Professional Documents

Culture Documents

Option Basic

Option Basic

Uploaded by

Dipak Kumar0 ratings0% found this document useful (0 votes)

12 views1 pageAn option is a derivative whose price is based on the price of an underlying asset. The price of the underlying asset is called the spot price. Options have different strike prices and the same expiration dates make up an option chain. There are two types of options - calls, which increase in value as the spot price rises, and puts, which increase in value as the spot price falls. The price of an option has two components - intrinsic value and time value. Intrinsic value can be zero at expiration but time value always reaches zero at expiration. Options are classified based on the relationship between the strike price and spot price.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn option is a derivative whose price is based on the price of an underlying asset. The price of the underlying asset is called the spot price. Options have different strike prices and the same expiration dates make up an option chain. There are two types of options - calls, which increase in value as the spot price rises, and puts, which increase in value as the spot price falls. The price of an option has two components - intrinsic value and time value. Intrinsic value can be zero at expiration but time value always reaches zero at expiration. Options are classified based on the relationship between the strike price and spot price.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageOption Basic

Option Basic

Uploaded by

Dipak KumarAn option is a derivative whose price is based on the price of an underlying asset. The price of the underlying asset is called the spot price. Options have different strike prices and the same expiration dates make up an option chain. There are two types of options - calls, which increase in value as the spot price rises, and puts, which increase in value as the spot price falls. The price of an option has two components - intrinsic value and time value. Intrinsic value can be zero at expiration but time value always reaches zero at expiration. Options are classified based on the relationship between the strike price and spot price.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

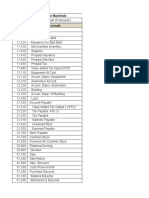

Basic Knowledge About "Option"

Option is called a "Derivative"

because price of an Option does not

depend on its own, it depends on the

price of other Asset or the price of an

Option is derived from the price of

other Asset.

The price of the Asset is called "Spot

Price" (for example, the price of Nifty

50, Nifty Bank, Stocks, etc.) from

which the price of an Option is

derived.

Option of an Asset has various "Strike

Prices". All Strike Prices of the same

expiry date at one place is called

"Option Chain".

The prices of Options of each "Strike

Price" are different to one another.

Options are two types, one is called

"Call Option" and other is called "Put

Option’.

When price of the Spot price

increases, the price of a Call Option

increases and the price of a Put

= Option decreases.

When price of the Spot price

decreases, the price of a Call Option

decreases and the price of a Put

Option increases.

The price of an Option is also called

"Premium".

The price of an Option is consisted of

two types of values, one is called

"Intrinsic Value" and other is called

"Time Value".

Every Option must have a certain

expiry date.

Only "Time Value" becomes zero on

the day of the expiry of an Option.

"Intrinsic Value" never be zero at

expiry of an Option.

According to the distance of Strike

Prices from the Spot Price, Strike

Prices have been divided into four

categories, (i) In The Money (ITM)

Option (ii) Out of The Money (OTM)

Option (iii) At The Money (ATM) (iv)

Near The Money (NTM).

In case of Call Option, when Strike

Price is greater than the Spot Price, it

is called OTM Call Option.

In case of Put Option, when the Spot

Price is greater than Strike Price, it is

called OTM Put Option.

In case of Put Option, when Strike

Price is greater than the Spot Price, it

is called ITM Put Option.

In case of Call Option, when the Spot

Price is greater than Strike Price, it is

called ITM Call Option.

When the Spot Price and Strike Price

are equal, it is called ATM Option. In

case of ATM Options, the prices of

Call Option and Put Option are almost

same.

The nearest Strike Price of the Spot

Price is called NTM.

Only ITM Option has both Intrinsic

Value and Time Value. OTM Option

has only Time Value.

For example, the present price of

Nifty Bank is Rs.39573.70 and the

price of the Call Option at Strike Price

of 39700 is Rs.683.65 and the price

of the Put Option at Strike Price of

39700 is Rs.742.

Here, Rs.39573.70 is the Spot Price.

The Strike Price of 39700 Call Option

is OTM Call Option because Strike

Price is greater than the Spot Price.

Therefore, Rs.683.65 has only Time

Value.

