Professional Documents

Culture Documents

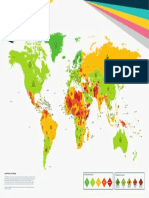

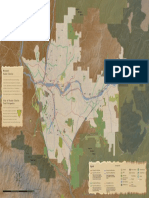

Riskmap Map 2023 A1 Eng

Uploaded by

Esthepanie ArceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Riskmap Map 2023 A1 Eng

Uploaded by

Esthepanie ArceCopyright:

Available Formats

Greenland

(Denmark)

Alaska (US) Iceland Sweden

Reykjavik

Finland

Faeroe Islands

(Denmark) Russian Federation

Norway

Oslo Helsinki

Tallinn St Petersburg

Stockholm

Estonia

Gothenburg

Riga Yekaterinburg

Northern Latvia Nizhniy Novgorod

Tomsk

Canada

Ireland

(UK)

DenmarkCopenhagen Malmo Lithuania Moscow

Novosibirsk

Kaliningrad Vilnius

(Russia)

Minsk

Dublin Belarus Samara

Ireland United Netherlands

Berlin

Kingdom Amsterdam

Poland Warsaw

London

Astana

Calgary Brussels Germany Sakhalin

Belgium Kyiv Aktobe

Prague

Luxembourg Czechia

Vancouver Ukraine

Paris Slovakia

Vienna Khabarovsk

Austria

Bratislava Kazakhstan Ulaanbaatar

Seattle Budapest Moldova

Liechtenstein Rostov on Don Atyrau

Quebec Bern Hungary Chisinau

France Switzerland Slovenia Mongolia

Montreal Ljubljana Zagreb Romania Harbin

Ottawa Croatia

Minneapolis Belgrade

Bosnia and Serbia Bucharest

Toronto Herzegovina Sarajevo Urumqi Changchun

Italy Almaty Vladivostok

Montenegro Sapporo

Andorra Corsica Podgorica Kosovo Sofia Bishkek

Detroit Boston Bulgaria Georgia

Chicago (France) Rome Albania Skopje

Barcelona Tirana North Macedonia

Tbilisi Uzbekistan Tashkent Shenyang

Istanbul

Azerbaijan Kyrgyzstan

New York

Madrid

Armenia

Philadelphia Ankara Yerevan Baku Beijing

United States of America Portugal Spain

Greece Turkey Nakhchivan Turkmenistan Tajikistan Tianjin

North Korea

Pyongyang

Washington (DC) (Azerbaijan) Dalian

St Louis Lisbon Dushanbe

San Francisco Athens Ashgabat

Annaba Seoul

Algiers Tunis Kurdistan Region Japan

Gibraltar Erbil

South Korea

Oran Malta Tehran Tokyo

Cyprus Nagoya

Osaka

Zhengzhou

Lebanon Syria Kabul Kashmir

Xi’an

Los Angeles

Phoenix Atlanta Casablanca Rabat

Tunisia Beirut

Damascus Baghdad Afghanistan Islamabad China Fukuoka

Dallas Madeira

Tripoli Israel

Tijuana Bermuda (UK) (Portugal) Amman Iraq Iran

Kandahar Lahore

Shanghai

Pacific Morocco Alexandria Palestinian Territories Chengdu Wuhan

Basra

Ocean Houston Atlantic Cairo Jordan Pakistan

New Orleans Canary Islands Chongqing

Hermosillo Ocean (Spain) Kuwait Nepal

Delhi

Algeria

Kathmandu

Libya Bhutan

Egypt Khobar Bahrain Fuzhou

Monterrey Miami

Qatar Dubai

Karachi Kunming Taipei

Bahamas Western Riyadh

Abu Dhabi Bangladesh Pacific

Havana

Sahara UAE Muscat Dhaka

Ocean

Saudi Ahmedabad Guangzhou

Mexico Tampico Arabia India Kolkata Chittagong

Shenzhen

Hong Kong

Cuba Turks and Caicos

Cancún

Jeddah Oman Myanmar Hanoi

Guadalajara

Hawaiian Islands (US) Dominican British Virgin Naypyidaw

Mexico City Port Sudan

Port-au-Prince Republic Islands

Mauritania Mumbai Laos

Cayman Islands Anguilla (UK)

