Professional Documents

Culture Documents

4.1 Tax Assignment

4.1 Tax Assignment

Uploaded by

Hazel Malveda GamillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4.1 Tax Assignment

4.1 Tax Assignment

Uploaded by

Hazel Malveda GamillaCopyright:

Available Formats

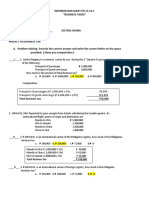

On the transactions listed below, classify each

of these transactions/businesses according to

these classifications. Write the number corresponding to your choice.

1. Subject to 12% value-added tax

2. Zero rated (0%) value-added tax

3. Subject to Other Percentage Tax (OPT)

4. Subject to Excise Tax

5. Subject to both 12% value - added tax and Excise tax

6. Exempt from business tax

TRANSACTIONS/BUSINESSES CLASSIFICATION

a). Sale of wines by an importer 1

b). Sale of cotton 1

c). Trader of goods whose gross receipts exceeds P3,000,000. 1

d). International air carrier transporting passengers only 3

e). International air carrier transporting goods only. 3

f). Importation of fertilizers. 6

g). An individual taxpayer whose gross receipts for the year amounted to P100,000. 6

h). Domestic common carriers transporting goods /cargoes. Gross receipts for the year

3

P2,600,000

i). Domestic common carriers (VAT registered) transporting goods/cargoes. Gross receipts

1

for the year amounted to P2,300,000.

j). Sale of sugar cane 5

k). Philippine commercial banks 1

l). MERALCO 2

m). A telephone franchise grantee offering local and overseas communication services.

1

Gross receipts for its first year of operations amounted to only P2,5000,000.

n). VAT registered exporter. 1

o). Sale of low-cost housing by VAT registered real estate companies. 3

p). Hog dealer. 1

q). New Wave Resort. 1

r). A radio television broadcasting franchisee. Gross receipt for the preceding year

1

amounted to P12,000,000.

s). Professional fees. 1

t). Traders of fresh fruits whose gross receipts exceeds P3,000,000. 6

You might also like

- BMG3 Compendium 1.3Document40 pagesBMG3 Compendium 1.3Theo Morina100% (1)

- Injection Moulding Lab ReportDocument27 pagesInjection Moulding Lab ReportErnie Yana IINo ratings yet

- Tax2.001 - Other Percentage Taxes - EEDocument9 pagesTax2.001 - Other Percentage Taxes - EEAbby Umipig75% (4)

- Quiz Tax OPTDocument5 pagesQuiz Tax OPTAnonymous 7HGskN0% (1)

- Mystara Players Guide 5eDocument226 pagesMystara Players Guide 5eMatheus Ramos89% (18)

- TAX.2904 Percentage Tax.Document12 pagesTAX.2904 Percentage Tax.Rodge Gabayoyo100% (2)

- 1 Other Percentage TaxesDocument5 pages1 Other Percentage TaxesFlorine Fate SalungaNo ratings yet

- 08 Chapter1Document63 pages08 Chapter1Inam Ul Haq100% (1)

- Trugo, Karluz BT - SW1 - C9Document15 pagesTrugo, Karluz BT - SW1 - C9moreNo ratings yet

- Problem On OPTDocument12 pagesProblem On OPTAlice Wu100% (1)

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Valvulas Moog Hoja de DatosDocument24 pagesValvulas Moog Hoja de DatosLuis Alberto RamosNo ratings yet

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Tax 2 Midterm Exercises and ExamDocument7 pagesTax 2 Midterm Exercises and ExamLynceeLapore0% (1)

- CPAR TAX - Other Percentage Taxes PDFDocument13 pagesCPAR TAX - Other Percentage Taxes PDFJohn Carlo CruzNo ratings yet

- RBS 6601Document15 pagesRBS 6601Pritesh Khilnani100% (3)

- Digital Image Processing (Image Enhancement)Document45 pagesDigital Image Processing (Image Enhancement)MATHANKUMAR.S100% (2)

- OPT, Excise Tax, DSTDocument9 pagesOPT, Excise Tax, DSTElmer Ortiz Lacson IINo ratings yet

- Ia Reviewer QuizzesandexamsDocument22 pagesIa Reviewer QuizzesandexamsReady PlayerNo ratings yet

- 1944 - Goland and Reissner - The Stresses in Cemented JointsDocument11 pages1944 - Goland and Reissner - The Stresses in Cemented JointsAbril Yu-ShanNo ratings yet

- Amit Kumar Sinha - Nutrizyme - Aquaculture HealthDocument40 pagesAmit Kumar Sinha - Nutrizyme - Aquaculture HealthMitshutopNo ratings yet

- Bar QuestionsDocument13 pagesBar QuestionsAllyne Bello BoyonganNo ratings yet

- 1.2. Problems On VAT - For Tax ReviewDocument19 pages1.2. Problems On VAT - For Tax ReviewJem ValmonteNo ratings yet

