Professional Documents

Culture Documents

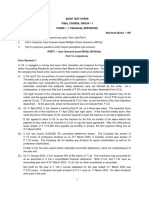

FR 1 New Question Paper

Uploaded by

Raj MittalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FR 1 New Question Paper

Uploaded by

Raj MittalCopyright:

Available Formats

This Question Paper is copyrighted property of AIR1CA Career Institute.

Sharing and Circulating it without

permission is punishable offence.

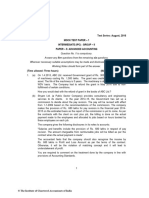

CA FINAL NEW COURSE (May 2022)

GROUP I – PAPER 1

FINANCIAL REPORTING

(Series 1)

Time Allowed: - 3 Hours Maximum Marks: 100

This paper comprises 6 questions. Question No. 1 is compulsory. Attempt

any 4 questions out of the remaining 5 questions.

Marks

1 H Ltd. acquired equity shares of S Ltd., a listed company, in two tranches as 20

mentioned in the below table:

Date Equity stake Remarks

purchased

1st November, 20X6 15% The shares were purchased based on

1st January, 20X7 45% the quoted price on the stock

exchange on the relevant dates.

Both the above-mentioned companies have Rupees as their functional currency.

Consequently, H Ltd. acquired control over S Ltd. on 1st January, 20X7. Following

is the Balance Sheet of S Ltd. as on that date:

Particulars Carrying value Fair value

(₹ in crore) (₹ in crore)

ASSETS:

Non-current assets

(a) Property, plant and equipment 40.0 90.0

(b) Intangible assets 20.0 30.0

(c) Financial assets

- Investments 100.0 350.0

Current assets

(a) Inventories 20.0 20.0

(b) Financial assets

- Trade receivables 20.0 20.0

- Cash held in functional currency 4.0 4.5

Non-current asset held for sale 4.0 4.5

TOTAL ASSETS 208

EQUITY AND LIABILITIES:

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 1

Equity

(a) Share capital (face value ₹ 100) 12.0 50.4

(b) Other equity 141.0 Not applicable

Non-current liabilities

(a) Financial liabilities

- Borrowings 20.0 20.0

Current liabilities

(a) Financial liabilities

- Trade payables 28.0 28.0

(b) Provision for warranties 3.0 3.0

(c) Current tax liabilities 4.0 4.0

TOTAL EQUITY AND LIABILITIES 208.0

Other information:

Property, plant and equipment in the above Balance Sheet include leasehold

motor vehicles having carrying value of ₹ 1 crore and fair value of ₹ 1.2 crore. The

date of inception of the lease was 1st April, 20X0. On the inception of the lease, S

Ltd. had correctly classified the lease as a finance lease. However, if facts and

circumstances as on 1st April, 20X7 are considered, the lease would be classified as

an operating lease.

Following is the statement of contingent liabilities of S Ltd. as on 1st January,

20X7:

Particulars Fair value Remarks

(₹ in crore)

Law suit filed by a 0.5 It is not probable that an outflow of

customer for a claim resources embodying economic benefits

of ₹ 2 crore will be required to settle the claim.

Any amount which would be paid in

respect of law suit will be tax deductible.

Income tax demand 2.0 It is not probable that an outflow of

of ₹ 7 crore raised resources embodying economic benefits

by tax authorities; S will be required to settle the claim.

Ltd. has challenged

the demand in the

court.

In relation to the above-mentioned contingent liabilities, S Ltd. has given an

indemnification undertaking to H Ltd. up to a maximum of ₹ 1 crore.

₹ 1 crore represents the acquisition date fair value of the indemnification

undertaking.

Any amount which would be received in respect of the above undertaking shall

not be taxable.

The tax bases of the assets and liabilities of S Ltd. is equal to their respective

carrying values being recognised in its Balance Sheet.

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 2

Carrying value of non-current asset held for sale of ₹ 4 crore represents its fair

value less cost to sell in accordance with the relevant Ind AS.

