Professional Documents

Culture Documents

Adv2019 0017

Uploaded by

Mox LexOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv2019 0017

Uploaded by

Mox LexCopyright:

Available Formats

No.

2019 - 0017

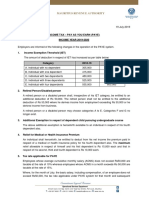

REPORT ON NON-REMITTING AND/OR

NON-REPORTING EMPLOYERS (AS OF JUNE

2019) NOW ON PHILHEALTH WEBSITE

Pursuant to Section 6.f of the Revised Implementing Rules and Regulations (IRR) of

the National Health Insurance Act of 2013, PhilHealth is mandated to establish and

maintain an updated membership and contribution database.

Section 15 of the same IRR provides for the Obligations of the Employer which include

the registration of their employees, payment of contributions and the submission of

remittance reports. As such, employers who have not had any premium remittance

and/or have not submitted their reports on premium payments are therefore

considered non-compliant.

The complete list of non-remitting and/or non-reporting employers as of June

2019 may be viewed at: https://www.philhealth.gov.ph/partners/employers/

NonRemitting_NonReportingEmployers_062019.pdf

These employers or their employees are given until August 30, 2019 to visit the

nearest PhilHealth Office in their localities to verify or validate their status and settle

their outstanding obligations. Non-compliance shall be subject to Rule II (Offenses of

Employers) of the Revised IRR of the NHI Act of 2013.

Further inquiries pertaining to this advisory may be referred to our 24/7 Corporate

Action Center at (02) 441-7442.

BGEN. RICARDO C. MORALES, AFP (RET) FICD

President and Chief Executive Officer (CEO)

You might also like

- Mauritius Revenue Authority: T: - F: - E: - WDocument2 pagesMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonNo ratings yet

- Guide On Income Tax: Employees Taking Up Employment For The First TimeDocument10 pagesGuide On Income Tax: Employees Taking Up Employment For The First TimeSohel RanaNo ratings yet

- The PF Act, 1952Document16 pagesThe PF Act, 1952Sonam SinghNo ratings yet

- Government Mandated Benefits PolicyDocument13 pagesGovernment Mandated Benefits PolicyNinoyz™100% (2)

- Philhealth Implementing Rules and RegulationsDocument2 pagesPhilhealth Implementing Rules and Regulationsboomar100% (1)

- Human Resource DepartmentDocument28 pagesHuman Resource Departmentharry22janNo ratings yet

- Taxs Note 2015Document17 pagesTaxs Note 2015Anonymous FQaTclTNNo ratings yet

- Provident FundDocument9 pagesProvident FundGopalakrishnan KuppuswamyNo ratings yet

- Provident Fund Act SummaryDocument10 pagesProvident Fund Act SummaryhemlatauNo ratings yet

- Philhealth Employer DutiesDocument2 pagesPhilhealth Employer DutiesthyallaNo ratings yet

- RMC No. 45-2020Document2 pagesRMC No. 45-2020AceGun'nerNo ratings yet

- Frequently Asked Questions - Atal Pension YojanaDocument11 pagesFrequently Asked Questions - Atal Pension YojanaBp PbNo ratings yet

- PhilHealth Penalties For Non-Remitting and Non-Reporting EmployersDocument1 pagePhilHealth Penalties For Non-Remitting and Non-Reporting EmployersElla SimoneNo ratings yet

- TS For PC 003-2015 For Unwarranted ClaimsDocument9 pagesTS For PC 003-2015 For Unwarranted ClaimsBugz ApilNo ratings yet

- PFDocument18 pagesPFPredhivrajNo ratings yet

- Tax ReturnDocument18 pagesTax ReturnJoachim NosikNo ratings yet

- WT IT - Declarations - Guidelines - FY - 2019-20 PDFDocument11 pagesWT IT - Declarations - Guidelines - FY - 2019-20 PDFGautham ReddyNo ratings yet

- Compliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Document57 pagesCompliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Himanshu ShahNo ratings yet

- Tool Kit Salary 2015Document11 pagesTool Kit Salary 2015Farhan JanNo ratings yet

