Professional Documents

Culture Documents

Journal Article

Uploaded by

IndrajithAbeysingheCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal Article

Uploaded by

IndrajithAbeysingheCopyright:

Available Formats

www.ccsenet.org/ass Asian Social Science Vol. 7, No.

5; May 2011

The Relationship between Organizational Resources and Systems:

An Empirical Research

Alimin Ismadi Ismail (Corresponding author)

Graduate School of Management (GSM), Universiti Putra Malaysia (UPM)

43400 Selangor, Malaysia

E-mail: aliminismadi@yahoo.com

Raduan Che Rose

Faculty of Economics and Management (FEM), Universiti Putra Malaysia (UPM)

43400 Selangor, Malaysia

E-mail: raduan@mohe.gov.my

Jegak Uli

Faculty of Educational Studies (FES), Universiti Putra Malaysia (UPM)

43400 Selangor, Malaysia

E-mail: jegak@ace.upm.edu.my

Haslinda Abdullah

Faculty of Economics and Management (FEM), Universiti Putra Malaysia (UPM)

43400 Selangor, Malaysia

E-mail: drhaslinda@gmail.com

Received: October 27, 2010 Accepted: November 29, 2010 doi:10.5539/ass.v7n5p72

Abstract

Organizational resources and systems have been conceptualized as to be able to significantly predict the level of

competitive advantage. This research empirically examined the importance and emphasis placed on the

relationship between organizational resources and systems, especially towards the attainment of firms’

competitive advantage. This research was conducted among manufacturers listed in the Federation of Malaysian

Manufacturers Directory 2008. A cross-sectional study using structured questionnaire was used to obtain

responses from the manufacturers. From the subsequent actual survey, 127 respondents replied and completed

the questionnaire (12.7% response rate). The large correlation (r = 0.72) implies a strong positive relationship

between the organizational resources and systems. As for the variance shared between these two variables, the

coefficient of determination (r² = 0.52) suggests that organizational resources help to account for nearly 52% of

the variance in systems, and vice versa. The theoretical implication of this study is that it supports and extends

the RBV of competitive advantage by illustrating the need for systematic management of resources towards

attaining competitive advantage.

Keywords: Organizational resources, Systems and competitive advantage, Resource-Based View (RBV)

1. Introduction

Studies have shown that there is a significant relationship between organizational resources, systems and

competitive advantage (Wernerfelt, 1984; Dierickx & Cool, 1989; Ma, 1999a, 1999b; Wiklund & Shepherd,

2003; Morgan, Kaleka, & Katsikeas, 2004). Empirical studies carried out have also found significant results in

72 ISSN 1911-2017 E-ISSN 1911-2025

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

such particular relationships (Morgan et al., 2004; Santhapparaj, Sreenivasan, & Loong, 2006; Phusavat &

Kanchana, 2007). Other past studies (Barney, 1991, 2001a, 2001b, 2007; Priem & Butler, 2001a, 2001b; King,

2007; Sirmon, Hitt, & Ireland, 2007) have also put forward the idea of the significant positive relationship

between organizational resources, systems and competitive advantage. As such, organizational resources and

systems have been conceptualized as to be able to significantly predict the level of competitive advantage. This

research empirically examined the importance and emphasis placed on the relationship between organizational

resources and systems, especially towards the attainment of firms’ competitive advantage.

2. Literature Review

2.1 Competitive Advantage

The pursuit of competitive advantage is indeed an idea that is at the heart of much of the strategic management

literature (Burden & Proctor, 2000; Fahy, 2000; Ma, 2000, 2004; Barney, 2001a, 2001b, 2007; Lin, 2003; Fahy,

Farrelly, & Quester, 2004; Cousins, 2005; Porter & Kramer, 2006; Liao & Hu, 2007). Understanding sources of

sustained competitive advantage has become a major area of study in strategic management (Porter, 1985, 1991;

Barney, 1991; Peteraf, 1993; Ma, 1999a, 1999b, 2004; Flint & Van Fleet, 2005; King, 2007). The resource-based

view stipulates that in strategic management the fundamental sources and drivers to firms’ competitive

advantage and superior performance are mainly associated with the attributes of their resources and capabilities

which are valuable and costly-to-copy (Barney, 1986, 1991, 2001a; Conner, 1991; Mills, Platts, & Bourne, 2003;

Peteraf & Bergen, 2003). Furthermore, other studies support the importance of having a good strategy to attain

competitive advantage from the resource-based view (Hult & Ketchen Jr., 2001; Ramsay, 2001; Foss & Knudsen,

2003; Gottschalg & Zollo, 2007). A well formulated and implemented strategy can have significant effect on the

attainment of competitive advantage level (Richard, 2000; Arend, 2003; Powell, 2003; Porter & Kramer, 2006).

The resource-based view provides an avenue for organizations to plan and execute their organizational strategy

by examining the position of their internal resources and capabilities towards achieving competitive advantage

(Kristandl & Bontis, 2007; Sheehan & Foss, 2007).

In this research, specific focus will be given to “competitive advantage” from the dimension of “value and

quality”, the main elements of which consist of “cost-based, product-based and service-based”. Other previous

studies have shown that there is a significant relationship between cost-based advantage and the performance of

organizations. Firms that enjoy cost-based competitive advantage over their rivals, for example in terms of

relatively lower manufacturing or production costs, lower cost of goods sold, and lower-price products, have

been shown to exhibit comparatively better performance (Gimenez & Ventura, 2002; Morgan et al., 2004).

Furthermore, it has also been identified that there is a significant relationship between product-based advantage

and performance of organizations. Firms that experience product-based competitive advantage over their rivals,

for example in terms of better and/or higher product quality, packaging, design and style, have been shown to

achieve relatively better performance (Gimenez & Ventura, 2002; Morgan et al., 2004). Similarly, research has

further illustrated that there is a significant relationship between service-based advantage and performance of

organizations. Firms that benefit from service-based competitive advantage compared to their rivals, for example

in terms of better and/or higher product flexibility, accessibility, delivery speed, reliability, product line breadth

and technical support, have accomplished comparatively better performance (Gimenez & Ventura, 2002;

Morgan et al., 2004).

