Professional Documents

Culture Documents

The Covid 19 Pandemic Impact On Banking Sector

Uploaded by

Lutchmee SurjooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Covid 19 Pandemic Impact On Banking Sector

Uploaded by

Lutchmee SurjooCopyright:

Available Formats

Darjana, D., Wiryono, S. K., & Koesrindartoto, D. P. (2022).

The COVID-19 Pandemic

Impact on Banking Sector. Asian Economics Letters, 3(3).

https://doi.org/10.46557/001c.29955

Peer-reviewed research

The COVID-19 Pandemic Impact on Banking Sector

a b c

Darjana Darjana 1 , S.K. Wiryono 1 , D.P. Koesrindartoto 1

1 School of Business and Management, Bandung Institute of Technology, Indonesia

Keywords: credit crunch, business matching, banking sector

https://doi.org/10.46557/001c.29955

Asian Economics Letters

Vol. 3, Issue 3, 2022

This paper aims to investigate the COVID-19 pandemic’s impact on the banking sector in

Indonesia between 2011 and 2020. The study reveals that a credit crunch has transpired

during the pandemic period. The result reveals that credit delivery decreased more during

the pandemic than during the non-pandemic period. We demonstrate this effect in our

examination of the pandemic’s impact on credit performance. We propose business

matching to overcome this dilemma.

I. Introduction the uncertainty during the pandemic period. Bank lending

behavior gravitates toward conservatism and risk aversion,

In this paper, we examine how the COVID-19 outbreak to avoid higher credit risk. Simultaneously, bank deposits

has affected credit performance in Indonesia. The hypoth- have increased, reflecting the cautious motive of depositors

esis is that the pandemic has overwhelmed credit delivery not spending money due to uncertain economic conditions.

by the banking sector. This hypothesis test is important With these findings, we make two contributions to the

because, during the pandemic, credit growth was negative literature. First, we examine the impact of the pandemic

amid the economic downturn, whereas banking deposits in terms of credit performance. Second, we propose busi-

(i.e., third-party funds) increased. The proposed relation ness matching as an alternative to relaxing regulations to

between the pandemic and credit performance is motivated overcome the credit crunch dilemma. The impact of the

by the credit crunch theory proposed by Bernanke & Lown pandemic on the banking sector involves impact evalua-

(1991). These authors define a credit crunch as a sudden tions that are part of a broader agenda of evidence-based

sharp reduction in the availability of money or credit from policymaking (Gertler et al., 2011). An impact analysis of

banks and other lenders. This situation occurs when there the pandemic has also been conducted in India for the

is a shortage of funds in the credit market, making it diffi- banking, insurance, and financial services industries (Ra

cult for borrowers to obtain financing. masamy, 2020). We complement this literature by seeking

This research shows the significant negative effect on an alternative route to overcome the credit crunch phe-

the performance of banking credit due to the pandemic, nomenon instead of regulation imposed by the authorities.

utilizing a quasi-experiment to analyze the impact. Similar Our prescriptive model is intended to be used for policy rec-

impact studies using quasi-experiments have been con- ommendations in the banking sector and by the authorities.

ducted on corporate performance in the energy industry Several studies have revealed the negative effects of the

and on the impact of COVID-19 testing and infection rates pandemic. For example, systemic risk in the financial in-

for the economy of Brazil, Russia, India, China, and South dustry has significantly increased. In the foreign exchange

Africa (Dash et al., 2021). market, there has been a bubble of increased activity sug-

We employ monthly data for Indonesia at the national gesting inefficiency (Narayan, 2020b). In the futures mar-

level from 2011 to 2020 and find that the decrease in credit ket, the relation between investor sentiment and crude oil

delivery was more significant during the pandemic than futures prices has changed (Huang & Zheng, 2020). In the

during the pre-pandemic period. These results are robust to oil market, inefficiency has become more apparent, and

issues related to the credit crunch phenomenon from the news on the COVID-19 pandemic and oil price has influ-

perspective of banking risk. Since March 2020, the interme- enced oil prices when the number of infections and oil price

diary function of the banking sector has been limited, con- volatility reached a certain threshold (Narayan, 2020a). In

tracting credit growth. The banking sector views the credit the stock market, news media speculation on the effect of

crunch as related to higher risks in the real sectors due to

a Corresponding author: Email: darjana@sbm-itb.ac.id

b Email: sudarso_kw@sbm-itb.ac.id

c Email: deddypri@sbm-itb.ac.id

The COVID-19 Pandemic Impact on Banking Sector

the pandemic has led to negative stock returns and higher just in trends. Our GDP and credit data are similar in levels

market volatility (Haldar & Sethi, 2021). in both periods, before and during the pandemic.

