Professional Documents

Culture Documents

Computation of Total Income For Itr

Uploaded by

avisinghoo70 ratings0% found this document useful (0 votes)

109 views2 pagesOriginal Title

Computation-of-total-income-for-itr-Copy

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views2 pagesComputation of Total Income For Itr

Uploaded by

avisinghoo7Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

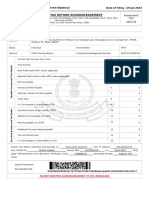

Computation of Total Income

Income from Salary (Chapter IV A) 748000

MAHALAXMI MEDICAL AND GENERAL STORE

S/O PUKHRAJ , MALIYON KA

MOHALLA , ARATHWARA ,

ARATHWARA , ARATHWARA ,

SIROHI , RAJASTHAN - 307028

Salary 798000

Less: Standard Deduction u/s 16(ia) 50000

748000

Income from Business or Profession (Chapter IV D) 59287

Income u/s 44AD 49749

Income from Other Sources (Chapter IV F) 800000

Other income 100000

Gross Total

1607287

Income

Total Income 1607287

Round off u/s 288 A 228440

less : Deduction

Net total Income 228440

Adjusted total income (ATI) is not more than Rs. 20 lakh hence AMT not applicable.

Tax Due 0

Rebate u/s 87A ( limit 12,500) 0

0

T.D.S./T.C.S 45990

-45990

Refundable (Round off u/s 288B) 45990

Tax calculation on Normal income of Rs 476700/-

Exemption Limit :250000

Tax on -21560 -1078

Total Tax = 11335

Income Declared u/s 44 AD Profit from Profit

Gross Receipts/Turnover 789000

Book Profit 58439 7.41%

Deemed Profit 14287.76 1.81%

Net Profit Declared 58439 7.41%

GST Turnover Detail

S.NO. GSTIN Turnover

789000

TOTAL 789000

Signature

(JAYANTI LAL RAVAL)

You might also like

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

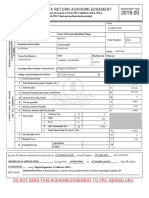

- Indian Income Tax Return Acknowledgement for Rs. 240,551Document1 pageIndian Income Tax Return Acknowledgement for Rs. 240,551maxNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

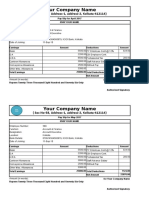

- Payslip Aug 2023Document1 pagePayslip Aug 2023paras rawatNo ratings yet

- Swati Web Technologies Private Limited: Salary Slip For July - 2023Document1 pageSwati Web Technologies Private Limited: Salary Slip For July - 2023r76768477No ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Teamhgs 165148 Nov 2017 Payslip 165148Document1 pageTeamhgs 165148 Nov 2017 Payslip 165148Mohammad IrfanNo ratings yet

- Ca Audit Report 2324Document6 pagesCa Audit Report 2324UmasankarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- Opes PayslipDocument1 pageOpes PayslipDipendra TOMARNo ratings yet

- Salary Pay Slip Model PDFDocument1 pageSalary Pay Slip Model PDFAbhishek BhardwajNo ratings yet

- Kanchan Pharma Private Limited: Salary Slip For July - 2023Document1 pageKanchan Pharma Private Limited: Salary Slip For July - 2023r76768477No ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Payslip For The Month of May 2023Document1 pagePayslip For The Month of May 2023kumarsandeep838383No ratings yet

- November 2016Document1 pageNovember 2016vasssssssSNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Document2 pagesCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Payslip Prakhar PRA745634 1635359400000Document1 pagePayslip Prakhar PRA745634 163535940000024hours service centerNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

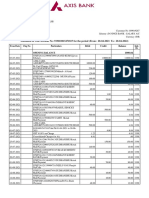

- Acctstmt FDocument3 pagesAcctstmt FAbhay SinghNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipanakinpowersNo ratings yet

- IBM Form 16 for Piyush MehtaDocument7 pagesIBM Form 16 for Piyush MehtaNeha Upadhyay MehtaNo ratings yet

- Payment Slip Dec 2022Document1 pagePayment Slip Dec 2022alik17548No ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Arul Payslip NewDocument1 pageArul Payslip Newrajeshkapoo0% (1)

- Offer Letter: D-278, Near Hanuman MandirDocument3 pagesOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNo ratings yet

- Jodhpur Vidyut Vitran Nigam Limited Pay Slip March-2020Document1 pageJodhpur Vidyut Vitran Nigam Limited Pay Slip March-2020Mukesh kumar Dewra100% (2)