In consideration of the additional stake purchased by H Ltd. on 1st January, 20X7,

it has issued to the selling shareholders of S Ltd. 1 equity share of H Ltd. for every

2 shares held in S Ltd. Fair value of equity shares of H Ltd. as on 1 st January, 20X7

is ₹ 10,000 per share.

On 1st January, 20X7, H Ltd. has paid ₹ 50 crore in cash to the selling shareholders

of S Ltd. Additionally, on 31st March, 20X9, H Ltd. will pay ₹ 30 crore to the selling

shareholders of S Ltd. if return on equity of S Ltd. for the year ended 31 st March,

20X9 is more than 25% per annum. H Ltd. has estimated the fair value of this

obligation as on 1st January, 20X7 and 31st March, 20X7 as ₹ 22 crore and ₹ 23

crore respectively. The change in fair value of the obligation is attributable to the

change in facts and circumstances after the acquisition date.

Quoted price of equity shares of S Ltd. as on various dates is as follows:

As on November, 20X6 ₹ 350 per share

As on 1st January, 20X7 ₹ 395 per share

As on 31st March, 20X7 ₹ 420 per share

On 31st May, 20X7, H Ltd. learned that certain customer relationships existing as

on 1st January, 20X7, which met the recognition criteria of an intangible asset as

on that date, were not considered during the accounting of business combination

for the year ended 31st March, 20X7. The fair value of such customer relationships

as on 1st January, 20X7 was ₹ 3.5 crore (assume that there are no temporary

differences associated with customer relations; consequently, there is no impact

of income taxes on customer relations).

On 31st May, 20X7 itself, H Ltd. further learned that due to additional customer

relationships being developed during the period 1st January, 20X7 to 31st March,

20X7, the fair value of such customer relationships has increased to ₹ 4 crore as

on 31st March, 20X7.

On 31st December, 20X7, H Ltd. has established that it has obtained all the

information necessary for the accounting of the business combination and that

more information is not obtainable.

H Ltd. and S Ltd. are not related parties and follow Ind AS for financial reporting.

Income tax rate applicable is 30%.

You are required to provide your detailed responses to the following, along with

reasoning and computation notes:

(a) What should be the goodwill or bargain purchase gain to be recognised by H

Ltd. in its financial statements for the year ended 31st March, 20X7. For this

purpose, measure non-controlling interest using proportionate share of the

fair value of the identifiable net assets of S Ltd.

(b) Will the amount of non-controlling interest, goodwill, or bargain purchase

gain so recognised in (a) above change subsequent to 31 st March, 20X7? If

yes, provide relevant journal entries.

(c) What should be the accounting treatment of the contingent consideration as

on 31st March, 20X7?

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 3

2 (a) P Pvt. Ltd. has a number of wholly-owned subsidiaries including S Pvt. Ltd. at 31st 12

March 20X2. P Pvt. Ltd. consolidated balance sheet and the group carrying amount

of S Pvt. Ltd. assets and liabilities (i.e. the amount included in that consolidated

balance sheet in respect of S Pvt. Ltd. assets and liabilities) at 31 st March 20X2 are

as follows:

Particulars Consolidated Group carrying amount of S

(₹ in millions) Pvt. Ltd. asset and liabilities

Ltd. (₹ in millions)

Assets

Non-Current Assets

Goodwill 380 180

Buildings 3,240 1,340

Current Assets

Inventories 140 40

Trade Receivables 1,700 900

Cash 3,100 1000

Total Assets 8,560 3,460

Equities & Liabilities

Equity

Share Capital 1600

Other Equity

Retained Earnings 4,260

Current liabilities

Trade Payables 2,700 900

Total Equity & Liabilities 8,560 900

Prepare consolidated Balance Sheet after disposal as on 31 st March, 20X2 when P

Pvt. Ltd. group sold 100% shares of S Pvt. Ltd. to independent party for ₹ 3,000

millions.