On the other hand, empirical results show that the DID estimation, for example, in the two-period case,

COVID-19 outbreak has had a significantly positive impact simply estimates the linear regression and the model, with

on increasing the innovative ability of Chinese listed com- the following specification:

panies of different scales and in selected industries (Han

& Qian, 2020). Additionally, the pandemic may have had

a significant positive influence on returns in the crude oil where Treatedt is a variable indicating whether a unit is

and stock markets (Liu et al., 2020). Demographic factors treated or not, Postt is a dummy variable that indicates the

and government policies are significant determinants of post-treatment period, and δ represents a DID estimator

COVID-19 outbreaks, as opposed to socioeconomic factors (i.e., the change in for treated units minus the change in

such as the gross domestic product (GDP) per capita or the for control units).

Human Development Index (Haldar & Sethi, 2021).

II. Data and Results

A. Data

B. Results

This study uses 10 years of monthly data. We have data

on the nominal value of total credit, which is decomposed We collected 10-year monthly series data from 2011 to

into credit for working capital, investment, consumption, 2020 and processed them with the DID method.

and small and medium enterprises (SMEs). We also have

credit data for selected economic sectors, namely, trading, B.1. Total Credit

industry, agriculture, and construction. We gather quarterly

GDP data from 2011 to 2020 released in 2010 (which is The results in Table 1 show that all the variables are sig-

also the base year) from Statistics Indonesia. We annualize nificant. The interaction coefficient is 18.87 and positive.

the data and then convert to monthly frequency. Monthly This result indicates that after/during the COVID-19 pe-

credit data were obtained from Indonesia Financial Statis- riod, the credit crunch took place with economic slowing.

tics, released by the central bank, Bank Indonesia. In the regression, the dependent variable is the level

Difference-in-differences (DID) analysis is one of the of the economy (GDP); the independent variable

most widely applicable methods for impact evaluation. We represents total credit; is a dummy variable that

apply the DID method as part of a quasi-experiment takes the value of one for the period from January to De-

(Bertrand et al., 2002), namely, an experimental approach cember 2020:12 (the COVID-19 pandemic period), and zero

without experimental controls. Although alternative meth- otherwise; and is the interaction vari-

ods for impact evaluation can be applied, such as a regres- able. The model has the following specifications:

sion discontinuity design and propensity matching (Khand

ker et al., 2010), the DID as it is commonly used in impact

evaluation (Baker, 2000). The DID method requires a treat-

ment group and a control group and a minimum of two ob- The estimation shows that the interaction variable

servation periods, before and after the treatment. In this has a coefficient of 18.88 at the 5% sig-

case, the treatment group involves credit performance that nificance level. The 2020 regression coefficient (gradient)

was affected by the pandemic. Additionally, the control of is 21.55, higher than the 2.36 from the pre-

group involves credit performance that was not affected by COVID-19 period. This result reveals that credit perfor-

the COVID-19 pandemic. The data for the two groups data mance underwent a significant change during the pandemic

are derived from monthly banking reports. period in 2020 from the pre-COVID-19 period (2011–2019).

For the DID results to be robust, we assume parallel

trends. This means that both the treatment and control B.2. Credit Decomposition

groups have matching linear trends, such that there is no

difference in treatment. The DID method assumes that the In terms of credit decomposition, changes in the perfor-

parallel trends/slopes do not change (i.e., the trend over mance of working capital credit (45% of total credit) and

time is the same for both groups). This is a pseudo-exper- investment credit (30% of the total credit) between the

imental design because it does not differentiate between pre-COVID-19 and COVID-19 periods are statistically sig-

the treatment and control groups and only separates the nificant (see Table 2). Meanwhile, it is statistically insignif-

data by period. The parallel trends of these variables in the icant for consumer credit and SME credit. However, the co-

period prior to treatment is suggestive of a counterfactual efficients (gradients) of the four other types of credits are

with similar trends. Likewise, these two variables (GDP and higher in the COVID-19 period than previously. Concur-

credit) pass the augmented Dickey–Fuller unit root test for rently, non-performing loans (NPLs) increased for working

stationary testing. Kahn-Lang & Lang (2020) verify that the capital credit and investment credit during the pandemic,

DID method is generally more plausible if the treatment but declined at the end of the period. Consumer credit NPLs

and control groups are similar in levels to begin with, not eventually began to decrease in the middle of 2020. This

Asian Economics Letters 2

The COVID-19 Pandemic Impact on Banking Sector

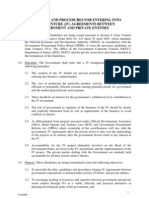

Table 1. DID Estimating Result

Dependent Baseline 2011:01 - Panel A: Pre-COVID-19 period: Panel B: COVID-19 period:

Variable: Yt 2020:12 2011:01 - 2019:12 2020:01 - 2020:12

Independent

Coefficients (SD) Coefficients (SD) Coefficients (SD)

Variables:

