Professional Documents

Culture Documents

152

Uploaded by

Swapnil Mahanta0 ratings0% found this document useful (0 votes)

8 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 page152

Uploaded by

Swapnil MahantaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

The client incurred 1.

1 million dollars on Proper assessment must be made on what costs

upgrading the website and hence there may be a are being capitalized and what costs are

risk of costs not being properly allocated expensed to ensure that assets are not

between revenue and capital expenditure. overstated and expenses are not understated

The company should only record the non- The auditor must perform verification checks

current when the complete legal ownership is and physical checks to confirm the existence also

transferred to the company i.e. all the assets after the year end the auditor should check

which is recorded must physically exist whether the warehouse if included in PPE has

completed its legal process

The economic useful lives of the fixtures and Proper assessment must be made to check the

fitting have been increased by one year to four reasonableness of such changes of estimates and

years which may pose a risk of overstatement of explanation from director must be demanded.

profits and non-current assets.

The credit period has been revised for a The auditor must have a look on the financial

customer who is struggling to pay a due of 1.2 position of the customer and assess whether it is

million dollars. There is risk that the customer is reasonable to not write off the receivable. If no

unable to pay but the management is stretching then, the auditor must discuss this with

the matter as it does not want to incur such a big management. Also look at the credit terms and

expense thereby overstating the profits and assess its appropriateness and have a look on

liquidity of the company the allowances made to address this matter if no

ask why

Due to the new bonus package, there has been a The auditor must increase the checking of after

sudden increase in customer accounts and the date cash receipts and must check at the year-

customers have been provided with very end the proportion of cash that has been

favourable terms. Hence there may be an risk of recovered from the due customers.

over-selling, as now due to conflict of interest,

the sales staff may have sold the goods on credit

without checking the creditworthiness

The company has been subject to a law suit due The auditor must take a legal advice as to the

to faultiness and causing a detrimental impact chances that the company shall be paying the

on its customer’s profits. There is a risk that the penalties. If it is probable, then the auditor

company will not properly record a provision for should read the claim by the customer and

this lawsuit and also a provision for the expenses discuss it with the management and the legal

which it will incur while recalling the product experts to arrive at a proper value of provision.

The auditor should also assess the provision

made in respect of product recall and check its

correctness

The finance director has asked the team to The audit partner should refuse such requests,

complete the audit in shorter timescale. This and if forced by the management they should

may compromise the audit quality and increase either resign or issue a disclaimer of opinion

the audit risk, that an unmodified opinion will

be issued to a false financial statements

You might also like

- HurlingDocument6 pagesHurlingMansoor SharifNo ratings yet

- Audit HURLING CO (B)Document5 pagesAudit HURLING CO (B)GOH SZE MENG JOYCELYNE100% (1)

- 154Document1 page154Swapnil MahantaNo ratings yet

- BJVJGDocument5 pagesBJVJGAvinash AcharyaNo ratings yet

- 202Document2 pages202MR.diwash PokhrelNo ratings yet

- Audit tt6Document11 pagesAudit tt6CHYE CHING OOINo ratings yet

- 153Document1 page153Swapnil MahantaNo ratings yet

- SD20 MJ19Document4 pagesSD20 MJ19Bhone ThantNo ratings yet

- Stephen f8 Question and AnswerDocument8 pagesStephen f8 Question and AnswerStephen FrancisNo ratings yet

- AA RevisionDocument20 pagesAA RevisionBhone ThantNo ratings yet

- 156Document2 pages156Swapnil MahantaNo ratings yet

- Audit Risk Auditor'S ResponseDocument7 pagesAudit Risk Auditor'S ResponsePink GirlNo ratings yet

- Planning and Risk AssessmentDocument19 pagesPlanning and Risk AssessmentMeta ShresthaNo ratings yet

- HarlemDocument2 pagesHarlemPrativa RegmiNo ratings yet

- Audit, Assurance and Related Services: Page 1 of 10Document10 pagesAudit, Assurance and Related Services: Page 1 of 10ANo ratings yet

- Audit Risk NotesDocument8 pagesAudit Risk NotesAditya KanabarNo ratings yet

- Session 3 - Practice Exercise 1 - Check Co - Audit Risks Respones - Question AnsDocument4 pagesSession 3 - Practice Exercise 1 - Check Co - Audit Risks Respones - Question AnsKim NgânNo ratings yet

- Q - 204 - Peony CompnayDocument4 pagesQ - 204 - Peony CompnayhusseinNo ratings yet

- Expert Q&A SolutionsDocument3 pagesExpert Q&A SolutionsSitiNadyaSefrilyNo ratings yet

- Question SEP Haris HanifDocument2 pagesQuestion SEP Haris HanifAliNo ratings yet

- Summer 2016 SolDocument7 pagesSummer 2016 SolMuhammad NawazNo ratings yet

- Solution Advanced Audit and Prof Ethics May 2010Document15 pagesSolution Advanced Audit and Prof Ethics May 2010Samuel DwumfourNo ratings yet

- Week 11reading Cont Lecture Notes - Audit For RPTDocument19 pagesWeek 11reading Cont Lecture Notes - Audit For RPTShalin LataNo ratings yet

- Chapter 6Document8 pagesChapter 6Jesther John VocalNo ratings yet

- Hart CoDocument4 pagesHart CoSITI SARAH JAUHARINo ratings yet

- Audit of Receivables - AuditingDocument9 pagesAudit of Receivables - AuditingTara WelshNo ratings yet

- Audit and AssuranceDocument11 pagesAudit and AssurancequratulainNo ratings yet

- Audit Substantive Procedures f8 CompressDocument39 pagesAudit Substantive Procedures f8 CompressApoorv jainNo ratings yet

- Murabah ProfitDocument15 pagesMurabah ProfitMuhammad ZulkifulNo ratings yet

- Audcap2 Unit 5 EssayDocument3 pagesAudcap2 Unit 5 EssaySel BarrantesNo ratings yet

- Risk and ResponsesDocument10 pagesRisk and ResponsesAbdullahNo ratings yet

- CA Inter (QB) - Chapter 5Document85 pagesCA Inter (QB) - Chapter 5Aishu SivadasanNo ratings yet

- Verification of Assets and LiabilitiesDocument62 pagesVerification of Assets and Liabilitiesanon_672065362No ratings yet

- AA - Revision: Dec 2011 Q3 - Lincoln CoDocument4 pagesAA - Revision: Dec 2011 Q3 - Lincoln CoTapiwa K NgungunyaniNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesGille Rosa Abajar100% (1)

- 15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnDocument4 pages15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnSomething ChicNo ratings yet

- Chap-6-Verification of Assets and LiabilitiesDocument48 pagesChap-6-Verification of Assets and LiabilitiesAkash GuptaNo ratings yet

- Auditing Accounts ReceivableDocument5 pagesAuditing Accounts ReceivableVivien NaigNo ratings yet

- September 19 AnswersDocument4 pagesSeptember 19 AnswersSophie ChopraNo ratings yet

- Q1. Identify and Explain EIGHT Audit Risks and Their ResponsesDocument3 pagesQ1. Identify and Explain EIGHT Audit Risks and Their ResponsesTashfeenNo ratings yet

- 01 Unit 1-Audit of LiabilitiesDocument9 pages01 Unit 1-Audit of Liabilitieskara albueraNo ratings yet

- Audit RevisionDocument53 pagesAudit Revisionmalachibroomes1No ratings yet

- Week 3 Discussion Questions and AnswersDocument6 pagesWeek 3 Discussion Questions and AnswersElaine LimNo ratings yet

- ACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Document20 pagesACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Amir ArifNo ratings yet

- Receivable Audit RisksDocument2 pagesReceivable Audit RisksKumarNo ratings yet

- Suggested Solutions To Chapter 6 Discussion QuestionsDocument8 pagesSuggested Solutions To Chapter 6 Discussion QuestionsGajan SelvaNo ratings yet

- F8 - AA - Mock A - 202103Document14 pagesF8 - AA - Mock A - 202103Thandi MazibukoNo ratings yet

- Acct462 Chapt 8Document17 pagesAcct462 Chapt 8valoruroNo ratings yet

- Audit Risk NOTESDocument8 pagesAudit Risk NOTESAtka FahimNo ratings yet

- JASMINEDocument6 pagesJASMINEabdirahman farah AbdiNo ratings yet

- F8 (AA) Kit - Que 82 - Blackberry CoDocument3 pagesF8 (AA) Kit - Que 82 - Blackberry CoChrisNo ratings yet

- Audit Risk NotesDocument14 pagesAudit Risk NotesRana NadeemNo ratings yet

- Auditor AppointmentDocument3 pagesAuditor Appointmentammar_qaiserNo ratings yet

- Hart Co Audit Risk Auditors ResponseDocument4 pagesHart Co Audit Risk Auditors Responsenajihah zakariaNo ratings yet

- Aa QM Sec B - Part 1Document19 pagesAa QM Sec B - Part 1lakshyatrivedi2003No ratings yet

- Aud689 Feb2022 SsDocument6 pagesAud689 Feb2022 SsAlexNo ratings yet

- CFAP 6 Winter 2021Document10 pagesCFAP 6 Winter 2021os96529No ratings yet

- Johnson Medical Case - CPA Core 1Document5 pagesJohnson Medical Case - CPA Core 1bushrasaleem5699No ratings yet

- Module - 2Document14 pagesModule - 2Jack Stephen.GNo ratings yet

- Criminal Law (Sexual Offences and Related Matters) Amendment Act 32 of 2007Document38 pagesCriminal Law (Sexual Offences and Related Matters) Amendment Act 32 of 2007olwethutshabalala620No ratings yet

- Legacy Life Among The Ruins 2e - Worlds of Legacy - Generation Ship - PlaybooksDocument16 pagesLegacy Life Among The Ruins 2e - Worlds of Legacy - Generation Ship - PlaybooksDan SalcudeanuNo ratings yet

- Case Summary Womens Legal Centre Decision 2022Document3 pagesCase Summary Womens Legal Centre Decision 2022Morongwa MatshoeuNo ratings yet

- Taiwan Kolin Corporation, LTD PowerpointDocument14 pagesTaiwan Kolin Corporation, LTD PowerpointCainta Mpl Jail TanNo ratings yet

- David Taylor VS Manila Electric Railroad and Light CompanyDocument1 pageDavid Taylor VS Manila Electric Railroad and Light CompanyRhea CalabinesNo ratings yet

- Constitution and By-Laws: PreambleDocument20 pagesConstitution and By-Laws: PreambleCK FlorNo ratings yet

- NMFS Opposition To InjunctionDocument34 pagesNMFS Opposition To InjunctionDeckbossNo ratings yet

- Law of Succession Revision Notes Case Summaries, July 2020Document65 pagesLaw of Succession Revision Notes Case Summaries, July 2020Tatenda MudyanevanaNo ratings yet

- Service Record LAWOP Emp. Certification Request FormDocument2 pagesService Record LAWOP Emp. Certification Request FormGiles Palencia BotavaraNo ratings yet

- Law346 Chapter 2-Chapter 6Document64 pagesLaw346 Chapter 2-Chapter 6RAUDAHNo ratings yet

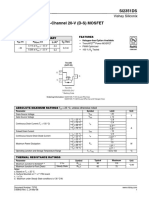

- Si2351DS: Vishay SiliconixDocument7 pagesSi2351DS: Vishay SiliconixbabasNo ratings yet

- CRPC Part-II Final AssignmentDocument7 pagesCRPC Part-II Final AssignmentMd Aríf Hussaín AlamínNo ratings yet

- Microsoft Supplier Code of Conduct EnglishDocument17 pagesMicrosoft Supplier Code of Conduct EnglishSahar SavvyNo ratings yet

- NorthWest Airlines, Inc. v. Cruz, G.R. No. 137136, November 3, 1999Document10 pagesNorthWest Airlines, Inc. v. Cruz, G.R. No. 137136, November 3, 1999Carlo LaguraNo ratings yet

- Lesson Proper For Week 7: Juvenile DelinquencyDocument38 pagesLesson Proper For Week 7: Juvenile DelinquencyMonrey SalvaNo ratings yet

- A Graphic Guide To: Civil ProcedureDocument18 pagesA Graphic Guide To: Civil ProcedureRafael Abedes100% (1)

- Evidence in Context, Problem SetDocument92 pagesEvidence in Context, Problem SetBrooke HendersonNo ratings yet

- Legal Management Final Req MbaDocument13 pagesLegal Management Final Req MbaJo Malaluan100% (1)

- Constitutional Law of IndiaDocument4 pagesConstitutional Law of IndiaFRH EnterprisesNo ratings yet

- Jurisdiction On CyberspaceDocument21 pagesJurisdiction On CyberspaceAntarik DawnNo ratings yet

- 02 People Vs TurcoDocument2 pages02 People Vs TurcoRan MendozaNo ratings yet

- Contract Tutorial 1Document1 pageContract Tutorial 1Ningguo LuNo ratings yet

- Article 371 A To 371 JDocument9 pagesArticle 371 A To 371 JRajaNo ratings yet

- Draft Gift DeedDocument4 pagesDraft Gift DeedDrashti ShahNo ratings yet

- Chapter Nine: Insurance in Construction IndustryDocument75 pagesChapter Nine: Insurance in Construction IndustryhNo ratings yet

- Dela Cruz v. Dela CruzDocument3 pagesDela Cruz v. Dela CruzSarah Jane UsopNo ratings yet

- Diya GaurDocument7 pagesDiya GaurfarheenNo ratings yet

- Honour Killing Case - RESPONDENTDocument18 pagesHonour Killing Case - RESPONDENTashwani kumarNo ratings yet

- SHG Registration Form 2022 1 PDFDocument6 pagesSHG Registration Form 2022 1 PDF680 classicNo ratings yet