Professional Documents

Culture Documents

LCC-L2 Saturday Class-4 Control Account (S)

Uploaded by

wu alanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LCC-L2 Saturday Class-4 Control Account (S)

Uploaded by

wu alanCopyright:

Available Formats

Control Account

Trade receivables and Trade payables Control Account

Question 1

The following information has been extracted from the books of Zhou Guanyu:

Balance at 1 March 2020:

$

Trade receivables 88,456

Trade payables 28,923

Transactions for the month of March 2020:

Credit sales 46,520

Cash sales 3,560

Cheque payments to credit suppliers 12,875

Credit purchases 15,385

Goods returned by credit customers 526

Cash purchases 240

Cash received from credit customers 150

Discount allowed 732

Goods returned to credit suppliers 232

Irrecoverable debts written off 420

Discount received 285

Direct debit payments made to credit suppliers 1,648

Cheques received from credit customers 42,188

Credit transfers from credit customers 2,597

Petty cash payments made to credit suppliers 84

Required

Prepare, for the month of March 2020, the:

(i) Trade receivables Control Account

$ $

(ii) Trade payables Control Account.

$ $

Question 2

Verstappen prepared the following incorrect trade payables ledger control account for the year ended 31 July 2018.

Trade Payables Ledger Control Account

Date Details $ Date Details $

1 August 2017 Balance b/d 8,240 31 July 2018 Credit purchases 75,386

31 July 2018 Cash book 74,114 Cash book/discount received 814

Purchase returns day book 1,424

Balance c/d 4,730

82,354 82,354

All purchases were on credit. Goods were sold with a 60% profit margin.

Verstappen provided the following information for the year ended 31 July 2018.

1 August 31 July

2017 2018

$ $

Cash in hand 100 150

Inventory 19,900 6,506

Trade receivables 11,385 12,225

Received from credit customers 194,200

Cash takings banked 18,100

Cash drawings 5,200

(a) Prepare a corrected trade payables ledger control account for the year ended 31 July 2018. Balance the

account on that date and bring the balance down on 1 August 2018.

Trade Payables Ledger Control Account

Details $ Details $

(b) Calculate for the year ended 31 July 2018:

(i) credit sales

(W1) Trade Receivables Ledger Control Account

Details $ Details $

(ii) cash sales

(W2) Cash Account

2017 Details $ 2017 Details $

(iii) gross profit.

(c) Prepare the statement of profit or loss for the year ended 31 July 2018 showing the trading section only.

Verstappen

Statement of profit or loss for the year ended 31 July 2018

$ $

You might also like

- 03.audit of ReceivablesDocument6 pages03.audit of ReceivablesZairah FranciscoNo ratings yet

- Exercises - Control AcountsDocument3 pagesExercises - Control AcountsPetrinaNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Tiger Corporation (Contributed by Oliver C. Bucao)Document4 pagesTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- CE1 - Acctg - Final Exam - 2019 - P2 - QDocument7 pagesCE1 - Acctg - Final Exam - 2019 - P2 - QnadineNo ratings yet

- Financial Accounting Paper1.1Document20 pagesFinancial Accounting Paper1.1MahediNo ratings yet

- Receivable - Q2Document3 pagesReceivable - Q2Dymphna Ann CalumpianoNo ratings yet

- PeerDocument8 pagesPeerronnelNo ratings yet

- QuestionsDocument8 pagesQuestionsHislord BrakohNo ratings yet

- Peer Mentoring PretestxxDocument7 pagesPeer Mentoring PretestxxronnelNo ratings yet

- Journal Entries & LedgerDocument16 pagesJournal Entries & LedgerdelgadojudithNo ratings yet

- Acctg 102 Prelim Exam With SolutionsDocument12 pagesAcctg 102 Prelim Exam With SolutionsYsabel ApostolNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- Revision Questions - CH 5,6,9,10 - Set 1 - SolutionDocument6 pagesRevision Questions - CH 5,6,9,10 - Set 1 - SolutionMinh ThưNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Sole Trader Accounting Handout 3Document5 pagesSole Trader Accounting Handout 3DenishNo ratings yet

- C02 Financial Accounting Fundamentals - Control AccountsDocument7 pagesC02 Financial Accounting Fundamentals - Control AccountsAlfred MakonaNo ratings yet

- Practice Set 3 (Lesson 6) Control AccountsDocument3 pagesPractice Set 3 (Lesson 6) Control Accountsborteydavid616No ratings yet