2.2 Organizational Resources

As mentioned, the resource-based view (RBV) of the firm predicts that certain types of resources owned and

controlled by firms have the potential and promise to generate competitive advantage which eventually leads to

superior firm’s performance (Wernerfelt, 1984, 1995; Dierickx & Cool, 1989; Barney, 1991, 1995, 2001a, 2001b;

Peteraf, 1993; Chaharbaghi & Lynch, 1999; Fahy, 2000; Priem & Butler, 2001a, 2001b; Miller & Ross, 2003;

Morgan et al., 2004; King, 2007; Sirmon et al., 2007; Ainuddin et al., 2007). Eisenhardt and Martin (2000),

Harrison, Hitt, Hoskisson, and Ireland (2001), Hoopes, Madsen, and Walker (2003), Ireland, Hitt, and Sirmon

(2003), Mills et al. (2003) and Morgan et al. (2004), following Wernerfelt (1984, 1995) and Barney (1986, 1991),

have examined and categorized resources into tangible resources i.e. human, physical, organizational, financial;

and intangible resources i.e. reputational, regulatory, positional, functional, social and cultural.

From the categories of resources cited above, the human resources (Adner & Helfat, 2003; Datta, Guthrie, &

Wright, 2005; Haslinda Abdullah, Raduan Che Rose, & Naresh Kumar, 2007a, 2007b; Raduan Che Rose &

Naresh Kumar, 2007) and the intangible resources (Oliver, 1997; Makadok, 2001) are deemed to be the more

important and critical resources in attaining and sustaining competitive advantage position because of their

nature, being not only valuable but also hard-to-copy relative to the other types of tangible resources (i.e.

Published by Canadian Center of Science and Education 73

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

physical and financial resources). In short, conceptually and empirically, resources are the foundation for

attaining and sustaining competitive advantage and eventually superior firm’s performance.

In this study, particular attention will be afforded to “resources” from the dimension of “tangible and intangible”,

the main elements of which consist of “physical, financial, experiential and human”. The resource-based view

(RBV) of the firm predicts that certain types of resources owned and controlled by firms have the potential and

promise to generate competitive advantage which eventually leads to superior firm’s performance. Physical

resources such as the plant, machinery, equipment, production technology and capacity have contributed

positively towards organizational competitive advantage and eventually result in superior firm’s performance

(Morgan et al., 2004; Ainuddin et al., 2007). In addition, financial resources such as the cash-in-hand, bank

deposits and/or savings and financial capital (stocks and shares) have also contributed positively towards

organizational competitive advantage and eventually result in superior firm’s performance (Morgan et al., 2004;

Ainuddin et al., 2007). Further, experiential resources such as product reputation, manufacturing experience and

brand-name have contributed positively towards organizational competitive advantage and eventually result in

superior firm’s performance (Morgan et al., 2004; Ainuddin et al., 2007). Human resources such as the top and

middle management, administrative and production employees also contribute positively towards organizational

competitive advantage which eventually result in superior firm’s performance (Adner & Helfat, 2003; Morgan et

al., 2004; Datta et al., 2005; Ainuddin et al., 2007; Haslinda Abdullah et al., 2007a; Raduan Che Rose & Naresh

Kumar, 2007).

2.3 Organizational Systems

Systems can be defined as “business processes and procedures” (Ray et al., 2004). According to Ray et al.

(2004), business processes are actions that firms engage in to accomplish some business purpose or objective.

Further, business processes can be thought of as the routines or activities that a firm develops in order to get

something done (Porter, 1991). Studies have shown that systems play a significant and vital role in the ensuing

resources, capabilities, competitive advantage and performance relationship (Porter & Millar, 1985; Gimenez &

Ventura, 2002; Wiklund & Shepherd, 2003; Winter, 2003; Bowen & Ostroff, 2004; Ray et al., 2004; Voss, 2005;

Neely, 2005; Franco-Santos et al., 2007; Perez-Freije & Enkel, 2007).

Critics of resource-based view have pinpointed that studies on resource-based view have been concentrating

more on the attributes of resources and capabilities to build competitive advantage. RBV study has been paying

less attention on the study of the relationship between firms’ resources and capabilities and the way firms are

organized. As far as organizational systems are concerned, this creates an opportunity for an empirical study. As

such, it will be potentially beneficial to examine the ensuing relationship between these variables (organizational

resources, capabilities and systems) and competitive advantage that has been lacking in empirical research.

Studies have shown the importance of organizational strategy for attaining good performance for the firm

(Thomas & Ramaswamy, 1994; Hall Jr., 1995; Kim & Mauborgne, 2005; Raduan Che Rose, Naresh Kumar, &

Hazril Izwar Ibrahim, 2007, 2008; Elamin, 2008). Excellent strategies can be implemented with good

organizational systems that will bind and coordinate the organizational resources and capabilities towards

attaining competitive advantage and performance for the firm. This is an area that is explored in this study as far

as organizational systems are concerned.

This research pays specific attention to “systems” from the dimension of “internal and external”, the main

elements of which consist of “process and interactions”. Process plays a significant role in harnessing

organizational resources, capabilities, competitive advantage and performance relationship, where process is

measured in terms of the emphasis on company vision, mission, policy and procedure deployment (Gimenez &

Ventura, 2002; Ray et al., 2004). Moreover, interactions also play significant and vital roles in the development

of organizational resources, capabilities, competitive advantage and performance relationship, where interactions

are measured in terms of the emphasis on teamwork approach, company procurement and logistic efficiency,

networking and relationship between the firms and their suppliers, distributors and customers (Gimenez &

Ventura, 2002; Ray et al., 2004).

2.4 Hypothesis

Studies have shown that there is a significant relationship between organizational resources and systems

(Wernerfelt, 1984; Porter & Millar, 1985; Barney, 1991, 2001a, 2001b; Chaharbaghi & Lynch, 1999; Priem &

Butler, 2001a, 2001b; Miller & Ross, 2003). Research results have indeed illustrated empirically that

organizational resources help to significantly explain the variance in organizational systems, and vice versa

(Gimenez & Ventura, 2002; Colotla, Shi, & Gregory, 2003). Other researchers have also put forward the

conceptual notion of the significant relationship between resources and systems especially towards improving

firms’ performance (Mascarenhas, Baveja, & Jamil, 1998; Ma, 1999b; Wiklund & Shepherd, 2003).

74 ISSN 1911-2017 E-ISSN 1911-2025

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

Based on these conceptual and empirical studies and findings, the hypothesis forwarded is as follows:

H1: There is a significant positive relationship between organizational resources and systems.

