Professional Documents

Culture Documents

TDS Rates Smart Notes (Nov 22) - Yash Khandelwal

Uploaded by

Umang BansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Rates Smart Notes (Nov 22) - Yash Khandelwal

Uploaded by

Umang BansalCopyright:

Available Formats

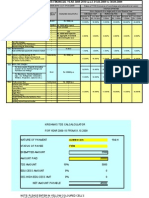

Chapter 12: TDS & TCS

SECTION RATES LIMITS/ CONDITIONS

Sec 192 Slab Rates TDS deducted at the time of payment

Salary

192A 10% Service < 5 yrs, Amount > 50K - TDS

PF Accumulated NO PAN - MMR Applicable.

Balance Service> 5 yrs - NO TDS

194I P&M - 2% NO TDS If Aggregate Rent is upto Rs.

Rent BUILDING - 10% 2,40,000

Rent kaun deta hai?- Main TDS is applicable on Non- refundable Deposits

194 C Ind/HUF - 1% NO TDS if:

• Single Payment is upto Rs. 30,000

C- Contractor Others - 2%

• Aggregate amt. during F. Y. is upto 1lac

• Contract is for Personal Purpose of

Ind/HUF

194 J - JANHIT Operation of • NO TDS if

Professional Fees Call Centre - 2% < 30,000

Fees for Non

FTS Royalty

Others - 10% compete

professional

FTS services Fees

Being a Professional The Limit of 30,000 is for each

Others

service

2% payment

10%

ROYALTY • Commission/sitting Fees Paid to

Non-Executive/Independent Directors.

sale, Distribution Others

of films 2% ↳ No Threshold limit

2%

• No TDS on personal payments by

Ind/HUF for FPS

194H- Hafta. 5% NO TDS if Amt is upto Rs. 15000.

Commission/Brokrage 5 takka NO TDS on Underwriting Commission

or brokrage on Public issue

12.1

194M- Man Se 5% KAUN KAATEGA - Individual/HUF

Payment of not covered in 194C, 194J, 194H

• Contract KISKA KATEGA - Any Resident Person

• Professional fees

LIMIT- Agg. Amt.> Rs. 50 lakh

• Commission/Brokrage

paid. in the P.Y.

Sec 194G- Gamble 5% NO TDS if Amt is upto Rs. 15000.

Lottery sale If Lottery seller wins lottery on unsold

Commission tickets, it will be taxable@30%

194D 5% NO TDS if Amt is upto Rs. 15000.

Insurance Commission

194B- Lottery, Puzzles • NO TDS if Amt is upto RS. 10,000

Badi lottery

30% • Deducted at the time of payment only

194BB - Horse Race

• If winning is in kind, the payer shall

Bhag Bhag release winnings only after ensuring

that TDS is paid to Govt

194E → Payment to NR 20% Sportsperson & Entertainer

Sportsman, Association, shall be NR+ Non-Citizen

+ cess 4%

ENTERTAINER (eff. 20.8%)

Refer Sec 115 BBA

in NR chapter.

→ TDS only applicable if amt. recd. by

Sec 195 Rate in Force

Payment made to NR or foreign Co. is taxable in India.

(given in finance

NR or Foreign co. at every year) → If Rates given in DTAA are lower,

then those Rates will apply.

194 10% Deducted at the time of payment only

TDS on Kaun kaatega- Payment made by

Dividend Domestic Company

Kiska Katega -

Cash

Any Resident Person any other Mode

No limit

No TDS upto Rs.

5000

12.2

193 10% No TDS:

Interest on Securities Int payable on CG or SG Securities

Int paid to LIC, GIC

194A- Alag wala Interest 10% LIMIT for Int paid by:

Interest other than -Banks/co-op bank/ Post off. - Rs. 40,000

Int. on securities -Others 5000

50,000 for senior citizens

194DA 5% On Income Component

(After 1.9.19)

Maturity Proceeds (Maturity less premium paid)

of LIP

NO TDS if:-

DA- DAULAT

• If amount less than Rs. 1,00,000

• If Sum is Recd. on death of Insured.