(UK) Kingston Santo Domingo St Martin

Sint Maarten

Nouakchott Vientiane

Puerto Rico

Belize City

Jamaica Haiti Niger Hyderabad

Acapulco US Virgin Islands Antigua and Barbuda Mali Yangon

Belize St Kitts and Nevis Guadeloupe (France)

Cabo Verde Eritrea Yemen N. Mariana Is. (US)

Guatemala San Pedro Sula Dominica Chad Khartoum

Asmara Sanaa

Honduras Martinique (France) Dakar

Sudan Thailand

Guatemala City Manila

Tegucigalpa St Lucia

Senegal

San Salvador Niamey Bangkok

El Salvador St Vincent and Gambia Banjul

Philippines Guam (US)

Nicaragua Aruba Curaçao the Grenadines Barbados Bamako

Ouagadougou

Aden Bangalore Chennai Vietnam

Managua Grenada Bissau Kano N’Djamena Cambodia

Bonaire Burkina Faso Djibouti Djibouti City Phnom Penh

Guinea-Bissau Guinea

Trinidad and Tobago Ho Chi Minh City

Costa Rica Caracas Nigeria Hargeisa Cebu

San José

Conakry Benin

Colón Panama City Ghana Abuja Addis Ababa

Somaliland

Freetown

Côte Togo Ethiopia

Panama Sierra Leone d'Ivoire South

Marshall Is. (US)

Central African Sri Lanka

Venezuela Georgetown Monrovia Yamoussoukro Porto-Novo

Lagos Sudan Colombo

Medellín Paramaribo

Lomé Republic Federated States of Micronesia

Guyana Liberia Abidjan Accra Sulu

Penang

Bogotá Cayenne Port Harcourt Cameroon Juba Aceh

Brunei Archipelago

Bangui

SurinameFrench Guiana Douala

Malabo Yaoundé Malaysia

Cali Colombia (France) Maldives Kuala Lumpur

Somalia

Equatorial Guinea Mogadishu

São Tomé and Príncipe Uganda Singapore

Libreville Kampala Kenya

Quito

Congo Congo Kismayo

(Democratic Republic of) Kalimantan

Ecuador Gabon Nairobi

Belém Rwanda Kigali

Guayaquil Sulawesi

São Luis Kiribati

Bujumbura Sumatra

Fortaleza Brazzaville Burundi Papua

Mombasa Maluku

Kinshasa

Cabinda

Tanzania Seychelles

(Angola) Zanzibar Papua Bougainville (PNG)

Natal Mbuji-Mayi Dodoma Jakarta New

Dar es Salaam

Java Surabaya

Indonesia Guinea

Recife

Luanda

Pacific Maceió Timor-Leste Port Moresby Solomon Islands

Ocean

Peru Comoros Indian

Lima Brazil Atlantic Lubumbashi Ocean

Salvador Ocean Angola Mayotte Darwin

Malawi (France)

Zambia

Lilongwe Samoa

Lusaka

Brasília Blantyre

Arequipa La Paz Vanuatu Fiji

Cairns

Bolivia Harare

Santa Cruz

Mozambique Antananarivo

Zimbabwe

Belo Horizonte Bulawayo Beira Port Louis

Madagascar Mauritius Tonga

New Caledonia

Namibia Réunion (France)

(France)

Rio de Janeiro Windhoek Botswana

Paraguay São Paulo

Asunción

Gaborone

Australia

Pretoria

Johannesburg Mbabane Maputo

Chile eSwatini

Brisbane

Maseru Lesotho

Durban

South Africa

Córdoba Santa Fe

Perth

Rosario

Santiago Uruguay Cape Town Sydney

Buenos Aires

Adelaide

Montevideo Canberra

Auckland

Argentina Melbourne

New Zealand

Wellington

Christchurch

Falkland Islands (UK)

