Professional Documents

Culture Documents

st124 Fill in

Uploaded by

ABODE PVT LIMITEDOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

st124 Fill in

Uploaded by

ABODE PVT LIMITEDCopyright:

Available Formats

Department of Taxation and Finance

New York State and Local Sales and Use Tax ST-124 (12/15)

Certificate of Capital Improvement

After this certificate is completed and signed by both the customer and the contractor performing the capital improvement,

it must be kept by the contractor. Copies of this certificate must be furnished to all subcontractors on the job and retained

as part of their records.

Read this form completely before making any entries.

This certificate may not be used to purchase building materials exempt from tax.

Name of contractor (print or type) Name of customer (print or type)

Address (number and street) Address (number and street)

City State ZIP code City State ZIP code

Sales tax Certificate of Authority number (if any)

To be completed by the customer

Describe capital improvement to be performed:

Project name

Street address (where the work is to be performed) City State ZIP code

I certify that:

• I am the (mark an X in one) owner tenant of the real property identified on this form; and

• the work described above will result in a capital improvement to the real property as outlined in the instructions of this form; and

• this contract (mark an X in one) includes does not include the sale of any items that will not become a permanent part of the

real property (for example, a free-standing microwave or washing machine).

I understand that:

• I will be responsible for any sales tax, interest, and penalty due on the contractor’s total charge for tangible personal property and for

labor if it is determined that this work does not qualify as a capital improvement; and

• I will be required to pay the contractor the appropriate sales tax on tangible personal property (and any associated services) when the

property installed by the contractor does not become a permanent part of the real property; and

• I will be subject to civil or criminal penalties (or both) under the Tax Law if I issue a false or fraudulent certificate.

Signature of customer Title Date

To be completed by the contractor

I, the contractor, certify that I have entered into a contract to perform the work described by the customer named above, and that I

accept this form in good faith. (A copy of the written contract, if any, is attached.) I understand that my failure to collect tax as a result of

accepting an improperly completed certificate will make me personally liable for the tax otherwise due, plus penalties and interest.

Signature of contractor or officer Title Date

This certificate is not valid unless all entries are completed.

Page 2 of 2 ST-124 (12/15)

Instructions

When the customer completes this certificate and gives it to the Temporary facilities at construction sites

contractor, who accepts it in good faith, it is evidence that the

Subcontracts to provide temporary facilities at construction sites

work to be performed will result in a capital improvement to real

that are necessary for the construction of a capital improvement

property.

are considered to be part of the capital improvement project.

A capital improvement to real property is an addition or alteration Examples of temporary facilities include temporary:

to real property that: • heat, electric, or plumbing services;

(a) substantially adds to the value of the real property or • protective pedestrian walkways; and

appreciably prolongs the useful life of the real property, and

• scaffolding services.

(b) becomes part of the real property or is permanently affixed

to the real property so that removal would cause material A primary contractor purchasing qualifying temporary facilities

damage to the property or article itself, and from a subcontractor must give the subcontractor a copy of

Form ST-124 issued to the primary contractor by the customer

(c) is intended to become a permanent installation.

(including a customer that is an exempt organization) to

The work performed by the contractor must meet all three of purchase the subcontractor’s services exempt from tax.

these requirements to be considered a capital improvement.

A certificate is accepted in good faith when a contractor has no

This certificate may not be issued unless the work qualifies as

knowledge that the certificate is false or is fraudulently given,

a capital improvement. See Tax Bulletin Capital Improvements

and reasonable ordinary due care is exercised in the acceptance

(TB-ST-104).

of the certificate.

If a contractor performs work that constitutes a capital

If a contractor gets a properly completed Form ST-124 from the

improvement, the contractor must pay tax on the purchase

customer within 90 days after rendering services, and accepts it

of building materials or other tangible personal property, but

in good faith, the customer bears the burden of proving the job

is not required to collect tax from the customer for the capital

or transaction was not taxable.

improvement. No credit or refund is allowed for the tax paid

on the cost of materials by the contractor. See Tax Bulletin If you are a contractor who installs items such as washing

Contractors – Sales Tax Credits (TB-ST-130). machines, clothes dryers, dishwashers, refrigerators, furniture,

etc., which when installed or placed in real property do not

For guidance as to whether a job is a repair or a capital

become part of the real property, you must collect tax on your

improvement, see Publication 862, Sales and Use Tax

charge for the installation. The individual charge for any of these

Classifications of Capital Improvements and Repairs to Real

items is also taxable as the sale of tangible personal property.

Property.

