Professional Documents

Culture Documents

Wollongong Spring 2022 ECON339 Exam

Uploaded by

Jahanzaib AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wollongong Spring 2022 ECON339 Exam

Uploaded by

Jahanzaib AhmedCopyright:

Available Formats

Faculty of Business and Law

School of Business

Student to complete:

Family name

Other names

Student number

Table number

ECON339

Applied Financial Modeling

Wollongong

Deferred and Supplementary Examination Paper

Spring, 2022

Exam duration 3 hours

Weighting 50 %

Items permitted by examiner NA

Aids supplied NA

Directions to students Answer ALL questions. Q1 (30 marks), Q2 (10 marks)

This exam paper must not be removed from the exam venue

2022 ECON339 Wollongong Spring 2022 Page 1 of 8

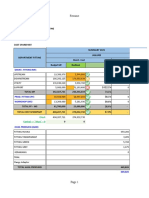

Q1. Gold has often been debated as a long-term hedge against inflation. In this question, we will test

whether the U.S. data support this proposition. Panel 1A shows the plot of the gold price (GPRICE) per troy

ounce in US$, while Panel 1B shows the annualised US inflation rate (INF) from December 1969 to August

2021.

Panel 1A: Gold price US$ Panel 1B: US inflation rate (%)

(a) Briefly explain the movement of the “GPRICE” and “INF”. [2]

(b) Panels 1C and 1D show the Augmented Dickey-Fuller (ADF) test results for the log(GPRICE) (i.e.,

LGPRICE) and INF, respectively. Why is the ADF test preferred to the DF test? [2]

(c) Write down the unit root test regression specification. [2]

Panel 1C (LGPRICE) Panel 1D (INF)

Exogenous: Constant, Linear Trend Exogenous: Constant, Linear Trend

Lag Length: 0 (Automatic - based on SIC, maxlag=18) Lag Length: 0 (Automatic - based on SIC, maxlag=18)

t-Statistic Prob.* t-Statistic Prob.*

Augmented Dickey-Fuller test Augmented Dickey-Fuller test

statistic -2.446591 0.3550 statistic -13.41585 0.0000

Test critical Test critical

values: 1% level -3.972925 values: 1% level -3.972949

5% level -3.417083 5% level -3.417095

10% 10%

level -3.130918 level -3.130925

2022 ECON339 Wollongong Spring 2022 Page 2 of 8

(d) Interpret the unit root test results in Panels 1C and 1D. What can you infer about the stationarity property

of LGPRICE and INF? [2]

(e) The regression output of LGPRICE on INF is shown below. Can you infer from this regression result?

Explain. [2]

Dependent Variable: LGPRICE

Method: Least Squares

Date: 09/27/21 Time: 12:10

Sample (adjusted): 1970M01 2021M08

Included observations: 620 after adjustments

Variable Coefficient Std. Error t-Statistic Prob.

INF 0.034774 0.005112 6.802009 0.0000

C 4.433328 0.050391 87.97825 0.0000

@TREND 0.004722 0.000112 42.04205 0.0000

R-squared 0.760146 Mean dependent var 6.032612

Adjusted R-squared 0.759369 S.D. dependent var 0.909837

S.E. of regression 0.446313 Akaike info criterion 1.229234

Sum squared resid 122.9034 Schwarz criterion 1.250668

Log likelihood -378.0625 Hannan-Quinn criter. 1.237565

F-statistic 977.7008 Durbin-Watson stat 0.077781

Prob(F-statistic) 0.000000

(f) I performed the Engle-Granger test on the U.S. logarithm of the consumer price index (LCPI) and

LGPRICE assuming that LCPI is I(1). At the 5% significance level, what can you infer about the test result?

[2]

Series: LCPI LGPRICE

Sample: 1969M12 2021M08

Included observations: 621

Cointegrating equation deterministics: C

Automatic lags specification based on Schwarz criterion (maxlag=18)

Dependent tau-statistic Prob.* z-statistic Prob.*

LCPI -1.367631 0.8103 -3.734399 0.8287

LGPRICE -1.777624 0.6415 -5.545364 0.6877

2022 ECON339 Wollongong Spring 2022 Page 3 of 8

(g) Given your findings in part (f), is gold a long-term hedge of inflation? Explain. [2]

(h) I proceed to study the short-run dynamic of the changes in gold price ( ∆ LGPRICE ¿ and inflation (INF)

and estimated a VAR model. Write down the VAR(1) model using the notation ∆ LGPRICE and INF. [2]

