Professional Documents

Culture Documents

BSP Receivership Authority Without Prior Hearing

Uploaded by

Roseller SasisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSP Receivership Authority Without Prior Hearing

Uploaded by

Roseller SasisCopyright:

Available Formats

I. SHORT TITLE : Vivas v.

Monetary Board of BSP

II. FULL TITLE : Alfeo D. Vivas, on his behalf and on behalf of the shareholders of

Eurocredit Community Bank versus The Monetary Board of the Bangko Sentral ng Pilipinas

and the Philippine Deposit Insurance Corporation - G.R. No. 191424, THIRD DIVISION,

August 7, 2013 Mendoza, J

III. TOPIC : Special Commercial Law - The New Central Bank Act (R.A. No.

7653) – Receivership

IV. STATEMENT OF FACTS:

Rural Bank of Faire Inc. (RBFI) was a duly registered rural banking institution in Cagayan. In

2005 the corporate life of RBFI expired, petitioner Vivas and his principals then acquired the

controlling interests of RBFI and acquired a Certificate of Authority extending the corporate life

of RBFI for another fifty (50) years and was later renamed to Eurocredit Community Bank Inc.

(ECBI). Bangko Sentral ng Pilipinas conducted a series of examinations through its Integrated

Supervision Department II and the result of the findings concluded that ECBI is illiquid,

insolvent, and was performing transactions which are considered unsafe and unsound banking

practices. ECBI then was placed under receivership without prior hearing. Petitioner alleged that

the resolution was in bad faith and implemented with arbitrariness because it is in violation of his

and the bank’s right to due process since there was no prior hearing when ECBI was placed

under receivership.

V. STATEMENT OF THE CASE:

Vivas filed a petition for prohibition in the Supreme Court praying for the issuance of a status

quo ante order or writ of preliminary injunction ordering the respondents to desist from closing

(ECBI) and from pursuing the receivership thereof.

VI. ISSUE:

Whether or not ECBI was entitled to due and prior hearing before its being placed under

receivership

VII. RULING:

The court ruled that at any rate, the Monetary Board may forbid a bank from doing business and

plate it under receivership without prior notice and hearing under Section 30 of R.A No. 7653 if

it warrants the following circumstances: 1.) The bank is unable to pay its liabilities as they

become due in the ordinary course of business, 2.) The bank has insufficient realizable assets as

determined by BSP, to meet its liabilities; or 3.) cannot continue in business without involving

probable losses to its depositors or creditors; or 4.) has willfully violated a cease and desist order

under Section 37 that has become final, involving acts or transactions which amount to fraud or a

dissipation of the assets of the institution; in which cases, the Monetary Board may summarily

and without need for prior hearing forbid the institution from doing business in the Philippines

and designate the Philippine Deposit Insurance Corporation as receiver of the banking institution.

The court also reiterated the doctrine of “close now, hear later” in the case of Bangko Sentral ng

Pilipinas Monetary Board v. Hon. Antonio-Valenzuala.

The “close now, hear later” doctrine has already been justified as a measure for the protection of

the public interest. Swift action is called for on the part of the BSP when it finds that a bank is in

dire straits. Unless adequate and determined efforts are taken by the government against

distressed and mismanaged banks, public faith in the banking system is certain to deteriorate to

the prejudice of the national economy itself, not to mention the losses suffered by the bank

depositors, creditors, and stockholders, who all deserve the protection of the government.

The doctrine is founded on practical and legal considerations to obviate unwarranted dissipation

of the bank’s assets and as a valid exercise of police power to protect the depositors, creditors,

stockholders, and the general public.

VIII. DISPOSITIVE PORTION:

WHEREFORE, the petition for prohibition is DENIED.

