Professional Documents

Culture Documents

FMGT Test Questions

Uploaded by

PuneetOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMGT Test Questions

Uploaded by

PuneetCopyright:

Available Formats

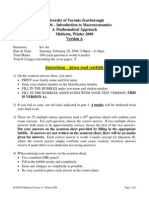

AQ058-3-2-FMGT CLASS TEST Page 1 of 1

Answer All Questions

You are thinking about investing your money in the stock market. You have the following two

stocks in mind: stock A and stock B. You know that the economy can either go in

recession(bad), normal or it will boom (good). You also know the following about your two

stocks:

State of the Economy Probability RA RB

Good 0.30 24% 30%

Normal 0.40 36% 18%

Bad 0.30 48% -6%

You also have information that the correlation coefficient between the two stocks as -0.6.

Required

Question 1

a) Calculate the expected return for stock A and stock B.

(10 Marks)

b) Calculate the risk (standard deviation) for stock A and for stock B.

(10 Marks)

c) Calculate the expected return and the standard deviation of a portfolio comprised of stocks A

and B. The weight in stock A is 60%.

(10 Marks)

d) Explain your answers

(20 marks)

(Total 50 Marks)

Question 2

Ideally, a company market value should reflect its fundamental values. If this is not the case, one

or more groups of stakeholders will suffer. Explain.

(50 Marks)

(Grand Total: 100 Marks)

END OF QUESTION PAPER

APU Level 2 Asia Pacific University of Technology & Innovation 202209

You might also like

- 2223 Level N AP Microeconomics Course QuestionsDocument21 pages2223 Level N AP Microeconomics Course Questionslayan100% (1)

- Tutorial QS IAS 16 Property, Plant and Equipment (PPE)Document2 pagesTutorial QS IAS 16 Property, Plant and Equipment (PPE)PuneetNo ratings yet

- Chapter 3 - Utility Theory: ST Petersburg ParadoxDocument77 pagesChapter 3 - Utility Theory: ST Petersburg Paradoxabc123No ratings yet

- A2 QMTDocument2 pagesA2 QMTAcha BachaNo ratings yet

- Acca Fa M3 PDFDocument14 pagesAcca Fa M3 PDFtommydunkNo ratings yet

- B294-TMA-Fall 2023-2024-V1Document4 pagesB294-TMA-Fall 2023-2024-V1adel.dahbour97No ratings yet

- Reading 2 Time-Series AnalysisDocument47 pagesReading 2 Time-Series Analysistristan.riolsNo ratings yet

- Assigment 3Document9 pagesAssigment 3Felipe PinedaNo ratings yet

- Assignment 2Document5 pagesAssignment 2Marcus GohNo ratings yet

- Chinese Yuan SolutionDocument1 pageChinese Yuan SolutionTrang QuynhNo ratings yet

- Acca Ma and Fma Management Accounting September 2018 To August 2019Document12 pagesAcca Ma and Fma Management Accounting September 2018 To August 20191 N Aaron AgarwalNo ratings yet

- PR Emet 2 PDFDocument2 pagesPR Emet 2 PDFgleniaNo ratings yet

- Tutorial 2 QuestionDocument7 pagesTutorial 2 QuestionMuhammad Brian EimanNo ratings yet

- My Courses: Started On State Completed On Time Taken Marks Grade 4.71 94Document9 pagesMy Courses: Started On State Completed On Time Taken Marks Grade 4.71 94Daniel MahechaNo ratings yet

- Cost FM 2 PDFDocument276 pagesCost FM 2 PDFYogesh ThakurNo ratings yet

- Institute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesDocument8 pagesInstitute and Faculty of Actuaries: Subject CM2A - Financial Engineering and Loss Reserving Core PrinciplesANo ratings yet

- BHMH2002 Introduction To Economics (S2, 2021) Assignment II - Question PaperDocument3 pagesBHMH2002 Introduction To Economics (S2, 2021) Assignment II - Question PaperChi Chung LamNo ratings yet

- IQM - June 2010Document20 pagesIQM - June 2010Dorwin NeroNo ratings yet

- QuestionsDocument8 pagesQuestionsZavyarNo ratings yet

- International Finance PDFDocument5 pagesInternational Finance PDFDivakara ReddyNo ratings yet

- Reading 50 Portfolio Risk and Return Part II AnswersDocument46 pagesReading 50 Portfolio Risk and Return Part II AnswersK59 Nguyen Thao LinhNo ratings yet

- Assigment 2Document14 pagesAssigment 2Felipe PinedaNo ratings yet

- AsDocument12 pagesAsShubham GautamNo ratings yet

- Bed2110 2124 Mathematics For Economist I Reg SuppDocument4 pagesBed2110 2124 Mathematics For Economist I Reg SuppQelvoh JoxNo ratings yet

- Contribution Margin Practice SolutionsDocument4 pagesContribution Margin Practice Solutionskljasdf lkjasdf;lljNo ratings yet

