Professional Documents

Culture Documents

Pre Final Quiz 4

Uploaded by

MARC JOHN ILANOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre Final Quiz 4

Uploaded by

MARC JOHN ILANOCopyright:

Available Formats

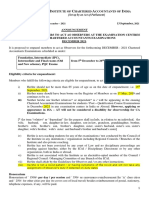

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

PRE-FINAL QUIZ NUMBER 4

Question 1: The income summary account

a) Generally has a credit balance after all the accounts that should be

closed have been closed

b) Summarizes changes in assets, liabilities, and net earnings or loss

for the accounting period

c) Summarizes revenue, expense, and net income or loss for

the accounting period

d) Is used to close the retained earnings account

Question 2: An adjusting entry to accrue wages incurred but not yet

paid is an example of

a) Reflecting unrecorded revenue earned during an accounting

period

b) Reflecting unrecorded expenses incurred during an

accounting period

c) Aligning recorded costs with appropriate accounting periods

d) Aligning recorded revenue with appropriate accounting periods

Question 3: If an entity uses special journals, in which journal would

the sale of merchandise for cash be recorded?

a) General journal

b) Sales journal

c) Cash receipts journal

d) Cash disbursements journal

Question 4: In the preparation of the worksheet, if the total debits are

greater than total credits under the balance sheet column

a) Assets are overstated

b) There is net loss

c) There is net income

d) Liabilities are understated

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

Question 5: Which of the following is an example of an accrued

expense?

a) Property tax incurred during the year to be paid next year

b) Depreciation expense

c) Equipment purchased at the beginning of the year and debited to

an expense account

d) Rent earned during the current year to be received at the end of

next year

Question 6: On May 1, 2020, the business paid for a one-year insurance

premium of P2,400 for the registration of the delivery truck. The entry

made was a debit to the Prepaid Insurance account and a credit to the

Cash account, both for P2,400.

What is the adjusted balance of the Prepaid Insurance account on

December 31, 2020?

Answer 1: 800 (2400 x 8/1290= 1600, 2400-1600=800)

Question 7 : On April 15, 2020, the business paid for a one-year

insurance premium of P3,600 for the registration of the delivery truck.

The entry made was a debit to the Insurance Expense account and a

credit to the Cash account, both for P3,600.

What is the adjusted balance of the Insurance Expense account on

December 31, 2020?

Answer 1: 1050 (3600 x 8.5/12=2550, 3600-2550=1050)

Question 8: If the business operations of a single proprietorship entity

resulted to a loss, the income summary account will be closed by

a) Debiting cash and crediting income summary

b) Debiting income summary and crediting owner’s capital

c) Debiting income summary and crediting cash

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

d) Crediting income summary and debiting owner’s capital

Question 9: An entity initially records prepayments in nominal

accounts. Which of the following year-end adjusting entries should be

reversed?

a) The adjusting entry to record amortization of patent

b) The adjusting entry to record doubtful accounts

c) The adjusting entry to record inventory at year-end

d) The adjusting entry to record the portion of rental received

in advance that is unearned at year-end

Question 10: Which of the following statements is correct regarding

the post-closing trial balance?

a) It shows that the accounting equation is in balance at the end of

the current accounting period

b) All of these statements are correct regarding the post-

closing trial balance

c) It will balance even if a transaction is not journalized and posted or

if a transaction is journalized and posted twice

d) It is a trial balance that consists of real accounts only

Question 11: Which of the following is not a possible combination of

journal entry?

a) Decrease in equity and increase in liability

b) Decrease in liability and decrease in asset

c) Increase in asset and increase in liability

d) Increase in asset and decrease in equity

Question 12: A reversing entry should never be made for an adjusting

entry that

a) Adjusts unexpired costs from an expense account to an asset

account

b) Accrues unrecorded revenue

c) Accrues unrecorded expenses

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

d) Adjusts expired costs from an asset account to an expense

account

Question 13: Reversing entries apply to all

a) Closing entries

b) Adjusting entries

c) Deferrals

d) Accruals

Question 14: The following data are taken from the records of OMG

Store:

Accounts receivable – P1,250,000

Credit balance of Allowance for bad debts – P12,000

Estimated uncollectible accounts – 4%

How much is the required Allowance for Bad Debts?

Answer 1: 50,000 (1,250,000 x 4%=50000)

Question 15: Reversing entries

a) Must be made at year-end

b) Are desirable to exercise consistency and establish

standardized procedures

c) Are necessary to achieve a proper matching of revenue and

expense

d) Are normally prepared for accruals and prepayments

Question 16: The records of Makabebe Enterprises at the end of the

period reveal the following with regard to its accounts receivable:

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

Experience

A Store B Store C Store Other Customers

rate

0 – 30 1% P80,000 P63,500 P- P123,800

31 – 60 4% 12,000 - - 86,700

61 – 90 10% 3,000 - - 35,600

91 – 180 15% - - 23,500 14,600

Over 189 25% - - - 25,900

Required: Compute for the uncollectible amount.