• If Maturity exempt u/s 10(10D)

194IA 1% of sale Price • No TDS on Rural Agri land

Sale of Immovable • Consideration < 50L → NO TDS

Property ↳ TDS on 50 lacs or more

Not

SDV

• Consideration includes maintainance fees,

parking fees & all other similar charges

194IB 5% • NO TDS IF RENT per month is upto

TDS on Rent NO PAN - 20% Rs. 50,000

of Immovable

• Deducted at the time of payment/

Property

credit of rent of last month w.e. earlier

• Deduction not to exceed Rent for

Last month

194 IC - Indira Colony.

10% IF CONSIDERATION IN KIND → NO TDS

Consideration for

agreement as per Sec

45(5A)

Joint development

Agreement

12.3

194 LA 10% of Amount upto Rs. 2,50, 000 → NO TDS

Compulsory Sale Price Rural or Urban Agri land-NO TDS

Acq of Immovable

Property

194K 10% NO TDS if payment is

TDS on Income KAUN KAATEGA - UTI/MF

upto Rs. 5000 in a P.Y.

KISKA KATEGA- Resident person

in respect of units.

194LB 5% KAUN KAATEGA - Inf. Debt Fund

TDs on Interest KISKA KATEGA - NR/FC.

on Infrastructure

Debt fund

194N- Nahi Denge When limit is 1 cr: → TDS only applicable on excess

amount over and above limit.

TDS on Cash Rate- 2%

withdrawls in Eg- withdrawal 1.20 cr

When limit is 20 lacs:.

excess of Rs. I crore TDS applicable on 0.20 Cr only.

20 lakhs to 1 crores- 2%

Above 1 crores-5%

Limit will be checked separately for

different banks

→ If assessee has not filed ROI for all 3

preceding P. Ys for which Due Date u/s

139(1) is expired, Limit will be Rs. 20

lakhs

1940 1% NO TDS if all the following conditions

are satisfied:

TDS on payment KAUN KAATEGA-E-Commerce

by E-commerce operator

KISKA KATEGA - E-Commerce i) E- comm. participants Ind/HUF

Operator participant (resident person)

ii) Gross amount of Sale/Services

during P.Y. is upto Rs. 5 lakh

206 AA -

If No PAN- 5% iii) PAN or aadhaar furnished.

12.4

Amendments (F.A. 21)

194P TDS rate- Slab Rate → Section only applicable if

Senior citizen has ONLY:.

Pairi Pauna

Payer-Specified Bank

TDS by Bank in

Payee- Individual

case of Senior Citizen Pension Interest in any

Resident aged

Income Account in which

75 yrs or more

he receives pension

→ That Alc should be with

the same Bank only.

Rate- 0.1%

194Q → Only applicable on excess amount over

NO PAN- 5% 50 lakhs, not whole amount.

Purchase of Goods

of more than Rs. 50 → TDS under this section not

Kaun Kaatega:.

lakhs during P.Y. applicable if:.

Any Buyer whose

last year

w.e.f. 1/7/21

TDS already TCS already

T/O> Rs. 10 crore

deducted collected

under any u/s 206C(1H)

Kiska Katega:

other section

Seller

eg. 1940

Notes:

→ Where both 194Q & 206C (1H) applies, TDS has to be deducted u/s 194Q

→ Where TDS u/s 194Q & TCS u/s 206(1)/(1F)/(1G) applies, TCS has to be collected

under above sections.

→ TDS u/s 194Q,194O, 206C(1H) not applicable on securities transactions through RSE.

→ TDS u/s 194Q not applicable on GST component. But It will be applicable on whole amount of any

Advance payment.

→ If Buyer is NR- 194Q not applicable But it will be applicable if

If Seller is NR - 206C(1H) not applicable NR has PE in India

→ For 1st Year of Business, TDS u/s 194Q not applicable since last year T/O is zero.

→ If Whole Income of Seller is Exempt- 194Q not applicable

If Whole Income of Buyer is Exempt - 206C(1H) not applicable

→ TDS u/s 194Q is applicable from 1.7.21, but for calculating threshold of Rs. 50 lakhs we will

consider purchases before 1.7.21 also. TDS will not be applicable on those purchases before 1.7.21

12.5

To whom HIJAC are applicable?

HIJAC (1) Assessee other than Individual/HUF

(2) Ind/HUF whose last year T/O> 1 cr in case of Business

G/R > 50 lacs in case of profession.

Master Chart for Remembering all limits

→ NO TDS if amount is upto →TDS is applicable starting

↳ No TDS If Amounts < Threshold limit from this Amount

Which means TDS is only applicable if

Sec 194IA → TDS applicable if

Amount paid is more than the

Amt is 50 lakhs or more

threshold Limit

→ NO TDS till Rs. 49,99,999

All Other sections Sec 194DA → TDS applicable if

Amt is 1,00,000 or more

→ No TDS till Rs. 99,999

Sec 192A → TDS applicable if

Amt is Rs. 50,000 or more

→ No TDs till Rs. 49,999.