2.3261 * 2.3634 * 2.672 *

Xt_Credit

(0.0403) (0.0271) (0.0463)

Dt_ COVID 18.8765 *

- -

Xt_Credit (4.6597)

91585.83 *

Dt_ COVID - -

(22504.84)

2391.79 * 2279.06 * 2547.846 *

Constant (α)

(165.7446) (106.3604) (156.0203)

N 120 108 12

Notes: This table presents estimating result (namely, coefficient, standard deviation (SD)) for independent variables selected from the model specification. The asterix sign (*) means

that the coefficient has passed at 5% significance level. The data are split into two samples: Panel A denotes the pre-COVID-19 sample period (2011-2019) while Panel B denotes the

COVID-19 sample period (2020). Baseline column shows the regression results with total samples.

Table 2. Estimation of Credit Decomposition

Dependent Baseline 2011:01 - Panel A: Pre-COVID-19 period: Panel B: COVID-19 period:

Variable: 2020:12 2011:01 - 2019:12 2020:01 - 2020:12

Independent

Coefficients (SD) Coefficients (SD) Coefficients (SD)

Variables:

5.3398 * 5.3223 * 22.7303 *

1

(0.0977) (0.0766) (0.0998)

7.9726 * 8.2706 * 41.6365 *

2

(0.1582) (0.1217) (0.1596)

8.4144 * 8.6372 * 18.4964

3

(0.1382) (0.0575) (0.1511)

12.9291 * 13.4112 * 14.5569

4

(0.2221) (0.0984) (0.2392)

1779.204 * 1808.431 * -41338.799 *

Constant1

(185.7102) (139.7457) (182.1004)

3859.366 * 3642.514 * -45923.1760 *

Constant2

(162.0112) (117.1909) (153.5992)

1934.754 * 1731.067 * -14552.0630 *

Constant3

(164.3405) (65.184) (171.4535)

1352.609 * 1041.112 * -907.1470 *

Constant4

(181.5038) (76.7945) (186.603)

N 120 108 12

Notes: This table reports estimating result (coefficient) for independent variables selected from model specification. The asterix sign (*) means that the variable has statistically

passed at 5% significance level. Coefficients in Panel B consist of and of each credit decomposition (1. Working Capital, 2. Investment, 3. Consumers, 4.

SMEs), respectively. Baseline column shows the regression results with total samples.

pattern could be due to the credit restructuring policy an- opment continued to function during the COVID-19 pan-

nounced in March 2020. demic.

The coefficient for the trade sector is statistically in-

B.3. Credit by Economic Sector significant, possibly because of the rise of the digital econ-

omy. The resiliency of the trade sector could be related to

Regarding credit by economic sector, the primary sectors online trading activities. Data from Statistics Indonesia re-

(industry, agriculture, construction) were significantly in- veal that, during the early pandemic, around March 2020,

fluenced by the pandemic, with the exception of trade (see online sales surged by 320% of total sales at the beginning

Table 3). of the year. The highest sales recorded is for food and bev-

Credit for agriculture and credit for construction have erages (480%). The jump becomes even steeper, with online

negative coefficients during the COVID-19 period. This re- sales in April 2020 increasing by 480% since January 2020.

sult indicates that, even during the economic downturn, the Several policies were instituted by the government and

two sectors still achieved positive performance. This can the authorities to handle the credit crunch. The Ministry

explain how the food harvesting and infrastructure devel-

Asian Economics Letters 3

The COVID-19 Pandemic Impact on Banking Sector

Table 3: Estimation of Credit by Economic Sectors

Dependent Baseline 2011:01 - Panel A: Pre-COVID-19 period: Panel B: COVID-19 period:

Variable: 2020:12 2011:01 - 2019:12 2020:01 - 2020:12

Independent

Coefficients (SD) Coefficients (SD) Coefficients (SD)

Variables

1 12.5433 * (0.4569) 11.9326 * (0.4322) 44.5463 (0.4487)

2 13.8039 * (0.3542) 13.5098 * (0.3448) 45.6548 * (0.3683)

3 27.1966 * (0.4756) 28.0318 * (0.1899) -127.3115 * (0.4409)

4 26.019 * (0.6808) 28.5675 * (0.4854) -108.2615 * (0.5651)

1891.366 *

Constant1 2237.982 * (335.6237) -28097.218 * (348.4054)

(364.5463)

2533.503 *

Constant2 2684.881 * (226.0487) -25316.089 * (241.4657)

(241.5494)

4628.198 *

Constant3 4470.399 * (48.7264) 65530.419 * (113.1093)

(130.2013)

6407.774 *

Constant4 6052.225 * (97.3447) 54750.625 * (113.3429)

(151.7185)