- Human Resource Department: by J.A.V.R.N.V.PRASADDocument28 pagesHuman Resource Department: by J.A.V.R.N.V.PRASADAmarnath VuyyuriNo ratings yet

- Employers Guide CurrentDocument62 pagesEmployers Guide Currentglamom100% (3)

- Frequently Asked Questions - Atal Pension YojanaDocument13 pagesFrequently Asked Questions - Atal Pension YojanaanuNo ratings yet

- Provident Fund DataDocument4 pagesProvident Fund DataAishwarya SharmaNo ratings yet

- NSSA RegistrationDocument10 pagesNSSA RegistrationTawanda Tatenda HerbertNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- FPF060 Member'sContributionRemittance V01Document3 pagesFPF060 Member'sContributionRemittance V01christine_balanagNo ratings yet

- Pag IbigDocument3 pagesPag IbigSharon Rillo Ofalda100% (1)

- Employer Reporting of Health Coverage Code Sections 6055 & 6056Document10 pagesEmployer Reporting of Health Coverage Code Sections 6055 & 6056Swati BhayanaNo ratings yet

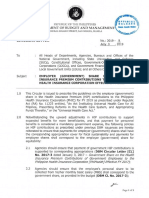

- DBM CL No. 8, S. 2019 (Employer Share On PHIC)Document3 pagesDBM CL No. 8, S. 2019 (Employer Share On PHIC)James G. DocogNo ratings yet

- SPF Enrollment FormDocument2 pagesSPF Enrollment FormMark BagamaspadNo ratings yet

- HRM Quiz 11Document1 pageHRM Quiz 11Ruby SparksNo ratings yet

- Take Home Activity 3Document6 pagesTake Home Activity 3Justine CruzNo ratings yet

- Provident Fund - SynopsisDocument9 pagesProvident Fund - SynopsisSIDDHANT MOHAPATRANo ratings yet

- Economic Benefits and Insurance A. Philhealth Insurance B. Social Security Services C. Employees Workers Compensation D. Pag Ibig Plan A. Philhealth InsuranceDocument7 pagesEconomic Benefits and Insurance A. Philhealth Insurance B. Social Security Services C. Employees Workers Compensation D. Pag Ibig Plan A. Philhealth InsuranceRosario BacaniNo ratings yet

- NBFA Application Form InstructionsDocument3 pagesNBFA Application Form InstructionsArvind GangwarNo ratings yet

- Employer Employee RequirementsDocument5 pagesEmployer Employee Requirementskevior2No ratings yet

- Circ32 2014 PDFDocument2 pagesCirc32 2014 PDFDenzel Edward CariagaNo ratings yet

- CM Unit - VDocument23 pagesCM Unit - Vsunilkumarmswa22No ratings yet

- Guidelines For Submission of Investment Proofs For F Y 13-14Document5 pagesGuidelines For Submission of Investment Proofs For F Y 13-14Harshal PanditNo ratings yet

- Notes On Provident Fund & E.S.IDocument2 pagesNotes On Provident Fund & E.S.IBhumika Pithadiya100% (2)

- Tax Savings Declarations GuidelinesDocument13 pagesTax Savings Declarations GuidelinesAditya DasNo ratings yet

- Income Taxation of Employees in The PhilippinesDocument4 pagesIncome Taxation of Employees in The Philippinesjoan villacastinNo ratings yet

- FAQ-Employee Provident Fund.311162455Document5 pagesFAQ-Employee Provident Fund.311162455penusilaNo ratings yet

- Tax Treatment For Family Members Working in The Family Business - Internal Revenue ServiceDocument2 pagesTax Treatment For Family Members Working in The Family Business - Internal Revenue ServiceJNo ratings yet

- Frequently Asked Questions - Atal Pension Yojana: I. Opening of Apy AccountDocument15 pagesFrequently Asked Questions - Atal Pension Yojana: I. Opening of Apy AccountKirti VNo ratings yet

- SSSFormDocument2 pagesSSSFormCY Lee100% (1)

- Provident Fund 164Document20 pagesProvident Fund 164nihirajoshi2023No ratings yet

