Professional Documents

Culture Documents

TAX317 - Topic - ITA Example Q

Uploaded by

Nurul Hannani SazaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX317 - Topic - ITA Example Q

Uploaded by

Nurul Hannani SazaliCopyright:

Available Formats

TAX317_Investment Incentives_Illustration Kelantan

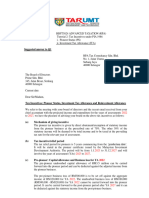

QUESTION 1

Sutera Sdn Bhd, a manufacturing company located in Sabah, has been in operation since

March 2020. The company manufactures a promoted product of national and strategic

importance to Malaysia and had been granted investment tax allowance incentives under

the Promotion of Investment Act 1986 effective from 1 January 2021.

The forecasted capital expenditure, adjusted income and capital allowances for the three

years are as follows:

Year ended 31 December 2021 2022 2023

RM’000 RM’000 RM’000

Land 180,000 - -

Factory building 90,000 60,000 -

Plant and machinery 30,000 40,000 60,000

Office equipment 8,000 - 10,000

Adjusted income/ (loss) 52,000 (36,000) 80,000

Capital allowances 26,100 33,300 46,300

Rental income 600 600 600

Required:

(a) State the tax relief period for the investment tax allowance incentive available to

Sutera Sdn Bhd.

(2 marks)

(b) For the year of assessment 2021, 2022 and 2023, compute the following:

(i) Chargeable income (if any).

(ii) Amount to be transferred to the exempt income account.

(iii) Amount of unabsorbed business loss to be carried forward to the year of

assessment 2024 (if any)

(12 marks)

TAX317_Investment Incentives_Illustration Kelantan

QUESTION 2

Sinar Sdn Bhd (year ended 30 September annually) is a manufacturing company located in

Penang. The company produces a product which has been listed as a promoted product.

The company had applied and was granted the investment tax allowance incentive for five

years effective from 1 October 2020.

The following expenditures were incurred by the company:

Date incurred Expenditure RM

7 September 2020 Plant and Equipment 80,000

5 September 2021 Building (Note 1) 330,000

4 June 2022 Heavy Machinery 110,000

Note 1:

It has been agreed that RM150,000 of the cost of the building is related to the administrative

office.

The following financial projection has been provided in respect of its manufacturing business:

2021 2022 2023

Year ending 30 September RM’000 RM’000 RM’000

Adjusted income/(loss) (35) 190 272

Capital allowances 25 48 65

Additional information:

i) There were unutilized capital allowances of RM20,000 brought forward from the year of

assessment 2020.

ii) The company received interest of RM15,000 annually from resident companies in

Malaysia.

iii) On 10 October 2021, the company donated RM6,500 to an approved institution.

Required:

For the years of assessment 2021, 2022 and 2013, compute the chargeable income and

amount to be credited to the exempt income account of Sinar Sdn Bhd (show all relevant

workings).

(9 marks)

You might also like

- Food Delivery Agreement SummaryDocument2 pagesFood Delivery Agreement SummaryChas Vnertia77% (35)

- A Study On Customer Satisfaction Towards AmazonDocument91 pagesA Study On Customer Satisfaction Towards Amazonpuja poddar82% (50)

- Cupcake Business PlanDocument13 pagesCupcake Business PlanCarl Wency Sarco Galenzoga67% (3)

- Pac All CAF Mocks With Solutions Compiled by Saboor AhmadDocument144 pagesPac All CAF Mocks With Solutions Compiled by Saboor AhmadRao Ali CA100% (2)

- Money laundering stages and detection methodsDocument4 pagesMoney laundering stages and detection methodsSrishtikumawat20% (5)

- Case Study 1 - Strategic HR Integration at The Walt Disney CompanyDocument2 pagesCase Study 1 - Strategic HR Integration at The Walt Disney CompanyTrần Thanh HuyềnNo ratings yet

- Based on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodDocument6 pagesBased on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodNajihah RazakNo ratings yet

- Mergers and Acquisitions: Mcgraw-Hill/IrwinDocument23 pagesMergers and Acquisitions: Mcgraw-Hill/IrwinHossain BelalNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Illustrative ExamplesDocument2 pagesIllustrative ExamplesNur PasilaNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

- Tutorial 2 A212 QuestionDocument10 pagesTutorial 2 A212 QuestionFatinNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- T2 Ans (PS & ITA) REVISED (1)Document6 pagesT2 Ans (PS & ITA) REVISED (1)alvinmono.718No ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- 6.1 Class Work Question On PGBPDocument5 pages6.1 Class Work Question On PGBPRakNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- 1695365508703_IncomeTax-IIDocument7 pages1695365508703_IncomeTax-IIAditya .cNo ratings yet

- T2 Ans 1,3 - 4 (PS - ITA)Document5 pagesT2 Ans 1,3 - 4 (PS - ITA)MinWei1107No ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- SS Project January 2023Document2 pagesSS Project January 2023NUR AFFIDAH LEENo ratings yet

- Calculating Deferred Tax for Permai BhdDocument3 pagesCalculating Deferred Tax for Permai Bhddini sofiaNo ratings yet

- CC1 A232 - QUESTIONDocument6 pagesCC1 A232 - QUESTIONDAHLIAH AZIZNo ratings yet

- Tutorial 2 - A202 QuestionDocument6 pagesTutorial 2 - A202 QuestionFuchoin ReikoNo ratings yet