N 120 108 12

Notes: This table reports estimating result (coefficient) for independent variables selected from model specification. The asterix sign (*) means that the variable has statistically

passed at 5% significance level. Coefficients in Panel B consist of and of each credit of economic sectors (1. Trade, 2. Industry, 3. Agriculture, 4. Construc-

tion), respectively. Baseline column shows the regression results with total samples.

of Finance released approximately INR 700 trillion (around banks increased particularly during the pandemic period,

USD 460 billion) in economic recovery funds as part of fiscal with 136.61% (year-on-year) growth. This was due to the

policy to boost the economy, especially among lower-in- government bond yield (6.17% at the end of 2020, Ministry

come households. Bank Indonesia lowered the policy rate of Finance (MOF)), which remained attractive for banks

by 150 basis points since early 2020, to 3.50%, the lowest compared to other placements.

rate in Indonesian economic history. Correspondingly, The collaboration policies among the authorities on the

Bank Indonesia lowered banking reserves and implemented demand side aim to increase public purchasing power for

loan to value as amacroprudential policy in the transporta- real sector activities. Simultaneously, policies on the supply

tion vehicle and property sectors. The Financial Services side support bank liquidity and decrease credit risk to im-

Authority of Indonesia introduced a relaxation policy for prove banking’s intermediary function. On the practical

credit restructuring (regulation #11/POJK.03/2020 about side, business matching for financing has been proposed for

the National Economic Stimulus as a Countercyclical Policy SMEs, in collaboration with the representative office of the

Impact of the Spread of COVID-19) to help debtors avoid central bank to integrate the real and financial sectors, par-

credit default. ticularly the banking sector. Communication and relation-

Generally, banking performance since December 2020 ship building between the real and financial sectors would

remained economically sound, according to several indica- be an alternative means to help overcome the credit crunch.

tors of the Financial Services Authority, such as the cap- Productive and safe sectors have been identified, such as

ital adequacy ratio (23.81%), liquid assets to third-party the information and communications and agricultural sec-

funds (31.67%), return on assets (1.59%), net interest mar- tors. The matrix in Table 4 was developed from a catalog

gin (4.32%), and gross NPLs (3.06%). However, the effect of pandemic spread risks and the 2020 annual growth of

of the relaxation of credit restructuring increased banking each economic sector. Productive and safe sectors are low

1

loans at risk (LAR). Bank reports at the end of 2020 stated risk and have strong prospects in terms of growth. The eco-

that, at the national level, the banking LAR stood at 25%, nomic sector could be a driving factor in the current eco-

and the commercial banks categories based on business ac- nomic recovery, such that financial institutions could be

tivity (BUKU) 4th group (with core capital above IDR 30 tril- persuaded to finance the productive and safe sectors.

lion) held the largest LAR position, with a rate approach-

ing 27%. This means banks were confronting more risks in III. Conclusion

terms of their intermediary function.

To keep their profit, rather than disburse credit, banks This research shows that the COVID-19 outbreak has af-

placed more of their large third-party funds into govern- fected the banking sector through declining credit delivery

ment bonds. The amount of government bonds held by to the real sectors. In terms of nominal value, total credit

1 The LAR measure is an indicator of the risk of default on loans that have been delivered. These include restructured loan and special

mention loan categories up to NPLs.

Asian Economics Letters 4

The COVID-19 Pandemic Impact on Banking Sector

the industry, agriculture, and construction were affected by

the COVID-19 outbreak, but not the credit of the trade.

This research contributes to the assessment of the ex-

istence of a credit crunch during the COVID-19 pandemic

by measuring the impact of the pandemic on the banking

sector. Alongside the policy of credit relaxation, business

matching is proposed to overcome the credit crunch. Banks

can disburse credit to the proposed productive and safe

economic sectors. In order to not remain just a concept, fu-

ture research could seek innovative business models to im-

plement the financing to overcome the credit crunch.

Acknowledgement

Table 4. Productive and Safe Economic Sectors

Notes: This matrix in row the economic sectors categorized into three levels of risk, de- We would like to thank and send our appreciation to the

rived from the Indonesian COVID Handling Task Force. The prospect of each economic

editors of the Asian Economics Letters journal particularly

sector is derived from the annual growth figures from Bank Indonesia.

Dr. Susan Sharma, Managing Editor and the reviewers who

have supported us by sending inputs and comments to im-

decreased in parallel with economic deceleration during prove this research.

the pandemic. Working capital credit and investment credit

were influenced by the pandemic, but not consumption

credit or SME credit. In the economic sector, the credit of

This is an open-access article distributed under the terms of the Creative Commons Attribution 4.0 International License

(CCBY-SA-4.0). View this license’s legal deed at https://creativecommons.org/licenses/by-sa/4.0 and legal code at https://cre-

ativecommons.org/licenses/by-sa/4.0/legalcode for more information.

