Professional Documents

Culture Documents

AHTN2022 CHAPTER96 wNOTES

Uploaded by

doookaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AHTN2022 CHAPTER96 wNOTES

Uploaded by

doookaCopyright:

Available Formats

646

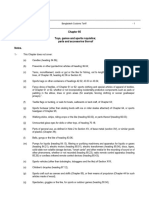

Chapter 96

Miscellaneous manufactured articles

E

Notes.

1. This Chapter does not cover :

(a) Pencils for cosmetic or toilet uses (Chapter 33);

NC

(b) Articles of Chapter 66 (for example, parts of umbrellas or walking-sticks);

(c) Imitation jewellery (heading 71.17);

(d) Parts of general use, as defined in Note 2 to Section XV, of base metal (Section XV), or

similar goods of plastics (Chapter 39);

(e) Cutlery or other articles of Chapter 82 with handles or other parts of carving or moulding

materials; heading 96.01 or 96.02 applies, however, to separately presented handles or

other parts of such articles;

(f) Articles of Chapter 90 (for example, spectacle frames (heading 90.03), mathematical

drawing pens (heading 90.17), brushes of a kind specialised for use in dentistry or for

medical, surgical or veterinary purposes (heading 90.18));

RE

(g) Articles of Chapter 91 (for example, clock or watch cases);

(h) Musical instruments or parts or accessories thereof (Chapter 92);

(ij) Articles of Chapter 93 (arms and parts thereof);

(k) Articles of Chapter 94 (for example, furniture, luminaires and lighting fittings);

(l) Articles of Chapter 95 (toys, games, sports requisites); or

(m) Works of art, collectors’ pieces or antiques (Chapter 97).

2. In heading 96.02 the expression “vegetable or mineral carving material” means :

(a) Hard seeds, pips, hulls and nuts and similar vegetable materials of a kind used for carving

(for example, corozo and dom);

FE

(b) Amber, meerschaum, agglomerated amber and agglomerated meerschaum, jet and mineral

substitutes for jet.

3. In heading 96.03 the expression “prepared knots and tufts for broom or brush making” applies

only to unmounted knots and tufts of animal hair, vegetable fibre or other material, which are

ready for incorporation without division in brooms or brushes, or which require only such further

minor processes as trimming to shape at the top, to render them ready for such incorporation.

4. Articles of this Chapter, other than those of headings 96.01 to 96.06 or 96.15, remain classified

in the Chapter whether or not composed wholly or partly of precious metal or metal clad with

RE

precious metal, of natural or cultured pearls, or precious or semi-precious stones (natural,

synthetic or reconstructed). However, headings 96.01 to 96.06 and 96.15 include articles in

which natural or cultured pearls, precious or semi-precious stones (natural, synthetic or

reconstructed), precious metal or metal clad with precious metal constitute only minor

constituents.

R

FO

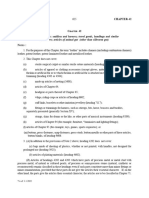

647

Rates of Duty (%)

ASEAN Member

Hdg. AHTN 2022 MFN

Description States Enjoying

E

No. Code ATIGA Concession

Starting

2022

(1) (2) (3) (4) (5) (6)

NC

96.01 Worked ivory, bone, tortoise-shell, horn, antlers,

coral, mother-of-pearl and other animal carving

material, and articles of these materials (including

articles obtained by moulding).

9601.10 - Worked ivory and articles of ivory :

9601.10.10 - - Cigar or cigarette cases, tobacco jars; ornamental 3 0 Except LA.

articles

9601.10.90 - - Other 3 0 Except LA.

9601.90 - Other :

- - Worked mother-of-pearl or tortoise-shell and articles of

RE

the foregoing :

9601.90.11 - - - Cigar or cigarette cases, tobacco jars; ornamental 7 0 All.

articles

9601.90.12 - - - Pearl nucleus 7 0 All.