You might also like

- Banco Filipino Savings and Mortgage Bank v. Monetary BoardDocument5 pagesBanco Filipino Savings and Mortgage Bank v. Monetary BoardElayne MarianoNo ratings yet

- Banco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Document14 pagesBanco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Ronald LasinNo ratings yet

- US V Purganan (MR)Document6 pagesUS V Purganan (MR)NN DDLNo ratings yet

- Cell City Worksheet - Identify Organelles and Their FunctionsDocument2 pagesCell City Worksheet - Identify Organelles and Their FunctionsnunyaNo ratings yet

- NG Gan Zee vs. Asian Crusader PDFDocument9 pagesNG Gan Zee vs. Asian Crusader PDFJanine AranasNo ratings yet

- 125.050 - Stronghold Insurance v. Cuenca (2013) - DigestDocument4 pages125.050 - Stronghold Insurance v. Cuenca (2013) - DigestJames LouNo ratings yet

- Republic of The Philippines vs. Security Credit and Acceptance Corporation (G.R. No. L-20583, January 23, 1967)Document3 pagesRepublic of The Philippines vs. Security Credit and Acceptance Corporation (G.R. No. L-20583, January 23, 1967)Judith PanggalisanNo ratings yet

- Security Bank Vs Great WallDocument2 pagesSecurity Bank Vs Great WallDylza Fia CaminoNo ratings yet

- Law On Negotiable Instruments: Law Merchant - The Custom of MerchantsDocument37 pagesLaw On Negotiable Instruments: Law Merchant - The Custom of MerchantsKeith Anthony AmorNo ratings yet

- Life Insurance - Tan Vs CADocument1 pageLife Insurance - Tan Vs CAShie La Ma RieNo ratings yet

- Central Textile Mills V National Wages CommissionDocument2 pagesCentral Textile Mills V National Wages CommissionPatrick ManaloNo ratings yet

- Steinberg v. Velasco (1929)Document1 pageSteinberg v. Velasco (1929)Andre Philippe RamosNo ratings yet

- Lucman v. MalawiDocument2 pagesLucman v. MalawiCy PanganibanNo ratings yet

- 1 Be Brave Notes / Banking LawDocument11 pages1 Be Brave Notes / Banking LawTriccie MangueraNo ratings yet

- Fortuito Over Which The Common Carrier Did Not Have Any ControlDocument2 pagesFortuito Over Which The Common Carrier Did Not Have Any ControlNichole Patricia PedriñaNo ratings yet

- Case Digest Liban V GordonDocument2 pagesCase Digest Liban V GordonGabriel UyNo ratings yet

- Weeks 1 2. Case DigestsDocument26 pagesWeeks 1 2. Case Digestsbang jamerlanNo ratings yet

- CA Agro-Industrial vs. Court of Appeals, 3 March 1993Document1 pageCA Agro-Industrial vs. Court of Appeals, 3 March 1993Jerome GonzalesNo ratings yet

- Central Bank V CADocument1 pageCentral Bank V CAchaNo ratings yet

- Case Name Facts & Issue RulingDocument15 pagesCase Name Facts & Issue RulingApril ToledoNo ratings yet

- 2022 Banking Case Digest FinalDocument18 pages2022 Banking Case Digest FinalJem PagantianNo ratings yet

- Poli Rev Integration Case Digests EditedDocument123 pagesPoli Rev Integration Case Digests EditedGreggy BoyNo ratings yet

- Mellon Bank vs. Magsino Case Digest G.R. No. 61011 October 18, 1990Document2 pagesMellon Bank vs. Magsino Case Digest G.R. No. 61011 October 18, 1990JNo ratings yet

- RR 10-76Document4 pagesRR 10-76Althea Angela GarciaNo ratings yet

- BPI Vs CASA - Forged SignaturesDocument2 pagesBPI Vs CASA - Forged SignaturesCarl MontemayorNo ratings yet

- Bar Ops Pilipinas 2016: MercantileDocument15 pagesBar Ops Pilipinas 2016: Mercantiletwenty19 lawNo ratings yet

- Roque, Jr. vs. COMELECDocument5 pagesRoque, Jr. vs. COMELECMonikka DeleraNo ratings yet