Download the global forecast for 2023: Business Risk Forecast

controlrisks.com/riskmap

1 2 3 4 5 6 7 8 9 10

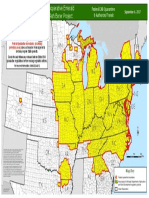

This is an outlook for the business

risk environment in each country on a

ten-point scale. The score is a composite

The Risk Ratings are compiled from sources that Control Risks considers to be reliable risk score that factors in Control Risks’

or are expressions of opinion. Control Risks has made reasonable commercial efforts political, security, operational,

Very low-increasing/ Medium, increasing/ High, increasing/ Very

to ensure the accuracy of the information on which the Risk Ratings are based. regulatory, cyber and integrity risks, Very low-stable Low-stable Low-increasing Medium, decreasing Medium, static High, static Very high-stable

including a range of ESG-related risks. Low-decreasing High, decreasing high, decreasing

However, the Risk Ratings are provided ‘as is’ and include reasonable judgements

Each rating reflects our outlook

in the circumstances prevailing at the time. The Risk Ratings provided should not be regarding overall risks to business at Risks to business very Between very low and low Risks to business low Risks to business low Risks to business Risks to business moderate Between medium and high Risks to business high and Between high and very Risks to business very high

construed as definitive or binding advice. Boundaries and names shown on this map the end of 2023 taking into account low and stable. A risk, the business environment and stable. A business but increasing. Generally moderate and decreasing. and static. Some areas will risk and subject to change, static, posing significant high risk, posing significant and remaining so, precluding

do not imply endorsement or acceptance by Control Risks. known or anticipated trends and business environment will be generally benign, but environment that will benign but posing some Challenging in some pose challenges to business posing elevated threats challenges to business operations. challenges to business and normal business operations.

developments that could impact the that will be predictable, subject to change. be generally predictable, challenges that require areas, the business that will be manageable. to business. Intensive risk Intensive management needed subject to change. Special precautions required

Copyright © Control Risks 2023. All rights reserved. Reproduction in whole or in part business environment during the year. stable, and supportive. stable, and benign. management. environment will improve. management required. to maintain operations. to operate.

prohibited without the prior consent of the Company.

GEOPOLITICAL

Policies to watch in 2023 US semiconductor

manufacturing supply

China chain (simplified flow)

“Dynamic zero COVID” policy

Localisation policies (across esign

Source: US-based Semiconductor Industry Association (SIA)

2.D

The US-China relationship is the greatest geopolitical risk for businesses in 2023. Conflict multiple sectors)

&D

1.R

remains very unlikely in 2023, but both countries are striving to be ready for when a 2023 Negative List

USA

crisis comes. Short of active conflict, companies in 2023 must monitor efforts to decouple 2023 Encouraged Industries for

critical supply chains. Foreign Investment

The Globa

Possible enforcement of Law on

l Risk Fore

Countering Foreign Sanctions,

Silicon

wa

cast

The solar photovoltaic supply chain is dominated by China f

er

Export Control Law, and

fab

Unreliable Entities List

rication

Source: Solar Photovoltaics: Supply Chain Deep Dive

Japan/

Production capacity by process stage (% global capacity) Assessment,US Department of Energy, February 2022

Europe

RiskMap is the leading annual forecast of

Polysilicon 72 28

United States fab

rica

tion 23

uit

Circ

CHIPS Act Taiwan

Ingots 98 2 Inflation Reduction Act (IRA) (China)/South

Korea/USA

business risks for a world in flux. It draws

Holding Foreign Companies

Accountable Act (HFCA)

Assem

Wafers 97 3 Outbound investment bly

,

te

screening mechanism

stin

on Control Risks expertise from across the

g, and packag

Connected apps and Malaysia/

Singapore

Cells 81 19 cross-border data

protection regulations

ing

(A

globe to deliver critical insights, helping

TP)

turing

fac

Modules 77 23 nu

ma

Product

China

businesses and organisations navigate risk

Inverter

58 42

(semiconductors) “China is racing to

Inverter

move its manufacturing “Rising bilateral End co

nsu

dominance up the tensions will

and succeed in a volatile world.

