Professional Documents

Culture Documents

EOQApplication Pharma

EOQApplication Pharma

Uploaded by

manshi choudhury0 ratings0% found this document useful (0 votes)

14 views7 pagesOriginal Title

EOQApplicationPharma

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views7 pagesEOQApplication Pharma

EOQApplication Pharma

Uploaded by

manshi choudhuryCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

EOQ Application in a Pharmaceutical

Environment: A Case Study

Roch Ouellet*

Jacques Roy**

Claude Cardinat***

‘Yves Rosconi***

ABSTRACT

This paper describes a successful application

of classical inventory theory at a drug manufac-

turing plant located in Monireal that has resulted

in annual savings in the order of $110,800 and

assisted management in its decision to invest in

larger production equipment. The basic assump-

tions underlying EOQ models are reviewed and

dealt with. For instance, an algorithm was devised

to handle the peaks in the demand of many A-

class items. Following the implementation of this

algorithm, buffer stocks were reduced signifi-

cantly while maintaining the same high levels of

service.

INTRODUCTION

The economic order quantity (E.O.Q.) formula,

first derived by F. W. Harris [6] in 1915, is still

demonstrated in most operations management

textbooks and introductory courses. It is a quite

simple formula but it cannot be applied blindly to

real world problems because of its simplifying

assumptions. However, we feel that it is still a

very useful tool when applied carefully and this

Paper illustrates one such application at a drug

manufacturing plant located in Montreal. It resulted

in annual savings in the order of $110,800 and

assisted management in its decision to invest in

larger production equipment.

Inventory control problems have been studied

extensively in the operations management and

Management science literature in the past three

decades. A recent survey (3] indicates that research

Papers on inventory control accounted for 22% of

articles published in four major journals dealing

‘Eoole des Hautes Etudes Commerciales, Montreal, Canada

"Université du Québec & Montréal, Montreal, Canada

***RhGne-Poulene Pharma Ine, Montreal, Canada

ournal of Operations Management

with operations management subjects in the last 2

years. But, while a great deal of this research has

proposed methods and techniques to improve

inventory control, today’s real world problems

still require more attention from researchers that

will help close the gap between the academic and

practicing worlds (2, 11, 12, 13].

Recently, many successful applications of clas-

sical inventory theory were reported in the liter-

ature [1, 5, 7, 8, 9]. But, at the same time, some

authors were concerned with the validity of clas-

sical theory [4] and others expressed the need for

a better definition of the parameters used in these

inventory models [12]. These aspects were con-

sidered in this application and will be discussed

later on.

PROBLEM DEFINITION

A drug manufacturing company (Rhéne-Poul-

enc Pharma Inc.) wishes to reduce its operating

costs while maintaining a high level of service to

its customers. In this section, we briefly describe

the company’s product line and production-inven-

tory planning and control system.

Product Line

The company produces 31 drugs in one or many

categories, e.g., tablets, capsules, creams, sup-

Positories, parenterals and oral liquids. Each cat-

egory refers to a specific production process. Fur

thermore, in a given category, a drug may be pro-

duced with varying doses, e.g., 10, 25, 50 or 100

mg per unit. These are produced independently

and are therefore considered as different “‘prod-

ucts” in our study. Finally, a drug falling into a

specific category with a given dosage, e.g. 25 mg

capsule, may be offered to the market in packages

of different sizes, e.g. packages of 100 and 500

capsules of a drug with a 25 me dose. These are

considered as different final products or “items”

while their production follows the same basi

Process except for the final packaging step.

”

Therefore, the 31 drugs produced by the com-

pany are in fact broken down into some 86 differ-

ent products put into packages of different sizes

for a total of 140 final products or items.

Forecasting

‘The marketing department is responsible for

producing forecasts. While they prepare point

forecasts of the monthly demand for all items, the

horizon and the revision period vary according to

the item class. The monthly demand for A-class

(see Figure 1, ABC Analysis) and seasonal items

is forecasted on a 6-month time horizon and fore-

casts are revised monthly. Forecasting for all other

items is made on a time horizon of one year, at

the beginning of each year.

