Professional Documents

Culture Documents

Criteria For Evaluating Governance

Uploaded by

arefayne wodajo0 ratings0% found this document useful (0 votes)

16 views1 pageThis document outlines 17 criteria for evaluating governance in financial services, including the role of the board in promoting controls, board composition and competence, existence of committees, independence of the board, oversight of business activities and risks, policies for critical decisions and exceptions, appointment processes, strategic planning, and the ability to exercise independent judgment.

Original Description:

Original Title

Criteria for evaluating Governance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines 17 criteria for evaluating governance in financial services, including the role of the board in promoting controls, board composition and competence, existence of committees, independence of the board, oversight of business activities and risks, policies for critical decisions and exceptions, appointment processes, strategic planning, and the ability to exercise independent judgment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageCriteria For Evaluating Governance

Uploaded by

arefayne wodajoThis document outlines 17 criteria for evaluating governance in financial services, including the role of the board in promoting controls, board composition and competence, existence of committees, independence of the board, oversight of business activities and risks, policies for critical decisions and exceptions, appointment processes, strategic planning, and the ability to exercise independent judgment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

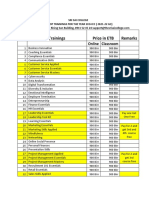

Criteria for evaluating Governance - Financial Services

S.n Point of view

1. Role of the board in promoting a control culture.

2. Board reviews of policies and procedures regarding controls

3. Composition of the board and board committees, and competence of members

4. Existence of audit, risk, and remuneration committees

5. Independence of the board

6. Proportion of non-executive directors to executive directors AND Management of

non-executive director conflicts

7. Terms of reference for the board and board committees

8. Frequency of board meetings AND Adequacy and timeliness of information received

by the board

9. Direction, understanding, monitoring, and control over business activities & related

risks

10. Existence of policies and procedures to ensure that critical decisions are made with

appropriate approval

11. Existence of processes to ensure that policy overrides are minimal and exceptions

are reported to management

12. Appointment process for non-exec directors, tenure & compensation

13. Consideration given by the board to the relationship with the regulator

14. Existence of a strategic-planning process, including objective setting, creation of

short-term business and operating plans, and monitoring of implementation

15. Extent to which the strategic-planning process reflects FSA’s priorities,

consideration given to risk profile, financial soundness, & capital adequacy

16. Participation levels on committees.

17. Willingness and ability to exercise independent judgement and to challenge

management.

You might also like

- Corp 2Document20 pagesCorp 2Prashant KerkettaNo ratings yet

- Corporate Governance CommitteeDocument12 pagesCorporate Governance CommitteeNitinNo ratings yet

- Introduction To GEBERMICDocument8 pagesIntroduction To GEBERMICMelch Yvan Racasa MarbellaNo ratings yet

- Name: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceDocument4 pagesName: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceAmol GadeNo ratings yet

- Corporate Governance and Regulatory Issues in Indian BankingDocument49 pagesCorporate Governance and Regulatory Issues in Indian BankingHariprasad KPNo ratings yet

- Board CommitteeDocument10 pagesBoard CommitteeSuraj Freesia VermaNo ratings yet

- Corporate GovernanceDocument14 pagesCorporate GovernanceMalik ArifNo ratings yet

- In CG Performance Evaluation of Boards and Directors NoexpDocument12 pagesIn CG Performance Evaluation of Boards and Directors NoexpMohammad Mahdi MozaffarNo ratings yet

- Lesson 2.2 Responsibilities of The BoardDocument9 pagesLesson 2.2 Responsibilities of The BoardYessameen Franco R. CastilloNo ratings yet

- Governance and Compliance Audit - NotesDocument208 pagesGovernance and Compliance Audit - NotesDanielNo ratings yet

- Wipro Corporate Governance Guidelines April09Document24 pagesWipro Corporate Governance Guidelines April09Devang Amit GhediaNo ratings yet

- 4.1 Board of DirectorsDocument6 pages4.1 Board of DirectorsIstiaq Ahmed PrinceNo ratings yet

- Terms and Conditions of Appointment of Independent DirectorsDocument14 pagesTerms and Conditions of Appointment of Independent DirectorsEsha ChaudharyNo ratings yet

- Oecd Prinsip 6Document3 pagesOecd Prinsip 6Dissa ElvarettaNo ratings yet

- Corporate Governance ReportDocument8 pagesCorporate Governance ReportMuhammad MuneebNo ratings yet

- Features of Corporate Governance - IDocument7 pagesFeatures of Corporate Governance - IDr-Neel Patel100% (2)