3. Methodology

This research was conducted among manufacturers listed in the Federation of Malaysian Manufacturers

Directory 2008. A cross-sectional study using structured questionnaire was used to obtain responses from the

manufacturers. Specifically, this particular research questionnaire was developed based on a modification,

extension and combination of past studies on organizational resources – 15 items (Morgan et al., 2004; Ainuddin

et al., 2007), systems – 10 items (Gimenez & Ventura, 2002; Ray et al., 2004) and competitive advantage – 15

items (Gimenez & Ventura, 2002; Morgan et al., 2004; Ray et al., 2004). A pilot study was initially conducted to

establish the reliability of the questionnaire scales and measurements (which was based on a five-point

Likert-scale). The result of the pilot test shows that the Cronbach’s alpha coefficients for the variables are well

above the minimum required alpha coefficient value of 0.70 (Nunnally, 1978; Ray et al., 2004). As such, the

research instrument is considered reliable and can be applied to measure the variables pertaining to the research.

For this particular study, 1000 manufacturers or samples were randomly selected from the FMM Directory 2008

(the sampling frame) to be the effective unit of analysis on the basis of being convenient, offering unrestricted

choice, having the least bias and offering the most generalizability (Sekaran, 2005). As for the simple random

sampling procedure or method, its choice was justified since such a sampling method has been adopted and

applied previously in other earlier empirical studies concerning manufacturers in particular (Morgan et al., 2004;

Ruzita Jusoh et al., 2008; Ruzita Jusoh & Parnell, 2008). In short, given the financial and time constraints faced

by the researcher in conducting this study, the choice of the sampling frame and the simple random sampling

procedure can be justified. From the subsequent actual survey, 127 respondents replied and completed the

questionnaire (12.7% response rate). The Cronbach’s alpha coefficients for the variables based on the actual

survey registered values well above the minimum required alpha coefficient value of 0.70 (i.e. resources = 0.87,

systems = 0.94 and competitive advantage = 0.86). This reflects the reliability and internal consistency of the

research instrument’s scale of measurement. Exploratory data analysis was initially conducted to ensure there is

no violation of the assumptions of normality, linearity and homogeneity of variance, which are amongst the

conditions needed in the multivariate data analysis.

4. Results and Discussions

Bivariate correlation was applied to test hypothesis 1. The main application of the Pearson product-moment

correlation coefficients is to describe the association between these variables. Based on Cohen (1988), the

guidelines to interpret the correlation coefficients (r) strength are as follows:

Small correlation r = 0.10 to 0.29

Medium correlation r = 0.30 to 0.49

Large correlation r = 0.50 to 1.00

The relationship between organizational resources (as measured by resources) and organizational systems (as

measured by systems) is investigated using Pearson product-moment correlation coefficient. Preliminary

analyses are conducted to ensure there is no violation of the assumptions of normality, linearity and

homoscedasticity. There is a strong, positive correlation between the two variables, r = 0.72, n = 127, p < 0.01,

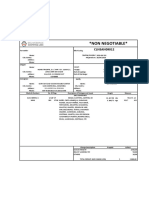

with high levels of resources associated with high levels of systems. Figure 1 below illustrates the relationship

between the two variables under observation.

The result implies that the more resources are utilized in the organizations, the better the systems that are

generated. The large correlation (r = 0.72) also suggests a strong positive relationship between resources and

systems. As for the variance shared between the two variables, the coefficient of determination (r² = 0.52)

indicates that resources help to explain nearly 52% of the variance in systems, and vice versa. This is a

significant amount of variance. As such, this finding lends support to hypothesis 1. There is indeed a significant

positive and linear relationship between organizational resources and systems.

The result suggests that the more resources are employed in the organizations, the better the systems that are

initiated. The large correlation (r = 0.72) also implies a strong positive relationship between the organizational

resources and systems. As for the variance shared between these two variables, the coefficient of determination

(r² = 0.52) suggests that organizational resources help to account for nearly 52% of the variance in systems, and

vice versa. This is a considerable amount of variance.

Published by Canadian Center of Science and Education 75

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

This result is conceptually in tandem with other previous research findings and such an outcome is anticipated

based on the conceptual studies by Mascarenhas et al. (1998) and Ma (1999b) involving relationship between

organizational resources and systems.

Mascarenhas et al. (1998) in particular emphasize the importance of having technical know-how, reliable process

and close external relationship (systems) to develop a firm’s core competency and its resources, which are

significantly important for developing strategy towards attaining competitive advantage. Whereas Ma (1999b)

argues that to achieve and sustain competitive advantage, a firm needs to creatively and proactively exploit the

three generic sources of competitive advantage (i.e. ownership-based, access-based and proficiency-based),

which are basically referring to the firm’s resources (assets), systems (process) and capabilities (competencies).

Empirically, this result supports the findings of the study by Gimenez and Ventura (2002) concerning the

performance and competitive advantage of manufacturers of food and perfumery-detergent products in Spain.

Using mail questionnaires sent out to 199 manufacturers sampled from the Fomento de la Produccion Espana

25.000 database, they attract 64 (or 32.2%) manufacturers to respond and provide the data for analysis. They

analyze the relationship between internal (resources) and external (systems) integration processes, and their

significant effect on firms’ performance and competitive advantage. Their result confirms that internal (resources)

and external (systems) integration processes are significantly and positively correlated (r = 0.796, n = 64, p <

0.05), and that both the resources and systems significantly lead to a better firm’s performance.

Empirically, the result of this study also supports the finding of the study by Colotla et al. (2003). They

empirically study the significant relationship between international factory and network capabilities and their

impact on operational performance. Their study uses a case-based methodology that combined multiple

interviews and ethnographic research at two (2) international manufacturing networks comprising eight (8)

factories in six (6) different countries. The manufacturers are involved in the refrigeration components (RefriCo)

and hydraulic valves (ValveCo) products manufacturing activities respectively. The empirical case study data

suggest that superior structural resources or superior resource deployment activities result in firms obtaining

competitive advantage. This case study example suggests the existence of significant interdependencies between

firms’ resources and systems.

The findings of the significant interaction between resources and systems in this study not only support other

earlier empirical results (Gimenez & Ventura, 2002; Colotla et al., 2003) but it also supports the conceptual

notion of the significant relationship between resources and systems especially towards improving firms’

performance (Mascarenhas et al., 1998; Ma, 1999b; Wiklund & Shepherd, 2003). Wiklund and Shepherd (2003)

study the significant relationship between resources, entrepreneurial orientation (systems) and performance.

