Professional Documents

Culture Documents

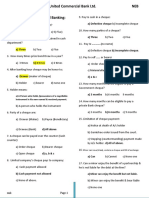

General Banking (Summarized)

Uploaded by

uttamdas79100%(1)100% found this document useful (1 vote)

169 views15 pages1. The document discusses various topics related to general banking such as a banker's obligations to customers, know your customer (KYC) objectives, types of cheques, and account opening requirements.

2. It addresses the statutory duties of bankers including honoring customers' cheques and bills, maintaining secrecy of accounts, and exercising lien. It also defines key terms like stale cheques, letter of authority, and standing instructions.

3. The document quizzes readers on regulations such as cash transaction report (CTR) thresholds, required documents for opening accounts for companies, firms, and societies, and record keeping periods for closed accounts. It covers critical issues in banking like money laundering prevention, types of deposits,

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document discusses various topics related to general banking such as a banker's obligations to customers, know your customer (KYC) objectives, types of cheques, and account opening requirements.

2. It addresses the statutory duties of bankers including honoring customers' cheques and bills, maintaining secrecy of accounts, and exercising lien. It also defines key terms like stale cheques, letter of authority, and standing instructions.

3. The document quizzes readers on regulations such as cash transaction report (CTR) thresholds, required documents for opening accounts for companies, firms, and societies, and record keeping periods for closed accounts. It covers critical issues in banking like money laundering prevention, types of deposits,

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

169 views15 pagesGeneral Banking (Summarized)

Uploaded by

uttamdas791. The document discusses various topics related to general banking such as a banker's obligations to customers, know your customer (KYC) objectives, types of cheques, and account opening requirements.

2. It addresses the statutory duties of bankers including honoring customers' cheques and bills, maintaining secrecy of accounts, and exercising lien. It also defines key terms like stale cheques, letter of authority, and standing instructions.

3. The document quizzes readers on regulations such as cash transaction report (CTR) thresholds, required documents for opening accounts for companies, firms, and societies, and record keeping periods for closed accounts. It covers critical issues in banking like money laundering prevention, types of deposits,

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 15

General Banking (Summarized)