If a contractor does not get a properly completed Certificate of

A contractor, subcontractor, property owner, or tenant, may

Capital Improvement within 90 days, the contractor bears the

not use this certificate to purchase building materials or other

burden of proving the work or transaction was a capital

tangible personal property tax free. A contractor’s acceptance

improvement. The failure to get a properly completed certificate,

of this certificate does not relieve the contractor of the liability for

however, does not change the taxable status of a transaction; a

sales tax on the purchase of building materials or other tangible

contractor may still show that the transaction was a capital

personal property subsequently incorporated into the real property

improvement.

as a capital improvement unless the contractor can legally issue

Form ST-120.1, Contractor Exempt Purchase Certificate. (See Contractors and subcontractors must keep any exemption

Publication 862 for additional information.) certificate for at least three years after the due date of the last

return to which it relates, or the date the return was filed, if later.

The term materials is defined as items that become a physical

The contractor must also maintain a method of associating an

component part of real or personal property, such as lumber,

exempt sale made to a particular customer with the exemption

bricks, or steel. This term also includes items such as doors,

certificate on file for that customer.

windows, sinks, and furnaces used in construction.

Need help?

Floor covering

Floor covering such as carpet, carpet padding, linoleum and

vinyl roll flooring, carpet tile, linoleum tile, and vinyl tile installed Visit our website at www.tax.ny.gov

as the initial finished floor covering in new construction, a • get information and manage your taxes online

new addition to an existing building or structure, or in a total • check for new online services and features

reconstruction of an existing building or structure, constitutes a

capital improvement regardless of the method of installation. As Telephone assistance

a capital improvement, the charge to the property owner for the

installation of floor covering is not subject to New York State and Sales Tax Information Center: (518) 485-2889

local sales and use taxes. However, the retail purchase of floor

To order forms and publications: (518) 457-5431

covering (such as carpet or padding) itself is subject to tax.

Text Telephone (TTY) Hotline (for persons with

Floor covering installed other than as described above does hearing and speech disabilities using a TTY): (518) 485-5082

not qualify as a capital improvement. Therefore, the charges for

materials and labor are subject to sales tax. The contractor may Persons with disabilities: In compliance with the

apply for a credit or refund of any sales tax already paid on the Americans with Disabilities Act, we will ensure that our

materials. lobbies, offices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions

The term floor covering does not include flooring such as about special accommodations for persons with disabilities, call the

ceramic tile, hardwood, slate, terrazzo, and marble. The rules information center.

for determining when floor covering constitutes a capital

improvement do not apply to such flooring. The criteria stated in Privacy notification

(a), (b), and (c) above apply to such flooring. See our website or Publication 54, Privacy Notification.

You might also like

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Textbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 4, Building Out Your Urgent Care CenterNo ratings yet

- Capital Improvement FormDocument2 pagesCapital Improvement Formnyc_guyNo ratings yet

- The Certificates Issued Under RIAI and GCCC Standard Form Construction ContractsDocument10 pagesThe Certificates Issued Under RIAI and GCCC Standard Form Construction ContractsMateusz MrowkaNo ratings yet

- Notes 1 Certificate Involve in ConstructionDocument20 pagesNotes 1 Certificate Involve in ConstructionHimura_No ratings yet

- 5 Long-Term Construction ContractDocument12 pages5 Long-Term Construction ContractMark TaysonNo ratings yet

- 6.1.1. Revenue Recognition - Construction ContractsDocument56 pages6.1.1. Revenue Recognition - Construction ContractsJhaister Ashley LayugNo ratings yet

- HTTPS://WWW - Scribd.com/doc/145414863/time Saver Standards Building TypesDocument3 pagesHTTPS://WWW - Scribd.com/doc/145414863/time Saver Standards Building TypesKelly cabigasNo ratings yet

- Beneficial Occupancy and Practical CompletionDocument3 pagesBeneficial Occupancy and Practical CompletionMuhammad ArslanNo ratings yet

- Amalan IkhtisasDocument22 pagesAmalan IkhtisasSyafiqah SaaraniNo ratings yet

- Thorburg Contract Sample 2Document19 pagesThorburg Contract Sample 2Ellen ProfetaNo ratings yet

- Model Residential Construction Contract Cost Plus Version 910Document20 pagesModel Residential Construction Contract Cost Plus Version 910tpushkar9208No ratings yet

- 5 Long Term Construction Contract 3e5ca4a29cf252303 Ffcc2ab83e9ecba CompressDocument12 pages5 Long Term Construction Contract 3e5ca4a29cf252303 Ffcc2ab83e9ecba Compressgelly studiesNo ratings yet

