Professional Documents

Culture Documents

Illustration Qbdjmahpyvluq

Illustration Qbdjmahpyvluq

Uploaded by

BLOODY ASHHEROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration Qbdjmahpyvluq

Illustration Qbdjmahpyvluq

Uploaded by

BLOODY ASHHERCopyright:

Available Formats

19-10-2022

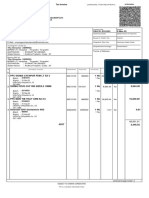

Quote No : qbdjmahpyvluq,Application No : 1100075574581

Benefit Illustration for HDFC Life Sanchay Par Advantage

This illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Par Advantage

Age is taken as on last birthday Proposal No:

Name of the Prospect /Policy holder: SUNIL KUMAR Name of the Product: HDFC Life Sanchay Par Advantage

Age: 36 A Non-Linked, Participating,

Tag Line:

Life Insurance Plan

Name of the Life Assured: SUNIL KUMAR

Unique Identification No: 101N136V02

Age: 36

GST Rate: 4.5% for first year

Policy Term 25 year(s)

2.25% second year onwards

Premium Payment Term: 12 year(s)

Amount of Installment Premium(Without GST): 45000

Mode of Payment of Premium: Annual

Mode of Payment of Survival Benefit: Annual

How to read and understand this benefit illustration?

This benefit illustration is intended to show year wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

Policy Details

Policy Option Immediate Income Sum Assured on Maturity Rs. 5,40,000

Sum Assured on Death (at inception

Bonus Type Cash Bonus 5,40,000

of the policy) Rs.

Premium Summary

Base CI IB Total Installment

PP Rider (PAC) PP Rider (ADC) PP Rider (CC)

Plan Rider Rider Premium

Instalment Premium without GST 45000 0 0 0 0 0 45000

Instalment Premium with First Year GST 47025 0 0 0 0 0 47025

Instalment Premium with GST 2nd Year

46013 0 0 0 0 0 46013

Onwards

(Amounts in Rupees.)

Total Benefits

Non Guaranteed Non-Guaranteed including Guaranteed and Non-Guaranteed Benefits

Guaranteed Benefits

Benefits @ 4% p.a. Benefits @ 8% p.a.

Maturity Benefit Death Benefit Surrender Benefit

Total Total

Single / Total Total Total Total

Policy Death Death

Annualized Maturity Maturity Surrender Surrender

Year Benefit Benefit

Premium Benefit, Benefit, Benefit Benefit

Survival Surrender Death Maturity Cash Surrender Cash Surrender incl of incl of

GA RB RB incl TB, incl TB, incl of TB, incl of TB,

Benefit Benefit# Benefit Benefit Bonus Benefit# Bonus Benefit# TB, if TB, if

if any, @ if any, @ if any, @ if any, @

any, @ any, @

4% 8% 4% 8%

4% 8%

(7+TB) (7+TB) (5+10) (5+13)

(6+TB) (6+TB)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

1 45,000 0 0 0 5,40,000 0 0 11,025 0 0 17,550 0 0 0 5,40,000 5,40,000 0 0

2 45,000 0 0 27,000 5,40,000 0 0 11,025 4,500 0 17,550 10,350 0 0 5,40,000 5,40,000 31,500 37,350

3 45,000 0 0 47,250 5,40,000 0 0 11,025 9,450 0 17,550 22,950 0 0 5,40,000 5,40,000 56,700 70,200

4 45,000 0 0 90,000 5,40,000 0 0 11,025 9,000 0 17,550 13,500 0 0 5,40,000 5,40,000 99,000 1,03,500

5 45,000 0 0 1,12,500 5,40,000 0 0 11,025 11,250 0 17,550 28,800 0 0 5,40,000 5,40,000 1,23,750 1,41,300

6 45,000 0 0 1,35,000 5,40,000 0 0 11,025 25,650 0 17,550 49,950 0 0 5,40,000 5,40,000 1,60,650 1,84,950

7 45,000 0 0 1,57,500 5,40,000 0 0 11,025 48,150 0 17,550 76,950 0 0 5,40,000 5,40,000 2,05,650 2,34,450

8 45,000 0 0 2,08,800 5,40,000 0 0 11,025 47,700 0 17,550 81,450 0 0 5,40,000 5,40,000 2,56,500 2,90,250

9 45,000 0 0 2,63,250 5,40,000 0 0 11,025 49,950 0 17,550 90,450 0 0 5,40,000 5,40,000 3,13,200 3,53,700

10 45,000 0 0 3,28,500 5,40,000 0 0 11,025 47,700 0 17,550 96,300 0 0 5,40,000 5,40,000 3,76,200 4,24,800

