Professional Documents

Culture Documents

CIA 1 - Risk and Return Analysis - Results Summary

Uploaded by

PADMANAP E 2127307Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIA 1 - Risk and Return Analysis - Results Summary

Uploaded by

PADMANAP E 2127307Copyright:

Available Formats

Student’s details:

Student’s Name Padmanap E

Reg. No. 2127307

Section F2

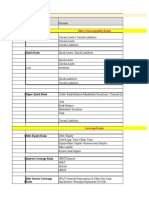

Risk-Return Analysis of any three asset classes – A summary table of the results

Panel - A PERIOD 1 - Returns PERIOD 1 - Risk

Stock Close Stock Close Price in Annualized Risk Expected Holding Annualized Coefficient of Sharpe Ratio

Price in January December 2019 returns or Premium Return Period Standard Variance

2019 Gain/Loss returns Return Deviation

Equity 367.20 491.55 0.163% 0.0640% -2.359% 45.54% 441.500% 1949.2257% 0.037%

10-year Govt. 7.418 6.554 -0.2487% Nil Nil 105.75% 441.28% 1947.29% -0.06%

Bond

BSE Nil Nil Nil Nil Nil Nil Nil Nil Nil

SENSEX/

NIFTY50

Gold 31531 39095 0.091% -2.384% -1.971% 23.99% 434.289% 1886.0689% 0.021%

Spot/ETF

Crude Oil Nil Nil Nil Nil Nil Nil Nil Nil Nil

Panel - B PERIOD 2 - Returns PERIOD 2 - RISK

Stock Close Stock Close Price in Annualized Risk Expected Holding Annualized Coefficient of Sharpe Ratio

Price in January December 2020 returns or Premium Return Period Standard Variance

2020 Gain/Loss returns Return Deviation

Equity 491.65 381.10 0.152% 0.0645% -1.483% -53.35% 410.407% 1684.3381% 0.037%

10-year Govt. 6.501 5.894 -1.384% Nil Nil 103.176% 430.540% 1853.649% -0.340%

Bond

BSE Nil Nil Nil Nil Nil Nil Nil Nil Nil

SENSEX/

NIFTY50

Gold 38977 50005 0.124% -3.290% -2.720% 28.30% 497.381% 2473.8768% 0.025%

Spot/ETF

Crude Oil Nil Nil Nil Nil Nil Nil Nil Nil Nil

Panel - C PERIOD 3 - Returns PERIOD 3 - Risk

Stock Close Stock Close Price in Annualized Risk Expected Holding Annualized Coefficient of Sharpe Ratio

Price in January December 2021 returns or Premium Return Period Standard Variance

2021 Gain/Loss returns Return Deviation

Equity 381.95 377.95 0.151% 0.0691% -5.126% -69.75% 423.807% 1796.1265% 0.037%

10-year Govt. 5.898 6.454 -1.037% Nil Nil 106.633% 444.950% 1979.809% -0.250%

Bond

BSE Nil Nil Nil Nil Nil Nil Nil Nil Nil

SENSEX/

NIFTY50

Gold 50143 47860 -0.021% Nil Nil -4.55% 460.323% 2118.9694% -0.005%

Spot/ETF

Crude Oil Nil Nil Nil Nil Nil Nil Nil Nil Nil

Panel – D COMPARISON TABLE

Period /Company Comparison between Comments on Risk and Returns

Jan 2019- Dec 2019 Equity Vs Govt. Bond The fact that money is floating more, quantitative easing, and chasing yields pushed

bond yields even lower in 2019.

Jan 2019- Dec 2019 Equity Vs Gold spot/ETF During this year, 2019 the prices of Gold and Equity fluctuates as when stock prices

fall and gold prices rise at the same time that stock prices rise.