- 9100 en TCDocument2 pages9100 en TCJHON FABER FORERO BARCONo ratings yet

- Model Residential Construction Contract Cost Plus Version 910Document30 pagesModel Residential Construction Contract Cost Plus Version 910Hadi Prakoso100% (2)

- Week 10 Revenue Recognition-Long-term Construction Contract - ACTG341 Advanced Financial Accounting and Reporting 1Document12 pagesWeek 10 Revenue Recognition-Long-term Construction Contract - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- 2223 Ipp Ws Solicitors Accounts 02 Ce01 GuideDocument24 pages2223 Ipp Ws Solicitors Accounts 02 Ce01 GuideGRZRGNo ratings yet

- certificate_and_paymentDocument4 pagescertificate_and_paymenttommy' sleepNo ratings yet

- Con - Resources - Cost - Plus - Residential - Contract 3Document20 pagesCon - Resources - Cost - Plus - Residential - Contract 3ibrahimdalia600No ratings yet

- RA 9184 Contract Implementation of Infrastructrure ProjectsDocument46 pagesRA 9184 Contract Implementation of Infrastructrure ProjectsJasmin VallentosNo ratings yet

- CAA MICROPROECT Sanju PDFDocument12 pagesCAA MICROPROECT Sanju PDFSanjana NevaseNo ratings yet

- Practical completion certificationDocument2 pagesPractical completion certificationlaikienfuiNo ratings yet

- Guide QBCC Consumer Building v3Document2 pagesGuide QBCC Consumer Building v3patNo ratings yet

- Estimating and Costing IDocument22 pagesEstimating and Costing IYusuf kiptumNo ratings yet

- Group 7 (Payment)Document74 pagesGroup 7 (Payment)illya amyraNo ratings yet

- Vtupulse.C: Module-5 Contract Management Post AwardDocument49 pagesVtupulse.C: Module-5 Contract Management Post AwardNayim InamdarNo ratings yet

- General Conditions of ContractDocument13 pagesGeneral Conditions of ContractDeepika GoelNo ratings yet

- B3 ContractDocument6 pagesB3 ContractfuentesmikeymikeNo ratings yet

- Equisolar Sub Contractor AgreementDocument13 pagesEquisolar Sub Contractor AgreementKelmerNo ratings yet

- The Basics of Construction LawDocument58 pagesThe Basics of Construction Lawjim123No ratings yet

- 104 Residential Tile ContractDocument2 pages104 Residential Tile ContractMarius IbanescuNo ratings yet

- Professional Practice Assignment 2: Vaishnavi S 1RW17AT103Document3 pagesProfessional Practice Assignment 2: Vaishnavi S 1RW17AT103Jahnavi JayashankarNo ratings yet

- S000 Proposal 01 - Elevations, Small ProjectsDocument3 pagesS000 Proposal 01 - Elevations, Small Projectsmarcanthonyrobert1No ratings yet

- Prof PracDocument26 pagesProf PraclourrenzNo ratings yet

- Construction ContractsDocument9 pagesConstruction ContractsMahir RahmanNo ratings yet

- Contract CostingDocument15 pagesContract CostingUjjwal BeriwalNo ratings yet

- E Flier Credit Notes in GSTDocument2 pagesE Flier Credit Notes in GSTSneha AgarwalNo ratings yet

- Building Inspection Terms and Conditions - EnvironDocument14 pagesBuilding Inspection Terms and Conditions - EnvironKenneth KemeNo ratings yet

- Building Permit Processing Fees and Architects Professional FeesDocument26 pagesBuilding Permit Processing Fees and Architects Professional FeesjamesbryanescanderNo ratings yet

- Seminar Slides 19Document42 pagesSeminar Slides 19cccqNo ratings yet

- Contracts Session 4Document109 pagesContracts Session 4guru jiNo ratings yet

- QUS3204 - Lecture 8 Certificate of PaymentDocument18 pagesQUS3204 - Lecture 8 Certificate of PaymentZdravo YNo ratings yet

- How To Properly Control Client-Induced Changes in Your EPCI ProjectDocument2 pagesHow To Properly Control Client-Induced Changes in Your EPCI ProjectdhaferjabNo ratings yet

- Works Contract - Concept and ValuationDocument31 pagesWorks Contract - Concept and ValuationArun AroraNo ratings yet

- Residential Construction Contract Cost PlusDocument16 pagesResidential Construction Contract Cost Plusmike100% (2)

- Sample Residential Remodeling Contract TemplateDocument60 pagesSample Residential Remodeling Contract TemplateHarshal KushwahNo ratings yet

- Liquidated Damages - JCTDocument4 pagesLiquidated Damages - JCTKiwalabye OsephNo ratings yet