Production Processes

We are dealing with standard products that are

produced in batches for inventory. There is one

production process for each of the product cate-

gories referred to previously. These production

processes involve efficient special-purpose equip-

ment and extensive quality control analyses that

imply high setup costs. To illustrate, Table 1 shows

the operations involved in the manufacturing of a

given capsule in batches of different sizes. First,

the ingredients are weighed and mixed together

according to a predetermined formula. It can be

seen from Table | that the time required to per-

form these operations does not vary much with

volume. The next operation is an in-process anal-

FIGURE 1

ABC Analysis

Percentage of sna ss lr sahe)

Percentage eitems1008- Hotes)

50

ysis required to ensure that the previous oper-

ations are performed correctly, especially with

respect to product homogeneity. The drug is then

fed into a capsule filling machine that is designed

to operate at high speeds and high outputs. The

production batch is then analyzed according to

specifications before it is finally packaged in bot-

tes of 100 and/or S00 capsules.

Planning and Control

We now briefly describe how the production

inventory system is managed. Three levels of

planning are used: aggregate on a yearly basis,

intermediate on a three-month basis and detailed

ona three-week basis. Production planning is based

onsales forecasts (described earlier), on the estab-

lishment of service levels that determine buffer

stocks requirements, and on production capacity.

The materials control department is responsible

for placing orders to the production department:

when stock levels for some item reach the reorder

point, considering sales forecasts and production

lead time, they place orders for each of the items

of this product (see Appendix 1). This fixed reor-

der quantity system triggers production orders of

a fixed batch size that is determined, for each

product, by computing the optimal quantity to

produce, as shown later on in the text. This enables,

the production department to plan its workload

and requirements in terms of manpower and raw

materials and to schedule production operations

accordingly.

The Impact of Government Regulations on

Production Management

‘An important characteristic of the drug industry

is that it is highly regulated; in particular, each

production batch has to be clearly identified with

TABLE 1

Production Process for a Given Capsule

Time Variable (hours)

Fixed |100,000]500,000| 1,500,000] 2,000,000

Operation | chours) | units | units | “units | units

Weighing | 1.00 | 075 | o7s| 150 | 1.50

Mixing 1.75 | 200 | 200| 350 | 400

in-process | 325 | — | — 7 Es

analysis.

Icapsule | 480 | 5.00 | 2600 | 45.00 | 67.00

filling |

Final 2600} — | — - -

analysis,

Packaging | 250 | 1.00 | 350 | 600 | 9.00

(Total 39.00 | 07s | 32.25 | 5600 | 6150 |

American Production and Inventory Control Society

a lot number and kept isolated from other batches

Until its final approval. This situation motivates

the production manager to standardize the pro-

duction process and favours production runs of

equal size for each product. This means that the

size of the orders placed for a given product by

the materials control department should be equal

toa preset production quantity. It also means that

the final products or items identified with a pro-

duction batch cannot be stored away or shipped

to the clients in part lots, as in many other man-

ufacturing settings, until the whole batch has been

approved. This feature enables us to determine

the optimal number of production runs (cycles)

for each product, by means of a model similar to

the classical EOQ model.

THE MODEL

Assuming that shortages are not considered at

this stage, the total incremental cost formula can

be expressed as follows for a typical product packed

into many (J) items:

TC =(C,+ SCY-N+>DC,D2N (1)

Where : TC

C,

Total costs

Fixed cost related to the pro-

duction of a lot

Cy = Fixed cost related to placing an

order for item j

= Unit inventory holding cost per

year for item j

Annual demand for item j

Number of items of a given

product

Number of production runs per

year for the product.

2

vow

Zz

f

Then, the optimal number of production runs (or

cycles) per year can be found by classical optim-

ization with the resulting formula:

+= [2x 7”

Ne la + Soo]

and the optimal quantity to produce, Q,*, simply

becomes: Q*= DJN*.

@

DISCUSSION

In this section, the basic assumptions underly-

ing classical EOQ models are reviewed and dealt

with.

Journal of Operations Management

The Cost Elements

Classical inventory theory models, like the one

used in our application, are often criticized because

of the problems faced when trying to define and

effectively measure the relevant costs. A recent

paper [4] suggests that these costs are “virtually

impossible to measure” and that more emphasis

should be placed on macro level policy analysis

While recognizing the difficulties associated with

costs measurements in general, we cannot agree

with the impossibility of applying EOQ models

and we will thus explain how the relevant costs

were obtained in our application.