The Strike Price of 39700 Put Option

is ITM Put Option because the Spot

Price is greater than the Strike Price.

Therefore, Rs.742 has both Intrinsic

Value and Time Value. The Intrinsic

Value in Rs.742 is Rs.126.30 (39700 -

39573.70) and Time Value is Rs.

615.70 (742 - 126.30). 20:42

You might also like

- Training Material On Options Trading - SharekhanDocument31 pagesTraining Material On Options Trading - SharekhanSaurabh MehtaNo ratings yet

- Day 1Document51 pagesDay 1Study Byte100% (1)

- Options BasicsDocument27 pagesOptions BasicsAmit KumarNo ratings yet

- Derivatives Buy PutDocument11 pagesDerivatives Buy PutRajan kumar singhNo ratings yet

- Presented by:-D.Pradeep Kumar Exe-MBA, IIPM, HydDocument25 pagesPresented by:-D.Pradeep Kumar Exe-MBA, IIPM, Hydpradeep3673No ratings yet

- Class Notes On OptionsDocument7 pagesClass Notes On OptionsAnvesha TyagiNo ratings yet

- Trading Options On Technical - Anjana GDocument96 pagesTrading Options On Technical - Anjana Gcodingfreek007100% (1)

- Angles Polygons Year 7 Series H ANSWERSDocument24 pagesAngles Polygons Year 7 Series H ANSWERSJoel100% (1)

- Options Theory For Professional TradingDocument4 pagesOptions Theory For Professional TradingRaju.KonduruNo ratings yet

- Options Mentorship - Day 1Document49 pagesOptions Mentorship - Day 1Unesh JughsNo ratings yet

- OptionDocument75 pagesOptionsachin251No ratings yet

- An Option Is Part of A Class of Securities Called DerivativesDocument9 pagesAn Option Is Part of A Class of Securities Called DerivativesajnabeeesNo ratings yet

- QP 10 Corrective Action ProcedureDocument4 pagesQP 10 Corrective Action ProcedureSocialWelfare SilangNo ratings yet

- Study On Option Strategy Fin Vikash SinhaDocument22 pagesStudy On Option Strategy Fin Vikash SinhaVikash SinhaNo ratings yet

- Option StrategyDocument154 pagesOption StrategySumit ManchandaNo ratings yet

- DerivativesDocument44 pagesDerivativesKhyati KariaNo ratings yet

- Corporate Level StrategyDocument18 pagesCorporate Level StrategyDuygu ÇınarNo ratings yet

- FMJDocument116 pagesFMJSam DeWittNo ratings yet

- Option BasicsDocument4 pagesOption Basicsbhavnesh_muthaNo ratings yet

- Bliss DevelopmentDocument2 pagesBliss DevelopmentmrpowerplusNo ratings yet

- Day 1Document28 pagesDay 1CHENAB WEST100% (1)

- Out of The Money-CONTRACTDocument2 pagesOut of The Money-CONTRACTramyatan SinghNo ratings yet

- Options TerminologyDocument4 pagesOptions TerminologyRohan sharmaNo ratings yet

- Understanding Strike PricesDocument2 pagesUnderstanding Strike PricesSeemaNo ratings yet

- Understanding Strike PricesDocument2 pagesUnderstanding Strike PricesSeemaNo ratings yet

- The Intrinsic ValueDocument2 pagesThe Intrinsic ValueAshwini AnandNo ratings yet

- Buying Selling Calls PutsDocument1 pageBuying Selling Calls PutsPhani KumarNo ratings yet

- Shreyash & Nishant C - OptionsDocument11 pagesShreyash & Nishant C - OptionsShreyash satamNo ratings yet

- In The Money ContractDocument2 pagesIn The Money Contractramyatan SinghNo ratings yet

- DerivativesDocument18 pagesDerivativesnikitaNo ratings yet

- Options MSCFIÂ DECÂ 2022Document8 pagesOptions MSCFIÂ DECÂ 2022kenedy simwingaNo ratings yet

- Options The Upside Without DownsideDocument44 pagesOptions The Upside Without DownsideasifanisNo ratings yet

- Options The Upside Without DownsideDocument31 pagesOptions The Upside Without DownsideasifanisNo ratings yet