Jan 2019- Dec 2019 Equity Vs Crude Oil Nil

Jan 2019- Dec 2019 Equity vs SENSEX / NIFTY50 Nil

Jan 2019- Dec 2019 Govt. Bond vs Gold Spot/ETF During 2019, the comparison Govt. Bond and Gold Spot follows traditional argument

of increasing govt. bond price affected the price of Gold (Rising yields are bad for

gold)

Jan 2019- Dec 2019 Govt. Bond vs Crude Oil Nil

Jan 2019- Dec 2019 Govt. Bond vs SENSEX/NIFTY50 Nil

Jan 2019- Dec 2019 Gold Spot/ETF vs Crude Oil Nil

Jan 2019- Dec 2019 Gold Spot/ ETF vs SENSEX/NIFTY50 Nil

Jan 2019- Dec 2019 Crude Oil vs SENSEX/ NIFTY 50 Nil

Period /Company Comparison between Comments on Risk and Returns

Jan 2020 – Dec 2020 Equity Vs Govt. Bond Equities become more appealing as bond yields fall even during 2020

Jan 2020 – Dec 2020 Equity Vs Gold spot/ETF Gold and Equity are both cyclical in nature, rising and falling of prices during the year

2020 in response to a variety of reasons (It is viewed by people as a safer investment

compare to equity)

Jan 2020 – Dec 2020 Equity Vs Crude Oil Nil

Jan 2020 – Dec 2020 Equity vs SENSEX / NIFTY50 Nil

Jan 2020 – Dec 2020 Govt. Bond vs Gold Spot/ETF In the year 2020, Gold spot price was rising steadily while the Govt. Bond yields was

decreasing. But the relation between this two has become stronger over the years.

Jan 2020 – Dec 2020 Govt. Bond vs Crude Oil Nil

Jan 2020 – Dec 2020 Govt. Bond vs SENSEX/NIFTY50 Nil

Jan 2020 – Dec 2020 Gold Spot/ETF vs Crude Oil Nil

Jan 2020 – Dec 2020 Gold Spot/ ETF vs SENSEX/NIFTY50 Nil

Jan 2020 – Dec 2020 Crude Oil vs SENSEX/ NIFTY 50 Nil

Period /Company Comparison between Comments on Risk and Returns

Jan 2021-Dec 2021 Equity Vs Govt. Bond The market has grown so distorted, as anticipated for 2019 and 2020, that investors are

now participating in bond rallies and investing in equities for yield.

Jan 2021-Dec 2021 Equity Vs Gold spot/ETF During 2021, the equity has been performed well comparatively as the investors invest

when prices are low, they buy them and keep them until they reach expected levels.

Jan 2021-Dec 2021 Equity Vs Crude Oil Nil

Jan 2021-Dec 2021 Equity vs SENSEX / NIFTY50 Nil

Jan 2021-Dec 2021 Govt. Bond vs Gold Spot/ETF 2021 comparison table shows the peak and troughs in Govt. Bond and Gold Spot. As

also it shows when govt. bond are at their lowest, gold spot thrives.

Jan 2021-Dec 2021 Govt. Bond vs Crude Oil Nil

Jan 2021-Dec 2021 Govt. Bond vs SENSEX/NIFTY50 Nil

Jan 2021-Dec 2021 Gold Spot/ETF vs Crude Oil Nil

Jan 2021-Dec 2021 Gold Spot/ ETF vs SENSEX/NIFTY50 Nil

Jan 2021-Dec 2021 Crude Oil vs SENSEX/ NIFTY 50 Nil

Period /Company Comparison between Comments on Risk and Returns

Equity 2019 vs 2020 Risk between the years 2019 and 2020 are higher than 2020. As risk is higher

the return on equity for the year 2019 is higher than 2020

As it clearly indicates that increased potential investment on Equity usually it

goes with increased risk.

10-year Govt. Bond 2019 vs 2020 The percentage has been reduced for 10-year Govt. Bond from 2019 to 2020.

This is lower than the long term average of the year 2019.

BSE SENSEX/ 2019 vs 2020 Nil

NIFTY50

Gold Spot/ETF 2019 vs 2020 The comparison table shows that Gold spot has inclined than the previous year

2019 and even the risk for the Gold spot has also increased.

This clearly indicates that investors are becoming more risk averse and are

putting money in gold, which increases the risk on Gold spot.

Crude Oil 2019 vs 2020 Nil

Equity 2020 vs 2021 Risk for the year 2021 is higher than risk for the year 2020 but at the same time

return on equity is higher for the year 2020, which is not like the previous

comparison of Equity during 2019 and 2020.

This result could be the reason of investors reduced risk associated with their

portfolio and limit their potential returns

10-year Govt. Bond 2020 vs 2021 10-year Govt. Bond further reduces at the beginning and rises at the end, which

results in increase in return compare to the previous year 2020.