Indeed, systems have contributed towards the improvement of the resource elements in order to achieve

competitive advantage.

5. Conclusion and Implications

This study examines and analyzes the relationship between organizational resources and systems. The specific

theoretical and empirical contribution of this study to the literature is conceptually and empirically exhibiting a

significant positive relationship between organizational resources and systems (r = 0.72), especially towards the

attainment of firms’ competitive advantage. As such, the overall contribution of this research to the literature is

that it has managed to further extend and strengthen the theoretical discourse on the RBV of competitive

advantage in particular by empirically illustrating the extent or magnitude of the relationship between the

organizational resources and systems as perceived by Malaysian manufacturers. In other words, this study shows

the essence and strength of the relationship between organizational resources and systems in their pursuit of

competitive advantage and performance. The theoretical implication of this study is that it supports and extends

the RBV of competitive advantage by illustrating the need for systematic management of resources towards

attaining competitive advantage.

References

Adner, R. & Helfat, C.E. (2003). Corporate effects and dynamic managerial capabilities. Strategic Management

Journal, 24, 1011-1025.

Ainuddin, R.A., Beamish, P.W., Hulland, J.S. & Rouse, M.J. (2007). Resource attributes and firm performance

in international joint ventures. Journal of World Business, 42, 47-60.

Arend, R.J. (2003). Revisiting the logical and research considerations of competitive advantage. Strategic

Management Journal, 24, 279-284.

76 ISSN 1911-2017 E-ISSN 1911-2025

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

Barney, J.B. (1986). Strategic factor markets: Expectations, luck, and business strategy. Management Science,

32(10), 1231-1241.

Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1),

99-120.

Barney, J.B. (1995). Looking inside for competitive advantage. Academy of Management Executive, 9(4), 49-61.

Barney, J.B. (2001a). Is the resource-based "view" a useful perspective for strategic management research? Yes.

Academy of Management Review, 26, 41-56.

Barney, J.B. (2001b). Resource-based theories of competitive advantage: A ten-year retrospective on the

resource-based view. Journal of Management, 27, 643-650.

Barney, J.B. (2007). Gaining and sustaining competitive advantage (3rd ed.). Upper Saddle River, NJ: Pearson

Education.

Bowen, D.E. & Ostroff, C. (2004). Understanding HRM-Firm performance linkages: The role of the “strength”

of the HRM system. Academy of Management Review, 29(2), 203-221.

Burden, R. & Proctor, T. (2000). Creating a sustainable competitive advantage through training. Team

Performance Management, 6(5/6), 90-97.

Chaharbaghi, K. & Lynch, R. (1999). Sustainable competitive advantage: Towards a dynamic resource-based

strategy. Management Decision, 37(1), 45-50.

Cohen, J.W. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Hillsdale, NJ: Lawrence

Erlbaum Associates.

Colotla, I., Shi, Y. & Gregory, M.J. (2003). Operation and Performance of international manufacturing networks.

International Journal of Operations & Production Management, 23(10), 1184-1206.

Conner, K.R. (1991). A historical comparison of resource-based theory and five schools of thought within

industrial organization economics: Do we have a new theory of the firm? Journal of Management, 17(1),

121-154.

Cousins, P.D. (2005). The alignment of appropriate firm and supply strategies for competitive advantage.

International Journal of Operations & Production Management, 25(5), 403-428.

Datta, D.K., Guthrie, J.P. & Wright, P.M. (2005). Human resource management and labour productivity: Does

industry matter? Academy of Management Journal, 48(1), 135-145.

Dierickx, I. & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage.

Management Science, 35(12), 1504-1511.

Eisenhardt, K.M. & Martin, J.A. (2000). Dynamic capabilities: What are they? Strategic Management Journal,

21, 1105-1121.

Elamin, A.M. (2008). Methods of researching strategy process in developing countries. European Journal of

Economics, Finance and Administrative Sciences, 10, 200-212.

Fahy, J. (2000). The resource-based view of the firm: some stumbling-blocks on the road to understanding

sustainable competitive advantage. Journal of European Industrial Training, 24(2/3/4), 94-104.

Fahy, J., Farrelly, F. & Quester, P. (2004). Competitive advantage through sponsorship: A conceptual model and

research propositions. European Journal of Marketing, 38(8), 1013-1030.

Federation of Malaysian Manufacturers. (2008). Malaysian Industries: FMM Directory 2008 (39th ed.). Kuala

Lumpur: Federation of Malaysian Manufacturers.

Flint, G.D. & Van Fleet, D.D. (2005). A comparison and contrast of strategic management and classical

economic concepts: Definitions, comparisons, and pursuit of advantages. [Online] Available:

http://www.uvsc.edu/schools/business/facultyScholar/jbi/jbi_v3.html (9th April, 2006).

Foss, N.J. & Knudsen, T. (2003). The resource-based tangle: Towards a sustainable explanation of competitive

advantage. Managerial and Decision Economics, 24, 291-307.

Franco-Santos, M., Kennerley, M., Micheli, P., Martinez, V., Mason, S., Marr, B., Gray, D. & Neely, A. (2007).

Towards a definition of a business performance measurement system. International Journal of Operations &

Production Management, 27(8), 784-801.

Published by Canadian Center of Science and Education 77

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

Gimenez, C. & Ventura, A. (2002). Supply chain management as a competitive advantage in the Spanish

grocery sector. Published Working Paper. No. 2, 04/2002, Universitat Pompeu Fabra’ (UPF), Barcelona, Spain.

Gottschalg, O. & Zollo, M. (2007). Interest alignment and competitive advantage. Academy of Management

Review, 32(2), 418-437.

Hall, E.H., Jr. (1995). Corporate diversification and performance: An investigation of causality. Australian

Journal of Management, 20(1), 25-42.

Harrison, J.S., Hitt, M.A., Hoskisson, R.E. & Ireland, R.D. (2001). Resource complementarity in business

combinations: Extending the logic to organizational alliances. Journal of Management, 27, pp. 679-690.

Haslinda Abdullah, Raduan Che Rose & Naresh Kumar. (2007a). Human resource development practices in

Malaysia: A case of manufacturing industries. European Journal of Social Sciences, 5(2), 37-52.

