Professional Documents

Culture Documents

Dont Be Stuck in The Last Century

Uploaded by

Sami Jemli0 ratings0% found this document useful (0 votes)

14 views9 pagesOriginal Title

1. Dont be stuck in the last century

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views9 pagesDont Be Stuck in The Last Century

Uploaded by

Sami JemliCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

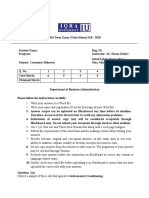

By GARY COKINS, CPIM;

JOSEPH CHERIAN; AND

PAMELA SCHWER, CMA

26 / STRATEGIC FINANCE / October 2015

DON’T BE

STUCK IN

THE LAST

CENTURY!

It’s time for

management

accountants to

work with decision

makers and give

them the information

they need to do

their jobs.

October 2015 / STRATEGIC FINANCE / 27

WHAT’S GOING ON? It’s the 21st Century,

but many management accountants continue to use

accounting practices established well before the middle of

the 20th Century. Resource expenses are severely misallo-

cated when calculating product costs, violating costing’s

causality principle (the need for cause-and-effect insights).

Little visibility is provided as to what is driving costs. Rarely

are channel and cost-to-serve customer costs calculated,

which today are arguably more important than the product

and standard service-line costs reported above the product

gross profit margin line. Antiquated bottom-up spreadsheet

consolidations of volume-insensitive projected cost center

account-level expenses are applied for budgets rather than

top-down driver-based budgets leveraging models. These

are just a few of the deficiencies.

The result is that all levels of decision makers are denied

the mission-critical information they need to manage

organizations, make good decisions, and improve perform-

ance. Yet management accountants are supposedly expand-

ing their role and supporting the executive team as strategic

advisors. Is the hype actually just a fantasy created by man-

agement accountants?

To answer this question, we’ll examine six areas in

which decision makers are concerned about the work of

management accountants. We’ll share information from

users who are frustrated and disillusioned by the inability

of accountants to provide them the insights and foresight to

improve their organizations. And we’ll describe some rela-

tively obvious solutions to resolve the deficiencies. This MANAGER

information is based on our years of experience in manage- 27 YEARS OF EXPERIENCE

ment accounting and finance and on interviews we con- $60 MILLION IN REVENUE

ducted with line managers from all sizes of companies in a

variety of industries. Although it’s going to seem like the “I don’t like [our] accounting formats.

purpose of this article is just to criticize management

accountants, our intent is to motivate and inspire them to [There’s] no consensus on what’s in the cost of

truly be the strategic advisors they are supposed to be.

The issues in this article don’t involve financial account-

goods sold. Nobody is sure what should go in

ing. They involve management accounting. Financial there. Where’s all the rest of the value chain in

accounting is used for regulatory compliance and following

rules to satisfy needs of the investment community. Its pur-

that number? [I] hate the roll-up of all these

pose is for valuation, and external audits assure the rules cost allocations. I don’t know what goes into

are followed. In contrast, the purpose of management

accounting (in addition to keeping the books and perform-

them and [so] I can’t manage them.”

ing a variety of financial transactions) is for internally gen-

erating questions to stimulate needed conversations and for

providing fact-based evidence to support decisions. Man-

agement accounting is for creating economic value. Finan-

cial accounting looks backward and reports. Management

accounting is meant to understand the recent past and to

look forward, just as every business must do to survive.

1. DO MANAGEMENT ACCOUNTANTS KNOW

WHAT THEIR INTERNAL CLIENTS WANT?

Perhaps CFOs don’t sufficiently understand the decision-

making needs of the various departments they serve, such

as marketing, sales, and operations. Today, with increasing

global volatility, faster moves from competitors, and the

Internet-led shift of power from suppliers to customers, a

company’s internal users of management accounting infor-

28 / STRATEGIC FINANCE / October 2015

mation need a much sharper pencil than in the past. For being provided means. This could be an issue of the man-

example, users need to know the return on investment ager being unaware of good accounting practices or of the

(ROI) for a marketing campaign or how profitable a cus- accountant not educating the manager about what each

tomer is, not just a customer’s sales volume. piece of information being provided consists of and how it

The decision maker is the management accountant’s is constructed or calculated.

client and deserves to be treated as such. That sharper pen- In today’s dynamic industries, where costs may not be

cil must address the issues related to the timing of informa- well understood, this can be a source of tension and misun-

tion and the level of detail and accuracy in that derstanding. Here are one manager’s opinions about cost

information—critical factors in management’s ability to allocations in the context of print and digital media: “This is

make good decisions. why [our] media [division] is in trouble. They thought for

A seasoned veteran (23 years of experience and who some wacky reason that electronics [their digital content]

works for a company with $75 million in revenue) said: just manufactured itself and we have no costs; it’s all free…