9601.90.19 - - - Other 7 0 All.

- - Worked capiz shells and articles of the foregoing :

9601.90.21 - - - Ornamental articles 7 0 Except LA.

9601.90.29 - - - Other 7 0 Except LA.

- - Other :

FE

9601.90.91 - - - Cigar or cigarette cases, tobacco jars; ornamental 7 0 Except LA.

articles

9601.90.99 - - - Other 7 /j 0 Except LA.

96.02 Worked vegetable or mineral carving material and

articles of these materials; moulded or carved articles

of wax, of stearin, of natural gums or natural resins or

of modelling pastes, and other moulded or carved

articles, not elsewhere specified or included; worked,

unhardened gelatin (except gelatin of heading 35.03)

RE

and articles of unhardened gelatin.

9602.00.10 - Gelatin capsules for pharmaceutical products 3 0 All.

9602.00.20 - Cigar or cigarette cases, tobacco jars; ornamental 5 0 All.

articles

9602.00.90 - Other 5 0 All.

96.03 Brooms, brushes (including brushes constituting

parts of machines, appliances or vehicles), hand-

operated mechanical floor sweepers, not motorised,

mops and feather dusters; prepared knots and tufts

for broom or brush making; paint pads and rollers;

squeegees (other than roller squeegees).

R

9603.10 - Brooms and brushes, consisting of twigs or other

vegetable materials bound together, with or without

handles :

9603.10.10 - - Brushes 10 0 All.

9603.10.20 - - Brooms 10 0 All.

FO

- Tooth brushes, shaving brushes, hair brushes, nail

brushes, eyelash brushes and other toilet brushes for

use on the person, including such brushes constituting

parts of appliances :

9603.21.00 - - Tooth brushes, including dental-plate brushes 10 0 All.

9603.29.00 - - Other 10 0 All.

9603.30.00 - Artists’ brushes, writing brushes and similar brushes for 3 0 All.

the application of cosmetics

648

Rates of Duty (%)

ASEAN Member

Hdg. AHTN 2022 MFN

Description States Enjoying

E

No. Code ATIGA Concession

Starting

2022

(1) (2) (3) (4) (5) (6)

9603.40.00 - Paint, distemper, varnish or similar brushes (other than 7 0 All.

NC

brushes of subheading 9603.30); paint pads and rollers

9603.50.00 - Other brushes constituting parts of machines, appliances 1 /j 0 All.

or vehicles

9603.90 - Other :

9603.90.10 - - Prepared knots and tufts for broom or brush making 3 0 All.

9603.90.20 - - Hand-operated mechanical floor sweepers, not 7 0 All.

motorised

9603.90.40 - - Other brushes 7 0 All.

9603.90.90 - - Other 7 0 All.

RE

96.04 Hand sieves and hand riddles.

9604.00.10 - Of metal 3 0 All.

9604.00.90 - Other 3 0 All.

96.05 9605.00.00 Travel sets for personal toilet, sewing or shoe or 7 0 All.

clothes cleaning.

96.06 Buttons, press-fasteners, snap-fasteners and press-

studs, button moulds and other parts of these

FE

articles; button blanks.

9606.10 - Press-fasteners, snap-fasteners and press-studs and

parts therefor :

9606.10.10 - - Of plastics 10 0 All.

9606.10.90 - - Other 10 0 All.

- Buttons :

9606.21.00 - - Of plastics, not covered with textile material 5 0 All.

9606.22.00 - - Of base metal, not covered with textile material 5 0 All.

9606.29.00 - - Other 5 0 All.

RE

9606.30 - Button moulds and other parts of buttons; button blanks :

9606.30.10 - - Of plastics 5 0 All.

9606.30.90 - - Other 5 0 All.

96.07 Slide fasteners and parts thereof.

- Slide fasteners :

9607.11.00 - - Fitted with chain scoops of base metal 5 0 All.

9607.19.00 - - Other 5 0 All.

