Professional Documents

Culture Documents

Accounting Outlines

Uploaded by

UNIVERSITY uni0 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

accounting outlines

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesAccounting Outlines

Uploaded by

UNIVERSITY uniCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

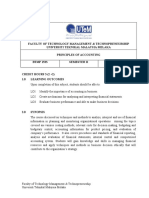

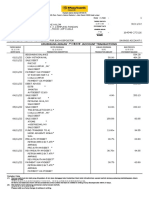

UNIVERSITY OF POONCH, RAWALAKOT

DEPARTMENT OF BUSINESS ADMINISTRATION

COOURSE OUTLINE AND BREAK-UP

Subject: Financial Accounting I COURSE CODE: BBA-124

Course Instructor: Nagina Jamil CREDIT HOURS: 03

Semester: 2ND

Prerequisites: Introduction to Business

COURSE DESCRIPTION/OBJECTIVE

The primary aim of Financial Accounting is to provide students with an introduction to the

process and function of financial reporting. Whilst a large proportion of the course is aimed at

understanding accounting as a process, taking a preparers‟ perspective, we will also seek to

develop an understanding of the importance of the role of accounting in today’s society.

LEARNING OUTCOMES

After studying this course the student will be able to understand:

1. The language of accounting and financial reporting;

2. Complete Accounting Cycle

3. Preparation and the role of Journal, Ledger and subsidiary books

4. Preparation of balance sheet, profit and loss account and cash flow statement.

RECOMMENDED TEXT BOOKS

1. M.A Ghani latest Edition, Principles of Accounting

2. Meigs and Meigs, Accounting for Business Decision, 9th Edition/Latest Edition

3. Williams, Haka, Bettner: Financial & Managerial Accounting, Latest Edition,

Prentice Hall

REFERENCE MATERIAL: Students can use the following reference books for

understanding the concepts

1. Professor Muhammad Ammanullah Khan: Financial Accounting, Latest Edition

2. Frank Wood‟s: Business Accounting 1, Eleventh Edition

3. Sohail Afzal: Accounting, Latest Edition

ASSESSMENT WITH WEIGHTS

The assessment framework for the judgment of students is comprised of

Midterm 30%

End term 50%

Internal evaluation 20%

The internal evaluation is comprised of 2 assignments, 2 best quizzes, class

participation, attendance and final project.

COURSE CONTENT

WEEK LECTUR# TOPICS QUIZES ASSIGNMENTS

Week Lecture 1 INTRODUCTION

01 Lecture 2 Book keeping

Lecture 3 Important terms in

accounting

Week Lecture 4 Double entry book

02 Lecture 5 keeping

Lecture 6 Advantages of double

entry book keeping

Disadvantages of

double entry book

keeping

Single entry vs. Double

entry

Advantages over single

entry system

Week Lecture 7 Accounting and its role

03 Lecture 8 Accounting definition

Lecture 9 and meaning

Branches of accounting

Functions of

accounting

Accounting system

Users of accounting

information

Week Lecture 10 Book keeping vs.