- Beatrice Peabody ExcelDocument4 pagesBeatrice Peabody Excelseth litchfieldNo ratings yet

- Bản Sao BA Statistic Midterm 1st Semester 2018Document5 pagesBản Sao BA Statistic Midterm 1st Semester 2018Phương AnhhNo ratings yet

- HomeworksDocument8 pagesHomeworksHaja SheriefNo ratings yet

- Two Exercises About The is-LM ModelDocument2 pagesTwo Exercises About The is-LM ModelMatheus AugustoNo ratings yet

- 18 Fy13ce Economics Detailed SolutionsDocument13 pages18 Fy13ce Economics Detailed SolutionsBrijaxzy Flamie Teai100% (1)

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- Week 10-11-Tutorial Questions Answers - RevisedDocument5 pagesWeek 10-11-Tutorial Questions Answers - RevisedDivya chandNo ratings yet

- Project 2Document5 pagesProject 2api-272951594100% (1)

- Bài Thi Giữa Kỳ Môn Kế Toán ÚcDocument14 pagesBài Thi Giữa Kỳ Môn Kế Toán ÚcTrang LêNo ratings yet

- FIN 201 Chapter 11 Homework QuestionsDocument4 pagesFIN 201 Chapter 11 Homework QuestionsKyzer GardiolaNo ratings yet

- The Data Below Are Annual Total Returns For General FoodsDocument1 pageThe Data Below Are Annual Total Returns For General FoodsTaimur TechnologistNo ratings yet

- MGEA06 Midterm 2009W Version ADocument8 pagesMGEA06 Midterm 2009W Version AexamkillerNo ratings yet

- Sta 3113 Revision QuestionsDocument7 pagesSta 3113 Revision Questionsvictor100% (1)

- Workshop 1 Introducing To EconomicsDocument18 pagesWorkshop 1 Introducing To EconomicslaradhilonNo ratings yet

- Caiib - Financial Management - Module - A Model Questions - (Set-I)Document22 pagesCaiib - Financial Management - Module - A Model Questions - (Set-I)Sai Vaishnav MandlaNo ratings yet

- Johnson & JohnsonDocument5 pagesJohnson & JohnsonAngela100% (1)

- Bad DebtsDocument2 pagesBad DebtsSum Yu KungNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Cost 2022-MayDocument7 pagesCost 2022-MayDAVID I MUSHINo ratings yet

- 15A51101 Engineering ChemistryDocument1 page15A51101 Engineering ChemistryJayakanthNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- Chapter 4 AnswerDocument6 pagesChapter 4 AnswerMohammed Seid100% (1)

- QMZG528 Sep22 AnDocument4 pagesQMZG528 Sep22 AnSooraj Dilip Kumar100% (1)

- Chapter 1. Introduction Q-No. 13Document9 pagesChapter 1. Introduction Q-No. 13Marvin CincoNo ratings yet

- BN3301-4-AY05-06-S2-Exam PaperDocument4 pagesBN3301-4-AY05-06-S2-Exam PaperDr BeanNo ratings yet

- Exercise List 1 - DCF Valuation v01Document4 pagesExercise List 1 - DCF Valuation v01Lorenzo ParenteNo ratings yet

- Suggested Solution: BHMH2002 Introduction To Economics Individual Assignment II (S2, 2021)Document3 pagesSuggested Solution: BHMH2002 Introduction To Economics Individual Assignment II (S2, 2021)Chi Chung LamNo ratings yet

- Kaplan Progress TestDocument20 pagesKaplan Progress TestFarahAin FainNo ratings yet

- Chino Materials Systems Capital Budgeting SolutionDocument12 pagesChino Materials Systems Capital Budgeting Solutionalka murarka100% (1)

- Mba ZC417 Ec-3m First Sem 2018-2019Document6 pagesMba ZC417 Ec-3m First Sem 2018-2019shiintuNo ratings yet

- Machine Drawing PDFDocument8 pagesMachine Drawing PDFBv Rajesh RëälNo ratings yet

- Stolyarov Mathematical EconomicsDocument35 pagesStolyarov Mathematical EconomicslordkesNo ratings yet

- Exam (Q) Set ADocument13 pagesExam (Q) Set Aflowerpot321100% (1)

- Risk and Return QUESTIONSDocument4 pagesRisk and Return QUESTIONSJulianNo ratings yet

- Maf 603-T2-PF Mgmt-Exercise 1Document1 pageMaf 603-T2-PF Mgmt-Exercise 1hazlamimalekNo ratings yet

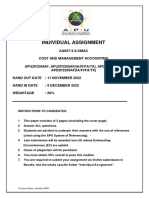

- CMAC - Individual Assignment - Cover - QDocument1 pageCMAC - Individual Assignment - Cover - QPuneetNo ratings yet

- Badges of TradeDocument2 pagesBadges of TradePuneetNo ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- Auditing StandardsDocument11 pagesAuditing StandardsPuneetNo ratings yet