- Body ConclusionDocument2 pagesBody ConclusionElla Marie LopezNo ratings yet

- Governance Standards For SACCOsDocument16 pagesGovernance Standards For SACCOsKivumbi WilliamNo ratings yet

- Corporate Governance PolicyDocument10 pagesCorporate Governance PolicyAjad AliNo ratings yet

- Corporate Governance in BanksDocument15 pagesCorporate Governance in BanksAKSHAY BHADAURIANo ratings yet

- Lecture 66Document2 pagesLecture 66ayamaher3323No ratings yet

- Ethics Revision Q&aDocument25 pagesEthics Revision Q&aTan KaihuiNo ratings yet

- Academic Support Unit ManualsDocument29 pagesAcademic Support Unit Manualsrhey80% (5)

- Performance Evaluation Criteria For Board Committees of Board Chairperson and Directors NewDocument2 pagesPerformance Evaluation Criteria For Board Committees of Board Chairperson and Directors NewAhmad NaseerNo ratings yet

- Risk Committee Terms of Reference PurposeDocument5 pagesRisk Committee Terms of Reference Purposeaqiilah subrotoNo ratings yet

- BUSS 426 Governance and Ethics NotesDocument43 pagesBUSS 426 Governance and Ethics NotesFabio NyagemiNo ratings yet

- Governance Standards For SACCOsDocument16 pagesGovernance Standards For SACCOsKivumbi William100% (1)

- Sierra Metals Inc. Board Mandate: Chairman, Composition and QuorumDocument3 pagesSierra Metals Inc. Board Mandate: Chairman, Composition and QuorumFlores Fernandez Abel NHNo ratings yet

- The Duties of Board of Directors To Ensure Corporate Governance in Nepalese ContextDocument26 pagesThe Duties of Board of Directors To Ensure Corporate Governance in Nepalese ContextBishop PantaNo ratings yet

- POSITION TITLE: Chief Financial Officer Department: Main Purpose of The JobDocument5 pagesPOSITION TITLE: Chief Financial Officer Department: Main Purpose of The JobshrimisahaNo ratings yet

- Fullbook - Ppsacmdd - 2017july 6 PDFDocument383 pagesFullbook - Ppsacmdd - 2017july 6 PDFNeha KujurNo ratings yet

- Governance Committee Terms of Reference Dec 18Document7 pagesGovernance Committee Terms of Reference Dec 18snk298No ratings yet

- Effective Governance, Leadership and Management Principles: Vision: A World Class Professional Accountancy InstituteDocument40 pagesEffective Governance, Leadership and Management Principles: Vision: A World Class Professional Accountancy Institutesyed younasNo ratings yet

- HSBC Bank Malaysia Berhad ("The Bank") Board of Directors Terms of ReferenceDocument26 pagesHSBC Bank Malaysia Berhad ("The Bank") Board of Directors Terms of ReferenceAmrezaa IskandarNo ratings yet

- CH 04Document23 pagesCH 04k 3117No ratings yet

- Assignment 1 BPDocument2 pagesAssignment 1 BPAli SajidNo ratings yet

- 2960Document3 pages2960erickson hernanNo ratings yet

- Assignment No 4Document3 pagesAssignment No 4Hajra ZANo ratings yet

- Corrporate Governance AssignmntDocument6 pagesCorrporate Governance AssignmntsulemanzaffarNo ratings yet

- Corporate Governance: Casual Vacancies On The Board of DirectorsDocument3 pagesCorporate Governance: Casual Vacancies On The Board of DirectorsMalik ArifNo ratings yet

- Trusted Board On Developing CompanyDocument3 pagesTrusted Board On Developing Companyequip2015indoNo ratings yet

- Corporate Governance GuidelinesDocument7 pagesCorporate Governance GuidelinesElaNo ratings yet

- Corporate Governance 1Document16 pagesCorporate Governance 1Iqbal HanifNo ratings yet

- QBEM Board CharterDocument9 pagesQBEM Board CharterSS CORPORATE SERVICESNo ratings yet

- Group 4: Rajjan Singh Rahul Arya Prasha SnehashishDocument13 pagesGroup 4: Rajjan Singh Rahul Arya Prasha SnehashishDushyant PandaNo ratings yet

- SWVL - Corporate Governance GuidelinesDocument6 pagesSWVL - Corporate Governance GuidelinesmostafaNo ratings yet

- Board Roles and Responsibilities - 0Document8 pagesBoard Roles and Responsibilities - 0Jester June B BondocNo ratings yet

