Professional Documents

Culture Documents

Tutorial 2: Swedish Company

Uploaded by

szh saOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 2: Swedish Company

Uploaded by

szh saCopyright:

Available Formats

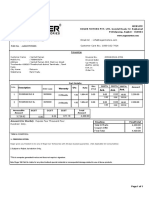

TUTORIAL 2

Question 1

Modern Interior Sdn. Bhd., with paid-up capital of RM2 million, is in the business of interior design

since 2001. Its gross income from all business sources was RM1.75 million at the beginning of

financial year 2021. For the year ended 31 December 2021, the company’s Statement of Profit or

Loss showed the following:

BASIC period 1/1/21-31/12/21 YA2021

Notes RM RM

Sales 4,125,000

Less (1,270,000

: Cost of sales 1 )

2,855,000

Add 176,00

: Interests 2 0

220,00

Rental of a building in Singapore 0

130,00

Dividends 3 0 526,000

3,381,000

Less 590,00

: Remuneration cost 4 0

Provision for bad debts 5 2,400

Repairs and maintenance 6 97,000

Entertainment expenses 7 68,000

Professional charges and subscriptions 8 48,700

105,50

Research and development 9 0

275,00

Donations 10 0

Depreciation 31,000

100,00 (1,317,600

General and administrative expenses 11 0 )

Net profit before tax 2,063,400

Notes: RM

1 Cost of sales include:

Stock obsolescence written off 12,000

Gross payment for technical advice to a Swedish company made in June 27,000

2021. No withholding tax has been deducted (latepayment).

2 Interest comprises of: (no business income ) ( section 4 c)

Interest accrued on fixed deposit in Malaysia(taxable) 80,000

Interest on fixed deposit from a bank in Singapore 96,000

(remitted to Malaysia) (exempted)

3 Dividends comprise of: (need to put section4 c)

Dividend from Australia (remitted) (exempted) 78,000

Dividend received from a pioneer status company (exempted)) 52,000

4 Remuneration comprises of:

420,00

Salaries (RM200,000 to the directors and RM88,000 to employees) 0

EPF (directors and employees) 80,000

Annual leave passage to Krabi, Thailand for CEO and family (private

expenses) nd 90,000

5 Provision for bad debts comprise:

Specific provision 400

General provision 2,000

6 Repairs and maintenance include:

Cost of equipment purchased (RM60,000) and delivery cost (RM2,000) incurred 62,000

on purchase of equipment

Machine maintenance 11,000

Repairs on the building rented out in Singapore 24,000

7 Entertainment expenses comprise of:

Lucky draw prizes to customers 51,000

Clients’ entertainment 17,000

8 Professional charges and subscriptions include:

Legal fees for handling income tax appeal 900

Accounting and statutory audit fees 7,200

Staff recruitment charges paid to an employment agency 10,000

Fees paid for registration of trademark in Switzerland 15,000

Stamp duty on increase in authorised share capital 10,000

Designing and printing of brochures 5,600

9 Research and development include:

Approved training expense for employees to acquire 19,500

technical skills in the designing of office equipment

Research expenses incurred on a new project (approved) 86,000

1

0 Donations comprise:

125,00

Cash donations to Kedah Public Library 0

150,00

Cash donation to Majlis Bandaraya Melaka Bersejarah (MBMB) 0

1 General and administrative expenses comprise of:

1

Allowance paid to one MMU student for 6 months internship program approved 4,200

by Talent Corp. Malaysia Bhd.

Compensation paid upon restrictive covenants 27,000

Lease rental of a motor vehicle licensed as commercial vehicle at RM3,000 36,000

per month (starting from 1 March 2019).

Construction of a showroom 32,800

Other information:

i. The current year and brought forward capital allowances amounted to RM65,000 and

RM9,800 respectively.

ii. Business loss brought forward from the Year of Assessment (YA) 2020 was RM29,000.

Required:

Calculate the income tax payable for Modern Interior Sdn. Bhd. for YA2021. Every item in the notes

to the statement must be included in your computation. Write ‘NIL’ where no adjustment is

necessary.