04 Lecture 11 Accounting

Lecture 12 Accounting cycle

Accounting principles &

accounting equation

Accounting principles

Week Lecture 13 Accounting equation

05 Lecture 14 Effects of transaction

Lecture 15 on accounting equation

Practice Problems &

Exercises

Nature of accounts & rules of

debit & credit

Account

Classification of

accounts

Week Lecture 16 Rules of debit & credit

06 Lecture 17 Practice Problems &

Lecture 18 Exercises

The Journal

Week Lecture 19 Practice Problems &

07 Lecture 20 Exercises

Lecture 21 Practice Problems & Q#1

Exercises

The Ledger

Week Lecture 22 Practice Problems &

08 Lecture 23 Exercises

Lecture 24 Practice Problems &

Exercises A#1

Preparing Trial Balance

Practice Problems &

Exercises

Week MID TERM

09 Lecture 25 Preparation of Financial

Lecture 26 Statements

Lecture 27 Preparing Profit and

Loss Account

Practice Problems &

Exercises

Preparing Balance

Sheet

Week Lecture 28 Practice Problems &

10 Lecture 29 Exercises

Lecture 30 The adjusting and closing

entries

Need for Adjusting

Entries

Types of Adjusting

Entries

Recording adjusting

entries

Week Lecture 31 Practice Problems &

11 Lecture 32 Exercises

Lecture 33 Preparing adjusted trial

balance

Practice Problems &

Exercises

Recording closing

entries

Week Lecture 34 Practice Problems &

12 Lecture 35 Exercises

Lecture 36 Preparing post-closing

trial balance

Practice Problems &

Exercises

Week Lecture 37 Preparing work-sheet

13 Lecture 38 Practice Problems &

Lecture 39 Exercises

Preparation of

Financial Statements

Practice Problems &

Exercises

Week Lecture 40 Cash and temporary

14 Lecture 41 investment

Lecture 42 Nature and

Composition of Cash

Cash Management and

Control Q#2

Maintaining Bank

Account

Bank Reconciliation

Practice Problems &

Exercises

Week Lecture 43 Short term investments

15 Lecture 44 Practice Problems &

Lecture 45 Exercises

Merchandising concerns

The operating cycle of

Merchandising

concerns

Periodic System

Perpetual System

Week Lecture 46 Accounting for

16 Lecture 47 Purchases and Sales

Lecture 48 Return and allowances A#2

Practice Problems &

Exercises

TERMINAL EXAM

You might also like

- Course Breakup - FsaDocument4 pagesCourse Breakup - FsaUNIVERSITY uniNo ratings yet

- 15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2Document2 pages15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2sephranesabajoNo ratings yet

- FYBCOM All Subects PDFDocument40 pagesFYBCOM All Subects PDFjatin katigarNo ratings yet

- Breakup AccountingDocument1 pageBreakup AccountingMZR QUMNo ratings yet

- Financial Accounting Weekly PlanDocument2 pagesFinancial Accounting Weekly PlanASMARA HABIBNo ratings yet

- Basic Financial Accounting and Reporting: Ishmael Y. Reyes, CPADocument39 pagesBasic Financial Accounting and Reporting: Ishmael Y. Reyes, CPAJonah Marie Therese Burlaza92% (13)

- General Information Book Cover: SyllabusDocument4 pagesGeneral Information Book Cover: SyllabusashnajananNo ratings yet

- Batch 21-23 - ACT 5001 - Financial Accounting - CODocument7 pagesBatch 21-23 - ACT 5001 - Financial Accounting - COShubham JhaNo ratings yet

- Course OutlineDocument3 pagesCourse OutlineArooj khalidNo ratings yet

- Module PA 1 (MGT) Semester Ganjil 2021-2022Document38 pagesModule PA 1 (MGT) Semester Ganjil 2021-2022Leonardus WendyNo ratings yet

- CVM5401 SynopsisDocument3 pagesCVM5401 SynopsisW.M.D.C WickramasingheNo ratings yet

- BM04.QT - DT.DGDCCT Actg221Document10 pagesBM04.QT - DT.DGDCCT Actg221irisbeautyariesNo ratings yet

- Course Plan - Ac1 (Non Acctg) WedDocument3 pagesCourse Plan - Ac1 (Non Acctg) WedAlta SophiaNo ratings yet

- Sno No Unit I:Introduction of AccountingDocument3 pagesSno No Unit I:Introduction of AccountingKancherla Bhaskara RaoNo ratings yet

- Principles of AccountingDocument5 pagesPrinciples of AccountingDawoodkhan safiNo ratings yet

- FFA Breakdown (Jaleel Ahmed Lectures)Document3 pagesFFA Breakdown (Jaleel Ahmed Lectures)aonabbasabro786No ratings yet

- 05 Basic AccountingDocument130 pages05 Basic AccountingSirazul Islam RanaNo ratings yet

- Lanado, Shiela R. DLL Week 8.fabm1.recentDocument3 pagesLanado, Shiela R. DLL Week 8.fabm1.recentDorothyNo ratings yet

- Advanced Accounting 1: Accounting Lab Module Uph Business SchoolDocument36 pagesAdvanced Accounting 1: Accounting Lab Module Uph Business SchoolDenisse Aretha LeeNo ratings yet

- LANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Document3 pagesLANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Edna MingNo ratings yet

- Dow University of Health Sciences: Course OverviewDocument4 pagesDow University of Health Sciences: Course OverviewRizwanNo ratings yet

- Principles of AccountingDocument3 pagesPrinciples of AccountingsamirNo ratings yet

- English Grammar For The Utterly ConfusedDocument27 pagesEnglish Grammar For The Utterly ConfusedAvantika BishtNo ratings yet

- MGT-205 Fundamentals of AccountingDocument6 pagesMGT-205 Fundamentals of AccountingMuqadas Wajid004No ratings yet

- Course Out Line For Exit Exam CoursesDocument26 pagesCourse Out Line For Exit Exam Coursesnatinaelbahiru74No ratings yet