Fixed costs associated with a production run—

These consist of setup costs (C,) and ordering

costs (C,) for each item j. Setup costs are found

by computing the dollar value of the labor hours

required for machine setups and batch analyses.

Ordering costs (C,.) are incurred whenever an order

placed for a specific item of a given product and,

in our case, are the same for each item So the

total fixed costs associated with a production run

(C, + & C,) simply becomes (C, + J+ Ca).

In our case, J is always very small: J = 1 or 2.

Since C,, is much less than C,, the total ordering

costs for a production run (JC,) are by far less

important than the setup costs. (See appendix 2

for a detailed example.)

While we are quite confident about the reliabil-

ity and true marginality of setup costs (see Table

|, for example), we nevertheless have some doubts

about ordering costs. So we performed a sensitiv.

ity analysis on the latter ones and found, as

expected, that even drastic changes in their value

would not change the optimal solution signifi-

cantly for most products (see Table 2),

Inventory holding costs— Inventory holding costs

were set at 30% of the value of items carried in

inventory. This cost was obtained by adding the

Opportunity cost of capital (19%) to the ware-

housing, insurance, obsolescence and damage costs

(16%) for a total of 35%. This was then multiplied

by the percentage of direct variable production

costs (raw materials and labor) over the total pro-

duction cost normally used to compute the inven-

tory value, Indeed, as explained in Rhodes [10],

all fixed costs should be excluded from the inven:

tory values used when calculating the holding cost,

In our case, fixed production costs represent only

15%, so we multiply 35% by 85% and obtain an

inventory holding cost of 30% (rounded value).

Of course, in a period where interest rates are

fluctuating very rapidly, it is becoming more and

more difficult to assess a proper value for the cost

st

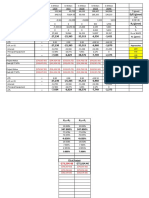

TABLE 2

Sensitivity Analysis for Ten Products

ecco Oeamanicn Sensitivity Analysis (+)

1 = 30% |i = 30% [1 = 25% ]I = 25% 1 = 85% [I = 40%

Product C= $70 |C,=$70 | C,=$70 |C,= $0 ©., = $70

1 [Ne 2077 480 442, 468 5.08 520 557 5.90

Te | siesi7 6222 10.33% | 100.02% | 10.17% | 100.32% | 101.12% | 102.16%

2 [N 9.65 4.08 371 477 4a | 438 470 5.56

To | s27ea $2006 10.46% | 100.0% | 101.45% | 100.27% | 101.03% | 104.6%

3 [N 18.22 sa | 478 563 620 587 599 7.08

To | $4955 $2645 | 100.45% | to0.s9% | 101.35% | 100.18% | 10.84% | 10432%

4 [N 287 483, 441 5.13 5.62 522 5.58 649

To | $2954 $2593, 100.43% | 100.20% | to1.te% | 10031% | 101.04% | 10443%

3 [NT 24 a7 7.95 9.05 993) 942 10.03 11.43,

To | $8257 $5300 100.43% | 10.07% | 10.87% | 10.32% | 101.01% | 103.73%

é [N 18.38 715 652 aos | aes | 773 «| 823 10.15

To | $8630 $5835, 10.41% | 100.71% | 102.20% | 10.27% | 10.96% | 106.18%

7 [we | 1578 525 479 569 624 5.66 6.06 721

To | seae4 $5023 100.1% | 10093% | 101.50% | 100.29% | 107.09% | 108.08%

a [N 25.44 895 817 10.19 11.16 9.66 10.33 1288

Te | $1216 $7024 100.42% | 10.83% | 102.45% | 10030% | 10103% | 106.71%

o [N 1.15) 261 2.39) 258 281 282 301 325

Te | $9610 $2658, 100.3% | 100.02% | 100.33% | 10032% | 101.06% | 102.42%

10 [Nv 51.32 1981 1809 2092 22.82 21.40 22.88 28.46

Te | sa2675 | $21,960 100.41% | 10.18% | 101.07% | 10.90% | 101.04% | 104.22%

with present production equipment

Inventory holding cost (as a percentage of value)

Ordering cost for one item

Number of runs per year

(+) with larger production equipment

Total costs per year (dollar value or percentage of minimal total costs: see note below)

Let TC{N|,C,) be the total costs per year, as given by 1), when N is the number of production runs per year, when the inventory

holding cost is set at | percent of the value of the product, and when Cy, is the ordering cost for one item. The "TC" line for

product 1 contains.