- Alfredo Ching Vs Secretary of JusticeDocument2 pagesAlfredo Ching Vs Secretary of JusticeLiliaAzcarraga100% (1)

- Both Parties Filed Separate Recourses To The CADocument2 pagesBoth Parties Filed Separate Recourses To The CANiajhan PalattaoNo ratings yet

- Orient Air Services v. CA, 197 SCRA 645 G.R. No. 76931 - CDDocument1 pageOrient Air Services v. CA, 197 SCRA 645 G.R. No. 76931 - CDJoseph James BacayoNo ratings yet

- 6 Republic Planters Vs CADocument2 pages6 Republic Planters Vs CAYPENo ratings yet

- Chapter I and II - Corporation LawDocument8 pagesChapter I and II - Corporation LawSui100% (1)

- 13 Canonizado Vs AguirreDocument2 pages13 Canonizado Vs AguirreGoodyNo ratings yet

- Camitan vs. Fidelity Investment Corporation PDFDocument15 pagesCamitan vs. Fidelity Investment Corporation PDFrapgracelimNo ratings yet

- RURAL BANK OF SAN MIGUEL v. MBDocument2 pagesRURAL BANK OF SAN MIGUEL v. MBEmi SicatNo ratings yet

- (g22) Manila Steamship Co. Inc. vs. Insa AbdulhamanDocument1 page(g22) Manila Steamship Co. Inc. vs. Insa AbdulhamanMhaliNo ratings yet

- Legal Memorandum - Issue On RA 9997Document8 pagesLegal Memorandum - Issue On RA 9997Sylvia VillalobosNo ratings yet

- 77-Government Service Insurance System vs. Court of Appeals, 308 SCRA 559, 21 June 1999Document8 pages77-Government Service Insurance System vs. Court of Appeals, 308 SCRA 559, 21 June 1999Jopan SJNo ratings yet

- 81 Lopez v. Pan AmDocument2 pages81 Lopez v. Pan AmArnel ManalastasNo ratings yet

- Rep. Vs Mendoza DigestDocument6 pagesRep. Vs Mendoza DigestXyrus BucaoNo ratings yet

- 125.054 - Shipside Incorporated v. CA (2001) - DigestDocument4 pages125.054 - Shipside Incorporated v. CA (2001) - DigestJames LouNo ratings yet

- Provisional Remedies GuideDocument30 pagesProvisional Remedies GuideJuno GeronimoNo ratings yet

- Citibank v. Sabeniano: Compensation and Offsetting of ObligationsDocument4 pagesCitibank v. Sabeniano: Compensation and Offsetting of ObligationsVen Albert BuenaobraNo ratings yet

- Digests 3Document11 pagesDigests 3SuiNo ratings yet

- Rule 62 Interpleader Case ExplainedDocument11 pagesRule 62 Interpleader Case ExplainedJD DXNo ratings yet

- Batangas CATV Inc. Vs CA - 138810 - September 29, 2004 - JDocument14 pagesBatangas CATV Inc. Vs CA - 138810 - September 29, 2004 - JjonbelzaNo ratings yet

- Reyes V CADocument2 pagesReyes V CANypho Pareño100% (1)

- HSBC v. Gonzalez: Probable Cause Found in Trust Receipts CaseDocument2 pagesHSBC v. Gonzalez: Probable Cause Found in Trust Receipts CaseteresakristelNo ratings yet

- 01 Magallona Vs Ermita Case DigestDocument2 pages01 Magallona Vs Ermita Case DigestJeremiah MontoyaNo ratings yet

- BPI Vs IACDocument1 pageBPI Vs IACcmv mendozaNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Simex International vs. Court of AppealsDocument2 pagesSimex International vs. Court of AppealsDivine Paula BioNo ratings yet

- Corpo Code CasesDocument14 pagesCorpo Code Casessabrina gayoNo ratings yet

- Loyola Grand Villas Homeowners V CADocument2 pagesLoyola Grand Villas Homeowners V CACharisse Christianne Yu CabanlitNo ratings yet