9607.20.00 - Parts 1 0 All.

R

96.08 Ball point pens; felt tipped and other porous-tipped

pens and markers; fountain pens, stylograph pens

and other pens; duplicating stylos; propelling or

sliding pencils; pen-holders, pencil-holders and

similar holders; parts (including caps and clips) of the

foregoing articles, other than those of heading 96.09.

FO

9608.10 - Ball point pens :

9608.10.10 - - Having a body mainly of plastics 7 0 All.

9608.10.90 - - Other 7 0 All.

9608.20.00 - Felt tipped and other porous-tipped pens and markers 7 0 All.

9608.30 - Fountain pens, stylograph pens and other pens :

9608.30.20 - - Fountain pens 5 0 All.

9608.30.90 - - Other 5 0 All.

9608.40.00 - Propelling or sliding pencils 3 0 All.

649

Rates of Duty (%)

ASEAN Member

Hdg. AHTN 2022 MFN

Description States Enjoying

E

No. Code ATIGA Concession

Starting

2022

(1) (2) (3) (4) (5) (6)

9608.50.00 - Sets of articles from two or more of the foregoing 5 0 All.

NC

subheadings

9608.60 - Refills for ball point pens, comprising the ball point and

ink-reservoir :

9608.60.10 - - Of plastics 5 0 All.

9608.60.90 - - Other 5 0 All.

- Other :

9608.91 - - Pen nibs and nib points :

9608.91.10 - - - Of gold or gold-plated 1 0 All.

9608.91.90 - - - Other 1 0 All.

9608.99 - - Other :

RE

9608.99.10 - - - Duplicating stylos 1 0 All.

- - - Other :

9608.99.91 - - - - Parts of ball point pens, of plastics 1 0 All.

9608.99.99 - - - - Other 1 0 All.

96.09 Pencils (other than pencils of heading 96.08),

crayons, pencil leads, pastels, drawing charcoals,

writing or drawing chalks and tailors’ chalks.

9609.10 - Pencils and crayons, with leads encased in a sheath :

FE

9609.10.10 - - Black pencils 7 0 All.

9609.10.90 - - Other 7 0 All.

9609.20.00 - Pencil leads, black or coloured 3 0 All.

9609.90 - Other :

9609.90.10 - - Slate pencils for school slates 5 0 All.

9609.90.30 - - Pencils and crayons other than those of subheading 5 0 All.

9609.10

- - Other :

RE

9609.90.91 - - - Writing or drawing chalks 5 0 All.

9609.90.99 - - - Other 5 0 All.

96.10 Slates and boards, with writing or drawing surfaces,

whether or not framed.

9610.00.10 - School slates 5 0 All.

9610.00.90 - Other 5 0 All.

96.11 9611.00.00 Date, sealing or numbering stamps, and the like 5 0 All.

(including devices for printing or embossing labels),

designed for operating in the hand; hand-operated

composing sticks and hand printing sets

R

incorporating such composing sticks.

96.12 Typewriter or similar ribbons, inked or otherwise

prepared for giving impressions, whether or not on

spools or in cartridges; ink-pads, whether or not

FO

inked, with or without boxes.

9612.10 - Ribbons :

9612.10.10 - - Of textile fabric 1 0 All.

9612.10.90 - - Other 1 0 All.

9612.20.00 - Ink-pads 7 0 All.

96.13 Cigarette lighters and other lighters, whether or not

mechanical or electrical, and parts thereof other than

flints and wicks.

650

Rates of Duty (%)

ASEAN Member

Hdg. AHTN 2022 MFN

Description States Enjoying

E

No. Code ATIGA Concession

Starting

2022

(1) (2) (3) (4) (5) (6)

9613.10 - Pocket lighters, gas fuelled, non-refillable :

NC

9613.10.10 - - Of plastics 10 0 All.

9613.10.90 - - Other 10 0 All.

9613.20 - Pocket lighters, gas fuelled, refillable :

9613.20.10 - - Of plastics 10 0 All.