—in column “Before,” the value of TC(27-77, 30%, $70)

—in column “Optimum, the value of TC(4.80, 30%, $70)

in the six columns of the sensitivity analysis the total costs using 4.80 runs per year, as a percentage of the minimal total

costs. For example, if| = 25% and C.,

the minimal total costs are then TO(4.42, 25%, $70)

100.83% of the minimum TC:

70, the optimal number of runs per year for product 1, as given by (2) is 4.42: and

$5729; under the hypothesis that the true values of | and Cx are 25%

and $70 respectively, the TC obtained by setting N equal to the value 4.80 given in the column “Optimum,” are $5748, Le.

100,83 = 100 x 574815729 = 100 x TO(4.80, 25%, $70\TO(4.42, 25%, $70),

Similary,

100.02 = 100 x TO(4.80, 25%, $0)TC(4.68, 25%, $0).

Therefore, the total costs per year for product 1 are quite insensitive to the values of | and C,.

of capital, which is a major element in the value

of inventory holding costs. This is why a sensitiv-

ity analysis was also performed on this cost com-

ponent (see Table 2) in order to ensure that our

solutions would remain valid inside a range of

realistic inventory holding costs.

3

Shortage costs— Shortage costs are not known

and are not considered in the model. However,

the very important topic of customer service in

terms of stock availability will be treated in the

next section.

American Production and Inventory Control Society

‘The Demand

A basic assumption for the use of EOQ models

is that the demand and lead time are known and

constant. In our case, the lead time consists mainly

of the time required to produce a batch and is well

known. However, the demand may vary signifi-

cantly from month to month. Indeed, some prod-

ucts are highly seasonal while others have a rather

constant demand except for peaks in June and

December. (These peaks arise from major custom-

ers placing orders immediately before the regular

price increase periods.)

So we performed an ABC analysis (see Figure

1) in order to study more carefully the behaviour

of the demand for the 20% of items falling into the

A class and representing 70% of the dollar value

of annual sales. We found that seasonal items were

less important ones (B + C classes) and that they

could be handled by computing two different lot

sizes corresponding to the periods of high and low

demands.

‘The demand for most A-class items was rather

steady with peaks just before the two annual price

increase periods. We decided to handle these peaks

by scheduling one or more production runs of

economic size which are to be ready and delivered

Just in time to meet the extra demand. We will

illustrate this approach with a typical product. To

simplify, let us assume that it is put into a single

size package, i.e. that there is only one item. We

first use the forecast annual demand D, in the

formula (2): we get the optimal number N.* of

lots, and the economic lot size Q,* = DJN.*.

Now, for each peak period, extra production runs

of size Q,* are scheduled. But these extra lots are

delivered immediately when ready: therefore, no

holding cost should be charged for them and the

cost function (1) should use the corrected demand

D, = D, ~ kQ.*

where k is the total number of extra lots and is

now determined manually (but see below). Let us

denote N,* the new optimal solution computed

from (2) when using the corrected demand. This

means that we are to produce a total of N;* + k

lots: N,* to meet the normal demand, and k to

meet the extra demand in peak periods. If N.* +

k 4 N,*, the economic lot size is not Q,*, but Q,*

= D,(N\* + k). And we should apply the formula

(2) to the re-corrected demand D; = D, — kQ;*.

So we iterate . . . This procedure can be formal-

ized as the following algorithm (we assume here

that D,, No*, Q.*, and k are already known):

Step I. Seti =1

Journal of Operations Management

Step 2. Set D; = D, — kQi,

Step 3. Compute (2) with this demand D, and

obtain N*

Step 4. Define Q* = DJ(N* + k)

Step 5. If the total number of lots for iteration

i (that is, N\* + k) is nearly equal to the

total number of lots for the previous

iteration (that is, N,* when i = 1, and

Ni, + k when i >'1), then go to step

6. If not, set i = i+1 and go back to

step 2.