Haslinda Abdullah, Raduan Che Rose & Naresh Kumar. (2007b). Human resource development strategies: The

Malaysian scenario. Journal of Social Science, 3(4), 213-222.

Hoopes, D.G., Madsen, T.L. & Walker, G. (2003). Why is there a Resource-based View? Toward a theory of

competitive heterogeneity. Strategic Management Journal, 24, 889-902.

Hult, G.T.M. & Ketchen, D.J., Jr. (2001). Does market orientation matter?: A test of the relationship between

positional advantage and performance. Strategic Management Journal, 22, 899-906.

Ireland, R.D., Hitt, M.A. & Sirmon, D.G. (2003). A model of strategic entrepreneurship: the construct and its

dimensions. Journal of Management, 29(6), 963-989.

Kim, W.C. & Mauborgne, R. (2005). Blue Ocean strategy: From theory to practice. California Management

Review, 47(3), 105-121.

King, A.W. (2007). Disentangling interfirm and intrafirm causal ambiguity: A conceptual model of causal

ambiguity and sustainable competitive advantage. Academy of Management Review, 32(1), 156-178.

Kristandl, G. & Bontis, N. (2007). Constructing a definition for intangibles using the resource based view of the

firm. Management Decision, 45(9), 1510-1524.

Liao, S.H. & Hu, T.C. (2007). Knowledge transfer and competitive advantage on environmental uncertainty: An

empirical study of the Taiwan semiconductor industry. Technovation, 27, 402-411.

Lin, B.W. (2003). Technology transfer as technological learning: A source of competitive advantage for firms

with limited R&D resources. R&D Management, 33(3), 327-341.

Ma, H. (1999a). Anatomy of competitive advantage: a SELECT framework. Management Decision, 37(9),

709-718.

Ma, H. (1999b). Creation and preemption for competitive advantage. Management Decision, 37(3), 259-267.

Ma, H. (2000). Competitive advantage and firm performance. Competitiveness Review, 10(2), 16-32.

Ma, H. (2004). Toward global competitive advantage: Creation, competition, cooperation and co-option.

Management Decision, 42(7), 907-924.

Makadok, R. (2001). Toward a synthesis of the resource-based and dynamic-capability views of rent creation.

Strategic Management Journal, 22, 387-401.

Mascarenhas, B., Baveja, A. & Jamil, M. (1998). Dynamics of core competencies in leading multinational

companies. California Management Review, 40(4), 117-132.

Miller, S.R. & Ross, A.D. (2003). An exploratory analysis of resource utilization across organizational units:

Understanding the resource-based view. International Journal of Operations & Production Management, 23(9),

1062-1083.

Mills, J., Platts, K. & Bourne, M. (2003). Competence and resource architectures. International Journal of

Operations & Production Management, 23(9), 977-994.

Morgan, N.A., Kaleka, A. & Katsikeas, C.S. (2004). Antecedents of export venture performance: A theoretical

model and empirical assessment. Journal of Marketing, 68, 90-108.

Neely, A. (2005). The evolution of performance measurement research: Developments in the last decade and a

research agenda for the next. International Journal of Operations & Production Management, 25(12),

1264-1277.

78 ISSN 1911-2017 E-ISSN 1911-2025

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

Nunnally, J.O. (1978). Psychometric theory. New York: McGraw-Hill.

Oliver, C. (1997). Sustainable competitive advantage: Combining institutional and resource-based views.

Strategic Management Journal, 18(9), 697-713.

Perez-Freije, J. & Enkel, E. (2007). Creative tension in the innovation process: How to support the right

capabilities. European Management Journal, 25(1), 11-24.

Peteraf, M.A. & Bergen, M.E. (2003). Scanning dynamic competitive landscapes: A market-based and

resource-based framework. Strategic Management Journal, 24, 1027-1041.

Peteraf, M.A. (1993). The cornerstones of competitive advantage: A resource-based view. Strategic Management

Journal, 14, 179-191.

Phusavat, K. & Kanchana, R. (2007). Competitive priorities of manufacturing firms in Thailand. Industrial

Management & Data Systems, 107(7), 979-996.

Porter, M.E. & Kramer, M.R. (2006). Strategy and society: The link between competitive advantage and

corporate social responsibility. Harvard Business Review, December 2006, 79-92.

Porter, M.E. & Millar, V.E. (1985). How information gives you competitive advantage. Harvard Business

Review, July-August 1985, 149-160.

Porter, M.E. (1985). Competitive Advantage. New York: Free Press.

Porter, M.E. (1991). Towards a dynamic theory of strategy. Strategic Management Journal, 12(8), 95-117.

Powell, T.C. (2003). Strategy without ontology. Strategic Management Journal, 24, 285-291.

Priem, R.L. & Butler, J.E. (2001a). Is the resource-based "view" a useful perspective for strategic management

research? Academy of Management Review, 26, 22-40.

Priem, R.L. & Butler, J.E. (2001b). Tautology in the resource-based view and the implications of externally

determined resource value: Further comment. Academy of Management Review, 26, 57-66.

Raduan Che Rose & Naresh Kumar. (2007). Blockade for career advancement in Japanese organization abroad:

The case of Malaysian subsidiaries. American Journal of Applied Sciences, 4(1), 8-13.

Raduan Che Rose, Naresh Kumar & Hazril Izwar Ibrahim. (2007). The effect of manufacturing strategy on

organizational performance. European Journal of Economics, Finance and Administrative Sciences, 9, 38-47.

Raduan Che Rose, Naresh Kumar & Hazril Izwar Ibrahim. (2008). Relationship between strategic human

resource management and organizational performance: Evidence from selected Malaysian firms. European

Journal of Economics, Finance and Administrative Sciences, 10, 86-97.

Ramsay, J. (2001). The resource based perspective, rents, and purchasing’s contribution to sustainable

competitive advantage. The Journal of Supply Chain Management, Summer 2001, 38-47.

Ray, G., Barney, J.B. & Muhanna, W.A. (2004). Capabilities, business processes, and competitive advantage:

Choosing the dependent variable in empirical tests of the resource-based view. Strategic Management Journal,

25, 23-37.

Richard, O.C. (2000). Racial diversity, business strategy and firm performance: A resource-based view.

Academy of Management Journal, 43(2), 164-177.

Ruzita Jusoh & Parnell, J.A. (2008). Competitive strategy and performance measurement in the Malaysian

context: An exploratory study. Management Decision, 46(1), 5-31.