43 57

mp

(passive

tion

components) value chain and not affect all USA

become self-sufficient companies equally.”

0 25 50 75 100

in critical technologies.”

China Rest of the World China & Asia

SECURITY OPERATIONAL

Number of active conflicts by year, 1946–2021 Source: UCDP PRIO dataset Green hydrogen risk ratings Source: Control Risks

Extra-systemic conflict Inter-state conflict

50 50

40 40

GEOPOLITICAL High High Low Low Medium

Direct impacts plus escalation and overspill risk from the Ukraine-Russia conflict will 30 30 Managing energy disruption and adaptation will be the main operational risk in 2023.

remain through 2023. Many businesses are assessing the impact of a conflict or escalation

in East Asia, given the region’s importance to global trade, manufacturing and growth.

20 20

Businesses should plan how to survive the price and supply shock, and how to thrive

in a new, comprehensively rewired, global energy system.

REGULATORY High Medium High Medium Medium

Control Risks is a global specialist

OPERATIONAL

10 10

risk consultancy that helps to

High Medium High Low Low

0 0

Northeast Asia GDP, GDP growth Three key drivers of change

1940

1950

1970

1980

1990

2000

2010

2020

2021

1940

1950

1970

1980

1990

2000

2010

2020

2021

1960

1960

SECURITY Medium High Medium Low Medium

and FDI Inflows (2021) in the global energy system

“In 2023 war, or Internal conflict Internationalised internal conflict

create secure, compliant and

PRODUCTION

TRANSPORTATION

& STORAGE

TRANSPORT

(SHIPPING, RAIL,

TRUCKS, CARS)

INDUSTRY

PROCESSES

POWER

GENERATION

GDP growth (annual %)1

the prospect of 50 50

ecu

rity and price

wc

arbon transit

ion chn

ological inn

ov

“Energy

s s Te

resilient organisations. By

y Lo a

5. 8

war, on several 40 40

disruption

rg

%

tio

Ene

n

GDP (current US$) 1

timelines and 30 30

presents both

combining unrivalled expertise

6 .4

tn

FDI inflows as a % of global total2 triggers should 20 20

risks and

be high on 10 10

opportunities.”

everyone’s 0 0

and experience with the power

1940

1950

1970

1980

1990

2000

2010

2020

2021

1940

1950

1970

1980

1990

2000

2010

2020

2021

1960

1960

USE

20

risk register.”

of data and technology, we provide

.8%

774.7bn3 Countries or regions with the biggest export values of

8.1%

368.1bn

electronic integrated circuits in 2020 (in billion USD) Source: UN Comtrade

Energy vulnerability levels vary significantly across Europe

0.3%

Commitment to decarbonisation targets Source: Science Based Targets and Control Risks Source: Control Risks

153.9 117.0 82.9 44.2 49.3 Even in a time of crisis, companies continue to increase their decarbonisation commitments High the insight and intelligence you

1. 8 t n

“Conflict risks are Medium

need to stay on track, realise

8 .9

2022 1,789 Low

not just a matter

%

5 .7

1.5%

1,282

%

2021

for corporate

2

1%

tn

4.

opportunities and grow.

9t

11. 4 % 1

7.

%

n

security directors 368 “This is not

1.6

2020

Hong Kong South Korea

– local or regional Mainland China US Malaysia

4.0

%

2019 189

the time for

flashpoints 123.1 86.2 64.4 28.9 14 65

6.4%

Mainland China can rapidly have Japan

2018

neglecting

Hong Kong 2017 34

renewables.”

Vietnam

1

World Bank East Asia & Pacific Taiwan global impacts.”