Asian Economics Letters 5

The COVID-19 Pandemic Impact on Banking Sector

References

Baker, J. L. (2000). Evaluating the impact of development Huang, W., & Zheng, Y. (2020). COVID-19: Structural

projects on poverty: A Handbook for Practitioners. The changes in the relationship between investor

World Bank. https://doi.org/10.1596/0-8213-4697-0 sentiment and crude oil futures price. Energy

Bernanke, B., & Lown, C. S. (1991). Credit crunch. Research Letters, 1(2), 13685. https://doi.org/10.4655

Brookings Papers on Economic Activity, 22(2), 205–248. 7/001c.13685

https://doi.org/10.2307/2534592 Kahn-Lang, A., & Lang, K. (2020). The promise and

Bertrand, M., Duflo, E., & Mullainathan, S. (2002). How pitfalls of differences-in-differences: reflections on

much should we trust differences-in-differences 16 and pregnant and other applications. Journal of

estimates?. NBER Working Paper. https://doi.org/10.3 Business and Economic Statistics, 38(3), 613–620. http

386/w8841 s://doi.org/10.1080/07350015.2018.1546591

Dash, D. P., Sethi, N., & Dash, A. K. (2021). Infectious Khandker, S. R., Koolwal, G. B., & Samad, H. A. (2010).

disease, human capital, and the BRICS economy in Handbook on impact evaluation: Quantitative methods

the time of COVID-19. MethodsX, 8, 101202. https://d and practices. World Bank.

oi.org/10.1016/j.mex.2020.101202 Liu, L., Wang, E. Z., & Lee, C. C. (2020). Impact of the

Gertler, P. J., Martinez, S., Premand, P., Rawlings, L. B., COVID-19 pandemic on the crude oil and stock

& Vermeersch, C. M. J. (2011). Impact evaluation in markets in the US: A time-varying analysis. Energy

practice. World Bank. Research Letters, 1(1), 13154. https://doi.org/10.4655

Haldar, A., & Sethi, N. (2021). The news affects 7/001c.13154

Covid-19 on the global financial market volatility. Narayan, P. K. (2020a). Oil price news and COVID-19—Is

Bulletin of Monetary Economics and Banking, Special there any connection? Energy Research Letters, 1(1),

Issue 2021, 33–58. 13176. https://doi.org/10.46557/001c.13176

Han, H., & Qian, Y. (2020). Did Enterprises’ Innovation Narayan, P. K. (2020b). Did bubble activity intensify

Ability Increase During the COVID-19 Pandemic? during COVID-19. Asian Economics Letters, 1(2),

Evidence From Chinese Listed Companies. Asian 17654. https://doi.org/10.46557/001c.17654

Economics Letters, 1(3), 18072. https://doi.org/10.465 Ramasamy, K. (2020). Impact analysis in banking,

57/001c.18072 insurance and financial services industry due to

covid-19 pandemic. Pramana Research Journal, 10,

8,19-29.

Asian Economics Letters 6

You might also like

- COVID-19 and Labor Markets in Southeast Asia: Impacts on Indonesia, Malaysia, the Philippines, Thailand, and Viet NamFrom EverandCOVID-19 and Labor Markets in Southeast Asia: Impacts on Indonesia, Malaysia, the Philippines, Thailand, and Viet NamNo ratings yet

- Does Macroprudential Policy Alleviate The Adverse Impac - 2023 - Journal of BankDocument16 pagesDoes Macroprudential Policy Alleviate The Adverse Impac - 2023 - Journal of BankM Silahul Mu'minNo ratings yet

- Research Proposal: A Research Project Proposal Submitted in Partial Fulfillment of The Requirements For The CIA IIIDocument8 pagesResearch Proposal: A Research Project Proposal Submitted in Partial Fulfillment of The Requirements For The CIA IIIprajith krishNo ratings yet

- Juara Harapan 1 - LKISSK 2021 - Eka NurhalimatusDocument22 pagesJuara Harapan 1 - LKISSK 2021 - Eka NurhalimatusKhairun AmalaNo ratings yet

- Nugroho Dan YudiantoroDocument17 pagesNugroho Dan YudiantoroFen FenNo ratings yet

- The Nexus Between Bank Credit Risk and Liquidity: Does The Covid-19 Pandemic Matter? A Case of The Oligopolistic Banking SectorDocument21 pagesThe Nexus Between Bank Credit Risk and Liquidity: Does The Covid-19 Pandemic Matter? A Case of The Oligopolistic Banking Sector20212111047 TEUKU MAULANA ARDIANSYAHNo ratings yet

- P - Issn: 2503-4413 E - Issn: 2654-5837, Hal 1 Dampak Pandemi Covid 19 Terhadap Kinerja Keuangan Sektor Perbankan Di IndonesiaDocument10 pagesP - Issn: 2503-4413 E - Issn: 2654-5837, Hal 1 Dampak Pandemi Covid 19 Terhadap Kinerja Keuangan Sektor Perbankan Di IndonesiaAn Nissa Ar RauufiNo ratings yet