12.6

Sec 206AB: TDS/TCS Rate for Non- Filers (F. A 2021)

In case of TDS, if payee has not of last 2 P.Ys, for which due date has

Filed Returns

expired (PY18-19, 19-20), & TDS deducted is 50,000 or more, then TDS Rate

shall be: - Twice the TDS/TCS Rate

w.e.is higher

- or 5%

192,

→ This section is not applicable on

192A NR payee not having

&

194B PE in India

194BB

194LBC

194N

→ In case payee/collectee did not furnish PAN: Rate as per Sec 206AA/206CC

or

5%

w.e. is higher.

12.7

TAX COLLECTED AT SOURCE

TCS RATES

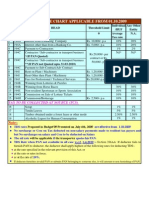

Sec 206C(1)

(a) Alcoholic liquor for human consumption 1%

(b) Tendu leaves 5%

(c) Timber obtained under a forest lease 2.5%

(d) Timber obtained by any mode other than (c) 2.5%

(e) Any other forest produce not being timber or tendu leaves. 2.5%

(f) Scrap 1%

(g) Minerals, being coal or lignite or iron ore 1%

Note : No TCS shall be collected if Resident Buyer gives declaration that above goods

are to be utilised for the purpose of manufacturing, processing or producing articles

or things or for generation of power and not for trading purposes.

Sec 206C(1C) : Lease or a licence of parking lot, toll plaza or mine or a quarry

TCS Rate - 2%.

TCS shall be collected by every person who grants a lease or a licence or enters into a

contract or otherwise transfers any right or interest in any -

- parking lot or

- toll plaza or

- a mine or a quarry

to another person (other than a public sector company) for the use of such parking

lot or toll plaza or mine or quarry for the purposes of business.

Note – Mining and quarrying excludes mining and quarrying of mineral oil i.e. mining

and quarrying of petroleum and natural gas.

Sec 206C(1F): Sale of motor vehicle of value exceeding 10 lakhs

TCS shall be collected by seller, on sale of a motor vehicle of the value > Rs. 10

lakhs, from the buyer @1% of the sale consideration.

Note: TCS under this section is not applicable when Manufacturer sells cars to the

dealers. Only applicable on Retail Sale

→ Limit of Rs. 10 Lacs has to be checked at each purchase, not on aggregate sale

made during the P.Y.

12.8

Sec 206C(1G)

TCS on Remittance outside India

OR Sale of Tour Package.

In case of authorized dealer, In case of Sale of an

who receives an amount Overseas tour program package,

of more than 7 lacs in p y. if seller receives any amount, Seller

from a buyer → who is is required to collect TCS @5%.

remitting amount outside

India under LRS of RBI,

the Auth. dealer is required to

collect TCS @ 5% in excess of Rs. 7 Lacs.

Note: If remitted amount is remitted out

of educational loan taken from Financial

Institution, TCS Rate shall be @ 0.5%

Sec 206C(1H)

Sale of goods of value exceeding 50 lakh

Sells goods exceeding

Seller Buyer

value 50 Lacs in a P.Y.

Having T/0 > 10Cr

in Last P.Y.

TCS shall be collected @ 0.1% at the time of receipt

of amount in excess of 50 Lacs

→ TCS is not required to be collected under this section if already collected u/s

206C(1)/(1F)/(1G) or if Goods are exported.

→ Where both 194Q & 206C (1H) applies, TDS has to be deducted u/s 194Q

→ TCS u/s 206C(1H) shall be calculated on whole amount including GST.

→ If Collectee did not provide PAN, TCS shall be collected @ 1%

→ In case of Sale of Fuel to NR Airlines, TCS u/s 206C(1H) not applicable

12.9

Additional Points

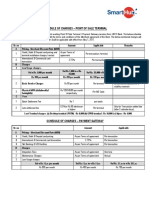

Due Date of Payment of TDS/TCS

TDS TCS

For Other Months 7th of Next month 7th of Next month

For March 30th April of Next F.Y. 7th April of Next F.Y.