(whole region) Japan

United Nations Conference on

23.7

2

Trade and Development (UNCTAD) East Asia & Pacific Republic of Korea 0 500 1000 1500 2000

3

International Monetary Fund (IMF) (rest of region) (South Korea) Taiwan Singapore Others Philippines Companies setting targets

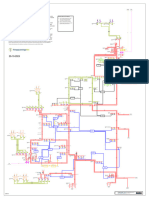

CYBER REGULATORY

Changes to digital legislation and regulations Forecast government fiscal balances in 2023 Source: IMF

controlrisks.com

Russia US China World Advanced Emerging Developing Oil

Tech sanctions CHIPS Act Cybersecurity Economies Markets Countries Producers Major Event Risk and Security

2020

2021

2022

2023

2020

2021

2022

2023

2020

2021

2022

2023

2020

2021

2022

2023

2020

2021

2022

2023

Training and Development Solutions

In 2023, we will witness the beginnings of a fundamental breakdown of global networks Governments around the world will be targeting revenue and striving to steady state 0.2 Third party risk management

into distinct regional, or even national architectures, caused by the weaponisation of finances. Wherever they turn, the corporate world will feel the heat one way or another. -0.5 Investigations, Litigation and Forensics

cyberspace and a clash of national interests. Austerity, shortage and strife will set the tone in 2023.

-2.2 Sanctions and trade compliance

-2.9

-4.0

-4.3

Industrial control system vulnerabilities disclosed Source: Control Risks

Sanctions and restrictions USD52bn investment Cybersecurity review for national

Top regulatory risks by major sector Source: Control Risks -4.9 -5.3 -5.5 -5.1 -4.9 -5.2

-4.6 Ethics, Compliance and Governance

-5.7

by US’ ICS-CERT escalate on cutting-edge tech in semiconductor manufacturing; security impacts across data -6.4 Ransomware and extortion response

While most of these risks will apply to every sector, Control Risks advises these sectors should -7.3 -7.4

ICS Cyber exploitation based on Control Risks tracking campaigns globally. We are seeing exports to Russia signals return of industrial policy processing organisations

as part of geopolitical competition particularly watch for the following categories of policy response Crisis Response

a related growth in the vulnerabilities of connected infrastructure and their exploitation by -9.3

with China -9.9

threat actors. It will continue to get worse… -10.5 Organisational Resilience

600 30 ICS Other technology and digital initiatives

vulnerabilities Inflation related unrest | energy and food prices Sources: Price data: World Bank | Unrest data: Seerist

Cyber and Digital

discovered EU China US Windfall taxes Trade controls Resource Non-financial Price Labour

500 25

KEY RISKS

ICS cyber Data Governance Act, China standards Clean Network Price controls Global nationalism reporting controls regulations

250

Investment Support

exploitation 180.0

Digital Services Act package 2035 Initiative Trade controls minimum Sanctions Supply chain

400 20 tax rules due diligence

ESG and Sustainable Business

Digital markets overhaul Global tech standards Network infrastructure security Sanctions 160.0

Data protection

300 15 200 Operational and Protective Security

140.0

OIL AND GAS

TECHNOLOGY

MINING

FINANCIAL

PHARMACEUTICAL

MANUFACTURING

Risk monitoring and threat intelligence programmes

200 10

150 120.0

Security Risk Management

100 5

100.0 Political and Country Risk

0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

0 100

80.0

SERVICES

75 15

60.0

50

60

In 2023, % Companies could 40.0

trillion

It is estimated that more than

“Ultimately, tomorrow’s invest a total

% “Regulatory changes in

more than

of the world’s

GDP will be digital organisation will

of up to

2023 will establish a new

“Companies will have to 0 20.0

OUR

May-22

Jun-22

Jul-22

Aug-22

Sep-22

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Jan-18

Feb-18

Mar-18

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

digitalised grapple with heightened

in 2023

of the world’s population will be covered be a fragmented one.” in IoT by 2025 threshold in government

uncertainty.” Total Unrest Energy Price Index Food Price Index

by at least one data privacy regulation (Gigabit) intervention.” The frequency of inflation-related unrest worldwide has increased sharply since mid-2021. Food and fuel prices

are likely to remain elevated in 2023 and will continue to drive elevated levels of unrest and political instability.