- Throughput Issue Troubleshooting: Huawei Technologies Co., LTDDocument48 pagesThroughput Issue Troubleshooting: Huawei Technologies Co., LTDmajidjan100% (1)

- Business TaxationDocument5 pagesBusiness TaxationMajoy BantocNo ratings yet

- Other Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATDocument14 pagesOther Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATJana Trina LibatiqueNo ratings yet

- Quiz in Midterm (Trasnfer and Business Tax)Document1 pageQuiz in Midterm (Trasnfer and Business Tax)Eumell Alexis PaleNo ratings yet

- OPT - HandoutDocument16 pagesOPT - HandoutGrant Kenneth D. FloresNo ratings yet

- Tax2 Seatworks-03.30.2020Document4 pagesTax2 Seatworks-03.30.2020Allen Fey De JesusNo ratings yet

- Week 3 Learning ObjectivesDocument2 pagesWeek 3 Learning Objectiveshazel sergioNo ratings yet

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoNo ratings yet

- Material 9 OPTDocument14 pagesMaterial 9 OPTnodnel salonNo ratings yet

- Opt Oct 2017 GCC Self TestDocument5 pagesOpt Oct 2017 GCC Self TestMary Grace SalcedoNo ratings yet

- Sde WRDocument10 pagesSde WRNitinNo ratings yet

- CBSE Class 12 Economics - National Income and Related Aggregates PDFDocument4 pagesCBSE Class 12 Economics - National Income and Related Aggregates PDFRijak BhatiaNo ratings yet

- This Study Resource Was: Business Taxes ProblemsDocument6 pagesThis Study Resource Was: Business Taxes ProblemsChris Jay LatibanNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesjamNo ratings yet

- Type Who / What Are Subject RA TE TAX Basis Additional NotesDocument7 pagesType Who / What Are Subject RA TE TAX Basis Additional NotesSavage KongNo ratings yet

- VAT ExercisesDocument3 pagesVAT ExercisesRonald MojadoNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- CPAR OPT Batch 93 HandoutDocument14 pagesCPAR OPT Batch 93 Handout6wv84xgwnbNo ratings yet

- Opt 2Document2 pagesOpt 2mNo ratings yet

- Signing A Note Payable To Purchase Equipment: A) B) C) D)Document31 pagesSigning A Note Payable To Purchase Equipment: A) B) C) D)Kim FloresNo ratings yet

- Example 1: Value in Use: Year Cash FlowDocument16 pagesExample 1: Value in Use: Year Cash Flowthuan luong trongNo ratings yet

- Tax.102 2 Other Percentage Taxes EEsDocument11 pagesTax.102 2 Other Percentage Taxes EEsJoana Lyn GalisimNo ratings yet

- Exempt SalesDocument4 pagesExempt SalesMary Joy DenostaNo ratings yet

- DocxDocument6 pagesDocxnena cabañesNo ratings yet

- ZERO-RATED PROBLEMS Oct 27Document6 pagesZERO-RATED PROBLEMS Oct 27AlexanderJacobVielMartinezNo ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- Tax 2 - Final Quiz 1Document5 pagesTax 2 - Final Quiz 1Uy SamuelNo ratings yet

- Name: - : of Agricultural Food Product in Its Original State From ADocument4 pagesName: - : of Agricultural Food Product in Its Original State From AHillary CanlasNo ratings yet

- ResearchDocument8 pagesResearchheyheyNo ratings yet

- Chapter 1Document2 pagesChapter 1Trisha Mae BoholNo ratings yet

- Dia Mae A. Generoso - Learning Activity 3Document10 pagesDia Mae A. Generoso - Learning Activity 3Dia Mae Ablao GenerosoNo ratings yet

- New Business-Studies-Paper-2-Revision-BookletDocument108 pagesNew Business-Studies-Paper-2-Revision-BookletRogue12layeNo ratings yet

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- Fac3761 Assignment 2 (783718) 2021Document2 pagesFac3761 Assignment 2 (783718) 2021qwivy.com0% (1)

- Computation of Corporate Tax PayersDocument14 pagesComputation of Corporate Tax PayersHilarie JeanNo ratings yet

- Module 1 - Financial Statement Analysis - P2Document4 pagesModule 1 - Financial Statement Analysis - P2Jose Eduardo GumafelixNo ratings yet

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliNo ratings yet

- Chapter 2Document21 pagesChapter 2TENGKU NURUL ALISYA TENGKU AHMADNo ratings yet

- Module 5 - Ias 2 Inventory (CN)Document14 pagesModule 5 - Ias 2 Inventory (CN)Given RefilweNo ratings yet

- The State of Mediterranean and Black Sea Fisheries 2018From EverandThe State of Mediterranean and Black Sea Fisheries 2018No ratings yet