- Law Cia 3Document2 pagesLaw Cia 3Valentina GonsalvesNo ratings yet

- Assignment 1Document3 pagesAssignment 1Glyzelle MellaNo ratings yet

- Corporate Governance StatementDocument15 pagesCorporate Governance StatementRahul PagariaNo ratings yet

- Topic 3 - GovernanceDocument27 pagesTopic 3 - GovernanceFarissa Elya100% (1)

- Board Structure & Operations, Director Duties and Oversight Roles MAY 2023Document34 pagesBoard Structure & Operations, Director Duties and Oversight Roles MAY 2023johnnhaviraNo ratings yet

- Principles in GovernanceDocument1 pagePrinciples in GovernanceNathaniel CastilloNo ratings yet

- 15 Chapter 6Document193 pages15 Chapter 6Tamizh KumarNo ratings yet

- SESI 4 Ch13Document29 pagesSESI 4 Ch13astridNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- SIA Kel 3 FinishDocument25 pagesSIA Kel 3 FinishNugraha HaritsNo ratings yet

- Questions & Discussions: Prof. Ruyin HUDocument18 pagesQuestions & Discussions: Prof. Ruyin HUJulius MadridNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- Sample Engagement 1st ReviewDocument9 pagesSample Engagement 1st Reviewarefayne wodajoNo ratings yet

- 4.2. Descriptive StatisticsDocument4 pages4.2. Descriptive Statisticsarefayne wodajoNo ratings yet

- @1lula Awol-Thesis Proposal After CommentDocument68 pages@1lula Awol-Thesis Proposal After Commentarefayne wodajoNo ratings yet

- Branch Cash Position26112022-4Document4 pagesBranch Cash Position26112022-4arefayne wodajoNo ratings yet

- Skill Development Trainings SIRSIA ScheduleDocument2 pagesSkill Development Trainings SIRSIA Schedulearefayne wodajoNo ratings yet

- Chapter 3 Cost II Relevant Cost and DMDocument54 pagesChapter 3 Cost II Relevant Cost and DMarefayne wodajoNo ratings yet

- Assumption For Human Resource Requirements For IADDocument2 pagesAssumption For Human Resource Requirements For IADarefayne wodajoNo ratings yet

- Fact Sheet Loan Review - MDocument2 pagesFact Sheet Loan Review - Marefayne wodajoNo ratings yet

- Cost and Management Accounting IIDocument9 pagesCost and Management Accounting IIarefayne wodajoNo ratings yet

- LeyricDocument1 pageLeyricarefayne wodajoNo ratings yet

- Inhouse Trainer Payment RequestDocument1 pageInhouse Trainer Payment Requestarefayne wodajoNo ratings yet

- It Risk Procedure Updated 2021Document48 pagesIt Risk Procedure Updated 2021arefayne wodajoNo ratings yet

- 9 AIS (Systems Development and Documentation Techniques)Document44 pages9 AIS (Systems Development and Documentation Techniques)arefayne wodajoNo ratings yet

- 6 CH AISDocument51 pages6 CH AISarefayne wodajoNo ratings yet

- New Product Risk ManagementDocument4 pagesNew Product Risk Managementarefayne wodajoNo ratings yet

- 4 To 6 CH AIS (Business Process and AIS)Document60 pages4 To 6 CH AIS (Business Process and AIS)arefayne wodajoNo ratings yet

- 1 CH AIS QCDocument40 pages1 CH AIS QCarefayne wodajoNo ratings yet

- Compliance Risk ManagementDocument6 pagesCompliance Risk Managementarefayne wodajoNo ratings yet

- Credit Risk ManagementDocument17 pagesCredit Risk Managementarefayne wodajoNo ratings yet

- All Updated Follow Up NewDocument267 pagesAll Updated Follow Up Newarefayne wodajoNo ratings yet

- Operational Risk ManagementDocument16 pagesOperational Risk Managementarefayne wodajoNo ratings yet

- Strategic Risk ManagementDocument7 pagesStrategic Risk Managementarefayne wodajoNo ratings yet

- National Bank of Ethiopia - Directives No. SBB-46-2010 - Customer Due Diligence of BanksDocument10 pagesNational Bank of Ethiopia - Directives No. SBB-46-2010 - Customer Due Diligence of Banksarefayne wodajoNo ratings yet

- Checklist For Risk ManagementDocument11 pagesChecklist For Risk Managementarefayne wodajoNo ratings yet

- Compliance AuditDocument37 pagesCompliance Auditarefayne wodajoNo ratings yet