1. The banker has a statutory obligation to

a). Honour customer’s cheque

b). Maintain secrecy of his customer’s account

c). Exercise Lien

d). Honour customer’s bill

2. Objectives of KYC is

a). To ensure appropriate customer identification

b). To monitor transactions of suspicious nature

c). To ensure that he/she would not deceive the bank

d). Only a and b

3. A customer’s letter of instructions, without any stamp, in connection with the

operations of his account is known as

a). Power of attorney

b). Probate

c). Letter of Authority

d). Mandate

4. In executing the standing instructions, there exists a relationship of

a). Debtor and Creditor

b). Bailee and Bailor

c). Trustee and beneficiary

d). Agent and Principal

5. Stop payment instruction of a cheque can be given by

a). Any payee of the cheque

b). Only drawer of the cheque

c). Any endorser of the cheque

d). All of the above

6. The paying banker can get protection for a materially altered cheque provided

a). The alteration is not apparent

b). The alteration is immaterial

c). He makes payment in due course

d). a and c together

7. A customer has issued a cheque where the date of which is already passed.

Such cheque is called

a). Stale cheque

b). Crossed cheque

c). Post-dated cheque

d). Ante dated cheque

8. The effect of General crossing is that it gives a direction to the

a). Collecting banker

b). Holder

c). Paying banker

d). a and c together

8A. The effect of Account paying crossing is that it gives a direction to the

a). Collecting banker c). Paying banker

b). Holder d). a and c together

9. CTR is required for which of the following amount in banks:

a). 5 Lacs

b). 5.50 Lacs

c). 7.00 Lacs

d). 10.00 Lacs

10. The document drawn by a debtor on the creditor agreing to pay a certain

amount of money is called

a). Cheque

b). Promissory note

c). Bill of exchange

d). Demand Draft

11. A cheque that is not crossed is called

a). Uncrossed cheque

b). Order cheque

c). Open cheque

d). Bearer cheque

12. While opening an account in the name of a company, the most important

document to be seen is

a). List of employees/directors of the company

b). List of promoters/shareholders of the company

c). Memorandum and Articles of Association of the Company

d). Instructions of the Registrar of Companies

13. How long a bank branch is required to preserve the information of a closed

account

a). 1 year

b). 2 years

c). 5 years

d). 10 years

14. While opening an account of a partnership firm, which of the following is

essentail

a). Verification of Partnership deed and partnership letter

b). Registration Certificate of Partnership

c). Registration Certificate from Cooperative sub-register

d). None of the above

15. As per Banking companies ( Amendment Act’ 2013) the maximum number of directors of

the bank including independent directors are to be

a). 20 including 2 independent directors

b). 15 including 2 independent directors

c). 20 including 3 independent directors

d). 18 including 3 independent directors

16. As regards Contract Act, 1872 which one of the following is not true

a). Agreements by persons of idiocy are not void

b). An agreement enforceable by law is a contract

c). In every contract there should be free consent

d). A minor can not be a guarantor

17. Layering under money laundering refers to

a). Disguising the origin of initial deposit through multiple transfers

b). Disguising the origin of initial deposit through multiple transactions

c). a and b

d). None of the above

18. In case of opening an account in the name of society which documents to

obtained/verified is

a). Copy of Bye Laws

b). Certificate given by the local authorities

c). Certificate given by the RJSC and Firms

d). None of the above

19. Section 85 of Negotiable Instrument Act’ 1881 extends protection to the

a). Collecting Banker

b). Paying Banker

c). Drawer of the cheque

d). Both a and b

20. Scheduled banks are to maintain SLR

a). 13% of total demand & time liabilities

b). 6.5% of total demand & time liabilities

c). 19%of total demand & time liabilities

d). 19.50% of total demand & time liabilities

21. Lien is a/an --------- of the ceditor to retain possession

a). Obligation

b). Right

c). Interest

d). Protection

22. The best suited deposit for a trading company is

a). Savings Deposit

b). Fixed Deposit

c). Current Deposit

d). Recurring Deposit

23. The rate of interest payable on various deposits is fixed by

a). Head office of each bank

b). Bank and Financial Institutions deposits under Ministry of finance

c). Association of Bankers Bangladesh

d). Bangladesh Bank

24. The most undesirable customer is

a). A minor

b). An unregistered firm

c). A married woman

d). An undischarged bankrupt

25. The document which can be used only for making local payment is

a). A cheque

b). A bankers cheque/PO

c). A bill of exchange

d). A demand draft

26. Ancillary business of a bank implies non-fund business and the income earned

from this source includes income by way of

a). Commission

b). Interest

c). Brokerage

d). Both a and c

27. BFIs are guided by

a). Financial Institutions Act-1993

b). Companies Act-1994

c). The Banking Companies Act-1991

d). Securities Exchange Commission Act-1993

28. What is the meaning of CAR

a). Capital Advance Ratio

b). Capital Asset Ratio

c). Capital Adequacy Ratio

d). Capital and Reserve Ratio

29. For clearing a MICR cheque bank should put

a). General Crossing

b). Special Crossing

c). Either a or b

d). None of the above

30. There are ---- parties involved in a guarantee

a). 2

b). 3

c). 4

d). None of these

31. Which of the following is not legal tender money?

a). Debit Card

b). Hundred Taka Currency Note

c). Cheque

d). Both (a) and (c)

32. Monetary policy deals with-

a). Interest rate

b). Money supply

c). Both (a) and (b)

d). None of the above

33. Garnishee order is issued by-

a). Policy order

b). National Board of Revenue

c). Court of Law

d). C.I.D

34. Money laundering refers to-

a). Concealing or disguising the illicit nature, source, location, ownership or

control of the proceeds of crime

b). Assisting any person involved in the commission of the predicate offence to

evade the legal consequences of such offence

c). Smuggling money or property earned through legal or illegal means to a

foreign country

d). All of these

35. Which of the following person cannot open an account with a bank?

a). An adult

b). Lunatic

c). Solvent

d). Minor with guardian

36. One of the directors of a limited company expired and cheques signed by him

are presence for payment, should be bank pay these cheques?

a). Cannot pay

b). Can pay upon other director’s confirmation

c). Can pay as a routine

d). Payments be stopped by the company

37. Which of the following is the lender’s recourse related law?

a). Contract Act, 1872

b). Bank Company Act, 1991

c). Artha Rin Adalat Ain, 2003

d). All of these

38. The Articles of Association of a Limited Company contains-

a). Objects of the company

b). Internal management of the company

c). Both (a) and (b)

d). None of the above

39. Banker’s Lien is a/an-

a). Hypothecation

b). IGPA for mortgage

c). Implied pledge

d). Bailment of goods

40. Non-Banking Financial Institutions are guided by-

a). Financial Institutions Act, 1993

b). Companies Act, 1994

c). The Banking Companies Act, 1991

d). Bangladesh Bank Order, 1972

41. Which of the following create liabilities of a bank?

a). Savings deposit

b). Fixed deposit

c). Current deposit

d). All of These

42. Which one is not included in financial crimes?

a). Cheque fraud

b). Credit card fraud

c). Over-invoicing for purchasing an office articles

d). Purchase of luxury items

43. When a cheque book is lost by a customer of a bank, which of the following

document needs to be executed?