11 45,000 0 0 3,96,000 5,40,000 0 0 11,025 49,950 0 17,550 1,09,350 0 0 5,40,000 5,40,000 4,45,950 5,05,350

12 45,000 0 0 4,86,000 5,67,000 0 0 11,025 36,450 0 17,550 1,09,350 0 0 5,67,000 5,67,000 5,22,450 5,95,350

13 0 0 0 4,86,000 5,67,000 0 0 11,025 50,850 0 17,550 1,38,600 0 0 5,67,000 5,67,000 5,36,850 6,24,600

14 0 0 0 4,86,000 5,67,000 0 0 11,025 64,800 0 17,550 1,68,750 0 0 5,67,000 5,67,000 5,50,800 6,54,750

15 0 0 0 4,86,000 5,67,000 0 0 11,025 79,200 0 17,550 1,99,800 0 0 5,67,000 5,67,000 5,65,200 6,85,800

16 0 0 0 4,86,000 5,67,000 0 0 11,025 1,16,100 0 17,550 2,56,050 0 0 5,67,000 5,67,000 6,02,100 7,42,050

17 0 0 0 4,86,000 5,67,000 0 0 11,025 1,30,500 0 17,550 2,90,250 0 0 5,67,000 5,67,000 6,16,500 7,76,250

18 0 0 0 4,86,000 5,67,000 0 0 11,025 1,45,350 0 17,550 3,25,350 0 0 5,67,000 5,67,000 6,31,350 8,11,350

19 0 0 0 4,86,000 5,67,000 0 0 11,025 1,59,750 0 17,550 3,62,250 0 0 5,67,000 5,67,000 6,45,750 8,48,250

20 0 0 0 4,86,000 5,67,000 0 0 11,025 1,74,600 0 17,550 4,00,500 0 0 5,67,000 5,67,000 6,60,600 8,86,500

21 0 0 0 4,86,000 5,67,000 0 0 11,025 1,89,450 0 17,550 4,40,100 0 0 5,67,000 5,67,000 6,75,450 9,26,100

22 0 0 0 4,86,000 5,67,000 0 0 11,025 2,04,300 0 17,550 4,81,950 0 0 5,67,000 5,81,850 6,90,300 9,67,950

23 0 0 0 4,86,000 5,67,000 0 0 11,025 2,19,150 0 17,550 5,25,150 0 0 5,67,000 6,07,950 7,05,150 10,11,150

24 0 0 0 4,86,000 5,67,000 0 0 11,025 2,34,000 0 17,550 5,70,600 0 0 5,67,000 6,35,850 7,20,000 10,56,600

25 0 0 0 0 5,67,000 5,40,000 0 11,025 0 0 17,550 0 5,40,000 6,82,200 5,67,000 7,00,650 0 0

Notes:

1. Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax. Refer Sales

Literature for explanation of terms used in this illustration.

2. The survival benefits are payable at the end of the policy year. Upon payment at Maturity(Last Payout), the policy terminates and no further benefits become payable.

3. The death benefits shown above are at the end of the year. Upon payment, of death benefit the policy terminates and no further benefit is payable.

4. The surrender benefits shown above are at the end of the year. Upon payment of surrender benefit, the policy terminates and no further benefit becomes payable.

5. The Premium and the Sum Assured on Maturity stated above is based on the information provided. They may vary as a result of underwriting.

6. Any statutory levy or charges (such as Goods and Service tax) including any indirect tax may be charged to the Policyholder either now or in future by the company and such

amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to payment of premium.

7. RB - Reversionary Bonus, TB - Terminal Bonus, GA - Guaranteed Additions

#In case cash bonuses have been paid out, the same shall be deducted from the Surrender Values indicated, at the time of pay out.

I PINTU KUMAR PANDIT, have explained the premiums charges and benefits under I SUNIL KUMAR,having received the information with respect to the above, have

the product fully to the prospect / policy holder. understood the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- IRS Recognition LetterDocument2 pagesIRS Recognition LetterSpartanEconNo ratings yet

- I62359021500004RPOSDocument3 pagesI62359021500004RPOSvishesh mishraNo ratings yet

- CPAR Income Tax of Corporations (Batch 93) - HandoutDocument41 pagesCPAR Income Tax of Corporations (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- Closing A Business in The PhilippinesDocument7 pagesClosing A Business in The PhilippinesWen ChiNo ratings yet

- Cagayan Electric v. CIR (1985) Case DigestDocument2 pagesCagayan Electric v. CIR (1985) Case DigestShandrei GuevarraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration - 2023-07-12T192907.748Document2 pagesIllustration - 2023-07-12T192907.748abinashsekharmishra1No ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationbrijesh.trivedi89No ratings yet

