Professional Documents

Culture Documents

CA Inter ESOP

Uploaded by

Harsh MundraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Inter ESOP

Uploaded by

Harsh MundraCopyright:

Available Formats

CA Inter Advanced Accounts | ESOP 3.

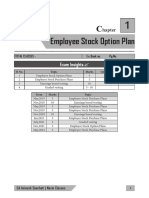

EMPLOYEE STOCK OPTION PLANS

Attempt Wise Analysis

May Nov May Nov Nov Jan June Dec

2018 2018 2019 2019 2020 2021 2021 2021

ESOP 5 10 5 5 10 5 5 5

ESOP

12

10 10

10

6

5 5 5 5 5 5

0

May 2018 Nov 2018 May 2019 Nov 2019 Nov 2020 Jan 2021 June 2021 Dec 2021

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.2

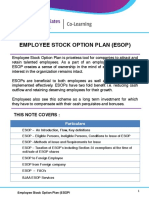

Q. No. R1 R2 R3 Special Point

Class Work

1 ICAI PQ 2

2 ICAI Illustration No 1 (Old Module)

3 ICAI Illustration No 1

4 ICAI PQ 1

5 Additional Qn

6 ICAI PQ 4

7 ICAI Illustration No 3

8 Exam Jan 21

MCMR

1 ICAI Illustration No 2

2 ICAI PQ 3

3 ICAI Illustration No 4

4 ICAI PQ 5, RTP Nov 18

5 RTP Nov 18

6 RTP May 19

7 RTP May 18

8 Exam Nov 18

9 Exam May 18

10 Exam May 19

11 RTP Nov 19

12 ICAI Illustration No 7

13 RTP May 20

14 RTP Nov 20

15 RTP May 21

16 Exam Nov 19

17 Exam Nov 20

18 RTP Nov 21

19 RTP Nov 21

20 QP July 21

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.3

21 Mock test 1 Oct 21 Serie 1

22 Mock Test 2 Oct 21 Serie 2

23 Exam Dec 21

Test In Time…Pass In Time

1 ICAI Illustration No 5

2 ICAI Illustration No 6

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.4

1. INTRODUCTION

Companies Act, 2013 states that Employee Stock Option means the option given to the whole

time directors, officers or employees of a company, which gives such directors, officers or

employees the benefit or right to purchase or subscribe at a future date, the securities offered

by the company at a predetermined price.

2. IMPORTANT TERMS IN THE ESOP PROCESS

Directors grade : 1,000 shares

Executive : M1 grade : 600 shares,

Vesting

M2 grade ; 400 shares

CA Vidya Other employees : 200 shares

Ltd.

Emplyee is

required to

achieve these

Employees

conditions

can exercise

within a time

the option Employee should work with

the company for at least 5 span of 6

(15.09.2017 -

years. years. i.e.

15.09.2018)

(15.09.2011) (15.09.2011 –

15.09.2017)

Exercise

period

Vesting

period

Face value of share : Rs.1

Grant Date

Exercise price : Rs.40

Fair Value : Rs.500

❖ Grant-: Grant of the option means giving an option to the employees to subscribe to the shares of

the company.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.5

❖ Vesting- Vesting means the process by which the employee gets the right to apply for and

be issued shares of the company under the options granted to him. Till the vesting takes

place, the employee does not have right to apply for the company’s shares.

❖ Vesting Period - It means the period during which the vesting of the options granted to an

employee takes place. The SEBI guidelines provide that the vesting period shall not be less than

one year from the date of grant of options.

❖ Exercise period - It means the time period after vesting within which the employee should

exercise his right to apply for the shares, otherwise the vested options would lapse. This period

starts from the date of vesting of options.

❖ Exercise - It means making of an application to the company by an employee together with the

requisite amount (exercise price), for issue of shares against the options already vested.

3. TYPES OF EMPLOYEE SHARE BASED PAYMENTS PLANS (ESOP)

EMPLOYEE SHARE BASED PAYMENTS PLANS

Employee Stock Option Employee Stock Purchase Share Appreciation Rights

Scheme (ESOS) Plan (ESPP) (SAR)/ Phantom Shares

• Company grants an option to

• Employees are given the right • No shares are offered to

employees to acquire shares at

to acquire shares of the employee.

future date at pre-determined

company immediately • Employee is given the

price.

• At price lower than prevailing appreciation in the

• Employees acquire shares on

market price. value of shares between

vesting within exercise period

• Shares issued under ESPP will two specified dates as

• Employees are free to dispose of an incentive that is linked

be subject to lock-in-period.

the shares subject to lock-in- to the performance of the

period. company.

• Exercise price is lower than the

• Stock appreciation rights

market price.

are not exercised if

• The accounting value of the market price on exercise

option = Number of options date is less than the

granted X (Market Price*– exercise price.

Exercise Price)

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.6

Employee Stock Option Scheme (ESOS) Accounting Entries

No. Particulars LF (Dr.) (Cr.)

(a) Employee Compensation Expenses A/c Dr.

To Employee Stock Options Outstanding A/c

(b) Stock option exercised by employees during exercise period

Bank A/c Dr.

Employee Stock Options Outstanding A/c Dr.

To Equity Share Capital A/c

To Securities Premium A/c

(c) Stock option lapsed on expiry of exercise period

Employee Stock Options Outstanding A/c Dr.

To General Reserve A/c

(d) Transfer of balance in Employee Compensation Expenses

A/c to Profit and Loss account every year

Profit & Loss A/c Dr.

To Employee Compensation Expenses A/c

4. ACCOUNTING PURPOSE

EMPLOYEE SHARE BASED PAYMENTS PLANS

Equity Settled Employee Share Based Payments

Cash Settled

Plans With Cash Alternatives

Employees receives cash Here either the enterprise or the

Employee receives

based on the price (or employee has a choice of whether the

Shares

value) of the enterprise’s enterprise settles the payment in cash or

shares by issue of shares.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.7

Let’s Get Started….With Class Work

1. ICAI PQ No 2

S Ltd. grants 1,000 options to its employees on 1.4.20X0 at ` 60. The vesting period is two and a

half years. The maximum exercise period is one year. Market price on that date is ` 90. Fair value

per option is ` 30. All the options were exercised on 31.7.20X3. Journalize, if the face value of

equity share is ` 10 per share.

2. ICAI Illustration No 1 (Old Module Question)

A Company has its share capital divided into shares of ` 10 each. On 1st April, 2007 it granted

10,000 employees’ stock options at ` 40, when the market price was ` 130. The options were to

be exercised between 16th December, 2007 and 15th March, 2008. The employees exercised

their options for 9,500 shares only; the remaining options lapsed. The company closes its books

on 31st March every year. Show Journal Entries.

3. ICAI Illustration No 1 (New Module Question)

A Company has its share capital divided into shares of ` 10 each. On 1st April, 20X1 it granted

10,000 employees’ stock options at ` 40, when the market price was ` 130. The fair value of options,

calculated using an option pricing model, is ` 90 per option. The options were to be exercised

between 15th March, 20X2 and 31st March, 20X2. The employees exercised their options for 9,500

shares only; the remaining options lapsed. The company closes its books on 31st March every

year.

Show Journal Entries.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.8

4. ICAI PQ No 1

X Co. Ltd. has its share capital divided into equity shares of ` 10 each. On 1.4.20X1 it granted

20,000 employees’ stock option at ` 50 per share when the market price was ` 120 per share.

Fair value per option was ` 70. The options were to be exercised between 15th March, 20X2 and

31st March, 20X2. The employees exercised their options for 16,000 shares only and the

remaining options lapsed. The company closes its books on 31st March every year. Show Journal

entries (with narration) as would appear in the books of the company up to 31st March, 20X2.

5. Pinnacle Ltd. Grants 100 stock options to each of its 1,000 employees on 01.04.2009 for `2

depending on the employees at the time of vesting of options. The market price of the share is

`5. These options will vest at the end of the year 1 if the earning of Pinnacle Ltd. is 15% or it

will vest at the end of year 2 if the average earnings of two years is 13%, or lastly it will vest

at the end of the third year if the average earning of the 3 years will be 10%. 5,000 unvested

options lapsed on 31.10.2010. 4,000 unvested options lapsed on 31.03.2011 and finally 3,500

unvested options lapsed on 31.03.2012

Following is the earning of Pinnacle Ltd.