Step 6. The current values of N* and Q* are

optimal. Stop.

This algorithm converges very fast: typically, only

one or two iterations are needed. This comes as

no surprise since the cost curve of the EOQ model

is known to be quite flat near the optimum.

In our application, the total number k of extra

lots was always very small and was in fact chosen

as one of the integers surrounding the quotient

(Di + DigiQ.*, where Q,* is the economic lot

size as given by (2) using the forecast annual demand

D,, and where D; (Djs) is the extra demand in

June (December), that is the difference between

the demand in June (December) and the average

demand for the other 10 months. For none of the

products, the last Q,* obtained from the algorithm

differed from Q,* enough to trigger a change in k.

But if we had to change k, it would be easy to

extend the algorithm to compute also the best

value of k. We should only add a new step, num-

bered as 0, and change the step 6:

Step 0. Define k as the nearest integer to the

quotient (Dz + Dj/Q,*.

Step6. Iflk ~ (Dj + Div/Q#*!>.5, setk equal

to the nearest integer to the quotient

(Dé + Di3/Q\*, and go back to step 1.

Otherwise, stop.

In practice, one may prefer to use in step 6 a

constant greater than .5 (e.g. .7) in order to elim

nate closed-loop situations.

For almost all products, the items have parallel

peak periods. The algorithm we described above

can be applied to this generalized context with

only minor and easy modifications. The demand

for both items of the product referred to previ

ously showed 2 peak periods, in June and

December; each peak period necessitated one extra

lot, so that here k = 2; in this example, we got

N,* = 20, N\* = 19, Ns* = 19. (For the few

products whose items have non-parallel peak peri-

ods, the mix of the items in the extra lots would

53

differ from the mix in the normal lot

procedures are applied in such a case.)

The fluctuations of the demand do not affect

markedly the economic lot size, but they have a

significant impact on the buffer stocks. For exam-

ple, the actual monthly demand for some item of

the product referred to in Table | has a standard

deviation of 1291 units. After adjusting it by sub-

tracting one extra lot to the demand of the two

peak months, we got a standard deviation of 728

units, i.e. a standard deviation which was only

56% of the standard deviation for the unadjusted

data. This result is of importance since the buffer

stock B is usually computed as

ad hoc

B= no

where o is the standard deviation of the demand

during the lead time, and the safety factor n is a

constant related to the predetermined service level.

Therefore, the amount of inventory kept as a buffer

against shortages due to the variability of demand

could be reduced by almost half for a similar pro-

tection (service level)

IMPLEMENTATION AND RESULTS

The model described above was implemented

by the company management during the summer

of 1981. On the basis of 1980 figures, the applica

tion of formula (2) to the 86 products would result

in potential savings of $85,800 due mainly to

reductions in setup costs. Table 3 gives a break-

down of savings by product category

On the basis of these results, the company man-

agement has decided to reconsider its production

batch sizes. Through a cost-benefit analysis, it was,

found that first year savings justified the invest-

ment in the larger production equipment required

to increase batch sizes.

So far in 1981-82, these changes have led to a

reduction of 164 man-hours per week in the pro-

duction and quality control departments. This was

TABLE 3

Breakdown of Savings by Product Category

Product category Cost savings

Tablets and capsules $50,100

Creams and suppositories $22,100

Parenterals $ 9,700

Oral liquids $ 3,900

Total $85,800

5

accomplished through normal attrition and

rescheduling of some employees on four-day weeks.

Following our analysis of the demand functions,

buffer stocks were reevaluated and additional sav

ings of $25,000 were identified while maintaining

the present high standards of service in terms of

stock availability.

Finally, the production of larger lots facilitates

production planning activities by reducing the

number of production orders or cycles.

CONCLUSION

This paper demonstrates that a careful appli-

cation of classical EOQ models can still generate

substantial savings today. Such models are more

readily understood and accepted by management

than more complex “black box”’ types of inven-

tory models. Furthermore, the computations

required for the 86 products were quite easy and

cheap to perform. As a matter of fact, all compu-

tations were performed on a programmable hand-

held calculator.

