Professional Documents

Culture Documents

MCQ Sample FAA

Uploaded by

YT Motivation0 ratings0% found this document useful (0 votes)

7 views1 page1) Managers of accounting information for decision making are called stakeholders.

2) Managerial accounting uses information related to both past events and future estimates.

3) A key attribute of accounting is identifying, measuring, and communicating economic information to informed users for decision making.

4) The Rs. 100,000 rent payment made in advance by ABC Limited till September 2021 represents a prepaid expense for the company as of March 31, 2021.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Managers of accounting information for decision making are called stakeholders.

2) Managerial accounting uses information related to both past events and future estimates.

3) A key attribute of accounting is identifying, measuring, and communicating economic information to informed users for decision making.

4) The Rs. 100,000 rent payment made in advance by ABC Limited till September 2021 represents a prepaid expense for the company as of March 31, 2021.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageMCQ Sample FAA

Uploaded by

YT Motivation1) Managers of accounting information for decision making are called stakeholders.

2) Managerial accounting uses information related to both past events and future estimates.

3) A key attribute of accounting is identifying, measuring, and communicating economic information to informed users for decision making.

4) The Rs. 100,000 rent payment made in advance by ABC Limited till September 2021 represents a prepaid expense for the company as of March 31, 2021.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Question Option-1 Option-2 Option-3 Option-4 Marks Right Answer

Users of the accounting information for decision making are called

Consumers Owners Stakeholders Management 0.5 3

__________________

Accounting information are used by managers in taking decisions relating to the Bonus Declaration to

Product Pricing Manipulate tax liability Product mix decisions 0.5 3

below, EXCEPT__________ Employees

Past Events and Future

Managerial accounting uses information related to ____________ Past Events only Future Estimates Only Current Values Only 1 4

Forecasts both

Identifying, measuring, Informed Decision Making

Which is NOT a key attribute to associate when defining the term "accounting"? Economic Information End of Period Activity 1 4

communicating by Users

ABC Limited prepares its accounts this year from April 2020 to March 2021. On

31 March 2021, it pays rent of around Rs. 100000 for one of its highway Expense for the financial year Asset as on 30 September Expense for the financial year

Asset as on 31 March 2021 2 2

advertisement hoarding in advance till September 2021. This Rs. 100000 2020-21 2021 2019-20

represents ____________ of the company.

For each item of assets, liabilities, equity, income and expenses ___________ are

Journal, Subsidiary Books Journal, Ledger Accounts, Ledger Journal, Journal Proper 0.5 3

prepared and the same are maintained in a ________________

Nullification compensating Income and Expenses are not

What is the key premise behind accounting equation? Cash Flow Dual Effect 0.5 2

transactions recorded

What is the effect of the below transaction on accounting equation? Increase in an asset; Decrease Increase in an asset; Increase Increase in an asset; Increase Decrease in an asset;

1 2

Company purchased raw materials worth Rs. 250000 on credit in another asset in a liability in capital Decrease in a liability

A company purchased stationary items on credit basis. What will be the effect on Increase in an asset; Decrease Increase in Liability; Increase in a Liability; Increase in Capital; Decrease

1 2

accounting equation? in another asset Decrease in Capital Increase in an Asset in a Liability

Consider the below transaction:

Credit Machinery A/c by Rs. Debit Machinery A/c by Rs. Debit Machinery A/c by Rs.

"Company purchased a machinery from BML Limited for Rs. 500000, 25% of Debit Machinery A/c by Rs.

500000; Debit Cash A/c Rs. 375000; Debit Cash A/c Rs. 500000; Credit Cash A/c Rs.

which was paid by cash immediately, and the remaining to be paid after 6 500000; Credit Cash A/c Rs. 2 4

125000; Debit BML Limited 125000; Credit BML Limited 125000; Credit BML Limited

months" 500000

A/c Rs. 375000 A/c Rs. 500000 A/c Rs. 375000

What will be the right journal entry for this?