Year Ended on Earnings (%)

31.03.2010 14%

31.03.2011 10%

31.03.2012 7%

850 employees exercised their vested options within a year and remaining options were

unexercised at the end of the contractual life. Pass journal entries for the above.

6. ICAI PQ No 4

On 1st April, 20X1, a company offered 100 shares to each of its 500 employees at ` 50 per share.

The employees are given an year to accept the offer. The shares issued under the plan shall be

subject to lock-in on transfer for three years from the grant date. The market price of shares of

the company on the grant date is ` 60 per share. Due to post-vesting restrictions on transfer, the

fair value of shares issued under the plan is estimated at ` 56 per share and fair value per option

worked out to be ` 6.

On 31st March, 20X2, 400 employees accepted the offer and paid ` 50 per share purchased.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.9

Nominal value of each share is ` 10.

Record the issue of share in the books of the company under the aforesaid plan.

7. ICAI Illustration No 3

Arihant Limited has its share capital divided into equity shares of ` 10 each. On 1- 10-20X1, it

granted 20,000 employees’ stock options at ` 50 per share, when the market price was ` 120

per share. The fair value of options, calculated using an option pricing model, is ` 70 per option

The options were to be exercised between 10th December, 20X1 and 31st March, 20X2. The

employees exercised their options for 16,000 shares only and the remaining options lapsed. The

company closes its books on 31st March every year. Show Journal Entries (with narration) as

would appear in the books of the company upto 31st March, 20X2.

8. ICAI QP Jan 21

Raja Ltd. has its share capital divided into equity shares of ` 10 each. On 01-08-2019, it granted

2,500 employees stock options at ` 50 per share, when the market price was ` 140 per share.

The options were to be exercised between 1-10-2019 to 31-03-2020. The employees exercised

their options for 2,400 shares only and the remaining options lapsed.

Raja Ltd. closes its books of accounts on 31st March, every year.

You are to required to pass the necessary Journal Entries (including narration) for the year

ended 31-03-2020, with regard to employees' stock options and give working notes also.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.10

‘My Career My Responsibility’

Career requires Action, Responsibility, and Ownership from you. You are the most

important factor in whether you experience career growth and development. The most

important issue about your career is taking responsibility for your own career.

1. ICAI Illustration No 2

ABC Ltd. grants 1,000 employees stock options on 1.4.20X0 at ` 40, when the market price is `

160. The fair value of options, calculated using an option pricing model, is ` 120 per option. The

vesting period is 2½ years and the maximum exercise period is one year. 300 unvested options

lapse on 1.5.20X2. 600 options are exercised on 30.6.2X13. 100 vested options lapse at the end of

the exercise period.

Pass Journal Entries giving suitable narrations.

Solution:

In the books of ABC Ltd.

Journal Entries

Date Particulars Dr. (`) Cr. (`)

31.3.20X1 Employees compensation expenses account Dr. 48,000

To Employee stock option outstanding a/c 48,000

(Being compensation expenses recognized in respect of

the employee stock option i.e. 1,000 options *( 160-40)

/2.5 amortised on straight line basis over 2.5 years)

Profit and loss account Dr. 48,000

To Employees compensation expenses a/c 48,000

(Being expenses transferred to profit and loss account at

year end)

31.3.20X2 Employees compensation expenses account Dr. 48,000

To Employee stock option outstanding a/c 48,000

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.11

(Being compensation expenses recognized in respect of

the employee stock option i.e. 1,000 options *( 160-40)

/2.5 amortised on straight line basis over 2.5 years)

Profit and loss account Dr. 48,000

To Employees compensation expenses a/c 48,000

(Being expenses transferred to profit and loss account at

year end)

31.3.20X3 Employee stock option outstanding account (W.N.1) Dr. 12,000

To General Reserve account (W.N.1) 12,000

(Being excess of employees compensation expenses

transferred to general reserve account)

30.6.20X3 Bank A/c (600 x ` 40) Dr. 24,000

Employee stock option outstanding account (600 x ` 120) Dr. 72,000

To Equity share capital account (600 x ` 10) 6,000

To Securities premium account (600 x ` 150) 90,000

(Being 600 employee stock option exercised at an

exercise price of ` 40 each)

01.10.20X3 Employee stock option outstanding account (W.N.2) Dr. 12,000

( 120*100)

To General reserve account (W.N.2) 12,000

(Being ESOS outstanding A/c on lapse of 100 options at

the end of exercise of option period transferred to General

Reserve A/c)

Working Notes:

1. On 31.3.20X3, ABC Ltd. will examine its actual forfeitures and make necessary

adjustments, if any, to reflect expenses for the number of options that actually vested.

Considering that 700 stock options have completed 2.5 years vesting period, the expense

to be recognized during the year is in negative i.e.

No. of options actually vested (700 x 120) ` 84,000

Less: Expenses recognized ` (48,000 + 48,000) (` 96,000)

Excess expense transferred to general reserve ` 12,000

2. Similarly, on 1.10.20X3, Employee Stock Option Outstanding Account will be

No. of options actually vested (600 x 120) ` 72,000

Less: Expenses recognized (` 84,000)

Excess expense transferred to general reserve ` 12,000

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.12

Employee Stock Options Outstanding will appear in the Balance Sheet under a separate heading,

between ‘Share Capital’ and ‘Reserves and Surplus’.

2. ICAI PQ No 3 and Mock Test Paper 1

A company has its share capital divided into shares of ` 10 each. On 1-4-20X1, it granted 5,000

employees stock options at ` 50, when the market price was ` 140. Fair value per option was `

90. The options were to be exercised between 1-3-20X2 to 31-03-20X2. The employees exercised

their options for 4,800 shares only; remaining options lapsed. Pass the necessary journal entries

for the year ended 31- 3-20X2, with regard to employees’ stock options.

Solution:

In the books of Company

Journal Entries

Date Particulars Dr(`) Cr(`)

1-3-13 to Bank A/c Dr. 2,40,000

31-3-13 Employees compensation expenses A/c Dr. 4,32,000

To Equity Share Capital A/c 48,000

To Securities Premium A/c 6,24,000

(Being allotment to employees 4,800 shares of ` 10

each at a premium of ` 130 at an exercise price of`

50 each)

31-3-13 Profit and Loss account Dr. 4,32,000

To Employees compensation expenses A/c 4,32,000

(Being transfer of employees compensation

expenses)

Working Note:

1. Employee Compensation Expenses = Discount between Market Price and option price

= ` 140 – ` 50 = ` 90 per share = ` 90 x 4,800 = ` 4,32,000/- in total.

2. The Employees Compensation Expense is transferred to Securities Premium Account.

3. Securities Premium Account = ` 50 – ` 10 = ` 40 per share + ` 90 per share on account of

discount of option price over market price = ` 130 per share = ` 130 x 4,800 = ` 6, 24,000/-

in total.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.13

3. ICAI Illustration No 4

Ajanta grants 120 share options to each of its 460 employees. Each grant is conditional on the

employee working for Ajanta over the next three years. Ajanta has estimated that the fair value

of each share option is ` 12. Ajanta estimates that 25% of employees will leave during the three-

year period and so forfeit their rights to the share options. Everything turns out exactly as

expected.

Required:

Calculate the amounts to be recognized as expense during the vesting period.

Solution:

Year Calculation Expense for Cumulative

Period Expense

1 55,200 options x 75% x ` 12 x 1/3 years 1,65,600 1,65,600

2 (55,200 options x 75% x ` 12 x 2/3 years) - 165,600 1,65,600 3,31,200

3 (55,200 options x 75% x ` 12 x 3/3 years) - 331,200 1,65,600 4,96,800

An enterprise should review all estimates taken in consideration for valuation of option. The value

of options recognised as expense in an accounting period is the excess of cumulative expense as

per latest estimates upto the current accounting period over total expense recognised upto the

previous accounting period.