For Sec 194M,194IA, 194IB:

→ TAN not required as TDS under these sections are deducted ocassionally

Due Date of Return : 194 IA - Form 26QB

30 Days from the end of

& Payment 194 IB - Form 26QB

month in which deducted

194 M - Form 26QB

Due Date of Return of TDS/TCS

Quarter Ended TCS Return TDS

30th June 15th July 31st July

30th September 15th October 31st October

31st December 15th January 31st January

31st March 15th May 31st May

Late Fees: Rs. 200 per day of delay in filing of TDS/TCS Returns

If TDS/TCS Return is filed after 1 year of Due Date → Penalty u/s 271H shall be

leviable - 10,000 to max 1,00,000.

12.10

Interest for Late Deduction/Collection of TDS/TCS

TDS TCS

1% per month

Late Deduction/Collection 1% per month

or part or part

Period Date on which TDS was

Date on which TCS was

deductible to date on

collectible to date on

which it is deducted

which it is actually paid

Late Payment 1.5 % per month -

or part

Period Date on which TDS was

deducted to date on

which it is actually paid

Time of Collecting TCS

(a) at the time of debiting the party or But for Sec 206C(1F) & 1(H),

(b) receipt of consideration TCS is collected only at the time of

w.e. is earlier receipt of consideration.

Section 206CC

If Collectee has not provided PAN or Aadhar, TCS Rate shall be:

Twice the TCS Rate

In case of Sec 206C(1H), It is 1%

OR

5%

w.e. is higher

Sec 201: Assessee in Default

If TDS is not deducted then, Assessee is treated as assessee in

OR deducted but not paid to Govt. default.

Penalty u/s 221 is attracted → which can be upto 100% of TDS Amount

12.11

Payer is not treated as Assessee in Default if :

filed return u/s 139(1)

paid tax on such income PayEE Has taken into account such

income

And Payer has furnished a certificate from his

CA in this regard to AO

12.12

You might also like

- You Exec - Brand Positioning Strategy CompleteDocument18 pagesYou Exec - Brand Positioning Strategy CompleteDianne DimoriNo ratings yet

- HSE Safety AlertsDocument7 pagesHSE Safety Alertsrasnowmah2012No ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- 葛传椝英语写作 by 葛传椝 (葛传椝)Document416 pages葛传椝英语写作 by 葛传椝 (葛传椝)付明璘100% (1)

- 27 Tds Calculator Rate ChartDocument5 pages27 Tds Calculator Rate ChartasareereNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Chapter 18 Earth Retaining Structures - 02242010 PDFDocument33 pagesChapter 18 Earth Retaining Structures - 02242010 PDFDiNa Novita Sari Alhinduan100% (2)

- Hupseng CompletedDocument23 pagesHupseng CompletedHii Nian Tin80% (5)

- Mobifone Tutela Analysis and Benchmarking July'23 - Ver1Document73 pagesMobifone Tutela Analysis and Benchmarking July'23 - Ver1simondiverNo ratings yet

- Wcdma Kpi Optimization: Presented by Ahmed AzizDocument64 pagesWcdma Kpi Optimization: Presented by Ahmed AzizCesar Ivan Alvear Vega100% (5)

- TDS & TCS Rates - Yash KhandelwalDocument15 pagesTDS & TCS Rates - Yash KhandelwalSahoo PrabhasNo ratings yet

- Important Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDocument1 pageImportant Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDaljeet SinghNo ratings yet

- Complete Tds CourseDocument32 pagesComplete Tds CourseAMLANNo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- TDS Chart Nov 23Document1 pageTDS Chart Nov 23Flashcap693No ratings yet

- TCS Provisions For The FY 2021-22 AY 2022-23Document11 pagesTCS Provisions For The FY 2021-22 AY 2022-23Hardik gabaNo ratings yet

- TDSDocument3 pagesTDSpeteno5623No ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- Tds Rate For The Fy 2021-22Document5 pagesTds Rate For The Fy 2021-22stridden24No ratings yet

- TDS & TCS - DT Nov 22Document4 pagesTDS & TCS - DT Nov 22bnanduriNo ratings yet

- TDS Final May 24Document1 pageTDS Final May 24Kochu KuchuNo ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- Tax Deducted at SourceDocument9 pagesTax Deducted at SourceAnsHika AroRaNo ratings yet

- Tax Deduction at Source: Subject NameDocument7 pagesTax Deduction at Source: Subject Nameharshita23hrNo ratings yet

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- SCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFDocument2 pagesSCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFnits_chawlaNo ratings yet

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Tds Rate Chart AY 21 22Document1 pageTds Rate Chart AY 21 22Keerthana.M MuruganNo ratings yet

- TDS RatesDocument1 pageTDS Ratespankaj_adv5314No ratings yet

- Income Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceDocument6 pagesIncome Tax Update: Budget 2019-20: TDS - Tax Deduction at SourceAjeet KumarNo ratings yet

- Jio Tariff Enterprise 199 Plans - 1401963Document1 pageJio Tariff Enterprise 199 Plans - 1401963Mahendra Kumar SoniNo ratings yet

- Tds Rate Chart AY 11 12Document1 pageTds Rate Chart AY 11 12PRENESHRAJNo ratings yet

- Rates of TDSDocument30 pagesRates of TDSsudhanshu88g1No ratings yet

- TDS ChartDocument3 pagesTDS ChartmmrkfastNo ratings yet

- Finals Taxation ReviewerDocument13 pagesFinals Taxation ReviewerAyessa GayamoNo ratings yet

- Adobe Scan Oct 27, 2023Document2 pagesAdobe Scan Oct 27, 2023Renalyn Ps MewagNo ratings yet

- Tax TablesDocument4 pagesTax TablesTan Concepcion & QueNo ratings yet

- PWC - Budget - 2020 - Analysis - 20 FebDocument35 pagesPWC - Budget - 2020 - Analysis - 20 FebGaury DattNo ratings yet

- TDS Rate Chart FY 2024-25Document4 pagesTDS Rate Chart FY 2024-25MOQADDARNo ratings yet

- Income Payment Subject To Creditable Withholding TaxDocument2 pagesIncome Payment Subject To Creditable Withholding TaxChelsea Anne VidalloNo ratings yet

- Deduction of Tax at Source With Regard To Salary Income Section 192 1. 2. 3Document4 pagesDeduction of Tax at Source With Regard To Salary Income Section 192 1. 2. 3Vidit GuptaNo ratings yet

- Tds Rate ChartDocument1 pageTds Rate Chartremesh78No ratings yet

- 4B & 4C Special RFC & NRFCDocument2 pages4B & 4C Special RFC & NRFCJP JimenezNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- Fusion 220Document1 pageFusion 220didgie.koech8820No ratings yet

- TDS SummaryDocument4 pagesTDS Summaryshubhamsingh143deepNo ratings yet

- TDS Rate Chart For FY 2024-25Document70 pagesTDS Rate Chart For FY 2024-25leelathecaNo ratings yet

- Tds Tcs SummaryDocument1 pageTds Tcs Summarygadiyasiddhi0No ratings yet

- 7 Understanding Taxation in Indonesia 1 PDFDocument13 pages7 Understanding Taxation in Indonesia 1 PDFYlaine Gonzales-PanisNo ratings yet

- B) Quote - Pvt. Ltd. Registration (For Limited Period Only) CRVVH JDocument1 pageB) Quote - Pvt. Ltd. Registration (For Limited Period Only) CRVVH Jhaleemahaseeb3No ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- TAX Last Minute by HerculesDocument8 pagesTAX Last Minute by Herculesjanjan3256No ratings yet

- DT - One Page Summary - Business Trust, Inv Fund, Sec. TrustDocument1 pageDT - One Page Summary - Business Trust, Inv Fund, Sec. TrustAruna RajappaNo ratings yet

- Analia Tax Notes-2011Document23 pagesAnalia Tax Notes-2011Butch MaatNo ratings yet

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- TDS CIRCULAR-compressedDocument24 pagesTDS CIRCULAR-compressedNitin VermaNo ratings yet

- TDS Rate Chart - FY 2021-22Document3 pagesTDS Rate Chart - FY 2021-22Ram YadavNo ratings yet

- Tds Rate Chart 11 12Document1 pageTds Rate Chart 11 12talawdekarNo ratings yet

- Schedule of Fees and ChargesDocument3 pagesSchedule of Fees and Chargesdeepakoneplus5No ratings yet

- TDS Rate Chart For AY 2009-2010: Prepared By-Himanshu MalikDocument2 pagesTDS Rate Chart For AY 2009-2010: Prepared By-Himanshu Malikysr_cool100% (6)

- Topic 2 Expanded Withholding TaxesDocument26 pagesTopic 2 Expanded Withholding TaxesTeresa AlbertoNo ratings yet

- Udit Electrical Exp1Document5 pagesUdit Electrical Exp1Umang BansalNo ratings yet

- ec0723d5-54f2-4640-976e-ba5a26e33da1Document1 pageec0723d5-54f2-4640-976e-ba5a26e33da1Umang BansalNo ratings yet

- EFFN098209Document11 pagesEFFN098209Umang BansalNo ratings yet

- Earned 1000000 Rs From Stock Market Option Buying by The End of 30th Nov 2022Document1 pageEarned 1000000 Rs From Stock Market Option Buying by The End of 30th Nov 2022Umang BansalNo ratings yet

- Earned 1000000 Rs From Stock Market Option Trading by The End of 30th Nov 2022Document1 pageEarned 1000000 Rs From Stock Market Option Trading by The End of 30th Nov 2022Umang BansalNo ratings yet

- ZumbroShopper15 10 07Document12 pagesZumbroShopper15 10 07Kristina HicksNo ratings yet

- Tri Review Turbidity Fact Sheet 01-08-15Document2 pagesTri Review Turbidity Fact Sheet 01-08-15Shyla Fave EnguitoNo ratings yet

- Voltmeter and Ammeter Using PIC Microcontroller PDFDocument11 pagesVoltmeter and Ammeter Using PIC Microcontroller PDFMohd Waseem Ansari100% (1)

- AK4452VNDocument87 pagesAK4452VNJudon ArroyoNo ratings yet

- Kojeve - Colonialism From A European PerspectiveDocument18 pagesKojeve - Colonialism From A European PerspectiveTetsuya MaruyamaNo ratings yet

- The Verb To Be ExplanationsDocument5 pagesThe Verb To Be ExplanationsLuz Maria Batista MendozaNo ratings yet

- Effect of Ambient Vibration On Solid Rocket Motor Grain and Propellant/liner Bonding InterfaceDocument7 pagesEffect of Ambient Vibration On Solid Rocket Motor Grain and Propellant/liner Bonding InterfaceZehra KabasakalNo ratings yet

- A History of Unit Stabilization: Colonel John R. Brinkerhoff, U.S. Army, RetiredDocument10 pagesA History of Unit Stabilization: Colonel John R. Brinkerhoff, U.S. Army, RetiredRockMechNo ratings yet

- Gear RatiosDocument2 pagesGear RatiosNagu SriramaNo ratings yet

- A Simple Runge-Kutta 4 TH Order Python Algorithm: September 2020Document5 pagesA Simple Runge-Kutta 4 TH Order Python Algorithm: September 2020alaa khabthaniNo ratings yet

- Biological AndNon-biologicalMethods For Silver Nanoparticles SynthesisDocument10 pagesBiological AndNon-biologicalMethods For Silver Nanoparticles SynthesisHernan DmgzNo ratings yet

- EPJ Web of Conferences - 170 X 250 MM Paper Size, One Column FormatDocument4 pagesEPJ Web of Conferences - 170 X 250 MM Paper Size, One Column FormatLaura ParkaNo ratings yet

- Capability Statement 1Document1 pageCapability Statement 1api-523267488No ratings yet

- Raguindin, Maricel B. (P.E Activity 2)Document4 pagesRaguindin, Maricel B. (P.E Activity 2)Maricel RaguindinNo ratings yet

- DDQ-20L6SC CN-090Document41 pagesDDQ-20L6SC CN-090Alfredo Valencia RodriguezNo ratings yet

- MORRISON BUSINESS CLUB - RevisedDocument27 pagesMORRISON BUSINESS CLUB - RevisedAndrew HoNo ratings yet

- BIR Form No GuidlineDocument11 pagesBIR Form No GuidlineFernando OrganoNo ratings yet

- Scheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringDocument4 pagesScheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringAmit GhadeNo ratings yet

- Zeelandia Article X-FreshDocument2 pagesZeelandia Article X-Freshafb4No ratings yet

- The Evidence Base For The Efficacy of Antibiotic Prophylaxis in Dental PracticeDocument17 pagesThe Evidence Base For The Efficacy of Antibiotic Prophylaxis in Dental PracticebmNo ratings yet

- Puma OpenDocument5 pagesPuma Opencaliniclodean7737No ratings yet

- A Sample Case Analysis For OB-IDocument3 pagesA Sample Case Analysis For OB-IKunal DesaiNo ratings yet

- Introduction To DeivativesDocument44 pagesIntroduction To Deivativesanirbanccim8493No ratings yet