“[If] I have to discuss with my customers the right way to and it isn’t. A lot of companies [in our industry] abandoned

do their order, shouldn’t accounting treat me the same? If print too soon for digital and then found out it wasn’t so

you wait until the month closes, you easy. You can’t charge the same

can’t do anything. I have to be amount for digital as you do for

proactive and get accounting to give print!”

me the numbers sooner. [They] do Was it the failure of the account-

not understand the business, so ants to provide realistic information

there is a communication problem. using an activity-based costing

We can’t assume they [the account-

ants] know [the business]. But they

FAST FACTS (ABC) approach with appropriate

cost allocations that directly caused

need to ask!” this bad decision, or did manage-

The central problem here is that INTERVIEWEES’ YEARS IN INDUSTRY ment fail to use all the data pro-

the CFO and the decision maker vided to them? Some people could

understand the rhythm of the busi- 2

LESS THAN 20 YEARS argue that the manager should have

ness and the timing of decisions dif- 20 - 30 YEARS challenged the accountant, but the

ferently. In addition to their different 27% 23% manager already has a full plate.

MORE THAN 30 YEARS

frameworks, they don’t know who Managers rely on the accountants to

should reach out to whom: Should reflect reality. At the end of the day,

the accountants assume that there’s 50% accountants need to recognize that

an undisputed way in which all they will take the blame.

businesses operate, or should they

learn to adapt to the nuances of the 2. DO MANAGEMENT

specific business within which they ACCOUNTANTS CARE

work? These nuances revolve prima-

rily around the level of detail, accu-

ANNUAL REVENUES ABOUT GIVING THE RIGHT

racy, and timing of data. Additionally, LESS THAN $10 MILLION

INFORMATION TO

if accounting is a service that has 13% $10

INTERNAL CLIENTS?

L – $90 MILLION

internal clients, perhaps, as this vet- 30% Suggesting that management

eran suggests, it should become 13% $100 – $900 MILLION

accountants don’t care is harsh, but

more client focused, providing 3 MORE THAN $1 BILLION sometimes it seems that they don’t

timely information and at the right 43% care in an appropriate way. Their

level of detail and accuracy. loyalty seems to be more to a disci-

Another manager (27 years, plinary culture or to self-imposed

$60 million in revenue) said, “I don’t codes of consistency, not to what

like [our] accounting formats. the internal client wants and needs.

[There’s] no consensus on what’s in One manager observed, “The para-

the cost of goods sold. Nobody is INDUSTRY REPRESENTATION dox, which continues to puzzle me,

sure what should go in there. is how chief financial officers and

FINANCIAL SERVICES 3%

Where’s all the rest of the value TECHNOLOGY 3%

controllers can be aware that their

chain in that number? [I] hate the EDUCATION 7% management accounting data is

roll-up of all these cost allocations. I RETAIL 10% flawed and misleading yet not take

MULTIMEDIA 17%

don’t know what goes into them and action to do anything about it…Now

SERVICES 17%

[so] I can’t manage them.” MANUFACTURING 43% I’m not referring to the financial

That problem isn’t just about 0 2 4 6 8 10 12 14 accounting data used for external

understanding how to treat man- reporting; that information passes

The research with line managers from all sizes

agers like clients but also about of companies in a variety of industries was strict audits. I’m referring to the

helping both parties understand conducted with a grant from the IMA Research management accounting [data] used

what the accounting information Foundation. internally for analysis and decisions.

October 2015 / STRATEGIC FINANCE / 29

For this data, there is no governmental regulatory agency responsible for profits. [There were] cost allocations you

enforcing rules, so the CFO can apply any accounting prac- couldn’t control, and yet you had to explain [them].” Even

tice he or she likes.” rules of thumb can be hard to use if the information doesn’t

The vast amounts of financial information that conform to arrive with the proper level of detail and accuracy and in

disciplinary or self-imposed rules likely are meaningless to time. Another manager (23 years, $75 million in revenue)

real decision makers. Management accounting information is noted, “I must have real-time data to make real-time deci-

meaningful only if it helps management make good decisions. sions; you can always get lots of data, but it’s the timing and

One manager (27 years, $60 million in revenue) com- the accuracy [I need] because [then] you can make better

plained that “[Accountants are too] rigid because they want decisions faster…I’ve got a budget that is a percentage of

to be consistent across divisions. But if divisions are differ- sales…if I don’t know sales, I don’t know what I can spend.”

ent, you can’t give them all the same data because they have Weaknesses in management accounting are real. The

different data needs!” Another (30 years, $40 million in rev- complaints we share here didn’t come from rookie man-

enue) added: “They never make an exception even though agers (average tenure in the industry reported by the

every client is different, and they want to pigeonhole them.” respondents was well above 20 years) in small and fledgling