Which of the below statements is a statement of financial position of a company? Income Statement Statement of Assets Balance Sheet Statement of Equity 0.5 3

Companies are required to prepare financial statements on a/an ___________ Any period with equal

Annual Quarterly Annual and quarterly 0.5 3

basis interval

Investments are called current investments, when they are invested For a period of more than one For a period of less than one Invested for earning quick Invested for long-term capital

1 2

________________ and generally used for ______________ needs year; Long-term year; Short-term profits; Short-term growth; Long-term

Some or all assets are Some assets serve as All assets of the firm are Loans are taken from secured

What is a key feature of a secured loan? 1 2

pledged as collaterals collaterals hypothecated institutions like bank

A company gives you the below information: Machinery Rs. 50000; Buildings

Assets Rs. 200000 = Assets Rs. 240000 = Assets Rs. 235000 = Assets Rs. 215000 =

Rs. 100000; Debtors Rs. 20000; Inventory Rs. 25000; Cash Rs. 5000; Creditors

Liabilities Rs. 75000 + Liabilities Rs. 35000 + Liabilities Rs. 40000 + Liabilities Rs. 60000 + 2 1

Rs. 35000; Bank Loan Rs. 40000. Write the accounting equation for this

Capital Rs. 125000 Capital Rs. 205000 Capital Rs. 195000 Capital Rs. 155000

company.

as a summary for an as a summary for an

A trial balance is prepared _________ as on a specific date without mention of any date 0.5 3

accounting year accounting period

A transaction of purchase of stationary was not recorded in the journal and

therefore is missing from the trial balance. Such errors are called Errors of Commission Errors of Omission Errors of Principle Compensating Errors 0.5 2

________________

Reduce from the respective Reduce from the respective Add to the respective expense Add to the respective expense

expense in Profit & Loss A/c; expense in Profit & Loss A/c; account in Profit & Loss A/c; in Profit & Loss A/c; Shown

How is the adjustment "Prepaid Expense" treated while preparing final accounts? 1 2

Shown as a liability in the Shown as an asset in the Shown as a liability in the as an asset in the Balance

Balance Sheet Balance Sheet Balance Sheet Sheet

Machinery A/c balance will be in ___________column of trial balance, whereas

Debit, Credit Credit, Debit Debit, Debit Credit, Credit 1 3

Depreciation A/c balance will be in ___________ column of trial balance

In a trial balance below balances are given:

Equipments A/c Rs. 500000; Furniture A/c Rs. 300000; Vehicles A/c Rs. 200000

Additional adjustments are required as below:

Rs. 115000 Rs. 140000 Rs. 145000 Rs. 105000 2 3

Depreciation on Equipments to be charged at 15%, on Furniture at 10% and on

vehicles at 20%.

What is the total amount of depreciation to be charged to Profit & Loss A/c?

Which of the below is NOT a member in the Accounting Standards Board of Representative from Tax

Nominated members by ICAI Representatives of RBI Representative from AICTE 0.5 3

India? Authority

In addition to the audit process, the compliance of accounting standards is also Provisions of the Companies

An Act of Law A Monitoring Authority Income Tax Department 0.5 4

implemented through ______________ Act, 2013

AS 11: Effect of Changes in AS 12: Accounting for AS 13: Accounting for AS 14: Accounting for

Below are the Indian GAAP notified, EXCEPT: 1 4

Foreign Exchange Rates Government Grants Investments Defined Benefit Plans

The goals of convergence of accountings standards are to establish Customisable set; by

Standardised set; Companies Single set; Internationally Multiple sets of; Globally 1 3

_____________ of standards to be used ______________ Companies

____________________ are a common set of principles, standards and practices Accounting Standards; Accounting Concepts; Accounting Conventions;

Accounting Concepts;

that define the basis of financial reporting, whereas __________________ is a GAAP; Accounting Accounting Standards; Accounting Standards; 2 1

GAAP; Accounting Concepts

collection of such ___________________________ Standards Accounting Concepts Accounting Conventions

Because they are set by

Because they are not

Because they are set by Because they are accepted by accounting bodies and widely

Why are GAAP "generally accepted"? specifically accepted by few 0.5 3

authorities accounting professionals accepted by accounting

entities

professionals

IFRS provides _________________ formats for presentation of financial

Mandatory Illustrative Detailed Simplified 0.5 2

statements

Summary of Accounting

Source of the information in Ratios related to the financial Summary of the previous

The purpose of notes to financial statements is to include ________________ Policies and other exploratory 1 4

the financial statements statement elements years' data

information

International Accounting International Financial Financial Accounting

Which of the below board would you associate with US GAAP? Accounting Standards Board 1 4