a). Guarantee bond, b). Treasury bond, c). Indemnity bond, d). Security bond

44. Deposits recorded by the depositor but not yet recorded by the Bank means-

a). Restricted deposit

b). Outstanding deposit

c). Deposit in transit

d). All of these

45. A note which is burnt or having sign of burn partially or wholly is called-

a). Altered Note

b). Damp Note

c). Deformed Note

d). Charred Note

46. How many handards are provided by the FATF for AML & CFT?

a). 35

b). 40

c). 38

d). 42

47. The relationship between a banker and a customer is:

a). That of a debtor and creditor

b). That of a creditor and a debtor

c). Primarily that of a debtor and a creditor

d). A & b together

48. The banker has a lien on:

Cheque given for collection

Cheque given for safe custody

Cheque left by mistake

A & b together

49. To constitute a person as a customer:

There must be frequency of transactions

There must be a dealing of a banking nature

There must be some sort of an account

There must be a single transaction of any nature

50. When banker customer relationship terminated:

Death

Insolvency or insanity of a customer

Closing of the account either on the initiative of the customer or

banker.

51. Types of lien:

2 types:

General lien

Particular lien

52. Relationship between Banker & Customer:

Deposit accounts……………. Debtor and Creditor

Advances……………………...Creditor and debtor

Safe custody deposit…………Bailee and bailor

Collection of a cheque……… Agent and Principal

Safe deposit locker…………. Lessor and lessee

53. Contracts by lunatics are

Always void

Always valid

Always voidable

At times voidable

54. The most important feature of a negotiable instrument is

Free transfer (A)

Transfer free from defects(B)

Right to sue

A and B together

55. In the case of a negotiable instrument, the following person generally gets a

good title

Finder of the lost instrument

Holder of a stolen instrument

Holder in due course

Holder of a forged instrument

56. A cheque bearing a date 31st April, 1992 is presented for payment on 5th May

1992. As per the practice

The cheque should be dishonoured with the remark “ non-existing date”

The cheque is returned with the remark” irregularly drawn”.

The cheque is dishonoured with the remark” not valid”

The cheque can be honoured.

57. Crossing a cheque without the knowledge of the drawer is a case of

Material alteration (A)

Immaterial alteration (B)

Authorized alteration (C)

A and c together

58. The following one is not a material alteration

Alteration of crossing

Alteration of place of payment

Conversion of blank endorsement into full endorsement

Alteration of the payee’s name

59. The paying banker can get protection for a materially altered cheque provided

The alteration is not apparent (A)

The alteration is immaterial (B)

He makes payment in due course (C)

a and c together

60. A “Not negotiable” crossing is a warning to the

Paying banker (A)

Collecting banker (B)

Holder (C)

A and B together

61. The following one is absolutely essential for special crossing

Two parallel transverse lines

Words “& Co.”

Words “Not negotiable”

Name of a banker

62. An order cheque can be converted into a bearer cheque by means of

Sans recourse endorsement

Special endorsement

Blank endorsement

Sans Frais endorsement

63. Negotiability gives to the transferee………. title of the transferor

The same title

No title

No better title

Better title

64. One of the following endorsement is not a valid one

Partial endorsement

Restrictive Endorsement

Facultative endorsement

Conditional endorsement

65. The liability of the Guarantor is

Primary

Co-extensive with that of principal debtor

Secondary

None of these

66. If a current account is being conducted unsatisfactorily, the banker can

Refuse to honour the cheques of that customer (A)

Refuse to issue a fresh cheque book (B)

Refuse to accept further deposits into that A/c. (C)

A and C together

67. The right to set-off is nothing but a

Right to sell

Right to retain

Right to combine

Right to appropriate

68. As soon as a banker receives a Garnishee Order absolute, he should

Close the A/c of the customer

Stop the operation of the A/c

Either close or stop the operation of the account depending upon

the wording

All of the above

69. A collecting banker is given protection only when he collects

A crossed cheque

An order cheque

A bearer cheque

A mutilated cheque

70. A collecting banker is given the statutory protection only when he act as

A holder

A holder for value

A holder in due course

An agent

71. When garnishee order is issued by the court attaching the account of a

customer, the banker is called.

Judgement debtor

Judgement creditor

Garnishee

Garnishor

72.When the amount stated in words and figures differ the banker

Can honour the amount in figures

Can honour the amount in words

Can honour the smaller amount

Can dishonor it

73. To get statutory protection the paying banker must make

Payment to a holder

Payment to a holder in due course

Payment in due course

Payment to a drawee in case of need

74. Which instruction is good for Banker:

a) Either or survivor

b) Any One Can Operate

c) Joint Operation.