Who deserves the blame—or shame? Many accountants companies (average revenue of those reported was well

know they are misallocating cost calculations that violate above $50 million). The answers to the questions raised by

costing’s causality principle. For example, they will allocate the complaints from managers are simple to suggest. The

indirect expenses, commonly referred to as overhead, with solution to a lack of knowledge is more knowledge. Man-

cost allocation factors such as the number or amount of agement accountants should spend time with their internal

direct labor or machine hours, units produced, sales, or customers, explaining the numbers and procedures and

square feet. None of these factors reflects the consumption answering any questions! The solution to the concerns

of the work activity costs. Activity cost drivers and their about lack of caring is to realize that the management

quantities for each activity more accurately reflect the costs. accounting information is critical to managing and improv-

This manager (42 years, $80 million in revenue) noted, ing the business. Just as a car with a great engine can sput-

“[Here’s a] process issue—if something is in the wrong ter if it’s run on poor fuel, a great company will stall if it’s

account, Accounting just puts it somewhere else, and you run on poor information—poor in timeliness and quality.

don’t know where it went. But they don’t have the knowl- The solution to sweeping good information under the

edge to know where it goes!” Added another (30 years, rug is to offer information that some can drill-down into.

$40 million in revenue), “I need more details about the This is simple to do today with query software, and it can

budget for my area. I need more detail about each of my be made visible with nimble information systems such as

major accounts. I know they have the information but ABC modeling tools. Numbers don’t exist on paper any-

choose not to share! I think part of this is that they are in more, and they aren’t carved in stone. And each bit of infor-

the Dark Ages with respect to how much information mation can have drill-down and roll-up capabilities,

can/should be shared.” creating a truly live or reactive document.

This veers into the realm of information design, which is

3. DO MANAGEMENT ACCOUNTANTS HIDE increasingly becoming an important responsibility of man-

agement accounting. In short, management accountants

INFORMATION? should not only generate timely, detailed, and accurate

Here’s a common failing: “One day the management information, but they should also render it usable and valu-

accountant realized that the calculations and practices on able to the decision maker. Unfortunately, college curricula

which the cost system was based were incorrect. [They] did and corporate training focus on the former and not enough

not reflect the economic realities of the company. The input on the latter, so new and seasoned management account-

expenses data was correct, but the calculated cost informa- ants need the right skills and training.

tion was flawed. A broadly averaged cost allocation factor Most colleges prepare their accounting students for jobs

for indirect and shared expenses was used with no causal with auditing firms. Hence, the emphasis is on financial

relationship to the outputs being costed. As a result, the accounting. This is shortsighted because few accountants

current and forward-looking information provided to sup- succeed in becoming partners in their firm and typically

port the president’s decision making was incorrect. No one join organizations as financial managers where they need

but the management accountant knew this problem more management accounting skills.

existed. He decided not to inform the president.” Or per-

haps the president does know that such problems exist but

doesn’t communicate with the same language. Without a

4. ARE MANAGEMENT ACCOUNTANTS

common language to express concerns, useful information CREATORS OF THEIR DYSFUNCTION?

wouldn’t be passed forward, so decisions would be based Given that the dysfunction in management accounting is

on partial information or on improperly aggregated infor- real, one natural question is whether management account-

mation. Consequently, such decisions would become sub- ants are to blame. A management consultant commented,

optimal and problematic. “Why do so many accountants behave so irresponsibly? The

Numerous complaints echoed those of this manager list of answers is long. Some believe the costing accuracy

(42 years, $200 million in revenue): “There was no infor- error is not that big. Some think that extra administrative

mation sharing for months…and then you were still held effort required to collect and calculate the new information

30 / STRATEGIC FINANCE / October 2015

will not offset the benefits of better decision making. What-

ever reasons are cited, accountants’ resistance to change is

based less on ignorance and more on the accountants’ mis-

conceptions about what determines and influences accu-

rate costing.” The consultant understood that accountants

wrongly perceive that employee time sheets are the pri-

mary source of cost accuracy. They are not. Cost accuracy is

determined by properly modeling activity costs with their

drivers.

Part of the problem is also the paternalistic attitudes

some management accountants have toward their internal

customers, treating them as unable to use or understand the

numbers. But that isn’t a constructive attitude or conducive

to good organizational functioning. Many times, the users of

the numbers may understand the numbers as well as the

accountants and because of their “skin in the game” may

MANAGER care differently about the trade-offs between timeliness

42 YEARS OF EXPERIENCE and correctness. Said one manager (42 years, now in a

$200 MILLION IN REVENUE company with $200 million in revenue): “I need real-time

accurate profitability numbers on a daily basis…I can’t wait

because then I can’t fix anything. I have done this a long

“I need real-time accurate time, [I’ve] built a number of companies…and you are only

profitability numbers on a daily profitable if you know today how you did…otherwise, you

can’t respond [in a way to become profitable].”

basis...I can’t wait because then I Another manager (32 years, $4 million in revenue) felt

can’t fix anything. I have done this that the company’s management accountant was too much

about the numbers and not enough about the business:

a long time. You are only profitable “[Our CFO] didn’t really understand the business. In other

if you know today how you places [where I’d worked before], the controller was like

the [CEO’s] third arm, his savant, his advisor….The guy here

did...otherwise you can’t respond is only about numbers [and not about advice].”