- 1701 GuidelinesDocument4 pages1701 GuidelinesJazz techNo ratings yet

- Reasons of RejectionDocument5 pagesReasons of RejectionImdadul AhmedNo ratings yet

- 5500 InformationDocument2 pages5500 InformationlanierupshawNo ratings yet

- Income Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonDocument6 pagesIncome Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonChira Rose Fejedero NeriNo ratings yet

- National Health Insurance Management Authority Press ReleaseDocument3 pagesNational Health Insurance Management Authority Press Releasedon KingNo ratings yet

- Employers GuideDocument12 pagesEmployers GuideteolichNo ratings yet

- Accounting and Reporting For Private Not-For-Profit EntitiesDocument42 pagesAccounting and Reporting For Private Not-For-Profit EntitiesJordan YoungNo ratings yet

- The Employee's Provident Fund Act 1952Document26 pagesThe Employee's Provident Fund Act 1952Manali SondouleNo ratings yet

- Contribution Rate Employee (12%)Document4 pagesContribution Rate Employee (12%)Kiran MettuNo ratings yet

- Guidelines On Securing Philhealth As of April 8 2022Document4 pagesGuidelines On Securing Philhealth As of April 8 2022mpNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Adv2018 0002Document1 pageAdv2018 0002Mox LexNo ratings yet

- Circ03 2001Document14 pagesCirc03 2001Mox LexNo ratings yet

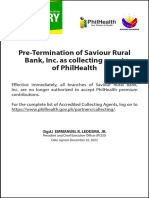

- Pa2024 0001Document1 pagePa2024 0001Mox LexNo ratings yet

- Circ38 2000Document2 pagesCirc38 2000Mox LexNo ratings yet

- Adv2018 0004Document1 pageAdv2018 0004Mox LexNo ratings yet

- Ad11 01 2006Document1 pageAd11 01 2006Mox LexNo ratings yet

- Circ32 2000Document1 pageCirc32 2000Mox LexNo ratings yet

- Ad06 02 2006Document1 pageAd06 02 2006Mox LexNo ratings yet

- Ad06 001 2006Document1 pageAd06 001 2006Mox LexNo ratings yet

- Circ02 2001Document1 pageCirc02 2001Mox LexNo ratings yet

- Circ24 2000Document1 pageCirc24 2000Mox LexNo ratings yet

- Ad05 001 2006Document1 pageAd05 001 2006Mox LexNo ratings yet

- adOWWA TransferDocument1 pageadOWWA TransferMox LexNo ratings yet

- Circ11 2000Document10 pagesCirc11 2000Mox LexNo ratings yet

- Circ20 2000Document2 pagesCirc20 2000Mox LexNo ratings yet

- Adv2021 003Document1 pageAdv2021 003Mox LexNo ratings yet

- Circ19 2000Document1 pageCirc19 2000Mox LexNo ratings yet

- Circ15 2000Document2 pagesCirc15 2000Mox LexNo ratings yet

- Circ18 2000Document2 pagesCirc18 2000Mox LexNo ratings yet

- Circ12 2000Document2 pagesCirc12 2000Mox LexNo ratings yet

- Circ09 2000Document2 pagesCirc09 2000Mox LexNo ratings yet

- Circ08 2000Document1 pageCirc08 2000Mox LexNo ratings yet

- Ad08 02 2006Document1 pageAd08 02 2006Mox LexNo ratings yet

- Ad01 01 2006Document1 pageAd01 01 2006Mox LexNo ratings yet

- Ad10 01 2006Document1 pageAd10 01 2006Mox LexNo ratings yet

- Ad07 02 2006Document1 pageAd07 02 2006Mox LexNo ratings yet

- Ad06 03 2006Document1 pageAd06 03 2006Mox LexNo ratings yet

- Ad02 01 2006Document1 pageAd02 01 2006Mox LexNo ratings yet

- Ad03 03 2006Document1 pageAd03 03 2006Mox LexNo ratings yet

- Ad04 02 2006Document1 pageAd04 02 2006Mox LexNo ratings yet