- Name: Bada Temidayo MATRIC NO: F/ND/13/3510050 Course: Tendering and Estimating (QUS 209) Level: ND Ii Lecturer: BLDR (Prince) V.O OlowuDocument7 pagesName: Bada Temidayo MATRIC NO: F/ND/13/3510050 Course: Tendering and Estimating (QUS 209) Level: ND Ii Lecturer: BLDR (Prince) V.O OlowuArome VictorNo ratings yet

- Building Inspection Report Terms and Conditions - EnvironDocument14 pagesBuilding Inspection Report Terms and Conditions - EnvironKenneth KemeNo ratings yet

- Qtlomordqot 39854443 1Document3 pagesQtlomordqot 39854443 1Dennis MendozaNo ratings yet

- PreSalesAgreement PDFDocument1 pagePreSalesAgreement PDFAnonymous To7jR7U100% (1)

- Construction Proposal and AgreementDocument6 pagesConstruction Proposal and Agreementpavan varmaNo ratings yet

- Construction Proposal TemplateDocument7 pagesConstruction Proposal TemplateJoevince Neil GacusNo ratings yet

- Waiterms-Revj - Doc : WAI EngineeringDocument7 pagesWaiterms-Revj - Doc : WAI EngineeringJam's RonNo ratings yet

- Short Form Agreement Between Client and Architect: Document EightDocument2 pagesShort Form Agreement Between Client and Architect: Document EightEppNo ratings yet

- Building Permit RequirementsDocument7 pagesBuilding Permit RequirementsKeithly Jeane BrionesNo ratings yet

- Roofing Terms and Conditions - EnvironDocument14 pagesRoofing Terms and Conditions - EnvironKenneth KemeNo ratings yet

- ContractDocument6 pagesContractCj GumiranNo ratings yet

- Scale Min FeesDocument23 pagesScale Min Feeslkeok0% (1)

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- IELTS Speaking Part 3 Sample QuestionsDocument1 pageIELTS Speaking Part 3 Sample QuestionsABODE PVT LIMITEDNo ratings yet

- Writing Task 2 TemplateDocument6 pagesWriting Task 2 TemplateABODE PVT LIMITEDNo ratings yet

- Vacancies at Pakistan Sweet HomeDocument1 pageVacancies at Pakistan Sweet HomeABODE PVT LIMITEDNo ratings yet

- IELTS Speaking Part 2 QuestionsDocument2 pagesIELTS Speaking Part 2 QuestionsABODE PVT LIMITEDNo ratings yet

- Sample Paper Revenue OfficerDocument7 pagesSample Paper Revenue OfficerABODE PVT LIMITEDNo ratings yet

- Public Sector Scientific Organization Seeks Engineers & ScientistsDocument1 pagePublic Sector Scientific Organization Seeks Engineers & ScientistsABODE PVT LIMITEDNo ratings yet

- ICAO Coordinator SG-07 On Contract Basis (Newspaper)Document1 pageICAO Coordinator SG-07 On Contract Basis (Newspaper)ABODE PVT LIMITEDNo ratings yet

- ATC AssDocument2 pagesATC AssABODE PVT LIMITEDNo ratings yet

- Pakistan Railways Recruitment 2022-1666298643-134-EDocument1 pagePakistan Railways Recruitment 2022-1666298643-134-EABODE PVT LIMITEDNo ratings yet

- Federal & Provincial Finance Acts, 2022 SummaryDocument61 pagesFederal & Provincial Finance Acts, 2022 SummaryABODE PVT LIMITEDNo ratings yet

- Dental NLE CSE Session-2 Assessment Criteria GuideDocument79 pagesDental NLE CSE Session-2 Assessment Criteria GuideABODE PVT LIMITEDNo ratings yet

- ConsolweightDocument2 pagesConsolweightABODE PVT LIMITEDNo ratings yet

- Advt No.05-2022 10-03-2022 X7 VersionDocument1 pageAdvt No.05-2022 10-03-2022 X7 VersionABODE PVT LIMITEDNo ratings yet

- Terms of Reference For Position of Assistant Manager (Tors Related To Product Division)Document1 pageTerms of Reference For Position of Assistant Manager (Tors Related To Product Division)ABODE PVT LIMITEDNo ratings yet

- Advertisement Admin Staff Daily WagesDocument2 pagesAdvertisement Admin Staff Daily WagesABODE PVT LIMITEDNo ratings yet

- Express and The Nation on 13-04-2022Document1 pageExpress and The Nation on 13-04-2022ABODE PVT LIMITEDNo ratings yet

