Professional Documents

Culture Documents

Fin544 - Mind Mapping (Chapter 2)

Fin544 - Mind Mapping (Chapter 2)

Uploaded by

nur fatihahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin544 - Mind Mapping (Chapter 2)

Fin544 - Mind Mapping (Chapter 2)

Uploaded by

nur fatihahCopyright:

Available Formats

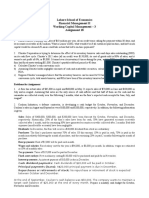

• Prospectus

✓ Formal summary that provides • Underpricing

• Underwriter Arrangements information on an issue of securities

✓ Issuing securities at an offering

✓ Firm Commitment – Firm that

price set below the true value of

buys an issue of securities from a

the security

company and resells it to the

public

The Initial Public ❖Assume the issuer incurs $1

Offering (IPO) million in other expenses to sell 3

✓ Best Efforts Commitment –

million shares at $40 each to an

Underwriters agree to sell as First offering of stock to

underwriter and the underwriter

much of the issue as possible but the general public

sells the shares at $43 each. The

do not guarantee the sale of the

end of the first day’s trading, the

entire issue

issuing company’s stock price

• Spread had risen to $70.

✓ Floatation Costs – The costs

incurred when a firm issues new

✓ Difference between public offer price and Cost of underpricing:

securities to the public

price paid by underwriter 3 million($70 − $43) = $81 million

❖Assume the issuing company incurs $1

million in expenses to sell 3 million shares at

$40 each to an underwriter; the

underwriter sells the shares at $43 each

3 million x ($43-$40)=$9 million

• General Cash Offer – Sale of securities open to all investors • Right Issue – Issue of securities offered only to current

by an already public company stockholders

➢ Seasoned Offering – Sale of securities by a firm that

is already publicly traded ❖ Ivanhoe Mines needs C$1.2 billion of new equity.

Market price C$24.73. Ivanhoe Mines decides to

➢ Shelf Registration – A procedure allows firms to file raise additional funds by offering the right to buy 3

one registration statement for several issues of the new shares for 20 at C$13.93 per share. With 100%

same security subscription, what is value of each right?

▪ Current market value = 20 × C$24.73 = C$494.60

▪ Total shares = 20 + 3 = 23

Security Sales by Public Companies ▪ Amount of new funds = 3 × C$13.93 = C$41.79

▪ New share price = (41.79 + 494.60) / 23 = C$23.32

▪ Value of a right = C$23.32 - C$13.93 = C$9.39

• International Security Issues – Sale of securities in other ❖ Lafarge Corp needs to raise €1.28billion of new equity.

countries The market price is €60/sh. Lafarge decides to raise

additional funds via a 4 for 17 rights offer at €41 per

➢ Eurobond – Bonds underwritten by a group of share. If we assume 100% subscription, what is the

international banks and offered simultaneously to value of each right?

investors in a number of countries

▪ Current market value = 17 × €60 = €1,020

➢ Global bonds – Bonds where one part is sold ▪ Total shares = 17 + 4 = 21

internationally in the eurobond market and the ▪ Amount of funds = 1,020 + (4x41) = €1,184

remainder sold in the company’s domestic ▪ New share price = (1,184) / 21 = €56.38

market ▪ Value of a right = 56.38 – 41 = €15.38

You might also like

- Module 3 Submit Team Culminating Project Milestone 1Document4 pagesModule 3 Submit Team Culminating Project Milestone 1api-719624868No ratings yet

- Br2e Int SB Practicefile AnswersDocument4 pagesBr2e Int SB Practicefile AnswersLe Dinh Thinh100% (1)

- BUSI 2800 Final Exam NotesDocument7 pagesBUSI 2800 Final Exam NotesAaron Agyemang100% (1)

- Chapter-8, Stock MarketsDocument20 pagesChapter-8, Stock MarketsMuhammad Ali BhojaniNo ratings yet

- Mind Mapping Chapter 1 Malaysian Legal SystemDocument3 pagesMind Mapping Chapter 1 Malaysian Legal Systemnur fatihah100% (1)

- Chapter 8-SHEDocument77 pagesChapter 8-SHEVip Bigbang100% (1)

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahNo ratings yet

- International Finance IF8 - World Equity MarketDocument32 pagesInternational Finance IF8 - World Equity MarketmoufaymaneeNo ratings yet