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- Square Yards Consulting Private Limited: Payslip For The Month of April 2023Document1 pageSquare Yards Consulting Private Limited: Payslip For The Month of April 2023Neelesh PandeyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Recoveries Earnings: Amount AmountDocument3 pagesRecoveries Earnings: Amount AmountVadamalai AdhimoolamNo ratings yet

- Indian ITR Acknowledgement for AY 2020-21Document1 pageIndian ITR Acknowledgement for AY 2020-21AJAY KUMAR JAISWALNo ratings yet

- PayslipDocument1 pagePayslipBalu PedapudiNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Parle Agro PVT Ltd-46Document1 pageParle Agro PVT Ltd-46QASWA ENGINEERING PVT LTDNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Bhanu Pay SlipDocument1 pageBhanu Pay SlipShyam ChouhanNo ratings yet

- 1st Page ITRV FY 20-21Document1 page1st Page ITRV FY 20-21naveen kumarNo ratings yet

- Awais Ahmed (UTL0477)Document1 pageAwais Ahmed (UTL0477)Awais AhmedNo ratings yet

- 10011488Document1 page10011488Anonymous BtiQTJz00% (1)

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- VIRCHOW Petrochemical Pay SlipsDocument5 pagesVIRCHOW Petrochemical Pay SlipsraajiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Mohammad AliNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Spectrum Consultants India Pvt Ltd November 2022 PayslipDocument1 pageSpectrum Consultants India Pvt Ltd November 2022 PayslipKiran PawarNo ratings yet

- Salary Slip FormatDocument2 pagesSalary Slip FormatManu SenNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- Payslip For BeginnerDocument1 pagePayslip For BeginnerKhan SahbNo ratings yet

- ITR-4 Acknowledgement for AY 2021-22Document1 pageITR-4 Acknowledgement for AY 2021-22Aditya Adi SinghNo ratings yet

- Computation of Total Income For ItrDocument2 pagesComputation of Total Income For ItrRajesh JainNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- All - Enrolment - Centres - List21-08-2021 14 - 43 - 31Document2 pagesAll - Enrolment - Centres - List21-08-2021 14 - 43 - 31Pratibha KumariNo ratings yet

- COUSTMER SUPPORT Position at Sanjeevana Institute For Career Advancement PVTDocument2 pagesCOUSTMER SUPPORT Position at Sanjeevana Institute For Career Advancement PVTavisinghoo7No ratings yet

- Adobe MIS As On 4 OctDocument2,948 pagesAdobe MIS As On 4 Octavisinghoo7No ratings yet

- 10 FebDocument1 page10 Febavisinghoo7No ratings yet

- SerialDocument1 pageSerial3jos3aNo ratings yet

- Lot 12 JulyDocument2 pagesLot 12 Julyavisinghoo7No ratings yet

- Feb HDFCDocument33 pagesFeb HDFCavisinghoo7No ratings yet

- 4577XXXXXXXXXX19 - 13 07 2023Document3 pages4577XXXXXXXXXX19 - 13 07 2023avisinghoo7No ratings yet

- Customer application photo statusDocument1 pageCustomer application photo statusavisinghoo7No ratings yet

- Preeti PathaniaDocument216 pagesPreeti Pathaniaavisinghoo7No ratings yet

- 30 Dec DataDocument104 pages30 Dec Dataavisinghoo7100% (1)

- Dsa LoginDocument144 pagesDsa Loginavisinghoo7No ratings yet

- 14 Jan LootDocument1 page14 Jan Lootavisinghoo7No ratings yet

- Data CheckDocument24 pagesData Checkavisinghoo7No ratings yet

- 21 Jan DataDocument61 pages21 Jan Dataavisinghoo7No ratings yet

- Customer Application Tracking ListDocument2 pagesCustomer Application Tracking Listavisinghoo7No ratings yet

- Lot 27Document2 pagesLot 27avisinghoo7No ratings yet

- SERVER102Document1 pageSERVER102avisinghoo7No ratings yet

- Payslip 2022 2023 10 700059 VPHSHBDDocument3 pagesPayslip 2022 2023 10 700059 VPHSHBDavisinghoo7No ratings yet

- Contact and Application Details ListDocument1 pageContact and Application Details Listavisinghoo7No ratings yet

- 1627 SalarySlipwithTaxDetailsDocument1 page1627 SalarySlipwithTaxDetailsavisinghoo7No ratings yet

- Payslip 09 2022Document1 pagePayslip 09 2022avisinghoo7No ratings yet

- Payslip 1185Document1 pagePayslip 1185avisinghoo7No ratings yet

- 18 Jan UsedDocument845 pages18 Jan Usedavisinghoo70% (1)

- Payslip 2022 2023 9 700059 VPHSHBDDocument1 pagePayslip 2022 2023 9 700059 VPHSHBDavisinghoo7No ratings yet