Standards Board Reporting Standards Board Standards Board

Under Indian GAAP requires that the entity identifies two segments, namely Operating; Non-operating; Business; Geographical; Ordinary; Extraordinary; Productwise; Servicewise;

2 2

_____________ and _________________ using ______________ approach Fundamental Risks and Rewards Value Unit

A company has invested in short term debt mutual funds (6 months holding

period). The same is categorised as ___________________ in their financial Non-Current Investments Current Investments Cash Equivalents Marketable Securities 0.5 2

statements

Stores, Spares and

Which of the below is an example for Other Current Assets in the Balance Sheet? Investments in Mutual Funds Loans given to related parties Prepaid Expenses 0.5 3

Consumables

In treating current assets and current liabilities, if there is no clarity on

Operating Cycle; 12 Cash Cycle; 1 Financial Year; 12 Calendar Year; 12 1 1

__________________, it is assumed to be ________________ months

Revenues and expenses

Revenues and expenses Revenues and expenses Revenues and expenses

usually not occurring in

What are Exceptional Items? occurring in ordinary course occurring in ordinary course usually not occurring in 1 1

ordinary course of business,

of business, but large in size of business ordinary course of business

but large in size

Depreciation/Amortisation is deducted from cash operating profit to arrive at

Net Profit Pre-tax Profit Gross Profit Operating Profit 2 4

____________________

Current Account balance with

In the term "Cash and Cash Equivalents", cash comprises of the below, EXCEPT: Cash on hand Bank Overdraft, if any Short-term investments 0.5 4

banks

A company receives interest on debentures it had invested few years ago. How is

Investing Cash Flow Financing Cash Flow Operating Cash Flow Non-cash Flow 0.5 1

this transaction treated in Cash Flow Statements?

Interest paid by a banking company is treated as _______________ and Interest Operating Activity; Also Financing Activity; Also Operating Activity; Financing Financing Activity; Operating

1 3

paid by a manufacturing company is treated as _______________ Operating Activity Financing Activity Activity Activity

A company shows a profit after taxes of Rs. 90 lacs. Below items are charged to

depreciation: Depreciation Rs. 10 lacs, Amortisation Rs. 3 lacs; Taxes paid Rs. Rs. 133 lacs Rs. 33 lacs Rs. 73 lacs Rs. 103 lacs 1 4

30 lacs. Determine the operating cash flow.

A company's beginning cash balance is Rs. 65 crores. The company generated

operating cash flows of Rs. 30 crores. It invested Rs. 10 crores in long term

Rs. 135 crores Rs. 155 crores Rs. 55 crores Rs. 5 crores 2 1

investments and issued shares worth Rs. 50 crores. What will be the closing cash

balance?

Which of the below NOT a profitability ratio? Return on Equity Return on Assets Price to Earnings Ratio Profitability Margin 0.5 3

Which of the below is a ratio used by an existing shareholder to assess the

effective cash return he is earnings on the current value of the company's share in Net Profit Ratio Earning per Share Dividend Payout Ratio Dividend Yield Ratio 0.5 4

the market?

A company reported a net loss of Rs. 25 millions for a year. If the total revenue is

0 Minus 33.33% 33.33% 66.67% 1 2

75 millions for the year, what is its net profit ratio?

The total sales of a firm are Rs. 500 crores. If the asset turnover is 6.5 times, what

Rs. 38.46 crores Rs. 76.92 crores Rs. 3900 crores Rs. 1750 crores 1 2

is company's capital employed?

To compute majority of the

Ratios can not analyse the Ratios are as good as the Ratios can be still be

ratios, information beyond

Which of the below is NOT one of the limitations of ratio analysis? company's strengths that are accounting policies used by computed on manipulated 2 2

financial statements are

not in monetary terms the company financial statements

required

Analysis of financial statements by a potential lender is an example of

Horizontal External Vertical Inter-firm 0.5 2

____________________ analysis

A company's factory building is damaged due to an unexpected earthquake in the

Loss from Discontinued

area. The loss is estimated to be almost Rs. 10 crores. This has to be reported as Comprehensive Income Other Comprehensive Income Extraordinary Items 0.5 3

Operations

_______________

A company's sales were Rs. 650 crores in current year. Their sales were Rs. 500

crores in the previous year. When preparing the comparative statement, what will Increase of Rs. 150 crores Decrease of Rs. 150 crores Increase of 25% Decrease of 23% 1 1

be the rupee change of this item?