[in a way to become profitable].” One manager actually defended the accountants: “I find

that CFOs can have good insight into the business but are so

busy doing [somewhat irrelevant] reports they don’t have

the time.”

5. ARE THE METHODS WRONG?

Despite repeated calls from so many luminaries in the field,

such as Robert S. Kaplan, and despite the clear value of pro-

viding more accurate costing, it’s apparent that organiza-

tions not using activity-based costing (or weak designs of

it) when the conditions for ABC apply are providing inaccu-

rate and misleading information to their users who are per-

forming analyses and making decisions based on that

flawed information. If decision makers don’t trust the infor-

mation or don’t get the right amount of detail in the infor-

mation with the right level of accuracy at the right time,

they probably won’t use the information. Or, even worse,

the decision makers will use the information implicitly,

trusting it to be accurate, and will make decisions that are

correct in terms of the information provided but wrong in

terms of the outcomes generated. As examples, they might

promote sales volume on a product or service that in reality

is unprofitable or discontinue a product, thinking it is

unprofitable when in fact it is very profitable. If this contin-

ues, the accounting profession as a whole loses credibility.

Here are three examples of data not having the right

detail, right accuracy, and/or right timeliness:

Manager 1 (24 years, $11 million in revenue): “I need a

October 2015 / STRATEGIC FINANCE / 31

report that would show profitability by profit center, and I

need a report that would allow me to plug in different sce-

narios for staffing and pricing to see what the optimum

would be. The reports I get right now are so integrated

that…I can’t get the total picture. I am getting a bottom line,

but it isn’t granular enough to show costs against each of

the elements.”

Same manager: “The digital side of business [isn’t] fully

loaded. We overload print products so digital looks good.

The real expenses need to be charged…because digital looks

better than it really is. I’m not a fan of allocations, but this

needs to have some kind of [rationale to the] allocations

because everyone is running around talking about how

profitable digital is, but we don’t have the true expenses

factored in!”

Manager 2 (10 years, $4 million in revenue): “Most diffi-

cult for me is the department allocations…why am I getting

the allocations I am? I want the detail. I am ultimately

responsible for the bottom line that includes those [costs]. I

never get to see the full company data so I could see where

I fit in. Am I pulling my weight? Do I need to pick it up?”

The annual budgeting process is also an issue. When

many management accountants began their careers, creating

reports for management meant giving programming requests

to the data processing department, who, in turn, would say it

would take 400 staff-days to write the code. Today, anyone

with spreadsheet skills can create that same report in

20 minutes, and that includes many modern managers.

So what does management expect to receive from

accountants for budgeting and planning? Many of those we

interviewed are looking for something more than historical

spending. They want trend data for their industry, for the

industries of their suppliers, and for the industries of their

customers. They want market intelligence. They want reli-

MANAGER

10 YEARS OF EXPERIENCE

able forecasting tools. $4 MILLION IN REVENUE

One manager explained that he wants a report that

would allow him to plug in different what-if scenarios for

staffing and pricing to see what the optimum level would be “Most difficult for me is the department

for each “job” or customer.

Some decision makers felt that their accountants lis-

allocations…why am I getting the allocations I am?

tened only during the budget cycle, then just forgot about I want the detail. I am ultimately responsible for the

looking ahead after that, instead focusing on reporting past

results and variances the rest of the year rather than look-

bottom line that includes those [costs]. I never

ing forward. An overriding theme from our interviews is get to see the full company data so I could see

that many of these managers just don’t care about using the

budget as any kind of decision-making tool. They view it as where I fit in. Am I pulling my weight? Do I need

a spending control tool. Others want to create their budget to pick it up?”

numbers almost as a game for obtaining rewards, so they

rarely use them to manage the business. Examples of the

decisions they make are whether to run a specific product

on a specific machine, whether to buy more raw materials

or not, whether to rework, or whether to run overtime

shifts. None of this involves budgets. It’s about real-time,

right-now forecasts of immediate needs, not what someone

might do six months from now. A note to the progressive

accountants: There should be a shift to top-down driver-

based modeling using consumption rates with forecasts to

calculate the required level of headcount and spending.