(i) The table below shows the different criteria used to determine the appropriate lag length of the VAR

model. What is the optimal lag length? [2]

VAR Lag Order Selection Criteria

Endogenous variables: DGPRICE INF

Exogenous variables: C

Date: 09/27/21 Time: 12:26

Sample: 1969M12 2021M08

Included observations: 612

Lag LogL LR FPE AIC SC HQ

0 -810.0112 NA 0.048698 2.653631 2.668065 2.659245

1 -645.0795 328.2464 0.028781 2.127711 2.171012* 2.144552*

2 -642.2466 5.619539 0.028891 2.131525 2.203694 2.159594

3 -635.6927 12.95782 0.028651 2.123179 2.224215 2.162475

4 -626.5261 18.06369 0.028171 2.106294 2.236198 2.156818

5 -622.8897 7.141925 0.028205 2.107483 2.266254 2.169234

6 -618.2868 9.010285 0.028149 2.105512 2.293151 2.178492

7 -612.9209 10.46888* 0.028024* 2.101049* 2.317555 2.185255

8 -609.7500 6.165488 0.028101 2.103758 2.349132 2.199193

(j) Using the regression model in part (h), I performed the Granger causality test to determine the predictive

power of INF on ∆ LGPRICE , and vice versa. State the null hypothesis of these Granger causality tests

using the coefficients/parameters in the VAR specification. [2]

2022 ECON339 Wollongong Spring 2022 Page 4 of 8

(k) The result of the Granger causality test is based on a VAR(1) model.

What can you infer from this test result at the 5% significance level? [2]

VAR Granger Causality/Block Exogeneity Wald Tests

Date: 09/27/21 Time: 12:31

Sample: 1969M12 2021M08

Included observations: 619

Dependent variable: DGPRICE

Excluded Chi-sq df Prob.

INF 0.577845 1 0.4472

All 0.577845 1 0.4472

Dependent variable: INF

Excluded Chi-sq df Prob.

DGPRICE 5.477190 1 0.0193

All 5.477190 1 0.0193

2022 ECON339 Wollongong Spring 2022 Page 5 of 8

(l) I generated the impulse response diagrams from the VAR model with

the Cholesky ordering ∆ LGPRICE and INF.

2022 ECON339 Wollongong Spring 2022 Page 6 of 8

What can you infer about the persistence of the shock INF on itself compared to the shock of ∆ LGPRICE

on itself? [2]

(m) Looking at the impulse response diagrams, what can you infer about the short-run dynamic response of

inflation to ∆ LGPRICE shock? [2]

(n) I produced the impulse response function with the Cholesky ordering INF and ∆ LGPRICE . Why do I

need to produce this additional impulse response function based on a different Cholesky ordering? [2]

(o) The forecast error variance decomposition of the VAR is shown below. What can you infer from this

result? [2]

2022 ECON339 Wollongong Spring 2022 Page 7 of 8

Q2. Consider the following simultaneous equation models.

Y 1t=α 1 + β 3 Y 3t + δ 1 X 1t +u 1t (1)

Y 2t=α 2 + β 1 Y 1t + β 3 Y 3 t +u 2t (2)

Y 3t =α 3+ β 2 Y 2t +δ 2 X 2t +u 3 t (3)

(a) Can you estimate equation (1) with OLS assuming X 1 and X 2are exogenous? Explain [2]

(b) Use the order condition to identify which of the above equations are just identified. [2]

(c) Consider the following set of simultaneous equations:

Y 1t=α 1 +δ 1 X 1t + u1t (4 )

Y 2t=α 2 + β 1 Y 1t + β 3 Y 3 t +u 2t (5)

Y 3t =α 3+ β 2 Y 2t +δ 2 X 2t +u 3 t (6)

Can you estimate equation (4) with OLS assuming X 1 and X 2are exogenous? Explain. [2]

(d) Write down the reduced form equation for the endogenous variables Y 2t and Y 3t ? [2]

(e) Can you estimate equations (5) and (6) with the Indirect Least Square method? Explain. [2]

2022 ECON339 Wollongong Spring 2022 Page 8 of 8

You might also like

- Test Bank to Accompany Microeconomics Se-đã Chuyển ĐổiDocument31 pagesTest Bank to Accompany Microeconomics Se-đã Chuyển ĐổiThiện Lê ĐứcNo ratings yet