Question 2

Glamreka Sdn. Bhd. is a company engaged in the manufacturing and selling of cabinets with a paid-

up capital of RM3 million on 1 November 2020. It closes its accounts on 31 October annually and is a

tax resident in Malaysia.

NON-SME (flat TAX RATE= 24%) ,YA2021= 1/11/2020-31/10/2021)

Glamreka Sdn. Bhd.’s gross income from all business sources was RM1.5 million at the beginning of

financial year 2021. Its profit and loss account for the year ended 31 October 2021 is as follows:

Glamreka Sdn. Bhd.

Statement of Profit or Loss for the year ended 31 October 2021

Note RM RM

Sales 2,400,000

(1,600,000

Less: Cost of sales 1 )

Gross profit 800,000

Add: Dividend 2 96,000

Interest 3 5,000

Profit on sale on fixed assets 10,000 111,000

Less: Advertising and promotion D 15,000

Depreciation ND 80,000

Entertainment 4 35,000

Foreign exchange loss 5 18,000

Freight and insurance 6 22,500

Legal and professional charges 7 40,500

Provision for doubtful debts 8 8,000

Subscriptions and donations 9 54,500

Research and development 10 50,000

Remuneration 11 240,000

Lease rental 12 21,600 (585,100)

Net profit before taxation 325,900

Notes: RM

1 Cost of sales includes:

Provision for stock obsolescence (out-of-date) ND 10,000

Damaged goods written off D NIL 8,500

2 Dividends were received from (X BUSINESS INCOME) S4©

Pioneer company in Malaysia (gross) exempted 36,000

Hong Kong (remitted) (gross) exempted (para 28 sch6) 20,040

Malaysian company (net) exempted 39,960

3 Interest: (business income- AR-customer-business) t nil

This represents charges on overdue trade accounts(AR) imposed by the company for

delayed payments BY customer

4 Entertainment:

This amount was incurred in providing food and drinks for a product launching

ceremony(100%D) except for RM10,000 which was incurred for the company's annual

dinner for its staff. (100%D)

5 Foreign exchange loss:

Realised loss incurred from purchase of machinery(capital)nd from China 10,000

Unrealised loss incurred from acquisition of raw materials from Indonesia ND 8,000

6 Freight and insurance charges:

Premium paid to Indonesian insurance company on imported goods D 12,000

Export credit premium paid to Malaysia Export Credit Insurance Bhd. DD 10,500

7 Legal and professional charges:

Audit fees 12,500

Income tax appeal 5,000

Registration of a new trademark in UK (dd) 15,000

Renewal of two existing trademarks in Malaysia 8,000

8 Provision for doubtful debts (trade):

Specific provision for doubtful debts 1,000

General provision for doubtful debts 3,000

Trade bad debts written off 4,000

9 Subscriptions and donations:

Entrance fee to a golf club for CEO (business and private uses) nd 5,000

Entrance fee to a trade association 5,500

Annual subscription to a trade association 2,000

Cash donation to a political party 15,000

Cash donation to Rumah Seri Kenanga (approved institution) 27,000

10 Research & development expenses:

Routine product testing and quality control expenses 18,000

Research expenses incurred on an approved project 32,000

11 Remuneration:

Salaries and bonuses for employees 180,000

Salary and bonuses for disabled employee 14,000

EPF contribution for all employees 46,000

12 Lease rental:

A Toyota 1-tonne lorry which costed RM155,000 when new was leased at a monthly rate

of RM1,800 since November 2015. D commercial

Additional information:

Capital allowances for the current year and brought forward from previous year were RM33,000

and RM55,000 respectively.

The company has a brought forward business loss of RM37,500 from the Year of Assessment (YA)

2020.