- University of The Philippines Baguio: Institute of Management Bs Management EconomicsDocument7 pagesUniversity of The Philippines Baguio: Institute of Management Bs Management EconomicsConradoNo ratings yet

- Centre of Financial Excellance Lecture Plan TT6 Practice Lecture Wise Accumulated %age of Completion CH# Details T/No. No. of Lectures AccumulatedDocument5 pagesCentre of Financial Excellance Lecture Plan TT6 Practice Lecture Wise Accumulated %age of Completion CH# Details T/No. No. of Lectures AccumulatedZubair ArshadNo ratings yet

- Instant Download Ebook PDF Financial Accounting 10th Edition by Jerry J Weygandt PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 10th Edition by Jerry J Weygandt PDF Scribdmarian.hillis984100% (45)

- ACN 201 - Course Outline, Summer 2017Document6 pagesACN 201 - Course Outline, Summer 2017saha sudipNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- Financial Accounting-BBA-Course-Outline-28022024-123018pmDocument7 pagesFinancial Accounting-BBA-Course-Outline-28022024-123018pmTehreem BukhariNo ratings yet

- Final NEP FYBAF Syllabus 23 24Document86 pagesFinal NEP FYBAF Syllabus 23 24Jai ShahNo ratings yet

- ACC101 Course Description SyllabusDocument4 pagesACC101 Course Description SyllabusCristina MosaNo ratings yet

- Elements of Book Kepping and AccountancyDocument6 pagesElements of Book Kepping and AccountancybhoideepakNo ratings yet

- Cat l1 1 Introduction To Financial AccouDocument224 pagesCat l1 1 Introduction To Financial AccouBat100% (1)

- Introduction To Business - Management - Syllabus - HM - 2018Document4 pagesIntroduction To Business - Management - Syllabus - HM - 2018Aldi AlNo ratings yet

- T.A.Pai Management Institute (Tapmi), Manipal: Basics of AccountingDocument3 pagesT.A.Pai Management Institute (Tapmi), Manipal: Basics of AccountingShubham JhaNo ratings yet

- Actg 6 - PrelimDocument91 pagesActg 6 - PrelimAlyssa marie BuenoNo ratings yet

- Financial Accounting 1 OutlineDocument6 pagesFinancial Accounting 1 OutlineRasab AhmedNo ratings yet

- Bookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaDocument35 pagesBookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaTom Vargas0% (1)

- Syllabus: Serial Number: Subject Title: Subject DescriptionDocument5 pagesSyllabus: Serial Number: Subject Title: Subject DescriptionRoronoa ZoroNo ratings yet

- Accountancy, Business, and Management 1 Module 1: Introduction To AccountingDocument19 pagesAccountancy, Business, and Management 1 Module 1: Introduction To AccountingdanelleNo ratings yet

- Accounting Lesson Plan Grade 8Document6 pagesAccounting Lesson Plan Grade 8Orphy ArifenNo ratings yet

- 0.2 Weekly Schedule - Acc4018 - Ay 2023 - 4Document4 pages0.2 Weekly Schedule - Acc4018 - Ay 2023 - 48xbtv6ky8vNo ratings yet

- Accounting MGT-130 FALL - 2019Document4 pagesAccounting MGT-130 FALL - 2019Sajid Ali100% (1)

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- F3 Financial AccountingDocument3 pagesF3 Financial AccountingSuureNo ratings yet

- 110101131Document667 pages110101131Santha Kannan100% (1)

- Financial Accounting 9Th by John Hoggett Full ChapterDocument41 pagesFinancial Accounting 9Th by John Hoggett Full Chapterstephanie.ullmann917100% (27)

- Acc. Course OutlineDocument5 pagesAcc. Course OutlineNoor DeenNo ratings yet

- Poa Blad 17ppDocument17 pagesPoa Blad 17ppphylliskathryn03No ratings yet

- Tp-Btmp1533-Sem 2 2020.2021Document11 pagesTp-Btmp1533-Sem 2 2020.2021Carrot SusuNo ratings yet

- Accounting & Governance - 1Document50 pagesAccounting & Governance - 1Yash AgrawalNo ratings yet

- Course Outline For BOOKKEEPING (Exploratory)Document2 pagesCourse Outline For BOOKKEEPING (Exploratory)Angelo DelgadoNo ratings yet

- FAR Course GuideDocument4 pagesFAR Course GuideMariel BombitaNo ratings yet

- Accounting and Finance For ManagersDocument324 pagesAccounting and Finance For ManagersSubin Roshan100% (2)