- Chapter 3Document14 pagesChapter 3Kethavarapu RamjiNo ratings yet

- Optoins Basics Simplified: by Vikas Pratap SinghDocument15 pagesOptoins Basics Simplified: by Vikas Pratap SinghIron ManNo ratings yet

- 6-Options BasicsDocument25 pages6-Options BasicsNine Not Darp EightNo ratings yet

- Introduction To Derivatives: Nse Academy CertifiedDocument55 pagesIntroduction To Derivatives: Nse Academy CertifiedSrividhya RaghavanNo ratings yet

- Options: Minimum Correct Answers For This Module: 3/6Document14 pagesOptions: Minimum Correct Answers For This Module: 3/6Jovan SsenkandwaNo ratings yet

- Derivatives InsightsDocument11 pagesDerivatives InsightsalfinprinceNo ratings yet

- OptionsDocument49 pagesOptionssacos16074No ratings yet

- RM 3Document96 pagesRM 3ankitadarji31No ratings yet

- Options & ModelsDocument48 pagesOptions & ModelsPraveen Kumar SinhaNo ratings yet

- Strike PriceDocument3 pagesStrike PriceNiño Rey LopezNo ratings yet

- Session 5Document22 pagesSession 5nikNo ratings yet

- Option Greeks Part IDocument11 pagesOption Greeks Part Iagt0062No ratings yet

- In The MoneyDocument2 pagesIn The Moneyjimmy victoriaNo ratings yet

- Module 4Document8 pagesModule 4Nidhin NalinamNo ratings yet

- Put OptionDocument12 pagesPut OptionVenkatNo ratings yet

- Call and Put Only Point..Document38 pagesCall and Put Only Point..seaswimmerNo ratings yet

- In The Money (ITM) at The Money (ATM) Out of The Money (OTM) : Numerical Problems On MoneynessDocument3 pagesIn The Money (ITM) at The Money (ATM) Out of The Money (OTM) : Numerical Problems On MoneynessravishNo ratings yet

- Long Call Condor - An Option Strategy: TH THDocument7 pagesLong Call Condor - An Option Strategy: TH THAasthaNo ratings yet

- Option Basics 1666005465935Document27 pagesOption Basics 1666005465935adikadam420No ratings yet

- Option Pricing-Intrinsic ValueDocument4 pagesOption Pricing-Intrinsic ValueMariaMehmoodNo ratings yet

- Points Forward Contract Futures Contract: MeaningDocument6 pagesPoints Forward Contract Futures Contract: Meaningershad123No ratings yet

- Derivatives MarketDocument62 pagesDerivatives MarketswastikNo ratings yet

- Option Pricing Theory & Financial OptionsDocument70 pagesOption Pricing Theory & Financial OptionsPiyush KhemkaNo ratings yet

- E Book of OptionsDocument29 pagesE Book of OptionsmohitNo ratings yet

- Hand Book On Derivatives Trading: National Stock Exchange of India LimitedDocument7 pagesHand Book On Derivatives Trading: National Stock Exchange of India LimitedKanwaljit Singh JollyNo ratings yet

- DunnaDocument69 pagesDunnaYanugonda ThulasinathNo ratings yet

- GHPLecture 4Document27 pagesGHPLecture 4Sagar AminNo ratings yet

- Derivatives Buy PutDocument10 pagesDerivatives Buy PutRajan kumar singhNo ratings yet

- Intro - Option 2Document15 pagesIntro - Option 2weicheng930616No ratings yet

- DerivativesDocument41 pagesDerivativesRajib MondalNo ratings yet

- Option StrategyDocument59 pagesOption StrategyTarkeshwar MahatoNo ratings yet

- Class 9 English Beehive Prose Word Meaning Chapter 6Document3 pagesClass 9 English Beehive Prose Word Meaning Chapter 6Dipak KumarNo ratings yet

- Letter To The Editor MCQDocument14 pagesLetter To The Editor MCQDipak KumarNo ratings yet

- The Magical WellDocument3 pagesThe Magical WellDipak KumarNo ratings yet

- Elementary School Classroom in A Slum PDFDocument25 pagesElementary School Classroom in A Slum PDFDipak KumarNo ratings yet