75. Types of Endorsement:

5 Nos. i.e Blank, full, partial, restrictive, conditional

76. The followings are the salient features of a Fixed Deposit account, except

It is repayable on the expiry of the specified period

It is a transferable instrument

Length of time is fixed

Rate of interest is fixed

77.The Executor is appointed by a will. The certified copy (issued by the Court)

of the will is known as -

(A) Trust Deed

(B) Codicil

(C) Will Deed (D). Probate

78.The safest form of crossing is:

(A) General Crossing

(B) Special Crossing

(C) Double Crossing

(D) A/C Payee Crossing

79.As per the Bank Company Act, 1991, every banking company incorporated in

Bangladesh shall transfer to the reserve fund -

(A) At least 20% of current year’s profit before tax

(B) At least 5% of demand and time liabilities

(C) At least 13% of demand and time liabilities

(D) None of the above

80.Payment in due course is the

(A) Payment to the last holder of the cheque

(B) Payment according to apparent tenor in good faith and without

negligence.

(C) Payment according to apparent tenor

(D) None of the above

81.The person promising to pay money under a promissory note is known as -

A) Drawer

B) Maker

C) Drawee

82.A person who is legally entitled to the possession of the negotiable instrument

in his own name and to receive the amount thereof is known as -

A) Holder in due course

B) Holder

C) Holder for value

D) None of these

83.A minor -

A) cannot draw a negotiable instrument;

B) cannot be a payee of a negotiable instrument;

C) cannot be drawee of a negotiable instrument

84.An order instrument can be made payable to the bearer by making

A) conditional endorsement;

B) full endorsement;

C) General endorsement

D) None of these

85.The person appointed to operate the account after his death by the deceased

himself before his death is called -

A. Executor;

B. Administrator;

C. Attorney

D. None of the above

86.A minor cannot -

A. accept a bill;

B. draw a bill; but minor able to draw, endorse a bill.

C. endorse a cheque

D. None of the above

87.Laws governing day-to-day transactions of a bank are contained in:

A. Negotiable Instrument Act-1881.

B. Bank Companies Act-1991.

C. N.I. Act.-1881 and Bank Companies Act.-1991.

88. A Bill of Exchange is payable:

(A) Only on Demand or at a fixed time.

(B) On Demand or at a fixed or determinable future time.

(C) Only at a fixed time or determinable future time

89. Who is the “Payee” of Cheque?

(A) The person named in Cheque to whom or to whose order the money is

to pay is the "Payee".

(B) The Person receiving payment of a cheque is the "Payee".

(C) "Payee" of a cheque is the person who presents it before a bank for

payment.

90. Fixed Deposit Receipts are:

(A) Assignable

(B) Negotiable

(C) Transferable

91. "Account Payee" crossing signifies that:

(A) A banker should collect it for the payee only.

(B) A banker must collect it through any account simply.

(C) A banker must collect it as a holder for value.

92. Can a stale Cheque be paid?

(A) May be paid after confirmation of the drawer.

(B)May be paid without confirmation of the drawer but after proper inquiry.

(C)Must not be paid under any circumstances.

93. In case of collection of cheques, the collecting banker gets statutory protection for only:

(A) Crossed cheques

(B) Order cheques

(C) All kinds of cheques

94. A collecting banker can collect a cheque either as:

(A) Agent or principal

(B) Trustee or holder for value

(C) Agent or holder for value

95. 'Not negotiable' cheque is:

(A) Neither transferable nor negotiable

(B) Transferable but not negotiable

(C) Transferable but not negotiability is subject to a caution about title

96. When a Locker is given to a customer on hire, what relationship is established

between the banker and the customer?

(A) Bailer and Bailee

(B) Agent and Principal

(C) Lessor and lessee

97. Interest on Savings ale is calculated annually on the basis of

(A) 360 days

(B) 365 days

(C) 364 days

98. In Case of Safe custody of valuables, the Banker enters into a relationship with

the Customer. In this case the Banker is:

(A) Debtor / Trustee.

(B) Pledged /Trustee

(C) Bailee / Trustee.