- May 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeDocument24 pagesMay 2016 Professional Examination Financial Accounting (1.1) Examiner'S Report, Questions and Marking SchemeMartn Carldazo DrogbaNo ratings yet

- Chapter 2Document8 pagesChapter 2imel100% (3)

- Intermediate Acctg Review-1Document3 pagesIntermediate Acctg Review-1Anonymous QWaWnuMNo ratings yet

- Control Account Test 2022Document6 pagesControl Account Test 2022Prince TshepoNo ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- Accounting Exercise (Y10) - 9 - 1 - 23Document4 pagesAccounting Exercise (Y10) - 9 - 1 - 23gaiyun209No ratings yet

- Chapter 3 End of Chapter Solutions - EvensDocument4 pagesChapter 3 End of Chapter Solutions - EvensAna StitelyNo ratings yet

- 2018 April Resource Booklet L2Document8 pages2018 April Resource Booklet L2Ronald YeeNo ratings yet

- Control AccountDocument10 pagesControl AccountTeo Yu XuanNo ratings yet

- Debtors and Creditors GuideDocument6 pagesDebtors and Creditors Guidesammie celeNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- Ap Tip Preweek 2017Document58 pagesAp Tip Preweek 2017Jay-L Tan100% (1)

- Receivables ProblemsDocument5 pagesReceivables ProblemsAbbygailNo ratings yet

- Financial Accounting I Test BankDocument5 pagesFinancial Accounting I Test BankKim Cristian MaañoNo ratings yet

- Accounts Receivable and Estimation of AFBDDocument1 pageAccounts Receivable and Estimation of AFBDeia aieNo ratings yet

- Drill-Receivables CompressDocument7 pagesDrill-Receivables CompressHannahbea LindoNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- Abfa1164 Pyq0522Document7 pagesAbfa1164 Pyq05220130 CrystalaquariusNo ratings yet

- Activity - Chapter 6 - Statement of Cash FlowsDocument4 pagesActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNo ratings yet

- Diy-Problems (Questionnaires)Document11 pagesDiy-Problems (Questionnaires)May Ramos100% (1)

- Audit 2 (T) - Topic2A SasaDocument27 pagesAudit 2 (T) - Topic2A SasaEleonora VinessaNo ratings yet

- Exam 2018 CfsDocument4 pagesExam 2018 CfsEpic Gaming MomentsNo ratings yet

- Tutorial Questions BBFA1053 2023 JanDocument39 pagesTutorial Questions BBFA1053 2023 JanJoelle LimNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- SA1 - Grade AS CAIE Accounting Paper 2Document7 pagesSA1 - Grade AS CAIE Accounting Paper 221ke23b15089No ratings yet

- 2018-1383 Samsona, Melanie S.Document8 pages2018-1383 Samsona, Melanie S.Melanie SamsonaNo ratings yet

- Seatwork No. 1 - Error Correction, Changes in Accounting Policies and Changes in Accounting EstimatesDocument1 pageSeatwork No. 1 - Error Correction, Changes in Accounting Policies and Changes in Accounting EstimatesAaron MañacapNo ratings yet

- Cash and Cash Equivalents Problem SetDocument3 pagesCash and Cash Equivalents Problem Setmarinel pioquidNo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Auditing Problem ExercisesDocument13 pagesAuditing Problem ExercisesJasmine Nouvel Soriaga CruzNo ratings yet

- Receivables ExercisesDocument5 pagesReceivables ExercisesChrystelle Gail LiNo ratings yet

- LQ - Cash and ReceivablesDocument1 pageLQ - Cash and ReceivablesWawex DavisNo ratings yet

- AppliedDocument5 pagesAppliedvhlast23No ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- LCC-L2 Saturday Class-2b Depreciation (S) (291022)Document3 pagesLCC-L2 Saturday Class-2b Depreciation (S) (291022)wu alanNo ratings yet

- LCC-L2 Saturday Class-2 Depreciation (S) (221022)Document3 pagesLCC-L2 Saturday Class-2 Depreciation (S) (221022)wu alanNo ratings yet

- LCC-L2 Saturday Class-1c Incomplete Record-Sole Trader (S) (191122)Document2 pagesLCC-L2 Saturday Class-1c Incomplete Record-Sole Trader (S) (191122)wu alanNo ratings yet

- LCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)Document2 pagesLCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)wu alanNo ratings yet

- IDFCFIRSTBankstatement 50001100003 230131263Document3 pagesIDFCFIRSTBankstatement 50001100003 230131263ayush900aNo ratings yet