2 (b) Lessee enters into a 10-year lease for 5,000 square metres of office space. The 8

annual lease payments are ₹ 1,00,000 payable at the end of each year. The interest

rate implicit in the lease cannot be readily determined. Lessee’s incremental

borrowing rate at the commencement date is 6% p.a. At the beginning of Year 7,

Lessee and Lessor agree to amend the original lease by extending the contractual

lease term by four years. The annual lease payments are unchanged (i.e., ₹

1,00,000 payable at the end of each year from Year 7 to Year 14). Lessee’s

incremental borrowing rate at the beginning of Year 7 is 7% p.a.

How should the said modification be accounted for?

3 (a) Mr. Niranjan is working for Infotech Ltd. Consider the following particulars: 8

Year 20X0-20X1 Year 20X1-20X2

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 4

Annual salary ₹ 30,00,000 ₹ 30,00,000

No. of working days during the year 300 days 300 days

Leave allowed 10 days 10 days

Leave taken 7 days 13 days

Leave unutilized carried forward to next 3 days NIL

year

Based on past experience, Infotech Ltd. assumes that Mr. Niranjan will avail the

unutilized leaves of 3 days of 20X0-20X1 in 20X1-20X2.

Infotech Ltd. contends that it will record ₹ 30,00,000 as employee benefits

expense in each of the years 20X0-20X1 and 20X1-20X2, stating that the leaves

will, in any case, be utilized by 20X1-20X2.

Comment on the accounting treatment proposed to be followed by Infotech Ltd.

Also pass journal entries for both the years.

3 (b) On 1st April, 20X1, Makers Ltd. raised a long term loan from foreign investors. The 8

investors subscribed for 6 million Foreign Currency (FCY) loan notes at par. It

incurred incremental issue costs of FCY 2,00,000. Interest of FCY 6,00,000 is

payable annually on 31st March, starting from 31st March, 20X2. The loan is

repayable in FCY on 31st March, 20X7 at a premium and the effective annual

interest rate implicit in the loan is 12%. The appropriate measurement basis for

this loan is amortised cost. Relevant exchange rates are as follows:

1st April, 20X1 – FCY 1 = ₹ 2.50.

31st March, 20X2 – FCY 1 = ₹ 2.75.

Average rate for the year ended 31st Match, 20X2 – FCY 1 = ₹ 2.42. The

functional currency of the group is Indian Rupee.

What would be the appropriate accounting treatment for the foreign currency

loan in the books of Makers Ltd. for the FY 20X1-20X2? Calculate the initial

measurement amount for the loan, finance cost for the year, closing balance and

exchange gain/loss.

3 (c) A holding company [being the entity under consideration] gives a 4

loan/intercorporate deposit to a subsidiary that is recoverable on demand, at a

rate of interest at 10%.

(a) Should such loan be disclosed as a current/non-current asset in the books of

the holding company?

How relevant would the commercial reality of the transaction be in

comparison to the legal terms of the transaction?

(b) How this loan/inter-corporate deposit that is repayable on demand would

be classified in the books of the subsidiary?

4 (a) KK Ltd. has granted an interest free loan of ₹ 10,00,000 to its wholly owned Indian 12

Subsidiary YK Ltd. There is no transaction cost attached to the said loan. The

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 5

Company has not finalised any terms and conditions including the applicable

interest rates on such loans. The Board of Directors of the Company are evaluating

various options and has requested your firm to provide your views under Ind AS

in following situations:

(i) The Loan given by KK Ltd. to its wholly owned subsidiary YK Ltd. is interest

free and such loan is repayable on demand.

(ii) The said Loan is interest free and will be repayable after 3 years from the

date of granting such loan. The current market rate of interest for similar

loan is 10%. Considering the same, the fair value of the loan at initial

recognition is ₹ 8,10,150.

(iii) The said loan is interest free and will be repaid as and when the YK Ltd. has

funds to repay the Loan amount.

Based on the same, KK Ltd. has requested you to suggest the accounting treatment

of the above loan in the stand-alone financial statements of KK Ltd. and YK Ltd.

and also in the consolidated financial statements of the group. Consider interest

for only one year for the above loan.