This is a superior approach to bottom-up consolidations of

cost center spreadsheets.

32 / STRATEGIC FINANCE / October 2015

6. DO EMPHASES IN THE DISCIPLINE NEED “bean counters to bean growers” if traditional practices

continue. There are problems of willful blindness, wrong

TO CHANGE? methods, and interpersonal styles.

Managers increasingly should be shifting from reacting to Where are management accountants going? Perhaps

after-the-fact reported outcomes to anticipating the future they are running to business analytics, and much of the

with predictive analysis and proactively making adjust- content of analytics is legitimately within the domain of

ments with better decisions. To close the gap, accountants management accounting. While Big Data and business ana-

should change their mind-set from management account- lytics are becoming the playground for marketing and oper-

ing to management economics. They need to classify ations professionals, if management accountants don’t learn

resource-expense behavior with changes in demand and to apply advanced analytics, they could become increas-

the planning horizon as sunk, fixed, step-fixed, or variable. ingly irrelevant.

This involves incremental and marginal expense analysis. The widening gap between what management account-

Their reporting should be more customer-centric, going ants provide and report and what decision makers need

beyond just product costing to include order type, channel, involves the shift from analyzing descriptive historical

and customer service expenses. To go from being reactive to information to analyzing predictive information, such as

proactive, the management accountant will need to com- budgets, driver-based rolling forecasts, cost estimates, and

municate with all internal customers (such as sales and what-if planning scenarios. Yet everyone can learn and

manufacturing) to adequately understand what the com- gain much from historical information. Although account-

pany’s customers want and how they behave. Management ants are gradually improving the quality of reported his-

accountants can’t become proactive by stumbling around in tory, decision makers are shifting their view toward

the dark with their eyes closed. They have to open their understanding the future better. This shift is a response to a

eyes, focus clearly on the customer, and become familiar more overarching change in executive management styles—

with what the customer needs and wants. from a command-and-control emphasis that is reactive

It also seems as if management accountants spend more (such as scrutinizing cost-variance analysis of actual vs.

time saying “no” than anything else. While there are legiti- planned outcomes) to an anticipatory, proactive style

mate areas where a “no” is required, the manager who has where organizational changes and adjustments, such as

a reasonable request for information shouldn’t be denied staffing and spending levels, can be made before negative

just because “that isn’t how we do things here.” A com- things happen and before minor problems become big

pany’s customers don’t care about internal issues and are ones.

even insulted when they’re told about a supplier’s internal Again, our intent in this article wasn’t to be discouraging

troubles—they have businesses to run and don’t have time or critical of accountants. It was to be motivational and

to be a confidant or friend to their supplier. inspirational. If the accounting profession doesn’t have an

One manager (42 years, $80 million in revenue) noted: open discussion about how the users to be served view

“[Their] tone is disrespectful against managers. Rules are accountants, then how can management accountants make

made up as they go. We have had financial challenges, but changes that will benefit providers and users of business

management could have contributed to solutions if we data? SF

weren’t viewed as the problem [by accountants].” And

another (27 years, $60 million in revenue) remarked,

“They are too firm on the rules…they have their ways and Gary Cokins, CPIM, is IMA’s executive-in-residence and is founder and

won’t change…and I will ask the same question(s) every owner of the consulting firm Analytics-Based Performance Management

month.” LLC in Cary, N.C. (www.garycokins.com). A thought leader in EPM,

In what other area can a client ask for something over business analytics, and advanced cost management, he previously was a

and over again and not get it? Nevertheless, there’s some consultant with Deloitte, KPMG, Electronic Data Systems (EDS), and SAS.

acknowledgment of the need for correctness, as in this He also a long-time member and active committee member of IMA. You can

quote from a decision maker (32 years, $4 million in rev- reach Gary at (919) 720-2718 or gcokins@garycokins.com.

enue): “What works in this relationship? [They’re] accu-

rate! Even about two-cent items. [He] was a pain in the

neck, but I appreciated it. And he kept us in line and out of Joseph Cherian, Ph.D., is an associate professor of marketing at the

jail.” This balanced the view of another manager (32 years, Graham School of Management at Saint Xavier University in Chicago, Ill.

$20 million in revenue): “[Our] prior controller was a Prior to this, he was at the University of Illinois at Chicago, where he also

‘know-it-all’ who knew nothing! Did not know business collaborated on research with colleagues in accounting. You can reach him

and tried to make decisions about what data to share or at cherian@sxu.edu.

collect. Was let go!” And someone else (27 years, $5 million

in revenue) offered: “In one breath [they] tell me I am

responsible, and then in the next I’m not. Plus, I don’t get Pamela Miller Schwer, CMA, is an associate professor and former

the control [of data or decisions]. Allocations are [of] chair of the Department of Accounting at Saint Xavier University,

Titanic [impact] if business conditions go south.” Chicago. Her four-decade accounting career began at Johnson & Johnson

Products and has included work in corporate, academia, and private con-

MAKING THE RIGHT CHANGES sulting. She is a member of IMA’s Fox River Valley Chapter. You can reach

Finance and accounting professionals won’t evolve from her at schwer@sxu.edu.