Required:

Calculate the income tax payable by Glamreka Sdn Bhd for YA2019. Every item in the notes to the

account must be shown in your computation. Write “Nil” where no adjustment is necessary.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PayrollDocument3 pagesPayrolldesiree joy corpuz100% (1)

- Question Bbaw2103 Financial AccountingDocument9 pagesQuestion Bbaw2103 Financial AccountingZakey Zainal0% (1)

- Tugas 20.445cs4Document8 pagesTugas 20.445cs4ina aktNo ratings yet

- KTS Free Ver 2Document16 pagesKTS Free Ver 2Nam NguyenNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- Sunway T4 (TX4014) - Tax Computation (Business Income)Document4 pagesSunway T4 (TX4014) - Tax Computation (Business Income)Ee LynnNo ratings yet

- Ch.6-Tutorial 1Document3 pagesCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)No ratings yet

- Jun 2019 QDocument9 pagesJun 2019 Qsiti dalinaNo ratings yet

- Example 2Document4 pagesExample 2Raudhatun Nisa'No ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- Tax Mac2002Document8 pagesTax Mac2002Insan KerdilNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

- A201 Bkat3023 Take Home Exam PDFDocument10 pagesA201 Bkat3023 Take Home Exam PDFdiyana farhanaNo ratings yet

- Week 11QDocument3 pagesWeek 11Qxinghe666No ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Mirri TaxDocument10 pagesMirri TaxMandanda LovemoreNo ratings yet

- Advanced Taxation Questions On Corporate TaxationDocument19 pagesAdvanced Taxation Questions On Corporate TaxationObeng CliffNo ratings yet

- Tax 2 Tutorial 2Document6 pagesTax 2 Tutorial 2szh saNo ratings yet

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourDocument5 pagesCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Question Tax Project Jan 2022 - 18012022Document7 pagesQuestion Tax Project Jan 2022 - 18012022MOHAMAD FARHAN AQMAL MOHD HERMIENo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Past Year QuestionDocument6 pagesPast Year QuestionNurulHuda Auni Binti Ab RahmanNo ratings yet

- SS Project January 2023Document2 pagesSS Project January 2023NUR AFFIDAH LEENo ratings yet

- ACC3024 Tutorial 4 Q (Apr 2023)Document3 pagesACC3024 Tutorial 4 Q (Apr 2023)Shermaine WanNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Document13 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Lyana InaniNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- Sunway T3 (TX4014) Tax Computation 2020Document3 pagesSunway T3 (TX4014) Tax Computation 2020Ee LynnNo ratings yet

- Week 10Document3 pagesWeek 10xinghe666No ratings yet

- Chapter 3 - Sesi 1 2022 2023Document42 pagesChapter 3 - Sesi 1 2022 2023黄勇添No ratings yet

- Acc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ADocument6 pagesAcc5115 - Intermediate Financial Reporting Statement of Comprehensive Income and Changes in Owner'S Equity Problem ARachel LuberiaNo ratings yet

- Topic 3 Practical ExampleDocument3 pagesTopic 3 Practical Exampleszh saNo ratings yet

- Tax Sept2002Document10 pagesTax Sept2002Insan KerdilNo ratings yet

- Business Income TutorialDocument5 pagesBusiness Income TutorialzulfikriNo ratings yet

- April 2022 (Fa4)Document7 pagesApril 2022 (Fa4)Amelia RahmawatiNo ratings yet

- Company Tax SS Sept 2021 (Rate 2021) .For StudentsDocument3 pagesCompany Tax SS Sept 2021 (Rate 2021) .For StudentsizzahNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- W13 Corporate TaxDocument4 pagesW13 Corporate TaxCC HOD AHOD W-Week 2020No ratings yet

- The Required Initial Disbursement That The Business Needs To Facilitate The Proposed Project Will Be P 11,830,562.58. The Itemization Is As Shown in Table 22Document16 pagesThe Required Initial Disbursement That The Business Needs To Facilitate The Proposed Project Will Be P 11,830,562.58. The Itemization Is As Shown in Table 22Lhara Mae ReyesNo ratings yet

- Tutorial 4 - Consolidated Statement of Cash FlowsDocument6 pagesTutorial 4 - Consolidated Statement of Cash FlowsFatinNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Can Drinks SDN BHDDocument3 pagesCan Drinks SDN BHDNURSABRINA BINTI ROSLI (BG)No ratings yet

- Advanced Taxation QuestionsDocument7 pagesAdvanced Taxation QuestionsObeng CliffNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- ACC 503 FinalDocument14 pagesACC 503 FinalFarid UddinNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- Tutorial 2 - A202 QuestionDocument6 pagesTutorial 2 - A202 QuestionFuchoin ReikoNo ratings yet

- Aguarin Problem 1 PDFDocument4 pagesAguarin Problem 1 PDFPingü D. Mad-flippérsNo ratings yet

- Fundamentals of Taxation 2017 Edition 10Th Edition Cruz Solutions Manual Full Chapter PDFDocument47 pagesFundamentals of Taxation 2017 Edition 10Th Edition Cruz Solutions Manual Full Chapter PDFmarushiapatrina100% (13)

- RPS Analisa Laporan Keuangan Agustus 2020Document24 pagesRPS Analisa Laporan Keuangan Agustus 2020Shiel VhyNo ratings yet

- United Bank LimitedDocument78 pagesUnited Bank Limitedshani27100% (1)

- Financial Statement Sample ModelDocument14 pagesFinancial Statement Sample ModelNaomi IrikefeNo ratings yet

- Technical Specification in Brief: Sandvik Dt912DDocument2 pagesTechnical Specification in Brief: Sandvik Dt912DNico CRa Valenzuela MartínezNo ratings yet

- Project Finance SCDL Paper Solved Exam Paper - 9Document4 pagesProject Finance SCDL Paper Solved Exam Paper - 9Deepak SinghNo ratings yet

- CB5E45903BDocument1 pageCB5E45903Bkrish tcrNo ratings yet

- Shweta AggarwalDocument87 pagesShweta Aggarwalkomal vermaNo ratings yet

- National Institute of Textile Engineering and Researc2Document15 pagesNational Institute of Textile Engineering and Researc2aemon05No ratings yet

- IEQ FinalDocument21 pagesIEQ FinalTejas HambirNo ratings yet

- Topic 6 OdlDocument19 pagesTopic 6 OdlNur NabilahNo ratings yet

- Production Planning and ControlDocument12 pagesProduction Planning and Controlsai mohanNo ratings yet

- Update BNP 2023Document34 pagesUpdate BNP 2023Bill LeeNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasSNRBTNo ratings yet

- Marathon 9 - Index NumbersDocument112 pagesMarathon 9 - Index NumbersSharda SurekaNo ratings yet

- S No. Name of Bank User Id Remarks: (7 Characters)Document4 pagesS No. Name of Bank User Id Remarks: (7 Characters)Sudeepa SudeepaNo ratings yet

- Problem Solving Quiz 1Document1 pageProblem Solving Quiz 1Cherry DerramasNo ratings yet

- Meaning of WTO: WTO - World Trade OrganisationDocument13 pagesMeaning of WTO: WTO - World Trade OrganisationMehak joshiNo ratings yet

- Course Code: ACT 202 Section:07 Group Assignment: Submitted ToDocument25 pagesCourse Code: ACT 202 Section:07 Group Assignment: Submitted ToMd.Mahmudul Hasan 1722269030100% (1)

- Annexure-VII-GCC - Composite Orders1Document105 pagesAnnexure-VII-GCC - Composite Orders1Bhageerathi SahuNo ratings yet

- Chapter 1 - Understanding The Supply ChainDocument29 pagesChapter 1 - Understanding The Supply Chainissafakhoury0318No ratings yet

- Tally Prime Exercise 1Document42 pagesTally Prime Exercise 1MohanNo ratings yet

- VCC LitepaperDocument10 pagesVCC LitepaperjuvriNo ratings yet

- Chinese Investments Employment Creation Algeria Egypt 2012 PDFDocument23 pagesChinese Investments Employment Creation Algeria Egypt 2012 PDFAbdul Wahab ZafarNo ratings yet

- Cao 1-2009 - Revised Rules For The Estab. of CBWDocument10 pagesCao 1-2009 - Revised Rules For The Estab. of CBWBertGeronMindanao100% (3)

- Blank Movable & ImmovableDocument3 pagesBlank Movable & ImmovableJyan DeuriNo ratings yet

- PAMB Medical Revision-35376814 PDFDocument9 pagesPAMB Medical Revision-35376814 PDFSoon SoonNo ratings yet