0% found this document useful (0 votes)

3K views18 pagesSTE Microproject

Uploaded by

OmeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

3K views18 pagesSTE Microproject

Uploaded by

OmeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

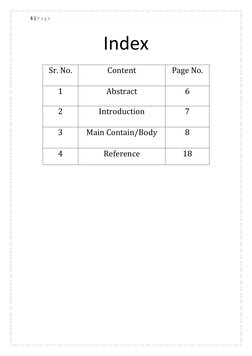

- Abstract

- Introduction

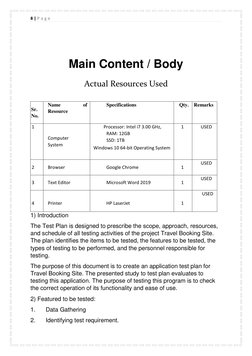

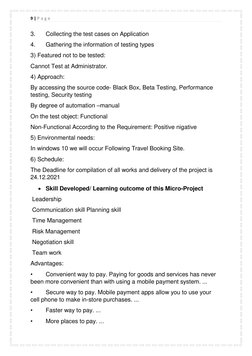

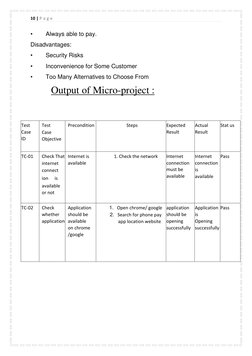

- Main Content/Body

- Reference