- Illustration - 2023-11-04T171018.610Document2 pagesIllustration - 2023-11-04T171018.610bakavoNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- How To Read and Understand This Benefit Illustration?: Proposal NoDocument2 pagesHow To Read and Understand This Benefit Illustration?: Proposal NoDINESH JYOTHINo ratings yet

- Illustration - 2022-10-11T115742.458Document3 pagesIllustration - 2022-10-11T115742.458BLOODY ASHHERNo ratings yet

- Illustration Qbxt9qkqiyoe8Document3 pagesIllustration Qbxt9qkqiyoe8mr copy xeroxNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Sanchay Par Advantage - Deferred IncomeDocument3 pagesSanchay Par Advantage - Deferred Incomesushant KumarNo ratings yet

- Hdfc-Illustration - 2022-09-09T113844.627Document3 pagesHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- Illustration - 2022-11-03T115112.732Document3 pagesIllustration - 2022-11-03T115112.732BLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationNiranjan LenkaNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- IllustrationDocument3 pagesIllustrationlosssssssssNo ratings yet

- Illustration - 2022-10-15T114040.772Document3 pagesIllustration - 2022-10-15T114040.772BLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Sandeep Pension PlanDocument3 pagesSandeep Pension PlanShruti SrivastavaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- IllustrationDocument2 pagesIllustrationShambhu RaulNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantagekesk32No ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- Illustration - 2023-07-12T192421.647Document2 pagesIllustration - 2023-07-12T192421.647abinashsekharmishra1No ratings yet

- IllustrationDocument2 pagesIllustrationapallover72No ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income Plansumit_22inNo ratings yet

- Illustration - 2022-03-17T111744.362Document2 pagesIllustration - 2022-03-17T111744.362shubham gaundNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Illustration 5Document2 pagesIllustration 5Phanindra GaddeNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Charts For An Income StatementDocument4 pagesCharts For An Income Statementapi-354584521No ratings yet

- ModuleDocument6 pagesModuledennissabalberinojrNo ratings yet

- Satyam Sudan: Offer LetterDocument2 pagesSatyam Sudan: Offer LetterssattyyaammNo ratings yet

- 1 Collector V Fisher DigestDocument4 pages1 Collector V Fisher DigestLadybird MngtNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- 2015 P T D (TribDocument28 pages2015 P T D (TribShafeyAliKhanNo ratings yet

- A STUDY OF PERCEPTION OF TAXPAYERS TOWARDS NewDocument41 pagesA STUDY OF PERCEPTION OF TAXPAYERS TOWARDS NewVijaykumar ChalwadiNo ratings yet

- Section 45B of GST 1990Document1 pageSection 45B of GST 1990786_haiderNo ratings yet

- LTA Declaration FormDocument1 pageLTA Declaration FormRavi Kumar0% (1)

- Cta Eb CV 01441 D 2017nov16 AssDocument32 pagesCta Eb CV 01441 D 2017nov16 AssLarry Tobias Jr.No ratings yet

- PWC Presenation On Double Tax Treaty Oct 1 2009Document29 pagesPWC Presenation On Double Tax Treaty Oct 1 2009Srini KalyanaramanNo ratings yet

- Inv 2433Document8 pagesInv 2433adarsh pagidiNo ratings yet

- PROINV4031 - CP PlasticsDocument1 pagePROINV4031 - CP PlasticsEms ZiyambeNo ratings yet

- L314 FPD 1 2020 2Document7 pagesL314 FPD 1 2020 2OBERT CHIBUYENo ratings yet

- 1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)Document5 pages1st Semester Transfer Taxation Long Quiz No. 01 (2nd Set)James ScoldNo ratings yet

- Invoice 1Document1 pageInvoice 1Rajan KMRNo ratings yet

- Invoice Emergency LightDocument1 pageInvoice Emergency LightAyush BhartiNo ratings yet

- DR Rao's Ent Super Speciality Hospital KPHB: 115-034014-00 SP1 Guide Rail Assembly 20,160 90189099Document1 pageDR Rao's Ent Super Speciality Hospital KPHB: 115-034014-00 SP1 Guide Rail Assembly 20,160 90189099noore rabbaniNo ratings yet

- Bpi Pera FaqDocument7 pagesBpi Pera FaqHana DumpayanNo ratings yet

- Limitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Document9 pagesLimitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Taxpert Professionals Private LimitedNo ratings yet

- 78940-SDL Attendance and LearningDocument21 pages78940-SDL Attendance and Learningprc.zamboanga.regulationcpdNo ratings yet

- VAT Registration Certificate On 31.MAR.2023Document1 pageVAT Registration Certificate On 31.MAR.2023Vishnu VNo ratings yet

- Final Black Book ProjectDocument53 pagesFinal Black Book ProjectHamzah ShaikhNo ratings yet

- Franchise Model CafeDocument1 pageFranchise Model Caferatna sawantNo ratings yet