The two key differences between common size income statement and a Number of years of

Expression as Index;

percentage change analysis statement are that Left to right; Top to bottom Qualitative; Quantitative comparison; Comparison 1 4

Expression as Percentage

_____________________________ and ______________________ base

The total value of non-current liabilities in two consecutive years for a company

are Rs. 56 lacs and 82 lacs, in a comparative statement what will be the increase Rs. 82 lacs; 82.00% Rs. 26 lacs; 46.43% Rs. 26 lacs; 31.71% Rs. 56 lacs; 56.00% 2 2

or decrease in rupee value and in percentage terms against this item?

You might also like

- Libby 10e Chap002 PPT AccessibleDocument47 pagesLibby 10e Chap002 PPT Accessible許妤君No ratings yet

- Anne Aylor, Inc.: Determination of Planning Materiality and Tolerable MisstatementDocument14 pagesAnne Aylor, Inc.: Determination of Planning Materiality and Tolerable MisstatementAlrac GarciaNo ratings yet

- Intercompany Profit Transactions - Inventories: Answers To Questions 1Document22 pagesIntercompany Profit Transactions - Inventories: Answers To Questions 1NisrinaPArisantyNo ratings yet

- Auditing and Assurance Principles Pre TestDocument9 pagesAuditing and Assurance Principles Pre TestKryzzel Anne JonNo ratings yet

- Module 2 - RevisedDocument31 pagesModule 2 - RevisedAries Gonzales Caragan25% (4)

- Financial Statements and Financial AnalysisDocument17 pagesFinancial Statements and Financial AnalysisVaibhav MahajanNo ratings yet

- Cfap1 Aafr PK PDFDocument386 pagesCfap1 Aafr PK PDFImran100% (1)

- Audit and Inventory Committee ReportDocument3 pagesAudit and Inventory Committee ReportGeaMary Labucay Manatad100% (1)

- Mock TestDocument26 pagesMock TestRadhika KushwahaNo ratings yet

- Case 5 - Fernandez, Hisham - BSAc-2B PDFDocument8 pagesCase 5 - Fernandez, Hisham - BSAc-2B PDFHISHAM F. MAINGNo ratings yet

- Lunar International College School of Graduate Studies Masters of Business Administration (MBA)Document52 pagesLunar International College School of Graduate Studies Masters of Business Administration (MBA)Sintayehu MeseleNo ratings yet

- Adjustment Entries II - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Entries II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Accounting Grade 12 Lesson Presentation: Accounting Concept Lo 1 AS 1, 2 and 4Document3 pagesAccounting Grade 12 Lesson Presentation: Accounting Concept Lo 1 AS 1, 2 and 4mambusiNo ratings yet

- AccountingDocument24 pagesAccountingnour mohammedNo ratings yet

- Ccounting Nformation YstemDocument37 pagesCcounting Nformation YstemafridaNo ratings yet

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDocument2 pagesFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteNo ratings yet

- 03 - Management AccountingDocument2 pages03 - Management AccountingCelsozeca2011No ratings yet

- Joaxjill NotesDocument6 pagesJoaxjill NotesAlliah Czyrielle Amorado PersinculaNo ratings yet

- Slides Part 1Document60 pagesSlides Part 1nichtnancyNo ratings yet

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- Unit 10 - Assignment LO2Document11 pagesUnit 10 - Assignment LO2Yasser ZayedNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesDyenNo ratings yet

- T Accounts: Basic Representations of The AccountsDocument21 pagesT Accounts: Basic Representations of The Accountscnsuu_No ratings yet

- Budgetary ControlDocument11 pagesBudgetary ControlrscjatNo ratings yet

- BBAW2103 - Tutorial 1Document69 pagesBBAW2103 - Tutorial 1M THREE THOUSAND RESOURCESNo ratings yet

- Fund W1-3Document55 pagesFund W1-3Edren LoyloyNo ratings yet

- Ratio Analysis: The Balance Sheet For FinancialDocument10 pagesRatio Analysis: The Balance Sheet For FinancialWahidul Islam 222-14-522No ratings yet