Ruzita Jusoh, Daing Nasir Ibrahim & Yuserrie Zainuddin. (2008). The performance consequence of multiple

performance measures usage: Evidence from the Malaysian manufacturers. International Journal of Productivity

and Performance Management, 57(2), 119-136.

Santhapparaj, A.S., Sreenivasan, J. & Loong, J.C.K. (2006). Competitive factors of semiconductor industry in

Malaysia: The managers’ perspectives. Competitiveness Review, 16(3&4), 197-211.

Sekaran, U. (2005). Research Methods for Business: A skill-building approach (4th ed.). New York: John Wiley

& Sons, Inc., U.S.A.

Sheehan, N.T. & Foss, N.J. (2007). Enhancing the prescriptiveness of the resource-based view through Porterian

activity analysis. Management Decision, 45(3), 450-461.

Published by Canadian Center of Science and Education 79

www.ccsenet.org/ass Asian Social Science Vol. 7, No. 5; May 2011

Sirmon, D.G., Hitt, M.A. & Ireland, R.D. (2007). Managing firm resources in dynamic environments to create

value: looking inside the black box. Academy of Management Review, 32(1), 273-292.

Thomas, A.S. & Ramaswamy, K. (1994). Matching managers to strategy: An investigation of performance

implications and boundary conditions. Australian Journal of Management, 19(1), 73-93.

Voss, C.A. (2005). Alternative paradigms for manufacturing strategy. International Journal of Operations &

Production Management, 25(12), 1211-1222.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171-180.

Wernerfelt, B. (1995). The resource-based view of the firm: Ten years after. Strategic Management Journal,

16(3), 171-174.

Wiklund, J. & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the

performance of small and medium-sized businesses. Strategic Management Journal, 24, 1307-1314.

Winter, S.G. (2003). Understanding dynamic capabilities. Strategic Management Journal, 24, 991-995.

Figure 1. Correlation between Resources and Systems

80 ISSN 1911-2017 E-ISSN 1911-2025

You might also like

- Organizational Behavior: A Case Study of Tata Consultancy Services: Organizational BehaviourFrom EverandOrganizational Behavior: A Case Study of Tata Consultancy Services: Organizational BehaviourNo ratings yet

- Tourist Visa Application Support LetterDocument2 pagesTourist Visa Application Support LetterIndrajithAbeysingheNo ratings yet

- How To Master The IELTSDocument248 pagesHow To Master The IELTSOleg Kasyan100% (1)

- Report On The Industrial Visit Linc LimitedDocument28 pagesReport On The Industrial Visit Linc LimitedRajdeep Paul100% (1)

- The Influence of Corporate Culture On Organizational Commitment: Case Study of Semiconductor Organizations in MalaysiaDocument17 pagesThe Influence of Corporate Culture On Organizational Commitment: Case Study of Semiconductor Organizations in MalaysiaSunway University100% (1)

- Project Quality Template (Att. IV)Document16 pagesProject Quality Template (Att. IV)aslam.ambNo ratings yet

- Chapter 5 Scheduling & Tracking Edited 03042014Document40 pagesChapter 5 Scheduling & Tracking Edited 03042014Shafiq KadirNo ratings yet

- SAP Product Costing & Material LedgerDocument162 pagesSAP Product Costing & Material Ledgerrohitmandhania96% (28)

- ACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FDocument3 pagesACC 206 Incomplete Manufacturing Costs Expenses and Selling Data For Two Different Cases Are As FebadbaddevNo ratings yet

- The Relationship Between Organisational Resources, Capabilities, Systems and Competitive AdvantageDocument24 pagesThe Relationship Between Organisational Resources, Capabilities, Systems and Competitive AdvantageAhmed FayekNo ratings yet

- The Relationship Between Organisational Resources, Capabilities, Systems and Competitive AdvantageDocument23 pagesThe Relationship Between Organisational Resources, Capabilities, Systems and Competitive AdvantageMario MartinezNo ratings yet

- Human Resource Management Practice and Organizational Performance - Case StudyDocument11 pagesHuman Resource Management Practice and Organizational Performance - Case StudyNancy AcostaNo ratings yet

- Organizational Resources and Sustained Competitive Advantage of Cooperative Organizations in MalaysiaDocument8 pagesOrganizational Resources and Sustained Competitive Advantage of Cooperative Organizations in Malaysiajust justNo ratings yet

- AiiiDocument17 pagesAiiiJeric RismaNo ratings yet

- John & Sung High Performace-MainDocument10 pagesJohn & Sung High Performace-MainKhushbuNo ratings yet

- 5560-Article Text-10881-1-10-20210115Document18 pages5560-Article Text-10881-1-10-20210115mekdi endaleNo ratings yet

- AliJunaidKhan - PJSS Vol40 No2 36Document15 pagesAliJunaidKhan - PJSS Vol40 No2 36Syed Shafqat ShahNo ratings yet

- HR Systems and Practices in RealityDocument19 pagesHR Systems and Practices in RealityarslanshaniNo ratings yet

- Sustainability and Economic Performance: Role of Organizational Learning and InnovationDocument11 pagesSustainability and Economic Performance: Role of Organizational Learning and InnovationAzhar MarvelousNo ratings yet

- The Effect of Enterprise Risk Management On Ameliorating Competitive Advantage: A Cross-Sectional Study of Software Houses in PakistanDocument20 pagesThe Effect of Enterprise Risk Management On Ameliorating Competitive Advantage: A Cross-Sectional Study of Software Houses in Pakistan553128495No ratings yet

- The Impact of Human Resource Management Practices On Competitive Advantage: Mediating Role of Employee Engagement in ThailandDocument10 pagesThe Impact of Human Resource Management Practices On Competitive Advantage: Mediating Role of Employee Engagement in ThailandPrakhar SahayNo ratings yet

- Mitchell Et Al. - 2020 - The Interactive Influence of Human and Social CapiDocument15 pagesMitchell Et Al. - 2020 - The Interactive Influence of Human and Social CapiRMADVNo ratings yet

- How Do High-Performance Work Systems Affect Innovation Performance? The Organizational Learning PerspectiveDocument22 pagesHow Do High-Performance Work Systems Affect Innovation Performance? The Organizational Learning PerspectiveAtiqa AslamNo ratings yet

- Dynamic Capabilities Impact Firm PerformanceDocument10 pagesDynamic Capabilities Impact Firm PerformanceJummy BMSNo ratings yet