- BUSI3502: Investments: Trading in Securities MarketsDocument34 pagesBUSI3502: Investments: Trading in Securities MarketsChendurNo ratings yet

- Busines FinanceDocument7 pagesBusines FinanceZain Ul AbdinNo ratings yet

- Derivative 1Document39 pagesDerivative 1Heera JhaNo ratings yet

- Derivatives Shahid A. ZiaDocument42 pagesDerivatives Shahid A. ZiaAlizay KhanNo ratings yet

- Derivative Securities Markets: Boliche, Marianne Chan, James Chua, Tomas Papa, JadeDocument85 pagesDerivative Securities Markets: Boliche, Marianne Chan, James Chua, Tomas Papa, JadeJimmyChaoNo ratings yet

- Chapter 3Document21 pagesChapter 3api-19665156No ratings yet

- Chapter 15 Raising CapitalDocument2 pagesChapter 15 Raising CapitalLorren YabutNo ratings yet

- Funds FinalsDocument5 pagesFunds FinalsSydney Miles MahinayNo ratings yet

- Topic 2 ClassDocument73 pagesTopic 2 ClassNokubongaNo ratings yet

- Chap 2 Fin MKT and Instruments PDFDocument120 pagesChap 2 Fin MKT and Instruments PDFKesarapu Venkata ApparaoNo ratings yet

- Fe 605Document4 pagesFe 605mogreNo ratings yet

- Securities MarketsDocument8 pagesSecurities Marketspiepkuiken-knipper0jNo ratings yet

- Topic 11 - DerivativesDocument38 pagesTopic 11 - DerivativesNur AsyiqinNo ratings yet

- Financial Market-Lecture 9 PDFDocument28 pagesFinancial Market-Lecture 9 PDFJeffNo ratings yet

- Topic 10 - Primary InvestmentDocument76 pagesTopic 10 - Primary InvestmentArun GhatanNo ratings yet

- Chapter 25: Warrants and ConvertiblesDocument26 pagesChapter 25: Warrants and ConvertiblesRojan DahalNo ratings yet

- Futures ContractsDocument45 pagesFutures ContractsRitika YachnaNo ratings yet

- Corporate Actions PresentationDocument12 pagesCorporate Actions PresentationSheetal LaddhaNo ratings yet

- Futures Valuation and Hedging: by Cheng Few Lee Joseph Finnerty John Lee Alice C Lee Donald WortDocument54 pagesFutures Valuation and Hedging: by Cheng Few Lee Joseph Finnerty John Lee Alice C Lee Donald WorttatekNo ratings yet

- The Stock Market: Investing Terms - These Words and Phrases Reflect Stock Market Terms ForDocument11 pagesThe Stock Market: Investing Terms - These Words and Phrases Reflect Stock Market Terms ForNinad ChouthkanthiwarNo ratings yet

- FIN4003 - Lecture02 - Mechanisms - of - Futures 16 Mar 2018Document27 pagesFIN4003 - Lecture02 - Mechanisms - of - Futures 16 Mar 2018Who Am iNo ratings yet

- FM 9 - IntroductionDocument11 pagesFM 9 - IntroductionJason AbanesNo ratings yet

- International Finance 5Document25 pagesInternational Finance 5Rahul BambhaNo ratings yet

- Capital MarketDocument43 pagesCapital MarketGUNAWAN WICAKSONO -No ratings yet

- Lecture 3.3 - CMDocument59 pagesLecture 3.3 - CMOlga SlaninaNo ratings yet

- Stocks PPTDocument6 pagesStocks PPTenghlish learnerNo ratings yet

- (LS) Part I-Topic 1 - Futures Markets-20230921Document33 pages(LS) Part I-Topic 1 - Futures Markets-20230921hannahlin115No ratings yet

- Valuation ConceptsDocument54 pagesValuation Conceptsmarine19.vedelNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- Accounting For Derivatives and Hedging Activities-Sent2020 PDFDocument38 pagesAccounting For Derivatives and Hedging Activities-Sent2020 PDFTiara Eva TresnaNo ratings yet

- 1.2 Investment - Securities MarketDocument35 pages1.2 Investment - Securities MarketMd. Ruhol AminNo ratings yet

- 3 - Derivatives MarketsDocument34 pages3 - Derivatives Marketsakent1No ratings yet