- Quick Quiz I ACCT3513 Taxation II Sem Jun 2021Document3 pagesQuick Quiz I ACCT3513 Taxation II Sem Jun 2021Tiana Ling Jiunn LiNo ratings yet

- Tutorial 2: Swedish CompanyDocument5 pagesTutorial 2: Swedish Companyszh saNo ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- June 2021Document82 pagesJune 2021刘宝英100% (1)

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Revision for test 2: Agriculture allowance and Double tax agreementDocument3 pagesRevision for test 2: Agriculture allowance and Double tax agreementRaudhatun Nisa'No ratings yet

- ADVANCED ACCOUNTING 2EDocument3 pagesADVANCED ACCOUNTING 2EHarusiNo ratings yet

- Revision FfarDocument6 pagesRevision Ffarleejw2810No ratings yet

- Confidential Advanced Taxation Mid-Semester Assessment QuestionsDocument5 pagesConfidential Advanced Taxation Mid-Semester Assessment QuestionsSanthiya MogenNo ratings yet

- Chapter 18 ProblemsDocument4 pagesChapter 18 ProblemsAhritch DalanginNo ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- Acb21103 Tutorial Capital Allowance 2023Document4 pagesAcb21103 Tutorial Capital Allowance 2023alifarhanah6No ratings yet

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Ruchira Sanket KaleNo ratings yet

- Soalan Tugasan Perakaunan BBAW2103Document9 pagesSoalan Tugasan Perakaunan BBAW2103Ina RawaNo ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- Tax Planning for New BusinessDocument11 pagesTax Planning for New BusinessmandyNo ratings yet

- Test 12Document2 pagesTest 12Shehzad KhanNo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Chartered Tax Institute of Malaysia Financial Accounting ExamDocument8 pagesChartered Tax Institute of Malaysia Financial Accounting ExamShawn LiewNo ratings yet

- Et BM 20Document4 pagesEt BM 20deliciousfood463No ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- FA Dec 2020Document9 pagesFA Dec 2020Shawn LiewNo ratings yet

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourDocument5 pagesCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Question Far270 Feb2021Document9 pagesQuestion Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Panasonic Malaysia 2Q 2022 Earnings Up 70Document15 pagesPanasonic Malaysia 2Q 2022 Earnings Up 70kimNo ratings yet

- FAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4Document6 pagesFAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4NUR NAJWA MURSYIDAH NAZRINo ratings yet

- A231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28Document7 pagesA231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28amyNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Answer SheetDocument49 pagesAnswer SheetMaryamKhalilahNo ratings yet

- 2019 Inditex Anual Report PDFDocument472 pages2019 Inditex Anual Report PDFShivangi RajouriyaNo ratings yet

- Coca-Cola Hellenic 2011 Annual Report (IFRS FinancialsDocument86 pagesCoca-Cola Hellenic 2011 Annual Report (IFRS FinancialskhankhanmNo ratings yet

- Parallax Workshop Clearwater 2016Document3 pagesParallax Workshop Clearwater 2016Alex BernalNo ratings yet

- Credit Card PresentationDocument24 pagesCredit Card Presentationpradeep367380% (5)

- Furkhan Pasha - ResumeDocument3 pagesFurkhan Pasha - ResumeFurquan QuadriNo ratings yet

- Traphaco Reviews Distribution Restructuring and 2019 Business PlanDocument4 pagesTraphaco Reviews Distribution Restructuring and 2019 Business PlanHai YenNo ratings yet

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet

- Presentation - Reconciling Supply and DemandDocument21 pagesPresentation - Reconciling Supply and DemandArthur BouchardetNo ratings yet

- Rewarding Human Resources: Unit VDocument78 pagesRewarding Human Resources: Unit VVanisha MurarkaNo ratings yet

- Balance of PaymentsDocument39 pagesBalance of PaymentsMarta Amarillo GarridoNo ratings yet

- Understanding Rwanda Agribusiness and Manufacturing SeDocument258 pagesUnderstanding Rwanda Agribusiness and Manufacturing Seooty.pradeepNo ratings yet

- Full Notes SapmDocument472 pagesFull Notes SapmJobin JohnNo ratings yet

- Dsr April 2024Document10 pagesDsr April 2024vapatel767No ratings yet

- National Bank For Agriculture and Rural Development (NABARD)Document58 pagesNational Bank For Agriculture and Rural Development (NABARD)kavita choudharyNo ratings yet

- Eyewear Industry: Visions Are ChangingDocument53 pagesEyewear Industry: Visions Are ChangingSagar BhagdevNo ratings yet

- Ayeesha QuestionDocument2 pagesAyeesha QuestionMahesh KumarNo ratings yet

- Understanding Transactions in The Controlling ModuleDocument31 pagesUnderstanding Transactions in The Controlling ModuleAbdelhamid HarakatNo ratings yet

- 522102166855455201Document2 pages522102166855455201Narayana NarayanaNo ratings yet

- THESISDocument62 pagesTHESISBetelhem EjigsemahuNo ratings yet

- ACCRUALSDocument2 pagesACCRUALSLiLi LemonNo ratings yet

- Accounting MemeDocument2 pagesAccounting MemeIan Jay DescutidoNo ratings yet

- Organizational Strategies and The Sales FunctionDocument25 pagesOrganizational Strategies and The Sales FunctionHriday PrasadNo ratings yet

- Financing Your Franchised BusinessDocument17 pagesFinancing Your Franchised BusinessDanna Marie BanayNo ratings yet