020Bhanu DangNo ratings yet

- GST Front Page PDFDocument1 pageGST Front Page PDFBhanu DangNo ratings yet

- Spa AssignmentDocument10 pagesSpa AssignmentBhanu DangNo ratings yet

- Minor Project ReportDocument24 pagesMinor Project ReportBhanu DangNo ratings yet

- Job, Batch and Operating Costing: Attempt HistoryDocument5 pagesJob, Batch and Operating Costing: Attempt HistoryBhanu DangNo ratings yet

- GSTF ReportDocument46 pagesGSTF ReportBhanu DangNo ratings yet

- Operating Costing / Service CostingDocument4 pagesOperating Costing / Service CostingBhanu DangNo ratings yet

- Assignment 2 Mm. 10Document2 pagesAssignment 2 Mm. 10Bhanu DangNo ratings yet

- 20 Bcom 17Document23 pages20 Bcom 17Bhanu DangNo ratings yet

- 1NH18MBA66Document70 pages1NH18MBA66Rutik Shrawankar100% (1)

- Important Questions GST CA Inter May 2022 ExamsDocument2 pagesImportant Questions GST CA Inter May 2022 ExamsBhanu DangNo ratings yet

- IDT CA FINAL Full Question Paper 20may 2016Document22 pagesIDT CA FINAL Full Question Paper 20may 2016Bhanu DangNo ratings yet

- GST Notes Semester 6Document39 pagesGST Notes Semester 6Bhanu DangNo ratings yet

- InvoiceDocument1 pageInvoiceAbhay Pratap SinghNo ratings yet

- VJH AWMy Vy N6 M2 C 4 ZDocument33 pagesVJH AWMy Vy N6 M2 C 4 ZRajkumarNo ratings yet

- Simple GST BillDocument11 pagesSimple GST BillKM computer & online workNo ratings yet

- Warrant of Levy On Real Property TaxDocument1 pageWarrant of Levy On Real Property TaxRhestie IlaganNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancerakeshNo ratings yet

- Boat 20000 Mah Power Bank (20 W, Quick Charge 3.0, Power Delivery 2.0)Document1 pageBoat 20000 Mah Power Bank (20 W, Quick Charge 3.0, Power Delivery 2.0)entertainment kingNo ratings yet

- Accounts List Detail PDFDocument2 pagesAccounts List Detail PDFAyu RikaNo ratings yet

- Writeup Circular 86-05-2019Document3 pagesWriteup Circular 86-05-2019Mithun KhatryNo ratings yet

- Withholding Tax: Taxation LawDocument21 pagesWithholding Tax: Taxation LawB-an JavelosaNo ratings yet

- Ashley Koons - Utility BillDocument2 pagesAshley Koons - Utility Billmaria fernandaNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- Chandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, GampahaDocument1 pageChandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, Gampahasasanka123asiri123No ratings yet

- Shree Jarandeshwar FPC - Sales: SR - No Gstin Party Name Invoice No October 2022 MonthDocument9 pagesShree Jarandeshwar FPC - Sales: SR - No Gstin Party Name Invoice No October 2022 MonthEKNATH PHALKENo ratings yet

- Tax Notes Chapter 4Document3 pagesTax Notes Chapter 4Sam ReyesNo ratings yet

- List of Income Payments Subject To EWTDocument4 pagesList of Income Payments Subject To EWTYuri SheenNo ratings yet

- Excise, Taxation and Narcotics - Government of SindhDocument1 pageExcise, Taxation and Narcotics - Government of SindhqqqNo ratings yet

- Public Finance PaperDocument10 pagesPublic Finance PaperDaniyal AbbasNo ratings yet

- Form No. 35 (See Rule 45)Document3 pagesForm No. 35 (See Rule 45)Savoir PenNo ratings yet

- Donors TaxDocument3 pagesDonors TaxMaris Joy BartolomeNo ratings yet

- Addis Ababa City Roads Authority: To Whom It May ConcernDocument2 pagesAddis Ababa City Roads Authority: To Whom It May ConcernDawit yirNo ratings yet

- SAP Workshop - Unit 2Document70 pagesSAP Workshop - Unit 2Iheanyi Achareke100% (1)

- Invoice 25 Januari - Kelab Pencinta Alam SMK SepulotDocument1 pageInvoice 25 Januari - Kelab Pencinta Alam SMK SepulotNOR AZIMA BINTI SHAARI MoeNo ratings yet

- s6 Econ (Public Finance and Fiscal Policy)Document50 pagess6 Econ (Public Finance and Fiscal Policy)juniormugarura5No ratings yet

- Proforma Invoice: Mr. Joseph LewisDocument2 pagesProforma Invoice: Mr. Joseph LewisShivaNo ratings yet

- Evaluate 2 - Donor's TaxDocument5 pagesEvaluate 2 - Donor's TaxNicolas AlonsoNo ratings yet

- Lucid ChartDocument2 pagesLucid ChartHenry M Gutièrrez SNo ratings yet

- 51 Dec 2019 - Ingram Micro India PVT LTDDocument1 page51 Dec 2019 - Ingram Micro India PVT LTDAseem TamboliNo ratings yet

- Medikart: (Duplicate) PO04322351372546Document1 pageMedikart: (Duplicate) PO04322351372546IramNo ratings yet

- CC PDFDocument6 pagesCC PDFJaya JayavardhanNo ratings yet

- Wells Fargo DocumentDocument6 pagesWells Fargo DocumentJc R100% (1)