- On The Face of It NotesDocument5 pagesOn The Face of It NotesDipak KumarNo ratings yet

- My Mother at 66 Important Question AnswerDocument5 pagesMy Mother at 66 Important Question AnswerDipak KumarNo ratings yet

- Novel About ChangeDocument1 pageNovel About ChangeDipak KumarNo ratings yet

- ICSE Treasure Trove Poems Solutions Class 10 Chapter 1 The Heart of A TreeDocument7 pagesICSE Treasure Trove Poems Solutions Class 10 Chapter 1 The Heart of A TreeDipak KumarNo ratings yet

- Open School (The Hindu)Document1 pageOpen School (The Hindu)Dipak KumarNo ratings yet

- Guide To Formal Letters - The BasicsDocument3 pagesGuide To Formal Letters - The BasicsCostelCosNo ratings yet

- July 2022 Top Officials CFCCDocument21 pagesJuly 2022 Top Officials CFCCBen SchachtmanNo ratings yet

- Delivery Hero - Performance ReportDocument31 pagesDelivery Hero - Performance ReportНикита СедовNo ratings yet

- Financial Acumen MasteryDocument3 pagesFinancial Acumen Masteryabc ptcNo ratings yet

- 5690-Article Text-10327-1-10-20210518Document21 pages5690-Article Text-10327-1-10-20210518Abhishek GadatiaNo ratings yet

- Problem 1 - 5-6Document4 pagesProblem 1 - 5-6Lowellah Marie BringasNo ratings yet

- Business Studies Project Class XiiDocument14 pagesBusiness Studies Project Class XiiMaheshNo ratings yet

- Joint Press Release January 22 2021 - Re PFAS - The Chemours Company - DuPont, Corteva, and Chemours Announce Resolution of Legacy PFAS ClaimsDocument3 pagesJoint Press Release January 22 2021 - Re PFAS - The Chemours Company - DuPont, Corteva, and Chemours Announce Resolution of Legacy PFAS ClaimsKirk HartleyNo ratings yet

- Kertas Kerja Neraca LajurDocument11 pagesKertas Kerja Neraca LajurSri Winarsih RamadanaNo ratings yet

- Build Customer RelationshipsDocument20 pagesBuild Customer RelationshipsFazleRabbiNo ratings yet

- Movie Production TermsheetsDocument3 pagesMovie Production TermsheetsSai TejaNo ratings yet

- Dipifr 2004 Dec A PDFDocument13 pagesDipifr 2004 Dec A PDFDessouki YousefNo ratings yet

- Effect of Electronic Word of Mouth in Online Impulsive Buying BehaviorDocument11 pagesEffect of Electronic Word of Mouth in Online Impulsive Buying BehaviorNabin ShakyaNo ratings yet

- Libro Ingles Unlam I CompletoDocument117 pagesLibro Ingles Unlam I CompletoSofi MiguensNo ratings yet

- 2021 PDFDocument9 pages2021 PDFNekhavhambe MartinNo ratings yet

- 2015 BP Sustainability ReportDocument23 pages2015 BP Sustainability ReportDebbie CollettNo ratings yet

- Operation & Maintenance Management: AssetDocument10 pagesOperation & Maintenance Management: AssetKaka MiaxNo ratings yet

- Lecture 1Document22 pagesLecture 1Arpon Kumer DasNo ratings yet

- AmazonlogisticsDocument49 pagesAmazonlogisticsDEEVANSH JAINNo ratings yet

- Advertising Week 2 HandoutsDocument6 pagesAdvertising Week 2 HandoutsTi TayNo ratings yet

- Chapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodDocument4 pagesChapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodMai Phương NguyễnNo ratings yet

- Samp Licio SDocument37 pagesSamp Licio SGregory WalterNo ratings yet

- Problem Set 5 (Solution)Document5 pagesProblem Set 5 (Solution)Akshit GaurNo ratings yet

- MST Group Brochure 2022 2 Page Spread Website FriendlyDocument15 pagesMST Group Brochure 2022 2 Page Spread Website FriendlyAlim KhalimbetovNo ratings yet

- Export PlanDocument18 pagesExport PlanNgọc YếnNo ratings yet