Answer 1: 21,667

Question 17: The income statement showed utilities expense of

P24,000 and the balance sheet showed utilities payable of P4,000.

How much was the utilities paid?

Answer 1: 28,000 (24,000 plus 4,000= 28000)

Question 18: The trial balance

a) In used to prepare the statement of financial position while the

general ledger is used to prepare the income statement

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

b) Is a listing of all the accounts and their balances in the order the

accounts appear in the statement of financial position

c) Can be used to uncover errors in journalizing and posting

d) Has as the primary purpose of proving that all journal entries were

made for the period

Question 19: The post-closing trial balance

a) Will balance if a transaction is not journalized and posted, or if a

transaction is journalized and posted twice

b) All of the choices are correct regarding the post-closing

trial balance

c) Consists of statement of financial position accounts only

d) Shows that the accounting equation is in balance at the end of the

accounting period

Question 20: Adjusting entries that should be reversed include those

for prepaid or unearned items that

a) Were originally entered in a revenue or expense account

b) Neither

c) Were originally entered in an asset or liability account

d) Both

Question 21: In the preparation of the worksheet, if the total debits

are greater than total credits under the income statement column

a) There is net income

b) Income is understated

c) Expense is overstated

d) There is net loss

Question 22: A general ledger is defined as

a) The entire group of accounts

b) A group of all statement of financial position accounts

c) A group of transactions

d) A group of all statement of comprehensive income accounts

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

Question 23: An account which represents unpaid expenses at the end

of the account period.

a) Expenses

b) Accrued expense

c) Prepaid expense

d) Deferred charges

Question 24: Which of the following statement/s is/are true about

reversing entries?

I. Income under accrual basis can be reversed

II. Expenses under cash basis can be reversed

III. Prepaid expense recorded under expense method can be reversed

IV. Unearned income recorded under liability method can be

reversed

a) I and III

b) I, II, and IV

c) I, III, and IV

d) II and IV

Question 25: Which of the following is/are true?

I. Statement of cash flows shows the balances of an entity’s assets,

liabilities, and equities

II. Statement of changes in equity shows the movements of an

entity’s cash account

III. Statement of comprehensive income shows the list of real

accounts

IV. Notes to financial statements shows the supporting details for the

accounts being show in other components of financial statement

a) I, II, III, and IV

b) IV only

c) III and IV

d) I, II, and IV

UNIVERSITY OF SAINT ANTHONY

College of Accountancy

ACCOUNTING 1 (Reviewer)

You might also like

- Accounting quiz answersDocument10 pagesAccounting quiz answersGab IgnacioNo ratings yet

- NUS Mock Mid-Term Test ReviewDocument9 pagesNUS Mock Mid-Term Test Reviewkik leeNo ratings yet

- REVIEWERDocument9 pagesREVIEWERHanns Lexter PadillaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Track Software Financial AnalysisDocument8 pagesTrack Software Financial AnalysisMohamed Ahmed ZeinNo ratings yet

- Enterprise computing systems and informationDocument53 pagesEnterprise computing systems and informationTrxtr GiananNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgageRex Traya100% (1)

- ACCA Qualification: Accountant in Business (AB) 2 Hours 50%Document19 pagesACCA Qualification: Accountant in Business (AB) 2 Hours 50%Bobby Singh100% (1)

- Sample Question - Not ArrangedDocument7 pagesSample Question - Not ArrangedJonh Paul SantosNo ratings yet

- Arrangement - Sample QuestionDocument7 pagesArrangement - Sample QuestionJonh Paul SantosNo ratings yet

- ACC 280 Final ExamDocument4 pagesACC 280 Final Examanon_624482436No ratings yet

- 2016 ACCT2111 Midterm KeyDocument10 pages2016 ACCT2111 Midterm KeyAnn MaNo ratings yet

- Mba-Sem I (New)Document7 pagesMba-Sem I (New)prashantNo ratings yet

- Acconting For Managers - 2Document6 pagesAcconting For Managers - 2akm.mhs20No ratings yet

- Financial Accounting Fundamentals QuizDocument12 pagesFinancial Accounting Fundamentals Quiztouria100% (1)

- Basic AcctgDocument5 pagesBasic AcctgMikee MendiolaNo ratings yet

- Financial Accounting AssignmentDocument11 pagesFinancial Accounting AssignmentAnish Agarwal0% (1)

- MCQ Financial AccountingDocument78 pagesMCQ Financial AccountingRange RoverNo ratings yet