You might also like

- Riskmap Map 2018 Uk WebDocument1 pageRiskmap Map 2018 Uk WebCosmin ReisslerNo ratings yet

- Risk Map Map 2019 Uka 184 WebDocument1 pageRisk Map Map 2019 Uka 184 WebAnonymous OY8hR2NNo ratings yet

- 2021 10 25 Political Riskmap 2022 A3Document1 page2021 10 25 Political Riskmap 2022 A3LuisDonairesNo ratings yet

- Riskmap 2021 Map Regions World A3v2Document1 pageRiskmap 2021 Map Regions World A3v2khanNo ratings yet

- 2021 Global Hunger Index by Severity: Rep. of MoldovaDocument2 pages2021 Global Hunger Index by Severity: Rep. of MoldovaMacMohanNo ratings yet

- WALM Poster - 3 1 2024Document1 pageWALM Poster - 3 1 2024YouTubeNo ratings yet

- Ookla State of 5g Poster 2024bDocument1 pageOokla State of 5g Poster 2024bmuh nasirNo ratings yet

- Serving: Orange East Orange Newark Jersey Gardens Mall ElizabethDocument2 pagesServing: Orange East Orange Newark Jersey Gardens Mall ElizabethDedii KurniawanNo ratings yet

- Trisavo Risk Map 2022Document1 pageTrisavo Risk Map 2022friska_arianiNo ratings yet

- Topographic Map of Gafford ChapelDocument1 pageTopographic Map of Gafford ChapelHistoricalMapsNo ratings yet

- Automated Speed Enforcement Site LocationsDocument1 pageAutomated Speed Enforcement Site Locationsraymond.gan25No ratings yet

- Congressional Districts - Compromise Plan: First District: 664,180 Second District: 664,181Document1 pageCongressional Districts - Compromise Plan: First District: 664,180 Second District: 664,181NEWS CENTER MaineNo ratings yet

- Yesu Piranthaar ViolinsDocument2 pagesYesu Piranthaar Violinsvijayaraj Ebenezar100% (1)

- Jodipati All Indraprasta SouthDocument6 pagesJodipati All Indraprasta Southwiwitoke3No ratings yet

- 3130 PDFDocument1 page3130 PDFLye Yu MinNo ratings yet

- World Abortion MapDocument1 pageWorld Abortion MapLuis Felipe Jimenez PerezNo ratings yet

- Lakeside-Map-Directory-2024Document1 pageLakeside-Map-Directory-2024coalclasherNo ratings yet

- FDH504 CableDocument1 pageFDH504 CableMuhammad UmairNo ratings yet

- PDF SvitDocument1 pagePDF Svituuusiskaz1965No ratings yet

- Trails Map 2016 - ReducedDocument1 pageTrails Map 2016 - ReducedmarcencaboNo ratings yet

- Abortion Laws MapDocument1 pageAbortion Laws Mapapi-602938753No ratings yet

- VO Back Flow AD Ref 4-1Document15 pagesVO Back Flow AD Ref 4-1wiwitoke3No ratings yet

- 720 Master List GlobalDocument3 pages720 Master List GlobalShilpa VaradarajanNo ratings yet

- VIRTUAL WETEX & DSS 2020 Water, Energy & Sustainability Halls LEGENDDocument1 pageVIRTUAL WETEX & DSS 2020 Water, Energy & Sustainability Halls LEGENDRafatNo ratings yet

- Track and Wheel Cable Price 2014 Spreads (Small)Document42 pagesTrack and Wheel Cable Price 2014 Spreads (Small)dhanysiregarNo ratings yet

- Netschema Transportnet 23NLT06 by HoogspanningsNetDocument1 pageNetschema Transportnet 23NLT06 by HoogspanningsNetmalik ansasNo ratings yet

- Lllllleeeee: O F FEDocument54 pagesLllllleeeee: O F FEthe next miamiNo ratings yet

- #2023 Aig Travel Security Risk MapDocument1 page#2023 Aig Travel Security Risk Mapมา ยา100% (1)