The risk for this particular year has also increased further than previous year as

it is more liquid and widely traded bond.

BSE SENSEX/ 2020 vs 2021 Nil

NIFTY50

Gold Spot/ETF 2020 vs 2021 During 2020 and 2021, Gold prices further increase and reduced at the year

end increased the risk for the gold than the previous year 2020.

This may be the reason as investors/people are paying the bank or government

to hold their money and invest in gold to get the opportunity of increase on the

return on investment.

Crude Oil 2020 vs 2021 Nil

Major Findings:

1. The influence of financial and economic variables on equity, government bonds, and gold spot were investigated using data from official

sources in this Risk and Return study results summary.

2. Bond effects are an important conclusion to examine; dropping bond prices have been linked to higher equities prices.

3. Stronger economic fundamentals drew investors away from bonds and into stocks, while worse economic growth did the opposite.

4. A favourable influence on equity market returns is expected, as rising prices are a sign of healthy economic growth.

5. The danger drawn to investors by the dispersion of returns is the reason for negative equities returns or other investments. Investors' risk

sentiment is influenced by this dispersion, and as a result, investment prices are declining.

You might also like

- Sample Loan Mod Package W ProposalDocument12 pagesSample Loan Mod Package W ProposalJules Caesar VallezNo ratings yet

- Mini - Case - AnalyticsDocument5 pagesMini - Case - AnalyticsAlex Ngai100% (1)

- Angel InvestorDocument2 pagesAngel InvestorThuận Lê100% (1)

- Statement Chase Ismosis o CarloDocument4 pagesStatement Chase Ismosis o CarloYoel CabreraNo ratings yet

- Capital Budgeting Case StudyDocument3 pagesCapital Budgeting Case StudySafi Sheikh100% (1)

- List of Standard Reports in Oracle EBSDocument17 pagesList of Standard Reports in Oracle EBSJilani Shaik100% (1)

- Goldilocks-All Bout GoldilocksDocument13 pagesGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- India Bulls Housing Finance LimitedDocument67 pagesIndia Bulls Housing Finance LimitedslohariNo ratings yet

- AKL P6-2 Achmad Faizal AzmiDocument5 pagesAKL P6-2 Achmad Faizal AzmiTiara Eva Tresna100% (1)

- An Overview of The Nigerian Financial SystemDocument9 pagesAn Overview of The Nigerian Financial SystemHayatu A. NuhuNo ratings yet

- Business Partner Configuration in SAP REFXDocument3 pagesBusiness Partner Configuration in SAP REFXdrdjdNo ratings yet

- SGB - Product Note With PriceDocument9 pagesSGB - Product Note With PriceYash SoniNo ratings yet

- SR Research SVCDocument8 pagesSR Research SVCshNo ratings yet

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Document3 pages6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoNo ratings yet

- Microsoft Word - Investing Asymmetry - Will Retail Investor Catch UpDocument4 pagesMicrosoft Word - Investing Asymmetry - Will Retail Investor Catch UpdpakmundraNo ratings yet

- Aurobindo Pharma Ratio Analysis Anuja Vagal SampleDocument13 pagesAurobindo Pharma Ratio Analysis Anuja Vagal SampleAryan RajNo ratings yet

- Aurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleDocument13 pagesAurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleAryan RajNo ratings yet

- AFM PPT FinalDocument45 pagesAFM PPT Final0nilNo ratings yet

- CH 17 InvestmentsDocument18 pagesCH 17 InvestmentsAbdi hasenNo ratings yet

- Vodafone Idea LTD.: Detailed QuotesDocument21 pagesVodafone Idea LTD.: Detailed QuotesVachi VidyarthiNo ratings yet

- Main Assumptions: Chapter 5: Financial PlanDocument5 pagesMain Assumptions: Chapter 5: Financial PlanValeria Quispe ToribioNo ratings yet

- Morning Brief - September 07, 2022Document1 pageMorning Brief - September 07, 2022ANKUR KIMTANINo ratings yet

- Bombay Dyeing and MFG Co LTDDocument19 pagesBombay Dyeing and MFG Co LTDSambhav ShahNo ratings yet