- Topic 7 Equity MarketsDocument25 pagesTopic 7 Equity MarketsKelly Chan Yun JieNo ratings yet

- FMI - Futures & OptionsDocument16 pagesFMI - Futures & Optionsjahanliza2001No ratings yet

- The Bond Market The Bond Market: Answers To End-of-Chapter Answers To End-of-Chapter Questions QuestionsDocument5 pagesThe Bond Market The Bond Market: Answers To End-of-Chapter Answers To End-of-Chapter Questions QuestionsTop DramasNo ratings yet

- PPT-W1Document35 pagesPPT-W1Wetty OktaviaNo ratings yet

- BFSI ModuleDocument7 pagesBFSI ModulevijayNo ratings yet

- Derivative MarketsDocument31 pagesDerivative MarketsShinam BansalNo ratings yet

- Zuwena PresentationDocument32 pagesZuwena Presentationmr basitNo ratings yet

- Stocks and Bonds and LoansDocument12 pagesStocks and Bonds and LoansAi catNo ratings yet

- Bodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Document74 pagesBodie - Essentials - of - Investments - 11e - Chapter03 - PPT MOD - Fall2020Anthony SukkarNo ratings yet

- Investment: Why T-Bills?Document3 pagesInvestment: Why T-Bills?blankNo ratings yet

- Silo - Tips - Chapter 10 Stocks and Their Valuation Answers To End of Chapter QuestionsDocument19 pagesSilo - Tips - Chapter 10 Stocks and Their Valuation Answers To End of Chapter QuestionsBeatrice ReynanciaNo ratings yet

- ACST6003 - Principles of Finance: Share Valuation Parrino Et Al - Chapter 7 Week 5Document27 pagesACST6003 - Principles of Finance: Share Valuation Parrino Et Al - Chapter 7 Week 5yida chenNo ratings yet

- Capital MarketDocument43 pagesCapital MarketdesmabiNo ratings yet

- Grade 11 Math Mod 8Document8 pagesGrade 11 Math Mod 8John Lois VanNo ratings yet

- Derivatives: Fundamentals and OverviewDocument72 pagesDerivatives: Fundamentals and OverviewAmit SinhaNo ratings yet

- Finman ReviewerDocument24 pagesFinman ReviewerXeleen Elizabeth ArcaNo ratings yet

- Derivatives Market: Abhishek Mehta (182) Alankar Das (190) Chand Singh (199) Gurinder Singh (208) Rajat KumarDocument22 pagesDerivatives Market: Abhishek Mehta (182) Alankar Das (190) Chand Singh (199) Gurinder Singh (208) Rajat KumarOberoi MalhOtra MeenakshiNo ratings yet

- Section I SlidesDocument46 pagesSection I SlidesThembelani ChiliNo ratings yet

- Unit 5 SlidesDocument52 pagesUnit 5 SlidesKGOTHATSO VALENTINE MALATJINo ratings yet

- Financial Markets: The Structure of The Three Types of Financial Market, and The Role of Government BondsDocument23 pagesFinancial Markets: The Structure of The Three Types of Financial Market, and The Role of Government BondsJoseph Maltby-SmithNo ratings yet

- 1 StocksDocument5 pages1 StocksMelNo ratings yet

- Derivaties CNDocument34 pagesDerivaties CNMarshNo ratings yet

- Derivatives SummaryDocument2 pagesDerivatives SummaryNurul AisyahNo ratings yet

- Chapter 4 - Stock MarketDocument41 pagesChapter 4 - Stock Marketnamanh.caolanhNo ratings yet

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoFrom EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNo ratings yet

- Mind Mapping Chapter 4 Sale of GoodsDocument2 pagesMind Mapping Chapter 4 Sale of Goodsnur fatihahNo ratings yet

- Mind Mapping Chapter 2 Law of ContractDocument2 pagesMind Mapping Chapter 2 Law of Contractnur fatihah100% (2)

- Mind Mapping Chapter 3 Law of AgencyDocument2 pagesMind Mapping Chapter 3 Law of Agencynur fatihahNo ratings yet

- Nur Fatihah Syuhada - Mind Mapping Chapter 4 Sale of GoodsDocument2 pagesNur Fatihah Syuhada - Mind Mapping Chapter 4 Sale of Goodsnur fatihahNo ratings yet