- Cost Accounting I - 1. Accounting SystemDocument31 pagesCost Accounting I - 1. Accounting SystemYusuf B'aşaranNo ratings yet

- SV - Topic 910 - IAS 8+ IAS 10Document17 pagesSV - Topic 910 - IAS 8+ IAS 10Nguyễn Thị Hà TiênNo ratings yet

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- Financial Management For Non-Finance Manager In-House Training PT Newmont Nusa TenggaraDocument264 pagesFinancial Management For Non-Finance Manager In-House Training PT Newmont Nusa Tenggaralizaaa 123No ratings yet

- Chapter 2Document47 pagesChapter 2Kei HanzuNo ratings yet

- ch01 LMSDocument8 pagesch01 LMSGiang TrầnNo ratings yet

- As 15 - Gratuity - Harmony Motors - 31032018Document15 pagesAs 15 - Gratuity - Harmony Motors - 31032018prasad and company limitedNo ratings yet

- Conflict in Decision MakingDocument12 pagesConflict in Decision MakingRupa dev royNo ratings yet

- B. Com (Banking and Insurance) - Sem-VI Subject: Auditing II Question BankDocument9 pagesB. Com (Banking and Insurance) - Sem-VI Subject: Auditing II Question Bankcharanjeet singh chawlaNo ratings yet

- Topic 4: Trial Balance: Learning ObjectivesDocument5 pagesTopic 4: Trial Balance: Learning ObjectivesAzim OthmanNo ratings yet

- 2020 Accounting Revision Term1 ACTIVITIES ENG v2 1Document21 pages2020 Accounting Revision Term1 ACTIVITIES ENG v2 1Sanele N ThabetheNo ratings yet

- Faa MCQ'S-1Document2 pagesFaa MCQ'S-1Onkar ShindeNo ratings yet

- Ch01 - Overview of AccountingDocument28 pagesCh01 - Overview of AccountingBlariousNo ratings yet

- Must Do Content Accountancy Class XiiDocument46 pagesMust Do Content Accountancy Class XiiHigi SNo ratings yet

- Handout For Financial AccountingDocument9 pagesHandout For Financial AccountingBlack ScoopNo ratings yet

- Standar Akuntansi KeuanganDocument32 pagesStandar Akuntansi KeuanganMelia FaniNo ratings yet

- Accounting 0452 Revision NotesDocument48 pagesAccounting 0452 Revision NotesMasood Ahmad AadamNo ratings yet

- 3.3. Preparation of Projected Financial Statements: Unit 3: Financial Planning Tools and ConceptsDocument9 pages3.3. Preparation of Projected Financial Statements: Unit 3: Financial Planning Tools and ConceptsTin CabosNo ratings yet

- Module 001: Review of The Basic Accounting Concepts and PrinciplesDocument18 pagesModule 001: Review of The Basic Accounting Concepts and PrinciplesHo Ming LamNo ratings yet

- CMD 2022-23 WPPR March & YtdDocument26 pagesCMD 2022-23 WPPR March & YtdTEMESGEN TEFERINo ratings yet

- Accounting 0452 Revision Notes For The yDocument48 pagesAccounting 0452 Revision Notes For The ytawanaishe shoniwaNo ratings yet

- CA-IPCC (Old Syllabus) : Tina - Seelig - The - Little - Risks - You - Can - Take - To - Increase - Your - Luck/reading-ListDocument3 pagesCA-IPCC (Old Syllabus) : Tina - Seelig - The - Little - Risks - You - Can - Take - To - Increase - Your - Luck/reading-Listsaravana pandianNo ratings yet

- CH 1 Part 1Document41 pagesCH 1 Part 1hstptr8wdwNo ratings yet

- Lecture 2 - Accounting The Language of BusinessDocument54 pagesLecture 2 - Accounting The Language of BusinessolgaszczechuraNo ratings yet

- BBP FI 03 Asset Accounting v.0Document20 pagesBBP FI 03 Asset Accounting v.0shailendra kumar100% (2)

- PC2 AnswerSheetDocument3 pagesPC2 AnswerSheetLuWiz DiazNo ratings yet

- Caie Igcse Accounting 0452 Theory v3Document23 pagesCaie Igcse Accounting 0452 Theory v3tarzan.shakilNo ratings yet

- Review On Basic AccountingDocument19 pagesReview On Basic AccountingRegina BengadoNo ratings yet

