Professional Documents

Culture Documents

Accounting Week13 Lec01 & Lec02 Notes

Uploaded by

ABUBAKAR Fawad0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesAccounting Week13 Lec01 & Lec02 Notes

Uploaded by

ABUBAKAR FawadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Financial Accounting

FINANCIAL ACCOUNTING

13. Company Accounts (Company Final Account)

Students’ Notes: This area covers the Accounts of Company related terms.

13.1 Practice Question 01:

From the following balances, takes from books of a business it is required to prepare Statement of profit

and loss (Income Statement) and Statement of Financial Statement (Balance Sheet) for the year ended

31.03 2021.

Account Explanation Dr. Amount Account Explanation Cr. Amount

Cash 29,100 Account Payable 10,000

Account Receivable 15,000 Paid up Capital 30,000

Building 50,000 Debentures / Bonds 20,000

Office Equipment 1,500 Sales 150,000

Furniture 2,000 Loan from Bank 2,000

Machinery 40,000 Last year Profit 2,500

Audit Fee (Expense) 1000

Purchases 60,000

Prepaid Rent 2,000

Opening Inventory 8,000

Salary 4,500

Advertising 200

Insurance Premium 1,200

Total 214,500 Total 214,500

The following further information is given:

✓ Closing stock Rs. 7,000

✓ Prepaid Insurance amount Rs. 400

✓ Interest payable on Debentures @ 10% p.a (Expense and liability both a time)

✓ Proposed annual Dividend 10% per share

13.2 Practice Question 02:

From the following trial balance of Noor and Sons. Prepare Income Statement and Balance Sheet for the

year ended 30 June 2022.

Account Explanation Dr. Amount Account Explanation Cr. Amount

Cash 11,500 Bill Payable 2,040

Account Receivable 32,670 Paid up Capital 70,000

Sales Return 1,730 Account Payable 9,440

Opening Stock 21,450 Purchases Return 190

Machinery 23,400 Purchase Discount 3,300

Office Equipment 5,500 Sales 52,730

Purchases 21,860

Wages 9,810

Carriage-Inward 2,170

Instructor: Farhan Bajwa

Financial Accounting

Sales Discount 2,100

Salary 4,460

Rent 1,050

Total 1,37,700 Total 1,37,700

The following further information is given:

✓ Closing stock Rs. 18,020

✓ Previous year Profit is Rs. 180

✓ Proposed annual Dividend is Rs. 3,500

✓ Depreciate machinery at 5%

13.3 Practice Question 03:

Following Trail Balance was extracted from the books of Nauman & Co. on 31th December 2022. Prepare

Statement of Profit and Loss and Statement of financial Position.

Account Explanation Dr. Amount Account Explanation Cr. Amount

Account Receivable 1,500 Paid up Capital 10,000

Plan and Machinery 15,360 Debentures 1000

Sales Return 260 Creditors 4,820

Opening Stock 4,156 Sales 22,665

Purchases 10,944 Other Income 1300

Carriage-Inward 1,350 Discount on Purchases 130

Income Tax 725

Advertisement 2,000

Salaries 2,240

Rent 1,380

Total 39,915 Total 39,915

The following further information is given:

✓ Closing stock Rs. 400

✓ Salary outstanding Rs. 360

✓ Proposed annual Dividend is Rs. 3,500

✓ Provision for General Reserves Rs. 2000

✓ Provision for Taxation Rs. 1000

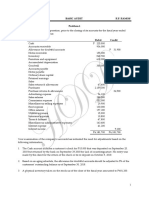

13.4 Practice Question 04:

The following Trial Balance was extracted from the books of Nadeem and Mustafa on 31st Dec 2019.

Prepare Statement of Profit and Loss and Statement of financial Position.

Account Explanation Dr. Amount Account Explanation Cr. Amount

Purchases 9,564 Paid up Capital 10,000

Opening Stock 4,516 Debentures 1,000

Sales Discount 260 Account Payable 4,300

Plant and Machinery 15,360 Sales 25,360

Account Receivable 1,620 Purchase Discount 130

Cash in Hand 3,415 Profit from last year 1,640

Salaries 300 Reserves for Doubtful Debt 300

Instructor: Farhan Bajwa

Financial Accounting

Rent 1,380

Advertisement 4,240

Insurance 725

Wages 1,350

Total 42,730 Total 42,730

The following further information is given:

✓ Closing stock Rs. 5,000

✓ Salary outstanding Rs. 300

✓ Rent Paid in Advance Rs. 380

✓ Depreciate Plant and Machinery at 10% p.a

✓ Proposed annual Dividend is 5% of paid-up Capital

✓ Provision for General Reserves Rs. 800

13.5 Practice Question 04:

Following Trial Balance, Prepare Statement of Profit and Loss and Statement of financial Position.