9613.20.90 - - Other 10 0 All.

9613.80 - Other lighters :

9613.80.10 - - Piezo-electric lighters for stoves and ranges 3 0 All.

9613.80.20 - - Cigarette lighters or table lighters, of plastics 10 0 All.

9613.80.30 - - Cigarette lighters or table lighters, other than of plastics 10 0 All.

RE

9613.80.90 - - Other 10 0 All.

9613.90 - Parts :

9613.90.10 - - Refillable cartridges or other receptacles, which 5 0 All.

constitute parts of mechanical lighters, containing

liquid fuel or liquefied gases

9613.90.90 - - Other 5 0 All.

96.14 Smoking pipes (including pipe bowls) and cigar or

cigarette holders, and parts thereof.

9614.00.10 - Roughly shaped blocks of wood or root for the 5 0 All.

FE

manufacture of pipes

9614.00.90 - Other 10 0 All.

96.15 Combs, hair-slides and the like; hair pins, curling

pins, curling grips, hair-curlers and the like, other

than those of heading 85.16, and parts thereof.

- Combs, hair-slides and the like :

9615.11 - - Of hard rubber or plastics :

RE

9615.11.20 - - - Of hard rubber 15 0 All.

9615.11.30 - - - Of plastics 15 0 All.

9615.19.00 - - Other 15 0 All.

9615.90 - Other :

- - Decorative hair pins :

9615.90.11 - - - Of aluminium 7 0 All.

9615.90.12 - - - Of iron or steel 7 0 All.

9615.90.13 - - - Of plastics 7 0 All.

9615.90.19 - - - Other 7 0 All.

- - Parts :

9615.90.21 - - - Of plastics 3 /j 0 All.

R

9615.90.22 - - - Of iron or steel /j 0 All.

3

9615.90.23 - - - Of aluminium 3 /j 0 All.

9615.90.29 - - - Other 3 /j 0 All.

- - Other :

FO

9615.90.91 - - - Of aluminium 7 0 All.

9615.90.92 - - - Of iron or steel 7 0 All.

9615.90.93 - - - Of plastics 7 0 All.

9615.90.99 - - - Other 7 0 All.

96.16 Scent sprays and similar toilet sprays, and mounts

and heads therefor; powder-puffs and pads for the

application of cosmetics or toilet preparations.

651

Rates of Duty (%)

ASEAN Member

Hdg. AHTN 2022 MFN

Description States Enjoying

E

No. Code ATIGA Concession

Starting

2022

(1) (2) (3) (4) (5) (6)

9616.10 - Scent sprays and similar toilet sprays, and mounts and

NC

heads therefor :

9616.10.10 - - Scent sprays and similar toilet sprays 7 0 All.

9616.10.20 - - Mounts and heads 3 0 All.

9616.20.00 - Powder-puffs and pads for the application of cosmetics 7 0 All.

or toilet preparations

96.17 Vacuum flasks and other vacuum vessels, complete;

parts thereof other than glass inners.

9617.00.10 - Vacuum flasks and other vacuum vessels, complete 3 0 All.

9617.00.20 - Parts thereof, other than glass inners 3 0 All.

RE

96.18 9618.00.00 Tailors’ dummies and other lay figures; automata and 7 0 All.

other animated displays used for shop window

dressing.

96.19 Sanitary towels (pads) and tampons, napkins

(diapers), napkin liners and similar articles, of any

material.

- Disposable articles :

9619.00.11 - - With an absorbent core of wadding of textile materials 15 0 All.

FE

9619.00.12 - - Sanitary towels and tampons of paper, paper pulp, 7 0 All.

cellulose wadding or webs of cellulose fibres

9619.00.13 - - Baby napkins and pads for incontinence, of paper, 7 0 All.

paper pulp, cellulose wadding or webs of cellulose

fibres

9619.00.14 - - Other, of paper, paper pulp, cellulose wadding or webs 7 0 All.

of cellulose fibres

9619.00.19 - - Other 15 0 All.