Further the Company is also planning to grant interest free loan from YK Ltd. to

KK Ltd. in the subsequent period. What will be the accounting treatment of the

same under applicable Ind AS?

4 (b) A shipping company is required by law to bring all ships into dry dock every five 8

years for a major inspection and overhaul. Overhaul expenditure might at first

sight seem to be a repair to the ships but it is actually a cost incurred in getting the

ship back into a seaworthy condition. As such the costs must be capitalised.

A ship which cost ₹ 20 million with a 20 year life must have major overhaul every

five years. The estimated cost of the overhaul at the five-year point is ₹ 5 million.

The actual overhead costs incurred at the end of year 5 are ₹ 6 million.

Calculate the Carrying Amount at the end of 5th year and Depreciation thereon.

5 (a) Anara Fertilisers Limited issued 2000 share options to its 10 directors for an 10

exercise price of ₹ 100.The directors are required to stay with the company for

next 3 years.

Fair value of the option estimated ₹ 130

Expected number of directors to vest the option 8

During the year 2, there was a crisis in the company and Management decided to

cancel the scheme immediately. It was estimated further as below-

Fair value of option at the time of cancellation was ₹ 90

Market price of the share at the cancellation date was ₹ 99

There was a compensation which was paid to directors and only 9 directors were

currently in employment. At the time of cancellation of such scheme, it was agreed

to pay an amount of ₹ 95 per option to each of 9 directors.

How the cancellation would be recorded?

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 6

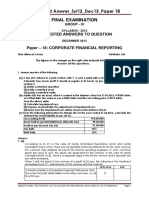

5 (b) Nivaan Limited commenced work on two long-term contracts during the financial 10

year ended on 31st March, 2019.

The first contract with A & Co. commences on 1 st June, 2018 and had a total sales

value of ₹ 40 lakh. It was envisaged that the contract would run for two years and

that the total expected costs would be ₹ 32 lakh. On 31st March, 2019, Nivaan

Limited revised its estimate of the total expected cost to ₹ 34 lakh on the basis of

the additional rectification cost of ₹ 2 lakh incurred on the contract during the

current financial year. An independent surveyor has estimated at 31st March, 2019

that the contract is 30% complete. Nivaan Limited has incurred costs up to 31st

March, 2019 of ₹ 16 lakh and has received payments on account of ₹ 13 lakh.

The second contract with B & Co. commenced on 1 st September, 2018 and was for

18 months. The total sales value of contract was ₹ 30 lakh and the total expected

cost is ₹ 24 lakh. Payments on account already received were ₹ 9.50 lakh and total

costs incurred to date were ₹ 8 lakh. Nivaan Limited has insisted on a large

deposit from B & Co. because the companies had not traded together prior to the

contract. The independent surveyor estimated that on 31st March, 2019 the

contract was 20% complete.

The two contracts meet the requirement of Ind AS 115 ‘Revenue from Contracts

with Customers’ to recognize revenue over time as the performance obligations

are satisfied over time.

The company also has several other contracts of between twelve and eighteen

months in duration. Some of these contracts fall into two accounting periods and

were not completed as at 31st March, 2019. In absence of any financial data

relating to the other contracts, you are advised to ignore these other contracts

while preparing the financial statements of the company for the year ended 31 st

March, 2019.

Prepare financial statement extracts for Nivaan Limited in respect of the two

construction contracts for the year ending 31st March, 2019.

6 (a) A freehold property was originally acquired for ₹ 40,00,000. Some years later, 5

after cumulative depreciation of ₹ 11,00,000 has been recognised, an impairment

loss of ₹ 3,50,000 is recognised, taking the carrying amount to ₹ 25,50,000, which

represents the estimated value in use of the property. Shortly thereafter, as a

consequence of a proposed move to new premises, the freehold property is

classified as held for sale. At the time of classification as held for sale, fair value

less costs to sell is assessed at ₹ 25,00,000.