- Fin544 - Mind Mapping (Chapter 4)Document3 pagesFin544 - Mind Mapping (Chapter 4)nur fatihahNo ratings yet

- Fin544 - Mind Mapping (Chapter 4)Document2 pagesFin544 - Mind Mapping (Chapter 4)nur fatihahNo ratings yet

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahNo ratings yet

- 55966bos45368may20 p5 cp3 PDFDocument26 pages55966bos45368may20 p5 cp3 PDFankush sharmaNo ratings yet

- Certificate Course in Export Import Management-2Document6 pagesCertificate Course in Export Import Management-2Imran KhanNo ratings yet

- Selection of HRDocument3 pagesSelection of HRSarah ShaikhNo ratings yet

- Lock Out Tag Out ProceduresDocument52 pagesLock Out Tag Out ProceduresDavid Arputharaj100% (5)

- Financial Management: I. Concept NotesDocument6 pagesFinancial Management: I. Concept NotesDanica Christele AlfaroNo ratings yet

- Mba Final Year ProjectDocument86 pagesMba Final Year Projectmonica.dNo ratings yet

- Text and Info MediaDocument1 pageText and Info Medialinei nuñalNo ratings yet

- 733380Document738 pages733380RashmikantNo ratings yet

- Quantitative TechniquesDocument4 pagesQuantitative TechniquescyrusNo ratings yet

- Jurnal Resti: Analisis Risiko Dan Kontrol Perlindungan Data Pribadi Pada Sistem Informasi Administrasi KependudukanDocument9 pagesJurnal Resti: Analisis Risiko Dan Kontrol Perlindungan Data Pribadi Pada Sistem Informasi Administrasi KependudukanAnggun MarizaNo ratings yet

- Analysis of Uti Mutual Fund With Reliance Mutual FundDocument64 pagesAnalysis of Uti Mutual Fund With Reliance Mutual FundSanjayNo ratings yet

- MFRS 137 (CH 5)Document30 pagesMFRS 137 (CH 5)WAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Literature Review On Consumer Perception PDFDocument6 pagesLiterature Review On Consumer Perception PDFafmzvadopepwrb100% (1)

- Subsidiary Book and Cash BookDocument27 pagesSubsidiary Book and Cash BookAtul Kumar SamalNo ratings yet

- Terms and Conditions of Employment in Ghana: Unit 2 SectionDocument6 pagesTerms and Conditions of Employment in Ghana: Unit 2 SectionBabamu Kalmoni JaatoNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildDwi Ahdini100% (1)

- Advantages of Internet BankingDocument2 pagesAdvantages of Internet BankingRoshan Dase0% (1)

- CCC Ripptc1Document26 pagesCCC Ripptc1SHIV SINGHNo ratings yet

- Internship Report On A Knit Composite MiDocument172 pagesInternship Report On A Knit Composite MiLizon music choiceNo ratings yet

- Tackling Informality - Comparing Approaches and Strategies in South Korean and Latin American CitiesDocument69 pagesTackling Informality - Comparing Approaches and Strategies in South Korean and Latin American CitiesAlexandre Sabino do NascimentoNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18SinpaoNo ratings yet

- Meagal Stelplast Steering A New PathDocument12 pagesMeagal Stelplast Steering A New PathAnirban KarNo ratings yet

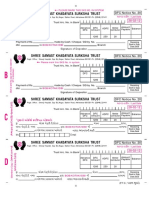

- Shree Samast Khadayata Surksha Trust: o o o o oDocument1 pageShree Samast Khadayata Surksha Trust: o o o o okrish oswalNo ratings yet

- SB2170 Howard AndersonDocument4 pagesSB2170 Howard AndersonRob PortNo ratings yet

- Rog Strix X570-I Gaming: DDR4 2133 Qualified Vendors List (QVL)Document29 pagesRog Strix X570-I Gaming: DDR4 2133 Qualified Vendors List (QVL)marcofranciscoNo ratings yet

- Full Ebook of 2023 Cfa Program Curriculum Level Ii Volume 3 Corporate Issuers and Equity Valuation 1St Edition Cfa Institute Online PDF All ChapterDocument69 pagesFull Ebook of 2023 Cfa Program Curriculum Level Ii Volume 3 Corporate Issuers and Equity Valuation 1St Edition Cfa Institute Online PDF All Chapterdarcayapa100% (6)