- l1 MergedDocument13 pagesl1 MergedaishaehabNo ratings yet

- The World As of 2072Document1 pageThe World As of 2072Will AndylNo ratings yet

- Location PlanDocument1 pageLocation Plankunal singhNo ratings yet

- Sector-6 (Palm Wood Enclave) Size 194 SQRDDocument1 pageSector-6 (Palm Wood Enclave) Size 194 SQRDWave cityNo ratings yet

- 5.ThirdFloor SMS 105Document1 page5.ThirdFloor SMS 105MohammedNo ratings yet

- MANDE - SUBMISSION - OZAR - FINAL DRAWWING 29.06.2022-ModelDocument1 pageMANDE - SUBMISSION - OZAR - FINAL DRAWWING 29.06.2022-Modelsiddhivinayaksankul34No ratings yet

- Dios Nunca MuereDocument5 pagesDios Nunca MuereRené RosadoNo ratings yet

- Screenshot 2023-05-25 at 1.53.52 PMDocument1 pageScreenshot 2023-05-25 at 1.53.52 PMik27419No ratings yet

- 06 Pohetakali Ff-LsectionDocument1 page06 Pohetakali Ff-Lsection4 frameNo ratings yet

- Travel Risk Map 2018Document1 pageTravel Risk Map 2018hamblahamblaNo ratings yet

- DS - Finishing Plant Ground Floor Equipment Layout (New Proposed)Document1 pageDS - Finishing Plant Ground Floor Equipment Layout (New Proposed)Sanket PatelNo ratings yet

- Marzin Enn He GavelDocument2 pagesMarzin Enn He GavelgrosseNo ratings yet

- Iis Detail Data Store DiagramDocument1 pageIis Detail Data Store DiagramHarsh PatNo ratings yet

- Magic With DiagramsDocument1 pageMagic With DiagramsSoniaBentancourteNo ratings yet

- USA Frequency Allocations Chart 2016 - The Radio SpectrumDocument1 pageUSA Frequency Allocations Chart 2016 - The Radio SpectrumJohanes StefanopaulosNo ratings yet

- University of Surrey Lecture EEEE3033 Filters 2016Document30 pagesUniversity of Surrey Lecture EEEE3033 Filters 2016John Bofarull GuixNo ratings yet

- E-M1-02 Basement 2 ACMV Layout PDFDocument1 pageE-M1-02 Basement 2 ACMV Layout PDFJohn InacayNo ratings yet

- Curridabat PDFDocument1 pageCurridabat PDFIlian El UnicoNo ratings yet

- FPCC Northwest Zone Map 10 15Document1 pageFPCC Northwest Zone Map 10 15Ardian SNo ratings yet

- The new map of the world: South Sudan creates geopolitical shiftDocument1 pageThe new map of the world: South Sudan creates geopolitical shiftvkasNo ratings yet

- Togui Hermanos Neira LoteDocument1 pageTogui Hermanos Neira Lotejuan camilo acosta neiraNo ratings yet

- 2010 Nor AmericaDocument1 page2010 Nor AmericanomorejoyoutthatstickNo ratings yet

- E-1 Lighting LayoutDocument1 pageE-1 Lighting LayoutSeph De LunaNo ratings yet

- BattletechDocument1 pageBattletechEric1201No ratings yet

- Ba Map TPKN FNL - Sabtu, 03 Desember 2022Document1 pageBa Map TPKN FNL - Sabtu, 03 Desember 2022Termo MeterNo ratings yet

- MOBIAK-TECHNICAL CATALOGUE 210x290mm PDFDocument40 pagesMOBIAK-TECHNICAL CATALOGUE 210x290mm PDFooo ooo0% (1)

- 2014pramana Text PDFDocument31 pages2014pramana Text PDFSasith RajasooriyaNo ratings yet

- Ну, погоди!Document1 pageНу, погоди!Swetlana DenizNo ratings yet

- National Grid MapDocument1 pageNational Grid Mapvprajan82No ratings yet

- Quarantined AreaDocument1 pageQuarantined AreamaggieNo ratings yet