Professional Documents

Culture Documents

SCF Assignment

Uploaded by

Piorobi DoydoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SCF Assignment

Uploaded by

Piorobi DoydoyCopyright:

Available Formats

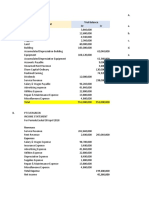

Statement of Cash Flows

Indirect Method

Assignment

The comparative balance sheet of Aragorn Company for the year ended December 31, 2016 and 2015, is

as follows:

Dec. 31, 2015 Dec. 2016

ASSETS

Cash P360,920 P443,240

Account receivable (net) 592,200 665,280

Inventories 1,022,560 887,880

Prepaid expenses 25,200 31,640

Land 302,400 302,400

Buildings 1,134,000 1,713,600

Accumulated Depreciation – buildings (414,540) (466,200)

Machinery and equipment 781,200 781,200

Acc. Dep - machinery and equipment (191,520) (214,200)

Patents 112,000 106,960

Total Assets P3,724,420 P4,251,800

LIABILITIES AND STOCKHOLDER’S EQUITY

Accounts payable (merchandise creditors) P927,080 P837,480

Dividends payable 25,200 32,760

Salaries payable 87,080 78,960

Mortgage note payable 0 224,000

Bonds payable 390,000 0

Common stock, P 1 par value 50,400 200,400

Paid in capital in excess of par 126,000 366,000

Retained earnings 2,118,660 2,512,200

Total Liabilities and Stockholder’s Equity P3,724,420 P4,251,800

Additional data obtained from an examination of the accounts in the ledger for 2016 are as follows:

a. Net income, P 524,580.

b. Depreciation expense reported on the income statement: buildings, P 51,660; machinery and

equipment, P 22,680.

c. Patent amortization reported on the income statement, P 5,040.

d. A building was constructed for P 579,600.

e. A mortgage note of P 224,000 was issued for cash.

f. 30,000 shares of common stock were issued at P 13 in exchange for bonds payable.

g. Cash dividends declared, P 131,040.

You might also like

- Dec 31, 2014 ($) Dec 31, 2013 ($) AssetsDocument2 pagesDec 31, 2014 ($) Dec 31, 2013 ($) AssetsRegita Ayu ParamithaNo ratings yet

- Discussion Problems - Consolidation Subsequent To Date of AcquisitionDocument2 pagesDiscussion Problems - Consolidation Subsequent To Date of AcquisitionMikee CincoNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- Assignment 5 - Statement of Cash FlowsDocument2 pagesAssignment 5 - Statement of Cash FlowsJezza Mae Gomba RegidorNo ratings yet

- Activity 6 Statement of Cash FlowsDocument2 pagesActivity 6 Statement of Cash Flowsnglc srzNo ratings yet

- Sanjay Industries: Final AccountsDocument16 pagesSanjay Industries: Final AccountsNickNo ratings yet

- Pas1 Activity LimbagoDocument6 pagesPas1 Activity LimbagoAndrea GranilNo ratings yet

- Numbers Tables BallsDocument5 pagesNumbers Tables BallsKia Khyte FloresNo ratings yet

- Royal Escape LTD - Co Balance Sheet For The Month Ended, Dec.31,2020Document9 pagesRoyal Escape LTD - Co Balance Sheet For The Month Ended, Dec.31,2020KemerutNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Seatwork No. 2 PDFDocument1 pageSeatwork No. 2 PDFSARAH ANDREA TORRESNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Case 6 1Document10 pagesCase 6 1cashmerehitNo ratings yet

- SOAL Test Magang OnlineDocument6 pagesSOAL Test Magang OnlineFajar SaputraNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Assignment Farm AccountsDocument6 pagesAssignment Farm AccountsCharles ChikumbiNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Master Budgeting SampleDocument7 pagesMaster Budgeting SampleGina Mantos GocotanoNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- Task 1 - Ratio Analysis - QuestionDocument2 pagesTask 1 - Ratio Analysis - QuestionHieu Tran Vo TamNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Stock AqDocument19 pagesStock AqLyka RoguelNo ratings yet

- 2510 Conso RevisedDocument63 pages2510 Conso Revisedjamm6136No ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- Bangladesh Lamps 3rd Q 2010Document3 pagesBangladesh Lamps 3rd Q 2010Sopne Vasa PurushNo ratings yet

- Workpaper Advanced Accounting 2Document2 pagesWorkpaper Advanced Accounting 2gabiNo ratings yet

- Assigment 3Document1 pageAssigment 3Syakil AhmedNo ratings yet

- Asawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueDocument22 pagesAsawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueLyka RoguelNo ratings yet

- CommercialMetals SolutionDocument5 pagesCommercialMetals SolutionFalguni ShomeNo ratings yet

- Salditos, Ericca P.Document7 pagesSalditos, Ericca P.Ericca SalditosNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisKimberly AsanteNo ratings yet

- Business Report-Flexible Packaging ProjectDocument26 pagesBusiness Report-Flexible Packaging ProjectSadia AfreenNo ratings yet

- Stern Corporation Balance SheetDocument4 pagesStern Corporation Balance SheetYessy KawiNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- Drill - Corporate LiquidationDocument3 pagesDrill - Corporate LiquidationGwyn OliverNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- CFS Subsequent To Date of AcquisitionDocument2 pagesCFS Subsequent To Date of AcquisitionGorden Kafare Bino0% (1)