- Solutions Manual Chapter 10 Economics of Innovation and GrowthDocument22 pagesSolutions Manual Chapter 10 Economics of Innovation and GrowthDaniiar KamalovNo ratings yet

- Chapter 04 - IfRS Part IDocument11 pagesChapter 04 - IfRS Part IDianaNo ratings yet

- End of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83Document2 pagesEnd of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83opi ccxv100% (1)

- (123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thDocument6 pages(123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thHa Lien Vu KhanhNo ratings yet

- Chapter 1 HWDocument5 pagesChapter 1 HWValerie Bodden Kluge100% (1)

- Testbank - Multinational Business Finance - Chapter 12Document15 pagesTestbank - Multinational Business Finance - Chapter 12Uyen Nhi NguyenNo ratings yet

- TN Đttc. 1Document40 pagesTN Đttc. 1Nguyễn Thị Thùy DươngNo ratings yet

- Mishkin 6ce TB Ch10Document27 pagesMishkin 6ce TB Ch10JaeDukAndrewSeo100% (1)

- TB 07Document28 pagesTB 07Ülgen Beste AktsNo ratings yet

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimeNo ratings yet

- LESSON 7: Non-Parametric Statistics: Tests of Association & Test of HomogeneityDocument21 pagesLESSON 7: Non-Parametric Statistics: Tests of Association & Test of HomogeneityJiyahnBayNo ratings yet

- Chapter1 2Document6 pagesChapter1 2Young Joo MoonNo ratings yet

- MngEcon06 Ch02Document55 pagesMngEcon06 Ch02dmkelompok3 exNo ratings yet

- Chapter-10 - Test BankDocument14 pagesChapter-10 - Test Bankwasif ahmedNo ratings yet

- lý thuyết cuối kì MNCDocument6 pageslý thuyết cuối kì MNCPhan Minh KhuêNo ratings yet

- Bank's Financial Statements ExplainedDocument6 pagesBank's Financial Statements ExplainedMohamed AmirNo ratings yet

- FIN323 Exam 2 SolutionsDocument7 pagesFIN323 Exam 2 SolutionskatieNo ratings yet

- Advanced Corporate Finance Quiz 2 SolutionsDocument3 pagesAdvanced Corporate Finance Quiz 2 SolutionslaurenNo ratings yet

- Financial Markets and Institutions Chapter 1 Multiple ChoiceDocument327 pagesFinancial Markets and Institutions Chapter 1 Multiple ChoiceStan TanNo ratings yet

- Final2017 Solution PDFDocument14 pagesFinal2017 Solution PDFVikram SharmaNo ratings yet

- Chap 019Document36 pagesChap 019skuad_024216No ratings yet

- Functions and Benefits of Financial MarketsDocument1 pageFunctions and Benefits of Financial Marketsamer_wahNo ratings yet

- International Economics Chapter 3 MCQsDocument25 pagesInternational Economics Chapter 3 MCQsAli AlshehhiNo ratings yet

- Mishkin 6ce TB Ch21Document37 pagesMishkin 6ce TB Ch21JaeDukAndrewSeoNo ratings yet

- Chapter19 GeDocument15 pagesChapter19 Gebillurengin8590No ratings yet

- FIN203 Tutorial 1 QDocument4 pagesFIN203 Tutorial 1 Q黄于绮100% (1)

- EC 203 Final Exam Assessment S11170973Document11 pagesEC 203 Final Exam Assessment S11170973Kajal Prasad100% (1)

- ECON 206 Sample MC Questions Midterm 2Document6 pagesECON 206 Sample MC Questions Midterm 2James DeenNo ratings yet

- MC Practice Ch 16 Capital StructureDocument3 pagesMC Practice Ch 16 Capital Structurebusiness docNo ratings yet

- 3070 Practice QuestionsDocument48 pages3070 Practice QuestionsDheeraj AroraNo ratings yet

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Document10 pagesThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNo ratings yet

- CH 06Document22 pagesCH 06Kreatif TuisyenNo ratings yet

- Stock ValuationDocument79 pagesStock ValuationRodNo ratings yet

- Chapter 11 Operating Exposure Multiple Choice and True/False Questions 11.1 Trident Corporation: A Multinational's Operating ExposureDocument14 pagesChapter 11 Operating Exposure Multiple Choice and True/False Questions 11.1 Trident Corporation: A Multinational's Operating Exposurequeen hassaneenNo ratings yet