- ACCO 20033 Financial Accounting and Reporting 1 MidtermDocument13 pagesACCO 20033 Financial Accounting and Reporting 1 MidtermNila FranciaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument11 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSherlock HolmesNo ratings yet

- Practice Test Chap 12 PDFDocument8 pagesPractice Test Chap 12 PDFHarshad SoniNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- Basic Accounting Multiple ChoiceDocument4 pagesBasic Accounting Multiple Choicenda04030% (1)

- Test Begins HereDocument6 pagesTest Begins HereRichardDinongPascual100% (1)

- Test Bank For Introduction To Financial Accounting 11Th Edition Horngren Sundem Elliott Philbrick 9780133251036 Full Chapter PDFDocument36 pagesTest Bank For Introduction To Financial Accounting 11Th Edition Horngren Sundem Elliott Philbrick 9780133251036 Full Chapter PDFjane.boyles334100% (11)

- Accounting Principles SEC FASB StandardsDocument9 pagesAccounting Principles SEC FASB StandardsJerry WideNo ratings yet

- Caft 001: Common Accounting and Finance TestDocument21 pagesCaft 001: Common Accounting and Finance TestNaren JangirNo ratings yet

- Quiz AnsDocument14 pagesQuiz AnsRosalind WangNo ratings yet

- Theory of Debits & CreditsDocument4 pagesTheory of Debits & CreditsLiwliwa BrunoNo ratings yet

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- MCQs of AccountingDocument29 pagesMCQs of AccountingImran Arshad33% (3)

- Acct 5930 Quiz 1 Question 1Document26 pagesAcct 5930 Quiz 1 Question 1Mauhammad NajamNo ratings yet

- BUSN1001 MSE S2 2018 QuestionsDocument8 pagesBUSN1001 MSE S2 2018 QuestionsjamiekarpasNo ratings yet

- Financial Accounting MCQSDocument54 pagesFinancial Accounting MCQSanon_82028478980% (20)

- Accounting GeniusDocument9 pagesAccounting Geniusryan angelica allanicNo ratings yet

- CUHK Midterm Exam 1st Term 2014-2015 for ACCT 2111 Intro Fin AccountingDocument11 pagesCUHK Midterm Exam 1st Term 2014-2015 for ACCT 2111 Intro Fin AccountingDonald YumNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- DarnaDocument26 pagesDarnaArunkumarNo ratings yet

- Cfas Mock Test PDFDocument71 pagesCfas Mock Test PDFRose Dumadaug50% (2)

- EY ENTRANCE TEST final-ACE THE FUTUREDocument18 pagesEY ENTRANCE TEST final-ACE THE FUTURETrà Hương100% (1)

- Acctg 12 Premid Exam QuestionnaireDocument11 pagesAcctg 12 Premid Exam QuestionnaireJanet AnotdeNo ratings yet

- Duration 2 Hours Max Marks 70Document25 pagesDuration 2 Hours Max Marks 70AgANo ratings yet

- FN163 Financial Accounts MCQs Test A 2016Document9 pagesFN163 Financial Accounts MCQs Test A 2016danpicks1234No ratings yet

- AccountingDocument290 pagesAccountingNibash KumuraNo ratings yet

- Quiz 1 FIN202Document4 pagesQuiz 1 FIN202Ngọc MinhNo ratings yet

- AF121: Introduction To Accounting Information SystemsDocument15 pagesAF121: Introduction To Accounting Information SystemsShikhaNo ratings yet

- Accountancy MCQDocument93 pagesAccountancy MCQabnadeemmalik111No ratings yet

- ACCA FA Progress Test PDFDocument21 pagesACCA FA Progress Test PDFNicat IsmayıloffNo ratings yet

- CIMA CBA Questions & AnswersDocument22 pagesCIMA CBA Questions & AnswersMir Fida NadeemNo ratings yet

- ACC 111 Midterm 1st Sem 2023Document8 pagesACC 111 Midterm 1st Sem 2023momogichocooNo ratings yet

- Financial Accounting Test II ReviewDocument3 pagesFinancial Accounting Test II ReviewBLACKPINKLisaRoseJisooJennieNo ratings yet

- Answers Are Hidden in White Ink-: Test II - Abstract About Financial AccountingDocument3 pagesAnswers Are Hidden in White Ink-: Test II - Abstract About Financial AccountingBLACKPINKLisaRoseJisooJennieNo ratings yet

- AnswerDocument2 pagesAnswerNirmal K PradhanNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- Wa0004Document8 pagesWa0004Timothy Manyungwa IsraelNo ratings yet

- MA2 Mock 3Document10 pagesMA2 Mock 3sameerjameel678No ratings yet

- Final Exam Autumn 2010-Final Solutions 020710Document20 pagesFinal Exam Autumn 2010-Final Solutions 020710Yasir MuyidNo ratings yet

- Barrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Document4 pagesBarrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Alishba KhanNo ratings yet

- NOV Pathfinder November 2016 FoundationDocument151 pagesNOV Pathfinder November 2016 FoundationOgahNo ratings yet

- San Beda College Alabang Midterm Examination 1st Semester AY2019-2020Document7 pagesSan Beda College Alabang Midterm Examination 1st Semester AY2019-2020Marriel Fate CullanoNo ratings yet

- Audit Committee Responsibilities QuizDocument9 pagesAudit Committee Responsibilities QuizrenesanitaNo ratings yet

- Accountancy Financial Statements - IDocument6 pagesAccountancy Financial Statements - Ibabaaijaz01No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Executive Order No. 266Document2 pagesExecutive Order No. 266Philip Ryken YuNo ratings yet

- Redefining Home Field Advantage: A Game Plan For Enhancing Fan EngagementDocument20 pagesRedefining Home Field Advantage: A Game Plan For Enhancing Fan EngagementHarsh BhatNo ratings yet

- Abigail Gunlock: 7657 Athenia Drive, Cincinnati OH, 45244 Gunlocal@mail - Uc.edu 513.473.1285Document2 pagesAbigail Gunlock: 7657 Athenia Drive, Cincinnati OH, 45244 Gunlocal@mail - Uc.edu 513.473.1285api-340013835No ratings yet

- Solution To Homework Set 1Document5 pagesSolution To Homework Set 1Behailu TesfayeNo ratings yet

- 2013-Q4 Ascend V1ewpoint (Issue 41)Document16 pages2013-Q4 Ascend V1ewpoint (Issue 41)awang90No ratings yet

- Case 1Document19 pagesCase 1adil abidNo ratings yet

- Fixed Asset Management for Improved PerformanceDocument6 pagesFixed Asset Management for Improved PerformanceMr SmartNo ratings yet

- Agile Use CasesDocument80 pagesAgile Use CasesJessica PetersonNo ratings yet

- Cases in Securities Regulation CodeDocument33 pagesCases in Securities Regulation CodeMarion JossetteNo ratings yet

- Glyndon Volunteer Fire Department: Application For EmploymentDocument8 pagesGlyndon Volunteer Fire Department: Application For EmploymentAaron RubalskyNo ratings yet

- Api Standard 541, 4Th Edition Form-Wound Squirrel Cage Induction Motors Larger Than 500 HorsepowerDocument9 pagesApi Standard 541, 4Th Edition Form-Wound Squirrel Cage Induction Motors Larger Than 500 HorsepowerVisal SasidharanNo ratings yet

- Summer Training ReportDocument76 pagesSummer Training ReportSuman GoyalNo ratings yet

- Case DigestDocument2 pagesCase DigestIan Punzalan TenorioNo ratings yet

- ICICI Lombard General Insurance Company Limited: Page 1 of 6Document6 pagesICICI Lombard General Insurance Company Limited: Page 1 of 6Utsav J BhattNo ratings yet

- Daily Lesson LOG: School Grade Level Teacher Learning Area Teaching Dates and Time SemesterDocument3 pagesDaily Lesson LOG: School Grade Level Teacher Learning Area Teaching Dates and Time SemesterMariel San PedroNo ratings yet

- Corporation and Estate Taxation - Sample ProblemDocument5 pagesCorporation and Estate Taxation - Sample Problemwind snip3r reojaNo ratings yet

- Sme 5Document4 pagesSme 5Ayesha KhanNo ratings yet

- Spa-To Withdraw Bank DepositDocument2 pagesSpa-To Withdraw Bank DepositLizza Bartolata100% (1)

- Exam 53697Document9 pagesExam 53697Vimal Shroff55No ratings yet

- Birth Date: Address: Mobile: Email: Diplomas / Basic Training Academic TrainingDocument4 pagesBirth Date: Address: Mobile: Email: Diplomas / Basic Training Academic TrainingMalek RekikNo ratings yet

- Statement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodDocument6 pagesStatement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodnovelNo ratings yet

- Internship Report RosheenDocument23 pagesInternship Report Rosheenaruba anwarNo ratings yet

- Standing OrdersDocument16 pagesStanding OrdersRamanah VNo ratings yet

- H&ss #5 #1 - Capitalism Development and OriginDocument6 pagesH&ss #5 #1 - Capitalism Development and OriginGaloNo ratings yet

- Baldomero Inciong vs. CADocument2 pagesBaldomero Inciong vs. CAPrincess JonasNo ratings yet

- Theory of Consumer BehaviourDocument81 pagesTheory of Consumer Behavioursupriya dasNo ratings yet