October 2015 / STRATEGIC FINANCE / 33

Reproduced with permission of the copyright owner. Further reproduction prohibited without

permission.

You might also like

- Real Numbers: Management Accounting in a Lean OrganizationFrom EverandReal Numbers: Management Accounting in a Lean OrganizationRating: 5 out of 5 stars5/5 (1)

- The Possible Challenge Faced by Accountants and Accounting Graduates in 21th CenturyDocument5 pagesThe Possible Challenge Faced by Accountants and Accounting Graduates in 21th CenturyJinChuaNo ratings yet

- TRANSFORM YOUR BUSINESS WITH A MONETIZATION REVOLUTIONDocument4 pagesTRANSFORM YOUR BUSINESS WITH A MONETIZATION REVOLUTIONFBanksNo ratings yet

- CFO TCS White-Paper Impact-of-Digital-Finance FV 081219Document10 pagesCFO TCS White-Paper Impact-of-Digital-Finance FV 081219karwa_a4uNo ratings yet

- Chapter 1Document23 pagesChapter 1yvergara00No ratings yet

- Accounting in A Nutshell 7: Financial Ratios and AnalysisDocument3 pagesAccounting in A Nutshell 7: Financial Ratios and AnalysisBusiness Expert PressNo ratings yet

- Finance ControllersDocument21 pagesFinance Controllersyashkanthaliya5No ratings yet

- Changing Role of Management AccountingDocument6 pagesChanging Role of Management AccountingDumidu Chathurange Dassanayake100% (1)

- Ratio Analysis of Tata ElxsiDocument34 pagesRatio Analysis of Tata ElxsiShaswatNo ratings yet

- Fdnacct C31a - Reflection Paper - Helaina SalesDocument4 pagesFdnacct C31a - Reflection Paper - Helaina SalesyannaNo ratings yet

- Understanding The Basics of Accounting, Finance, and Financial ManagementDocument17 pagesUnderstanding The Basics of Accounting, Finance, and Financial Managementfrickzy ibanezNo ratings yet

- Copy of Managerial Accounting Basics_20240109_100321_0000Document20 pagesCopy of Managerial Accounting Basics_20240109_100321_0000shafinasimanNo ratings yet

- B203B-Week 4 - (Accounting-1)Document11 pagesB203B-Week 4 - (Accounting-1)ahmed helmyNo ratings yet

- Importance of Financial Accounting Over Other AccountingDocument6 pagesImportance of Financial Accounting Over Other AccountingSantiago ospina ballenNo ratings yet

- HRM Midterm ReviewerDocument4 pagesHRM Midterm ReviewerDarid De JesusNo ratings yet

- Corporate Governance Efforts Reduce but Can't Prevent Creative AccountingDocument10 pagesCorporate Governance Efforts Reduce but Can't Prevent Creative AccountingqwertyNo ratings yet

- 11185529845Document3 pages11185529845hafsaahmedabdirahman2No ratings yet

- The 10 Biggest Challenges Businesses Face Today (And Need Consultants For) - Hiscox Business Blog PDFDocument1 pageThe 10 Biggest Challenges Businesses Face Today (And Need Consultants For) - Hiscox Business Blog PDFvenkatNo ratings yet

- Materials5 Us Practice of Now Report 2020Document42 pagesMaterials5 Us Practice of Now Report 2020Robert CastilloNo ratings yet

- Business Requirements: Group MembersDocument6 pagesBusiness Requirements: Group MembersUmerNo ratings yet

- I. Definition of Management Accounting and Application: 1. DefinitionDocument7 pagesI. Definition of Management Accounting and Application: 1. DefinitionNguyen Dinh Khanh (FGW HCM)No ratings yet

- 1-Budgets - The Hidden Barrier To Successs in The Information AgeDocument3 pages1-Budgets - The Hidden Barrier To Successs in The Information Agemeiling_1993100% (1)

- CH - 5 Accounting RatiosDocument47 pagesCH - 5 Accounting RatiosAaditi V100% (1)

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulNo ratings yet

- Data VisualisationDocument41 pagesData VisualisationGunay ibrahimliNo ratings yet

- Accounting & BusinessDocument14 pagesAccounting & BusinessXarreigh Dien VilladaresNo ratings yet

- Dairy AccountsDocument10 pagesDairy Accountsm_zubairNo ratings yet

- Best Practices in Cash ManagementDocument5 pagesBest Practices in Cash Managementadi2005No ratings yet

- Abdul Sami FADocument76 pagesAbdul Sami FAAbdul SamiNo ratings yet

- The New-Age CFO: Driver of Real-Time Business: AuthorDocument10 pagesThe New-Age CFO: Driver of Real-Time Business: AuthorPawanNo ratings yet

- 1st PaperDocument8 pages1st PaperShirisha N RajNo ratings yet

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationNo ratings yet

- K010250 - Actionable Profitability Analytics Article - 0 PDFDocument6 pagesK010250 - Actionable Profitability Analytics Article - 0 PDFnazirkuraNo ratings yet

- Ch1 - Managerial Accounting and The Business EnvironmentDocument29 pagesCh1 - Managerial Accounting and The Business EnvironmentehtikNo ratings yet

- Using Analytics To Reduce DsoDocument8 pagesUsing Analytics To Reduce DsoTony KayNo ratings yet

- Are Your People Financially LiterateDocument2 pagesAre Your People Financially LiterateexevalNo ratings yet

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioNo ratings yet

- Business Driven Fraud Management Javelin 2017Document22 pagesBusiness Driven Fraud Management Javelin 2017Sidhu KaurNo ratings yet

- Credit Risk and Bad Debt in TelecommunicationsDocument3 pagesCredit Risk and Bad Debt in TelecommunicationsAssuringBusiness100% (3)

- Financial RatiosDocument30 pagesFinancial RatiosMomal KhawajaNo ratings yet

- Building Trust in Management Accounting - Strategic FinanceDocument13 pagesBuilding Trust in Management Accounting - Strategic FinanceninaNo ratings yet

- The Ethics of Creative Accounting: Does It All Add Up?Document3 pagesThe Ethics of Creative Accounting: Does It All Add Up?qwertyNo ratings yet

- Acca F2 Management Accounting: June2015Document17 pagesAcca F2 Management Accounting: June2015keerthana_giri8772No ratings yet

- E Tivity2 Bsa 2d PastorjanmichaelsDocument7 pagesE Tivity2 Bsa 2d PastorjanmichaelsJan Michael PastorNo ratings yet

- 1.2 Rapid Change in Accountantâ ™s RoleDocument13 pages1.2 Rapid Change in Accountantâ ™s RoleelinaNo ratings yet

- Accounting Information OverviewDocument4 pagesAccounting Information OverviewmartinNo ratings yet

- Essons: AAAI Beginners SeriesDocument4 pagesEssons: AAAI Beginners SeriesHenal ShahNo ratings yet

- NCERT Class 12 Accountancy Accounting RatiosDocument47 pagesNCERT Class 12 Accountancy Accounting RatiosKrish Pagani100% (1)

- Accounting Ratios: Inancial Statements Aim at Providing FDocument53 pagesAccounting Ratios: Inancial Statements Aim at Providing FPathan Kausar100% (1)

- Leac 205Document47 pagesLeac 205Jyoti SinghNo ratings yet

- Signavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsuranceDocument11 pagesSignavio White Paper - Contradictory Choices 2021s Challenges For Banking Financial Services InsurancepipocaazulNo ratings yet

- Recent Developments in Accounting: Inflation, Human Resources, Social and Environmental ReportingDocument17 pagesRecent Developments in Accounting: Inflation, Human Resources, Social and Environmental Reportingsuraj bhaiNo ratings yet

- Business Analytics For Banking: Three Ways To WinDocument8 pagesBusiness Analytics For Banking: Three Ways To Winkaushik.grNo ratings yet

- WP Business Analytics in BankingDocument8 pagesWP Business Analytics in BankingYanyan RivalNo ratings yet

- MIS AaDocument42 pagesMIS AaTiny GechNo ratings yet

- As Applied To My Professional Career: ReferencesDocument2 pagesAs Applied To My Professional Career: ReferencesSagun AryalNo ratings yet

- Module 1 - Introduction To Accounting and CompaniesDocument14 pagesModule 1 - Introduction To Accounting and CompaniesWahyu Maydillah NurrohmanNo ratings yet

- Case #2 Should We Stay or Should We GoDocument5 pagesCase #2 Should We Stay or Should We GoSami JemliNo ratings yet

- Case #1 COST ALLOCATION AND ETHICDocument11 pagesCase #1 COST ALLOCATION AND ETHICSami JemliNo ratings yet

- Product Costing SystemsDocument10 pagesProduct Costing SystemsMariver LlorenteNo ratings yet

- SMU-PPT - Day 2Document74 pagesSMU-PPT - Day 2Sami JemliNo ratings yet

- CSR-PPT - Day 1Document88 pagesCSR-PPT - Day 1Sami JemliNo ratings yet

- Aron Smith: Head of MarketingDocument2 pagesAron Smith: Head of MarketingChitraNo ratings yet

- Course Information Course Number Course Title Degree Program Module N0 and Code Coordinator Lecturer ETCTS Credits Contact Hours (Per Week)Document3 pagesCourse Information Course Number Course Title Degree Program Module N0 and Code Coordinator Lecturer ETCTS Credits Contact Hours (Per Week)zemeNo ratings yet

- Consumer Behavior Sunday 1145 Mid ExamDocument4 pagesConsumer Behavior Sunday 1145 Mid ExamHamza WaseemNo ratings yet

- Herbert Andrew - ResumeDocument3 pagesHerbert Andrew - Resumeapi-683125989No ratings yet

- Code of Ethics For EducatorsDocument4 pagesCode of Ethics For EducatorsJEANNE BALIADNo ratings yet

- Br2e Upper-Int Reading Notes 14 ANSWERSDocument1 pageBr2e Upper-Int Reading Notes 14 ANSWERSGerardo CarvajalNo ratings yet

- Golu Final YearDocument1 pageGolu Final YearSarika YadavNo ratings yet

- Indian Education Society’s Management College Final Exam for Sales Force ManagementDocument1 pageIndian Education Society’s Management College Final Exam for Sales Force ManagementAakash SharmaNo ratings yet

- FABM 1 LAS Quarter 4 Week 3..Document14 pagesFABM 1 LAS Quarter 4 Week 3..Jonalyn DicdicanNo ratings yet

- Developing and Managing TalentDocument130 pagesDeveloping and Managing TalentBlizkriegNo ratings yet

- Final CH 2Document16 pagesFinal CH 2Prachi SanklechaNo ratings yet

- Governance Framework for Capital Works ProjectsDocument141 pagesGovernance Framework for Capital Works ProjectsAlexNo ratings yet

- Introduction To Financial Strategy For Public ManagersDocument7 pagesIntroduction To Financial Strategy For Public ManagersfehNo ratings yet

- Start From Scratch PMP GuideDocument48 pagesStart From Scratch PMP GuideMELVIN MAGBANUANo ratings yet

- Academic Reputation Tracking Your Top 10 Questions AnsweredDocument12 pagesAcademic Reputation Tracking Your Top 10 Questions AnsweredLigia BocaNo ratings yet

- Thomas 1Document2 pagesThomas 1Thomas HoenyeameNo ratings yet

- East Sussex Growth Strategy: Doing Business BrilliantlyDocument41 pagesEast Sussex Growth Strategy: Doing Business BrilliantlyShahbaz AhmedNo ratings yet

- Applied Economics: Impact of Business On The Community: ExternalitiesDocument13 pagesApplied Economics: Impact of Business On The Community: ExternalitiesPangangan NHS100% (1)

- Guide To Doing Business in ZambiaDocument21 pagesGuide To Doing Business in ZambiaNazia RuheeNo ratings yet

- Choosing Entrepreneurship as a CareerDocument10 pagesChoosing Entrepreneurship as a CareerKaustubh JahagirdarNo ratings yet

- Flourishing School Handbook GuideDocument48 pagesFlourishing School Handbook GuideNyekoDenishNo ratings yet

- U.S. Consulate General HCMC Annual Program Statement 2023Document19 pagesU.S. Consulate General HCMC Annual Program Statement 2023nguyenvinh daoNo ratings yet

- H&ss #5 #10 - Mass CultureDocument3 pagesH&ss #5 #10 - Mass CultureGaloNo ratings yet

- Corporate Product Recall and Its Influence On Corporate PerformanceDocument6 pagesCorporate Product Recall and Its Influence On Corporate PerformanceAouniza AhmedNo ratings yet

- 9707 Business Studies: MARK SCHEME For The May/June 2013 SeriesDocument7 pages9707 Business Studies: MARK SCHEME For The May/June 2013 SeriesShah RahiNo ratings yet

- Filipino: Ikalawang Markahan - Modyul 1 Tono NG Pagbigkas NG Tanka at HaikuDocument20 pagesFilipino: Ikalawang Markahan - Modyul 1 Tono NG Pagbigkas NG Tanka at HaikuJhener Nonesa76% (17)

- Ey India Sustainability Report 2018Document78 pagesEy India Sustainability Report 2018Abhinav NaiduNo ratings yet

- Chapter 3 - Industrial Building AllowanceDocument13 pagesChapter 3 - Industrial Building AllowanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Unit 1: Introduction To Service Marketing: Chapter OutlineDocument18 pagesUnit 1: Introduction To Service Marketing: Chapter OutlineIshita GosaliaNo ratings yet

- Resume Shourya Kapoor FinalDocument3 pagesResume Shourya Kapoor FinalOnCourse MumbaiNo ratings yet