99.Post-dated Cheques are not paid by a banker because:

a. Banker may face problems in future

b. It does not constitute 'Payment in due course'

c. It is the practice of the Banks

100. FDR is:

a. Not negotiable

b. Negotiable by endorsement and delivery

c. Negotiable by delivery

101. Where the banker pays cash before clearing of the cheque, he becomes

a. Holder in due course

b. Trustee

c. Holder for value

102. Statutory protection has been given to the collecting banker

a. Only for crossed cheques

b. Only for specially crossed cheques

c. Both for open and crossed cheque

103. One of the differences between promissory notes and cheques is:

a. A promissory note contains a promise to pay and a cheque contains

an order to pay

b. A promissory note is always payable to bearer and a cheque contains an

order to pay

c. A promissory note is always crossed and a cheque may be crossed or

uncrossed

104. The action of a creditor banker in taking into account sums owing by him to the

debtor in order to arrive at the net sum is called:

a. Set off

b. Assignment

c. Lien

105. Crossing of Cheque is:

a. A material part of a cheque

b. A material alteration of a cheque

106. The Current Bank Rate is:

A. 7 %

B. 6 %

C. 5 %

107. The followings are the salient features of a Fixed Deposit account, except

(A) It is repayable on the expiry of the specified period

(B) It is a transferable instrument

(C) Length of time is fixed

(D) Rate of interest is fixed

108. Travellers Cheques are issued by

A) Travel Agencies

B) Commercial Banks

C) Tourist Department of Government of Bangladesh

D) None of these

109. When a banker accepts the securities for safe custody, the relationship

between a banker and a customer is that of -

A) a debtor and a creditor

B) Trustee and Beneficiary

C) Principal and Agent

D) None of these

110. A Traveller’s Cheque is valid for a period of

a. Three months from date of issue;

b. Six months from date of issue;

c. Three years from date of issue;

d. Unlimited time

111. When the customer is operating the locker -

a. the banker should remain with the customer in the safe room;

b. the banker should not remain with the customer in the safe room;

c. no other person should be present in the safe room

d. None of these

112. A promissory note is

a. A conditional promise

b. An unconditional promise

c. Either a or b

113. Demand Draft is:

a. Not a negotiable instruction

b. A quasi negotiable instrument

c. A negotiable instrument

114. Bill of lading is:

a. A negotiable instrument

b. Not a negotiable instrument

c. Not of the above

115. Payment order is:

a. Not a negotiable instrument

b. A negotiable instrument, c. Some negotiable instrument

116. A negotiable instrument:

a. May be conditional

b. Must be unconditional

c. All of the above

117. Bill of exchange may be drawn on:

a. Bank

b. Person or firm

c. All of the above

118. Number of negotiable instrument is:

a. Three

b. Four

c. Five

119. A bill of exchange is always payable:

a. On demand

b. After expiry of certain period, c. Either a or b

120. A cheque dated in advance is known as:

a. Anti-dated

b. Post dated

c. None of the above

121. A cheque after expiry of six months is known as:

a. Antidated

b. Stale

c. Both a and b

122. Who can endorse a cheque:

a. Drawer as a holder

b. Holder

c. Any one of the above

123. A “Not negotiable” crossing is:

a. Special crossing

b. General crossing

c. Both a and b

124. “A/c. payee” crossed cheque is:

a. Transferable by endorsement

b. Not transferable

c. Transferable in case of need

125. A “Not Negotiable” crossed cheque is:

a. Not transferable

b. Transferable but nobody will be holder in due course

c. None of the above

126. A collecting banker will get protection:

a. Under section 13 of N.I. Act 1881

b. Under section 31 of N.I. Act 1881

c. Under section 131 of N.I. Act 1881

127. A cheque crossed “A/c. Payee” is a

a. Special crossing

b. General crossing,

c. Either a or b

128. Stamping is required under stamp Act in:

a. Promissory note

b. Payment order

c. All of the above

129. Bank can pay the proceeds of the cheque to:

a. Payee

b. Holder

c. None of the above

130. An order cheque can become bearer by:

a. Full endorsement

b. Blank endorsement

c. Conditional endorsement

131. A Negotiable instrument loses its negotiability by

a. Blank endorsement

b. Full endorsement, c. Restricted endorsement

132. A cheque crossed “& company” can be transferable only to:

a. A company

b. Any person or company

c. None of the above

133. Order contained in Bill of Exchange should be:

a) Conditional

b) Unconditional

c) Uncertain

d) Sufficient

134. A cheque is paid:

a) On Demand

b) On acceptance

135. Types of Crossing:

a) General

b) Special

c) All of the above

136. Which account does not require any introducer?

a) Individual

b) Limited Company

c) Proprietorship

d) Public Limited Company Account

137. Policy of dormant Account:

SB- Two Year

CD-One Year

138. Which one is called banker’s cheque:

Pay Order

139. Validity of Cheques:

6 Months, BB Cheque: 3 Months.

140. A banker is a PRIVILEGED debtor

141. Honoring of a cheque is a STATUTORY obligation, whereas maintenance of

secrecy is a CONTRACTUAL obligation.

142. A banker’s lien is always a GENERAL LIEN

143. A banker’s lien is generally described as an IMPLIED PLEDGE

144. Either or Survivor clause protects a banker from unwanted disputes in the

case of a joint account.