4. RTP Nov 2018, ICAI PQ 5

JKS Ltd. has its share capital divided into equity shares of ` 10 each. On 1.1.20X1 it granted

5,000 employee stock options at ` 30 per share, when the market price was ` 50 per share.

Fair value per option was ` 20. The options were to be exercised between 15th March, 20X1 and

31st March, 20X1. The employees exercised their options for 3,600 shares only and the

remaining options lapsed. The company closes its books on 31st March every year. Show Journal

entries (with narration) as would appear in the books of the company up to 31st March, 20X1.

Solution:

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.14

Journal Entries in the books of JKS Ltd

Date Particulars ` `

15.03.2018 Bank A/c (3,600 x ` 30) Dr. 1,08,000

to 31.3.18 Employee compensation expense A/c (3,600 x ` 20) Dr. 72,000

To Equity share capital A/c (3600 x ` 10) 36,000

To Securities premium A/c (3600 x ` 40) 1,44,000

(Being shares issued to the employees against the

options vested to them in pursuance of Employee Stock

Option Plan)

31.3.18 Profit and Loss A/c Dr. 72,000

To Employee compensation expenses A/c 72,000

(Being transfer of employee compensation expenses

transfer to Profit and Loss Account)

Working Notes:

1. No entry is passed when stock options are granted to employees. Hence, no entry will be

passed on 1st January 2018;

2. Market Price = ` 50 per share and stock option price = ` 30, Hence, the difference ` 50 –

` 30 = ` 20 per share is equivalent to employee cost or employee compensation expense

and will be charged to P &L Account as such for the number of options exercised i.e. 3,600

shares.

5. RTP Nov 2018

At the beginning of year 1, the enterprise grants 1,000 stock options to each member of its sales

team, conditional upon the employees remaining in the employment of the enterprise for three

years, and the team selling more than 50,000 units of a particular product over the three-year

period. The fair value of the stock options is ` 15 per option at the date of grant.

During year 2, the enterprise increases the sales target to 1,00,000 units. By the end of year 3, the

enterprise has sold 55,000 units, and the stock options do not vest.

Twelve members of the sales team have remained in service for the three-year period. You are

required to examine and give comment in light of the relevant Guidance Note that whether the

company should recognise the expenses on the base of options granted or not.

Also state will your answer differ if, instead of modifying the performance target, the enterprise

had increased the number of years of service required for the stock options to vest from three

years to ten years.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.15

Solution:

Paragraph 19 of the Guidance Note on Share Based Payments requires, for a performance

condition that is not a market condition, the enterprise to recognize the services received during

the vesting period based on the best available estimate of the number of shares or stock options

expected to vest and to revise that estimate, if necessary, if subsequent information indicates

that the number of shares or stock options expected to vest differs from previous estimates. On

vesting date, the enterprise revises the estimate to equal the number of instruments that

ultimately vested. However, paragraph 24 of the Guidance Note requires, irrespective of any

modifications to the terms and conditions on which the instruments were granted, or a

cancellation or settlement of that grant of instruments, the enterprise to recognize, as a

minimum, the services received, measured at the grant date fair value of the instruments

granted, unless those instruments do not vest because of failure to satisfy a vesting condition

(other than a market condition) that was specified at grant date.

Furthermore, paragraph 26(c) of the Guidance Note specifies that, if the enterprise modifies

the vesting conditions in a manner that is not beneficial to the employee, the enterprise does

not take the modified vesting conditions into account when applying the requirements for

treatment of vesting conditions as specified in Guidance Note.

Therefore, because the modification to the performance condition made it less likely that the

stock options will vest, which was not beneficial to the employee, the enterprise takes no

account of the modified performance condition when recognizing the services received. Instead,

it continues to recognize the services received over the three-year period based on the original

vesting conditions. Hence, the enterprise ultimately recognizes cumulative remuneration

expense of ` 1,80,000 over the three- year period (12 employees × 1,000 options × ` 15).

The same result would have occurred if, instead of modifying the performance target, the

enterprise had increased the number of years of service required for the stock options to vest

from three years to ten years Because such a modification would make it less likely that the

options will vest, which would not be beneficial to the employees, the enterprise would take no

account of the modified service condition when recognizing the services received. Instead, it

would recognize the services received from the twelve employees who remained in service over

the original three- year vesting period.

6. RTP May 2019

A company has its share capital divided into shares of ` 10 each. On 1-1-20X1, it granted 7,500

employees stock options at ` 50, when the market price was ` 140. The options were to be

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.16

exercised between 1-3-20X2 to 31-03-20X2. The employees exercised their options for 7,200

shares only; remaining options lapsed. Pass the necessary journal entries for the year ended 31-

3-20X2, with regard to employees’ stock options

Solution

In the books of Company Journal Entries

Date Particulars Dr.(`) Cr.(`)

1-3-X2 to Bank A/c (7,200 x 50) Dr. 3,60,000

31-3-X2 Employees compensation expenses A/c Dr. 6,48,000

To Equity Share Capital A/c (7,200 x 10) 72,000

To Securities Premium A/c (7,200 x ` 130) 9,36,000

(Being allotment to employees 7,200 shares of ` 10

each at a premium of ` 130 at an exercise price of ` 50

each)

31-3-X2 Profit and Loss account Dr. 6,48,000

To Employees compensation expenses A/c 6,48,000

(Being transfer of employees compensation expenses)

Working Notes:

1. Employee Compensation Expenses = Discount between Market Price and option price

= ` 140 – ` 50 = ` 90 per share = ` 90 x 7,200 = ` 6,48,000 in total.

2. Securities Premium Account = ` 50 – ` 10 = ` 40 per share + ` 90 per share on account of

discount of option price over market price = ` 130 per share = ` 130 x 7,200= ` 9,36,000 in

total.

7. RTP May 2018

PQ Ltd. grants 100 stock options to each of its 1,000 employees on 1 -4-2015, conditional upon

the employee remaining in the company for 2 years. The fair value of the option is ` 18 on the

grant date and the exercise price is ` 55 per share. The other information is given as under:

a. Number of employees expected to satisfy service condition are 930 in the 1st year and

850 in the 2nd year.

b. 40 employees left the company in the 1st year of service and 880 employees have

actually completed 2 year vesting period.

You are required to calculate ESOP cost to be amortized by PQ Ltd. in the years 2015- 2016 and

2016-2017.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.17

Solution

Calculation of ESOP cost to be amortized

Particulars 2015-2016 2016-2017

Fair value of options per share ` 18 ` 18

No. of options expected to vest

under the scheme 93,000 (930 x 100) 88,000 (880 x 100)

Fair value of options ` 16,74,000 ` 15,84,000

Value of options recognized as (` 16,74,000 / 2) (` 15,84,000 – ` 8,37,000)

expenses 8,37,000 7,47,000

8. QP Nov 2018

Lucky Ltd. grants 100 stock options to each of its 1,500 employees on 1-4-2014 for ` 40,

depending upon the employees at the time of vesting of options. Options would be exercisable

within a year it is vested. The market price of the share is ` 70 each. These options will vest

at the end of year 1 if the earning of Lucky Ltd. is 15%, or it will vest at the end of the year

2 if the average earning of two years is 13% or lastly it will vest at the end of the third year

if the average earning of 3 years will be 10% 8,000, unvested options lapsed on 31-3-2015.

6,000 unvested options lapsed on 31-3-2016 and finally 4,000 unvested options lapsed on 31-

3-2017.

The earnings of Lucky Ltd. for the three financial years ended on 31st March, 2015; 2016 and

2017 are 14%, 10% and 8% respectively.

1,250 employees exercised their vested options within a year and remaining options were

unexercised at the end of the contractual life.

You are required to give the necessary journal entries for the above and also prepare the statement

showing compensation expense to be recognized at the end of each year.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.18

Solution:

Date Particulars ` `

31.3.2015 Employees compensation expense A/c Dr. 21,30,000

To ESOS outstanding A/c 21,30,000

(Being compensation expense recognized in

respect of the ESOP i.e. 100 options each granted to 1,500

employees at a discount of ` 30 each, amortised on

straight line basis over vesting years (Refer W.N.)

Profit and Loss A/c Dr. 21,30,000

To Employees compensation expenses A/c 21,30,000

(Being expenses transferred to profit and Loss A/c)

31.3.2016 Employees compensation expenses A/c Dr. 5,90,000

To ESOS outstanding A/c 5,90,000

(Being compensation expense recognized in respect of

the ESOP- Refer W.N.)

Profit and Loss A/c Dr. 5,90,000

To Employees compensation expenses A/c 5,90,000

(Being expenses transferred to profit and Loss A/c)

31.3.2017 Employees compensation Expenses A/c Dr. 12,40,000

To ESOS outstanding A/c 12,40,000

(Being compensation expense recognized in respect of

the ESOP- Refer W.N.)

Profit and Loss A/c Dr. 12,40,000

To Employees compensation expenses A/c 12,40,000

(Being expenses transferred to profit and Loss A/c)

2018-19 Bank A/c (1,250 x100 x40) Dr. 50,00,000

ESOS outstanding A/c Dr. 37,50,000

[(39,60,000 x 1,25,000/ 1,32,000]

To Equity share capital (1250 x 100 x 10) 12,50,000

To Securities premium A/c 75,00,000

[ (1250 x 100 x (70-10)]

(Being 1,25,000 options exercised at an exercise price of

` 40 each)

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.19

31.3.2019 ESOS outstanding A/c Dr. 2,10,000

To General Reserve A/c 2,10,000

(Being ESOS outstanding A/c on lapse of 7,000 options at

the end of exercise of option period transferred to General

Reserve A/c)

Working Note:

Statement showing compensation expense to be recognized at the end of:

Particulars Year 1 Year 2 Year 3

2014-15 2015-16 2016-17

Number of options expected to vest* 1,42,000 options 1,36,000 options 1,32,000 options

Total compensation expense accrued ` 42,60,000 ` 40,80,000 ` 39,60,000

(70-40)

Compensation expense of the year 42,60,000 x 1/2 = 40,80,000 x 2/3

` 21,30,000 = ` 27,20,000 ` 39,60,000

Compensation expense recognized

previously Nil ` 21,30,000 ` 27,20,000

Compensation expenses to be recognized

for the year ` 21,30,000 ` 5,90,000 ` 12,40,000

*It is assumed that each share is of ` 10 each and Lucky Ltd. expects all the options to be vested

after deducting actual lapses during the year.

9. QP May 2018

Suvidhi Ltd. offered 50 shares to each of its 1500 employees on 1st April 2017 for ` 30. Option

would be exercisable within a year it is vested. The shares issued under the plan shall be subject

to lock-in on transfer for three years from the grant date. The market price of shares of the

company is ` 50 per share on grant date. Due to post vesting restrictions on transfer, the fair

value of shares issued under the plan is estimated at ` 38 per share.

On 31st March, 2018, 1200 employees accepted the offer and paid ` 30 per share purchased.

Nominal value of each share is ` 10.

Record the issue of shares in the books of the company under the aforesaid plan.

Solution

Journal Entries in the books of Suvidhi Ltd.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.20

Date Particulars Dr. (`) Cr. (`)

31.3.18 Bank A/c (60,000 shares x ` 30) Dr. 18,00,000

Employees stock compensation expense A/c Dr. 4,80,000

To Share Capital A/c (60,000 shares x ` 10) 6,00,000

To Securities Premium (60,000 shares x ` 28) 16,80,000

(Being shares issued under ESOP @ ` 30 to 1,200

employees)

Profit & Loss A/c Dr. 4,80,000

To Employees stock compensation expense A/c 4,80,000

(Being Employees stock compensation expense transferred

to Profit & Loss A/c)

Working Note:

Fair value of an option = ` 38 – ` 30 = ` 8

Number of shares issued = 1,200 employees x 50 shares/employee = 60,000 shares Fair

value of ESOP which will be recognized as expenses in the year 2017-2018

= 60,000 shares x ` 8 = ` 4,80,000

Vesting period = 1 year

Expenses recognized in 2017-2018 = ` 4,80,000

10. QP May 19

Bee Ltd. has its share capital divided into Equity Shares of ` 10 each. On 1st April, 2017, the

company offered 250 shares to each of its 520 employees at ` 60 per share, when the market

price was ` 150 per share. The options were to be exercised between 01-03-2018 to 31-03-2018.

410 employees accepted the offer and paid ` 60 per share on purchased shares and the remaining

options lapsed.

The company closes its books on 31st March every year.

You are required to show Journal Entries (with narrations) as would appear in the books of

Bee Ltd. for the year ended 31st March, 2018 with regard to employees stock options.

Solution

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.21

Journal Entries in the books of Bee Ltd.

Date Particulars ` `

1.3.18 Bank A/c (1,02,500 x ` 60) Dr. 61,50,000

To31.3.18

Employee compensation expense A/c (1,02,500 x `90) Dr. 92,25,000

To Equity share capital A/c (1,02,500 x `10) 10,25,000

To Securities premium A/c (1,02,500 x `140) 1,43,50,000

(Being shares issued to the employees against the options

vested to them in pursuance of

Employee Stock Option Plan)

31.3.18 Profit and Loss A/c Dr. 92,25,000

To Employee compensation expense A/c

(Being transfer of employee compensation expenses to Profit

and Loss Account)

11. RTP Nov 19

The following particulars in respect of stock options granted by a company are available:

Grant date April 1, 2016

Number of employees covered 50

Number of options granted per employee 1,000

Fair value of option per share on grant date (`) 9

The options will vest to employees serving continuously for 3 years from vesting date, provided the

share price is ` 65 or above at the end of 2018-19.

The estimates of number of employees satisfying the condition of continuous employment were

48 on 31/03/17, 47 on 31/03/18. The number of employees actually satisfying the condition of

continuous employment was 45.

The share price at the end of 2018-19 was ` 68.

You are required to compute expenses to be recognised in each year in the books of the company.

Solution:

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.22

The vesting of options is subject to satisfaction of two conditions viz. service condition of

continuous employment for 3 years and market condition that the share price at the end of 2018-

19 is not less than ` 65. The company should recognise value of option over 3-year vesting period

from 2016-17 to 2018-19.

Year 2016-17

Fair value of option per share = ` 9

Number of shares expected to vest under the scheme = 48 × 1,000 = 48,000

Fair value = 48,000 × ` 9 = ` 4,32,000

Expected vesting period = 3 years

Value of option recognised as expense in 2016-17 = ` 4,32,000 /3 = ` 1,44,000

Year 2017-18

Fair value of option per share = ` 9

Number of shares expected to vest under the scheme = 47 × 1,000 = 47,000

Fair value = 47,000 × ` 9 = ` 4,23,000

Expected vesting period = 3 years

Cumulative value of option to recognise as expense in 2016-17 and 2017-18

= (` 4,23,000/ 3) × 2 = ` 2,82,000

Value of option recognised as expense in 2016-17 = ` 1,44,000

Value of option recognised as expense in 2017-18

= ` 2,82,000 – ` 1,44,000 = ` 1,38,000

Year 2018-19

Fair value of option per share = ` 9

Number of shares actually vested under the scheme = 45 × 1,000 = 45,000

Fair value = 45,000 × ` 9 = ` 4,05,000

Vesting period = 3 years

Cumulative value of option to recognise as expense in 2016-17, 2017-18 and 2018-19 = ` 4,05,000

Value of option recognised as expense in 2016-17 and 2017-18 = ` 2,82,000

Value of option recognised as expense in 2018-19 = ` 4,05,000 – ` 2,82,000 = ` 1,23,000

12. ICAI ILLUSTRATION NO 7

At the beginning of year 1, an enterprise grants 10,000 stock options to a senior executive,

conditional upon the executive remaining in the employment of the enterprise until the end of

year 3. The exercise price is ` 40. However, the exercise price drops to ` 30 if the earnings of the

enterprise increase by at-least an average of 10 per cent per year over the three-year period.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.23

On the grant date, the enterprise estimates that the fair value of the stock options, with an

exercise price of ` 30, is ` 16 per option. If the exercise price is ` 40, the enterprise estimates that

the stock options have a fair value of ` 12 per option.

During year 1, the earnings of the enterprise increased by 12 per cent, and the enterprise expects

that earnings will continue to increase at this rate over the next two years. The enterprise,

therefore, expects that the earnings target will be achieved, and hence the stock options will have

an exercise price of ` 30.

During year 2, the earnings of the enterprise increased by 13 per cent, and the enterprise continues

to expect that the earnings target will be achieved.

During year 3, the earnings of the enterprise increased by only 3 per cent, and therefore the

earnings target was not achieved. The executive completes three years’ service, and therefore

satisfies the service condition. Because the earnings target was not achieved, the 10,000 vested

stock options have an exercise price of ` 40.

You are required to calculate the amount to be charged to Profit and Loss Account every year on

account of compensation expenses.

Solution:

Since the exercise price varies depending on the outcome of a performance condition which is not

a market condition, the effect of that performance condition (i.e. the possibility that the exercise

price might be ` 40 and the possibility that the exercise price might be ` 30) is not considered

when estimating the fair value of the stock options at the grant date. Instead, the enterprise

estimates the fair value of the stock options at the grant date under each scenario and revises

the transaction amount to reflect the outcomes of that performance condition at the end of every

year based on the information available at that point of time.

Calculation of compensation expense to be charged every year

Year Calculation Expense for the year Cumulative expense

(`) (`)

1 10,000 x ` 16 x 1/3 53,333 53,333

2 10,000 x ` 16 x 2/3 53,334 1,06,667

3 10,000 x ` 12 x 3/3 13,333 1,20,000

Reference: The students are advised to refer the bare text of the Guidance Note on Employee

Share Based Payments.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.24

13. RTP MAY 20

On 1st April, 2019, a company offered 100 shares to each of its 400 employees at ` 25 per share.

The employees are given a month to accept the shares. The shares issued under the plan shall

be subject to lock-in to transfer for three years from the grant date i.e. 30 th, April 2019. The

market price of shares of the company on the grant date is ` 30 per share. Due to post-vesting

restrictions on transfer, the fair value of shares issued under the plan is estimated at ` 28 per

share.

Up to 30th April, 2019, 50% of employees accepted the offer and paid ` 25 per share purchased.

Nominal value of each share is ` 10. You are required to record the issue of shares in the books of

the company under the aforesaid plan.

Solution:

Fair value of an option = ` 28

Difference between Fair value and Issue Price =` 28 – ` 25 = 3.

Number of employees accepting the offer = 400 employees x 50% = 200 employees Number of

shares issued = 200 employees x 100 shares/employee = 20,000 shares Employee Compensation

Expenses recognized in 2019-20 =20,000 shares x ` 3 = ` 60,000

Securities Premium A/c = ` 28 – 10 = ` 18 per share = 20,000 x 18 = ` 3,60,000

Journal Entry

Date Particulars ` `

30.04.2019 Bank (20,000 shares x ` 25) Dr. 5,00,000

Employees compensation expense A/c Dr. 60,000

To Share Capital 2,00,000

To Securities Premium 3,60,000

(Being stock purchase option accepted by 200

employees for 100 shares each at ` 25 per share on a

Fair Value of ` 28 per share)

Note: Employees compensation expenses amounting ` 60,000 will ultimately be charged to profit

& loss account.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.25

14. RTP NOV 20

Kaushal Ltd. has its share capital divided into equity shares of ` 10 each. On 1.1.2020 it granted

5,000 employee stock options at ` 30 per share, when the market price was ` 50 per share. The

options were to be exercised till the month of March, 2020. The employees exercised their

options for 3,600 shares only and the remaining options lapsed. Show Journal entries (with

narration) as would appear in the books of the company till the month of March, 2020 relating

to ESOPs as the company closes its books on 31st March every year.

Solution:

Journal Entries in the books of Kaushal Ltd.

Date Particulars ` `

1.3.2020 Bank A/c Dr. 1,08,000

to 31.3.2020 Employee compensation expense A/c Dr. 72,000

To Equity share capital A/c 36,000

To Securities premium A/c 1,44,000

(Being shares issued to the employees against the

options vested to them in pursuance of Employee

Stock Option Plan)

31.3.2020 Profit and Loss A/c Dr. 72,000

To Employee compensation expenses A/c 72,000

(Being transfer of employee compensation expenses

transfer to Profit and Loss Account)

Working Note:

Market Price = ` 50 per share and stock option price = ` 30, Hence, the difference ` 50 –

` 30 = ` 20 per share is equivalent to employee cost or employee compensation expense and

will be charged to P&L Account as such for the number of options exercised i.e. 3,600 shares.

15. RTP MAY 21

PQ Ltd. grants 100 stock options to each of its 1,000 employees on 1-4-2018, conditional upon the

employee remaining in the company for 2 years. The fair value of the option is ` 18 on the grant

date and the exercise price is ` 55 per share. Number of employees expected to satisfy service

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.26

conditions are 930 in the 1st year and 850 in the 2nd year. However, 880 employees actually

completed 2 year vesting period.

You are required to calculate ESOP cost to be amortized by PQ Ltd. in the years 2018-2019 and

2019-2020.

Solution:

Calculation of ESOP cost to be amortized

2018-2019 2019-2020

Fair value of options per share ` 18 ` 18

No. of options expected to vest under the scheme 93,000 (930 x 100) 88,000 (880 x 100)

Fair value of options ` 16,74,000 ` 15,84,000

Value of options recognized as expenses 8,37,000 7,47,000

(` 16,74,000 / 2) (` 15,84,000 – ` 8,37,000)

16. QP NOV 19

On 1st April, 2018, XYZ Ltd., offered 150 shares to each of its 750 employees at ` 60 per share.

The employees are given a year to accept the offer. The shares issued under the plan shall be

subject to lock-in period on transfer for three years from the grant date. The market price of

shares of the company on the grant date is ` 72 per share. Due to post- vesting restrictions on

transfer, the fair value of shares issued under the plan is estimated at ` 67 per share.

On 31st March, 2019, 600 employees accepted the offer and paid ` 60 per share purchased.

Nominal value of each share is ` 10.

You are required to record the issue of shares in the books of the XYZ Ltd., under the aforesaid

plan.

Solution:

Fair value of an option = ` 67(considered on grant date) – ` 60 = ` 7

Number of shares issued = 600 employees x 150 shares/employee = 90,000 shares Fair value of

ESOP = 90,000 shares x ` 7 = ` 6,30,000

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.27

Vesting period = 1 year

Expenses recognized in 2018-19 = ` 6,30,000

Date Particulars ` `

31.03.2019 Bank (90,000 shares x ` 60) Dr. 54,00,000

Employees stock compensation expense A/c Dr. 6,30,000 9,00,000

To Share Capital (90,000 shares x ` 10) 51,30,000

To Securities Premium (90,000shares x ` 57)

(Being option accepted by 600 employees & payment

made @ ` 60 per share)

Profit & Loss A/c Dr. 6,30,000

To Employees stock compensation expense A/c 6,30,000

(Being Employees stock compensation expense transferred

to Profit & Loss A/c)

17. QP NOV 20

Sun Ltd. grants 100 stock options to each of its 1200 employees on 01.04.2016 for ` 30, depending

upon the employees at the time of vesting of options. Options would be exercisable within a year

it is vested. The market price of the share is ` 60 each. These options will vest at the end of the

year 1 if the earning of Sun Ltd. is 16% or i t will vest at the end of year 2 if the average earning

of two years is 13%, or lastly it will vest at the end of the third year, if the average earning of 3

years is 10%. 6000 unvested options lapsed on 31.3.2017, 5000 unvested options lapsed on

31.03.2018 and finally 4000 unvested options lapsed on 31.03.2019.

The earnings of Sun Ltd. for the three financial years ended on 31st March, 2017, 2018 and 2019

are 15%, 10% and 6%, respectively.

1000 employees exercised their vested options within a year and remaining options were

unexercised at the end of the contractual life.

You are requested to give the necessary journal entries for the above and prepare the statement

showing compensation expenses to be recognized at the end of each year.

Solution:

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.28

Date Particulars ` `

31.3.2017 Employees compensation expense A/c Dr. 17,10,000

To ESOS outstanding A/c 17,10,000

(Being compensation expense recognized in respect of

the ESOP i.e. 100 options each granted to 1,200 employees

at a discount of ` 30 each, amortized on straight line

basis over vesting years (Refer W.N.)

Profit and Loss A/c Dr. 17,10,000

To Employees compensation expenses A/c 17,10,000

(Being expenses transferred to profit and Loss A/c)

31.3.2018 Employees compensation expenses A/c Dr. 4,70,000

To ESOS outstanding A/c 4,70,000

(Being compensation expense recognized in respect of

the ESOP- Refer W.N.)

Profit and Loss A/c Dr. 4,70,000

To Employees compensation expenses A/c 4,70,000

(Being expenses transferred to profit and Loss A/c)

31.3.2019 Employees compensation Expenses A/c Dr. 9,70,000

To ESOS outstanding A/c 9,70,000

(Being compensation expense recognized in respect of

the ESOP- Refer W.N.)

Profit and Loss A/c 9,70,000

To Employees compensation expenses A/c 9,70,000

(Being expenses transferred to profit and Loss A/c)

2019-20 Bank A/c (1,00,000 x ` 30) Dr. 30,00,000

ESOS outstanding A/c [(31,50,000/1,05,000) x 1,00,000] Dr. 30,00,000

To Equity share capital (1,00,000 x ` 10) 10,00,000

To Securities premium A/c (1,00,000 x ` 50) 50,00,000

(Being 1,00,000 options exercised at an exercise price of ` 30

each)

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.29

31.3.2020 ESOS outstanding A/c Dr. 1,50,000

To General Reserve A/c 1,50,000

(Being ESOS outstanding A/c on lapse of 5,000 options at the

end of exercise of option period transferred to General

Reserve A/c)

Working Note:

Statement showing compensation expense to be recognized at the end of:

Particulars Year 1 Year 2 Year 3

(31.3.2017) (31.3.2018) (31.3.2019)

Number of options expected to vest 1,14,000 options 1,09,000 options 1,05,000 options

Total compensation expense accrued (60-30) ` 34,20,000 ` 32,70,000 ` 31,50,000

Compensation expense of the year 34,20,000 x 1/2 32,70,000 x 2/3 ` 31,50,000

= ` 17,10,000 = ` 21,80,000

Compensation expense recognized previously Nil ` 17,10,000 ` 21,80,000

Compensation expenses to be recognized for the year ` 17,10,000 ` 4,70,000 ` 9,70,000

18. RTP NOV 21

On 1st April, 2020, XYZ Ltd., offered 150 shares to each of its 750 employees at ` 60 per share.

The employees are given a year to accept the offer. The shares issued under the plan shall be

subject to lock-in period on transfer for three years from the grant date. The market price of

shares of the company on the grant date is ` 72 per share. Due to post-vesting restrictions on

transfer, the fair value of shares issued under the plan is estimated at ` 67 per share on the grant

date. On 31st March, 2021, 600 employees accepted the offer and paid ` 60 per share purchased.

Face value of each share is ` 10. You are required to record the issue of shares in the books of the

XYZ Ltd., under the aforesaid plan.

Solution:

Fair value of an option = ` 67 – ` 60 = ` 7

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.30

Number of shares issued = 600 employees x 150 shares/employee = 90,000 shares Fair value of

ESOP = 90,000 shares x ` 7 = ` 6,30,000

Vesting period = 1 year

Expenses recognized in 2020-21 = ` 6,30,000

Date Particulars ` `

31.03.2021 Bank (90,000 shares x ` 60) Dr. 54,00,000

Employees stock compensation expense A/c Dr. 6,30,000

To Share Capital (90,000 shares x ` 10) 9,00,000

To Securities Premium (90,000 shares x ` 57) 51,30,000

(Being option accepted by 600 employees & payment

made @ ` 60 per share)

Profit & Loss A/c Dr. 6,30,000

To Employees stock compensation expense A/c 6,30,000

(Being Employees stock compensation expense

transferred to Profit & Loss A/c)

19. RTP NOV 21

Define the following terms:

(i) Vesting

(ii) Exercise Period

(iii) Grant date

(iv) Exercise Price

Solution:

(i) Vesting: It means the process by which the employee is given the right to apply for the shares

of the company against the option granted to him under the employees’ stock option plan.

(ii) Exercise Period: It is the time period after vesting within which the employee should exercise

his right to apply for shares against the option vested in him in pursuance of the employees’

stock option plan.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.31

(iii) Grant Date: It is the date at which the enterprise and its employees agree to the terms of

an employee share-based payment plan. At grant date, the enterprise confers on the employees

the right to cash or shares of the enterprise, provided the specified vesting conditions, if any, are

met.

(iv) Exercise Price: It is the price payable by the employee for exercising the option granted to

him in pursuance of employees’ stock option scheme.

20. QP JULY 21

At the beginning of the year 1, Harmony Limited grants 600 options to each of its 1000 employees.

The contractual life of option granted is 6 years.

Other relevant information is as follows:

Vesting Period 3 years

Exercise period 3 years

Expected Life 5 years

Exercise Price ` 100

Market Price ` 100

Expected Forfeitures per year 3%

The option granted vest according to a graded schedule of 25% at the end of the year 1, 25% at

the end of the year 2 and the remaining 50% at the end of the year 3.

You are required to calculate total compensation expenses for the options expected to vest and

cost and cumulative cost to be recognized at the end of all the three years assuming that expected

forfeiture rate does not change during the vesting period when the Intrinsic value of the options

at the grant date is ` 7 per option.

Solution:

Since the options granted have a graded vesting schedule, the enterprise segregates the total plan

into different groups, depending upon the vesting dates and treats each of these groups as a

separate plan. The enterprise determines the number of options expected to vest under each group

as below:

Vesting Date Options expected to vest

(Year-end)

1 600 options x 1,000 employees x 25% x 0.97 1,45,500 options

2 600 options x 1,000 employees x 25% x 0.97 x 0.97 1,41,135 options

3 600 options x 1,000 employees x 50% x 0.97x 0.97 x 0.97 2,73,802 options

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.32

Total options expected to vest 5,60,437 options

In case of intrinsic value method, total compensation expense for the options expected to vest

would be

Vesting Date Expected Vesting Value per Compensation

(End of year) (No. of Options) Option (`) Expense (`)

1 1,45,500 7 10,18,500

2 1,41,135 7 9,87,945

3 2,73,802 7 19,16,614

5,60,437 39,23,059

Total compensation expense of ` 39,23,059, determined at the grant date, would be attributed to

the years 1, 2 and 3 as below:

Vesting Date Cost to be recognized

(End of year) Year 1 Year 2 Year 3

1 10,18,500

2 4,93,972.50* 4,93,972.50

3 6,38,871 6,38,871 6,38,872

Cost for the year 21,51,343.50 11,32,843.50 6,38,872

Cumulative cost 21,51,343.50 32,84,187 39,23,059

* Alternatively, it may be rounded off as ` 4,93,972 in year 1 and ` 4,93,973 in year 2.

21. Mock Test Oct 21 Series 1

On 1st October, 2020, A Limited granted 25,000 Employees’ Stock Option at ` 70 per share. The

market price of share was ` 130 per share. The options were to be exercised between 1st December,

2020 and 31st March, 2021. The face value of shares is ` 10 each. The employees exercised option

for 18,000 shares only and the balance options lapsed. The company closes its books of accounts

on 31st March every year.

Pass necessary journal entries with narration to record the transaction in the books of the

company.

Solution:

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.33

Journal Entries in the books of A Ltd.

Date Particulars Dr. (`) Cr. (`)

01.12.2020 to Bank A/c (18,000 x ` 70) Dr. 12,60,000

31.03.2021 Employee compensation expenses account Dr. 10,80,000

[18,000 x (` 130- ` 70)]

To Equity share capital account (18,000 x ` 10) 1,80,000

To Securities premium account (18,000 x `120) 21,60,000

(Being 18,000 employees stock option exercised at

an exercise price of ` 70 each)

31.3.2021 Profit and Loss account Dr. 10,80,000

To Employee compensation expenses 10,80,000

account

(Being transfer of employee compensation expenses

account to profit and loss account)

Working Note:

Fair value of an option = Market price of a share – Exercise price of a share

= ` 130 – ` 70 = ` 60 per share

22. Mock Test Oct 21 Series 2

Raja Ltd. has its share capital divided into equity shares of ` 10 each. On 01-08-2019, it granted

2,500 employees stock options at ` 50 per share, when the market price was ` 140 per share. The

options were to be exercised between 1 -10-2019 to 31-03-2020. The employees exercised their

options for 2,400 shares only and the remaining options lapsed. Raja Ltd. closes its books of

accounts on 31st March, every year.

You are to required to pass the necessary Journal Entries (including narration) for the year ended

31-03-2020, with regard to employees' stock options and give working notes also.

Solution:

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.34

Journal Entries in the books of Raja Ltd.

` `

1.10.19 Bank A/c Dr. 1,20,000

to 31.3.20 Employee compensation expense A/c To Equity Dr. 2,16,000

share capital A/c 24,000

To Securities premium A/c 3,12,000

(Being shares issued to the employees against the options

vested to them in pursuance of Employee Stock Option Plan)

31.3.20 Profit and Loss A/c Dr. 2,16,000

To Employee compensation expense A/c 2,16,000

(Being transfer of employee compensation expenses to Profit

and Loss Account)

No entry is passed when stock options are granted to employees. Hence, no entry will be passed

on 1st August, 2019;

Working Note:

Market Price = ` 140 per share and stock option price = 50, Hence, the difference 140 – 50 = `

90 per share is equivalent to employee cost or employee compensation expense and will be charged

to P&L Account as such for the number of options exercised i.e. 2,400 shares. Hence, Employee

compensation expenses will be 2,400 shares X ` 90 = ` 2,16,000

23. Exam Dec 21

A Company grants 2,000 Employees Stock Options on 1st April,2018 at ` 60 when the market prize

is ` 170. The Vesting period is 2.5 years and the maximum exercise period is 1 year. 600 unvested

options lapse on 01.05.2020. 1200 options are exercised on 30.06.2021. 200 vested options lapse at

the end of the exercise period. You are required to pass necessary journal entries with narrations.

www.Swapnilpatni.com CA Anandh R Bhanggariya

CA Inter Advanced Accounts | ESOP 3.35

Nazar Hati Durghatna Ghati…

Test In Time…Pass In Time

1. ICAI Illustration No 5

P Ltd. granted option for 8,000 equity shares of nominal value of ` 10 on 1st October, 20X0 at `

80 when the market price was ` 170. Fair value per option is ` 90. The vesting period is 4½ years,

4,000 unvested options lapsed on 1st December, 20X2, 3,000 options were exercised on 30th

September, 20X5 and 1,000 vested options lapsed at the end of the exercise period. Pass Journal

Entries for above transactions.

2. ICAI Illustration No 6

Choice Ltd. grants 100 stock options to each of its 1,000 employees on 1.4.20X1 for ` 20, depending

upon the employees at the time of vesting of options. Options would be exercisable within a year

it is vested. The market price of the share is ` 50 each. These options will vest at the end of year

1 if the earning of Choice Ltd. is 16%, or it will vest at the end of the year 2 if the average

earning of two years is 13%, or lastly it will vest at the end of the third year if the average

earning of 3 years will be 10%. 5,000 unvested options lapsed on 31.3.20X2. 4,000 unvested

options lapsed on 31.3.20X3 and finally 3,500 unvested options lapsed on 31.3.20X4. Consider

fair value per option is ` 30.

Following is the earning of Choice Ltd in the Last 3 years:

Year ended on Earning (in %)

31.3.20X2 14%

31.3.20X3 10%

31.3.20X4 7%

850 employees exercised their vested options within a year and remaining options were

unexercised at the end of the contractual life. Pass Journal entries for the above.

www.Swapnilpatni.com CA Anandh R Bhanggariya

You might also like

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Benchmarking of Equity Compensation in Indian IndustryDocument35 pagesBenchmarking of Equity Compensation in Indian IndustryShantanu KaneNo ratings yet

- Priya Singh (ESOP Presentation)Document17 pagesPriya Singh (ESOP Presentation)Priya SinghNo ratings yet

- Of Mployees' Tock Ption Lan: E S O PDocument35 pagesOf Mployees' Tock Ption Lan: E S O Pashwani7789No ratings yet

- About ESOPDocument36 pagesAbout ESOPv_sudarshanNo ratings yet

- ESOP Buyback LiquidationDocument36 pagesESOP Buyback LiquidationAbhishek GoenkaNo ratings yet

- Human Resource Management: Employee Stock Option PlanDocument27 pagesHuman Resource Management: Employee Stock Option PlanRupakshi Saurabh GaurNo ratings yet

- Employee Stock Option Plan (Esop) : This Note CoversDocument32 pagesEmployee Stock Option Plan (Esop) : This Note CoversVaurun GNo ratings yet

- CH 5 - ESOPDocument34 pagesCH 5 - ESOPVrutika ShahNo ratings yet

- Legal & Procedural AspectsDocument35 pagesLegal & Procedural Aspectskhalid nashrullahNo ratings yet

- Human Resource Management: Employee Stock Option PlanDocument19 pagesHuman Resource Management: Employee Stock Option PlanAyush GuptaNo ratings yet

- Converted 110401Document53 pagesConverted 110401Javal ChoksiNo ratings yet

- Unit IiDocument91 pagesUnit IiImproving LifeNo ratings yet

- Employee Stock Option PlanDocument7 pagesEmployee Stock Option Plankrupalee100% (1)

- Assignment Employee Stock Over PlansDocument5 pagesAssignment Employee Stock Over PlansManinder Singh KainthNo ratings yet

- Stock Incentives GrantDocument1 pageStock Incentives GrantSAYANTAN GHOSHNo ratings yet

- Legal & Procedural AspectsDocument31 pagesLegal & Procedural AspectsDisha AwtaniNo ratings yet

- Compensation Management: Xime, Bangalore D T DevareDocument20 pagesCompensation Management: Xime, Bangalore D T DevareJainendra SinhaNo ratings yet

- ESOPs - IMIDocument13 pagesESOPs - IMIrangoli maheshwariNo ratings yet

- EsopDocument27 pagesEsopNakul GargNo ratings yet

- DeNisi Sarkar HR PPT Ch03Document70 pagesDeNisi Sarkar HR PPT Ch03Rohit KumarNo ratings yet

- Shaivi Shah - 203 - FYBAF - FADocument11 pagesShaivi Shah - 203 - FYBAF - FAShaiviNo ratings yet

- C&B Assignment 10 - 19MBA1055Document2 pagesC&B Assignment 10 - 19MBA1055VINITHANo ratings yet

- HRP Presentation: Abrar Mahir Ahmed Nowsheen Tabassum Bushra Tabassum Farisa Tazree AhmedDocument32 pagesHRP Presentation: Abrar Mahir Ahmed Nowsheen Tabassum Bushra Tabassum Farisa Tazree AhmedFarisa Tazree Ahmed 1912999630No ratings yet

- Modern Compensation TechniquesDocument18 pagesModern Compensation TechniquesSuniel100% (1)

- ESOP Guide For Founders - Xto10xDocument28 pagesESOP Guide For Founders - Xto10xAdarsh ChamariaNo ratings yet

- HRM Presentation 1 (ESOP)Document8 pagesHRM Presentation 1 (ESOP)chetnak21No ratings yet

- Ongc Higher Management RecruitmentDocument10 pagesOngc Higher Management RecruitmentTapas TiwariNo ratings yet

- 5 6104822306436023530Document191 pages5 6104822306436023530RITESH100% (3)

- Amity Business School: MBA Class of 2012, Semester IDocument21 pagesAmity Business School: MBA Class of 2012, Semester IMayank TiwariNo ratings yet

- Conclusion & RecommendationDocument4 pagesConclusion & RecommendationGauravNo ratings yet

- Ifrs 2: Share Based PaymentsDocument7 pagesIfrs 2: Share Based PaymentsNomanNo ratings yet

- Profitability Analysis: of The Company For Three Years (ROE, ROA, EPS, Dividend, Payout Ratio Etc.)Document16 pagesProfitability Analysis: of The Company For Three Years (ROE, ROA, EPS, Dividend, Payout Ratio Etc.)Sabab ZamanNo ratings yet

- Super Project SlidesDocument5 pagesSuper Project Slidesp23ayushsNo ratings yet

- A Project Report On Analysis of Working Capital ManagementDocument85 pagesA Project Report On Analysis of Working Capital ManagementBabasab Patil (Karrisatte)50% (2)

- Advance A (Ca I) N (2020) : Ccounting Ntermediate OtesDocument14 pagesAdvance A (Ca I) N (2020) : Ccounting Ntermediate OtesBhavani reddyNo ratings yet

- Self Appraisal FormDocument3 pagesSelf Appraisal FormVamsi Krishna NukarajuNo ratings yet

- Understanding of KPIs (Autosaved)Document35 pagesUnderstanding of KPIs (Autosaved)Ayman TamimNo ratings yet

- Rizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)Document3 pagesRizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)faheemNo ratings yet

- 6c656pms & Esop NewDocument24 pages6c656pms & Esop NewSasanka YalamanchiliNo ratings yet

- HCG - Appraisal Form - Editable - Sherry MathewDocument3 pagesHCG - Appraisal Form - Editable - Sherry MathewsherrymattNo ratings yet

- Assignment (Fmi) : Submitted To - NISHA GOEL MA'MADocument9 pagesAssignment (Fmi) : Submitted To - NISHA GOEL MA'MAbharti palNo ratings yet

- Managing Poor PerformanceDocument35 pagesManaging Poor Performanceraathi_cdiNo ratings yet

- Compensation and Benefits: MBA Sem 4Document13 pagesCompensation and Benefits: MBA Sem 4Sidharth ChoudharyNo ratings yet

- SLCM Esop Summary Notes by RS AcademyDocument3 pagesSLCM Esop Summary Notes by RS AcademyRaghavNo ratings yet

- Module III BM LLL CMDocument24 pagesModule III BM LLL CMNaman AgrawalNo ratings yet

- MNRE Draft Grading Report - HVR Solar Private LimitedDocument25 pagesMNRE Draft Grading Report - HVR Solar Private LimitedAkash BansalNo ratings yet

- 3658 8773 1 SMDocument32 pages3658 8773 1 SMPriyo PujiNo ratings yet

- Iimu Summer Placement Audited Report 2021-23 June 171Document13 pagesIimu Summer Placement Audited Report 2021-23 June 171Valerie KudrowNo ratings yet

- 01 Individual Business Case ChemiKal Corp TL V3Document7 pages01 Individual Business Case ChemiKal Corp TL V3Annette BarbozaNo ratings yet

- Rift Valley University Hawassa Campus Master of Business Administration Program Assignment On Human Resource ManagementDocument12 pagesRift Valley University Hawassa Campus Master of Business Administration Program Assignment On Human Resource ManagementHACHALU FAYENo ratings yet

- Consulting Club Application Form 2022 - BMDocument6 pagesConsulting Club Application Form 2022 - BMShashank AgarwalaNo ratings yet

- Chapter 5Document48 pagesChapter 5aluatNo ratings yet

- NAPS PresentationDocument7 pagesNAPS PresentationDiwakar DwivediNo ratings yet

- Employees and MGMT QuestionnaireDocument3 pagesEmployees and MGMT QuestionnaireAAKANSHA BUDHANINo ratings yet

- Employee Stock OptionsDocument18 pagesEmployee Stock OptionsAkanksha GanveerNo ratings yet

- Organizational Climate SurveyDocument40 pagesOrganizational Climate Surveybiswobrm0% (1)

- Annual Appraisal FormDocument8 pagesAnnual Appraisal FormLalangNo ratings yet

- At1 Acc205 1916Document3 pagesAt1 Acc205 1916Shubham Saurav SSNo ratings yet

- Enterprise Structure & Master DataDocument10 pagesEnterprise Structure & Master DatapaiashokNo ratings yet

- Navigating The Case Analysis Process For Strategic ManagementDocument27 pagesNavigating The Case Analysis Process For Strategic ManagementMariana Herrera ArboledaNo ratings yet

- BBA Project Handbook 2021Document13 pagesBBA Project Handbook 2021alinaNo ratings yet

- CPADocument13 pagesCPAAlwyn Pinto100% (1)

- Pengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitDocument10 pagesPengaruh Threat Emotions, Kepercayaan Merek Dan Harga Terhadap Keputusan Pembelian Produk Susu Anlene ActifitDiwan HYNo ratings yet

- Business Finance 2.2: Financial Ratios: Lecture NotesDocument16 pagesBusiness Finance 2.2: Financial Ratios: Lecture NotesElisabeth HenangerNo ratings yet

- National Power Corporation vs. City of CabanatuanDocument21 pagesNational Power Corporation vs. City of CabanatuanMp CasNo ratings yet

- Effective SME Family Business Succession StrategiesDocument9 pagesEffective SME Family Business Succession StrategiesPatricia MonteferranteNo ratings yet

- Tariq Zahid Bhurgari-1411561-BBA 4BDocument4 pagesTariq Zahid Bhurgari-1411561-BBA 4BAbdul Moiz YousfaniNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- P&GDocument19 pagesP&GVenky PragadaNo ratings yet

- Case Study Currency SwapsDocument2 pagesCase Study Currency SwapsSourav Maity100% (2)

- Merger, Acquisition, TakeoverDocument25 pagesMerger, Acquisition, Takeoverpintu_brownyNo ratings yet

- Director Senior Manager Customer Service in NYC Resume Linda SaginarioDocument3 pagesDirector Senior Manager Customer Service in NYC Resume Linda SaginarioLindaSaginarioNo ratings yet

- Dissertation FinalDocument83 pagesDissertation FinalSaurabh YadavNo ratings yet

- Steps of An Internal AuditDocument3 pagesSteps of An Internal AuditDownload100% (1)

- The Kerala State Co-Operative Bank LTD Customer Rights PolicyDocument14 pagesThe Kerala State Co-Operative Bank LTD Customer Rights PolicyAkhilAkhilNo ratings yet

- Income Generating ProjectDocument5 pagesIncome Generating ProjectZwei Gonzaga FernandezNo ratings yet

- College Majors Requiring StatisticsDocument1 pageCollege Majors Requiring StatisticsCarlos GorianNo ratings yet

- Entrepreneurship AssignmentDocument7 pagesEntrepreneurship AssignmentMazhar ArfinNo ratings yet

- Case Study AssignmentDocument5 pagesCase Study AssignmentABHAY SINGH33% (3)

- Internship Report: Bangabandhu Sheikh Mujibur Rahman Science & Technology University, Gopalganj-8100Document10 pagesInternship Report: Bangabandhu Sheikh Mujibur Rahman Science & Technology University, Gopalganj-8100Md SAIMNo ratings yet

- Ais ReportDocument2 pagesAis ReportMarianne Angelica AndaquigNo ratings yet

- 31 - Vinoya Vs NLRCDocument8 pages31 - Vinoya Vs NLRCArthur YamatNo ratings yet

- Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesDocument3 pagesUniversiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesPutri Naajihah 4GNo ratings yet

- Earnings Per Share (Eps)Document11 pagesEarnings Per Share (Eps)Faisal khanNo ratings yet

- Smart Investors DataDocument6 pagesSmart Investors DataSamrat SahaNo ratings yet

- BTL tài chính doanh nghiệp mớiDocument19 pagesBTL tài chính doanh nghiệp mớiDo Hoang LanNo ratings yet

- Andreessen Horowitz FinalDocument4 pagesAndreessen Horowitz FinalYuqin ChenNo ratings yet

- Front Page of JoonixDocument78 pagesFront Page of JoonixJyoti YadavNo ratings yet