- Hybrid Securities: Structuring, Pricing and Risk AssessmentFrom EverandHybrid Securities: Structuring, Pricing and Risk AssessmentNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- 3.1 Ais HazelgamillaDocument6 pages3.1 Ais HazelgamillaHazel Malveda GamillaNo ratings yet

- Gamilla Hazel Bit 004Document1 pageGamilla Hazel Bit 004Hazel Malveda GamillaNo ratings yet

- Assignment 3.1 SeatworkDocument3 pagesAssignment 3.1 SeatworkHazel Malveda GamillaNo ratings yet

- Tax Assignment 2.1Document1 pageTax Assignment 2.1Hazel Malveda GamillaNo ratings yet

- Getting To Know You Tax AssignmentDocument1 pageGetting To Know You Tax AssignmentHazel Malveda GamillaNo ratings yet

- Tax Assignment 2.2Document1 pageTax Assignment 2.2Hazel Malveda GamillaNo ratings yet

- Assignment 2Document2 pagesAssignment 2Hazel Malveda GamillaNo ratings yet

- 3.2 Tax AssignmentDocument1 page3.2 Tax AssignmentHazel Malveda GamillaNo ratings yet

- Assignment 1Document1 pageAssignment 1Hazel Malveda GamillaNo ratings yet

- 6.1 Tax AssignmentDocument3 pages6.1 Tax AssignmentHazel Malveda GamillaNo ratings yet

- 4.2 Assignment TaxDocument1 page4.2 Assignment TaxHazel Malveda GamillaNo ratings yet

- Prelim The Professional Standard Independence-Consanguinity AffinityDocument1 pagePrelim The Professional Standard Independence-Consanguinity AffinityHazel Malveda Gamilla0% (1)

- 3.1 Tax AssignmentDocument1 page3.1 Tax AssignmentHazel Malveda GamillaNo ratings yet

- Worksheet Partial in DerivativesDocument2 pagesWorksheet Partial in DerivativesVanessa HardjadinataNo ratings yet

- Semilla BrasileñaDocument17 pagesSemilla BrasileñaCarlos valenciaNo ratings yet

- STM32L053R8Document136 pagesSTM32L053R8Armando BaronNo ratings yet

- Full Download Book Handbook of Microbial Nanotechnology PDFDocument35 pagesFull Download Book Handbook of Microbial Nanotechnology PDFdonald.everhart573100% (23)

- Manual ReadySoftDocument36 pagesManual ReadySoftGreg ReynekeNo ratings yet

- A Midsummer NightDocument48 pagesA Midsummer Nightkamyp0pNo ratings yet

- Artigo JardelDocument20 pagesArtigo JardelOlavonazareno CostaNo ratings yet

- Critique Paper On ZarkDocument2 pagesCritique Paper On ZarkMartinne ChloeNo ratings yet

- Slit RollingDocument16 pagesSlit Rollingreichfuhrer100% (1)

- Blue Sun - Phoenix 5000 Feed - Dastec ParaguayDocument4 pagesBlue Sun - Phoenix 5000 Feed - Dastec ParaguayCesc MezaNo ratings yet

- Wenker Patel 2023 A Water Nymph S Curse and The Serotonergic Mechanism of Postictal Breathing DysfunctionDocument3 pagesWenker Patel 2023 A Water Nymph S Curse and The Serotonergic Mechanism of Postictal Breathing DysfunctionpolianakrsianNo ratings yet

- Bostik Paneltack HM Dekton Tds en 2020Document5 pagesBostik Paneltack HM Dekton Tds en 2020Miguel ZuzaNo ratings yet

- Bevel Helical Geared Motor KAD68Document1 pageBevel Helical Geared Motor KAD68Parmasamy SubramaniNo ratings yet

- Current Trends in Friction Stir Welding (FSW) and Friction Stir Spot Welding (FSSW) (PDFDrive)Document216 pagesCurrent Trends in Friction Stir Welding (FSW) and Friction Stir Spot Welding (FSSW) (PDFDrive)Marcin LosyNo ratings yet

- Microwave Mutton Curry: IngredientsDocument8 pagesMicrowave Mutton Curry: IngredientsmukulpharmNo ratings yet

- E069-0001 Error Code Due To A High Voltage Output LeakDocument3 pagesE069-0001 Error Code Due To A High Voltage Output LeakOKI RADITYONo ratings yet

- Edit Final Thesis of ProjectDocument54 pagesEdit Final Thesis of ProjectAshok KumarNo ratings yet

- Acids and BasesDocument11 pagesAcids and BasesTanya NdlovuNo ratings yet

- Vektor Ablerex-800L - 1000L-TearsheetDocument1 pageVektor Ablerex-800L - 1000L-TearsheetJhonSitanalaNo ratings yet

- Campus Map 2016 - 0Document1 pageCampus Map 2016 - 0KylieNo ratings yet