- Paper 6 Quality Management A Compulsory RequirementDocument21 pagesPaper 6 Quality Management A Compulsory RequirementDiego PérezNo ratings yet

- HRM Practices Enhancing Research PerformanceDocument6 pagesHRM Practices Enhancing Research PerformanceSanaullah shahanNo ratings yet

- The Effectiveness of Strategic Human ResourceDocument12 pagesThe Effectiveness of Strategic Human ResourceMohamed HamodaNo ratings yet

- Human Resource Management, Performance and Organisational Sustainability: A New ParadigmDocument16 pagesHuman Resource Management, Performance and Organisational Sustainability: A New ParadigmKiran PodarNo ratings yet

- HRM and Innovation StrategyDocument25 pagesHRM and Innovation StrategySri KanNo ratings yet

- The Role of Ethical Leadership On Employee Performance in Guilan University of Medical SciencesDocument8 pagesThe Role of Ethical Leadership On Employee Performance in Guilan University of Medical SciencesazmiNo ratings yet

- Exploring Relationship Among Organizatio PDFDocument17 pagesExploring Relationship Among Organizatio PDFHernanNo ratings yet

- Aligning Supply Chain Costs via ERP CoordinationDocument32 pagesAligning Supply Chain Costs via ERP CoordinationGómez GómezNo ratings yet

- The Impact of Human Resource Management Practices On Competitive Advantage: Mediating Role of Employee Engagement in ThailandDocument11 pagesThe Impact of Human Resource Management Practices On Competitive Advantage: Mediating Role of Employee Engagement in ThailandshillaNo ratings yet

- Competency Based Competitive AdvantageDocument30 pagesCompetency Based Competitive AdvantageTata SubramanianNo ratings yet

- International Small Business Journal-2014-Sheehan-545-70 PDFDocument27 pagesInternational Small Business Journal-2014-Sheehan-545-70 PDFBenjamin EricksonNo ratings yet

- Employee performance, organizational commitment, and HRM practicesDocument6 pagesEmployee performance, organizational commitment, and HRM practicesQuốc-Hưng NguyễnNo ratings yet

- Human Resource Management and Labor Productivity: Does Industry Matter?Document12 pagesHuman Resource Management and Labor Productivity: Does Industry Matter?Prima VandayaniNo ratings yet

- Megha Mrp1Document21 pagesMegha Mrp1TheRanjith18No ratings yet

- Antecedents and Consequences of Diversity and Equality Managementsystems The Importance of Gender Diversity in The TMT and Lower Tomiddle ManagementDocument14 pagesAntecedents and Consequences of Diversity and Equality Managementsystems The Importance of Gender Diversity in The TMT and Lower Tomiddle ManagementAmar AmaraNo ratings yet

- HR Alignment Case Study Interior Sindh UniversitiesDocument9 pagesHR Alignment Case Study Interior Sindh UniversitiesFitria MaulidaNo ratings yet

- E O Effectiveess S M A - B E (Smae) M - M E K S: BstractDocument17 pagesE O Effectiveess S M A - B E (Smae) M - M E K S: BstractfairusNo ratings yet

- Human Resource Systems and Employee Performance in Ireland and The Netherlands A Test of The Complementarity HypothesisDocument27 pagesHuman Resource Systems and Employee Performance in Ireland and The Netherlands A Test of The Complementarity HypothesisRizal HaronNo ratings yet

- 5155 - 77 - 15 - DSS For Competency Evaluation - 1Document18 pages5155 - 77 - 15 - DSS For Competency Evaluation - 1Mera ViNo ratings yet

- Achieving Organizational Effectiveness Through Employee Engagement: A Role of Leadership Style in WorkplaceDocument9 pagesAchieving Organizational Effectiveness Through Employee Engagement: A Role of Leadership Style in WorkplaceGaneshkumar SunderajooNo ratings yet

- FM 1Document10 pagesFM 1Rohit prasadNo ratings yet

- 23 - Last - Impact of SHRM Practices On Organizational Performance FinalDocument11 pages23 - Last - Impact of SHRM Practices On Organizational Performance FinaliisteNo ratings yet

- Adams2014 CollaborationDocument19 pagesAdams2014 CollaborationAyush iit bhuNo ratings yet

- Asia Pac J Human Res - 2021 - Heffernan - HRM System Strength and Employee Well Being The Role of Internal Process andDocument23 pagesAsia Pac J Human Res - 2021 - Heffernan - HRM System Strength and Employee Well Being The Role of Internal Process andDYNA FITRIANo ratings yet

- DR ImranZahraanProf DR AbuBakarDocument6 pagesDR ImranZahraanProf DR AbuBakarAdnan SheikhNo ratings yet

- 9 Ijmres 10012020Document11 pages9 Ijmres 10012020International Journal of Management Research and Emerging SciencesNo ratings yet

- 08 Ijmres 10022020Document13 pages08 Ijmres 10022020International Journal of Management Research and Emerging SciencesNo ratings yet

- Pjcss 236Document22 pagesPjcss 236Awi SkakNo ratings yet

- A Comparative Study Impact ofDocument16 pagesA Comparative Study Impact ofvishal_debnathNo ratings yet

- An EmpiricalDocument40 pagesAn EmpiricalSupriyadiNo ratings yet

- IJMP80403 Payambarpour Hooi With Cover Page v2Document27 pagesIJMP80403 Payambarpour Hooi With Cover Page v2MansiNo ratings yet

- Dynamic Capabilities and Organizational Performance The Mediating Role of InnovationDocument17 pagesDynamic Capabilities and Organizational Performance The Mediating Role of InnovationAhmad JadallahNo ratings yet

- Changing Face of Higher Education in IndiaDocument20 pagesChanging Face of Higher Education in Indiapavan kumarNo ratings yet

- Impact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachDocument11 pagesImpact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachMuhammad Fahad ButtNo ratings yet

- Impact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachDocument11 pagesImpact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachiisteNo ratings yet

- Impact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachDocument11 pagesImpact of SHRM Practices On Organizational Performance: An Application of Universalistic ApproachiisteNo ratings yet

- IJCER (WWW - Ijceronline.com) International Journal of Computational Engineering ResearchDocument5 pagesIJCER (WWW - Ijceronline.com) International Journal of Computational Engineering ResearchInternational Journal of computational Engineering research (IJCER)No ratings yet