- FM - UASM - OM - Siti Diyah Ayu LestariDocument4 pagesFM - UASM - OM - Siti Diyah Ayu LestariSiti Dyah Ayu LNo ratings yet

- Financial Management Project: Presented byDocument16 pagesFinancial Management Project: Presented byAsif KhanNo ratings yet

- Mohd Saqlain - SAPMDocument6 pagesMohd Saqlain - SAPMMOHD SAQLAIN MOVINA PARVEENNo ratings yet

- OIlsDocument5 pagesOIlsdprosenjitNo ratings yet

- JS Income FundDocument9 pagesJS Income Fundcoolbouy85No ratings yet

- Amarnath Advisors DataDocument12 pagesAmarnath Advisors Dataashutosh trivediNo ratings yet

- MF COMPARISON - Small CapDocument3 pagesMF COMPARISON - Small CapRajkumar GNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- Financial Management - DB - Mod3Document19 pagesFinancial Management - DB - Mod3Madhav AgarwalNo ratings yet

- 9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckDocument80 pages9-14-2021 DoubleLine Total Return Webcast With Jeffrey Gundlach - Slide DeckZerohedgeNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysishashim shahNo ratings yet

- Fcpo-Bmd News: Futures Tumble Dragging Cash Prices Lower To Compete With Us$80 Reduction in Indonesian LevyDocument4 pagesFcpo-Bmd News: Futures Tumble Dragging Cash Prices Lower To Compete With Us$80 Reduction in Indonesian Levykunal singhNo ratings yet

- Proyeccion Economica Mundial 2020Document16 pagesProyeccion Economica Mundial 2020huacholeNo ratings yet

- CH 14 Solutions To Selected End of Chapter ProblemsDocument5 pagesCH 14 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- Roughly in Line Q1Document3 pagesRoughly in Line Q1John PecisNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Fullerton SGD Heritage Income: June 2020Document3 pagesFullerton SGD Heritage Income: June 2020InaRizkyNo ratings yet

- Apollo Hospitals Enterprise Limited: Strong BUYDocument9 pagesApollo Hospitals Enterprise Limited: Strong BUYakumar4uNo ratings yet

- Edelweiss SP - ARC - Jul'19 PMS PDFDocument12 pagesEdelweiss SP - ARC - Jul'19 PMS PDFPanache ZNo ratings yet

- Property & REIT Sector 200903Document3 pagesProperty & REIT Sector 200903Brian StanleyNo ratings yet

- Morning - India 20210825 Mosl Mi PG008Document8 pagesMorning - India 20210825 Mosl Mi PG008vikalp123123No ratings yet

- Sovereign Gold Bond 2021-22: Series IIIDocument8 pagesSovereign Gold Bond 2021-22: Series IIIfnopulseNo ratings yet

- Wealth Creation: - Fire Bolt InvestmentsDocument22 pagesWealth Creation: - Fire Bolt Investmentskrish3291No ratings yet

- Daily Market Update May 2022Document3 pagesDaily Market Update May 2022Dheeraj JhunjhunwalaNo ratings yet

- Fuel Prices - January 14 2019Document1 pageFuel Prices - January 14 2019Tiso Blackstar GroupNo ratings yet

- Week 7 - Bond Prices and YieldsDocument47 pagesWeek 7 - Bond Prices and YieldsshanikaNo ratings yet

- Time Value of Money and FormulasDocument5 pagesTime Value of Money and Formulasjanam shahNo ratings yet

- FSA-Assignment: Company Analysis of Glenmark PharmaceuticalsDocument26 pagesFSA-Assignment: Company Analysis of Glenmark PharmaceuticalsSanjib Kumar RamNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- Finance KT-5: ValuationDocument15 pagesFinance KT-5: ValuationABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- Fuel Prices - January 11 2019Document1 pageFuel Prices - January 11 2019Tiso Blackstar GroupNo ratings yet

- PBW - Invesco WilderHill Clean Energy ETF Fact SheetDocument2 pagesPBW - Invesco WilderHill Clean Energy ETF Fact SheetRahul SalveNo ratings yet

- Ruffer Investment Company LimitedDocument19 pagesRuffer Investment Company LimitedForkLogNo ratings yet