- Other :

RE

9619.00.92 - - Sanitary towels (pads) 15 0 All.

9619.00.93 - - Other, knitted or crocheted 15 0 All.

9619.00.99 - - Other 15 0 All.

96.20 Monopods, bipods, tripods and similar articles.

9620.00.10 - Of plastics 15 0 All.

9620.00.20 - Of carbon and graphite 5 0 All.

9620.00.30 - Of iron and steel 15 0 All.

9620.00.40 - Of aluminium 15 0 All.

9620.00.50 - Of wood 10 0 All.

R

9620.00.90 - Other :

9620.00.90.100 - - For the machines of Chapter 84 7 0 All.

- - For the machines, appliances or instruments of

Chapter 90 :

9620.00.90.200 - - - For goods of heading 90.15 0 0 All.

FO

9620.00.90.300 - - - Other 3 0 All.

9620.00.90.900 - - Other 10 0 All.

________________________________________________________________________________________________

You might also like

- AHTN2017Document7 pagesAHTN2017OwiNo ratings yet

- Chapter 96aDocument7 pagesChapter 96aANNALENE OLITNo ratings yet

- Chapter 96Document19 pagesChapter 96Glevis AlvarezNo ratings yet

- Miscellaneous Manufactured Articles NotesDocument3 pagesMiscellaneous Manufactured Articles NotesSakib Ex-rccNo ratings yet

- AHTN2022 CHAPTER71 wNOTESDocument7 pagesAHTN2022 CHAPTER71 wNOTESdoookaNo ratings yet

- Pearls, Precious Stones and Metals ChapterDocument18 pagesPearls, Precious Stones and Metals ChapterRireNo ratings yet

- AHTN2022 CHAPTER97 wNOTESDocument3 pagesAHTN2022 CHAPTER97 wNOTESdoookaNo ratings yet

- Top Indonesian Imports to India by Value 2015-2016Document6 pagesTop Indonesian Imports to India by Value 2015-2016AnjaliNo ratings yet

- Articles of Stone, Plaster, Cement, Asbestos, Mica or Similar MaterialsDocument7 pagesArticles of Stone, Plaster, Cement, Asbestos, Mica or Similar MaterialsRK VelagacherlaNo ratings yet

- Section-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofDocument6 pagesSection-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofHema JoshiNo ratings yet

- AHTN2022 CHAPTER92 wNOTESDocument3 pagesAHTN2022 CHAPTER92 wNOTESdoookaNo ratings yet

- Section XX Chapter-95: ITC (HS), 2012 Schedule 1 - Import PolicyDocument6 pagesSection XX Chapter-95: ITC (HS), 2012 Schedule 1 - Import Policylahsivlahsiv684No ratings yet

- AHTN2022 CHAPTER95 wNOTESDocument5 pagesAHTN2022 CHAPTER95 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER94 wNOTESDocument6 pagesAHTN2022 CHAPTER94 wNOTESdoookaNo ratings yet

- CH 71Document10 pagesCH 71SomaSorrowNo ratings yet

- Chapter 952Document3 pagesChapter 952Istiaq XaowadNo ratings yet

- AHTN2022 CHAPTER69 wNOTESDocument4 pagesAHTN2022 CHAPTER69 wNOTESdoookaNo ratings yet

- SL Coustom Duty RatesDocument8 pagesSL Coustom Duty Ratesprasadi.ariyadasaNo ratings yet

- Chapter 71Document20 pagesChapter 71Kehra SongNo ratings yet

- Import Restrictions Imposed On Multiple Items RelaxedDocument12 pagesImport Restrictions Imposed On Multiple Items RelaxedDarshana SanjeewaNo ratings yet