Account Explanation Dr. Amount Account Explanation Cr. Amount

Opening Inventory 6,500 Sales 55,000

Cash in Hand 375 Profit from last year 250

Cash at Bank 8,000 Purchase Return 500

Sales Return 600 Account Payable 8,470

Investments in Debentures 3,000 Purchase Discount 110

Insurance 200 Bill Payable 3,400

Account Receivable 10,000 Debentures 5,000

Sales Discount 100 Authorized Capital 30,000

Bad Debt 300 Paid-up Capital 15,000

Carriage-Inward 150

Bill Receivable 4,000

Rent 550

Furniture 1,100

Repair Charges 15

Stationary 90

Trading Expense 250

Salaries 3,500

Purchases 48,000

Postage and Telegram 80

Interest on Debentures 120

Office Equipment 800

Total 87,730 Total 87,730

The following further information is given:

✓ Closing stock Rs. 9,000

✓ Interest on debentures Rs. 750

✓ Proposed annual Dividend is 5% of paid-up Capital

✓ Provision for General Reserves Rs. 1000

✓ Reserves for Provident fund Rs. 900

Instructor: Farhan Bajwa

You might also like

- MCB Bank Account Types GuideDocument6 pagesMCB Bank Account Types GuideGhulam AbbasNo ratings yet

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- What Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Document7 pagesWhat Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Ya-ting YangNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Practical Question Accountancy MainDocument22 pagesPractical Question Accountancy MainDubai SheikhNo ratings yet

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cielo Corp accounting adjustmentsDocument3 pagesCielo Corp accounting adjustmentsCarina Mae Valdez ValenciaNo ratings yet

- Final Accounts ProblemsDocument6 pagesFinal Accounts Problemsbhanu.chandu100% (1)

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Philippines Casual Employment Contract Graphic DesignerDocument3 pagesPhilippines Casual Employment Contract Graphic Designerariel lapiraNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- FV PV (1+i) FV $ 100 (1+0.10) FVDocument6 pagesFV PV (1+i) FV $ 100 (1+0.10) FVRey Joyce Abuel100% (2)

- Accounting Fundamentals - Practice Worksheet SolutionsDocument11 pagesAccounting Fundamentals - Practice Worksheet SolutionsMeet PatelNo ratings yet

- Business Income TutorialDocument5 pagesBusiness Income TutorialzulfikriNo ratings yet

- Income Statement and Balance Sheet - Handout 4ADocument10 pagesIncome Statement and Balance Sheet - Handout 4AsakthiNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- Basic Financial Accounting Course for Human Resource StudentsDocument10 pagesBasic Financial Accounting Course for Human Resource StudentsNur Syafiqah NurNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- BDFA1103Document5 pagesBDFA1103Yukie LimNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Profit and Loss - Balance SheetDocument4 pagesProfit and Loss - Balance SheetAnklesh kumar Gupta100% (1)

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- 3.1 Profit and Loss - Balance SheetDocument7 pages3.1 Profit and Loss - Balance Sheetjangirvihan2No ratings yet

- Financial Statements - Lesson 02 (Part 2) QuestionsDocument3 pagesFinancial Statements - Lesson 02 (Part 2) QuestionsNirmal JayakodyNo ratings yet

- Adam's Learning Centre, Lahore: Company AccountsDocument6 pagesAdam's Learning Centre, Lahore: Company AccountsMasood Ahmad AadamNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Capital and Revenue TransactionsDocument7 pagesCapital and Revenue Transactionscarolm790No ratings yet

- TABANI’S SCHOOL OF ACCOUNTANCY MOCK EXAMDocument5 pagesTABANI’S SCHOOL OF ACCOUNTANCY MOCK EXAMBilal ShaikhNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- January 31: Birendra Mahato Adjusting Entries and WorksheetDocument17 pagesJanuary 31: Birendra Mahato Adjusting Entries and WorksheetAjit UpretyNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- Final Accounts QuesDocument2 pagesFinal Accounts QuesJiller GgNo ratings yet

- 6273 - 21010126079 - Corporate Accounting 2Document15 pages6273 - 21010126079 - Corporate Accounting 2APURVA RANJANNo ratings yet

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- General Journal Entries for Retail BusinessDocument7 pagesGeneral Journal Entries for Retail BusinessPath_of_windNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- Particulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRDocument9 pagesParticulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRasdfNo ratings yet

- Basic Final AccountQuestions Part 2Document6 pagesBasic Final AccountQuestions Part 2Jahanzaib ButtNo ratings yet