ACKNOWLEDGEMENTS

The authors wish to express their thanks to Pro-

fessor Gilbert Laporte who read a first draft of thi

paper and made helpful comments, and to the

referees and editors of the journal for their valu-

able comments and suggestions.

REFERENCES

1. Austin, L. M., “Project EOQ: A Success Story in Implementing

‘Academic Research,” Interfaces, Vol. 7, No. 4 (August 1977,

pp. I

Bulla, E. S., "Research in Operations Management."* Journal

‘of Operations Management, Vol. 1, No. 1 (1980), pp. 1-7

3. Chase, R. B., “A Classification and Evaluation of Research in

Operations Management,"* Journal of Operations Management,

Vol. 1, No. 11980) pp. 9-14

4. Gardner, E. 8., Jr, "Inventory Theory and the Gods of Olym

pus," Interfaces, Vol. 10, No. (August 1980), pp. 42-85

5. Gross, D., Harris, C. M., and Robets,P. D., “Bridging the Gap.

Between Mathematical Inventory Theory and Construction of a

‘Workable Model," International Journal of Production Research,

Vol. 10, No, 3 (1972), pp. 201-214

6, Harris, F., Operations and Cost, Factory Management Series,

A.W, Shaw Co., Chicago, 1915.

7. Jaikumat, R.and Ran, U. R., "An On-Line Inte

Management System," Interfaces, Vol.7, No.1,

ber 1976), pp. 19-30.

8. Laurence, M. J., “An Integrated Inventory Control System,”

Interfaces, Vol. 7, No. 2 (February 1977), pp. 5

9, Liberatore, M.J., “Using MRP and EOQ\Safety Stock for Raw

Materials Inventory Control: Discussion and Case Study.

Interfaces, Vol. 9, No.2, Part | (February 1979), pp. 1-6.

10. Rhodes, P_, “Iaventory Carrying Cost May Be Less than You've

Been Told.” Production & Inventory Management Review and

APICS News, Oct. 981, pp. 35-36

American Production and Inventory Control Society

11, Silver, E. A.. “Operations Research in Inventory Management:

‘AReview and Critique,” Opas. Res., Vol.29, No. 4(Uuly-August

1981), pp, 628-648.

12, Wagner, H. M., “Research Portfolio for Inventory Management

and Production Planning Systems." Opns. Res., Vol. 29, No. 3,

Part 1 (May-June 1980), pp. 445-475,

13, Zanakis, S. H. etal. “From Teaching to Implementing Inven-

tory Management," interfaces, Vol. 10, No.6 December 198),

pp. 103-110.

APPENDIX 1. REORDER POINT SETTING

ler point setting procedure is used by the

yn department t¢ itiate the manufactur-

ing of a product batch. This procedure, as illus-

trated in the following example, takes into account

the randomness of the demand during the lead

time period by adding a buffer stock to the average

demand.

Product Y

Pharmaceutical form: Capsules

Item : Bottle of 100 capsules

Average sales per month : 421 bottles

Standard deviation 60 bottles

1) Production lead time : 8.9 days

weighing: 0.5 days

mixing : 0.6 days

sieving 0.9 days,

encapsulating : 4.7 days

cleaning 1.3 days

packaging —: 0.9 days

8.9 days

2) Lead time related to production variations :

3 days

The encapsulating step requires a three-day

buffer stock.

3) Analytical testing lead time : 3.7 days

4) Total lead time and buffer stock :

Total lead time:

L = 8.9 +3 + 3.7 = 15.6 days

Standard deviation for lead time:

a = om x VERO

= 60 x VI5.620 = 53 bottles

Buffer stock to implement a service level of

95% (under the normality hypothesis)

B = no, = 1.65 x 53 = 87.5 bottles

5) Reorder point:

Average demand for lead time:

D = 421 x 15.6/20 = 328.4 bottles

Reorder point

R =D + no, = 328.4 + 87.5 = 416 bottles

Journal of Operations Management

APPENDIX 2. FIXED COSTS FOR A TYPICAL

PRODUCT

We compute here the fixed costs associated with

a production run for a typical product.