- Bahan Praktikum Pertemuan Ke 13 NOR MAULIDA 1CDocument11 pagesBahan Praktikum Pertemuan Ke 13 NOR MAULIDA 1CNor MaulidaNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- UntitledDocument49 pagesUntitledAdinda Lidya Rahayu SapphiraNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- FS Withadj QuesDocument7 pagesFS Withadj QuesHimank SaklechaNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Document6 pagesExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaNo ratings yet

- Andy's Cannabis Financial StatementsDocument3 pagesAndy's Cannabis Financial Statementsnickstevens24No ratings yet

- Study Guide 6.4Document2 pagesStudy Guide 6.4nhloniphointelligenceNo ratings yet

- Balance Sheet QUESTIONANSWERDocument19 pagesBalance Sheet QUESTIONANSWERJoyce Ann Agdippa BarcelonaNo ratings yet

- Set A: Problem 1Document6 pagesSet A: Problem 1FINAH MEL DIVINANo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Day 1 To Day 4Document186 pagesDay 1 To Day 4Sameer PadhyNo ratings yet

- PDFDocument6 pagesPDFjoshua yakubuNo ratings yet

- PROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash BasisDocument4 pagesPROBLEM 6: CASH TO ACCRUAL: Enterprises Records All Transactions On The Cash Basischuchu tvNo ratings yet

- Free Cash FlowDocument8 pagesFree Cash FlowSisila Agusti AnggrainiNo ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- CV TahirDocument5 pagesCV TahirPawan MaheshwariNo ratings yet

- Government Accounting and Financial ReportingDocument91 pagesGovernment Accounting and Financial ReportingMurphy Red100% (1)

- Cost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020Document6 pagesCost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020sanathNo ratings yet

- Balance SheetDocument2 pagesBalance SheetPro ResourcesNo ratings yet

- Financial Accounting Report: Balance Sheet Query ListDocument4 pagesFinancial Accounting Report: Balance Sheet Query ListLabi LabiNo ratings yet

- Managerial AccountingDocument4 pagesManagerial AccountingMitch Tokong MinglanaNo ratings yet

- MSQ-13 - Overview of The MS Practice by The CPADocument7 pagesMSQ-13 - Overview of The MS Practice by The CPAJohan Gutierrez100% (1)

- Compilation Review Agreed-Upon ProceduresDocument11 pagesCompilation Review Agreed-Upon ProceduresJulrick Cubio EgbusNo ratings yet

- Solution Manual For Financial Managerial Accounting 10th by Carl S Warren James M Reeve Jonathan DuchacDocument24 pagesSolution Manual For Financial Managerial Accounting 10th by Carl S Warren James M Reeve Jonathan DuchacRobertGonzalesyijx100% (35)

- Ind AS 1 - Presentation of Financial Statements - CA - Chinnsamy Ganesan - Ind AS Knowledge Series No.2 - English (AutoDocument77 pagesInd AS 1 - Presentation of Financial Statements - CA - Chinnsamy Ganesan - Ind AS Knowledge Series No.2 - English (AutoGita ThoughtsNo ratings yet

- Q1 at 1920Document4 pagesQ1 at 1920aleachonNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Abdullah ShahNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument18 pagesIAS 16 Property, Plant and EquipmentMuhammad Umar IqbalNo ratings yet

- Mca RatiosDocument38 pagesMca RatiosGambhir Commerce Classes0% (1)

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- New Registration FormDocument3 pagesNew Registration FormRenato WilsonNo ratings yet

- Bab 10 Anggaran FleksibelDocument73 pagesBab 10 Anggaran FleksibelAdinda Novia SariNo ratings yet

- FSA2Document10 pagesFSA2adzida-1No ratings yet

- Fundamentals of Accounting I The Double-Entry Bookkeeping System ACCOUNTING CYCLE: Journalizing - Preparation of Trial Balance I. Conceptual SkillsDocument13 pagesFundamentals of Accounting I The Double-Entry Bookkeeping System ACCOUNTING CYCLE: Journalizing - Preparation of Trial Balance I. Conceptual SkillsericacadagoNo ratings yet

- Babesa Higher Scondary School: Trial Examination, 2021 Accountancy Writing Time: 3 Hours Class: XII Full Marks: 100Document22 pagesBabesa Higher Scondary School: Trial Examination, 2021 Accountancy Writing Time: 3 Hours Class: XII Full Marks: 100Kuenga GeltshenNo ratings yet

- Exercise 1: Discussion QuestionsDocument2 pagesExercise 1: Discussion QuestionsCharice Anne VillamarinNo ratings yet

- Chapter 4 FARDocument20 pagesChapter 4 FARSree Mathi SuntheriNo ratings yet

- Accounting Fundamentals II: Lesson 6 (Printer-Friendly Version)Document7 pagesAccounting Fundamentals II: Lesson 6 (Printer-Friendly Version)gretatamaraNo ratings yet

- Job Order CostingDocument49 pagesJob Order CostingKuroko71% (7)

- A Consolidated Full Tutorial Booklet 2018Document32 pagesA Consolidated Full Tutorial Booklet 2018Sufina SallehNo ratings yet

- Auditing and Assurance Services A Systematic Approach 9th Edition Messier Test BankDocument26 pagesAuditing and Assurance Services A Systematic Approach 9th Edition Messier Test BankKimberlyDavisxjniy100% (65)

- Level of Preparedness and ConfidenceDocument7 pagesLevel of Preparedness and ConfidenceCindy Bartolay67% (3)

- Accounting June 2011 Unit 1Document9 pagesAccounting June 2011 Unit 1nymazeeNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- Lecture - 1 - Accounting - in - Business - NUS ACC1002 2020 Spring PostDocument42 pagesLecture - 1 - Accounting - in - Business - NUS ACC1002 2020 Spring PostZenyui100% (1)