- Organisational JusticeDocument6 pagesOrganisational JusticeArief HarunNo ratings yet

- The_Impact_of_Organizational_Culture_and_PerformanDocument14 pagesThe_Impact_of_Organizational_Culture_and_PerformanASWADHAIKALNo ratings yet

- PJSS Vol36 No1 16Document13 pagesPJSS Vol36 No1 16Tanmeet kourNo ratings yet

- Environmental Strategy As ModeratorDocument11 pagesEnvironmental Strategy As ModeratorMubinul IslamNo ratings yet

- SSRN Id2381570Document15 pagesSSRN Id2381570Abc 13 XyzNo ratings yet

- Heliyon: Mohamed Mahmoud Khtatbeh, Anuar Shah Bali Mahomed, Suhaimi Bin Ab Rahman, Rosmah MohamedDocument9 pagesHeliyon: Mohamed Mahmoud Khtatbeh, Anuar Shah Bali Mahomed, Suhaimi Bin Ab Rahman, Rosmah MohamedRobinson GarciaNo ratings yet

- ELT UpcomingSessionsDocument1 pageELT UpcomingSessionsIndrajithAbeysingheNo ratings yet

- Keep Satisfied Keep Satisfied Manage Closely Manage Closely: Stakeholders - Power/Interest GridDocument3 pagesKeep Satisfied Keep Satisfied Manage Closely Manage Closely: Stakeholders - Power/Interest GridIndrajithAbeysingheNo ratings yet

- DMB Presentation Animated FINALDocument16 pagesDMB Presentation Animated FINALSérgio R. AguiarNo ratings yet

- Executive SummaryDocument49 pagesExecutive SummaryIndrajithAbeysingheNo ratings yet

- Matearial Western Province 2011Document29 pagesMatearial Western Province 2011Pilippenge Asanka Iraj LaknathaNo ratings yet

- Guidance On PMP CertificationDocument45 pagesGuidance On PMP Certificationpriyod_chandranNo ratings yet

- Vatnbt29042019 eDocument1 pageVatnbt29042019 eIndrajithAbeysingheNo ratings yet

- Payment Delays in Sri Lankan ConstructionDocument10 pagesPayment Delays in Sri Lankan Constructionchamil_dananjayaNo ratings yet

- Shop & Office ActDocument26 pagesShop & Office ActIndrajithAbeysingheNo ratings yet

- SVat Quick GuideDocument20 pagesSVat Quick GuideIndrajithAbeysinghe100% (1)

- Client Research Report Revised Vertis HolmesDocument8 pagesClient Research Report Revised Vertis Holmesapi-665648997No ratings yet

- Welch Allyn 5200-101A AC Power Supply For Spot Vital Signs Monitor and VSM 52000 - EbayDocument1 pageWelch Allyn 5200-101A AC Power Supply For Spot Vital Signs Monitor and VSM 52000 - EbayImranFarashNo ratings yet

- Material ControlDocument16 pagesMaterial ControlbelladoNo ratings yet

- Accounting For Partnerships PDFDocument213 pagesAccounting For Partnerships PDFMohamed EL-MihyNo ratings yet

- MB 0042Document30 pagesMB 0042Rehan QuadriNo ratings yet

- Ajay Kumar Dubey April 2023Document2 pagesAjay Kumar Dubey April 2023Ajay DubeyNo ratings yet

- Lean Production: Ron Tibben-LembkeDocument36 pagesLean Production: Ron Tibben-LembkeamorntepNo ratings yet

- Multiple Project Tracking Template 39Document18 pagesMultiple Project Tracking Template 39carlos civicosNo ratings yet

- Guidelines For Developing A Mutual Recognition Arrangement/agreementDocument43 pagesGuidelines For Developing A Mutual Recognition Arrangement/agreementLia RayyaNo ratings yet

- Brand awareness and usage analysis of Surf Excel and Ariel detergentsDocument18 pagesBrand awareness and usage analysis of Surf Excel and Ariel detergentsMuhammad Hassaan BhagatNo ratings yet

- Desired Income (Step Costs)Document2 pagesDesired Income (Step Costs)Ann louNo ratings yet

- Crescent Steel's Supply ChainDocument16 pagesCrescent Steel's Supply ChainMuhammad AhmedNo ratings yet

- Why ISO 20000? Awareness Presentation: Subtitle or PresenterDocument14 pagesWhy ISO 20000? Awareness Presentation: Subtitle or PresenterRoberto Fabiano FernandesNo ratings yet

- The Core Skills of A Successful Entrepreneur: - by Aaarush BansalDocument12 pagesThe Core Skills of A Successful Entrepreneur: - by Aaarush BansalAarush BansalNo ratings yet

- JSA Installation of GearboxDocument2 pagesJSA Installation of GearboxDaniel TOMBENo ratings yet

- Management of Small Scale Industries (A 3.6) : Kaviyatri Bahinabai Chaudhari North Maharashtra University, JalgaonDocument5 pagesManagement of Small Scale Industries (A 3.6) : Kaviyatri Bahinabai Chaudhari North Maharashtra University, JalgaonKhanNo ratings yet

- Acc 16Document28 pagesAcc 16Erin MalfoyNo ratings yet

- Final Examination Course: Audit and Assurance Services Course Code: Aud4033 Duration: 3 HoursDocument7 pagesFinal Examination Course: Audit and Assurance Services Course Code: Aud4033 Duration: 3 HoursAmirul HafiyNo ratings yet

- Non Negotiable : CLNSAN09012Document1 pageNon Negotiable : CLNSAN09012Diana SuarezNo ratings yet

- SUMMARY REPORT InternDocument3 pagesSUMMARY REPORT Internnur amanina ayuniNo ratings yet

- IMAGE InternationalDocument4 pagesIMAGE InternationalJohann Barnaby RubioNo ratings yet

- 2021 Guide To Effective ProxiesDocument483 pages2021 Guide To Effective ProxiesValter FariaNo ratings yet

- Filomena Merchandising 2019 Income StatementDocument42 pagesFilomena Merchandising 2019 Income StatementABM-AKRISTINE DELA CRUZNo ratings yet

- 6.4 Activity 2Document2 pages6.4 Activity 2Israfel CariagaNo ratings yet

- Prescribed Format of Cost Sheet (For Imfl and Beer Only)Document3 pagesPrescribed Format of Cost Sheet (For Imfl and Beer Only)sujal_shr21No ratings yet