- Vivas vs. Monetary BoardDocument2 pagesVivas vs. Monetary BoardCaroline A. LegaspinoNo ratings yet

- 33 - Vivas v. Monetary Board G.R. No. 191424 2013Document4 pages33 - Vivas v. Monetary Board G.R. No. 191424 2013November Lily OpledaNo ratings yet

- SPCL DigestDocument2 pagesSPCL DigestWang Da XiaNo ratings yet

- Vivas Vs The Monetary BoardDocument4 pagesVivas Vs The Monetary BoardIan Joshua RomasantaNo ratings yet

- Vivas Vs BSP Monetary Board FactsDocument7 pagesVivas Vs BSP Monetary Board FactsAlyssa GomezNo ratings yet

- VIVAS Vs THE MONETARY BOARDDocument4 pagesVIVAS Vs THE MONETARY BOARDIan Joshua RomasantaNo ratings yet

- Mercantile Law I. Letters of CreditDocument217 pagesMercantile Law I. Letters of Creditnorman whyNo ratings yet

- Poli 09 17Document77 pagesPoli 09 17Roseller SasisNo ratings yet

- Taxation Law BarQA 2009-2017 PDFDocument195 pagesTaxation Law BarQA 2009-2017 PDFAjilNo ratings yet

- J Insurance CasesDocument18 pagesJ Insurance CasesRoseller SasisNo ratings yet

- Labor Law BarQA 2009-2017Document313 pagesLabor Law BarQA 2009-2017Katherine Janice De Guzman-PineNo ratings yet

- 2021 Criminal Procedure SyllabusDocument10 pages2021 Criminal Procedure SyllabusMahe TayawaNo ratings yet

- Criminal Law 1 Course OutlineDocument22 pagesCriminal Law 1 Course OutlineRoseller SasisNo ratings yet

- PoliDocument208 pagesPoliAdine DyNo ratings yet

- Essential Beverage Service KnowledgeDocument15 pagesEssential Beverage Service KnowledgeRoseller SasisNo ratings yet

- UST 19 Civil Law - BarQA 2009-2017 PDFDocument206 pagesUST 19 Civil Law - BarQA 2009-2017 PDFnorman whyNo ratings yet

- Philam Insurance Co., Inc., Now Chartis Philippines Insurance, Inc. vs. Parc Chateau Condominium Unit Owners Association Inc, March 04, 2019, G.R. No. 201116Document2 pagesPhilam Insurance Co., Inc., Now Chartis Philippines Insurance, Inc. vs. Parc Chateau Condominium Unit Owners Association Inc, March 04, 2019, G.R. No. 201116Roseller SasisNo ratings yet

- UCPB General Insurance Co., Inc. v. Masagana Telemart, Inc., G.R. No. 137172, 04 April 2001, (356 SCRA 307)Document3 pagesUCPB General Insurance Co., Inc. v. Masagana Telemart, Inc., G.R. No. 137172, 04 April 2001, (356 SCRA 307)Roseller SasisNo ratings yet

- Philippine Phoenix Surety & Insurance Company v. Woodwork, Inc., G.R. No. L-25317, 06 August 1979, (92 SCRA 419Document2 pagesPhilippine Phoenix Surety & Insurance Company v. Woodwork, Inc., G.R. No. L-25317, 06 August 1979, (92 SCRA 419Roseller SasisNo ratings yet

- Insurance Loss vs DamageDocument2 pagesInsurance Loss vs DamageRoseller SasisNo ratings yet

- Double InsuranceDocument9 pagesDouble InsuranceRoseller SasisNo ratings yet

- Pacific Banking Corporation v. Court of Appeals, G.R. No. L-41014, 28 November 1988Document2 pagesPacific Banking Corporation v. Court of Appeals, G.R. No. L-41014, 28 November 1988Roseller SasisNo ratings yet

- Philamcare Health Systems, Inc. v. Court of Appeals and Julita Trinos G.R. No. 125678. March 18, 2002Document2 pagesPhilamcare Health Systems, Inc. v. Court of Appeals and Julita Trinos G.R. No. 125678. March 18, 2002Roseller SasisNo ratings yet

