Professional Documents

Culture Documents

YES BANK - Case Study

YES BANK - Case Study

Uploaded by

kausal santhoshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

YES BANK - Case Study

YES BANK - Case Study

Uploaded by

kausal santhoshCopyright:

Available Formats

CHALLENGES

The challenge for a new entrant was to create a strategic differentiator that would make for a

compelling proposition for depositors and borrowers alike.

Key challenges for the bank initially was raising liabilities.

Growth

YES BANK grew at a blistering pace due to its strategic and management team focus on the four

pillars of Product Capital – Financial Markets, Investment Banking, Transaction Banking and

Corporate Finance. (supplemented by building relationships in Commercial Banking, Retail Banking

and Institutional Banking segments.

In 2005, Bank had generated an early stage profitability with its assets amounting to $273.74

million.

The Bank had issued an IPO which was oversubscribed 30 times.

DIFFERENTIATION

YES BANK experienced growth because of the innovative and differentiated series of

business strategies carried out by the Bank.

Such differentiated practices involve adapting differentiated human resource practices also

the Bank differentiated itself from other players in the industry through its unique

‘Knowledge Banking’ approach. The top mgt of YES BANK considered KB as the heart of all

their core businesses.

Through this KB approach, YES BANK provided knowledge driven Banking solutions to their

commercial and corporate banking clients and this in turn helped the Bank in

institutionalizing strong customer relationships and also allowed the cross selling of products

more effectively, thereby generating fee-based revenues with lower capital requirements.

Another major differentiator factor for YES BANK was its “Responsible Banking” concept.

This concept implies that promoting financially inclusive growth along with being selective

and investing only in those businesses that are socially and environmentally responsible.

OPERATIONS

Operations - Introduced a new approach in its operations. As capital and operational

expenditures in technology account for a significant portion for the typical Indian Bank’s cost

structure, YES BANK in 2004 signed a 7-year agreement with Wipro Infotech.

This resulted in Wipro in managing the entire non-core technological infrastructure

requirements of the Bank, including the IT infrastructure and hardware, networking and

managing a data centre on a build, own and operate basis.

First contract of such sort in Indian Banking history. Many competing Banks have been

following the same suit.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Virat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013Document97 pagesVirat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013InfiniteKnowledgeNo ratings yet

- ProcessDocument3 pagesProcesskausal santhoshNo ratings yet

- Chart TitleDocument2 pagesChart Titlekausal santhoshNo ratings yet

- Consumer Protection ActDocument4 pagesConsumer Protection Actkausal santhoshNo ratings yet

- Notes Ii LabDocument25 pagesNotes Ii Labkausal santhoshNo ratings yet

- Data Role PlayDocument2 pagesData Role Playkausal santhoshNo ratings yet

- Formal LearningDocument7 pagesFormal Learningkausal santhoshNo ratings yet

- AuditDocument5 pagesAuditKyanna Mae LecarosNo ratings yet

- Paving The Pathways To Impact: in Horizon EuropeDocument10 pagesPaving The Pathways To Impact: in Horizon Europefatmama7031No ratings yet

- Asva Finance One PaperDocument4 pagesAsva Finance One PaperAlpazl RaqqasyiNo ratings yet

- Dublin Case StudyDocument2 pagesDublin Case Studyapi-265604463100% (1)

- Challenges Faced by Microfinance InstitutionsDocument20 pagesChallenges Faced by Microfinance InstitutionsPrince Kumar Singh100% (2)

- Anexo 2. T2 - David RicardoDocument9 pagesAnexo 2. T2 - David RicardoYari JojoaNo ratings yet

- Panauti Municipality at A Glance: Agriculture Revolution, Beautiful Natural, Arts and Culture CityDocument9 pagesPanauti Municipality at A Glance: Agriculture Revolution, Beautiful Natural, Arts and Culture Citypawanshrestha1No ratings yet

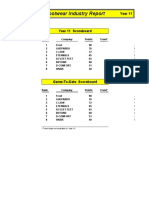

- Footwear Industry ReportDocument11 pagesFootwear Industry ReportIvar TrocheNo ratings yet

- RT Competition StandardDocument4 pagesRT Competition StandardJohn KalvinNo ratings yet

- HRM Final Report 8968Document27 pagesHRM Final Report 8968Rao AzizNo ratings yet

- Foundation University Business Incubation Center (Fubic)Document8 pagesFoundation University Business Incubation Center (Fubic)Danish HafeezNo ratings yet

- Exam MB 901 Microsoft Dynamics 365 Fundamentals Skills MeasuredDocument9 pagesExam MB 901 Microsoft Dynamics 365 Fundamentals Skills MeasuredMarcelo Plada IntNo ratings yet

- 2020:21 Unit 6 - Strategic Direction and LeadershipDocument28 pages2020:21 Unit 6 - Strategic Direction and LeadershipMckhayle AugierNo ratings yet

- Total Non-Basic Charges:: (Cite Your Source Here.)Document1 pageTotal Non-Basic Charges:: (Cite Your Source Here.)osman taşNo ratings yet

- U7.Fashion Companies Should Never Outsource Their Work To Other Countries. Do You Agree or Disagree ?Document1 pageU7.Fashion Companies Should Never Outsource Their Work To Other Countries. Do You Agree or Disagree ?11tranthiphuongthao05No ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- Daily Treasury Report0323 ENGDocument3 pagesDaily Treasury Report0323 ENGBiliguudei AmarsaikhanNo ratings yet

- Accounting For The Circular Economy 31012021Document3 pagesAccounting For The Circular Economy 31012021NassimNo ratings yet

- Bifm Pula Money Market Fund Factsheet Q4 2021Document1 pageBifm Pula Money Market Fund Factsheet Q4 2021Unaswi Pearl ShavaNo ratings yet

- Managing The Project BudgetDocument68 pagesManaging The Project BudgetGanesh Tigade100% (1)

- Cost Management TrainingDocument109 pagesCost Management TrainingAbdelhamid HarakatNo ratings yet

- Synopsis Sagar Project - A Study On The Need of CRM in OrganizatonDocument3 pagesSynopsis Sagar Project - A Study On The Need of CRM in OrganizatonViraja GuruNo ratings yet

- Mechanics of Options MarketsDocument53 pagesMechanics of Options MarketsbharatNo ratings yet

- Abstract For AmruthaDocument8 pagesAbstract For AmruthaShama UthappaNo ratings yet

- MotorcycleDocument42 pagesMotorcycleAiddie GhazlanNo ratings yet

- Accounting 101 Chapter 2Document11 pagesAccounting 101 Chapter 2Kriss AnnNo ratings yet

- Cambodia Trade Integration Strategy 2019-2023 Main Report & Action MatrixDocument410 pagesCambodia Trade Integration Strategy 2019-2023 Main Report & Action MatrixSamdy Lonh100% (2)

- SBS Instalment Plans at 0% Markup : Alfalah Credit Cards Application FormDocument2 pagesSBS Instalment Plans at 0% Markup : Alfalah Credit Cards Application FormWajiha HaroonNo ratings yet

- Class 12 - Payout Policy - 1Document1 pageClass 12 - Payout Policy - 1Stepan MaykovNo ratings yet