- ECON 122 Test 2 MemoDocument5 pagesECON 122 Test 2 MemokgahlisoNo ratings yet

- Multiple Choice Questions Financial MarketsDocument16 pagesMultiple Choice Questions Financial Marketshannabee00No ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- BadmintonDocument5 pagesBadmintonHarpocrates Azazel0% (1)

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Week 8 Practice Test With SolutionsDocument8 pagesWeek 8 Practice Test With SolutionspartyycrasherNo ratings yet

- Min-Variance Portfolio & Optimal Risky PortfolioDocument4 pagesMin-Variance Portfolio & Optimal Risky PortfolioHelen B. EvansNo ratings yet

- Answer Key To Problem Set 4Document11 pagesAnswer Key To Problem Set 4ryohazuki76No ratings yet

- Mishkin 6ce TB Ch17Document32 pagesMishkin 6ce TB Ch17JaeDukAndrewSeoNo ratings yet

- Chapter 22Document14 pagesChapter 22Yousef ADNo ratings yet

- Comparative Advantage - The Basis For Exchange (Chapter 2)Document42 pagesComparative Advantage - The Basis For Exchange (Chapter 2)John Chan100% (1)

- Chap 8Document60 pagesChap 8لبليايلاNo ratings yet

- Required Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate FinanceDocument2 pagesRequired Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate Financegenius_2No ratings yet

- Macroeconomics Testbank Ch 9 Money Functions LiquidityDocument62 pagesMacroeconomics Testbank Ch 9 Money Functions LiquidityHabyarimana ProjecteNo ratings yet

- Investments Levy and Post PDFDocument82 pagesInvestments Levy and Post PDFDivyanshi SatsangiNo ratings yet

- Forecasting Topic 6Document6 pagesForecasting Topic 6Ahmed Munawar100% (1)

- Chapter 16Document16 pagesChapter 16queen hassaneenNo ratings yet

- MNCDocument5 pagesMNCPhan Minh KhuêNo ratings yet

- Calculating Cost of CapitalDocument5 pagesCalculating Cost of CapitalKuralay TilegenNo ratings yet

- PRD 521 CAT Answers Analyzed for Critical Path and Queuing ModelsDocument7 pagesPRD 521 CAT Answers Analyzed for Critical Path and Queuing ModelsmarkwechenjeNo ratings yet

- Isye4031 Regression and Forecasting Practice Problems 2 Fall 2014Document5 pagesIsye4031 Regression and Forecasting Practice Problems 2 Fall 2014cthunder_1No ratings yet

- Exam SampleDocument2 pagesExam SampleAlex BezmanNo ratings yet

- Assignment 6-8Document19 pagesAssignment 6-8Abhishek Satish WaghNo ratings yet

- Quantitative Macroeconomics Ardl Model: 100403596@alumnos - Uc3m.esDocument10 pagesQuantitative Macroeconomics Ardl Model: 100403596@alumnos - Uc3m.esManuel FernandezNo ratings yet

- Blunt Flat PlateDocument11 pagesBlunt Flat PlatekeanshengNo ratings yet

- Dokumen - Tips - Finance 129 Financial Institutions Management Syllabus Textbooks FinancialDocument29 pagesDokumen - Tips - Finance 129 Financial Institutions Management Syllabus Textbooks FinancialJahanzaib AhmedNo ratings yet

- PQ 2022 Financial Management SyllabusDocument7 pagesPQ 2022 Financial Management SyllabusJahanzaib AhmedNo ratings yet

- COMM469 Financial Institutions Management CourseDocument5 pagesCOMM469 Financial Institutions Management CourseJahanzaib AhmedNo ratings yet

- BU.231.710. - Financial Institutions - Page 1 of 5Document5 pagesBU.231.710. - Financial Institutions - Page 1 of 5Jahanzaib AhmedNo ratings yet

- Sleep Hygiene Sleep QualityandDocument8 pagesSleep Hygiene Sleep QualityandVriddhi AgrawalNo ratings yet

- DL1 - Epicyclic Gear Train & Holding Torque ManualDocument4 pagesDL1 - Epicyclic Gear Train & Holding Torque Manualer_arun76100% (1)

- Resume summary of monthly sparepart costs and production in 2021Document590 pagesResume summary of monthly sparepart costs and production in 2021winda listya ningrumNo ratings yet