At the next reporting date, the property market has improved and fair value less

costs to sell is reassessed at ₹ 26,50,000.

Six months after that, the property market has continued to improve, and fair

value less costs to sell is now assessed at ₹ 30,00,000.

Subsequently after some time, the property is sold for ₹ 30,00,000.

Determine the relevant accounting treatments as per Ind AS 105.

6 (b) On 31st March, 20X1, XYZ Ltd. makes following estimate of cash flows for one of its 5

asset located in USA:

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 7

Year Cash flows

20X1-20X2 US$ 80

20X2-20X3 US$ 100

20X3-20X4 US$ 20

Following information has been provided:

Particulars India USA

Applicable discount rate 15% 10%

Exchange rates are as follows:

As on Exchange rate

31st March, 20X1 ₹ 45/US $

As on Expected Exchange rate

31st March, 20X2 ₹ 48/US $

31st March, 20X3 ₹ 51/US $

31st March, 20X4 ₹ 55/US $

Calculate value in use as on 31st March, 20X1.

6 (c) Nikka Limited has obtained a term loan of ₹ 620 lacs for a complete renovation 5

and modernisation of its Factory on 1st April, 20X1. Plant and Machinery was

acquired under the modernisation scheme and installation was completed on 30 th

April, 20X2. An expenditure of ₹ 510 lacs was incurred on installation of Plant and

Machinery, ₹ 54 lacs has been advanced to suppliers for additional assets

(acquired on 25th April, 20X1) which were also installed on 30th April, 20X2 and

the balance loan of ₹ 56 lacs has been used for working capital purposes.

Management of Nikka Limited considers the 12 months period as substantial

period of time to get the asset ready for its intended use.

The company has paid total interest of ₹ 68.20 lacs during financial year 20X1-

20X2 on the above loan. The accountant seeks your advice how to account for the

interest paid in the books of accounts. Will your answer be different, if the whole

process of renovation and modernization gets completed by 28th February, 20X2?

6 (d) K ltd. issued 500,000, 6% convertible debentures @ ₹ 10 each on 01 April 20X1. 5

The debentures are due for redemption on 31 March 20X5 at a premium of 10%,

convertible into equity shares to the extent of 50% and balance to be settled in

cash to the debenture holders. The interest rate on equivalent debentures without

conversion rights was 10%.

You are required to separate the debt and equity components at the time of issue

and show the accounting entries in Company’s books at initial recognition. The

following present values of Re 1 at 6% and at 10% are provided:

Interest rate Year 1 Year 2 Year 3 Year 4

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 8

6% 0.94 0.89 0.84 0.79

10% 0.91 0.83 0.75 0.68

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 9

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- PST AFR 2015 2023Document111 pagesPST AFR 2015 2023PhilipNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument9 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsayushiNo ratings yet

- Asset Base Approach ProblemsDocument5 pagesAsset Base Approach Problemspratik waliwandekarNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- Consolidation Question PaperDocument42 pagesConsolidation Question PaperNick VincikNo ratings yet

- Test Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDocument8 pagesTest Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDev ReddyNo ratings yet

- Advance Accounts TestDocument3 pagesAdvance Accounts Testdivya shahasaneNo ratings yet

- MTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingDocument6 pagesMTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingBhupen SharmaNo ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- FR MTP Nov'22Document27 pagesFR MTP Nov'22Kushagra SoniNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Complex and Disposal of Sub (4416)Document5 pagesComplex and Disposal of Sub (4416)zeeshan sikandarNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- 4th Sem PRT 3Document25 pages4th Sem PRT 3Sunanda MathuriaNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- MTP - Nov - 20 AccountsDocument19 pagesMTP - Nov - 20 AccountsPartibha GehlotNo ratings yet

- Test 3 QPDocument7 pagesTest 3 QPDharmateja ChakriNo ratings yet

- Discussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsDocument7 pagesDiscussion Question #5 Solution-Table 1.0 Shows The Order of Current Assets in Terms of Liquidity (Most To Least) Current AssetsRijul DUbeyNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument12 pages(In Lakhs) : © The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Company Accounts, Cost and Management AccountingDocument10 pagesCompany Accounts, Cost and Management AccountingmeetwithsanjayNo ratings yet