- 1475-Article Text-4599-1-10-20220711Document24 pages1475-Article Text-4599-1-10-20220711Rahmat RamdaniNo ratings yet

- From Pandemic To Financial Contagion High-Frequency Risk Metrics and Bayesian Volatility AnalysisDocument11 pagesFrom Pandemic To Financial Contagion High-Frequency Risk Metrics and Bayesian Volatility AnalysisArina HidhayatikaNo ratings yet

- Bank Lending During The Covid 19 PandemicDocument18 pagesBank Lending During The Covid 19 PandemicAlip Rahman MaulanaNo ratings yet

- 1 s2.0 S1062940823001134 MainDocument20 pages1 s2.0 S1062940823001134 MainPedro SilvaNo ratings yet

- Impact of Credit Facilities and Contemporary Economic Environment On The Accessibility To Credit of Customers - Case Study in Binh Duong, VietnamDocument17 pagesImpact of Credit Facilities and Contemporary Economic Environment On The Accessibility To Credit of Customers - Case Study in Binh Duong, VietnamHT BerdNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewNAZREEN SHAHAL 2227536No ratings yet

- 1 s2.0 S0378426622002187 MainDocument13 pages1 s2.0 S0378426622002187 Mainwiem chibaNo ratings yet

- Covid 19 Blow On Indian Banks ParalyzedDocument24 pagesCovid 19 Blow On Indian Banks Paralyzedtanu kapoorNo ratings yet

- A Comparative Study On Financial Performance Between Islamic and Conventional Banking in Indonesia During The COVID-19 PandemicDocument14 pagesA Comparative Study On Financial Performance Between Islamic and Conventional Banking in Indonesia During The COVID-19 PandemicLusan GivianaNo ratings yet

- International Review of Economics and Finance: Chen Zheng, Junru ZhangDocument17 pagesInternational Review of Economics and Finance: Chen Zheng, Junru ZhangShameel IrshadNo ratings yet

- IJFBS V11.i3 Sutarti 62 71Document10 pagesIJFBS V11.i3 Sutarti 62 71Andi AbdurahmanNo ratings yet

- How Did Depositors Respond To COVID 19 Levine 2021 RfsDocument36 pagesHow Did Depositors Respond To COVID 19 Levine 2021 RfsHuy Lê ThanhNo ratings yet

- Dampak Peningkatan Restrukturisasi Utang Akibat Covid-19 Terhadap Profitabilitas Perusahaan PerbankanDocument5 pagesDampak Peningkatan Restrukturisasi Utang Akibat Covid-19 Terhadap Profitabilitas Perusahaan PerbankanChindy PrasyandaNo ratings yet

- 381-Article Text-930-1-10-20230802Document18 pages381-Article Text-930-1-10-20230802Dzikri AtharNo ratings yet

- Paper PresentationDocument10 pagesPaper PresentationRakshitha AparnaNo ratings yet

- Behavioral nanceandCOVID-19 Cognitive Errors That Determine The Nancial FutureDocument6 pagesBehavioral nanceandCOVID-19 Cognitive Errors That Determine The Nancial FutureWahyuni MertasariNo ratings yet

- Consequences of COVID-19 On Banking Sector Index: Artificial Neural Network ModelDocument16 pagesConsequences of COVID-19 On Banking Sector Index: Artificial Neural Network Modelgod of thunder ThorNo ratings yet

- Davasrule Dzlivs DDDocument6 pagesDavasrule Dzlivs DDnino nakashidzeNo ratings yet

- COVID-19 and Its Impact On The Indian EconomyDocument13 pagesCOVID-19 and Its Impact On The Indian EconomyAbhitesh BakshiNo ratings yet

- Dampak Implementasi RestrukturisasiDocument35 pagesDampak Implementasi RestrukturisasiAllifil MuizNo ratings yet

- Claw Tute ReportDocument7 pagesClaw Tute Reportkavya kharbandaNo ratings yet

- 1 s2.0 S0927538X22001238 MainDocument21 pages1 s2.0 S0927538X22001238 MainYaseen KhanNo ratings yet

- 834-Article Text-2322-1-10-20221128Document10 pages834-Article Text-2322-1-10-20221128Blind WormNo ratings yet

- Journal Pre-Proof: Review of Economic DynamicsDocument51 pagesJournal Pre-Proof: Review of Economic DynamicsannoporciNo ratings yet

- Bank Capital and Risk Relationship During COVID-19 A Cross-Country Evidence (10-1108 - SEF-04-2023-0199)Document23 pagesBank Capital and Risk Relationship During COVID-19 A Cross-Country Evidence (10-1108 - SEF-04-2023-0199)cuonghienNo ratings yet