Setup Costs:

They amount to $577.42 and are found as fol-

lows:

1) Total Analysis Costs ($553.30)

i) Biology laboratory costs ($434.50). These

costs were found by computing the total fixed

hours of analysis required per batch and mul-

tiplying by the hourly rate of operation at the

biology laboratory:

11 hours/batch x $39.50/hour =

$434.S0/batch

ii) Control laboratory costs ($118.80). These

costs were found as described above:

6hours/batch x $19.80/hour = $118.80/batch

2) Production setup costs ($24.12). These costs

were found by computing the total fixed

operation time associated with a production

run and multiplying by the hourly rate paid

to production employees. Fixed operations

consist of setting up weighing and mixing

operations, raw material transportation from

storage, weight adjustments, equipment

cleaning and internal transfer of in-process

inventories. For our typical product, these

fixed operations required 2.75 hours at an

hourly rate of $8.77, for a total cost of $24.12

per production run

3) Total setup costs (C,). Total setup costs are

then simply found by adding total analysis

costs to production setup costs:

C, = $553.30 + $24.12 = $577.42

Ordering Costs:

‘They are allocated in the following manner:

—Personnel originating the order: $ S/order

—Computer processing : $25/order

—Placing raw materials and

production orders $15/order

—Packaging and control $25/order

Total ordering costs: $70/order

This typical product is offered in two different

packages. Therefore, each production run requires

two orders, one for each item, and the total order-

ing costs per production run is $140. This figure is

by far less important than the amount of $577.42

which represents the total setup costs.

55

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Faircent™ - Powering P2P Lending Revolution - Group 1 - PBMODELDocument3 pagesFaircent™ - Powering P2P Lending Revolution - Group 1 - PBMODELmanshi choudhuryNo ratings yet

- DelhiveryDocument2 pagesDelhiverymanshi choudhuryNo ratings yet

- CRM Quiz2Document240 pagesCRM Quiz2manshi choudhuryNo ratings yet

- 2022 Biswajeet CRMpart 1Document30 pages2022 Biswajeet CRMpart 1manshi choudhuryNo ratings yet

- Global Journalof Pureand Applied MathematicsDocument8 pagesGlobal Journalof Pureand Applied Mathematicsmanshi choudhuryNo ratings yet

- Analysis of Inventory Management by Using Economic Order Quantity Model - A Case StudyDocument10 pagesAnalysis of Inventory Management by Using Economic Order Quantity Model - A Case Studymanshi choudhuryNo ratings yet

- Mergers Acquisition CaseStudyDocument4 pagesMergers Acquisition CaseStudymanshi choudhuryNo ratings yet

- Cloud Implementation by Mindtree - Group 10Document11 pagesCloud Implementation by Mindtree - Group 10manshi choudhuryNo ratings yet

- The Circular Economy of Tata in ActionDocument16 pagesThe Circular Economy of Tata in Actionmanshi choudhuryNo ratings yet

- CRM Term Project BriefDocument2 pagesCRM Term Project Briefmanshi choudhuryNo ratings yet

- The IB League 2022 - Support File - XIMB - Team BlastersDocument2 pagesThe IB League 2022 - Support File - XIMB - Team Blastersmanshi choudhuryNo ratings yet

- Splat StudiosDocument1 pageSplat Studiosmanshi choudhuryNo ratings yet

- What Is The Right Supply ChainDocument1 pageWhat Is The Right Supply Chainmanshi choudhuryNo ratings yet

- PM Gray Chapter 7 PERT Appendix Ex 7.1 - 7.2Document5 pagesPM Gray Chapter 7 PERT Appendix Ex 7.1 - 7.2manshi choudhuryNo ratings yet

- Test Report: Molecular Analysis For Qualitative Detection of Sars-Cov-2Document1 pageTest Report: Molecular Analysis For Qualitative Detection of Sars-Cov-2manshi choudhuryNo ratings yet

- Keeping The Lights On BCP WhitepaperDocument15 pagesKeeping The Lights On BCP Whitepapermanshi choudhuryNo ratings yet

- FLSmidthDocument24 pagesFLSmidthmanshi choudhuryNo ratings yet

- A Simpler Way To Modernize Your Supply ChainDocument3 pagesA Simpler Way To Modernize Your Supply Chainmanshi choudhuryNo ratings yet