You might also like

- GB MaterialsDocument21 pagesGB Materialsuttamdas79No ratings yet

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Basics of Banking Question BankDocument54 pagesBasics of Banking Question BankRashmi Ranjana100% (1)

- Banking Knowledge TestDocument57 pagesBanking Knowledge TestJubaida Alam 203-22-694100% (2)

- JAIIB Principles of Banking MCQ MOD BDocument4 pagesJAIIB Principles of Banking MCQ MOD BChandru Mba100% (1)

- 1 Old Question MCQ With AnswearDocument13 pages1 Old Question MCQ With AnswearMuhammad Akmal HossainNo ratings yet

- Notes Mcq's-Jaiib BankingDocument7 pagesNotes Mcq's-Jaiib BankingNikhil MalhotraNo ratings yet

- MCQ On Banking Law & Practice Set 2Document11 pagesMCQ On Banking Law & Practice Set 2Amisha SinghNo ratings yet

- Model Paper - 4Document7 pagesModel Paper - 4Shiva DubeyNo ratings yet

- Foreign Trade Document ReviewDocument11 pagesForeign Trade Document Reviewuttamdas79No ratings yet

- Cca Questions All Merged by VKG PDFDocument75 pagesCca Questions All Merged by VKG PDFabhishekNo ratings yet

- SME Business Division: Question BankDocument26 pagesSME Business Division: Question BankKawoser AhammadNo ratings yet

- JaiibprinciplesbankingmodulesabquestionsDocument59 pagesJaiibprinciplesbankingmodulesabquestionssanjaykv98100% (1)

- Customer and Banker Relationship MCQDocument13 pagesCustomer and Banker Relationship MCQsn n100% (3)

- Multiple Choice and AnswerDocument63 pagesMultiple Choice and AnswerJubaida Alam 203-22-694100% (2)

- Uniform Customs and Practice For Documentary CreditsDocument4 pagesUniform Customs and Practice For Documentary Creditssaptarshi nandi100% (1)

- Iibf ExamDocument13 pagesIibf ExamRahul MondalNo ratings yet

- Cash & GB MCQ NEW ESKATON FDocument18 pagesCash & GB MCQ NEW ESKATON FJubaida Alam Juthy57% (7)

- Multiple Choice QuestionsDocument33 pagesMultiple Choice QuestionsSunil Kumar Gadwal100% (1)

- Forex - Objective Type Qns Apr. 2006Document32 pagesForex - Objective Type Qns Apr. 2006Bhavik SolankiNo ratings yet

- 2000 Banking Awareness MCQsDocument193 pages2000 Banking Awareness MCQsSniper Souravsharma100% (1)

- MCQ On IT 2Document8 pagesMCQ On IT 2udai_chakraborty5511No ratings yet

- Banking Principles MCQ GuideDocument15 pagesBanking Principles MCQ GuidevanamamalaiNo ratings yet

- Foreign Exchange 1Document32 pagesForeign Exchange 1Abhay ParkarNo ratings yet

- MCQ7 Foreign XchangeDocument37 pagesMCQ7 Foreign XchangeClassicaver100% (1)

- Bank Management MCQDocument60 pagesBank Management MCQmohasNo ratings yet

- Test Supplement 11 ForexDocument21 pagesTest Supplement 11 ForexRaj NayakNo ratings yet

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorNo ratings yet

- None of The AboveDocument10 pagesNone of The AboveShradha Padhi100% (1)

- L Ll. Lll. Lv. 2. L Ll. Ill. LV, 3. L Ll. Lll. Lv. 4. L. Ll. Lll. IV. 5. L. Ll. Lll. Lv. 6. L. 11. Lll. Lv. 7. A) D) 8. Al B) C) D)Document11 pagesL Ll. Lll. Lv. 2. L Ll. Ill. LV, 3. L Ll. Lll. Lv. 4. L. Ll. Lll. IV. 5. L. Ll. Lll. Lv. 6. L. 11. Lll. Lv. 7. A) D) 8. Al B) C) D)Kawoser Ahammad100% (1)

- 500 Banking Awareness MCQsDocument35 pages500 Banking Awareness MCQsTrishanu0% (1)

- Question Bank RMGDocument7 pagesQuestion Bank RMGKawoser Ahammad100% (3)

- 515-Sample QuestionssDocument71 pages515-Sample QuestionssRoy100% (1)

- Foreign Exchange ManagementDocument21 pagesForeign Exchange ManagementSreekanth GhilliNo ratings yet

- Important Banking Awareness PDFDocument193 pagesImportant Banking Awareness PDFsidNo ratings yet

- 178 Q A of FOREIGN EXCHANGE - IDocument27 pages178 Q A of FOREIGN EXCHANGE - IfindrohitsharmaNo ratings yet