- An Analysis of The Impacts of Covid-19 On The Sustainability of The Banking Sector of Pakistan A Cael's ApproachDocument12 pagesAn Analysis of The Impacts of Covid-19 On The Sustainability of The Banking Sector of Pakistan A Cael's ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Covid-19 On Microfinance Institutions of Nepal: NRB Working Paper No. 51Document13 pagesImpact of Covid-19 On Microfinance Institutions of Nepal: NRB Working Paper No. 51NarenBistaNo ratings yet

- Security AnalysisDocument16 pagesSecurity AnalysisAtique Naveed BajwaNo ratings yet

- JAFB - Vol 10 - 6 - 4Document21 pagesJAFB - Vol 10 - 6 - 4YassinefartakhNo ratings yet

- Working Paper Series: The Great Lockdown: Pandemic Response Policies and Bank Lending ConditionsDocument56 pagesWorking Paper Series: The Great Lockdown: Pandemic Response Policies and Bank Lending ConditionsCHITHRANo ratings yet

- Journal Pre-Proof: Finance Research LettersDocument12 pagesJournal Pre-Proof: Finance Research LettersRuhma ZainabNo ratings yet

- Journal of Banking and Finance: Asli Demirgüç-Kunt, Alvaro Pedraza, Claudia Ruiz-OrtegaDocument22 pagesJournal of Banking and Finance: Asli Demirgüç-Kunt, Alvaro Pedraza, Claudia Ruiz-OrtegaLutchmee SurjooNo ratings yet

- Groningen Finance Growth WPDocument59 pagesGroningen Finance Growth WPStelios KaragiannisNo ratings yet

- Key Words: Covid-19, Credit Cycle, High-Yield Bonds, Leveraged Loans, Clos, Default Rates, Recovery Rates, Rating/Inflation, Crowding-Out, ZombiesDocument26 pagesKey Words: Covid-19, Credit Cycle, High-Yield Bonds, Leveraged Loans, Clos, Default Rates, Recovery Rates, Rating/Inflation, Crowding-Out, Zombiesveda20No ratings yet

- 2022-Impact of Income Diversification On The Default Risk of Vietnamese Commercial Banks in The Context of The COVID 19 PandemicDocument23 pages2022-Impact of Income Diversification On The Default Risk of Vietnamese Commercial Banks in The Context of The COVID 19 PandemicIbrahim KhatatbehNo ratings yet

- Dampak Risk ManagementDocument18 pagesDampak Risk Managementcarlosmanuelfeto26No ratings yet

- Has COVID-19 Hindered Small Business Activities - The Role of FintechDocument12 pagesHas COVID-19 Hindered Small Business Activities - The Role of FintechFaizan KhanNo ratings yet

- Covid Bdbank SSRNDocument50 pagesCovid Bdbank SSRNSumon iqbalNo ratings yet

- CC 005Document24 pagesCC 005Sisilia MarsheilaNo ratings yet

- Loan Disbursement PDFDocument10 pagesLoan Disbursement PDFGemechu GuduNo ratings yet

- Financial SectorDocument12 pagesFinancial Sectorayanfeoluwa odeyemiNo ratings yet

- Determinants of Non-Performing Loans in Pakistan: Tanweer@s3h.nust - Edu.pkDocument15 pagesDeterminants of Non-Performing Loans in Pakistan: Tanweer@s3h.nust - Edu.pkChương Nguyễn ĐìnhNo ratings yet

- 10 30855-Gjeb 2022 8 3 001-1739783 PDFDocument10 pages10 30855-Gjeb 2022 8 3 001-1739783 PDFPatricia PeñaNo ratings yet

- Islami, 295-305 v2Document11 pagesIslami, 295-305 v2AlanNo ratings yet

- Financial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsDocument8 pagesFinancial Review and Financial Distress On Covid 19 Pandemic A Comparison of Two South East Asia Countries in The Real Estate and Property Sub SectorsInternational Journal of Innovative Science and Research Technology100% (1)

- Journal of Retailing and Consumer ServicesDocument11 pagesJournal of Retailing and Consumer ServiceslaluaNo ratings yet

- Corona Virus Impacts On Small Medium Enterprise TowardDocument10 pagesCorona Virus Impacts On Small Medium Enterprise TowardPhoan AldrichNo ratings yet

- Jurnal Internasional 3Document9 pagesJurnal Internasional 3Bella Nur anggrainiNo ratings yet

- Febryy Armando Pranata 2101020005Document70 pagesFebryy Armando Pranata 2101020005Maharani KharismaNo ratings yet

- The Impact of Financial Performance On The Profitability of The Indonesian Banking During The Covid-19 PandemicDocument6 pagesThe Impact of Financial Performance On The Profitability of The Indonesian Banking During The Covid-19 PandemicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effects of Covid-19 Pandemic On Accounting and Financial Reporting in NigeriaDocument12 pagesEffects of Covid-19 Pandemic On Accounting and Financial Reporting in NigeriacpamutuiNo ratings yet