- Virginia Perez v. CA G.R. No. 112329, January 28, 2000Document2 pagesVirginia Perez v. CA G.R. No. 112329, January 28, 2000Roseller SasisNo ratings yet

- Young v. Midland Textile Insurance Company, G.R. No. 9370, 31 March 1915, (30 Phil. 617)Document2 pagesYoung v. Midland Textile Insurance Company, G.R. No. 9370, 31 March 1915, (30 Phil. 617)Roseller SasisNo ratings yet

- 2.) Frank v. Kosuyama, G.R. No. L-38010, December 21, 1933Document2 pages2.) Frank v. Kosuyama, G.R. No. L-38010, December 21, 1933Sarah AtienzaNo ratings yet

- Sps. Sta. Maria V CA 285 SCRA 351Document2 pagesSps. Sta. Maria V CA 285 SCRA 351Roseller SasisNo ratings yet

- The Insular Life Assurance Co., Ltd. v. Heirs of Alvarez, G.R. Nos. 207526, 210156, 03 October 2018, (881 SCRA 516Document2 pagesThe Insular Life Assurance Co., Ltd. v. Heirs of Alvarez, G.R. Nos. 207526, 210156, 03 October 2018, (881 SCRA 516Roseller SasisNo ratings yet

- White Gold Marine Services, Inc. vs. Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) Ltd. G.R. No. 154514. July 28, 2005Document2 pagesWhite Gold Marine Services, Inc. vs. Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) Ltd. G.R. No. 154514. July 28, 2005Roseller SasisNo ratings yet

- Pacific Timber Export Corporation v. Court of Appeals, G.R. No. L-38613, 25 February 1982 (112 SCRA 199)Document2 pagesPacific Timber Export Corporation v. Court of Appeals, G.R. No. L-38613, 25 February 1982 (112 SCRA 199)Roseller SasisNo ratings yet

- Navarro vs. IAC (Accr) February 12, 1997Document2 pagesNavarro vs. IAC (Accr) February 12, 1997Roseller SasisNo ratings yet

- Great Pacific Life Assurance Company v. Court of Appeals, G.R. No. L-31845. 30 April 1979, (89 SCRA 543)Document2 pagesGreat Pacific Life Assurance Company v. Court of Appeals, G.R. No. L-31845. 30 April 1979, (89 SCRA 543)Roseller SasisNo ratings yet

- Sps. Sta Maria V CA 285 SCRA 351Document2 pagesSps. Sta Maria V CA 285 SCRA 351Roseller SasisNo ratings yet

- UCPB General Insurance Co., Inc. vs. Asgard Corrugarated, January 26, 2021Document2 pagesUCPB General Insurance Co., Inc. vs. Asgard Corrugarated, January 26, 2021Roseller Sasis100% (1)

- Navarro vs. IAC (Accr) February 12, 1997Document2 pagesNavarro vs. IAC (Accr) February 12, 1997Roseller SasisNo ratings yet

- Substance Abuse Types Criteria DiagnosisDocument2 pagesSubstance Abuse Types Criteria Diagnosiskristel_nicole18yahoNo ratings yet

- Poor Police-Community Relations: Definitional IssuesDocument16 pagesPoor Police-Community Relations: Definitional IssuesJustin RibotNo ratings yet

- The Science of Anti-Semitism: by Professor Alexandru C. Cuza Translated by Dr. Dimitrie GazdaruDocument5 pagesThe Science of Anti-Semitism: by Professor Alexandru C. Cuza Translated by Dr. Dimitrie GazdaruPedro NestorNo ratings yet

- Pedophilia, Minor-Attracted Persons, and The DSMDocument12 pagesPedophilia, Minor-Attracted Persons, and The DSMCayoBuay100% (1)

- Unit 3 Review SheetDocument1 pageUnit 3 Review SheetMartin MartinezNo ratings yet