- IMPS, NUUP, QSAM and UPI banking services explainedDocument200 pagesIMPS, NUUP, QSAM and UPI banking services explainedLakshmi Narasaiah100% (1)

- Foreign Exchange Management PDFDocument2 pagesForeign Exchange Management PDFAkash RajaniNo ratings yet

- Accounting MCQs With AnswersDocument77 pagesAccounting MCQs With AnswersAbhijeet AnandNo ratings yet

- MCQ On Home Loans (A K Marandi, SBLC-Siliguri)Document4 pagesMCQ On Home Loans (A K Marandi, SBLC-Siliguri)Raghu Nayak100% (1)

- 1st Digital Banking MCQs (MC Plus, Baroda Connect, M-Invest, PP Card)Document20 pages1st Digital Banking MCQs (MC Plus, Baroda Connect, M-Invest, PP Card)KapilYadavNo ratings yet

- Mock Test 3Document17 pagesMock Test 3Diksha SharmaNo ratings yet

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- MCQ On ExportsDocument13 pagesMCQ On ExportsAvlNarasimhaNo ratings yet

- Jaiib Sample QuestionsDocument4 pagesJaiib Sample Questionskubpyg100% (1)

- Compliance QuizDocument49 pagesCompliance Quizsreenu naikNo ratings yet

- BankingDocument110 pagesBankingN100% (1)

- Objective Type Questions in BankingDocument27 pagesObjective Type Questions in Bankingmidhungbabu81% (31)

- Sample Question Bank ExamsDocument12 pagesSample Question Bank Examsfor project100% (1)

- BIBM Question BankDocument99 pagesBIBM Question BankSalman Ahmed100% (1)

- Retail BankingDocument10 pagesRetail BankingPayal hazra100% (1)

- Mcqs On ForexDocument62 pagesMcqs On ForexRaushan Ratnesh70% (20)

- Jaiib I 50q-PrinciplesDocument33 pagesJaiib I 50q-PrinciplessharmilaNo ratings yet

- Multiple Choice TestDocument41 pagesMultiple Choice TestpraveenparthivNo ratings yet

- Dra New QuestionDocument8 pagesDra New QuestionHarsh PatelNo ratings yet

- Ni Act MCQDocument7 pagesNi Act MCQParthNo ratings yet

- 1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractorDocument17 pages1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractoramitatforeNo ratings yet

- Model Questions - Jaiib Principles of Banking - Module A & BDocument10 pagesModel Questions - Jaiib Principles of Banking - Module A & Bapi-3808761No ratings yet

- Multiple Choice QuestionsDocument20 pagesMultiple Choice QuestionsHenryNo ratings yet

- Jaiib mcq2 Nov08Document51 pagesJaiib mcq2 Nov08Dipti Jain100% (2)

- ValuationDocument2 pagesValuationuttamdas79No ratings yet

- New Report FinalDocument2 pagesNew Report Finaluttamdas79No ratings yet

- CDCS Exam Prep on IncotermsDocument5 pagesCDCS Exam Prep on Incotermsuttamdas79No ratings yet

- SanctionDocument4 pagesSanctionuttamdas79No ratings yet

- General Banking Part-01Document20 pagesGeneral Banking Part-01uttamdas79No ratings yet

- Banking's Digital Transformation by 2030Document5 pagesBanking's Digital Transformation by 2030uttamdas79No ratings yet

- Credit MaretialsDocument21 pagesCredit Maretialsuttamdas79No ratings yet

- Back to Back LC QuizDocument10 pagesBack to Back LC Quizuttamdas79No ratings yet

- Credit Questions Summarized (Final Dose)Document40 pagesCredit Questions Summarized (Final Dose)uttamdas79No ratings yet

- Foreign Trade Document ReviewDocument11 pagesForeign Trade Document Reviewuttamdas79No ratings yet

- FOREXDocument3 pagesFOREXuttamdas79No ratings yet

- Country Capital Currency ListDocument1 pageCountry Capital Currency Listuttamdas79No ratings yet

- Essay Final 1Document23 pagesEssay Final 1uttamdas79No ratings yet

- Credit RiskDocument1 pageCredit Riskuttamdas79No ratings yet

- RMG Industry GuideDocument5 pagesRMG Industry Guideuttamdas79No ratings yet

- Credit BossDocument8 pagesCredit Bossuttamdas79No ratings yet

- Analitical Moinul ViDocument4 pagesAnalitical Moinul Viuttamdas79No ratings yet

- Short QuestionDocument25 pagesShort Questionuttamdas79No ratings yet

- Header LpuDocument3 pagesHeader LpuL.a.ZumárragaNo ratings yet

- Lamb To The Slaughter EssayDocument5 pagesLamb To The Slaughter Essaypflhujbaf100% (2)