- CC 003Document22 pagesCC 003Sisilia MarsheilaNo ratings yet

- COVID-19 and The Credit CycleDocument32 pagesCOVID-19 and The Credit CycleJeromeNo ratings yet

- Real Estate Black BookDocument9 pagesReal Estate Black BookVishal Dhekale0% (2)

- SBI Magnum Balanced Fund - Fund Snapshot - SBI Mutual Fund - Value Research OnlineDocument2 pagesSBI Magnum Balanced Fund - Fund Snapshot - SBI Mutual Fund - Value Research OnlineRajkumarNo ratings yet

- ATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020Document2 pagesATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020anton clementeNo ratings yet

- 44th Annual Report 2005-2006: National Organic Chemical Industries LimitedDocument73 pages44th Annual Report 2005-2006: National Organic Chemical Industries Limitedsandesh1506No ratings yet

- Accounting Cycle Requirement 1: Journal Entries T-AccountsDocument5 pagesAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloNo ratings yet

- 17 - Equitable PCI Bank vs. NG Sheung NgorDocument3 pages17 - Equitable PCI Bank vs. NG Sheung NgorSeventeen 17No ratings yet

- An Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionDocument26 pagesAn Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionSekender AliNo ratings yet

- Acctg1205 - Chapter 4 PROBLEMSDocument6 pagesAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronNo ratings yet

- The Corporate Director's Guide ESG OversightDocument19 pagesThe Corporate Director's Guide ESG OversightJenny Ling Lee Mei A16A0237No ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- Online Indian Share Market Live NSE Intraday Tips Today Shri Stock TipsDocument3 pagesOnline Indian Share Market Live NSE Intraday Tips Today Shri Stock TipsShritock TipsNo ratings yet

- Guidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesDocument25 pagesGuidelines and Procedures For Entering Into Joint Venture (JV) Agreements Between Government and Private EntitiesPoc Politi-ko ChannelNo ratings yet

- Miami: Condominio-1 de La Familia RomeroDocument5 pagesMiami: Condominio-1 de La Familia RomeroConrado Gonzalo Garcia JaminNo ratings yet

- (B) Increase DecreaseDocument5 pages(B) Increase Decreaseyiming peiNo ratings yet

- Mergers and Acquisitions Guide: 2020 EDITIONDocument67 pagesMergers and Acquisitions Guide: 2020 EDITIONharyaNo ratings yet

- Mega KPI BundleDocument11 pagesMega KPI Bundlepepito.supermarket.baliNo ratings yet

- Fiserv November SalaryDocument1 pageFiserv November SalarySiddharthNo ratings yet

- Jurnal Eliminasi - Inter Company ProfitDocument14 pagesJurnal Eliminasi - Inter Company ProfitIrfan JayaNo ratings yet

- A.P.S Iapm Unit 3Document19 pagesA.P.S Iapm Unit 3vinayak mishraNo ratings yet

- Triangle Chart Patterns and Day Trading StrategiesDocument10 pagesTriangle Chart Patterns and Day Trading Strategiespeeyush24No ratings yet

- 10 Innovations and Challenges in Msme SectorDocument5 pages10 Innovations and Challenges in Msme SectorShukla SuyashNo ratings yet

- Income Tax Lessons July 2019 0 PDFDocument124 pagesIncome Tax Lessons July 2019 0 PDFHannah YnciertoNo ratings yet

- Pension Guide: Based On Institutional Framework FOR Expediting Pension Cases Developed by Establishment DivisionDocument26 pagesPension Guide: Based On Institutional Framework FOR Expediting Pension Cases Developed by Establishment DivisionAcademy Of Commerce And Management SciencesNo ratings yet

- Coinremitter Allows Merchants To Integrate APIDocument5 pagesCoinremitter Allows Merchants To Integrate APIPratik MehetaNo ratings yet

- The Economics of Commercial Real Estate PreleasingDocument33 pagesThe Economics of Commercial Real Estate PreleasingSuhas100% (1)

- Motex AssignmentDocument13 pagesMotex Assignmentmotuma dugasaNo ratings yet

- Rotomac Fraud CaseDocument11 pagesRotomac Fraud CaseShashank Shankar33% (3)

- Monetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFDocument81 pagesMonetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFbereket nigussieNo ratings yet

- Cal Homeowners Insurance Valuation V2Document77 pagesCal Homeowners Insurance Valuation V2Melissa Maher100% (1)

- AE100: FAR: Partnership: Basic Concepts and ConsiderationsDocument9 pagesAE100: FAR: Partnership: Basic Concepts and Considerationsdiane pandoyosNo ratings yet