- Sample Judicial AffidavitDocument4 pagesSample Judicial AffidavitJZ SQ100% (2)

- Ad 93-14-12Document1 pageAd 93-14-12Mohamad Hazwan Mohamad JanaiNo ratings yet

- Jimenez v. BucoyDocument2 pagesJimenez v. BucoyReymart-Vin MagulianoNo ratings yet

- ACT NO. 3135 An Act To Regulate The Sale of Property Under Special Powers Inserted in or Annexed To Real-Estate MortgagesDocument3 pagesACT NO. 3135 An Act To Regulate The Sale of Property Under Special Powers Inserted in or Annexed To Real-Estate MortgagesAnakin SakawakaNo ratings yet

- THE INDEPENDENT Issue 512Document44 pagesTHE INDEPENDENT Issue 512The Independent Magazine100% (1)

- Fear Paralysis ReflexDocument2 pagesFear Paralysis ReflexIris De La CalzadaNo ratings yet

- Superiority of Muslim Women Over Hoors (Hoor al-Ayn/Houris) of Jannah (Paradise)Document4 pagesSuperiority of Muslim Women Over Hoors (Hoor al-Ayn/Houris) of Jannah (Paradise)yasir_0092100% (4)

- Legal EthicsDocument28 pagesLegal EthicsCarol JacintoNo ratings yet

- Political Law and Governance SyllabusDocument14 pagesPolitical Law and Governance SyllabusmailguzmanNo ratings yet

- Whip-Cracking in The Czech Republic and SlovakiaDocument3 pagesWhip-Cracking in The Czech Republic and SlovakiaBogdan SlobodzeanNo ratings yet

- Social 20 Final Exam ReviewDocument4 pagesSocial 20 Final Exam Reviewapi-263138429No ratings yet

- List of Malaysian PortsDocument8 pagesList of Malaysian PortsLaviena BagariaNo ratings yet

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

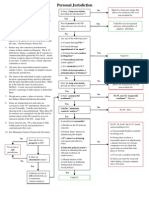

- Civil Procedure Personal Jurisdiction FlowchartDocument2 pagesCivil Procedure Personal Jurisdiction FlowchartBrandon Hauver100% (30)

- 02 - G.Knowledge - 18th-QAT - PEF PAPERS-1Document2 pages02 - G.Knowledge - 18th-QAT - PEF PAPERS-1haxxaansiddiqueNo ratings yet

- (9789004440777 - "The Turk" in The Czech Imagination (1870s-1923) ) "The Turk" in The Czech Imagination (1870s-1923)Document250 pages(9789004440777 - "The Turk" in The Czech Imagination (1870s-1923) ) "The Turk" in The Czech Imagination (1870s-1923)Halil İbrahim ŞimşekNo ratings yet

- Case 005 - People V PinedaDocument8 pagesCase 005 - People V PinedadirtylipopipsNo ratings yet

- Abinales and Amoroso: State and SocietyDocument390 pagesAbinales and Amoroso: State and SocietyClarisse100% (1)

- SWD 2023 698 Moldova ReportDocument127 pagesSWD 2023 698 Moldova ReportZiarul de GardăNo ratings yet

- Letter From Gloria SteinemDocument1 pageLetter From Gloria Steinemjkozin1488No ratings yet

- Merchant of Venice Critical AnalysisDocument2 pagesMerchant of Venice Critical AnalysisRasesh ThakerNo ratings yet

- PNOC Alternative Fuels Corporation vs. National Grid Corporation of The PhilippinesDocument2 pagesPNOC Alternative Fuels Corporation vs. National Grid Corporation of The PhilippinesClarebeth Recaña Ramos100% (1)

- Family Law AssignmentDocument2 pagesFamily Law Assignmentisha04tyagiNo ratings yet

- Top 100 Films of All Time ListDocument4 pagesTop 100 Films of All Time ListCristina948No ratings yet

- Modfule 5 Crim ProDocument12 pagesModfule 5 Crim ProDonita BernardinoNo ratings yet