- Advt No.10-2022 30-03-2022 X7 VersionDocument1 pageAdvt No.10-2022 30-03-2022 X7 VersionABODE PVT LIMITEDNo ratings yet

- Azam PaymentDocument1 pageAzam PaymentABODE PVT LIMITEDNo ratings yet

- Bsbsmb401a-Establish Legal and Risk Management Requirement of Small Business - (Assessment II)Document7 pagesBsbsmb401a-Establish Legal and Risk Management Requirement of Small Business - (Assessment II)qumbershah90No ratings yet

- Riph - Task SheetsDocument2 pagesRiph - Task SheetsAIDAN GYLE ABROGARNo ratings yet

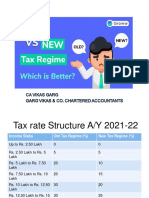

- Tax Regime Analysis: Opt for Old or New Tax SlabsDocument9 pagesTax Regime Analysis: Opt for Old or New Tax Slabsscintillating26No ratings yet

- 2020 2021 Purples Notes TaxationDocument310 pages2020 2021 Purples Notes TaxationMichael James Madrid MalinginNo ratings yet

- On June 15 201 1 A Second Hand Machine Was Purchased For 77 000Document1 pageOn June 15 201 1 A Second Hand Machine Was Purchased For 77 000Let's Talk With HassanNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument4 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon Cityjobelle barcellanoNo ratings yet

- W8 Ben Default - 2021 12 27 - Preview - DocDocument1 pageW8 Ben Default - 2021 12 27 - Preview - DocJavielito RamirezbriosoNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- Grounds of AppealDocument2 pagesGrounds of AppealNitin RautNo ratings yet

- Local Government Code Policy and ApplicationDocument2 pagesLocal Government Code Policy and ApplicationEmildan GastardoNo ratings yet

- CIR V Va de PrietoDocument2 pagesCIR V Va de PrietoAngela ConejeroNo ratings yet

- Winebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDocument24 pagesWinebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDarrel John SombilonNo ratings yet

- Kochi Municipal Corporation 3feb2020Document5 pagesKochi Municipal Corporation 3feb2020Shaji JkNo ratings yet

- Re Query of Mr. Roger C. PrioreschiDocument2 pagesRe Query of Mr. Roger C. PrioreschiLolit CarlosNo ratings yet

- History of Taxation in the PhilippinesDocument29 pagesHistory of Taxation in the PhilippinesBulajyo Pangngay JolinaNo ratings yet

- CIR v. CTA and Smith Kline, G.R. No. L-54108, 1984Document4 pagesCIR v. CTA and Smith Kline, G.R. No. L-54108, 1984JMae MagatNo ratings yet

- The India Cements Limited: OrginalDocument3 pagesThe India Cements Limited: OrginalVadde Anil KumarNo ratings yet

- Strengthening State-Society Relations Through Tax ReformsDocument3 pagesStrengthening State-Society Relations Through Tax ReformsSiwangoNo ratings yet

- III. TAX 1 COMPILATION - Case # 60-78Document54 pagesIII. TAX 1 COMPILATION - Case # 60-78Aleezah Gertrude RaymundoNo ratings yet

- JANUARY To DECEMBER 2022 USD Tax TablesDocument1 pageJANUARY To DECEMBER 2022 USD Tax TablesAndrew MusarurwaNo ratings yet

- Ca Suraj Satija Ssguru Charge of GSTDocument12 pagesCa Suraj Satija Ssguru Charge of GSTSunny YadavNo ratings yet

- GST & Custom Law AssignmentDocument13 pagesGST & Custom Law AssignmentNikita -0251 ENo ratings yet

- Senior CitizensDocument5 pagesSenior CitizensAndrea DeteraNo ratings yet

- GST Case Study on Joint Development AgreementDocument7 pagesGST Case Study on Joint Development Agreementraj pandeyNo ratings yet

- Tax DefinitionDocument2 pagesTax DefinitionZainab Aftab 5221-FMS/BBA/S18No ratings yet

- CIR v. CA - Non-Profit Educational Institutions Not Subject to Contractor's TaxDocument3 pagesCIR v. CA - Non-Profit Educational Institutions Not Subject to Contractor's TaxFox Briones Alfonso100% (1)

- Power of Taxation: Subject: Income Taxation Topic: Introduction To TaxationDocument8 pagesPower of Taxation: Subject: Income Taxation Topic: Introduction To TaxationJoshua CabinasNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023TARUN PRASADNo ratings yet

- G.R. No. L-43082 Lorenzo V Posadas 64 Phil 353Document7 pagesG.R. No. L-43082 Lorenzo V Posadas 64 Phil 353Shereen AlobinayNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet