Professional Documents

Culture Documents

Week 10

Uploaded by

xinghe666Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 10

Uploaded by

xinghe666Copyright:

Available Formats

Week 10

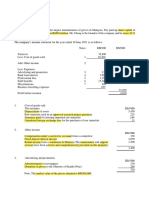

Question 1

GMT Sdn. Bhd., a Malaysian tax resident company, is engaged in the manufacture and sale of plastic

products. The paid up share capital of the company as at 1 January 2021 was RM2.6 million.

The company’s statement of profit or loss for the year ended 31 December 2021 is as follows:

Notes RM'000 RM'000

Turnover 1 4,800

Less: Cost of goods sold 2 2,100

2,700

Add: Other income 3 80

2,780

Less: Expenses

Depreciation 90

Bonus 70

Bad and doubtful debts 4 52

Compensation 5 20

Donations 6 75

Travelling and entertainment 7 60

Legal expenses 8 81

Repair and maintenance 9 145

Salaries and wages 10 745

Export credit insurance premium 11 25

Library facilities 12 120

Statutory audit fee 16

1,499

Profit before taxation 1,281

Notes:

1. Turnover

Turnover includes an unrealized gain from foreign exchange in respect of the sale of inventories

amounting to RM30,000.

2. Cost of goods sold

This includes the following:

RM’000

A provision for stock obsolescence 170

A provision for warranty 12

3. Other income

This comprises the following:

RM’000

Interest income in respect of late payment by trade receivables 50

Dividend income (single tier) 30

Question 1 (Continued)

4. Bad and doubtful debts (trade)

RM’000

Bad debts written-off during the year 18

Net increase in general provision 30

Net increase in specific provision 19

Bad debts recovered during the year* (15)

52

* It was not tax deductible when the amount was written off previously.

5. Compensation

Compensation paid to one of its distributors to terminate the contract.

6. Donations

The following donations were made:

RM’000

Cash donation to a political party 15

Donation in kind to an approved organization 60

75

7. Travelling and entertainment

Included entertainment allowances paid to marketing personnel of RM38,000.

8. Legal expenses

The expenses are related to the following:

RM’000

Obtaining a bank loan 40

Trading goods lost in transit 20

Renewal of a trading license 21

81

9. Repair and maintenance

RM’000

Renewal of wiring 45

Replacement of damaged tiles of the same quality 20

Extension of the factory building 80

145

10. Salaries and wages

RM’000

Salaries and allowances 700

Leave passage for a senior marketing manager to Sabah 15

Remuneration of disabled employee 30

745

Question 1 (Continued)

11. Export credit insurance premiums

The export credit insurance is provided by a company approved by the Ministry of Finance.

12. Library facilities

The amount was incurred in respect of providing library facilities which are accessible to the public.

13. Other information

Capital allowance for the year of assessment 2021 amounting to RM250,000.

Required:

(a) Compute the tax payable by GMT Sdn. Bhd. for the year of assessment 2021. You are to indicate

‘nil’ in your computation for every item that does not require any tax adjustment. (17 marks)

(b) Explain the tax treatment for each of the items in Notes 3, 5, 11 and 12. (8 marks)

[Total: 25 marks]

Question 2

SSB Sdn. Bhd. purchased the following assets during its financial year ended 30 June 2021:

RM’000

A heavy machine, costing: 120

Cost of alteration of building to install the machine 60

Total cost incurred 180

A heavy machine, costing: 110

Cost of levelling land to prepare a site to install the machine 10

Total cost incurred 120

Note: The annual allowance rate for heavy machine is 20%.

Required:

(a) “Only a tax resident company is entitled to claim capital allowances”.

Comment on this statement. (4 marks)

(b) Compute the capital allowances and tax written down value for both machines for the year of

assessment 2014.

