Professional Documents

Culture Documents

Quiz Intermediate

Uploaded by

AndreasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Intermediate

Uploaded by

AndreasCopyright:

Available Formats

1.

(A)

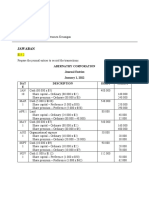

Sr. No. Accounts Debit Credit Calculation

1 Treasury share 27,160 280 * 97

Cash 27,160

2 Retained earnings 90,400 (4,800 - 280) * 20

Dividend payable 90,400

3 Dividend payable 90,400

Cash 90,400

4 Cash 28,560 280 * 102

Treasury share 27,160 280 * 97

Paid-in capital for treasury share 1,400

5 Treasury share 52,500 500 * 105

Cash 52,500

6 Cash 33,600 350 * 96

Paid in capital from treasury

1,400

share

Retained earnings 1,750

Treasury share 36,750

(B)

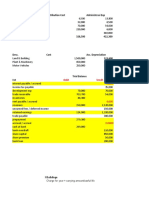

N Accounts Debit Credit

o

1. Treasury Shares (280 x $97) 27.160

Cash 27.160

2. Retained Earnings ([4.800-280] x $20) 90.400

Dividend Payable 90.400

3. Dividend Payable 90.400

Cash 90.400

4. Cash 28.560

Treasury Shares 27.160

Paid in Capital For treasury share 1.400

5. Treasury Shares 52.500

Cash 52.500

6. Cash 33.600

Paid In Capital 1.400

Retained Earnings 1.750

Treasury Shares 36.750

Common Shares ( $100 per shares authorized 18.000 shares ) $480.000

Add : Retained Earnings $305.850

Total paid in capital and retained earnings $785.850

Less : Treasury Shares $15.750

Shareholder’s Equity $750.100

2.

(A)

Answer :

Account Receivable 2,700,000

Sales 2,700,000

Waranty Expense 108,000

Waranty Liability 108,000

2019

Waranty Liability 60,000

Inventory 24,000

Accrued Payroll 36,000

(B)

2018 = $ 0

2019 = $ 60.000

(C) 2018 Balance Current Liabilities = 54,000

3. Basic earnings per share

= Net income / Average number of shares outstanding

= $7,400,000 / 2,000,000

= $3,700,000

Compute the amount of after tax savings if the bonds are converted in to shares of common stock.

Savings = Interest expense x (1 - tax rate) = $220,000 x (1 - 0.30) = $154,000

Net income after conversion

= Net income before conversion + Savings in interest expense if bonds are converted = $7,400,000+

$154,000

= $7,554,000

Compute the number of shares to be issued to convert the bonds after two years at a conversion

ratio of 16:1

Number of shares to be issued = (4,000,000/$1,000) x 15 = 60,000

Compute the total number of shares outstanding after conversion of bonds.

Total number of shares after conversion of bonds = 2,000,000 + 60,000 = 2,060,000

Diluted earnings per share

= Net income after conversion / Number of shares outstanding after conversion

= $7,554,000/ 2,060,000

= $3,6669

=$3,667 (if rounded off)

You might also like

- VivaldiDocument3 pagesVivaldiAlia Azhara100% (1)

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Microfinance Ass 1Document15 pagesMicrofinance Ass 1Willard MusengeyiNo ratings yet

- 313 314 Financing Cycle CORNEL-MannelleDocument3 pages313 314 Financing Cycle CORNEL-MannelleFaker MejiaNo ratings yet

- Topic 15Document35 pagesTopic 15Francesjoyze LahoraNo ratings yet

- Finalchapter 23Document7 pagesFinalchapter 23Jud Rossette ArcebesNo ratings yet

- Solved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroDocument4 pagesSolved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroeannetiyabNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Final Mock ExamDocument6 pagesFinal Mock ExamfarhanmammadovupsystemsNo ratings yet

- FINANCIAL ACCOUNTING 2 CAT FinalDocument7 pagesFINANCIAL ACCOUNTING 2 CAT FinalmusajamesNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Soal AkuntansiDocument4 pagesSoal AkuntansinairobiNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Club A/c's: TopicDocument16 pagesClub A/c's: TopicJames KAGWAPENo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- Ass. Chapter 11 Shareholders Equity (Part 2)Document12 pagesAss. Chapter 11 Shareholders Equity (Part 2)Jea Ann CariñozaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Activity 1 Intact 3Document7 pagesActivity 1 Intact 3Kate NuevaNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- CHAPTER 3 Bai TapDocument19 pagesCHAPTER 3 Bai TapPhuong Anh HoangNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Akuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Document2 pagesAkuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Muhamad Rizal DinyatNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- 3.1.cash Flows Class QuestionsDocument3 pages3.1.cash Flows Class Questionsmali CNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Chapter 15Document10 pagesChapter 15Julia Angelica WijayaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- Company Acc PracticeDocument9 pagesCompany Acc PracticeRaffayNo ratings yet