- Jenny Randles - Mind Monsters - Invaders From Inner Space (1990)Document219 pagesJenny Randles - Mind Monsters - Invaders From Inner Space (1990)DirkTheDaring11100% (15)

- Test Bank For Close Relations An Introduction To The Sociology of Families 4th Canadian Edition McdanielDocument36 pagesTest Bank For Close Relations An Introduction To The Sociology of Families 4th Canadian Edition Mcdanieldakpersist.k6pcw4100% (44)

- Customer: Id Email Password Name Street1 Street2 City State Zip Country Phone TempkeyDocument37 pagesCustomer: Id Email Password Name Street1 Street2 City State Zip Country Phone TempkeyAgus ChandraNo ratings yet

- Simpack Off-Line and Real Time SimulationDocument23 pagesSimpack Off-Line and Real Time SimulationAnderson ZambrzyckiNo ratings yet

- COE10205, Other Corrosion Monitoring TechniquesDocument62 pagesCOE10205, Other Corrosion Monitoring Techniquesامين100% (1)

- Lesson 4 - Nature of The Speech Communication ProcessDocument4 pagesLesson 4 - Nature of The Speech Communication ProcessDon Miguel SpokesNo ratings yet

- I/O Buffer Megafunction (ALTIOBUF) User GuideDocument54 pagesI/O Buffer Megafunction (ALTIOBUF) User GuideSergeyNo ratings yet

- CSIR NET December 2019 Admit CardDocument1 pageCSIR NET December 2019 Admit CardDevendra Singh RanaNo ratings yet

- Vastu House PlanDocument187 pagesVastu House Planshilpa shahNo ratings yet

- Students Attendances System Using Face RecognitionDocument8 pagesStudents Attendances System Using Face RecognitionIJRASETPublicationsNo ratings yet

- Synopsis MphilDocument10 pagesSynopsis MphilAyesha AhmadNo ratings yet

- D Series: Instruction ManualDocument2 pagesD Series: Instruction ManualMartin del ValleNo ratings yet

- User Manual: Smart Alarm System & AppDocument41 pagesUser Manual: Smart Alarm System & AppEduardo Jose Fernandez PedrozaNo ratings yet

- Teaser Rheosolve D 15ASDocument2 pagesTeaser Rheosolve D 15ASwahyuni raufianiNo ratings yet

- 720-C-001 (Vent Wash Column)Document4 pages720-C-001 (Vent Wash Column)idilfitriNo ratings yet

- Operation and Maint Manual Swill Hydraulic PlateformDocument16 pagesOperation and Maint Manual Swill Hydraulic Plateformmicell dieselNo ratings yet

- Volkswagen 2.0L TDI Common Rail Engine Service TrainingDocument90 pagesVolkswagen 2.0L TDI Common Rail Engine Service TrainingАлла Харютина100% (1)

- How to Critique a Work in 40 StepsDocument16 pagesHow to Critique a Work in 40 StepsGavrie TalabocNo ratings yet

- 4-Day Hands-On Python ProgrammingDocument3 pages4-Day Hands-On Python ProgrammingÃmåñûēl DïrïbãNo ratings yet

- jrc122457 Dts Survey Deliverable Ver. 5.0-3Document46 pagesjrc122457 Dts Survey Deliverable Ver. 5.0-3Boris Van CyrulnikNo ratings yet

- Adaboost With Totally Corrective Updates For Fast Face DetectionDocument6 pagesAdaboost With Totally Corrective Updates For Fast Face DetectionNguyen Quoc TrieuNo ratings yet

- BfgsDocument10 pagesBfgshusseinNo ratings yet

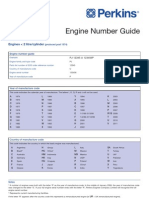

- Perkins Engine Number Guide PP827Document6 pagesPerkins Engine Number Guide PP827Muthu Manikandan100% (1)

- Substitution in The Linguistics of Text and Grammatical ThoughtDocument17 pagesSubstitution in The Linguistics of Text and Grammatical ThoughtThảo HanahNo ratings yet

- Certificate of Incorporation Phlips India LimitedDocument1 pageCertificate of Incorporation Phlips India LimitedRam AgarwalNo ratings yet

- 1 National Workshop For Sustainable Built Environment South - South PartnershipDocument14 pages1 National Workshop For Sustainable Built Environment South - South PartnershipRajendra KunwarNo ratings yet

- Management Science PDFDocument131 pagesManagement Science PDFAngela Lei SanJuan BucadNo ratings yet