- Corporate Governance: How To Add Value To Your Company: A Practical Implementation GuideFrom EverandCorporate Governance: How To Add Value To Your Company: A Practical Implementation GuideRating: 1 out of 5 stars1/5 (1)

- sd13 Using Income Tax InformationDocument9 pagessd13 Using Income Tax InformationAngela JoyceNo ratings yet

- IESCO - SAP - ERP - FI - TD Fiori - AADocument50 pagesIESCO - SAP - ERP - FI - TD Fiori - AAFahim JanNo ratings yet

- Company Valuation Based On Ev/ebitda and Ev/ebit Multiples: A Case Study of A Brazilian Mining CompanyDocument55 pagesCompany Valuation Based On Ev/ebitda and Ev/ebit Multiples: A Case Study of A Brazilian Mining CompanyRicardo AlvesNo ratings yet

- NBFC Thematic On Securitisation - Spark - 25nov19Document35 pagesNBFC Thematic On Securitisation - Spark - 25nov19chetankvoraNo ratings yet

- Texto en Ingles Finanzas CorporativasDocument2 pagesTexto en Ingles Finanzas CorporativasyercaNo ratings yet

- Ringkas CHPTR 6Document8 pagesRingkas CHPTR 6Yuli TambarikiNo ratings yet

- The Statement of Financial PositionDocument17 pagesThe Statement of Financial Positionlouielyn candidoNo ratings yet

- Quiz BFDocument3 pagesQuiz BFlope pecayo0% (1)

- Rescue Financing in Light of The Insolvency and Bankruptcy Code, 2016: Success, Challenges and InspirationsDocument14 pagesRescue Financing in Light of The Insolvency and Bankruptcy Code, 2016: Success, Challenges and InspirationsSHIVAM BHATTACHARYANo ratings yet

- PDF Module 7 2nd Quarter Entrep - CompressDocument16 pagesPDF Module 7 2nd Quarter Entrep - CompressRaiza CabreraNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- Derivatives Market in India 12345Document107 pagesDerivatives Market in India 12345Dastha GiriNo ratings yet

- Cendant CorporationDocument7 pagesCendant CorporationMar100% (1)

- Merc 2018 BarDocument5 pagesMerc 2018 BarAizenPaulaNo ratings yet

- Amani Boniface AsseyDocument4 pagesAmani Boniface AsseyHeet PatelNo ratings yet

- Ibs Desa Pandan 1 30/11/22Document12 pagesIbs Desa Pandan 1 30/11/22mizzy ahmadNo ratings yet

- Disney Q1-Fy20-EarningsDocument15 pagesDisney Q1-Fy20-EarningsImnevada AcidNo ratings yet

- CHAP - 5 - Measuring and Evaluating The Performance of BanksDocument7 pagesCHAP - 5 - Measuring and Evaluating The Performance of BanksNgoc AnhNo ratings yet

- Modle Paper 1Document7 pagesModle Paper 1Yaseen MaalikNo ratings yet

- 74697bos60485 Inter p1 cp5 U3Document35 pages74697bos60485 Inter p1 cp5 U3aryanharsh2004No ratings yet

- A-Financial Accounting - Midterm Exam QuestionsDocument8 pagesA-Financial Accounting - Midterm Exam QuestionsAmbra KoraNo ratings yet

- 2018 Fortune 500 W Contacts SampleDocument18 pages2018 Fortune 500 W Contacts SampleShrin RajputNo ratings yet

- Entrepreneurship Development (BM-302) : Assignment 1Document7 pagesEntrepreneurship Development (BM-302) : Assignment 1AbhishekNo ratings yet

- 2 - CorpoDocument10 pages2 - CorpoDarlene GanubNo ratings yet

- A55 SSRN-id2814978Document36 pagesA55 SSRN-id2814978Camilo OvalleNo ratings yet

- M6 CgbleDocument2 pagesM6 Cgblezeeshan sikandarNo ratings yet

- Key Answer Financial Statement - TP1Document7 pagesKey Answer Financial Statement - TP1Riza AdiNo ratings yet

- Finance Analyst - Finance All in One BundleDocument16 pagesFinance Analyst - Finance All in One Bundleyogesh patilNo ratings yet

- Dividend PolicyDocument51 pagesDividend PolicyMmonower HosenNo ratings yet

- The Benefits of Good Loan Structuring: Cameron McraeDocument3 pagesThe Benefits of Good Loan Structuring: Cameron McraeRoman AhmadNo ratings yet