- NjpmsDocument20 pagesNjpmsRahul ShahNo ratings yet

- BPI Equity Value Fund - November 2023 v2Document3 pagesBPI Equity Value Fund - November 2023 v2Lexter Renzo RamosNo ratings yet

- Fuel Prices - October 4 2019Document1 pageFuel Prices - October 4 2019Anonymous gugmco8CNo ratings yet

- FMI Assignment-10Document3 pagesFMI Assignment-10diveshNo ratings yet

- Abans Finance Pvt. Ltd. October 2020Document19 pagesAbans Finance Pvt. Ltd. October 2020Supreeth SANo ratings yet

- Fund Performance: Managed Equity Dollar January 04, 2021 Money MarketDocument5 pagesFund Performance: Managed Equity Dollar January 04, 2021 Money MarketRon CatalanNo ratings yet

- Fuel Prices - October 10 2019Document1 pageFuel Prices - October 10 2019Anonymous DmAspukuNo ratings yet

- Evaluating The Firm'S Dividend PolicyDocument11 pagesEvaluating The Firm'S Dividend PolicyYash Aggarwal BD20073No ratings yet

- Venkata Kanada - Computation of Total Income - A Y 2021-22Document32 pagesVenkata Kanada - Computation of Total Income - A Y 2021-22POTANA TELUGU BHAGAVATAMNo ratings yet

- Nomura - May 6 - CEATDocument12 pagesNomura - May 6 - CEATPrem SagarNo ratings yet

- Final AssignmentDocument54 pagesFinal AssignmentValentin PicavetNo ratings yet

- Fuel Prices - February 21 2019Document1 pageFuel Prices - February 21 2019Tiso Blackstar GroupNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Internship ReportDocument18 pagesInternship ReportSofonias MenberuNo ratings yet

- Fin304 1midterm2Document5 pagesFin304 1midterm2darkhuman343No ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- PutnamDocument60 pagesPutnamThat is my name I am not a shy political animalNo ratings yet

- The Credit Channel Is An Enhancement Mechanism For Traditional Monetary PolicyDocument2 pagesThe Credit Channel Is An Enhancement Mechanism For Traditional Monetary PolicyigrinisNo ratings yet

- KEQ FV and PV TablesDocument4 pagesKEQ FV and PV TablesRaj ShravanthiNo ratings yet

- Dividend Policy of A Firm PDFDocument28 pagesDividend Policy of A Firm PDFpaisa321No ratings yet

- COVID-19 Outbreak: Impact On Sri Lanka and RecommendationsDocument19 pagesCOVID-19 Outbreak: Impact On Sri Lanka and RecommendationsMohamed FayazNo ratings yet

- Project Report: "A Descriptive Analysis of Depository Participant WithDocument97 pagesProject Report: "A Descriptive Analysis of Depository Participant WithJOMONJOSE91No ratings yet

- Fixed Income Portfolio StrategiesDocument28 pagesFixed Income Portfolio Strategies9986212378No ratings yet

- AS Economics Chapter 9Document4 pagesAS Economics Chapter 9Rao AliNo ratings yet

- Capital Allocation Between The Risky and The Risk-Free AssetDocument32 pagesCapital Allocation Between The Risky and The Risk-Free AssetanushreegoNo ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- What Is Systematic Investment PlanDocument5 pagesWhat Is Systematic Investment PlanAbhijitNo ratings yet

- Core Banking Solution - BrochureDocument2 pagesCore Banking Solution - BrochureReeta DuttaNo ratings yet

- 9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent CommissionersDocument10 pages9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent Commissionerscristina.llaneza02100% (1)

- Housing ReportDocument6 pagesHousing ReportJasmin QuebidoNo ratings yet

- Introduction To Private and Public BankDocument17 pagesIntroduction To Private and Public BankAbhishek JohariNo ratings yet

- Assignment 2 Anul 1 Id - Tos - Nivel LicentaDocument4 pagesAssignment 2 Anul 1 Id - Tos - Nivel LicentaCostache DanielaNo ratings yet

- Homework Solutions Chapter 1Document9 pagesHomework Solutions Chapter 1Evan BruendermanNo ratings yet

- Frequently Asked Questions For Branch BankingDocument3 pagesFrequently Asked Questions For Branch BankingEMBA KUBSNo ratings yet