- Financial Statement - Without AdjustmentDocument29 pagesFinancial Statement - Without AdjustmentAnmol SinghNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Punjab University B.Com Part 1 Past Paper 2015 QuestionDocument5 pagesPunjab University B.Com Part 1 Past Paper 2015 QuestionPraver MalhotraNo ratings yet

- Accounts Project 2Document17 pagesAccounts Project 2navya almalNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Assignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Document1 pageAssignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Rojila luitelNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Ibraheem Limited Final AccountsDocument2 pagesIbraheem Limited Final AccountsAdnan SiddiquiNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Final Accounts Problems SheetDocument2 pagesFinal Accounts Problems SheetSaransh MaheshwariNo ratings yet

- Financial Statements for SH Trading & Liza EnterpriseDocument10 pagesFinancial Statements for SH Trading & Liza Enterpriseassg USMNo ratings yet

- Chap 004Document42 pagesChap 004NguyênNo ratings yet

- Logic and Critical ThinkingDocument8 pagesLogic and Critical ThinkingABUBAKAR FawadNo ratings yet

- Chap 002Document45 pagesChap 002ABUBAKAR FawadNo ratings yet

- GTR TyreDocument3 pagesGTR TyreABUBAKAR FawadNo ratings yet

- AK Mock BA 99.2 1st LEDocument4 pagesAK Mock BA 99.2 1st LEBromanineNo ratings yet

- Discussion QuestionsDocument22 pagesDiscussion QuestionsAndhikaa Nesansa NNo ratings yet

- Understanding NPO accounting entries and financial statementsDocument3 pagesUnderstanding NPO accounting entries and financial statementsMarie GarpiaNo ratings yet

- Accountancy Test Paper Class XIIDocument20 pagesAccountancy Test Paper Class XIIPriya SinghNo ratings yet

- BEP ExercisesDocument11 pagesBEP ExercisesBarack MikeNo ratings yet

- Null 001.2001.issue 139 enDocument36 pagesNull 001.2001.issue 139 enMark RiveraNo ratings yet

- Acc 106 Ebook Answer Topic 2Document6 pagesAcc 106 Ebook Answer Topic 2syifa azhari 3BaNo ratings yet

- What Is Goodwill?: Key TakeawaysDocument4 pagesWhat Is Goodwill?: Key TakeawaysTin PangilinanNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument47 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualbacksideanywheremrifn100% (30)

- CDC Investors Guide - Annex ADocument13 pagesCDC Investors Guide - Annex ARalph Ronald CatipayNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Mapping of Trial Balance in Financial StatementsDocument3 pagesMapping of Trial Balance in Financial StatementsCool DudeNo ratings yet

- Accruals & PrepaymentsDocument5 pagesAccruals & PrepaymentsClouds consultantsNo ratings yet

- 2000 Econ. Paper 1 (Original)Document8 pages2000 Econ. Paper 1 (Original)peter wongNo ratings yet

- Scheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Document8 pagesScheme of Taxation of Firms: Computation of Income of Partnership Firms (Section 40B)Anonymous ckTjn7RCq8No ratings yet

- Extent (How Much) DecisionsDocument21 pagesExtent (How Much) DecisionsHanacchiNo ratings yet

- PFRS 10, Consolidated Financial StatementsDocument32 pagesPFRS 10, Consolidated Financial Statementsjulia4razoNo ratings yet

- Сorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdDocument24 pagesСorporate Income Tax (Cit) : Dinara Mukhiyayeva, PhdAruzhan BekbaevaNo ratings yet

- LCCI Level 4 Certificate in Financial Accounting VQR Resource Booklet ASE20101 April 2019Document12 pagesLCCI Level 4 Certificate in Financial Accounting VQR Resource Booklet ASE20101 April 2019Musthari KhanNo ratings yet

- Cvp-Bep AnalysisDocument13 pagesCvp-Bep AnalysisVeronica ApallaNo ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- Comparing The Compensation of A PSU and A StartupDocument11 pagesComparing The Compensation of A PSU and A Startuphuga lalaNo ratings yet

- Chapter 05: Statement of Financial Position Statement of Financial Position, Also Referred To As The Balance SheetDocument10 pagesChapter 05: Statement of Financial Position Statement of Financial Position, Also Referred To As The Balance SheetStella OktavianiNo ratings yet

- Provision and Reserve DefinitionsDocument1 pageProvision and Reserve Definitionssujan BhandariNo ratings yet

- Old Bridge Mutual Fund - Factsheet March 2024Document8 pagesOld Bridge Mutual Fund - Factsheet March 2024Bharathi 3280No ratings yet

- Akuntansi PenyesuaianDocument8 pagesAkuntansi PenyesuaianWidad NadiaNo ratings yet