- 6thsem HoldingCompany 2013act AmitMitra 10apr2020Document32 pages6thsem HoldingCompany 2013act AmitMitra 10apr2020sdmsmk sdmsmkNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 18 Final Examination: Suggested Answers To QuestionDocument39 pagesSuggested Answer - Syl12 - Dec13 - Paper 18 Final Examination: Suggested Answers To QuestionkkpaiNo ratings yet

- CA Inter Law Ans Dec 2021Document21 pagesCA Inter Law Ans Dec 2021Punith KumarNo ratings yet

- MTP 11 1 Questions 1696062519Document6 pagesMTP 11 1 Questions 1696062519kabeeramitbarot96No ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- CA Final FR Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Final FR Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- FTP 1 AaDocument8 pagesFTP 1 AaYash RankaNo ratings yet

- 12 Accounts CBSE Sample Papers 2019Document10 pages12 Accounts CBSE Sample Papers 2019Salokya KhandelwalNo ratings yet

- Learning Unit 4 Consolidation of A Wholly Owned Subsidiary AfterDocument27 pagesLearning Unit 4 Consolidation of A Wholly Owned Subsidiary AfterThulani NdlovuNo ratings yet

- 6th Semester Paper 2022Document5 pages6th Semester Paper 2022Chandrarup BanerjeeNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Paper - 1: Financial Reporting: Assets David Ltd. Parker Ltd. Non-Current AssetsDocument32 pagesPaper - 1: Financial Reporting: Assets David Ltd. Parker Ltd. Non-Current AssetsayushiNo ratings yet

- FR (New) Suggested Ans CA Final Jan 21Document33 pagesFR (New) Suggested Ans CA Final Jan 21ritz meshNo ratings yet

- Complex and Disposal of Sub (4416)Document5 pagesComplex and Disposal of Sub (4416)Ahmad vlogsNo ratings yet

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Document52 pagesPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3No ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Extra Questions On Ind As 105Document5 pagesExtra Questions On Ind As 105Monu RaiNo ratings yet

- Series 1 PDFDocument8 pagesSeries 1 PDFBKLMMDFKLFBNo ratings yet

- Paper - 1: Financial Reporting: AssetsDocument43 pagesPaper - 1: Financial Reporting: AssetsTisha AggarwalNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- SBI Debit Card - Insurance CoverDocument2 pagesSBI Debit Card - Insurance CoverRaj MittalNo ratings yet

- HB Camp MachineDocument2 pagesHB Camp MachineRaj MittalNo ratings yet

- Tds Deduction Rate Chart For Ay 2023 2024 Fy 2022 2023Document2 pagesTds Deduction Rate Chart For Ay 2023 2024 Fy 2022 2023Raj MittalNo ratings yet

- Angel One Margin Offer ScreenshotDocument2 pagesAngel One Margin Offer ScreenshotRaj MittalNo ratings yet

- Sale of Used Motor Car Under GSTDocument5 pagesSale of Used Motor Car Under GSTRaj MittalNo ratings yet

- ABC Analysis May23Document11 pagesABC Analysis May23Raj MittalNo ratings yet

- Final Result Write Up 2021 17032023Document12 pagesFinal Result Write Up 2021 17032023Raj MittalNo ratings yet

- 176166.SCC Unaudited Standalone Financial Results 31.12.20142Document2 pages176166.SCC Unaudited Standalone Financial Results 31.12.20142Raj MittalNo ratings yet

- Low Version Final EIRC Directory For WebsiteDocument164 pagesLow Version Final EIRC Directory For WebsiteRaj MittalNo ratings yet

- Kunci Jawaban Modul AKL Bu Iin - OlivethewennoDocument17 pagesKunci Jawaban Modul AKL Bu Iin - OlivethewennoOliviane Theodora WennoNo ratings yet