- Audit CH 9Document6 pagesAudit CH 9Phoebe Dayrit CunananNo ratings yet

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Dave Chapter 9Document11 pagesDave Chapter 9Mark Dave SambranoNo ratings yet

- KayaTo Company - SolutionsDocument1 pageKayaTo Company - SolutionsChryshelle LontokNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- CH 10 Incomplete RecordsDocument27 pagesCH 10 Incomplete RecordsPawan Poynauth0% (1)

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Adaptive Leadership: Leadership: Theory and PracticeDocument14 pagesAdaptive Leadership: Leadership: Theory and PracticeJose Daniel Quintero100% (1)

- Just in Time and TQMDocument8 pagesJust in Time and TQMBhramadhathNo ratings yet

- Motivation Theories Description and CriticismDocument14 pagesMotivation Theories Description and CriticismAhmed Elgazzar89% (18)

- B. Inggris X - 7Document8 pagesB. Inggris X - 7KabardiantoNo ratings yet

- Matrix PBX Product CatalogueDocument12 pagesMatrix PBX Product CatalogueharshruthiaNo ratings yet

- Low Voltage Switchgear Specification: 1. ScopeDocument6 pagesLow Voltage Switchgear Specification: 1. ScopejendrikoNo ratings yet

- Newsletter 1-2021 Nordic-Baltic RegionDocument30 pagesNewsletter 1-2021 Nordic-Baltic Regionapi-206643591100% (1)

- Angel C. Delos Santos: Personal DataDocument8 pagesAngel C. Delos Santos: Personal DataAngel Cascayan Delos SantosNo ratings yet

- ABI TM 13 16 SL - EngDocument1 pageABI TM 13 16 SL - EngJuan Carlos Benitez MartinezNo ratings yet

- CTS2 HMU Indonesia - Training - 09103016Document45 pagesCTS2 HMU Indonesia - Training - 09103016Resort1.7 Mri100% (1)

- Unit 2 - Industrial Engineering & Ergonomics - WWW - Rgpvnotes.inDocument15 pagesUnit 2 - Industrial Engineering & Ergonomics - WWW - Rgpvnotes.inSACHIN HANAGALNo ratings yet

- Case 3 SectionC Group 1 (Repaired)Document3 pagesCase 3 SectionC Group 1 (Repaired)SANDEEP AGRAWALNo ratings yet

- Outline Calculus3Document20 pagesOutline Calculus3Joel CurtisNo ratings yet

- ETNOBotanica NombresDocument188 pagesETNOBotanica Nombresjalepa_esNo ratings yet

- DR S GurusamyDocument15 pagesDR S Gurusamybhanu.chanduNo ratings yet

- Paul Spicker - The Welfare State A General TheoryDocument162 pagesPaul Spicker - The Welfare State A General TheoryTista ArumNo ratings yet

- RECYFIX STANDARD 100 Tipe 010 MW - C250Document2 pagesRECYFIX STANDARD 100 Tipe 010 MW - C250Dadang KurniaNo ratings yet

- RSC Article Template-Mss - DaltonDocument15 pagesRSC Article Template-Mss - DaltonIon BadeaNo ratings yet

- Gujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalDocument18 pagesGujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalABCDNo ratings yet

- Accounting Students' Perceptions On Employment OpportunitiesDocument7 pagesAccounting Students' Perceptions On Employment OpportunitiesAquila Kate ReyesNo ratings yet

- Drager Narkomed 6400 Field Service Procedure Software Version 4.02 EnhancementDocument24 pagesDrager Narkomed 6400 Field Service Procedure Software Version 4.02 EnhancementAmirNo ratings yet

- IQAc 04-05Document10 pagesIQAc 04-05ymcacollegewebsiteNo ratings yet

- RPH Week 31Document8 pagesRPH Week 31bbwowoNo ratings yet

- Ahmad Syihabudin: BiodataDocument2 pagesAhmad Syihabudin: BiodatabhjjqrgrwmNo ratings yet

- Dessler HRM12e PPT 01Document30 pagesDessler HRM12e PPT 01harryjohnlyallNo ratings yet

- DS Important QuestionsDocument15 pagesDS Important QuestionsLavanya JNo ratings yet

- Enzymes IntroDocument33 pagesEnzymes IntropragyasimsNo ratings yet

- Priest, Graham - The Logic of The Catuskoti (2010)Document31 pagesPriest, Graham - The Logic of The Catuskoti (2010)Alan Ruiz100% (1)

- Brosur YSIO X.preeDocument20 pagesBrosur YSIO X.preeRadiologi RSUD KilisuciNo ratings yet