- Section-XVIII Chapter-92: Musical Instruments Parts and Accessories of Such ArticlesDocument2 pagesSection-XVIII Chapter-92: Musical Instruments Parts and Accessories of Such ArticlesShahnawaz SiddiqueNo ratings yet

- CN 15 en 14Document5 pagesCN 15 en 14Toni D.No ratings yet

- Section Vi: Miscellaneous Chemical ProductsDocument28 pagesSection Vi: Miscellaneous Chemical ProductsRohini Rohan ShahNo ratings yet

- Chap 82Document7 pagesChap 82jawaharlaljain41No ratings yet

- Ahtn2017 Chapter94 Oct2017Document5 pagesAhtn2017 Chapter94 Oct2017Nova CastroNo ratings yet

- Other Base Metals Cermets Articles Thereof: Sub-Heading NoteDocument2 pagesOther Base Metals Cermets Articles Thereof: Sub-Heading NoteSakib Ex-rccNo ratings yet

- AHTN2022 CHAPTER68 wNOTESDocument5 pagesAHTN2022 CHAPTER68 wNOTESdoookaNo ratings yet

- HSN Code Schedule AlphaDocument38 pagesHSN Code Schedule AlphadineshknpNo ratings yet

- Section XII Chapter-66: ITC (HS), 2012 Schedule 1 - Import PolicyDocument1 pageSection XII Chapter-66: ITC (HS), 2012 Schedule 1 - Import PolicydkhatriNo ratings yet

- Imports and Exports (Control) Act, No. 1 of 1969: RegulationsDocument15 pagesImports and Exports (Control) Act, No. 1 of 1969: RegulationsShami MudunkotuwaNo ratings yet

- Chapter 6Document3 pagesChapter 6PC AdvisorsNo ratings yet

- Section-Vii Chapter-40: Rubber and Articles ThereofDocument11 pagesSection-Vii Chapter-40: Rubber and Articles ThereofRAFI T MNo ratings yet

- Customs Tariff - Schedule 96Document15 pagesCustoms Tariff - Schedule 96reme moNo ratings yet

- Chap 69Document6 pagesChap 69RK VelagacherlaNo ratings yet

- Chapter 95-1Document13 pagesChapter 95-1ribijaNo ratings yet

- Chapter 95Document13 pagesChapter 95Jason BryantNo ratings yet

- AHTN2022 CHAPTER25 wNOTESDocument6 pagesAHTN2022 CHAPTER25 wNOTESdoookaNo ratings yet

- Section Xiii: Ceramic ProductsDocument15 pagesSection Xiii: Ceramic ProductsmoodredNo ratings yet

- LEATHER PRODUCTS LISTDocument38 pagesLEATHER PRODUCTS LISTSaurabh SharmaNo ratings yet

- Chapter 903Document8 pagesChapter 903Zarzis RonyNo ratings yet

- Wood and Wood Charcoal Articles GuideDocument11 pagesWood and Wood Charcoal Articles GuideOwiNo ratings yet

- Miscellaneous chemical products overviewDocument16 pagesMiscellaneous chemical products overviewanil73No ratings yet

- CH 26Document5 pagesCH 26dkhatri01No ratings yet

- Section-Ix Chapter-44: Wood and Articles of Wood Wood CharcoalDocument14 pagesSection-Ix Chapter-44: Wood and Articles of Wood Wood CharcoalShaivik SharmaNo ratings yet

- Vat Commodity Code Schedule WiseDocument34 pagesVat Commodity Code Schedule Wiseseetharaman_63100% (2)

- Bangladesh Customs Tariff Chapter on Ores, Slag and AshDocument2 pagesBangladesh Customs Tariff Chapter on Ores, Slag and AshSakib Ex-rccNo ratings yet

- PCT & HS CodesDocument7 pagesPCT & HS CodesAsad IsmailNo ratings yet

- Trade May Tables 2021 Final1Document195 pagesTrade May Tables 2021 Final1rogerNo ratings yet

- chap-42Document6 pageschap-42Harsh BhattNo ratings yet

- Chapter 95Document13 pagesChapter 95diggNo ratings yet

- Import ChinaDocument835 pagesImport ChinaNirav KhakhariaNo ratings yet

- Ceramic Products Chapter SummaryDocument3 pagesCeramic Products Chapter SummaryMilind PatelNo ratings yet

- Sale Tax With 2 RatesDocument5 pagesSale Tax With 2 RatesMOHD JEFRI BIN TAJARINo ratings yet

- Volume Two-1Document223 pagesVolume Two-1Hab GebrishNo ratings yet

- Section VI Chapter-38: ITC (HS), 2012 Schedule 1 - Import PolicyDocument18 pagesSection VI Chapter-38: ITC (HS), 2012 Schedule 1 - Import PolicydkhatriNo ratings yet

- Chapter 82Document22 pagesChapter 82Benn ClarkeNo ratings yet

- VEGETABLE PRODUCTS SECTION IIDocument3 pagesVEGETABLE PRODUCTS SECTION IIlaila ursabiaNo ratings yet

- AHTN2022 CHAPTER93 wNOTESDocument3 pagesAHTN2022 CHAPTER93 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER85 wNOTESDocument41 pagesAHTN2022 CHAPTER85 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER97 wNOTESDocument3 pagesAHTN2022 CHAPTER97 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER95 wNOTESDocument5 pagesAHTN2022 CHAPTER95 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER03 wNOTESDocument18 pagesAHTN2022 CHAPTER03 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER83 wNOTESDocument5 pagesAHTN2022 CHAPTER83 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER67 wNOTESDocument2 pagesAHTN2022 CHAPTER67 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER63 wNOTESDocument5 pagesAHTN2022 CHAPTER63 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER02 wNOTESDocument7 pagesAHTN2022 CHAPTER02 wNOTESdoookaNo ratings yet

- AHTN2017Document4 pagesAHTN2017norwiNo ratings yet

- AHTN2022 CHAPTER75 wNOTESDocument2 pagesAHTN2022 CHAPTER75 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER94 wNOTESDocument6 pagesAHTN2022 CHAPTER94 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER87 wNOTESDocument40 pagesAHTN2022 CHAPTER87 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER41 wNOTESDocument4 pagesAHTN2022 CHAPTER41 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER92 wNOTESDocument3 pagesAHTN2022 CHAPTER92 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER59 wNOTESDocument5 pagesAHTN2022 CHAPTER59 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER89 wNOTESDocument4 pagesAHTN2022 CHAPTER89 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER90 wNOTESDocument13 pagesAHTN2022 CHAPTER90 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER86 wNOTESDocument4 pagesAHTN2022 CHAPTER86 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER58 wNOTESDocument5 pagesAHTN2022 CHAPTER58 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER88 wNOTESDocument3 pagesAHTN2022 CHAPTER88 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER72 wNOTESDocument21 pagesAHTN2022 CHAPTER72 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER64 wNOTESDocument4 pagesAHTN2022 CHAPTER64 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER32 wNOTESDocument6 pagesAHTN2022 CHAPTER32 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER91 wNOTESDocument4 pagesAHTN2022 CHAPTER91 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER60 wNOTESDocument4 pagesAHTN2022 CHAPTER60 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER57 wNOTESDocument4 pagesAHTN2022 CHAPTER57 wNOTESdoookaNo ratings yet

- AHTN2022 CHAPTER74 wNOTESDocument6 pagesAHTN2022 CHAPTER74 wNOTESdoookaNo ratings yet

- Global Internship for Language TeachersDocument5 pagesGlobal Internship for Language TeachersCarlos ChamorroNo ratings yet

- Our Lady of Consolation Orchestra InstrumentsDocument2 pagesOur Lady of Consolation Orchestra InstrumentsCelestian Valensario PaderangaNo ratings yet

- Group Assgnmt 8 Rev080515Document9 pagesGroup Assgnmt 8 Rev080515Suhaila NamakuNo ratings yet

- Obessive Compulsive Disorder (OCD)Document10 pagesObessive Compulsive Disorder (OCD)marketingmoneyindiaNo ratings yet

- Mora Solvendi (Delay of The Debtor)Document11 pagesMora Solvendi (Delay of The Debtor)John Paul100% (1)

- Landman Training ManualDocument34 pagesLandman Training Manualflashanon100% (2)

- Quality Management in Apparel Industry PDFDocument9 pagesQuality Management in Apparel Industry PDFJyoti Rawal0% (1)

- Surrealismo TriplevDocument13 pagesSurrealismo TriplevVictor LunaNo ratings yet

- Engineers Guide To Microchip 2018Document36 pagesEngineers Guide To Microchip 2018mulleraf100% (1)

- CartridgeDocument26 pagesCartridgeMnavya SaiNo ratings yet

- How The Voice Works HandoutDocument7 pagesHow The Voice Works HandoutMatthew ColleyNo ratings yet

- Buckley V UkDocument12 pagesBuckley V UkShriya ChandankarNo ratings yet

- Test Bank For American Pageant Volume 1 16th EditionDocument36 pagesTest Bank For American Pageant Volume 1 16th Editionzoonwinkfoxyj8100% (48)

- What Is MotivationDocument6 pagesWhat Is MotivationJohn Paul De GuzmanNo ratings yet

- Lesson Plans by Noman Niaz MaharDocument3 pagesLesson Plans by Noman Niaz MaharNoman Niaz 13No ratings yet

- KluberDocument20 pagesKluberJako MishyNo ratings yet

- TNPSC Vas: NEW SyllabusDocument12 pagesTNPSC Vas: NEW Syllabuskarthivisu2009No ratings yet

- CAPITAL ALLOWANCE - Exercise 3 (May2021)Document2 pagesCAPITAL ALLOWANCE - Exercise 3 (May2021)NORHAYATI SULAIMANNo ratings yet

- Dangerous Journeys - Rules (GDW5000)Document418 pagesDangerous Journeys - Rules (GDW5000)DeviousDVS100% (5)

- Chapter 3 of LPL Textbook PDFDocument26 pagesChapter 3 of LPL Textbook PDFandreaNo ratings yet

- The Merchant of Venice QuestionsDocument9 pagesThe Merchant of Venice QuestionsHaranath Babu50% (4)

- NEW HOLLAND - Trucks, Tractor & Forklift Manual PDDocument14 pagesNEW HOLLAND - Trucks, Tractor & Forklift Manual PDAjjaakka0% (2)

- Kim Hoff PAR 117 JDF 1115 Separation AgreementDocument9 pagesKim Hoff PAR 117 JDF 1115 Separation AgreementlegalparaeagleNo ratings yet

- Tsu m7 Practice Problems Integral CalculusDocument1 pageTsu m7 Practice Problems Integral CalculusJAMNo ratings yet

- Moldavian DressDocument16 pagesMoldavian DressAnastasia GavrilitaNo ratings yet

- ISL201-Solved MCQs 100 - Correct For Mid Term Papers (WWW - Virtualstudysolutions.blogspot - Com)Document70 pagesISL201-Solved MCQs 100 - Correct For Mid Term Papers (WWW - Virtualstudysolutions.blogspot - Com)bc190200669 BUSHRANo ratings yet

- Afro Asian LiteratureDocument62 pagesAfro Asian LiteratureNicsyumulNo ratings yet

- Communication Strategy Target AudienceDocument47 pagesCommunication Strategy Target Audienceguille simariNo ratings yet

- Arts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteDocument25 pagesArts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteTony SawmaNo ratings yet

- Free Easy Autopilot BTC Method 2Document4 pagesFree Easy Autopilot BTC Method 2Adderall 30MG XRNo ratings yet