- Booking Confirmation On IRCTC, Train 11401, 28-Nov-2023, 2A, NK - HEMDocument1 pageBooking Confirmation On IRCTC, Train 11401, 28-Nov-2023, 2A, NK - HEMSaumya PatilNo ratings yet

- Estmt - 2024 01 31Document4 pagesEstmt - 2024 01 31ellamaekitchensNo ratings yet

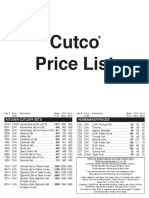

- Cutco Price List 8-19-15Document4 pagesCutco Price List 8-19-15Eddie Goynes JrNo ratings yet

- Monthly Billing Statement: Ma Katherine Dela Cruz PantojaDocument4 pagesMonthly Billing Statement: Ma Katherine Dela Cruz Pantojamaria katherine pantojaNo ratings yet

- Electronic Commerce Eighth EditionDocument86 pagesElectronic Commerce Eighth EditionazarudeengNo ratings yet

- Invoice: Course Invoice Description Due Date Net Vat % Vat GrossDocument2 pagesInvoice: Course Invoice Description Due Date Net Vat % Vat Grossmanu madhav0% (1)

- Gmail - Booking Confirmation On IRCTC, Train - 16316, 09-Dec-2021, SL, TCR - SBCDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 16316, 09-Dec-2021, SL, TCR - SBCchristyNo ratings yet

- Adjusting EntriesDocument1 pageAdjusting EntriesJohn Raymond MarzanNo ratings yet

- EA-Part - 3Document5 pagesEA-Part - 3aman9936543060No ratings yet

- Ausfb Credit Card Usage Terms Condition PDFDocument2 pagesAusfb Credit Card Usage Terms Condition PDFSagar GuptaNo ratings yet

- VII.E Payment SystemDocument49 pagesVII.E Payment Systemroshan kcNo ratings yet

- Tutorial 4 (4.2,4.3,4.4), 5, and 6Document6 pagesTutorial 4 (4.2,4.3,4.4), 5, and 6Syahirah IibrahimNo ratings yet

- Arrival Report Sample 1Document3 pagesArrival Report Sample 1Artwin BunardiNo ratings yet

- Mbaf0701 - Far - Unit - 2Document13 pagesMbaf0701 - Far - Unit - 2RahulNo ratings yet

- Experience Guide Finbooster Credit Card PDFDocument11 pagesExperience Guide Finbooster Credit Card PDFChirag GandhiNo ratings yet

- FABM 2 2nd Quarter (Week 1) Students Copy 2Document45 pagesFABM 2 2nd Quarter (Week 1) Students Copy 2tjhunter077No ratings yet

- Summary of Charges: My Bill Summary For May 2022Document2 pagesSummary of Charges: My Bill Summary For May 2022livia popNo ratings yet

- UntitledDocument35 pagesUntitledKara Sophia BatucanNo ratings yet

- Booking Confirmation On IRCTC, Train: 12311, 16-Jul-2022, 2A, BWN - KKDEDocument1 pageBooking Confirmation On IRCTC, Train: 12311, 16-Jul-2022, 2A, BWN - KKDEAtul GoyalNo ratings yet

- Analyzing Impulse Buying BehaviorDocument71 pagesAnalyzing Impulse Buying BehaviorMohit AggarwalNo ratings yet

- FE1679 Consumer Guide To Reloadable Prepaid CardsDocument4 pagesFE1679 Consumer Guide To Reloadable Prepaid Cards1 1No ratings yet

- 138 Cross QuestionDocument2 pages138 Cross Questionteam wisdomlegalNo ratings yet

- Proposed System of PaytmDocument8 pagesProposed System of PaytmDivij PatelNo ratings yet

- Subject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Document3 pagesSubject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Noble InfoTechNo ratings yet

- Mock Call GuidelinesDocument4 pagesMock Call GuidelinesTurtle ArtNo ratings yet

- Bank Reconciliation: Intermediate Accounting 1Document4 pagesBank Reconciliation: Intermediate Accounting 1Kesiah FortunaNo ratings yet

- Сommonwealth AU UnsecDocument3 pagesСommonwealth AU Unsecbefix80880No ratings yet

- Intermediate Accounting 1 by Sir ChuaDocument22 pagesIntermediate Accounting 1 by Sir ChuaAnalyn LafradezNo ratings yet

- Worksheet 1.3 Introducing Trail BalancesDocument3 pagesWorksheet 1.3 Introducing Trail Balancesaysilislam528No ratings yet