(c) Explain the tax treatments for the following situations:

(i) Asset owned for less than 2 years; (3 marks)

(ii) Non-commercial vehicles; (3 marks)

(iii) Hire purchase instalment payments. (2 marks)

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sunway T4 (TX4014) - Tax Computation (Business Income)Document4 pagesSunway T4 (TX4014) - Tax Computation (Business Income)Ee LynnNo ratings yet

- Week 11QDocument3 pagesWeek 11Qxinghe666No ratings yet

- Example 2Document4 pagesExample 2Raudhatun Nisa'No ratings yet

- W13 Corporate TaxDocument4 pagesW13 Corporate TaxCC HOD AHOD W-Week 2020No ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Tutorial 2: Swedish CompanyDocument5 pagesTutorial 2: Swedish Companyszh saNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Accounting 621Document2 pagesAccounting 621Sarah Precious NkoanaNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Final Accounts of Banking Companies Problems and SolutionsDocument27 pagesFinal Accounts of Banking Companies Problems and Solutionsmy Vinay96% (57)

- CSOCF Acquisition Both Methods Malim Nawar BHDDocument7 pagesCSOCF Acquisition Both Methods Malim Nawar BHDSyafahani SafieNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Ch.6-Tutorial 1Document3 pagesCh.6-Tutorial 1NURSABRINA BINTI ROSLI (BG)No ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Sunway T3 (TX4014) Tax Computation 2020Document3 pagesSunway T3 (TX4014) Tax Computation 2020Ee LynnNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- ACCT 101 - Assignment Question (13861)Document5 pagesACCT 101 - Assignment Question (13861)Aneziwe ShangeNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Practice Problem 7.0Document4 pagesPractice Problem 7.0Paw VerdilloNo ratings yet

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Document3 pagesQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNo ratings yet

- Business Income TutorialDocument5 pagesBusiness Income TutorialzulfikriNo ratings yet

- Chapter 8 - Tutorial IDocument6 pagesChapter 8 - Tutorial INUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Jun 2019 QDocument9 pagesJun 2019 Qsiti dalinaNo ratings yet

- Q10 Namib LimitedDocument2 pagesQ10 Namib Limitedamosmalusi5No ratings yet

- Bnaking Profit and Loss Account 1Document12 pagesBnaking Profit and Loss Account 1madhumathi100% (1)

- FAR1 ASN01 Balance Sheet and Income Statement PDFDocument1 pageFAR1 ASN01 Balance Sheet and Income Statement PDFira concepcionNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Assignment ACC506 Mac-Jun 2017Document16 pagesAssignment ACC506 Mac-Jun 2017Syahmi AhmadNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 2 Numericals of Schedule 3 For PracticeDocument3 pages2 Numericals of Schedule 3 For PracticeAchyut AwasthiNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- Far110 Group Assignment 2Document7 pagesFar110 Group Assignment 21ANurul AnisNo ratings yet

- Assignment 1Document2 pagesAssignment 1Triila manillaNo ratings yet

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- Solution in Partnership Liquidation InstallmentDocument20 pagesSolution in Partnership Liquidation InstallmentNikki GarciaNo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- Amended - Final - Unit 5 - AAB-Accounting Principles - A2Document6 pagesAmended - Final - Unit 5 - AAB-Accounting Principles - A2Quang MinhNo ratings yet

- Statement of Comprehensive Income RM RMDocument11 pagesStatement of Comprehensive Income RM RMKashveena BathmanathanNo ratings yet

- Solution Fin Accting FundamentalsDocument7 pagesSolution Fin Accting Fundamentalsabhaymvyas1144No ratings yet

- Accpro 12 CDocument6 pagesAccpro 12 CShubhamNo ratings yet

- T8 Financial Strategy III (Suggested Answers)Document3 pagesT8 Financial Strategy III (Suggested Answers)xinghe666No ratings yet

- Week 4Document27 pagesWeek 4xinghe666No ratings yet

- Week 2Document41 pagesWeek 2xinghe666No ratings yet

- Week 7Document3 pagesWeek 7xinghe666No ratings yet

- LiabilitiesDocument21 pagesLiabilitieschokieNo ratings yet

- Pranjali Soni Industrial Training ReportDocument26 pagesPranjali Soni Industrial Training ReportPIYUSH PANDYANo ratings yet