- Session 3Document23 pagesSession 3Trisha BanerjeeNo ratings yet

- 11.1.1.7.1 OICA Metric Reference GuideDocument11 pages11.1.1.7.1 OICA Metric Reference GuideAnandNo ratings yet

- To Be Uploaded 1 Fabm 1 PS 11 Q4 1005Document73 pagesTo Be Uploaded 1 Fabm 1 PS 11 Q4 1005Kristoffer AngNo ratings yet

- BBP FI 02 General Ledger Accounting v.0Document14 pagesBBP FI 02 General Ledger Accounting v.0shailendra kumarNo ratings yet

- Chapter 2Document51 pagesChapter 2Thùy DungNo ratings yet

- Finance TermpaperDocument12 pagesFinance Termpaper21.Tamzid TapuNo ratings yet

- Financial Information For Managers The Financial Statement Analysis Week 4Document32 pagesFinancial Information For Managers The Financial Statement Analysis Week 4jeff28No ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- IFRS Illustrative Financial Statements (Dec 2014)Document238 pagesIFRS Illustrative Financial Statements (Dec 2014)Aayushi AroraNo ratings yet

- Advanced Financial Accounting 10th Edition Christensen Solutions Manual 1Document42 pagesAdvanced Financial Accounting 10th Edition Christensen Solutions Manual 1gilbertNo ratings yet

- HDJJDDocument15 pagesHDJJDjustin maharlikaNo ratings yet

- MCQs On Correlation and Regression AnalysisDocument15 pagesMCQs On Correlation and Regression AnalysiskapuNo ratings yet

- ch21 ReclassificationDocument6 pagesch21 ReclassificationmercyvienhoNo ratings yet

- Ebm Essay Pooja v2Document5 pagesEbm Essay Pooja v2Pooja KetaruthNo ratings yet

- ExercisesDocument2 pagesExercisesMuhammad Aiman Md NorNo ratings yet

- GL Import ReferencesDocument37 pagesGL Import ReferencesSanthosh KrishnanNo ratings yet

- G) KFN RF ( (PSFPG ) G / +:yfsf) Va/Kq: Sfo (ZFNF Uf) I7L Tyf Cgt/Lqmof Sfo (QMDDocument6 pagesG) KFN RF ( (PSFPG ) G / +:yfsf) Va/Kq: Sfo (ZFNF Uf) I7L Tyf Cgt/Lqmof Sfo (QMDArtha sarokarNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFDocument61 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFthomasowens1asz100% (10)

- Nathan Pierski Cover LetterDocument1 pageNathan Pierski Cover Letterapi-350314755No ratings yet

- Chapter 5 - Worksheet and Financial StatementsDocument3 pagesChapter 5 - Worksheet and Financial StatementsAna Margarita BacalsoNo ratings yet

- Review in Midterm Examination - Acc 204Document18 pagesReview in Midterm Examination - Acc 204Diane Marinel De LeonNo ratings yet

- CS2 Speaking TestDocument9 pagesCS2 Speaking TesthansanakarunanayakeNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Document20 pagesFundamentals of Accountancy, Business and Management 1: Quarter 2 - LAS 19Althea MorseNo ratings yet

- Curriculum Vitae - 2023 English PDFDocument4 pagesCurriculum Vitae - 2023 English PDFAmâncio CumbaneNo ratings yet

- Table 3: Optional Exemptions From Retrospective ApplicationDocument3 pagesTable 3: Optional Exemptions From Retrospective ApplicationnatiNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- 118-Article Text-1353-1-10-20230308Document11 pages118-Article Text-1353-1-10-20230308Sandy ZulfianNo ratings yet

- Government AccountingDocument28 pagesGovernment AccountingRazel TercinoNo ratings yet

- Working Capital Management AssignmentDocument10 pagesWorking Capital Management AssignmentRitesh Singh RathoreNo ratings yet

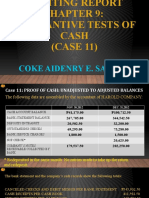

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Financial StatementsDocument49 pagesFinancial Statementsfietha67% (3)

- Cost and Management AccountingDocument82 pagesCost and Management Accountinghimanshugupta6100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Journal Accounting and AuditingDocument143 pagesJournal Accounting and AuditinghazemzNo ratings yet