- 0 - 5225382 - 1 - Salary Slip - Sep 2022Document1 page0 - 5225382 - 1 - Salary Slip - Sep 2022avisinghoo7No ratings yet

- Acct Statement - XX1817 - 12102022Document3 pagesAcct Statement - XX1817 - 12102022avisinghoo7No ratings yet

- Vishal Singh (E0267)Document1 pageVishal Singh (E0267)avisinghoo7No ratings yet

- 2 Luca Castellani Paperless TradeDocument12 pages2 Luca Castellani Paperless Tradeavisinghoo7No ratings yet

- Case For Critical Analysis Elektra Products, Inc.: Management DynamicsDocument11 pagesCase For Critical Analysis Elektra Products, Inc.: Management Dynamicsjojo_p_javierNo ratings yet

- Moments of TruthDocument15 pagesMoments of Truthdiana rNo ratings yet

- HidadfrDocument55 pagesHidadfrArvind JSNo ratings yet

- CP Shipping Desk 2018Document18 pagesCP Shipping Desk 2018Farid OMARINo ratings yet

- SALES FORECASTING TECHNIQUESDocument12 pagesSALES FORECASTING TECHNIQUESUjjwal MalhotraNo ratings yet

- BournvitaDocument39 pagesBournvitaSwapnil PandeyNo ratings yet

- ĐỀ IIG - TEST 03Document34 pagesĐỀ IIG - TEST 032221003204No ratings yet

- Indian Footwear Industry: Global Production and Export PowerhouseDocument6 pagesIndian Footwear Industry: Global Production and Export PowerhouseVishal DesaiNo ratings yet

- Scan To Scribd With CcscanDocument13 pagesScan To Scribd With CcscanclarkcclNo ratings yet

- Nmims HRM AssignmentDocument9 pagesNmims HRM AssignmentDurvas KarmarkarNo ratings yet

- Financial Reporting Council Guidance On Audit Committees: AppendixDocument14 pagesFinancial Reporting Council Guidance On Audit Committees: AppendixnmamNo ratings yet

- Train With Bain 2 HandoutDocument7 pagesTrain With Bain 2 HandoutAnn100% (1)

- Itp For All MaterialsDocument59 pagesItp For All MaterialsTauqueerAhmad100% (1)

- Alternative Beta Matters 2017 Q2 NewsletterDocument13 pagesAlternative Beta Matters 2017 Q2 NewsletterLydia AndersonNo ratings yet

- Dpti 004 05Document1 pageDpti 004 05Joshua CooperNo ratings yet

- Amazon As An EmployerDocument2 pagesAmazon As An EmployerSagar Bhoite100% (1)

- Pricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDocument11 pagesPricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- Hiring and Selection Case Group 0006BDocument10 pagesHiring and Selection Case Group 0006BKonanRogerKouakouNo ratings yet

- Chapter 3 Digital EntrepreneurshipDocument17 pagesChapter 3 Digital Entrepreneurshipj9cc8kcj9wNo ratings yet

- Student ProfileDocument24 pagesStudent ProfileDeepNo ratings yet

- Appendix F - HSE - InpexDocument10 pagesAppendix F - HSE - InpexGrinaldi BurhanNo ratings yet

- Essential Statistics Regression and Econometrics 2nd Edition Smith Solutions ManualDocument13 pagesEssential Statistics Regression and Econometrics 2nd Edition Smith Solutions Manualjustinparkerywkjmfiotz100% (17)

- EN-Invitation To Tender-2023-0002-FinalDocument5 pagesEN-Invitation To Tender-2023-0002-FinalOzreniusNo ratings yet

- Muller and Phipps - Google SearchDocument1 pageMuller and Phipps - Google Searchwarishaabbasi13No ratings yet

- MANPOWER PLANNING - INTRO-RecordedDocument10 pagesMANPOWER PLANNING - INTRO-Recordedsammie celeNo ratings yet

- Marketing Research Completed RevisedDocument70 pagesMarketing Research Completed RevisedJodel DagoroNo ratings yet

- DHL Express - USA Customs Duty InvoiceDocument1 pageDHL Express - USA Customs Duty InvoiceShahid SaleemNo ratings yet

- Swift 2017stantardsforum Tec3 SwiftgpiDocument30 pagesSwift 2017stantardsforum Tec3 SwiftgpisunetravbNo ratings yet

- Last 6 Months Bank StatementDocument8 pagesLast 6 Months Bank StatementGajanandNo ratings yet

- 5G Connectivity and Its Effects in NigeriaDocument15 pages5G Connectivity and Its Effects in NigeriastephendivineoluwaseunNo ratings yet