- Icici PruDocument1 pageIcici PruPraveen KumarNo ratings yet

- Bana WaxDocument25 pagesBana WaxHababes Sotelo SolomonNo ratings yet

- Ang Giok Chip V Springfield Fire & Marine InsuranceDocument4 pagesAng Giok Chip V Springfield Fire & Marine InsuranceKatrina Mae MagallanesNo ratings yet

- APP Form Mabuhay AccommodationDocument3 pagesAPP Form Mabuhay AccommodationJhelen De LeonNo ratings yet

- 001 G.R. No. L-15895 Enriquez V Sun LifeDocument3 pages001 G.R. No. L-15895 Enriquez V Sun LifeWilbert ChongNo ratings yet

- Workmen Compensatio Policy - PFDDocument9 pagesWorkmen Compensatio Policy - PFDPlanning DAPLNo ratings yet

- Artex Development Co. Vs Wellington Insurance Co.Document1 pageArtex Development Co. Vs Wellington Insurance Co.thornapple25No ratings yet

- How Artificial Intelligence Is Shaping The Insurance IndustryDocument4 pagesHow Artificial Intelligence Is Shaping The Insurance Industry123I4 Fozia Murtaza-M2No ratings yet

- Business Finance Chapter 1Document23 pagesBusiness Finance Chapter 1Cresca Cuello Castro100% (1)

- CIR v. Lincoln Philippines - G.R. No. 119176Document5 pagesCIR v. Lincoln Philippines - G.R. No. 119176Ash SatoshiNo ratings yet

- Corporate Business RiskDocument30 pagesCorporate Business RiskCinthyaNo ratings yet

- Excess and Surplus Lines Laws in The United States - 2018 PDFDocument154 pagesExcess and Surplus Lines Laws in The United States - 2018 PDFJosué Chávez CastellanosNo ratings yet

- Risk and InsuranceDocument63 pagesRisk and InsuranceGuruKPO100% (2)

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- What To Do After Admission For Freemover StudentsDocument34 pagesWhat To Do After Admission For Freemover StudentsKunchur NarayanNo ratings yet

- Workday HCM UserGuide PDFDocument166 pagesWorkday HCM UserGuide PDFDebayan Ray100% (7)

- 11-13-13 EditionDocument28 pages11-13-13 EditionSan Mateo Daily JournalNo ratings yet

- LifeInsur E311 2022 10 9EDDocument312 pagesLifeInsur E311 2022 10 9EDEldho GeorgeNo ratings yet

- Wa0005.Document3 pagesWa0005.Zk insorence PointNo ratings yet

- Acc 106 P3 LessonDocument6 pagesAcc 106 P3 LessonRowella Mae VillenaNo ratings yet

- Kerangka Kerja Dan Proses Manajemen RisikoDocument16 pagesKerangka Kerja Dan Proses Manajemen RisikoKL RSUDNo ratings yet

- Sotheby's Terms and ConditionsDocument7 pagesSotheby's Terms and ConditionsThomas CheungNo ratings yet

- Commercial Roofing Help EbookDocument22 pagesCommercial Roofing Help EbookChoice Roof Contractor Group100% (1)

- PCSI vs. RamoleteDocument2 pagesPCSI vs. RamoletePreciousNo ratings yet

- Corporate Governance and The Role of Institutional InvestorsDocument47 pagesCorporate Governance and The Role of Institutional InvestorsSaritaMeenaNo ratings yet

- HSB Construction Insurance Annual ROIDocument22 pagesHSB Construction Insurance Annual ROIМирослав НевидовчићNo ratings yet

- New Employee OrientationDocument58 pagesNew Employee OrientationGobin AndyNo ratings yet

- Ocom@insurance Gov PHDocument5 pagesOcom@insurance Gov PHCat DacioNo ratings yet