- Clinical Practice Guidelines On Postmenopausal Osteoporosis: An Executive Summary and Recommendations - Update 2019-2020Document17 pagesClinical Practice Guidelines On Postmenopausal Osteoporosis: An Executive Summary and Recommendations - Update 2019-2020Marwa YassinNo ratings yet

- Vedic Healing Through Gems4Document3 pagesVedic Healing Through Gems4gesNo ratings yet

- Cargo Security Awareness - Etextbook - 2nd - Ed - 2016 - TCGP-79Document185 pagesCargo Security Awareness - Etextbook - 2nd - Ed - 2016 - TCGP-79kien Duy Phan80% (5)

- LP Lab ManuelDocument23 pagesLP Lab ManuelRavi Kumar LankeNo ratings yet

- How English Works - A Grammar Handbook With Readings - Answer Key PDFDocument38 pagesHow English Works - A Grammar Handbook With Readings - Answer Key PDFAlessio Bocco100% (1)

- Environmental, Health and Safety Guidelines For Textiles ManufacturingDocument20 pagesEnvironmental, Health and Safety Guidelines For Textiles ManufacturingHitesh ShahNo ratings yet

- Resume Masroor 3Document3 pagesResume Masroor 3mohammad masroor zahid ullahNo ratings yet

- Analyzing Historical DocumentDocument4 pagesAnalyzing Historical DocumentChristine Joy VillasisNo ratings yet

- Writing Part 2 - An Essay: (120-180 Words)Document7 pagesWriting Part 2 - An Essay: (120-180 Words)María Daniela BroccardoNo ratings yet

- Presentation - On SVAMITVADocument18 pagesPresentation - On SVAMITVAPraveen PrajapatiNo ratings yet

- The Black Emperor's Grand Grimoire - by Frank GenghisDocument144 pagesThe Black Emperor's Grand Grimoire - by Frank GenghisFrank Genghis0% (2)

- 10-09 Oct-Eng-NLDocument4 pages10-09 Oct-Eng-NLdhammadinnaNo ratings yet

- Legalism QuotesDocument14 pagesLegalism QuotesfruittinglesNo ratings yet

- Intro To Rizal LawDocument61 pagesIntro To Rizal Lawnicachavez030No ratings yet

- Inergen Order Data SheetDocument31 pagesInergen Order Data Sheetkarim3samirNo ratings yet

- Vivekananda's Role as Revivalist Reformer and His Ideas of Equality and Spiritual RevolutionDocument2 pagesVivekananda's Role as Revivalist Reformer and His Ideas of Equality and Spiritual RevolutionMartin VanlalhlimpuiaNo ratings yet

- Types of DC Motors Notes Electric DrivesDocument77 pagesTypes of DC Motors Notes Electric DrivesJyothish VijayNo ratings yet

- Letter of Request For Brgy. ProfileDocument2 pagesLetter of Request For Brgy. ProfileRhea Mae MacabodbodNo ratings yet

- DTC Codes Mercedes CPC4 EnglishDocument24 pagesDTC Codes Mercedes CPC4 Englishjonny david martinez perez100% (1)

- Review Relative Clauses, Articles, and ConditionalsDocument10 pagesReview Relative Clauses, Articles, and ConditionalsNgoc AnhNo ratings yet

- Enquiries: 1. Enquiry From A Retailer To A Foreign ManufacturerDocument7 pagesEnquiries: 1. Enquiry From A Retailer To A Foreign ManufacturerNhi Hoàng Lê NguyễnNo ratings yet

- Individualized Learning Program Project Evaluation FormDocument3 pagesIndividualized Learning Program Project Evaluation Formakbisoi1No ratings yet

- Award 34509Document43 pagesAward 34509Brendon ChiaNo ratings yet

- Service Training: Vorsprung Durch Technik WWW - Audi.deDocument15 pagesService Training: Vorsprung Durch Technik WWW - Audi.depuncimanNo ratings yet

- AET Aetna 2017 Investor Day Presentation - Final (For Website) PDFDocument73 pagesAET Aetna 2017 Investor Day Presentation - Final (For Website) PDFAla BasterNo ratings yet

- Module 5 HomeworkDocument4 pagesModule 5 HomeworkCj LinceNo ratings yet

- The Role of Human Resource Costs To Achieve Competitive Advantage in The Jordanian Commercial BanksDocument10 pagesThe Role of Human Resource Costs To Achieve Competitive Advantage in The Jordanian Commercial BanksGizachewNo ratings yet

- Flared Separable FittingDocument9 pagesFlared Separable FittingbenNo ratings yet