- EconomicsDocument128 pagesEconomicsVicky Feliciano100% (1)

- FinmanDocument18 pagesFinmanMaryllon VillardoNo ratings yet

- A Call For Unity, A Call To Collective ActionDocument3 pagesA Call For Unity, A Call To Collective ActionVen DeeNo ratings yet

- Business Idea Validation ChecklistDocument4 pagesBusiness Idea Validation ChecklistVidhya DevadigaNo ratings yet

- Accenture ASEAN Consumer Research CPGDocument20 pagesAccenture ASEAN Consumer Research CPGtswijayaNo ratings yet

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah BiljannahNo ratings yet

- 2018 Accounting Templates For Accounting Officers of CGDocument38 pages2018 Accounting Templates For Accounting Officers of CGkasozi martinNo ratings yet

- SEC OpDocument11 pagesSEC OpeasyisthedescentNo ratings yet

- BMAN 20081 AND 20611 Financial Statement Analysis: 2020-21 Ratio Analysis - Creating A Structured AnalysisDocument11 pagesBMAN 20081 AND 20611 Financial Statement Analysis: 2020-21 Ratio Analysis - Creating A Structured AnalysisMunkbileg MunkhtsengelNo ratings yet

- For HODDocument94 pagesFor HODVinu VaviNo ratings yet

- Measuring Wool's FootprintDocument3 pagesMeasuring Wool's FootprintThe Guardian100% (1)

- Manhattan Urban Area Comprehensive Plan Update - Trends and Forces Report PDFDocument78 pagesManhattan Urban Area Comprehensive Plan Update - Trends and Forces Report PDFVikesh RavichandrenNo ratings yet

- Custom Clearnence ProcedureDocument7 pagesCustom Clearnence ProcedureAdeeb AkmalNo ratings yet

- Tallyerp9book Sample PageDocument24 pagesTallyerp9book Sample PagerudramanvNo ratings yet

- Credit Rating AgencyDocument3 pagesCredit Rating AgencyJaved KhanNo ratings yet

- Morning Slot: (09:30 AM To 10:30 AM) : Course OutcomesDocument12 pagesMorning Slot: (09:30 AM To 10:30 AM) : Course OutcomesSachin BhartiNo ratings yet

- CH 11 QuizDocument4 pagesCH 11 QuizprowersappraiserNo ratings yet

- Yogesh Alp-CvDocument6 pagesYogesh Alp-CvAnindya SharmaNo ratings yet

- Globaphobe Vs GlobaphileDocument4 pagesGlobaphobe Vs GlobaphileHiền LưuNo ratings yet

- Commodities Market ModuleDocument170 pagesCommodities Market ModuleSameera Kadiyala100% (1)

- Module 8 Total Quality ManagementDocument9 pagesModule 8 Total Quality ManagementMary Joy Morallon CalaguiNo ratings yet

- Board Resolution SampleDocument2 pagesBoard Resolution SampleMildred Pags100% (1)

- Chase Bank Statement TemplateDocument1 pageChase Bank Statement Templategmbeverywhere21No ratings yet

- Tesla: A Successful Entrepreneurship StrategyDocument10 pagesTesla: A Successful Entrepreneurship StrategyLuthfi Bin LokmanNo ratings yet

- Grade 12 SSIP Sessions 6-7 Business Studies (LHS) Booklet 2013Document16 pagesGrade 12 SSIP Sessions 6-7 Business Studies (LHS) Booklet 2013Sweetness MakaLuthando LeocardiaNo ratings yet

- Assignment: Cabotage PolicyDocument15 pagesAssignment: Cabotage PolicyMuhammad Adli Bin Ja'affar100% (1)

- IFP - Loan CalutationDocument23 pagesIFP - Loan CalutationnishiNo ratings yet

- ROI For A CRM Initiative at CRMDocument20 pagesROI For A CRM Initiative at CRMKanika Razdan BajajNo ratings yet

- Non Governmental OrganizationDocument6 pagesNon Governmental OrganizationCristine Joy FerrerNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)